Key Insights

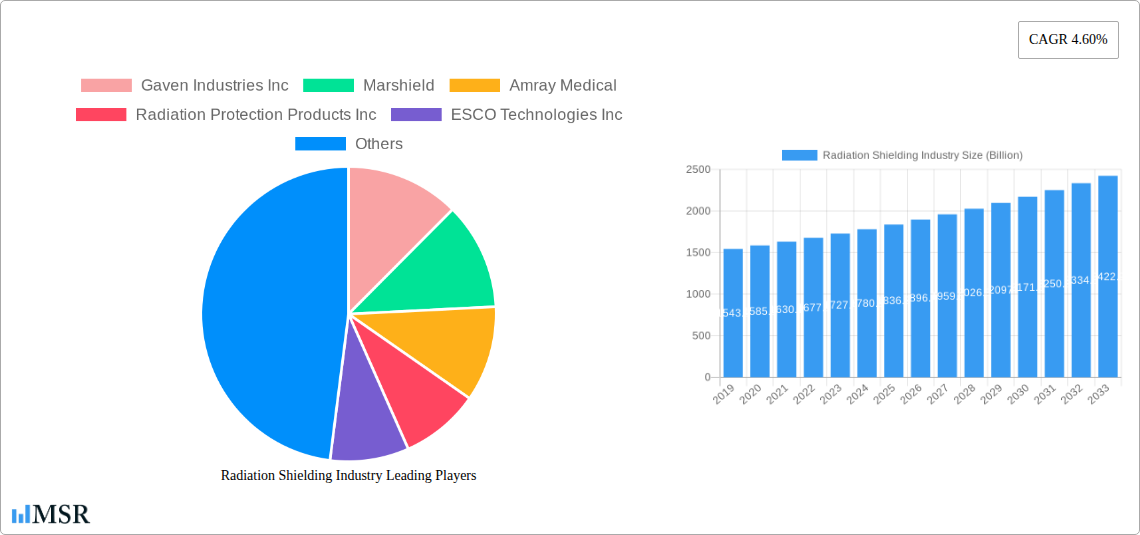

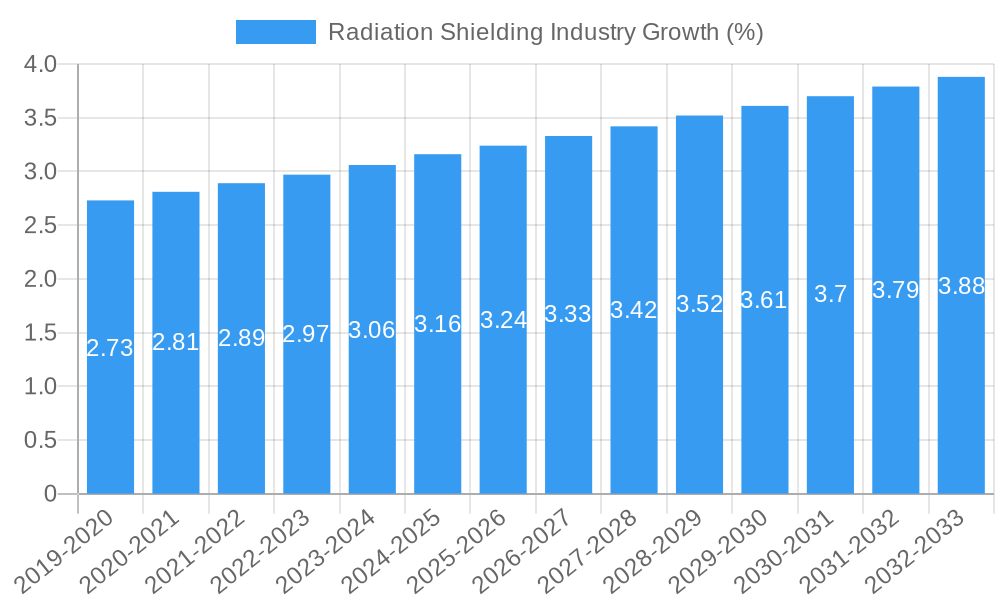

The global Radiation Shielding market is poised for robust expansion, currently valued at an estimated USD 1.8 billion. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.60%, projecting a significant upward trajectory through 2033. Key market drivers include the escalating adoption of advanced radiation therapy techniques for cancer treatment, the increasing demand for enhanced safety protocols in diagnostic imaging procedures, and a heightened awareness regarding radiation exposure risks across various industries. The expanding healthcare infrastructure, particularly in emerging economies, coupled with substantial investments in research and development for more effective and lightweight shielding materials, are further fueling market momentum. The market is segmented into Radiation Therapy Shielding and Diagnostic Shielding solutions, catering primarily to Hospitals and Diagnostic Centers, Research Institutes, and other end-users. These segments are driven by continuous innovation in medical technology and a growing emphasis on patient and staff safety.

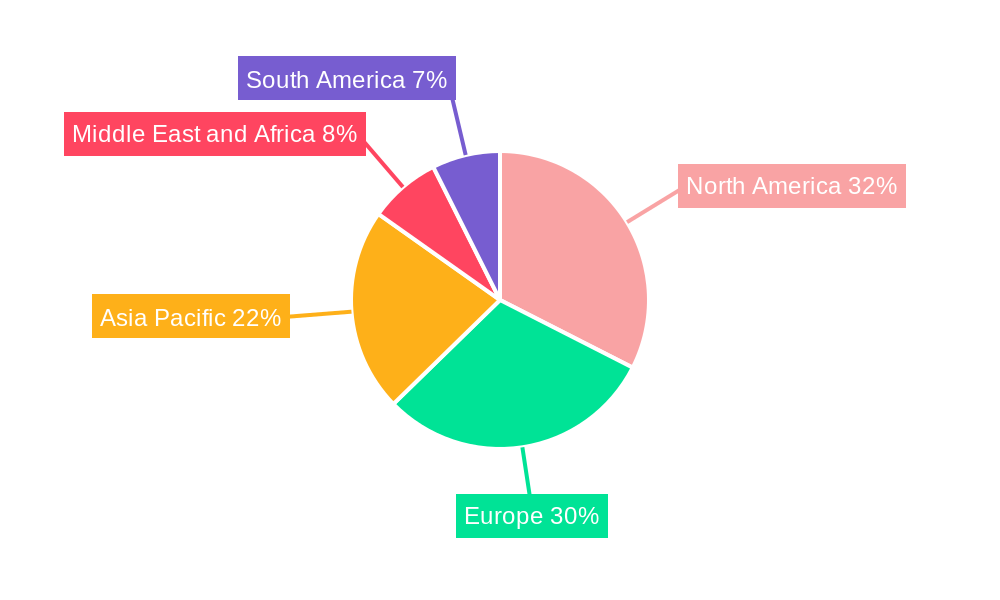

Geographically, North America and Europe currently represent dominant markets due to their well-established healthcare systems and early adoption of advanced radiation technologies. However, the Asia Pacific region is anticipated to witness the most substantial growth, propelled by rapid economic development, increasing healthcare expenditure, and a rising prevalence of diagnostic and therapeutic procedures. The Middle East and Africa, along with South America, also present significant untapped potential. While the market benefits from strong demand, challenges such as the high initial cost of advanced shielding materials and the need for skilled installation professionals could present some constraints. Nevertheless, the overarching trend points towards a consistently expanding market, driven by the indispensable need for radiation safety in an increasingly technologically driven world.

This in-depth report provides a definitive analysis of the global Radiation Shielding Industry, offering critical insights and actionable intelligence for radiation therapy shielding, diagnostic shielding, and other vital applications. Explore market dynamics, technological advancements, and strategic opportunities shaping this crucial sector through 2033, with a detailed base year analysis of 2025. Discover key trends impacting hospitals and diagnostic centers, research institutes, and diverse other end users.

Radiation Shielding Industry Market Concentration & Dynamics

The Radiation Shielding Industry exhibits a moderate to high market concentration, with a few key players dominating specific niches. Companies like Gaven Industries Inc, Marshield, Amray Medical, Radiation Protection Products Inc, ESCO Technologies Inc, Nelco Inc, Global Partners in Shielding Inc, Veritas Medical Solutions LLC, A&L Shielding, and Ray-Bar Engineering Corp are at the forefront. The innovation ecosystem is driven by continuous advancements in material science and manufacturing processes, leading to the development of lighter, more effective, and versatile shielding solutions. Regulatory frameworks, particularly those governing medical device safety and radiation exposure limits, play a significant role in shaping product development and market entry strategies. While substitute products like concrete and specialized paints exist, their efficacy and application scope are often limited compared to advanced radiation shielding materials and systems. End-user trends highlight a growing demand for integrated and customized solutions, particularly within the diagnostic shielding and radiation therapy shielding segments. Merger and acquisition activities, though not extensively documented in recent public records, are anticipated to increase as companies seek to consolidate market share, acquire specialized technologies, and expand their geographical reach. The Radiation Shielding Industry is characterized by a healthy competitive landscape, fostering innovation and driving down costs.

Radiation Shielding Industry Industry Insights & Trends

The Radiation Shielding Industry is projected to experience robust growth, driven by an escalating demand for advanced safety solutions across healthcare, industrial, and research sectors. The global radiation shielding market size is estimated to reach a substantial figure, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This upward trajectory is significantly influenced by the increasing prevalence of cancer cases worldwide, necessitating more sophisticated radiation therapy shielding techniques and equipment. Similarly, the expanding use of diagnostic imaging technologies, such as CT scanners and X-ray machines, fuels the demand for effective diagnostic shielding to protect both patients and medical professionals.

Technological disruptions are revolutionizing the industry. Innovations in composite materials, including advanced polymers and metal alloys, are yielding radiation shielding materials that offer superior attenuation capabilities with reduced weight and thickness. This is crucial for portable shielding solutions and for optimizing space within healthcare facilities. Furthermore, the development of smart shielding technologies, incorporating real-time monitoring and adaptive attenuation, is an emerging trend.

Evolving consumer behaviors within the healthcare sector are also playing a pivotal role. There's a growing emphasis on patient safety and compliance with stringent radiation exposure regulations, prompting healthcare providers to invest in state-of-the-art radiation shielding solutions. Research institutions are also expanding their utilization of particle accelerators and other radiation-generating equipment, further amplifying the need for specialized shielding. The integration of digital technologies and AI in healthcare is indirectly boosting the demand for shielded environments that can accommodate advanced imaging and treatment delivery systems. The Radiation Shielding Industry is thus poised for sustained expansion, characterized by innovation, increasing regulatory compliance, and a growing awareness of the critical importance of radiation protection.

Key Markets & Segments Leading Radiation Shielding Industry

The Radiation Shielding Industry is witnessing significant growth across several key markets and segments. North America, particularly the United States, currently leads the global market due to its advanced healthcare infrastructure, substantial investment in medical research, and stringent regulatory environment mandating high standards of radiation safety. The economic growth in this region, coupled with a high prevalence of diseases requiring diagnostic and therapeutic radiation interventions, directly translates into increased demand for radiation therapy shielding and diagnostic shielding solutions.

Dominant Solution Segments:

- Radiation Therapy Shielding: This segment is a primary growth engine, driven by the increasing incidence of cancer globally and advancements in radiotherapy techniques. The demand for high-performance shielding for linear accelerators, proton therapy units, and brachytherapy applications is substantial.

- Diagnostic Shielding: The widespread adoption of advanced medical imaging modalities like CT, MRI, and X-ray in hospitals and diagnostic centers fuels continuous demand for effective shielding solutions to ensure patient and staff safety.

Dominant End User Segments:

- Hospitals and Diagnostic Centers: These institutions represent the largest consumer base for radiation shielding products and solutions. The continuous expansion of healthcare facilities and upgrades to existing medical equipment necessitate ongoing investment in shielding. Factors like government healthcare spending and private insurance coverage play a crucial role in driving demand.

- Research Institutes: As scientific research continues to explore the frontiers of nuclear physics, medical research, and materials science, the need for specialized shielding for particle accelerators, research reactors, and experimental setups in research institutes is significant. This segment often requires highly customized and robust shielding solutions.

The dominance of these segments is further reinforced by governmental initiatives promoting advanced medical technologies and research, alongside an aging global population that often requires more frequent diagnostic imaging and radiation-based treatments. The robust infrastructure in developed economies allows for the seamless integration of these shielding solutions, while emerging economies are rapidly catching up, presenting vast untapped potential.

Radiation Shielding Industry Product Developments

The Radiation Shielding Industry is experiencing a wave of product innovations focused on enhancing efficacy, reducing weight, and improving ease of deployment. Developments in advanced composite materials, such as lead-polymer hybrids and tungsten-infused composites, are offering superior radiation attenuation properties compared to traditional lead shielding. This allows for the creation of lighter, more flexible, and thinner shielding components, suitable for a wider range of applications, including portable shielding devices and custom-fitted solutions for complex geometries within medical facilities. Integration of smart features, like real-time monitoring of radiation levels and adaptive shielding capabilities, is also an emerging trend, enhancing safety and operational efficiency.

Challenges in the Radiation Shielding Industry Market

The Radiation Shielding Industry faces several significant challenges that can impede market growth. Regulatory hurdles and the complex approval processes for new shielding materials and devices can lead to prolonged time-to-market. Supply chain disruptions, particularly for raw materials like lead and specialized composites, can impact production timelines and cost-effectiveness. Furthermore, intense competition among established players and emerging manufacturers can put pressure on profit margins. The high initial investment required for advanced shielding technologies can also be a barrier for smaller healthcare providers or research institutions, especially in developing regions.

Forces Driving Radiation Shielding Industry Growth

Several key factors are propelling the growth of the Radiation Shielding Industry. The increasing global incidence of cancer and the corresponding rise in the adoption of advanced radiotherapy treatments are primary drivers. Simultaneously, the expanding use of diagnostic imaging technologies in healthcare worldwide, coupled with stringent regulations mandating radiation protection for patients and medical personnel, significantly boosts demand. Technological advancements in material science, leading to more effective, lightweight, and cost-efficient shielding solutions, also play a crucial role. Furthermore, increasing government investments in healthcare infrastructure and medical research, particularly in emerging economies, are creating new market opportunities.

Challenges in the Radiation Shielding Industry Market

Long-term growth catalysts for the Radiation Shielding Industry lie in continued innovation and market expansion. The development of novel, eco-friendly radiation shielding materials with comparable or superior performance to lead will be critical for sustainability. Strategic partnerships between shielding manufacturers and medical device companies will foster integrated solutions that meet evolving clinical needs. Furthermore, expansion into emerging markets in Asia-Pacific, Latin America, and Africa, where healthcare infrastructure is rapidly developing, presents substantial growth potential. Focusing on niche applications, such as portable shielding for field use or specialized shielding for nuclear medicine, will also contribute to sustained expansion.

Emerging Opportunities in Radiation Shielding Industry

Emerging opportunities within the Radiation Shielding Industry are abundant, driven by technological advancements and evolving global needs. The growing demand for miniaturized and portable shielding solutions for remote healthcare access and emergency response is a significant trend. Development of advanced materials with inherent radiation-blocking properties, beyond traditional lead, will open new application avenues. The increasing focus on nuclear medicine and advanced imaging techniques creates opportunities for specialized shielding for PET scanners and cyclotrons. Furthermore, the burgeoning space exploration sector and the need for radiation protection for astronauts and sensitive equipment present a nascent but potentially lucrative market.

Leading Players in the Radiation Shielding Industry Sector

- Gaven Industries Inc

- Marshield

- Amray Medical

- Radiation Protection Products Inc

- ESCO Technologies Inc

- Nelco Inc

- Global Partners in Shielding Inc

- Veritas Medical Solutions LLC

- A&L Shielding

- Ray-Bar Engineering Corp

Key Milestones in Radiation Shielding Industry Industry

- April 2022: Radiaction Medical Ltd. received Food and Drug Administration 510(K) clearance to market its RadiationShield System in the United States, enhancing options for advanced radiation protection.

- March 2022: Rampart IC secured an exclusive distribution agreement with Japan Lifeline (JLL), assuring distribution to the Japanese market. The Rampart M1128, a portable and adjustable device with 1mm lead equivalency shielding panels, offers a significant protective area for medical professionals, impacting the portable shielding segment.

Strategic Outlook for Radiation Shielding Industry Market

- April 2022: Radiaction Medical Ltd. received Food and Drug Administration 510(K) clearance to market its RadiationShield System in the United States, enhancing options for advanced radiation protection.

- March 2022: Rampart IC secured an exclusive distribution agreement with Japan Lifeline (JLL), assuring distribution to the Japanese market. The Rampart M1128, a portable and adjustable device with 1mm lead equivalency shielding panels, offers a significant protective area for medical professionals, impacting the portable shielding segment.

Strategic Outlook for Radiation Shielding Industry Market

The strategic outlook for the Radiation Shielding Industry market is exceptionally positive, characterized by ongoing innovation and expanding applications. Growth accelerators include the relentless pursuit of advanced materials that offer superior attenuation with reduced weight and cost, catering to the evolving needs of hospitals and diagnostic centers and research institutes. Strategic opportunities lie in developing integrated shielding systems that seamlessly incorporate with new diagnostic and therapeutic equipment, as well as in expanding into underserved emerging markets. The industry's focus on enhancing patient and staff safety, coupled with global regulatory trends, ensures a sustained demand for high-performance radiation shielding solutions, positioning the market for significant future growth.

Radiation Shielding Industry Segmentation

-

1. Solution

- 1.1. Radiation Therapy Shielding

- 1.2. Diagnostic Shielding

-

2. End User

- 2.1. Hospitals and Diagnostic Centers

- 2.2. Research Institutes

- 2.3. Other End Users

Radiation Shielding Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Radiation Shielding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Nuclear Medicine and Radiation Therapy for Diagnosis and Treatment; Rising Burden of Chronic Diseases; Growing Safety Awareness Among People Working in Radiation-prone Environments

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Among Healthcare Professionals; High Cost of Radiation Shielding

- 3.4. Market Trends

- 3.4.1. Diagnostic Shielding Holds Significant Share in the Global Medical Radiation Shielding Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Radiation Therapy Shielding

- 5.1.2. Diagnostic Shielding

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals and Diagnostic Centers

- 5.2.2. Research Institutes

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Radiation Therapy Shielding

- 6.1.2. Diagnostic Shielding

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals and Diagnostic Centers

- 6.2.2. Research Institutes

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Radiation Therapy Shielding

- 7.1.2. Diagnostic Shielding

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals and Diagnostic Centers

- 7.2.2. Research Institutes

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Radiation Therapy Shielding

- 8.1.2. Diagnostic Shielding

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals and Diagnostic Centers

- 8.2.2. Research Institutes

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Middle East and Africa Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Radiation Therapy Shielding

- 9.1.2. Diagnostic Shielding

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals and Diagnostic Centers

- 9.2.2. Research Institutes

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. South America Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Radiation Therapy Shielding

- 10.1.2. Diagnostic Shielding

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals and Diagnostic Centers

- 10.2.2. Research Institutes

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Radiation Shielding Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Gaven Industries Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Marshield

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Amray Medical

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Radiation Protection Products Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ESCO Technologies Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nelco Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Global Partners in Shielding Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Veritas Medical Solutions LLC*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 A&L Shielding

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ray-Bar Engineering Corp

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Gaven Industries Inc

List of Figures

- Figure 1: Global Radiation Shielding Industry Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 3: North America Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 5: South America Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 7: Europe Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 9: Asia Pacific Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 11: MEA Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Radiation Shielding Industry Revenue (Billion), by Solution 2024 & 2032

- Figure 13: North America Radiation Shielding Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Radiation Shielding Industry Revenue (Billion), by End User 2024 & 2032

- Figure 15: North America Radiation Shielding Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 17: North America Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Radiation Shielding Industry Revenue (Billion), by Solution 2024 & 2032

- Figure 19: Europe Radiation Shielding Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 20: Europe Radiation Shielding Industry Revenue (Billion), by End User 2024 & 2032

- Figure 21: Europe Radiation Shielding Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 23: Europe Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Radiation Shielding Industry Revenue (Billion), by Solution 2024 & 2032

- Figure 25: Asia Pacific Radiation Shielding Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 26: Asia Pacific Radiation Shielding Industry Revenue (Billion), by End User 2024 & 2032

- Figure 27: Asia Pacific Radiation Shielding Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 29: Asia Pacific Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Radiation Shielding Industry Revenue (Billion), by Solution 2024 & 2032

- Figure 31: Middle East and Africa Radiation Shielding Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 32: Middle East and Africa Radiation Shielding Industry Revenue (Billion), by End User 2024 & 2032

- Figure 33: Middle East and Africa Radiation Shielding Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 35: Middle East and Africa Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Radiation Shielding Industry Revenue (Billion), by Solution 2024 & 2032

- Figure 37: South America Radiation Shielding Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 38: South America Radiation Shielding Industry Revenue (Billion), by End User 2024 & 2032

- Figure 39: South America Radiation Shielding Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Radiation Shielding Industry Revenue (Billion), by Country 2024 & 2032

- Figure 41: South America Radiation Shielding Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Radiation Shielding Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 3: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 4: Global Radiation Shielding Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: United States Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: Canada Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: Mexico Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 10: Brazil Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Mexico Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: Rest of South America Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Germany Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: France Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: Italy Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Spain Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Russia Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 22: China Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: Japan Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: India Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: South Korea Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 30: Middle East Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: Africa Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 33: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 34: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 35: United States Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Canada Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Mexico Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 38: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 39: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 40: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 41: Germany Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 43: France Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Italy Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 45: Spain Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 47: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 48: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 49: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 50: China Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: Japan Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: India Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 53: Australia Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: South Korea Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 56: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 57: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 58: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 59: GCC Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 60: South Africa Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 61: Rest of Middle East and Africa Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 62: Global Radiation Shielding Industry Revenue Billion Forecast, by Solution 2019 & 2032

- Table 63: Global Radiation Shielding Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 64: Global Radiation Shielding Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 65: Brazil Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 66: Argentina Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 67: Rest of South America Radiation Shielding Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Shielding Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Radiation Shielding Industry?

Key companies in the market include Gaven Industries Inc, Marshield, Amray Medical, Radiation Protection Products Inc, ESCO Technologies Inc, Nelco Inc, Global Partners in Shielding Inc, Veritas Medical Solutions LLC*List Not Exhaustive, A&L Shielding, Ray-Bar Engineering Corp.

3. What are the main segments of the Radiation Shielding Industry?

The market segments include Solution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Nuclear Medicine and Radiation Therapy for Diagnosis and Treatment; Rising Burden of Chronic Diseases; Growing Safety Awareness Among People Working in Radiation-prone Environments.

6. What are the notable trends driving market growth?

Diagnostic Shielding Holds Significant Share in the Global Medical Radiation Shielding Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Among Healthcare Professionals; High Cost of Radiation Shielding.

8. Can you provide examples of recent developments in the market?

In April 2022, Radiaction Medical Ltd. received Food and Drug Administration 510(K) clearance to market its RadiationShield System in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Shielding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Shielding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Shielding Industry?

To stay informed about further developments, trends, and reports in the Radiation Shielding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence