Key Insights

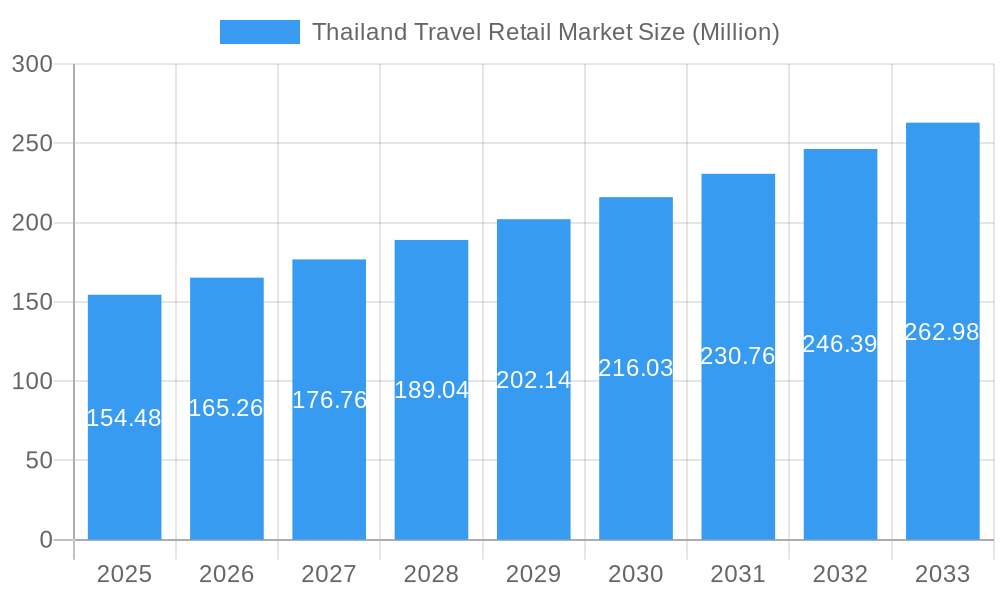

The Thailand travel retail market, valued at $154.48 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This expansion is fueled by several key factors. The surge in international tourism to Thailand, particularly from high-spending Asian countries, significantly boosts demand for luxury goods and local products within airport and border shops. Furthermore, the increasing disposable income of Thai consumers and a growing preference for convenient, duty-free shopping experiences contribute to market expansion. Strategic initiatives by airport authorities to enhance retail spaces and improve the overall passenger experience further support this growth. Competitive pricing strategies employed by major players like King Power International Group and The Shilla Duty Free are also attracting more shoppers. However, potential challenges remain, such as fluctuations in global economic conditions that might impact tourist spending and the vulnerability to external shocks affecting international travel. Effective management of these factors will be key to sustaining the projected growth trajectory.

Thailand Travel Retail Market Market Size (In Million)

The market segmentation, while not explicitly detailed, likely comprises categories such as cosmetics and perfumes, liquor and tobacco, fashion and accessories, and food and beverages. The competitive landscape is highly consolidated, with major players exhibiting a strong market presence and actively expanding their offerings. The forecast period (2025-2033) reveals considerable potential for market expansion, requiring companies to stay agile in adapting to evolving consumer preferences and emerging trends like the increasing demand for sustainable and ethically sourced products, and the integration of technology, such as mobile payment systems and personalized shopping experiences, within the duty-free landscape. Continuous improvement of airport infrastructure and streamlining of customs procedures would further enhance the shopping experience and propel future growth.

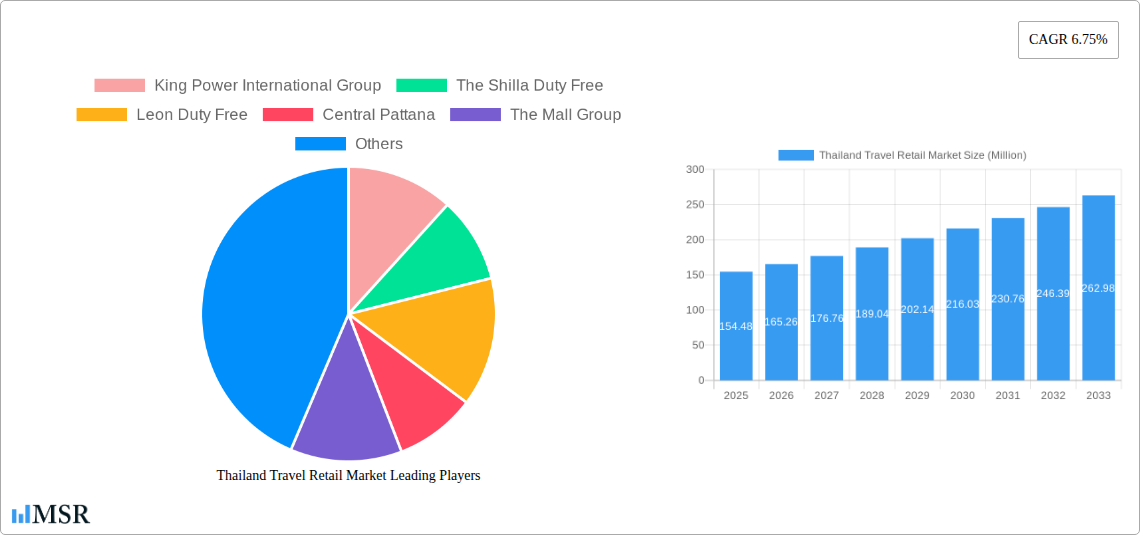

Thailand Travel Retail Market Company Market Share

Thailand Travel Retail Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand travel retail market, covering its evolution from 2019 to 2024 (historical period), the current market landscape in 2025 (base and estimated year), and projecting its trajectory until 2033 (forecast period). The report delves into market dynamics, key players, emerging trends, and strategic opportunities, offering invaluable insights for industry stakeholders. With a focus on market size (in Millions), CAGR, and key performance indicators, this report is an essential resource for strategic decision-making in this dynamic sector. The study period covers 2019-2033.

Thailand Travel Retail Market Market Concentration & Dynamics

The Thailand travel retail market exhibits a moderately concentrated landscape, dominated by key players like King Power International Group, The Shilla Duty Free, and Leon Duty Free. However, the presence of numerous smaller operators fosters competition. The market's dynamism is fueled by an innovative ecosystem, with companies constantly seeking to enhance the customer experience through technology integration and new product offerings. Regulatory frameworks, while generally supportive of the industry, influence market access and operations. Substitute products, such as online retail and domestic shopping, exert competitive pressure. Furthermore, evolving consumer preferences towards premium and personalized experiences drive market trends.

- Market Share: King Power International Group holds an estimated xx% market share in 2025, followed by The Shilla Duty Free with xx% and Leon Duty Free with xx%.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating a moderate level of consolidation. The forecast period is expected to see an increase to approximately xx deals due to expanding market opportunities.

- Innovation Ecosystem: A strong focus on digitalization, personalized offers, and experiential retail is shaping the innovation landscape.

- Regulatory Framework: The government's policies on tourism and duty-free regulations significantly impact market growth.

Thailand Travel Retail Market Industry Insights & Trends

The Thailand travel retail market is experiencing robust growth, driven by a surge in inbound tourism and rising disposable incomes. The market size is estimated at xx Million in 2025, with a CAGR of xx% projected for 2025-2033. Technological disruptions, such as mobile payment adoption and personalized marketing through data analytics, are reshaping the consumer experience. Evolving consumer behaviors, including a preference for omnichannel shopping and a demand for authentic and sustainable products, influence market strategies. The rising popularity of experiential retail, focusing on providing unique experiences within airports and shopping centers, significantly contributes to market expansion.

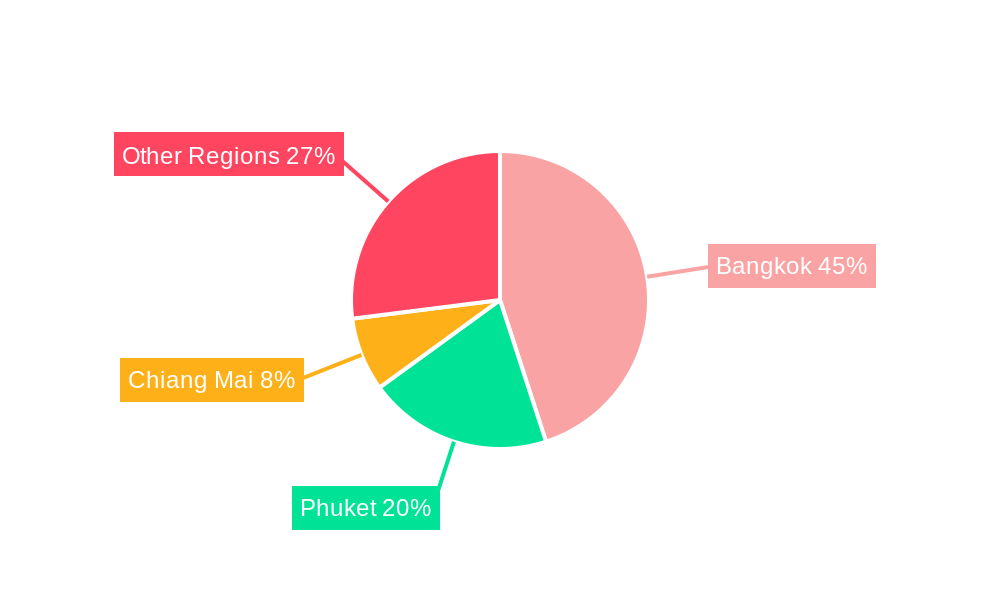

Key Markets & Segments Leading Thailand Travel Retail Market

Bangkok's Suvarnabhumi and Don Mueang airports are the dominant segments within the Thailand travel retail market, owing to their high passenger traffic and strategic locations. Phuket International Airport also plays a significant role.

- Growth Drivers:

- Robust Tourism Growth: Thailand's attractiveness as a tourist destination is a primary driver.

- Infrastructure Development: Investments in airport infrastructure and transportation networks enhance market access.

- Economic Growth: Rising disposable incomes and a burgeoning middle class fuel spending.

The dominance of these airports is rooted in their high tourist footfall, strategic locations facilitating accessibility, and supportive infrastructure. These factors contribute to the higher sales volumes and profitability within these segments compared to other locations.

Thailand Travel Retail Market Product Developments

Recent product innovations focus on leveraging technology to enhance customer experience, including personalized recommendations through mobile apps, contactless payment options, and interactive displays. The emphasis on locally sourced and sustainable products is gaining traction, catering to environmentally conscious travelers. Companies are also focusing on exclusive product launches and collaborations to differentiate themselves and attract consumers.

Challenges in the Thailand Travel Retail Market Market

The Thailand travel retail market faces challenges like intense competition, economic fluctuations impacting tourism, and potential supply chain disruptions. Regulatory changes and shifting consumer preferences also pose significant challenges. The impact of these factors can vary but can potentially lead to reduced margins, slower sales growth, and increased operational costs.

Forces Driving Thailand Travel Retail Market Growth

Key growth drivers include the rise in tourism, increased disposable incomes, the development of new airport infrastructure, and government support for the travel retail sector. Technological advancements, such as the integration of digital payment systems and personalized marketing strategies, are also contributing significantly to the market's expansion.

Long-Term Growth Catalysts in Thailand Travel Retail Market

Long-term growth will be fueled by strategic partnerships, further expansion into regional markets, and continuous innovation in product offerings and customer experiences. Investment in technology and infrastructure, and an emphasis on sustainable and ethical practices, will be crucial for sustaining long-term growth.

Emerging Opportunities in Thailand Travel Retail Market

Emerging opportunities include the growing demand for luxury goods and experiences, the rise of omnichannel retail, and the expansion of e-commerce and mobile shopping in the travel retail space. The integration of augmented reality and virtual reality technologies to enhance the shopping experience also presents new opportunities.

Leading Players in the Thailand Travel Retail Market Sector

- King Power International Group

- The Shilla Duty Free

- Leon Duty Free

- Central Pattana

- The Mall Group

- Jaidee Duty Free

- SIAM Gems Group

- Paradise Duty Free

- Regent Plaza Group

- Bangkok Airways

- The Airways International

- Airports of Thailand

- JR Duty Free

Key Milestones in Thailand Travel Retail Market Industry

- October 2023: Foreo expands into Don Mueang Airport in collaboration with King Power.

- November 2023: PTT Oil and Retail Business announces a $900 Million investment to expand across Southeast Asia.

Strategic Outlook for Thailand Travel Retail Market Market

The Thailand travel retail market holds significant future potential, driven by sustained tourism growth and increasing consumer spending. Strategic opportunities lie in embracing technological advancements, fostering strategic partnerships, and delivering exceptional customer experiences to capitalize on the market's expansion. Adapting to evolving consumer preferences and navigating regulatory landscapes will be crucial for sustained success.

Thailand Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels (Borders, Downtown)

Thailand Travel Retail Market Segmentation By Geography

- 1. Thailand

Thailand Travel Retail Market Regional Market Share

Geographic Coverage of Thailand Travel Retail Market

Thailand Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels (Borders, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Power International Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leon Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Central Pattana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mall Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaidee Duty Free

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIAM Gems Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paradise Duty Free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Regent Plaza Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bangkok Airways

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Airways International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Airports of Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JR Duty Free**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 King Power International Group

List of Figures

- Figure 1: Thailand Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Thailand Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Thailand Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Travel Retail Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Thailand Travel Retail Market?

Key companies in the market include King Power International Group, The Shilla Duty Free, Leon Duty Free, Central Pattana, The Mall Group, Jaidee Duty Free, SIAM Gems Group, Paradise Duty Free, Regent Plaza Group, Bangkok Airways, The Airways International, Airports of Thailand, JR Duty Free**List Not Exhaustive.

3. What are the main segments of the Thailand Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Travel Retail Market?

To stay informed about further developments, trends, and reports in the Thailand Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence