Key Insights

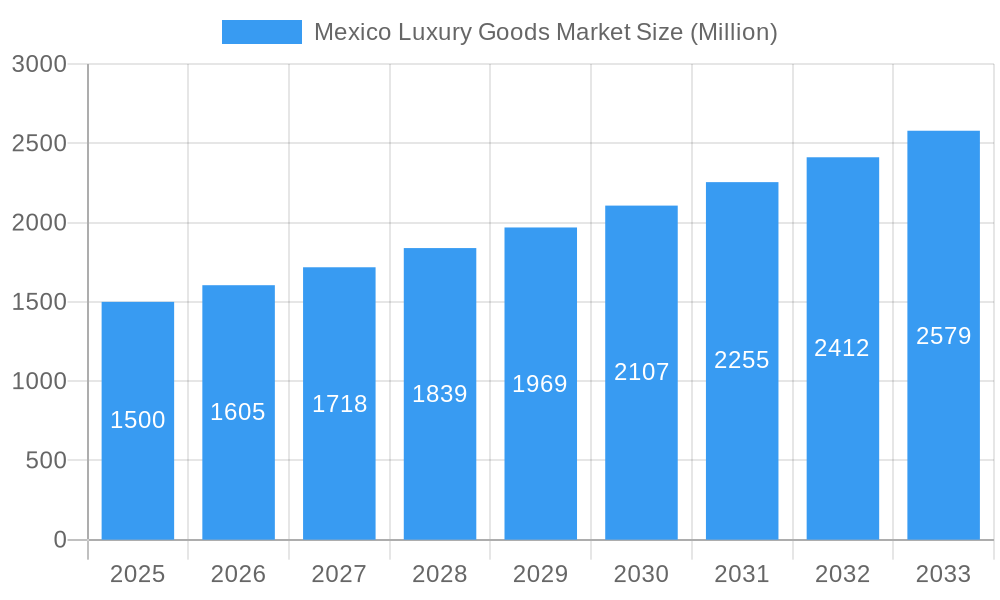

The Mexico luxury goods market is poised for substantial growth, projected to reach $3.61 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.83%. This expansion is propelled by increasing disposable incomes among affluent consumers, the aspirational purchasing power of a growing middle class, and robust inbound tourism. The demand for premium, internationally recognized brands, amplified by the burgeoning e-commerce landscape, significantly fuels market momentum. Key segments like apparel and jewelry demonstrate particularly strong potential, aligning with global luxury sector trends. Despite potential economic volatility and inflationary pressures, the long-term outlook remains highly positive. While single-brand stores currently emphasize experiential retail, online channels are rapidly emerging as a critical future growth avenue. Leading luxury conglomerates and esteemed brands are strategically positioned, while local and emerging brands are increasingly capturing market share by catering to specific cultural nuances and competitive pricing.

Mexico Luxury Goods Market Market Size (In Billion)

Strategic market segmentation presents diverse opportunities. The "Other Accessories" category, within the "By Type" segmentation, offers significant potential for niche and personalized luxury items, addressing the growing demand for exclusivity. Multi-brand retail environments are vital for broader customer reach, while a robust online presence is indispensable for engaging digitally-native younger consumers. Adapting to evolving consumer preferences and dynamic market conditions is paramount for competitive success. Furthermore, strategic collaborations with local distributors and influencers can enhance market penetration. Navigating the dynamic interplay between established global luxury houses and innovative local brands will be pivotal in defining market leadership.

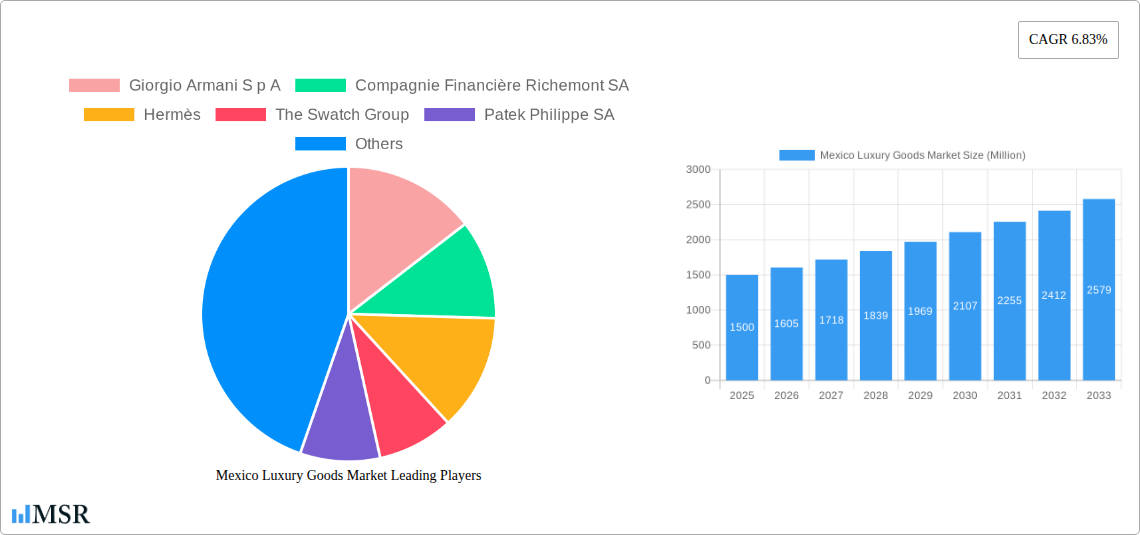

Mexico Luxury Goods Market Company Market Share

Mexico Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico luxury goods market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state and future trajectory. The report covers key segments including clothing and apparel, footwear, bags, watches, jewelry, and other accessories, across various distribution channels such as single-brand stores, multi-brand stores, and online stores. Leading players like LVMH Moet Hennessy Louis Vuitton, Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), and The Estee Lauder Companies are analyzed, providing a holistic view of this dynamic market. The report is packed with actionable insights and key performance indicators (KPIs) to help businesses strategize for success in the Mexican luxury goods market. Expect detailed analysis of market size (in Millions), CAGR, market share, and M&A activity.

Mexico Luxury Goods Market Market Concentration & Dynamics

The Mexican luxury goods market presents a dynamic and evolving competitive landscape. While a core group of established international brands commands a significant portion of the market share, the burgeoning presence of niche and artisanal Mexican brands fosters vibrant competition. Innovation is a key differentiator, primarily fueled by international players who consistently introduce cutting-edge designs, premium materials, and advanced technologies. Navigating the regulatory environment, which is generally receptive to foreign investment, requires careful attention to specific import/export regulations and taxation protocols. The market also contends with the influence of accessible luxury and premium alternatives, particularly in the fashion and accessories sectors, where brands offering a compelling value proposition can capture consumer attention. End-user preferences are increasingly shifting towards sustainability and ethical sourcing, prompting brands to prioritize environmentally conscious production and transparent supply chains. While mergers and acquisitions (M&A) have been a less prominent feature in recent years, with an estimated [Insert Specific Number Here] M&A deals recorded during the historical period (2019-2024), this presents a notable opportunity for future market consolidation and strategic alliances.

- Market Share: The top 5 players collectively account for approximately [Insert Percentage Here]% of the market share, highlighting a moderate level of concentration.

- M&A Deal Counts: A total of [Insert Specific Number Here] M&A deals were observed between 2019 and 2024, with projections indicating a rise to an estimated [Insert Specific Number Here] deals in the forecast period (2025-2033).

- Innovation Ecosystem: Innovation is predominantly driven by global luxury houses, with a growing recognition of the need to nurture and integrate local design talent and manufacturing capabilities.

- Regulatory Framework: The regulatory environment is largely favorable to foreign direct investment, though adherence to nuanced import/export laws and fiscal policies remains crucial for seamless operations.

Mexico Luxury Goods Market Industry Insights & Trends

The Mexican luxury goods market has witnessed significant growth during the historical period (2019-2024), driven by factors such as rising disposable incomes among the affluent population, a growing middle class, and increasing tourism. The market size in 2024 is estimated at $xx Million, with a projected CAGR of xx% from 2025 to 2033, reaching $xx Million by 2033. Technological disruptions, such as the rise of e-commerce and personalized marketing, are transforming the retail landscape. Consumers are increasingly digitally savvy, demanding seamless online shopping experiences and personalized brand interactions. Evolving consumer behaviors reflect a stronger emphasis on sustainability, ethical sourcing, and unique brand experiences. The market is also influenced by global trends and macroeconomic factors, including exchange rate fluctuations and global economic uncertainty.

Key Markets & Segments Leading Mexico Luxury Goods Market

The Mexican luxury goods market is characterized by a robust and diversifying demand across multiple categories. While sustained growth is evident across the board, the Watches and Jewelry segments stand out as poised for exceptional expansion, projecting the highest market share in millions for 2025 due to their inherent value and enduring appeal.

- By Type: The dominant segments are Watches and Jewelry, followed closely by Bags and Clothing & Apparel, reflecting a balanced consumer interest in personal adornment and statement fashion pieces.

- By Distribution Channel: While Single-brand stores continue to be the cornerstone of luxury retail, offering immersive brand experiences, Online stores are experiencing a significant surge in growth, catering to the demand for convenience and broader accessibility.

Key Growth Catalysts:

- Economic Prosperity: A growing affluent demographic with increasing disposable incomes is a fundamental driver for luxury consumption.

- Global Tourism Hub: Mexico's appeal as a premier tourist destination significantly boosts luxury sales, especially in cosmopolitan centers and popular vacation spots.

- Modernized Infrastructure: Enhancements in urban infrastructure across major cities are improving the accessibility and shopping experience for luxury consumers.

- Evolving Consumer Values: A pronounced shift towards conscious consumption, emphasizing sustainable practices, ethical production, and unique experiential luxury offerings, is reshaping purchasing decisions.

Dominance and Strategic Insights: The prominent position of watches and jewelry underscores Mexico's deep appreciation for high-value, enduring luxury items and a strong sense of brand allegiance. The continued success of single-brand retail emphasizes the critical role of compelling brand narratives and the creation of exclusive environments in capturing consumer loyalty. Furthermore, the rapid ascent of online channels highlights the market's successful embrace of digital transformation and the growing consumer preference for seamless, accessible, and personalized shopping journeys.

Mexico Luxury Goods Market Product Developments

The Mexican luxury goods market is experiencing a wave of innovation across its diverse segments, with a particular emphasis on novel materials, refined designs, and the integration of cutting-edge technologies. Brands are proactively incorporating sustainable and ethically sourced materials, offering extensive personalization and customization options, and leveraging technology to elevate the customer journey. The increasing popularity of smartwatches and connected jewelry signifies a fusion of technology and tradition, while the strategic use of augmented reality (AR) and virtual reality (VR) is revolutionizing the in-store and online luxury shopping experience. These advancements are crucial for brands seeking to differentiate themselves, capture market share, and meet the escalating demand for innovative, personalized, and technologically integrated luxury products.

Challenges in the Mexico Luxury Goods Market Market

The Mexican luxury goods market navigates a complex terrain marked by several significant challenges. Navigating intricate import/export regulations and evolving taxation policies can pose substantial hurdles for market entry and sustained operations. Supply chain vulnerabilities, encompassing material sourcing complexities and logistical bottlenecks, can lead to product scarcity and price volatility, directly impacting profitability and the ability to meet consumer demand. Furthermore, the market is characterized by intense competition, stemming from both deeply entrenched international luxury houses and agile, emerging local brands, creating a competitive pressure that necessitates strategic differentiation and robust marketing efforts. For instance, import tariffs can significantly escalate the cost of goods, thereby eroding profit margins. Supply chain disruptions, particularly concerning the procurement of unique materials and efficient logistics, can impede the market's capacity to satisfy demand. Additionally, the presence of both globally recognized brands and aggressive local players intensifies the competition for market share.

Forces Driving Mexico Luxury Goods Market Growth

The Mexican luxury goods market is propelled by a confluence of powerful growth drivers. Foremost among these is the sustained economic expansion leading to an increasing affluence within the upper-income echelons of the Mexican population. Simultaneously, a burgeoning middle class is demonstrating a growing aspiration and capacity to engage with luxury purchases. The rapid advancement and widespread adoption of digital technologies, particularly sophisticated e-commerce platforms, are democratizing access to luxury goods and enhancing affordability. Finally, a proactive and supportive government stance towards foreign investment continues to foster an environment conducive to market expansion and the influx of international luxury brands.

Long-Term Growth Catalysts in the Mexico Luxury Goods Market

Long-term growth in the Mexican luxury goods market will be propelled by continued innovation in product design and technology, strategic partnerships between international and local brands, and expansion into new markets and customer segments. Investment in sustainable and ethical sourcing will also contribute to market growth by fulfilling consumer demands.

Emerging Opportunities in Mexico Luxury Goods Market

Emerging opportunities include the increasing popularity of personalized luxury experiences, the growing demand for sustainable and ethically produced goods, and the potential for expansion into new regional markets within Mexico. Leveraging social media and influencer marketing will also yield significant opportunities for brand promotion and reach.

Leading Players in the Mexico Luxury Goods Market Sector

- Giorgio Armani S p A

- Compagnie Financière Richemont SA

- Hermès

- The Swatch Group

- Patek Philippe SA

- PRADA S P A

- LVMH Moet Hennessy Louis Vuitton

- Kering

- Rolex SA

- H & M Hennes & Mauritz AB (H&M)

- The Estee Lauder Companies

Key Milestones in Mexico Luxury Goods Market Industry

- October 2020: Hermès launched its first beauty line, Rouge Hermès, expanding its product portfolio and targeting a new customer segment.

- November 2021: Chanel opened a new store in Malaysia (though not directly in Mexico, this reflects brand expansion strategies impacting the overall luxury landscape).

- February 2022: TOUS launched a new concept store in Kuala Lumpur, demonstrating continued expansion and brand building among international luxury players.

Strategic Outlook for Mexico Luxury Goods Market Market

The future of the Mexican luxury goods market appears bright, with substantial growth potential driven by rising disposable incomes, technological advancements, and evolving consumer preferences. Brands that successfully adapt to changing consumer behaviors, embrace technological innovations, and prioritize sustainability will be best positioned for success in this dynamic market. Strategic partnerships and expansion into underserved regions within Mexico present significant growth opportunities for existing and new market entrants.

Mexico Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

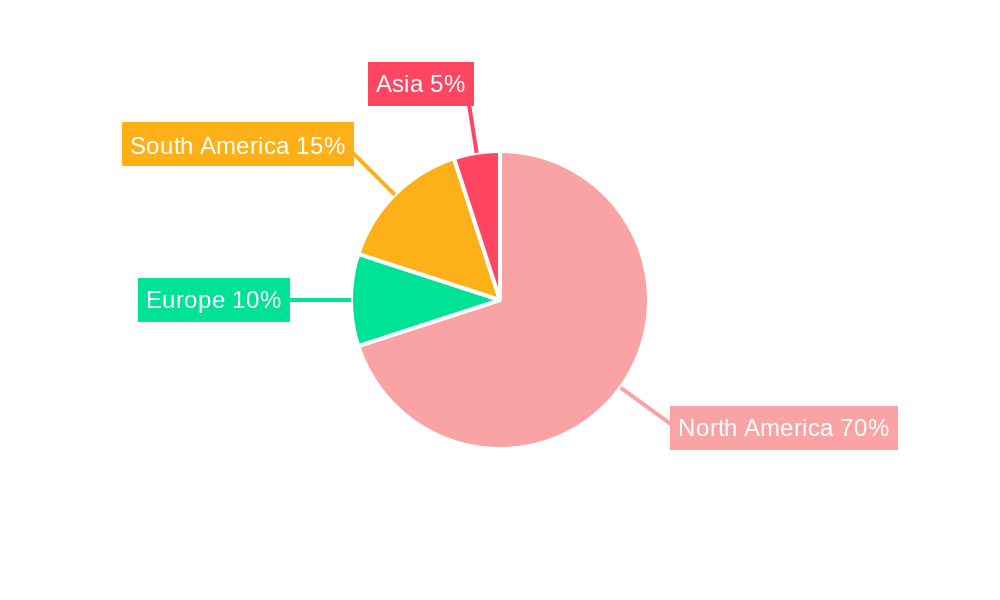

Mexico Luxury Goods Market Segmentation By Geography

- 1. Mexico

Mexico Luxury Goods Market Regional Market Share

Geographic Coverage of Mexico Luxury Goods Market

Mexico Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference for E-commerce Platform to Purchase Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermès

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Patek Philippe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRADA S P A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Estee Lauder Companies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Mexico Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Luxury Goods Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Mexico Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), The Estee Lauder Companies.

3. What are the main segments of the Mexico Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Increasing Preference for E-commerce Platform to Purchase Luxury Goods.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, TOUS, the Spanish luxury brand launched a new concept store in Kuala Lumpur, Malaysia. The new boutique features a large assortment of key categories including bags, jewelry, gemstones, and perfumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Mexico Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence