Key Insights

The South Korean luxury goods market is projected to reach $2.02 billion by 2025, with a compound annual growth rate (CAGR) of 1.31% from 2025 to 2033. This growth is fueled by an expanding affluent consumer base, rising disposable incomes, and a strong demand for global luxury brands. Key market segments, including apparel, footwear, accessories, and jewelry, are anticipated to drive this expansion. The market benefits from a diverse retail landscape, encompassing both single-brand and multi-brand stores, as well as a rapidly growing online luxury sector, offering multiple engagement channels for brands.

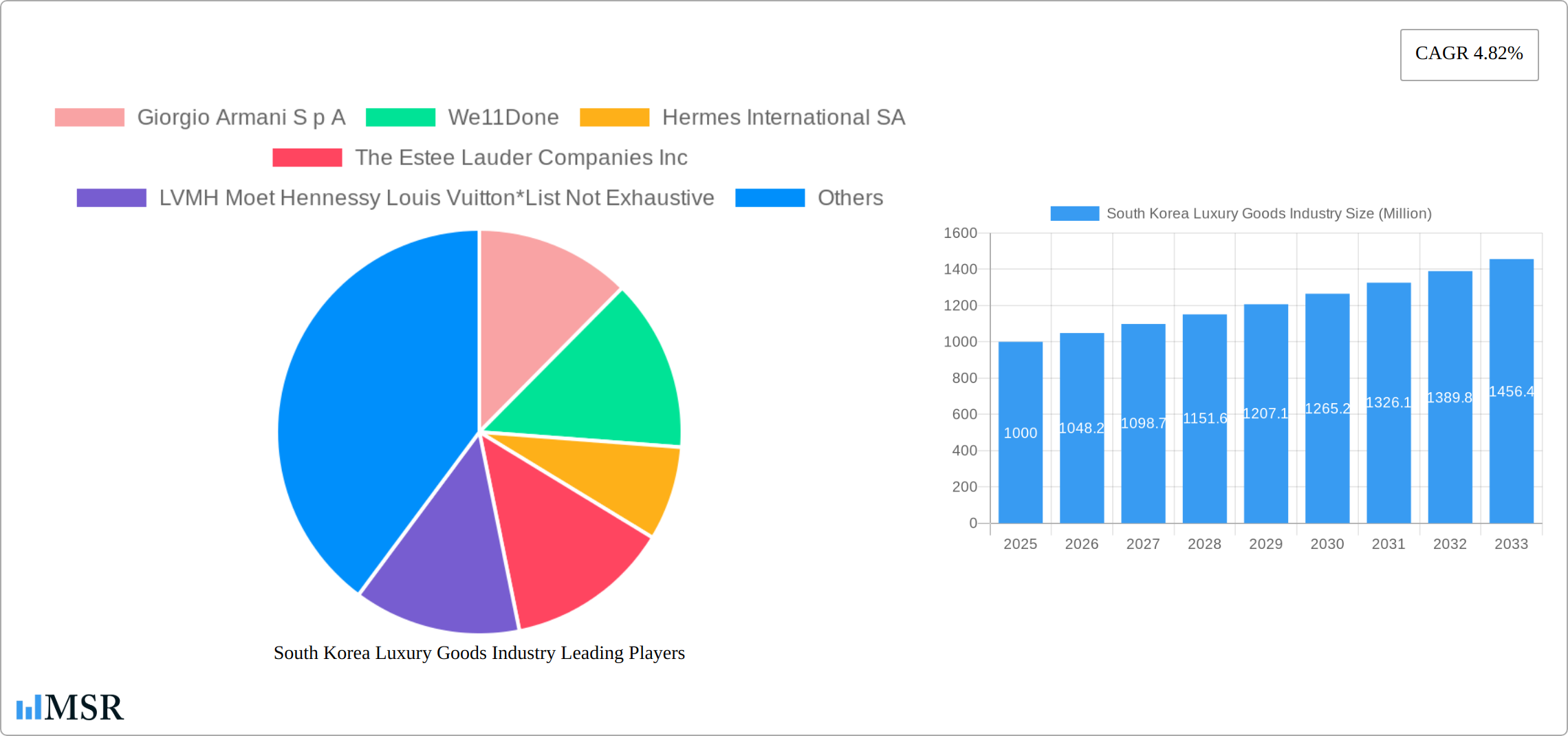

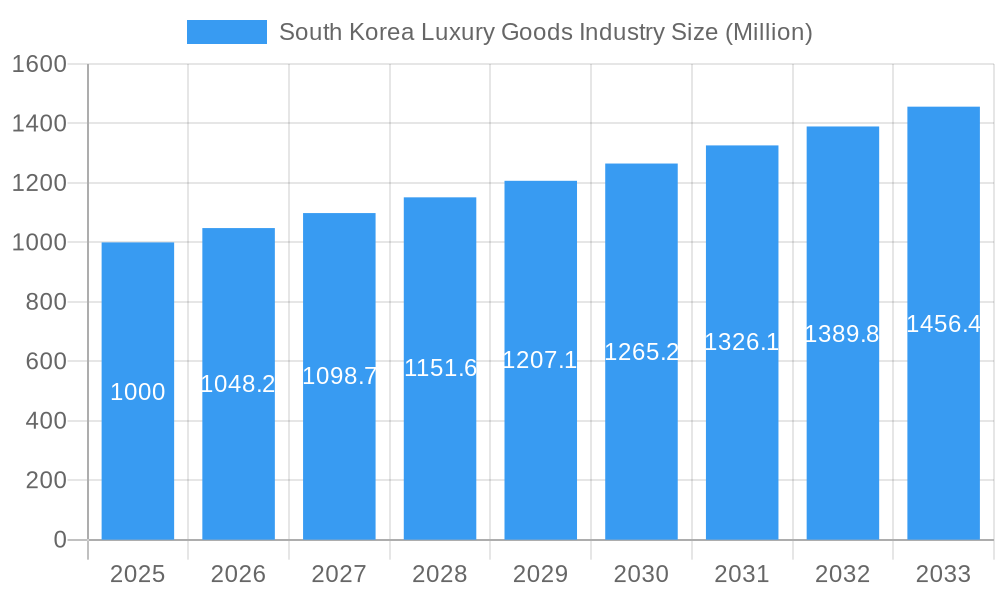

South Korea Luxury Goods Industry Market Size (In Billion)

Established players such as LVMH, Kering, Chanel, and Prada, alongside emerging domestic and international brands, contribute to a competitive environment that encourages innovation and product diversity. Despite this positive outlook, the market is subject to potential challenges including economic volatility, geopolitical risks, and evolving consumer preferences. The persistent issue of counterfeit goods and the imperative to maintain brand exclusivity also pose ongoing concerns for market participants. To ensure sustainable growth, luxury brands must prioritize effective brand management, targeted marketing strategies aligned with consumer trends, and robust anti-counterfeiting measures. A comprehensive omnichannel approach, integrating online and offline channels, will be essential for maximizing market share and meeting the varied demands of South Korean luxury consumers.

South Korea Luxury Goods Industry Company Market Share

South Korea Luxury Goods Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea luxury goods industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on the lucrative South Korean luxury market. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of xx%.

South Korea Luxury Goods Industry Market Concentration & Dynamics

The South Korean luxury goods market showcases a complex interplay of established international players and burgeoning domestic brands. Market concentration is moderate, with a few key players holding significant shares, but a dynamic competitive landscape fostering innovation and disruption. The regulatory framework, while generally supportive of foreign investment, involves specific import duties and labeling requirements. Substitute products, particularly in the apparel and accessories segments, exert competitive pressure, influencing consumer choices. End-user trends favor exclusivity, sustainability, and personalization.

Market Share (2025 Estimates):

- LVMH Moët Hennessy Louis Vuitton: xx%

- Kering Group (Gucci): xx%

- Chanel: xx%

- Others: xx%

M&A Activity (2019-2024):

- A total of xx M&A deals were recorded, demonstrating significant investor interest and consolidation within the industry. The majority focused on acquiring promising domestic brands or expanding distribution networks.

South Korea Luxury Goods Industry Industry Insights & Trends

The South Korean luxury goods market has experienced robust growth driven by several factors. Rising disposable incomes, a young and affluent population, and a strong affinity for high-end brands are key drivers. Technological advancements such as e-commerce platforms and personalized marketing strategies are transforming the industry's landscape. Evolving consumer behaviors reflect a preference for experiences over material possessions and a heightened focus on brand storytelling and sustainability.

The market size reached XX Million in 2024, a significant increase from XX Million in 2019. The CAGR during this period was xx%, reflecting strong market momentum. This upward trajectory is expected to continue, driven by factors like increased tourism and the growing popularity of K-beauty and K-fashion globally. Technological disruptions, such as the rise of social commerce and personalized shopping experiences, are also transforming the consumer journey and fueling market growth.

Key Markets & Segments Leading South Korea Luxury Goods Industry

The South Korean luxury goods market is predominantly driven by the following segments and distribution channels:

By Type:

- Clothing and Apparel: This segment holds the largest market share, fueled by strong demand for designer clothing and K-fashion trends.

- Bags: Luxury handbags remain a significant contributor to overall market revenue, with global brands and local designers competing for market share.

- Watches and Jewelry: This segment shows consistent growth, driven by both international and domestic luxury brands.

By Distribution Channel:

- Single-Brand Stores: Flagship stores and boutiques remain a crucial sales channel, providing an exclusive and curated brand experience.

- Online Stores: E-commerce is rapidly gaining traction, offering convenience and expanding market reach. Luxury brands are adapting their online presence to create a seamless omnichannel shopping experience.

Growth Drivers:

- Strong Economic Growth: South Korea's robust economy provides a solid foundation for luxury goods consumption.

- Rising Disposable Incomes: The increasing purchasing power of the South Korean population fuels demand for premium products.

- Favorable Demographics: A large, young, and affluent population is a key driver of luxury goods consumption.

- Tourism: International tourism plays a significant role in boosting sales of luxury goods.

South Korea Luxury Goods Industry Product Developments

The South Korean luxury goods market is witnessing significant product innovation. Brands are focusing on incorporating sustainable materials, utilizing advanced technologies for personalization, and creating exclusive collaborations to stay ahead of the competition. Technological advancements in manufacturing, such as 3D printing and advanced materials, are also impacting product development and driving differentiation. The emphasis on sustainability, ethical sourcing, and unique designs is becoming increasingly important in attracting discerning consumers.

Challenges in the South Korea Luxury Goods Industry Market

The South Korean luxury goods market, while robust, faces a complex interplay of challenges. Intense competition, both from established international luxury houses and increasingly sophisticated domestic brands, creates a highly dynamic and demanding landscape. Supply chain vulnerabilities, exacerbated by global events, continue to disrupt inventory and increase costs. Keeping pace with the rapidly evolving preferences of discerning Korean consumers requires agility and innovation. Navigating regulatory complexities, including import tariffs and compliance standards, adds another layer of operational difficulty. Furthermore, escalating raw material and labor costs directly impact profitability and price competitiveness, necessitating efficient cost management strategies. The pervasive issue of counterfeit goods remains a significant threat, eroding brand reputation and impacting legitimate sales. Finally, the influence of macroeconomic factors, such as fluctuating exchange rates and economic uncertainty, introduces an additional degree of risk.

Forces Driving South Korea Luxury Goods Industry Growth

Despite these challenges, several powerful forces are propelling growth within the South Korean luxury goods market. A burgeoning affluent consumer base, with significantly increasing disposable incomes, forms the bedrock of this expansion. The seamless integration of e-commerce and sophisticated digital marketing strategies allows brands to reach and engage this target audience effectively. The global popularity of K-beauty and K-fashion, alongside a growing appreciation for Korean culture, creates a strong foundation for both domestic and international brands to leverage. Government initiatives aimed at promoting tourism and attracting foreign investment foster a favorable business environment. Moreover, a rising consumer consciousness regarding sustainability and ethical sourcing presents significant opportunities for brands committed to responsible practices. This aligns with the values of many younger, affluent consumers.

Long-Term Growth Catalysts in the South Korea Luxury Goods Industry

Long-term growth is supported by continued economic expansion, evolving consumer preferences towards personalized experiences and sustainable products, and ongoing innovation in product design and technology. Strategic partnerships between international and local brands will foster market expansion and introduce new product lines. Government support for the luxury industry and tourism will create a conducive business environment.

Emerging Opportunities in South Korea Luxury Goods Industry

The South Korean luxury market presents a wealth of exciting opportunities for forward-thinking brands. The increasing demand for personalized luxury experiences, moving beyond simply purchasing a product to creating bespoke moments and memories, is a key trend. The rise of the metaverse and immersive shopping technologies offers innovative avenues for brand engagement and customer interaction. The growing demand for sustainable and ethically sourced products provides a compelling opportunity for brands to differentiate themselves and appeal to values-driven consumers. Expansion into untapped markets in smaller cities and regions across the country presents significant potential for growth. Finally, developing highly targeted and creative marketing strategies that effectively leverage social media and influencer marketing is crucial for reaching and engaging the coveted luxury consumer.

Leading Players in the South Korea Luxury Goods Industry Sector

Key Milestones in South Korea Luxury Goods Industry Industry

- May 2022: Dior opened a large pop-up store in Seoul, highlighting the growing importance of the South Korean market.

- January 2022: Sequoia Capital China invested in We11done, signifying the potential of South Korean luxury brands.

- February 2021: Kampos, an Italian luxury brand, entered the South Korean market, underscoring its strategic importance.

Strategic Outlook for South Korea Luxury Goods Industry Market

The South Korean luxury goods market exhibits strong potential for sustained growth, fueled by a robust economy, evolving consumer preferences, and rapid technological advancements. Brands that successfully enhance their digital presence, embrace sustainable practices, and deliver personalized experiences are best positioned to thrive. Strategic collaborations between international luxury conglomerates and innovative domestic brands can unlock new market segments and foster groundbreaking innovation. The long-term prospects for the South Korean luxury market are exceptionally promising, offering substantial rewards for companies that can effectively adapt to the market's dynamic shifts and successfully capture the attention and loyalty of affluent Korean consumers. This requires a deep understanding of the cultural nuances and the evolving desires of this sophisticated market.

South Korea Luxury Goods Industry Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

South Korea Luxury Goods Industry Segmentation By Geography

- 1. South Korea

South Korea Luxury Goods Industry Regional Market Share

Geographic Coverage of South Korea Luxury Goods Industry

South Korea Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 We11Done

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gentle Monster

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chanel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering Group (Gucci)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prada Holding S p A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: South Korea Luxury Goods Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: South Korea Luxury Goods Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: South Korea Luxury Goods Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Luxury Goods Industry?

The projected CAGR is approximately 1.31%.

2. Which companies are prominent players in the South Korea Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, We11Done, Hermes International SA, The Estee Lauder Companies Inc, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Gentle Monster, Chanel, Kering Group (Gucci), Rolex SA, H & M Hennes & Mauritz AB (H&M), Prada Holding S p A.

3. What are the main segments of the South Korea Luxury Goods Industry?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Dior, the French fashion brand opened a large pop-up store in Seoul, South Korea. The store features several rooms inside, each dedicated to a definite segment of the women's ready-to-wear line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the South Korea Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence