Key Insights

The Singapore retail market is poised for robust expansion, projected to reach $144.42 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.7% through 2033. This growth is propelled by increasing disposable incomes, the booming e-commerce sector driven by technological adoption and high internet penetration, and a growing consumer demand for convenience. Tourism and Singapore's strategic location further enhance market dynamism. Key trends include omnichannel integration, personalized customer experiences, and a heightened focus on sustainability. While challenges like rising operational costs and global competition persist, the market outlook remains favorable due to sustained consumer demand and supportive government initiatives.

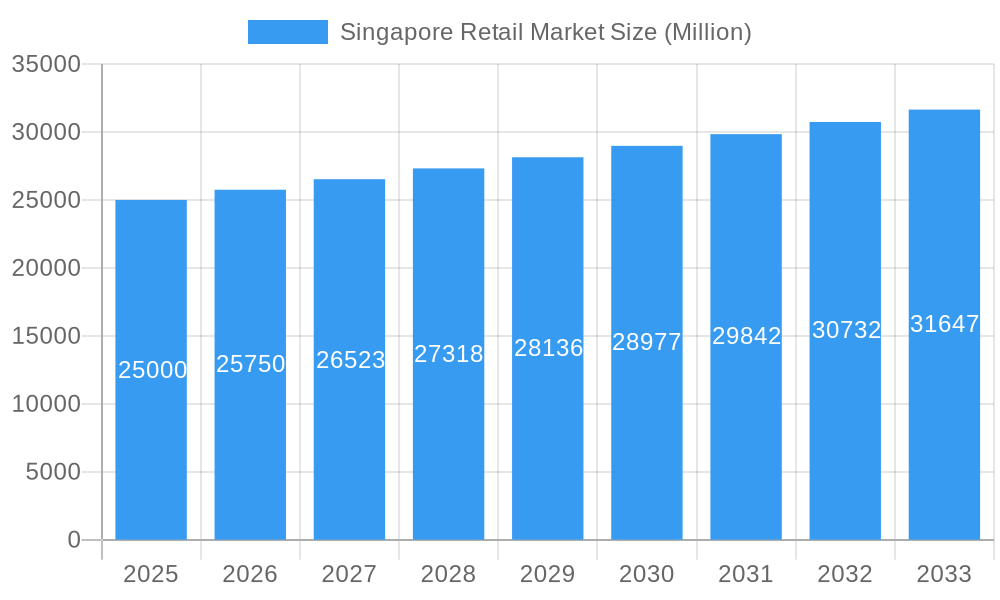

Singapore Retail Market Market Size (In Billion)

Competitive forces in the Singapore retail sector are intense. Established retailers such as Dairy Farm International Holdings and NTUC FairPrice are challenged by prominent e-commerce platforms and specialized niche players. Companies like Sheng Siong Group Ltd and Japan Foods Holding Ltd highlight market diversification. The presence of international brands, including Watsons and RedMart, underscores global interest. Success in this environment hinges on adapting to evolving consumer preferences, embracing technological innovation, and delivering exceptional customer experiences. The sustained growth trajectory presents significant opportunities for both established and emerging businesses, emphasizing the critical importance of understanding local market dynamics and consumer behavior.

Singapore Retail Market Company Market Share

Singapore Retail Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Singapore retail market, covering market dynamics, industry trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers invaluable insights for investors, retailers, and industry stakeholders seeking to navigate this dynamic market. Expect detailed analysis supported by robust data and projections, illuminating opportunities and challenges within the S$XX Million market.

Singapore Retail Market Market Concentration & Dynamics

The Singapore retail market exhibits a dynamic interplay of concentration and competition. While established players like Dairy Farm International Holdings (DFI), Sheng Siong Group Ltd, and NTUC FairPrice hold significant market share, the landscape is also characterized by a vibrant ecosystem of smaller businesses and emerging e-commerce players. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately xx% combined market share.

- Market Share: Dairy Farm International Holdings (DFI) and Sheng Siong Group Ltd are expected to retain the largest market shares in 2025, with xx% and xx% respectively. NTUC FairPrice follows closely behind.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on consolidation within specific segments like grocery and convenience stores. The forecast period (2025-2033) anticipates a further xx deals, driven by both organic growth and strategic acquisitions.

- Innovation Ecosystem: Singapore's robust technology infrastructure and government support for innovation foster a dynamic environment for retail tech startups. This is evident in the growth of e-commerce platforms and the adoption of advanced technologies like AI and big data analytics.

- Regulatory Framework: Singapore's regulatory framework emphasizes consumer protection and fair competition. Regulations regarding data privacy and e-commerce practices are continuously evolving to keep pace with technological advancements.

- Substitute Products: The rise of online marketplaces and direct-to-consumer brands presents a growing challenge to traditional brick-and-mortar retailers, necessitating a shift towards omnichannel strategies.

- End-User Trends: Singaporean consumers exhibit a preference for convenience, quality, and personalized experiences. This drives the demand for seamless online and offline shopping experiences, personalized recommendations, and sustainable and ethically sourced products.

Singapore Retail Market Industry Insights & Trends

The Singapore retail market is poised for robust expansion, with projections indicating a market size of S$XX Million by 2025 and an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This sustained growth is underpinned by a confluence of powerful catalysts:

- Digital Transformation and E-commerce Dominance: The accelerated adoption of e-commerce, amplified by shifts in consumer behavior during and post-pandemic, continues to fundamentally reshape the retail ecosystem. Online sales channels are no longer just an option but a critical component of any successful retail strategy.

- Pervasive Technological Integration: The increasing implementation of cutting-edge technologies such as Artificial Intelligence (AI) for hyper-personalization, big data analytics for deep consumer insights, and blockchain for enhanced supply chain transparency, are unlocking unprecedented opportunities for operational efficiency and enriched customer experiences.

- Dynamic Consumer Expectations: Modern consumers are increasingly prioritizing seamless convenience, highly personalized interactions, and demonstrably sustainable and ethical product offerings. Retailers who can effectively cater to these evolving demands will gain a significant competitive edge.

- Market Scale and Trajectory: With an estimated market value of S$xx Million in 2024, the Singapore retail sector is projected to ascend to S$xx Million by 2033, signifying a healthy and consistent CAGR of xx%.

- Core Growth Engines: A strong foundation of economic prosperity, rising disposable incomes, and a youthful, highly digitally-literate population are collectively fueling the market's expansive trajectory.

- Navigating Market Hurdles: While growth prospects are bright, retailers must proactively address the challenges posed by a fiercely competitive marketplace and escalating operational expenditures.

Key Markets & Segments Leading Singapore Retail Market

The dominant segments in the Singapore retail market include grocery, fashion, and electronics. The grocery segment, spearheaded by players like Sheng Siong Group Ltd and NTUC FairPrice, holds the largest market share.

- Drivers of Grocery Segment Dominance:

- High consumer spending on groceries due to rising household incomes

- Strong brand recognition of established players

- Effective supply chain management and efficient distribution networks

- Government support for food security initiatives

The dominance of these segments is rooted in factors like population density, high disposable income, and the increasing demand for convenient shopping options. Further granular analysis highlights the success of omnichannel strategies, particularly in the grocery segment. The rise of e-groceries has enhanced customer convenience, leading to market expansion in this sector.

Singapore Retail Market Product Developments

Innovations in the Singapore retail sector are increasingly focused on creating immersive and efficient customer journeys. This includes the seamless integration of smart technologies within physical retail spaces, the deployment of AI-driven recommendation engines for highly personalized product suggestions, and a growing emphasis on the availability of ethically sourced and sustainable product lines. These advancements are not only elevating customer satisfaction but also bolstering the competitive standing of retailers. Furthermore, the strategic pivot towards robust omnichannel strategies underscores a commitment to creating a fluid and integrated experience across online and offline touchpoints, fostering deeper customer engagement and leveraging data-driven insights for more impactful and personalized marketing initiatives.

Challenges in the Singapore Retail Market Market

The trajectory for sustained long-term growth in the Singapore retail market hinges on the proactive cultivation of strategic alliances, the relentless pursuit of technological advancements, and judicious expansion into emerging markets. Forging collaborative partnerships with innovative technology providers and demonstrating a keen ability to adapt to the ever-shifting landscape of consumer preferences are paramount for maintaining momentum. The broader Southeast Asian region presents particularly compelling long-term growth prospects for astute retailers.

Forces Driving Singapore Retail Market Growth

Technological advancements, rising disposable incomes, and supportive government policies are key growth drivers. The adoption of e-commerce technologies and the expansion of digital payment options enhance customer convenience and accessibility. Government initiatives aimed at promoting innovation and entrepreneurship in the retail sector further fuel market expansion.

Challenges in the Singapore Retail Market Market

The trajectory for sustained long-term growth in the Singapore retail market hinges on the proactive cultivation of strategic alliances, the relentless pursuit of technological advancements, and judicious expansion into emerging markets. Forging collaborative partnerships with innovative technology providers and demonstrating a keen ability to adapt to the ever-shifting landscape of consumer preferences are paramount for maintaining momentum. The broader Southeast Asian region presents particularly compelling long-term growth prospects for astute retailers.

Emerging Opportunities in Singapore Retail Market

Emerging opportunities lie in personalized shopping experiences, the adoption of sustainable practices, and the development of innovative retail technologies. The integration of augmented reality and virtual reality in shopping experiences could further enhance customer engagement. Expanding into niche markets like organic food and personalized health products offers potential for growth.

Leading Players in the Singapore Retail Market Sector

- Japan Foods Holding Ltd

- Sheng Siong Group Ltd

- Watsons

- RedMart Ltd

- ABR Holdings Ltd

- NTUC FairPrice

- QAF Limited

- U Stars

- Dairy Farm International Holdings (DFI)

- Font Creative Pte Ltd

Key Milestones in Singapore Retail Market Industry

- April 2021: Closure of Naiise, highlighting the challenges faced by smaller retailers during the pandemic. This event underscored the need for adaptability and resilience in the face of economic downturns.

Strategic Outlook for Singapore Retail Market Market

The Singapore retail market is characterized by substantial long-term growth potential, propelled by ongoing technological innovation, a deep understanding of evolving consumer demands, and a supportive regulatory environment fostered by government initiatives. Success in the coming years will be intrinsically linked to the formation of strategic partnerships, the effective implementation of omnichannel strategies, and an unwavering focus on delivering exceptional customer experiences. The future prosperity of the market will largely depend on retailers' agility in adapting to the dynamic retail landscape, their commitment to embracing digital transformation, and their dedication to consistently providing superior value to their consumers.

Singapore Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 2.2. Specialty Stores

- 2.3. Department Stores

- 2.4. E-commerce

- 2.5. Other Distribution Channels

Singapore Retail Market Segmentation By Geography

- 1. Singapore

Singapore Retail Market Regional Market Share

Geographic Coverage of Singapore Retail Market

Singapore Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upgrading Technology is Helping the Market to Record More Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 5.2.2. Specialty Stores

- 5.2.3. Department Stores

- 5.2.4. E-commerce

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Foods Holding Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sheng Siong Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Watsons

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedMart Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABR Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NTUC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QAF Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 U Stars

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dairy Farm International Holdings (DFI)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Font Creative Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Japan Foods Holding Ltd

List of Figures

- Figure 1: Singapore Retail Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Singapore Retail Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Singapore Retail Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Retail Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Singapore Retail Market?

Key companies in the market include Japan Foods Holding Ltd, Sheng Siong Group Ltd, Watsons, RedMart Ltd, ABR Holdings Ltd, NTUC, QAF Limited, U Stars, Dairy Farm International Holdings (DFI), Font Creative Pte Ltd.

3. What are the main segments of the Singapore Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 144.42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upgrading Technology is Helping the Market to Record More Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2021, Singapore homegrown retailer Naiise has shut down after struggling to survive through the pandemic, with its owner Dennis Tay filing for personal bankruptcy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Retail Market?

To stay informed about further developments, trends, and reports in the Singapore Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence