Key Insights

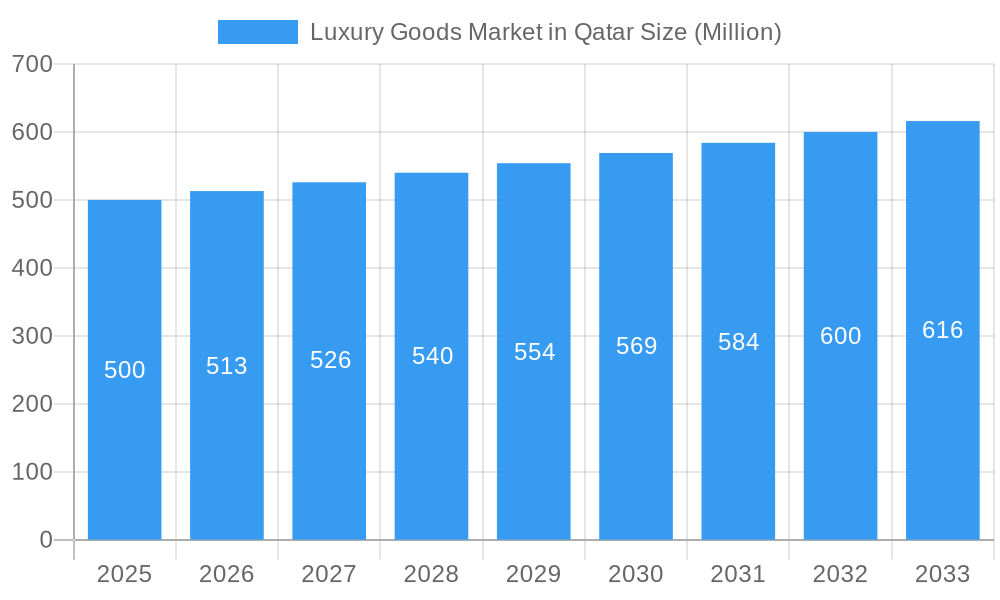

Qatar's luxury goods market exhibits robust growth potential, influenced by regional economic strengths and global luxury trends. With a projected Compound Annual Growth Rate (CAGR) of 5.38%, the market is estimated to reach a size of 563.28 million by the base year 2025. This expansion is fueled by rising disposable incomes among affluent Qatari consumers, a thriving tourism sector attracting high-net-worth individuals, and a strong preference for premium brands and exclusive experiences. Key market segments include apparel, jewelry, watches, and footwear, with online luxury retail also poised for significant contribution due to increasing digital adoption.

Luxury Goods Market in Qatar Market Size (In Million)

While specific data for Qatar is limited, its luxury market performance is expected to align with and potentially surpass global trends, given its unique economic landscape. Factors such as government support for tourism and luxury retail, alongside the resilience of high-net-worth individuals' spending power, are anticipated to drive market growth. Potential challenges include economic volatility and regional competition, but the overall outlook for Qatar's luxury sector remains highly promising, offering substantial opportunities for established and emerging brands.

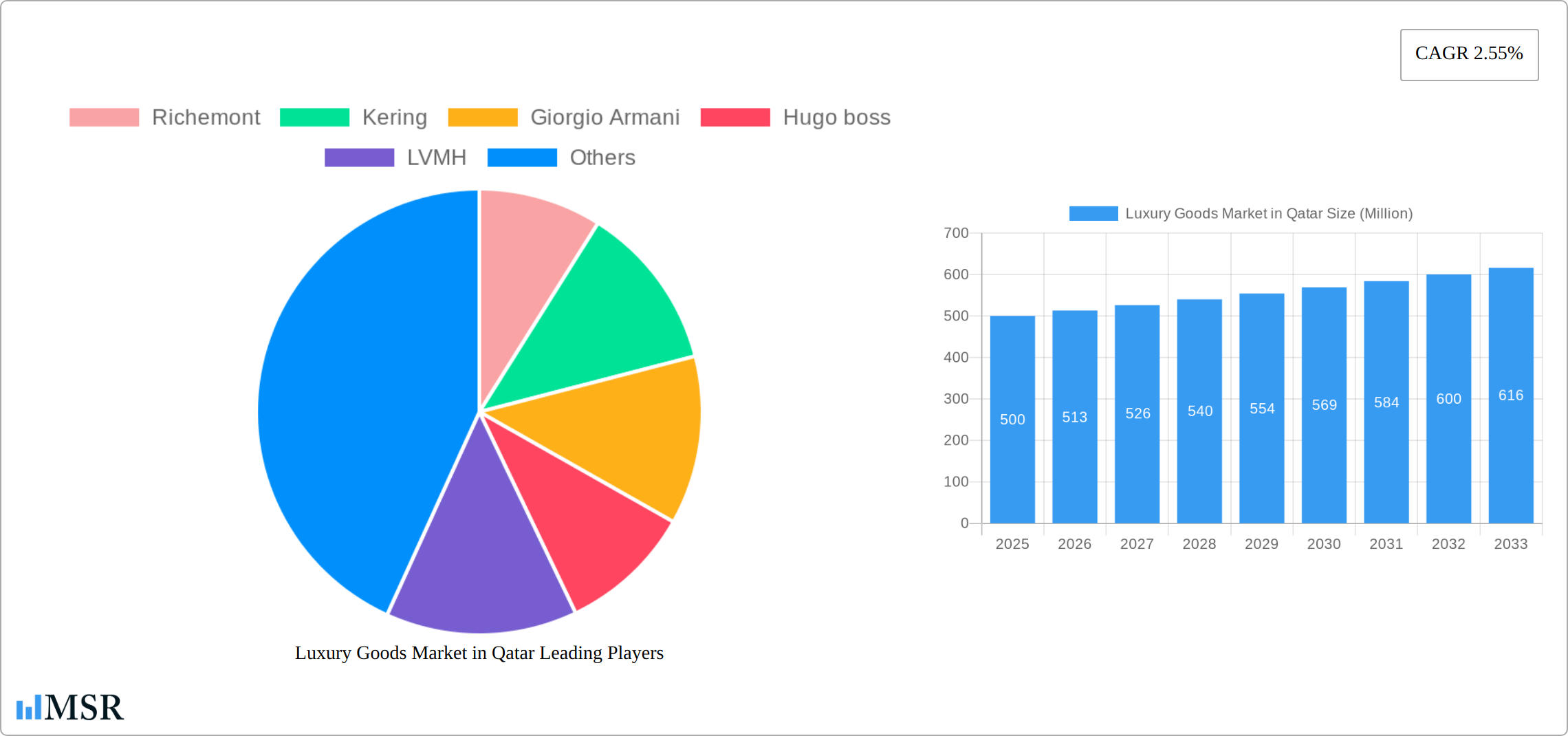

Luxury Goods Market in Qatar Company Market Share

Luxury Goods Market in Qatar: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Luxury Goods Market in Qatar, offering invaluable insights for industry stakeholders, investors, and businesses operating within this lucrative sector. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. The report leverages robust data analysis and market forecasting to deliver actionable intelligence, helping you navigate the complexities of the Qatari luxury goods landscape.

Luxury Goods Market in Qatar Market Concentration & Dynamics

This section delves into the competitive landscape of the Qatari luxury goods market. We analyze market concentration, assessing the market share held by key players like LVMH, Richemont, Kering, and Chanel. We also examine the role of innovation ecosystems, the impact of regulatory frameworks, the presence of substitute products, and evolving end-user trends. Furthermore, the report provides an overview of M&A activities, including the number of deals and their impact on market consolidation. The analysis considers the historical period (2019-2024), the base year (2025), and forecasts to 2033. Data on specific market share percentages for individual companies is unavailable at this time (xx). However, the report quantifies the level of market concentration using a Herfindahl-Hirschman Index (HHI) calculation (xx).

- Market Concentration: High concentration with a few dominant players. (HHI: xx)

- Innovation Ecosystems: Limited but growing, driven by technology adoption and e-commerce.

- Regulatory Frameworks: Relatively stable but subject to change.

- Substitute Products: Limited due to the exclusive nature of luxury goods.

- End-User Trends: Shift towards online purchases and personalized experiences.

- M&A Activities: xx M&A deals observed during the historical period.

Luxury Goods Market in Qatar Industry Insights & Trends

This section analyzes the overall market size and growth trajectory of the Qatari luxury goods market. The report presents a detailed overview of market growth drivers, including economic prosperity, tourism, and rising disposable incomes among affluent consumers. We examine the impact of technological disruptions, such as the rise of e-commerce and social media marketing, on consumer behavior. Furthermore, we delve into evolving consumer preferences and the increasing demand for sustainable and ethically sourced luxury products. The market size in 2025 is estimated at xx Million USD, with a CAGR of xx% from 2025 to 2033.

Key Markets & Segments Leading Luxury Goods Market in Qatar

This section delves into the dynamic landscape of the luxury goods market in Qatar, identifying the most influential segments and the factors propelling their growth.

By Type:

- Watches: Witnessing robust demand, particularly from discerning consumers with high purchasing power who value the prestige and intricate craftsmanship associated with renowned watchmaking brands.

- Jewelry: Continues to hold a significant market share, deeply intertwined with cultural preferences for precious metals and gemstones, and increasingly recognized for its investment value and heirloom potential.

- Bags: Demonstrates exceptional growth potential, propelled by evolving fashion trends, the influence of social media, and the continuous introduction of diverse and innovative product offerings from iconic fashion houses.

- Clothing and Apparel: Exhibits strong performance, driven by the allure of both globally recognized luxury brands and the increasing sophistication of local designers, catering to a sophisticated clientele.

- Footwear: Enjoys steady growth, mirroring global luxury footwear trends with an emphasis on craftsmanship, comfort, and statement designs that appeal to fashion-conscious individuals.

- Other Accessories: Maintains consistent demand for high-end eyewear, exquisite scarves, leather goods, and other meticulously crafted accessories that serve as essential components of a luxury lifestyle.

By Distribution Channel:

- Single Brand Stores: Remains the dominant channel, offering an immersive brand experience, unparalleled exclusivity, and personalized service that resonates with loyal patrons.

- Multi-Brand Stores: Plays a crucial role by providing a curated selection of diverse luxury offerings, enabling consumers to compare products and discover new brands within a sophisticated retail environment.

- Online Stores: Is experiencing rapid expansion, fueled by the increasing digital adoption among Qatari consumers and the convenience of accessing a wider range of luxury products from the comfort of their homes.

- Other Distribution Channels: Includes strategically located duty-free shops at Hamad International Airport, offering a unique shopping opportunity for travelers, and high-end department stores that provide a comprehensive luxury retail experience.

By Gender:

- Female: Commands the larger market share, driven by a strong appetite for luxury fashion, iconic handbags, exquisite jewelry, and haute couture, reflecting a deep appreciation for style and craftsmanship.

- Male: Represents a significant and growing segment, with particular demand for luxury watches, premium accessories, bespoke tailored clothing, and high-quality leather goods that underscore sophistication and professional success.

Dominance Analysis: While single-brand stores continue to be the preferred channel for an exclusive experience, the rapid expansion of online sales signifies a transformative shift in consumer behavior. The female demographic currently holds a more substantial market share, though the male luxury segment is demonstrating noteworthy growth and potential.

Key Drivers:

- Exceptional Disposable Incomes: Qatar's consistently high GDP per capita and a population with significant disposable income are foundational pillars supporting robust luxury spending.

- Flourishing Tourism Sector: The influx of international tourists, attracted by Qatar's cultural attractions and world-class events, significantly contributes to the sales of luxury goods, especially through duty-free channels and within premier shopping destinations.

- World-Class Retail Infrastructure: The presence of opulent and modern shopping malls, coupled with state-of-the-art airport facilities, provides an ideal and accessible platform for luxury brands to engage with consumers and showcase their collections.

- Growing Affluence and Aspiration: An increasingly affluent population with a strong aspiration for premium products and experiences fuels the demand for luxury items as symbols of success and personal expression.

Luxury Goods Market in Qatar Product Developments

Recent years have witnessed significant innovation in luxury goods, including the integration of technology (e.g., smartwatches) and sustainable materials. Brands are increasingly focusing on personalization and unique experiences to cater to discerning consumers. This is driving the introduction of customized designs and limited-edition collections.

Challenges in the Luxury Goods Market in Qatar Market

The market faces challenges, including supply chain disruptions, potential economic fluctuations impacting consumer confidence, and intense competition from both established and emerging luxury brands. These factors can lead to price volatility and reduced profit margins, especially in times of global uncertainty.

Forces Driving Luxury Goods Market in Qatar Growth

Key growth drivers include consistent economic growth, a young and affluent population, and the government's ongoing investment in infrastructure and tourism. The growing popularity of online luxury shopping and the introduction of innovative products are also contributing factors.

Long-Term Growth Catalysts in Luxury Goods Market in Qatar

Long-term growth will be driven by increased tourism, further economic diversification, and the government's continued support for the retail sector. Investments in sustainable luxury goods and personalized experiences will also attract new customer segments.

Emerging Opportunities in Luxury Goods Market in Qatar

Significant opportunities for growth in Qatar's luxury market lie in the strategic expansion of e-commerce platforms, offering seamless digital shopping experiences that cater to convenience-seeking consumers. The introduction of highly personalized shopping journeys, including bespoke consultations and exclusive previews, can foster deeper customer loyalty. Embracing and communicating sustainable and ethical practices in sourcing and production is increasingly important to a conscious consumer base. Furthermore, the growing demand for unique, limited-edition, and artisanal products presents a lucrative avenue. The continued development and promotion of Qatar as a premier luxury tourism destination will also unlock substantial opportunities for the retail sector.

Leading Players in the Luxury Goods Market in Qatar Sector

- Richemont (Chopard, Cartier, Van Cleef & Arpels, IWC Schaffhausen, Jaeger-LeCoultre, Panerai)

- Kering (Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen)

- Giorgio Armani (including Emporio Armani, Armani Exchange, Giorgio Armani Privé)

- Hugo Boss (including Boss and HUGO)

- LVMH (Louis Vuitton, Christian Dior, Tiffany & Co., Bulgari, Fendi, Celine, Givenchy)

- Chanel

- Puig (Carolina Herrera, Paco Rabanne, Jean Paul Gaultier)

- Joyalukkas (prominent in jewelry)

- PVH Corp. (Calvin Klein, Tommy Hilfiger)

- Prada SpA (Prada, Miu Miu)

- Rolex (a benchmark in luxury watchmaking)

- Hermès

- Burberry

- Versace

Key Milestones in Luxury Goods Market in Qatar Industry

- April 2022: Louis Vuitton opened its first store at Qatar Duty-Free in Hamad International Airport, Doha. This significantly enhanced the luxury shopping experience for international travelers.

- November 2022: The launch of Ounass, a luxury e-commerce platform, broadened access to a wider range of luxury brands and products for Qatari consumers. This marked a significant step in the growth of online luxury retail in the country.

Strategic Outlook for Luxury Goods Market in Qatar Market

The Qatari luxury goods market exhibits robust growth potential, fueled by a strong economy, strategic government investments, and the increasing preference for premium goods and experiences. The strategic focus should be on enhancing the digital presence, fostering sustainable practices, and delivering personalized customer experiences to capture the expanding market share.

Luxury Goods Market in Qatar Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single Brand Stores

- 2.2. Multi Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Gender

- 3.1. Male

- 3.2. Female

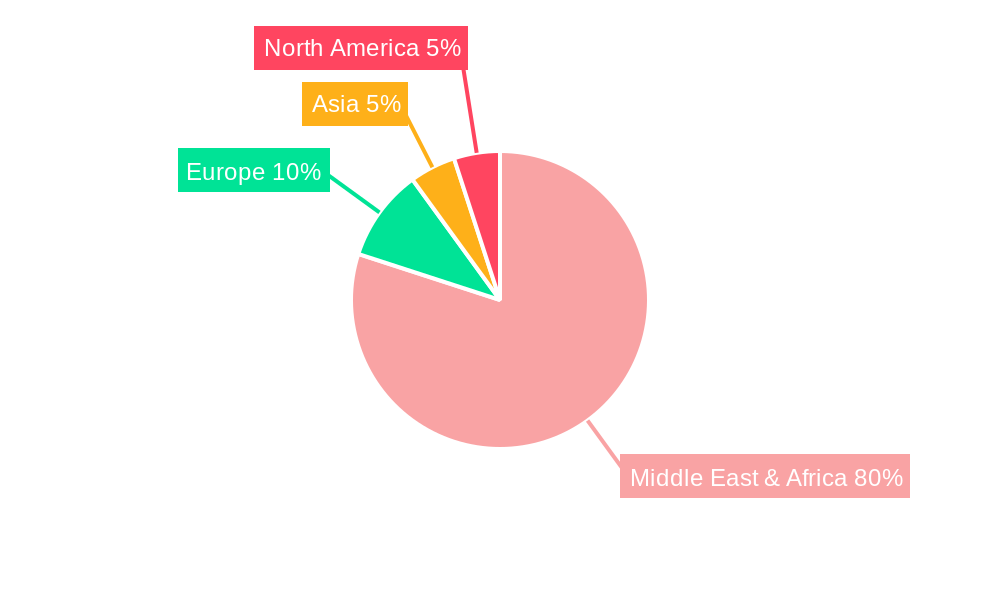

Luxury Goods Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Qatar Regional Market Share

Geographic Coverage of Luxury Goods Market in Qatar

Luxury Goods Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar becoming the Luxury Fashion Hub to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Gender

- 5.3.1. Male

- 5.3.2. Female

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single Brand Stores

- 6.2.2. Multi Brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Gender

- 6.3.1. Male

- 6.3.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single Brand Stores

- 7.2.2. Multi Brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Gender

- 7.3.1. Male

- 7.3.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single Brand Stores

- 8.2.2. Multi Brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Gender

- 8.3.1. Male

- 8.3.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single Brand Stores

- 9.2.2. Multi Brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Gender

- 9.3.1. Male

- 9.3.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single Brand Stores

- 10.2.2. Multi Brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Gender

- 10.3.1. Male

- 10.3.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Richemont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hugo boss

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puig

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Joyalukkas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Prada SpA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rolex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Richemont

List of Figures

- Figure 1: Global Luxury Goods Market in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 3: North America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 7: North America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 8: North America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 9: North America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 11: South America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 15: South America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 16: South America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 17: South America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 23: Europe Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 24: Europe Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 31: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 32: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 39: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 40: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Global Luxury Goods Market in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 8: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 15: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 22: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 35: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 45: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Qatar?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Luxury Goods Market in Qatar?

Key companies in the market include Richemont, Kering, Giorgio Armani, Hugo boss, LVMH, Chanel, Puig, Joyalukkas, PVH, Prada SpA*List Not Exhaustive, Rolex.

3. What are the main segments of the Luxury Goods Market in Qatar?

The market segments include Type, Distribution Channel, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 563.28 million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar becoming the Luxury Fashion Hub to Support Market Growth.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Qatar?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence