Key Insights

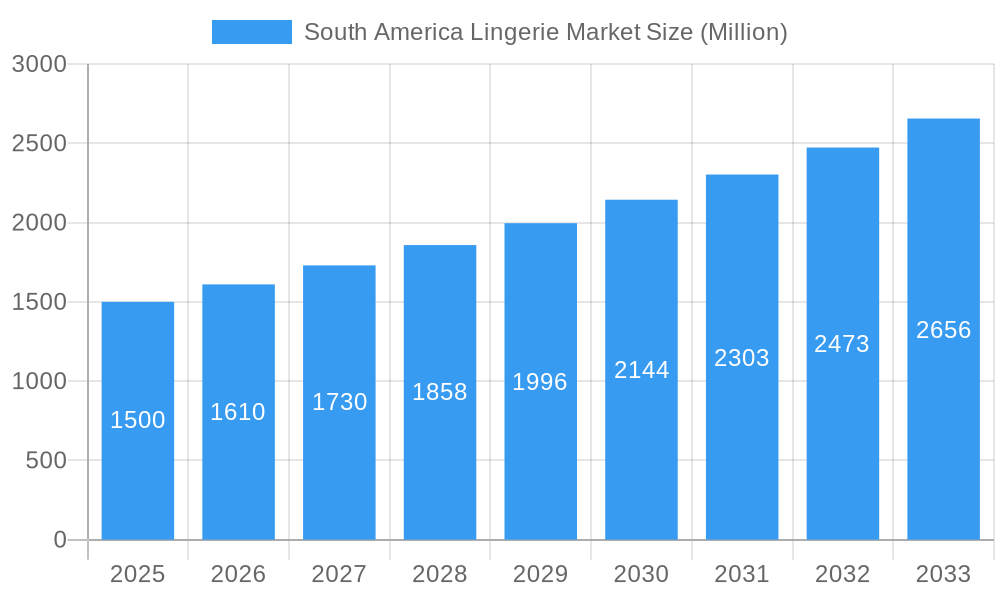

The South American lingerie market, projected to reach $40.09 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 6% through 2033, is experiencing significant expansion. Key growth drivers include rising disposable incomes in major economies like Brazil and Argentina, increased demand for inclusive sizing and designs driven by body positivity movements, and the growing convenience of e-commerce. While comfort and functionality remain paramount, a notable trend towards sustainable and ethically produced lingerie is emerging.

South America Lingerie Market Market Size (In Billion)

Despite these positive trends, the market faces challenges such as economic instability affecting discretionary spending and intense competition from both international and local brands. Successful market penetration requires product innovation, strategic marketing, and a robust online presence. Brassieres and briefs continue to dominate product segments, with online retail channels demonstrating substantial growth. Leading players like CLO intimo, Leonisa, and Victoria's Secret & Co. are actively capitalizing on these dynamics. Brazil and Argentina are identified as primary market contributors, necessitating a focus on their unique consumer preferences and purchasing behaviors.

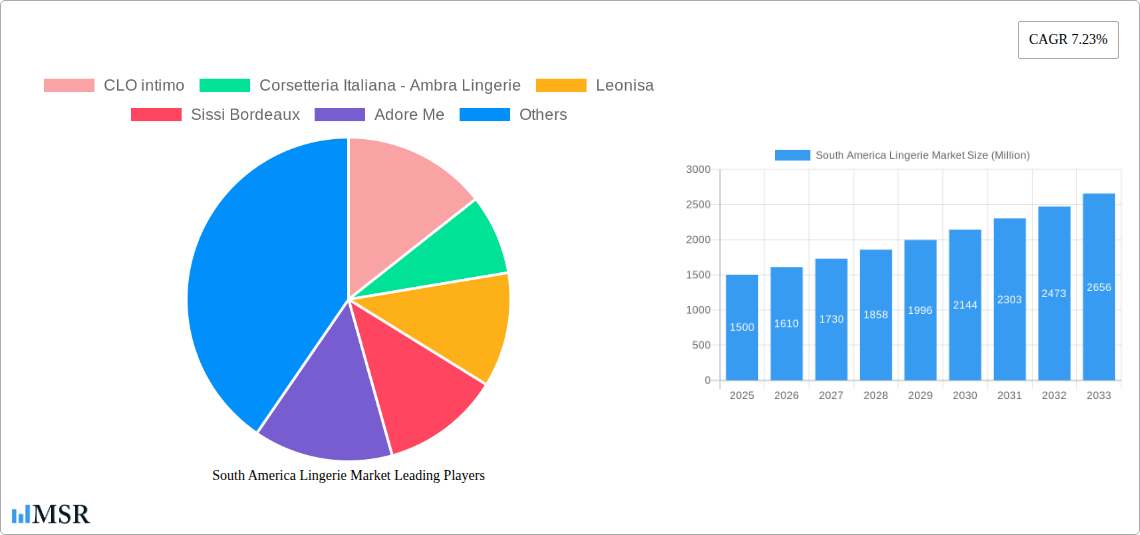

South America Lingerie Market Company Market Share

This comprehensive market analysis provides critical insights into the South America Lingerie Market. The report examines market size, growth catalysts, competitive strategies, and future outlooks for the period 2025-2033, with a historical context from 2019 to 2024.

South America Lingerie Market Market Concentration & Dynamics

The South America lingerie market exhibits a moderately concentrated landscape, with a handful of major players like Leonisa and Victoria's Secret & Co. holding significant market share. However, the presence of numerous smaller regional and local brands contributes to a competitive environment. The market is characterized by a dynamic innovation ecosystem, with continuous product development and diversification in terms of fabric, design, and functionality. Regulatory frameworks, while varying across countries, generally focus on product safety and labeling standards. Substitute products, such as loungewear and sleepwear, pose a degree of competitive pressure, particularly in the lower price segments. Consumer trends indicate increasing preference for comfort, sustainability, and body-positive designs. Mergers and acquisitions (M&A) activity in the sector has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, indicating a potential for future consolidation. Market share data suggests Leonisa holds approximately xx% of the market, followed by Victoria's Secret & Co. with approximately xx%, while other major players like CLO intimo and Sissi Bordeaux collectively account for another xx%.

- Market Concentration: Moderately Concentrated

- M&A Deal Count (2019-2024): xx

- Key Players Market Share (Estimated 2025): Leonisa (xx%), Victoria's Secret & Co. (xx%), Others (xx%)

- Innovation Ecosystem: High level of product innovation

- Regulatory Landscape: Varies by country; focuses on safety and labeling.

South America Lingerie Market Industry Insights & Trends

The South America lingerie market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size in 2025 is estimated at $xx Million, expected to reach $xx Million by 2033. This growth is driven by several factors: rising disposable incomes, increasing awareness of body positivity, expanding e-commerce penetration, and a growing preference for premium and specialized lingerie products. Technological advancements, such as the use of innovative fabrics and smart technologies, are disrupting traditional manufacturing and retail practices. Consumer behavior is evolving, with a strong shift towards online shopping and greater demand for personalized and customized products catering to diverse body types and preferences. Furthermore, the market is seeing a rise in demand for sustainable and ethically sourced lingerie, influencing brand strategies and product development. Market segmentation based on age groups reveals a significant portion of the market is coming from the millennial and Gen Z demographics, driving demand for diversity and inclusivity in designs.

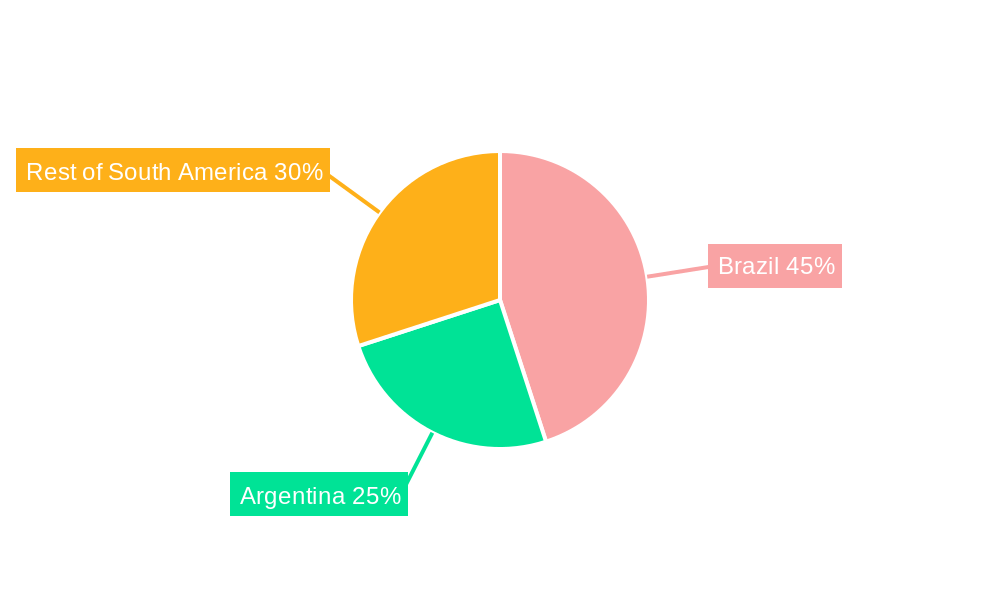

Key Markets & Segments Leading South America Lingerie Market

Brazil and Colombia currently represent the largest markets within South America for lingerie, accounting for approximately xx% and xx% of the total market value, respectively. The Brassiere segment holds the largest market share within the product type category, driven by a high demand and the wide variety of styles and functionalities offered.

Dominant Regions/Countries:

- Brazil

- Colombia

Dominant Segments (By Product Type):

- Brassieres: This segment is fueled by high demand across various styles and functionalities. The preference for comfortable and supportive bras continues to drive growth.

- Briefs: This segment witnesses significant growth parallel with the brassiere segment, reflecting consumer preference for coordinated sets.

Dominant Segments (By Distribution Channel):

- Online Retail Stores: The increasing penetration of e-commerce is driving this segment's rapid growth, enhanced by convenience and access to a broader selection.

- Specialty Stores: These stores offer personalized service and expert advice, leading to strong sales in higher-priced segments.

Drivers for Dominant Segments:

- Economic Growth: Rising disposable incomes in key markets fuel premium lingerie purchases.

- E-commerce Expansion: Enhanced online retail presence improves accessibility and convenience.

- Strong Brand Awareness: Successful marketing strategies and established brand loyalty in both product type and distribution channel enhance sales.

South America Lingerie Market Product Developments

The South America lingerie market showcases continuous product innovation, with a strong focus on enhancing comfort, functionality, and sustainability. Manufacturers are increasingly incorporating advanced materials like seamless technology, breathable fabrics, and sustainable options to appeal to a wider range of customers. Technological advancements are evident in smart bras incorporating fitness tracking features, alongside the rise of inclusive sizing and design embracing body positivity. These innovations drive competitive advantage and cater to evolving consumer needs.

Challenges in the South America Lingerie Market Market

The South America lingerie market faces challenges such as fluctuating raw material prices, impacting manufacturing costs and product pricing. Intense competition from both established international and emerging local brands presents a significant hurdle. Furthermore, complex and sometimes inconsistent regulatory environments across different countries pose challenges for seamless market entry and operation. Supply chain disruptions, particularly experienced during recent global events, have also affected production efficiency and delivery times.

Forces Driving South America Lingerie Market Growth

Key drivers for growth include increasing disposable incomes, particularly among younger demographics, leading to higher spending on fashion and apparel. The expanding e-commerce infrastructure and increased internet penetration significantly contribute to market accessibility and reach. Growing awareness of body positivity and inclusivity encourages the development of products catering to a wider range of body types and sizes. Furthermore, the rising demand for sustainable and ethical lingerie, coupled with the introduction of innovative and technologically advanced products, fuels growth within this market.

Long-Term Growth Catalysts in the South America Lingerie Market

Long-term growth is expected to be propelled by continued innovation in materials, design, and technology within the lingerie industry. Strategic partnerships between brands and retailers to enhance distribution and reach are vital. Expanding into untapped markets within South America and exploring new product categories, such as athleisure wear, are essential for long-term success.

Emerging Opportunities in South America Lingerie Market

Emerging opportunities include leveraging the growing demand for sustainable and ethically produced lingerie. Personalized and customized lingerie options offer a significant avenue for growth, especially through online platforms. Furthermore, capitalizing on the increasing popularity of athleisure wear within the market offers exciting avenues for expansion and diversification.

Leading Players in the South America Lingerie Market Sector

- CLO intimo

- Corsetteria Italiana - Ambra Lingerie

- Leonisa

- Sissi Bordeaux

- Adore Me

- Catalogo SAC

- Victoria's Secret & Co

- Carmel

- Groupe Chantelle

- AEO Inc

- Lili Pink

- PVH Corp

- List Not Exhaustive

Key Milestones in South America Lingerie Market Industry

- January 2021: AEO Inc. announced the expansion of its Aerie lingerie line with 50 new locations, aiming for a total of 400 storefronts. This significantly increased their market presence.

- March 2022: Victoria's Secret launched its spring campaign featuring Brazilian model Lais Ribeiro, promoting its "Love & Lemons" lingerie line. This boosted brand visibility and sales.

- July 2022: Aerie released its "Smoothez" underwear line, specifically designed for people with disabilities. This demonstrated a commitment to inclusivity and market diversification.

Strategic Outlook for South America Lingerie Market Market

The South America lingerie market holds significant potential for continued growth, driven by evolving consumer preferences, technological advancements, and expanding e-commerce penetration. Strategic opportunities include focusing on product innovation, sustainable practices, and inclusive sizing. Brands that successfully adapt to changing consumer demands and leverage digital channels will be well-positioned to capitalize on the market's long-term growth trajectory.

South America Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Columbia

- 3.4. Rest of South America

South America Lingerie Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Columbia

- 4. Rest of South America

South America Lingerie Market Regional Market Share

Geographic Coverage of South America Lingerie Market

South America Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Increased Online Retail Adoption Facilitated Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Columbia

- 5.3.4. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Columbia

- 5.4.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Brassiere

- 6.1.2. Briefs

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Columbia

- 6.3.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Brassiere

- 7.1.2. Briefs

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Columbia

- 7.3.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Columbia South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Brassiere

- 8.1.2. Briefs

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Columbia

- 8.3.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of South America South America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Brassiere

- 9.1.2. Briefs

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Columbia

- 9.3.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 CLO intimo

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Corsetteria Italiana - Ambra Lingerie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Leonisa

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sissi Bordeaux

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Adore Me

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Catalogo SAC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Victoria's Secret & Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Carmel

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Groupe Chantelle

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AEO Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lili Pink

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PVH Corp *List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 CLO intimo

List of Figures

- Figure 1: South America Lingerie Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Lingerie Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: South America Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: South America Lingerie Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South America Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Lingerie Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the South America Lingerie Market?

Key companies in the market include CLO intimo, Corsetteria Italiana - Ambra Lingerie, Leonisa, Sissi Bordeaux, Adore Me, Catalogo SAC, Victoria's Secret & Co, Carmel, Groupe Chantelle, AEO Inc, Lili Pink, PVH Corp *List Not Exhaustive.

3. What are the main segments of the South America Lingerie Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.09 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Increased Online Retail Adoption Facilitated Market Growth.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

In July 2022, Aerie, an American Eagle Outfitters brand, has announced the release of Smoothez, a new underwear line designed exclusively for persons with disabilities of various body shapes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Lingerie Market?

To stay informed about further developments, trends, and reports in the South America Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence