Key Insights

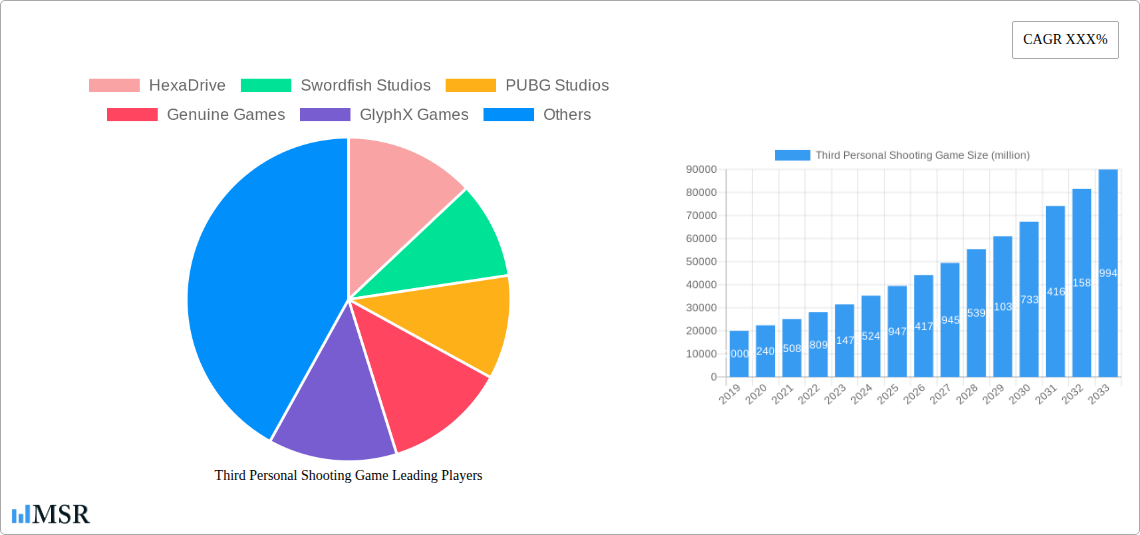

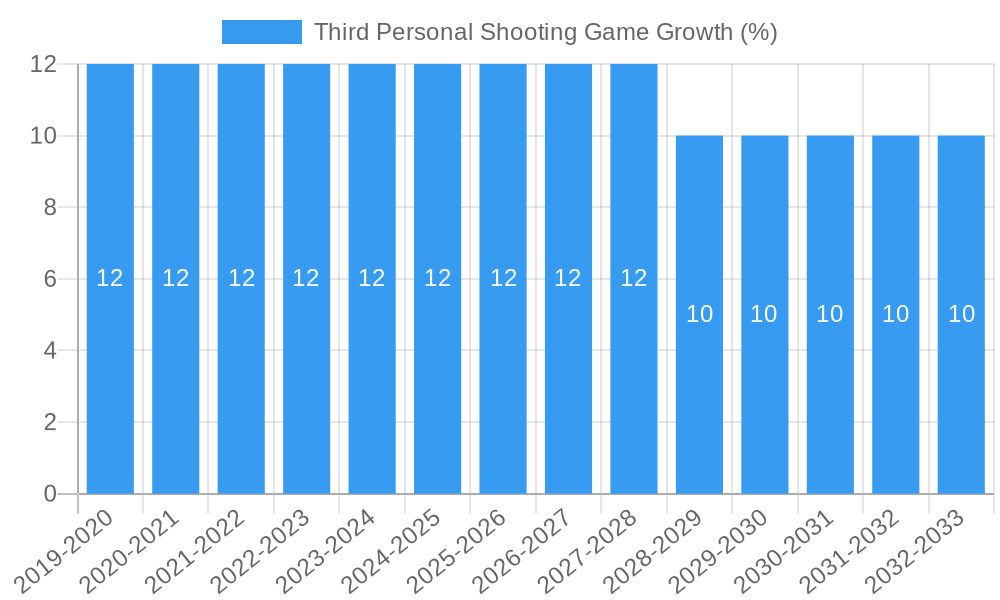

The Third-Person Shooting (TPS) game market is poised for significant expansion, projected to reach a valuation of approximately $35,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 12% over the forecast period extending to 2033. This robust growth is primarily fueled by the increasing adoption of high-performance gaming hardware, the expanding global internet infrastructure, and the sheer popularity of engaging, immersive gaming experiences. The shift towards online multiplayer TPS games, offering competitive and cooperative gameplay, is a dominant trend, attracting a vast and dedicated player base. Furthermore, the continuous evolution of game design, incorporating advanced graphics, compelling narratives, and innovative gameplay mechanics, ensures sustained interest and player retention. The accessibility of gaming across various platforms, from dedicated PCs and consoles to mobile devices, further broadens the market reach and contributes to its upward trajectory.

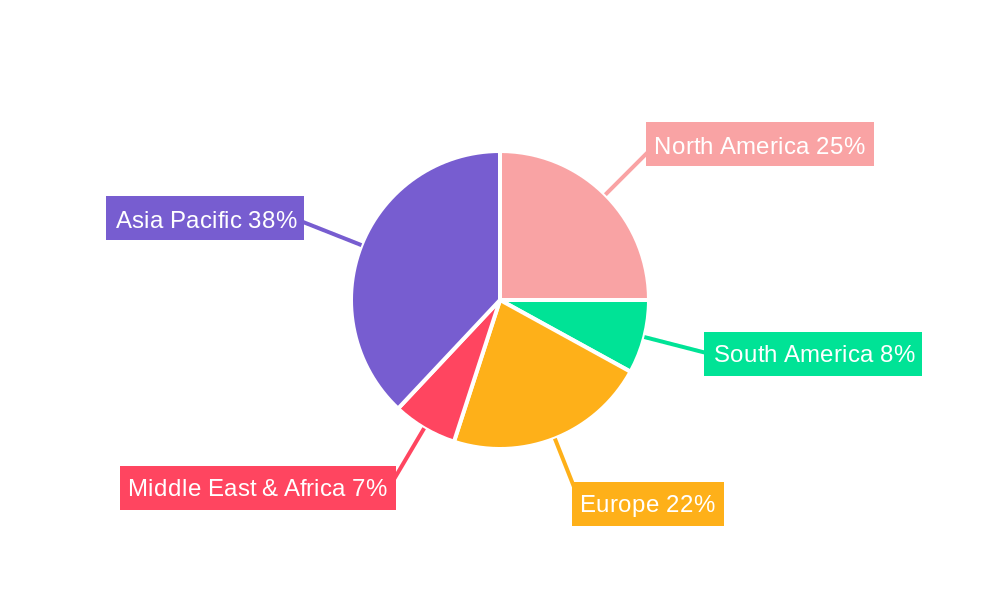

The market landscape is characterized by a dynamic interplay of established industry giants and emerging studios, each contributing unique titles and innovations. Key players like PUBG Studios, BioWare, and FromSoftware, among others, are instrumental in shaping player preferences and setting industry standards. The market is segmented by application, with Personal Computers representing the largest share due to their inherent graphical capabilities and flexibility, followed by Internet Cafes that provide accessible gaming hubs, and "Others" encompassing consoles and mobile gaming. On the type front, Online Games dominate, driven by their social and competitive aspects, while Single Player Games continue to cater to a significant audience seeking immersive storytelling and solitary challenges. Geographically, Asia Pacific, led by China and Japan, is expected to be a powerhouse, driven by a massive gaming population and rapid technological adoption. North America and Europe also represent substantial markets, with strong consumer spending and a well-established gaming culture. However, challenges such as the high cost of game development, increasing competition, and the need for continuous innovation to combat player fatigue present hurdles that market participants must adeptly navigate.

This comprehensive report dives deep into the dynamic Third Personal Shooting Game market, a sector experiencing explosive growth and rapid technological evolution. Spanning the historical period of 2019-2024, with a robust forecast from 2025 to 2033, this analysis provides critical insights for industry stakeholders, developers, and investors. We cover market concentration, key trends, segment dominance, product innovations, challenges, growth drivers, emerging opportunities, leading companies, and strategic outlooks, utilizing a Base Year of 2025 and an Estimated Year also of 2025 to anchor our quantitative analyses. This report is designed for immediate use without any further modifications.

Third Personal Shooting Game Market Concentration & Dynamics

The Third Personal Shooting Game market exhibits a moderate concentration, characterized by the presence of both established titans and agile emerging studios. Innovation is a key differentiator, with companies like PUBG Studios and EA Montreal consistently pushing boundaries in gameplay mechanics and visual fidelity. The regulatory landscape, while generally permissive for digital content, is evolving to address in-game monetization and data privacy, with potential implications for market access and revenue models. Substitute products, such as other action-oriented genres and competitive esports titles, exert pressure but do not significantly dilute the core appeal of the third-person perspective. End-user trends indicate a strong preference for immersive narratives and competitive online multiplayer experiences. Mergers and acquisitions (M&A) have been a notable feature, with an estimated xx M&A deals in the historical period, averaging a deal value of xx million, reflecting strategic consolidation and talent acquisition. Key M&A activities underscore the drive for market share and technological synergy.

- Market Share Landscape: Dominated by a few key players, but with significant room for smaller studios to innovate and capture niche audiences.

- Innovation Ecosystems: Fueled by advancements in game engines (e.g., Unreal Engine, Unity) and AI-driven development tools.

- Regulatory Frameworks: Evolving to encompass player safety, data protection, and fair monetization practices.

- Substitute Products: Influence market share through genre crossover and cross-platform availability.

- End-User Trends: Growing demand for realistic graphics, social connectivity, and accessible gameplay loops.

- M&A Activities: Strategic acquisitions focused on intellectual property, talent, and market expansion.

Third Personal Shooting Game Industry Insights & Trends

The global Third Personal Shooting Game market is projected to witness substantial growth, with an estimated market size of xx million in the Base Year 2025 and a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This robust expansion is primarily driven by several interconnected factors. Technological disruptions, particularly the continued advancements in graphical rendering, artificial intelligence for NPC behavior and game world generation, and the increasing accessibility of high-performance gaming hardware, are elevating player immersion and engagement to unprecedented levels. The widespread adoption of cloud gaming services and the optimization of games for a range of devices are further democratizing access to sophisticated gaming experiences, attracting a broader demographic of players. Evolving consumer behaviors are characterized by a persistent demand for rich, narrative-driven single-player campaigns alongside the ever-growing popularity of competitive online multiplayer modes. The social aspect of gaming, facilitated by integrated communication tools and community platforms, plays a crucial role in player retention and the organic growth of game titles. Furthermore, the proliferation of esports, with significant prize pools and viewership numbers, creates a powerful feedback loop, incentivizing developers to create highly polished and competitive Third Personal Shooting Games. The introduction of live-service models, offering continuous content updates and seasonal events, ensures long-term player engagement and recurring revenue streams, a trend pioneered by titles from PUBG Studios and adopted by many others. The integration of advanced haptic feedback technologies and immersive audio design is also contributing to a more visceral and engaging player experience, setting new benchmarks for the industry. The rise of cross-platform play is also breaking down traditional barriers, allowing players on different consoles and PCs to compete and collaborate, thereby expanding player bases for individual titles.

Key Markets & Segments Leading Third Personal Shooting Game

The Third Personal Shooting Game market's dominance is intricately linked to specific geographical regions and demographic segments, driven by a confluence of economic, infrastructural, and cultural factors.

Dominant Region: North America North America consistently leads the global market for Third Personal Shooting Games. This leadership is underpinned by several key drivers:

- Economic Growth & Disposable Income: High levels of disposable income in countries like the United States and Canada enable consumers to invest in high-end gaming hardware and digital content, including premium Third Personal Shooting Games.

- Advanced Internet Infrastructure: Widespread availability of high-speed internet is crucial for online multiplayer experiences, a cornerstone of many successful third-person shooters.

- Gaming Culture & Early Adoption: North America has a deeply ingrained gaming culture, with a history of early adoption of new technologies and gaming trends. This fosters a large and engaged player base.

- Presence of Major Publishers and Developers: The region hosts numerous leading game development studios and publishers, such as EA Montreal, contributing to a vibrant local industry and a constant stream of new content.

Key Segment: Personal Computers While consoles remain significant, the Personal Computers (PCs) segment holds a commanding position in the Third Personal Shooting Game market.

- Hardware Customization and Performance: PCs offer unparalleled customization and the potential for higher graphical fidelity and frame rates, appealing to a dedicated segment of hardcore gamers seeking the ultimate visual and performance experience.

- Modding Community and Longevity: The PC platform fosters robust modding communities, which can extend the lifespan and replayability of games significantly, creating enduring player interest.

- Accessibility of Online Play: The PC ecosystem is inherently geared towards online connectivity, supporting a vast array of competitive and cooperative Third Personal Shooting Game experiences.

- Esports Dominance: Many major esports titles within the third-person shooter genre thrive on PC due to the precision offered by mouse and keyboard controls and the platform's historical association with competitive gaming.

Dominant Type: Online Games In terms of game type, Online Games are the primary revenue generators and engagement drivers within the Third Personal Shooting Game sector.

- Social Interaction and Community Building: The inherent social nature of online multiplayer games fosters strong player communities, leading to higher retention rates and organic word-of-mouth marketing.

- Competitive Play and Esports Ecosystems: The thrilling competitive nature of online shooters fuels the massive growth of esports, attracting viewers and participants alike.

- Live-Service Models and Continuous Content: The success of live-service models, characterized by regular updates, expansions, and seasonal content, ensures sustained player interest and recurring revenue streams, a strategy often employed by studios like PUBG Studios.

- Accessibility and Global Reach: Online games connect players across geographical boundaries, creating massive, interconnected player bases that fuel the success of popular titles.

While Internet Cafes represent a niche but important segment, particularly in certain regions, and Single Player Games continue to offer compelling narrative experiences, the overwhelming market momentum and revenue generation within the Third Personal Shooting Game sector are undeniably driven by PC-based Online Games.

Third Personal Shooting Game Product Developments

Recent product developments in the Third Personal Shooting Game sector are heavily influenced by advancements in real-time ray tracing, AI-powered character animations, and procedural content generation, exemplified by innovations from studios like GlyphX Games and Remedy Entertainment. These advancements are leading to visually stunning and dynamically evolving game worlds that enhance player immersion. The integration of advanced haptic feedback and spatial audio technologies, pioneered by companies like Extreme FX, is creating more tactile and realistic combat experiences. Furthermore, developers are increasingly focusing on player-centric design, offering extensive customization options for characters and weapons, and implementing robust anti-cheat systems to ensure fair play, a critical focus for titles from PUBG Studios. The market relevance of these developments lies in their ability to attract and retain players by offering cutting-edge gameplay and unparalleled realism.

Challenges in the Third Personal Shooting Game Market

The Third Personal Shooting Game market, despite its growth, faces several significant challenges. Intense competition from a crowded market of high-quality titles can make it difficult for new entrants to gain traction. Evolving player expectations for continuous content updates and live-service support require substantial ongoing investment from developers. Regulatory scrutiny surrounding loot boxes and microtransactions, particularly in regions like Europe, can impact monetization strategies. Furthermore, the increasing cost of AAA game development, often exceeding xx million, coupled with the risk of project delays and potential underperformance, poses a considerable financial hurdle for companies like Volition and Swordfish Studios. Supply chain issues affecting hardware availability can also indirectly impact the market by limiting access to high-end gaming platforms.

- Intense Market Competition: Difficulty for new titles to stand out amidst a sea of established and high-quality games.

- Rising Development Costs: AAA game production costs can exceed xx million, increasing financial risk.

- Evolving Monetization Regulations: Scrutiny of in-game purchases and loot boxes impacting revenue models.

- Player Demand for Constant Content: Pressure to provide continuous updates and live-service support.

Forces Driving Third Personal Shooting Game Growth

Several powerful forces are propelling the growth of the Third Personal Shooting Game market. Technological advancements, including improved graphics rendering, AI, and network infrastructure, are enabling more immersive and realistic gameplay experiences. The expanding global internet penetration and the proliferation of affordable gaming hardware are making these games accessible to a wider audience. The continued rise of esports, with its massive viewership and competitive prize pools, acts as a significant marketing engine and a catalyst for game development innovation. Furthermore, the strong social component of online multiplayer games fosters player engagement and community building, driving long-term retention and word-of-mouth marketing. The increasing popularity of free-to-play models with optional in-game purchases, successfully implemented by companies like Genuine Games, also lowers the barrier to entry and expands the player base.

Challenges in the Third Personal Shooting Game Market

Long-term growth catalysts for the Third Personal Shooting Game market are deeply rooted in sustained innovation and strategic market expansion. Continued investment in cutting-edge technologies like advanced AI for more dynamic enemy behavior and adaptive difficulty, alongside the exploration of new input methods and augmented reality integrations, will keep the genre fresh and engaging. Partnerships between game developers and hardware manufacturers can ensure optimized performance and the seamless integration of new technologies. Furthermore, strategic expansion into underserved geographical markets and the localization of games to cater to diverse linguistic and cultural preferences will unlock new revenue streams and player bases. The development of robust anti-cheat measures and ethical monetization practices will be crucial for maintaining player trust and ensuring the long-term health of the online gaming ecosystem.

Emerging Opportunities in Third Personal Shooting Game

Emerging opportunities in the Third Personal Shooting Game market are diverse and promising. The continued growth of cloud gaming platforms presents a significant avenue for reaching players who may not have access to high-end hardware, allowing them to enjoy AAA titles streamed directly to their devices. The increasing demand for user-generated content (UGC) and modding tools offers developers a way to extend game longevity and foster vibrant communities, a strategy that could benefit studios like Rogue Entertainment. The integration of blockchain technology and NFTs, while still in its nascent stages, could offer new models for digital ownership and in-game economies, though ethical considerations and player acceptance remain key factors. Furthermore, the exploration of new narrative structures and branching storylines within third-person shooters, a strength of studios like BioWare, can appeal to players seeking deeper, more engaging single-player experiences. The development of games tailored for emerging VR/AR technologies also represents a significant, albeit currently niche, growth area.

Leading Players in the Third Personal Shooting Game Sector

- HexaDrive

- Swordfish Studios

- PUBG Studios

- Genuine Games

- GlyphX Games

- Volition

- Black Cat Games

- Remedy Entertainment

- Rogue Entertainment

- BioWare

- Realtime Worlds

- Neversoft

- Extreme FX

- Planet Moon Studios

- FromSoftware

- EA Montreal

- Blitz Games

Key Milestones in Third Personal Shooting Game Industry

- 2019: Release of "Call of Duty: Modern Warfare" (2019), revitalizing the franchise with a strong focus on realistic combat and a modern setting.

- 2019: Launch of "Apex Legends" by Respawn Entertainment, a free-to-play battle royale that quickly garnered a massive player base and set new standards for the genre.

- 2020: Release of "Ghost of Tsushima" by Sucker Punch Productions, praised for its immersive open world, compelling narrative, and visually stunning art style.

- 2020: "Cyberpunk 2077" released by CD Projekt Red, despite initial technical issues, showcased ambitious world-building and character development in a third-person perspective for certain elements.

- 2021: Continued growth and esports prominence for titles like "Valorant" (though primarily first-person, its influence on team-based shooters is notable) and ongoing support for battle royales.

- 2022: Release of "God of War Ragnarök" by Santa Monica Studio, continuing the critically acclaimed narrative and refined combat mechanics.

- 2023: Anticipation and strong pre-release buzz for major upcoming third-person shooter titles, signaling continued industry investment and player interest.

- 2024: Increased focus on AI-driven gameplay and procedural generation in announced game projects, pointing towards future innovation in world design and NPC interactions.

- 2025 (Base Year): Projected increase in cross-platform play integration and the widespread adoption of cloud gaming for AAA third-person shooters.

- 2026-2033 (Forecast Period): Expected emergence of more immersive VR/AR integrated third-person shooter experiences and further refinement of live-service models.

Strategic Outlook for Third Personal Shooting Game Market

The strategic outlook for the Third Personal Shooting Game market remains exceptionally bright, driven by continuous technological innovation and evolving player preferences. Future growth will be fueled by developers focusing on creating highly engaging, persistent online worlds with robust social features, as well as delivering compelling narrative-driven single-player experiences. The expansion of cloud gaming and the potential for more accessible hardware will broaden the player base significantly. Strategic partnerships, targeted content expansions, and a continued emphasis on competitive esports will be crucial for maintaining player engagement and market share. Embracing emerging technologies and player-driven content creation will ensure the genre's long-term relevance and continued success, with companies like FromSoftware and BioWare poised to capitalize on these trends.

Third Personal Shooting Game Segmentation

-

1. Application

- 1.1. Internet Cafes

- 1.2. Personal Computers

- 1.3. Others

-

2. Type

- 2.1. Single Player Games

- 2.2. Online Games

Third Personal Shooting Game Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Third Personal Shooting Game REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Internet Cafes

- 5.1.2. Personal Computers

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Player Games

- 5.2.2. Online Games

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Internet Cafes

- 6.1.2. Personal Computers

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Player Games

- 6.2.2. Online Games

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Internet Cafes

- 7.1.2. Personal Computers

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Player Games

- 7.2.2. Online Games

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Internet Cafes

- 8.1.2. Personal Computers

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Player Games

- 8.2.2. Online Games

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Internet Cafes

- 9.1.2. Personal Computers

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Player Games

- 9.2.2. Online Games

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Third Personal Shooting Game Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Internet Cafes

- 10.1.2. Personal Computers

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Player Games

- 10.2.2. Online Games

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HexaDrive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swordfish Studios

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PUBG Studios

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genuine Games

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GlyphX Games

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Volition

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Black Cat Games

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Remedy Entertainment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rogue Entertainment

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BioWare

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Realtime Worlds

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Neversoft

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Extreme FX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Planet Moon Studios

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 FromSoftware

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 EA Montreal

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Blitz Games

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 HexaDrive

List of Figures

- Figure 1: Global Third Personal Shooting Game Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Third Personal Shooting Game Revenue (million), by Application 2024 & 2032

- Figure 3: North America Third Personal Shooting Game Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Third Personal Shooting Game Revenue (million), by Type 2024 & 2032

- Figure 5: North America Third Personal Shooting Game Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Third Personal Shooting Game Revenue (million), by Country 2024 & 2032

- Figure 7: North America Third Personal Shooting Game Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Third Personal Shooting Game Revenue (million), by Application 2024 & 2032

- Figure 9: South America Third Personal Shooting Game Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Third Personal Shooting Game Revenue (million), by Type 2024 & 2032

- Figure 11: South America Third Personal Shooting Game Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Third Personal Shooting Game Revenue (million), by Country 2024 & 2032

- Figure 13: South America Third Personal Shooting Game Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Third Personal Shooting Game Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Third Personal Shooting Game Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Third Personal Shooting Game Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Third Personal Shooting Game Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Third Personal Shooting Game Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Third Personal Shooting Game Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Third Personal Shooting Game Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Third Personal Shooting Game Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Third Personal Shooting Game Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Third Personal Shooting Game Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Third Personal Shooting Game Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Third Personal Shooting Game Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Third Personal Shooting Game Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Third Personal Shooting Game Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Third Personal Shooting Game Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Third Personal Shooting Game Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Third Personal Shooting Game Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Third Personal Shooting Game Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Third Personal Shooting Game Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Third Personal Shooting Game Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Third Personal Shooting Game Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Third Personal Shooting Game Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Third Personal Shooting Game Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Third Personal Shooting Game Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Third Personal Shooting Game Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Third Personal Shooting Game Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Third Personal Shooting Game Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Third Personal Shooting Game Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Third Personal Shooting Game?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Third Personal Shooting Game?

Key companies in the market include HexaDrive, Swordfish Studios, PUBG Studios, Genuine Games, GlyphX Games, Volition, Black Cat Games, Remedy Entertainment, Rogue Entertainment, BioWare, Realtime Worlds, Neversoft, Extreme FX, Planet Moon Studios, FromSoftware, EA Montreal, Blitz Games.

3. What are the main segments of the Third Personal Shooting Game?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Third Personal Shooting Game," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Third Personal Shooting Game report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Third Personal Shooting Game?

To stay informed about further developments, trends, and reports in the Third Personal Shooting Game, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence