Key Insights

The North America travel retail market, encompassing sales within airports, train stations, and border crossings, demonstrates significant expansion. Driven by the post-pandemic rebound in air travel, rising disposable incomes, and a growing preference for convenient, duty-free shopping, the market is poised for substantial growth. Strategic collaborations between retailers and airlines, alongside an expanding airport infrastructure and the integration of digital technologies like mobile payments, further enhance purchasing incentives and personalized experiences. Key revenue-generating categories include beauty and cosmetics, spirits and tobacco, and luxury goods.

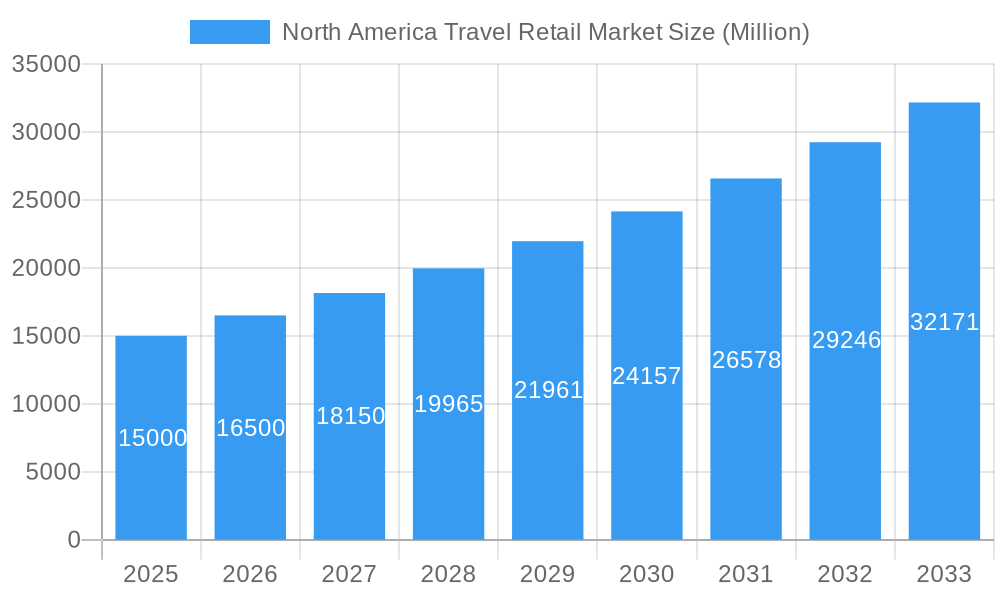

North America Travel Retail Market Market Size (In Billion)

Projected to grow at a Compound Annual Growth Rate (CAGR) of 4.07%, the North America travel retail market is estimated to reach a market size of $12.76 billion by 2025. This sustained expansion is underpinned by continued air passenger traffic increases, innovative retail formats, and an elevated focus on the passenger experience. The sector anticipates increased investment in technology, data analytics, and omnichannel strategies to personalize customer journeys and optimize sales performance. Regional economic factors and tourism density will influence localized growth, but the overall outlook remains exceptionally positive, presenting ample opportunities for market participants.

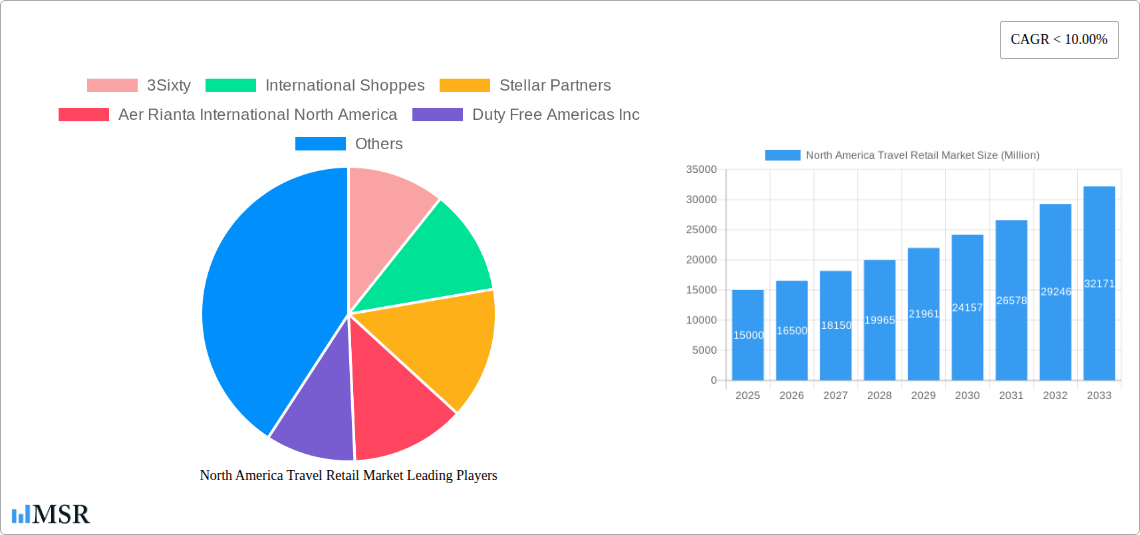

North America Travel Retail Market Company Market Share

Unlock Growth in the North America Travel Retail Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America travel retail market, offering invaluable insights for industry stakeholders seeking to navigate the evolving landscape. From market dynamics and leading players to emerging opportunities and future growth projections, this report equips you with the data-driven strategies needed to thrive. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033.

North America Travel Retail Market Market Concentration & Dynamics

This section delves into the competitive landscape of the North America travel retail market, examining market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with key players holding significant market share, although fragmentation exists within specific segments. The estimated market share of the top 5 players in 2025 is approximately 60%, indicating opportunities for both expansion and consolidation. M&A activity has been notable, with approximately xx deals recorded between 2019 and 2024, largely driven by the pursuit of scale and diversification. Innovation within the sector focuses on enhancing customer experience through technology and streamlining operations for increased efficiency. Regulatory changes, particularly those impacting duty-free allowances and cross-border trade, significantly impact market dynamics. Substitute products, such as online retail and local shopping, present ongoing competitive challenges. End-user preferences are shifting towards personalized experiences, seamless transactions, and omnichannel shopping, creating opportunities for companies to adapt and innovate.

North America Travel Retail Market Industry Insights & Trends

The North America travel retail market experienced a period of disruption followed by recovery in recent years, influenced by global events such as the COVID-19 pandemic and evolving travel patterns. The market size in 2025 is estimated at $xx Million, exhibiting a CAGR of xx% during the forecast period (2025-2033). Growth drivers include increasing air passenger traffic, rising disposable incomes, and a preference for convenience and curated shopping experiences. The rise of e-commerce and mobile technologies has introduced new channels, while consumers' increasing expectations for personalization, seamless payment systems, and loyalty programs demand innovative business models. The market is experiencing notable technological disruption, with automated retail concepts, AI-powered recommendations, and enhanced digital marketing campaigns reshaping how brands interact with their customers.

Key Markets & Segments Leading North America Travel Retail Market

The airports segment dominates the North America travel retail market, accounting for approximately 70% of total revenue in 2025. This dominance stems from high passenger traffic, a captive audience, and strategic partnerships with airport authorities.

Key Drivers for Airport Segment Dominance:

- High Passenger Traffic: Major hubs like New York JFK, LAX, and Chicago O'Hare contribute substantially to overall sales.

- Captive Audience: Travelers have limited alternative shopping opportunities within airport environments.

- Strategic Partnerships: Collaborations between retailers and airport authorities are key to securing prime locations and optimizing retail space.

- Duty-Free Sales: Duty-free offerings contribute significantly to the revenue generated within airport environments.

Other segments, such as cruise lines and border crossings, are experiencing moderate growth but lag behind the airport sector in terms of market share. The United States accounts for the largest share of the market, driven by its extensive airport network and significant tourist traffic. Canada and Mexico hold smaller but growing shares due to increased domestic and international travel.

North America Travel Retail Market Product Developments

Recent product innovations focus on leveraging technology to enhance the customer journey. The introduction of automated retail, personalized recommendations, and seamless mobile payments are creating a more efficient and engaging shopping experience. Companies are emphasizing the development of exclusive travel retail products and branding to create a sense of occasion and enhance the appeal of purchases. These advancements enhance customer loyalty and offer a competitive edge.

Challenges in the North America Travel Retail Market Market

The North America travel retail market faces several challenges, including increasing competition from e-commerce, fluctuating passenger traffic due to global events, and regulatory changes impacting duty-free sales. Supply chain disruptions and increased costs also pose significant challenges, affecting product availability and profitability. The constant need to adapt to evolving consumer preferences and enhance the shopping experience necessitates considerable investment in technology and personnel.

Forces Driving North America Travel Retail Market Growth

Key growth drivers include the anticipated recovery and growth in air passenger traffic, rising disposable incomes among travelers, and the increasing adoption of advanced technologies enhancing the shopping experience. Government initiatives to support tourism and economic development in key travel hubs will also fuel market expansion. Furthermore, increased collaboration between retailers and airport authorities is streamlining operations and improving customer experience, thereby driving sales.

Long-Term Growth Catalysts in the North America Travel Retail Market

Long-term growth hinges on continuous innovation, strategic partnerships, and market expansion. The development of new product lines tailored to the travel retail space will maintain consumer appeal. Strategic alliances between retailers, airlines, and airport authorities facilitate improved logistics and market penetration. Expanding into new, high-growth travel destinations can significantly boost revenue and market share.

Emerging Opportunities in North America Travel Retail Market

Emerging opportunities include the expansion of omnichannel strategies integrating online and offline shopping experiences, tapping into the growing demand for personalized and experiential retail, and utilizing advanced data analytics to optimize inventory management, promotional strategies, and consumer engagement. The development of sustainable and ethically sourced products will also appeal to environmentally conscious travelers.

Leading Players in the North America Travel Retail Market Sector

- 3Sixty

- International Shoppes

- Stellar Partners

- Aer Rianta International North America

- Duty Free Americas Inc

- Dufry

- DFS Group

- Heinemann Americas

- The Nuance Group (Canada) Inc

- ALFA Brands Inc

- List Not Exhaustive

Key Milestones in North America Travel Retail Market Industry

- June 2021: 3Sixty Duty Free partners with Global Crossing Airlines for onboard duty-free sales, expanding product reach and convenience for travelers.

- April 2021: Hudson Group launches a multi-brand automated retail concept, introducing a contactless, 24/7 shopping experience and showcasing innovation in the sector.

Strategic Outlook for North America Travel Retail Market Market

The North America travel retail market holds significant future potential, driven by ongoing technological advancements, evolving consumer preferences, and increased focus on personalized experiences. Companies that effectively integrate digital technologies, optimize supply chains, and develop strategic partnerships will capture the largest market share in the coming years. Investing in innovative products and services, along with proactive adaptation to regulatory changes, is crucial for continued success and sustainable growth within this dynamic market.

North America Travel Retail Market Segmentation

-

1. Retail Activity Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

- 1.7. Others (Stationery, Electronics, etc.)

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other(Railway Stations, Border, Downtown)

-

3. Geography

- 3.1. USA

- 3.2. Canada

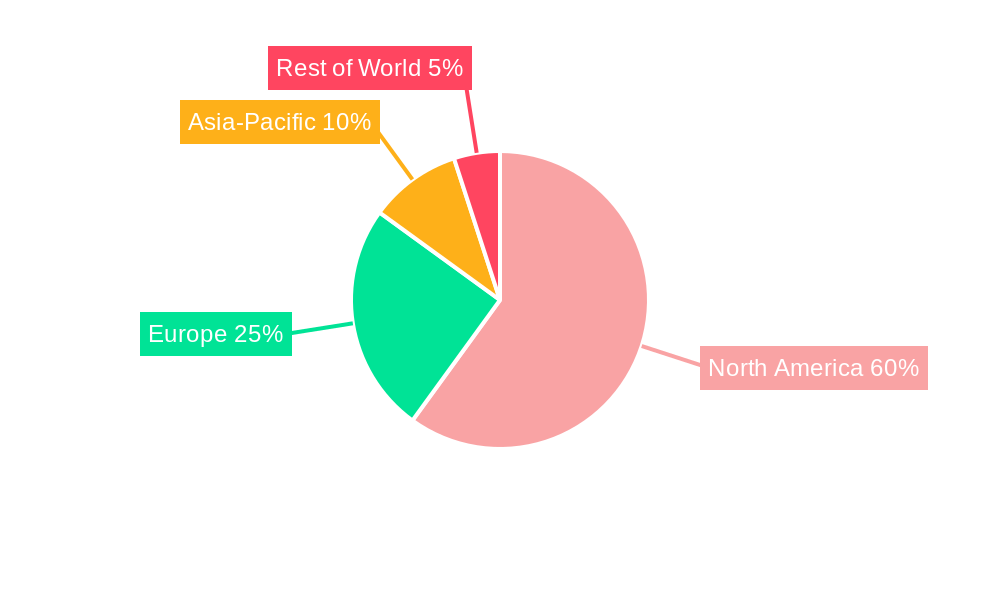

North America Travel Retail Market Segmentation By Geography

- 1. USA

- 2. Canada

North America Travel Retail Market Regional Market Share

Geographic Coverage of North America Travel Retail Market

North America Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Airport Retailing is Generating Higher Revenues than other Channels in North America Travel Retail Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others (Stationery, Electronics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other(Railway Stations, Border, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. USA

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. USA

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6. USA North America Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine & Spirits

- 6.1.4. Food & Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.1.7. Others (Stationery, Electronics, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.2.4. Other(Railway Stations, Border, Downtown)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. USA

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7. Canada North America Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine & Spirits

- 7.1.4. Food & Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.1.7. Others (Stationery, Electronics, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.2.4. Other(Railway Stations, Border, Downtown)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. USA

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 3Sixty

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 International Shoppes

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Stellar Partners

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Aer Rianta International North America

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Duty Free Americas Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Dufry

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 DFS Group

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Heinemann Americas

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 The Nuance Group (Canada) Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 ALFA Brands Inc *List Not Exhaustive

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 3Sixty

List of Figures

- Figure 1: Global North America Travel Retail Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: USA North America Travel Retail Market Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 3: USA North America Travel Retail Market Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 4: USA North America Travel Retail Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: USA North America Travel Retail Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: USA North America Travel Retail Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: USA North America Travel Retail Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: USA North America Travel Retail Market Revenue (billion), by Country 2025 & 2033

- Figure 9: USA North America Travel Retail Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Travel Retail Market Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 11: Canada North America Travel Retail Market Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 12: Canada North America Travel Retail Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Canada North America Travel Retail Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Canada North America Travel Retail Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Canada North America Travel Retail Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Travel Retail Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Canada North America Travel Retail Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Travel Retail Market Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 2: Global North America Travel Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global North America Travel Retail Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global North America Travel Retail Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global North America Travel Retail Market Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 6: Global North America Travel Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global North America Travel Retail Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global North America Travel Retail Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global North America Travel Retail Market Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 10: Global North America Travel Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global North America Travel Retail Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global North America Travel Retail Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Travel Retail Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the North America Travel Retail Market?

Key companies in the market include 3Sixty, International Shoppes, Stellar Partners, Aer Rianta International North America, Duty Free Americas Inc, Dufry, DFS Group, Heinemann Americas, The Nuance Group (Canada) Inc, ALFA Brands Inc *List Not Exhaustive.

3. What are the main segments of the North America Travel Retail Market?

The market segments include Retail Activity Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.76 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Airport Retailing is Generating Higher Revenues than other Channels in North America Travel Retail Market..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2021- 3Sixty Duty Free has partnered with Global Crossing Airlines to allow travellers to purchase a range of travel retail products via their onboard inflight duty free programme.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Travel Retail Market?

To stay informed about further developments, trends, and reports in the North America Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence