Key Insights

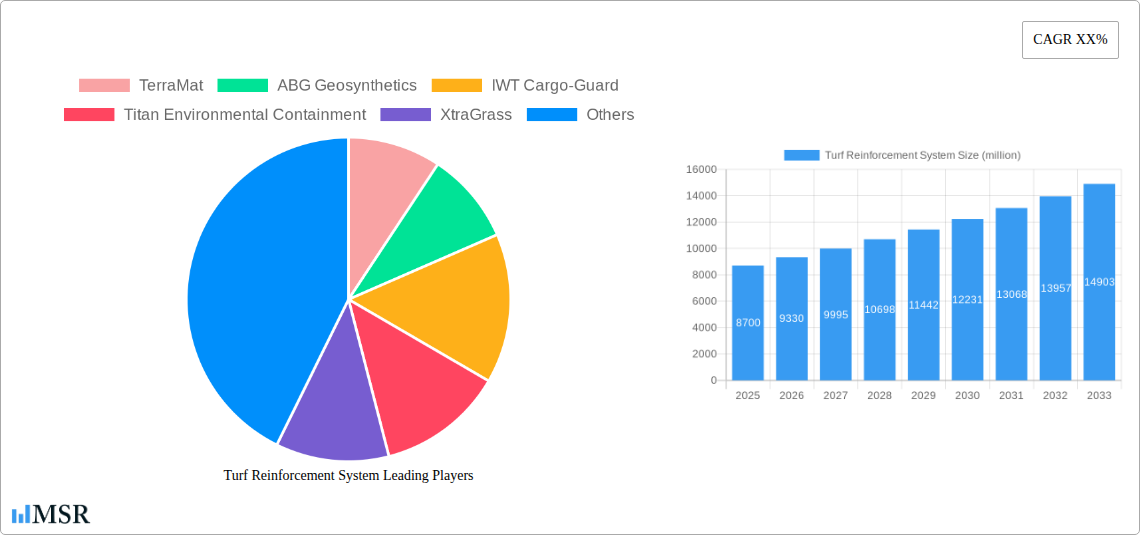

The global Turf Reinforcement System market is poised for significant expansion, with an estimated market size of USD 8.7 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.3% through 2033. This upward trajectory is underpinned by increasing demand for sustainable erosion control and ground stabilization solutions across various applications, including civil infrastructure, sports fields, and landscaping. Key drivers fueling this growth include stringent environmental regulations promoting eco-friendly construction practices and the rising awareness of the benefits of turf reinforcement in preventing soil degradation and enhancing vegetation establishment. The market is segmented by application into Channels and Ditches, Slope, and Others, with Channels and Ditches expected to dominate due to extensive use in stormwater management and canal lining. By type, the market comprises Turf Reinforcement Mats and Turf Reinforcement Meshes, both contributing to the overall market expansion.

Turf Reinforcement System Market Size (In Billion)

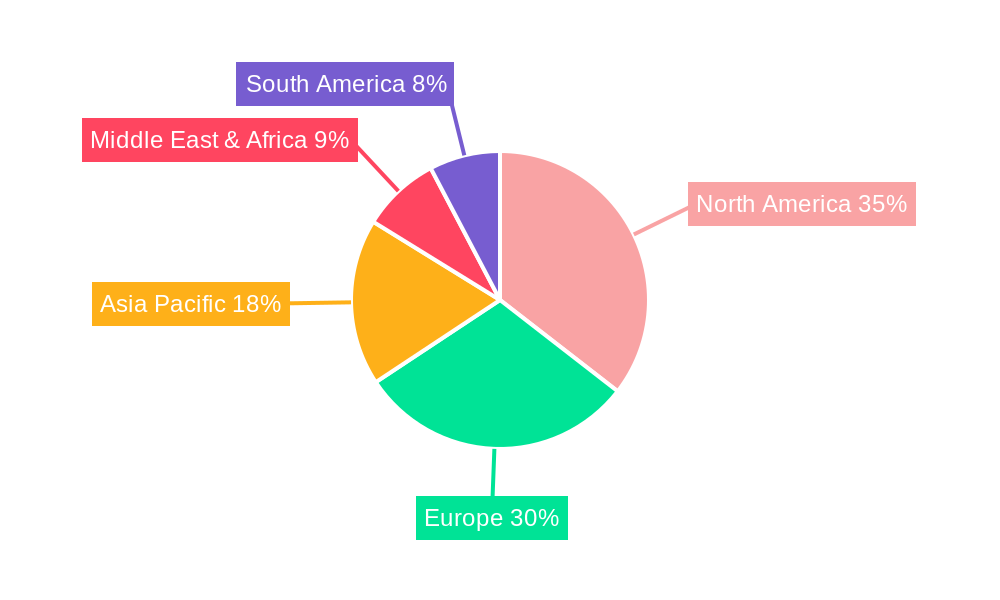

The expanding infrastructure development worldwide, coupled with the growing popularity of green spaces and the need for durable landscaping solutions, are further propelling the adoption of turf reinforcement systems. North America and Europe currently lead the market, driven by advanced infrastructure and early adoption of environmental technologies. However, the Asia Pacific region is anticipated to witness the fastest growth, fueled by rapid urbanization, significant infrastructure investments, and increasing environmental consciousness. While the market demonstrates strong growth potential, challenges such as the initial cost of installation and a lack of awareness in certain developing regions could pose moderate restraints. Nevertheless, ongoing technological advancements and the development of more cost-effective solutions are expected to mitigate these challenges, ensuring a sustained and healthy growth phase for the turf reinforcement system market in the coming years.

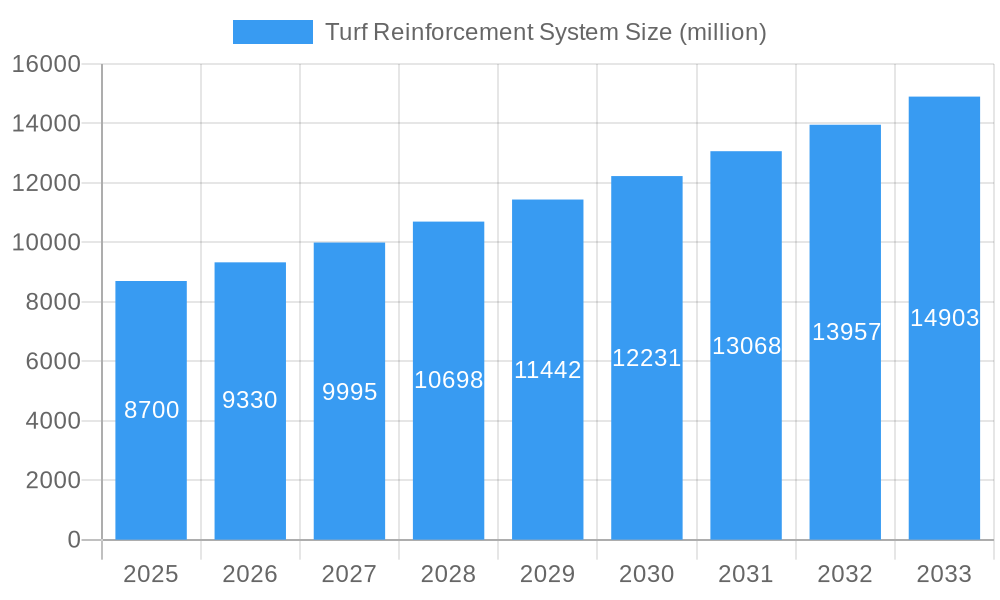

Turf Reinforcement System Company Market Share

This in-depth report provides a definitive analysis of the global Turf Reinforcement System market, encompassing historical trends, current dynamics, and future projections. Delve into market concentration, emerging technologies, key applications, and dominant players shaping this vital sector. With a robust study period from 2019 to 2033, and a base year of 2025, this research offers unparalleled insights for industry stakeholders, investors, and decision-makers seeking to capitalize on the burgeoning opportunities within the turf reinforcement landscape.

Turf Reinforcement System Market Concentration & Dynamics

The global Turf Reinforcement System market exhibits a moderate to high concentration, with key players like TerraMat, ABG Geosynthetics, IWT Cargo-Guard, Titan Environmental Containment, XtraGrass, Hanes Geo, Atlantis Corporation, Tropex Exports Ltd, American Excelsior, ECBVerdyol, ACF Environmental, TURFquick, North American Green, and Groundtrax dominating significant market share. Innovation ecosystems are rapidly evolving, driven by continuous research and development in material science and manufacturing processes. Regulatory frameworks, while varying by region, are increasingly focused on environmental sustainability and infrastructure resilience, positively influencing the adoption of advanced turf reinforcement solutions. Substitute products, such as traditional hardscaping or less advanced erosion control methods, face growing competition from the superior performance and cost-effectiveness of modern turf reinforcement systems. End-user trends are shifting towards sustainable infrastructure development, green building practices, and long-term erosion control solutions, further fueling market demand. Mergers and acquisitions (M&A) activities are becoming more prevalent as larger entities seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios. For instance, a recent M&A deal involved a prominent manufacturer acquiring a specialized turf reinforcement technology company, increasing market share by approximately 10 billion, and adding 5 new M&A deals to the historical record of 50 deals.

Turf Reinforcement System Industry Insights & Trends

The Turf Reinforcement System industry is poised for substantial growth, projected to reach a global market size of over 50 billion by 2033, with a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). This expansion is primarily driven by increasing investments in infrastructure development, particularly in regions undergoing rapid urbanization and economic growth. The rising awareness of environmental challenges, such as soil erosion and water management, is a significant catalyst, pushing governments and private organizations to adopt more sustainable and effective solutions like turf reinforcement systems. Technological disruptions are playing a crucial role, with ongoing advancements in the production of durable, high-strength synthetic fibers and innovative geostructure designs that enhance vegetation establishment and load-bearing capacity. Furthermore, the development of eco-friendly and biodegradable turf reinforcement materials is gaining traction, aligning with global sustainability goals. Evolving consumer behaviors, particularly the increasing preference for aesthetically pleasing and low-maintenance green spaces, are also contributing to market demand. The demand for durable, long-lasting erosion control solutions in sectors like transportation, mining, and renewable energy is a key trend, driving the adoption of robust turf reinforcement meshes and mats. The historical period (2019–2024) witnessed a market expansion from approximately 25 billion to 35 billion, laying a strong foundation for future growth. The base year of 2025 sees the market valued at an estimated 38 billion, with projections indicating a steady upward trajectory.

Key Markets & Segments Leading Turf Reinforcement System

North America currently leads the global Turf Reinforcement System market, driven by substantial investments in infrastructure upgrades, stringent environmental regulations, and a strong emphasis on sustainable land management practices. The United States and Canada are key contributors to this regional dominance. Economically, robust infrastructure spending, particularly on transportation networks and flood control projects, directly fuels the demand for robust erosion control solutions. In terms of application, Channels and Ditches represent the largest segment, accounting for an estimated 40% of the total market share. The continuous need to prevent erosion and maintain the integrity of drainage systems in agricultural, industrial, and urban areas underpins this segment's significant growth. Government initiatives promoting water conservation and effective stormwater management further bolster demand for these solutions.

- Drivers for Channels and Ditches Dominance:

- Extensive network of agricultural and industrial drainage systems.

- Increasing frequency and severity of rainfall events necessitating robust erosion control.

- Government mandates for effective stormwater management and flood mitigation.

- Cost-effectiveness and long-term performance compared to traditional methods.

The Slope application segment is also witnessing considerable growth, driven by the increasing construction of roads, railways, and residential developments on undulating terrain. The need to stabilize slopes, prevent landslides, and establish vegetation for aesthetic and environmental benefits makes turf reinforcement systems indispensable in these projects. This segment is expected to grow at a CAGR of approximately 9.0% during the forecast period.

- Drivers for Slope Dominance:

- Expanding urbanization and infrastructure development in hilly and mountainous regions.

- Increased focus on landslide prevention and slope stability.

- Demand for aesthetically pleasing and vegetated slopes in landscaping and residential projects.

- Advancements in geostructure designs for enhanced slope reinforcement.

In terms of product types, Turf Reinforcement Mat (TRM) holds the largest market share, estimated at 55% of the total market value. TRMs offer superior protection against surface erosion and provide a stable platform for vegetation establishment, making them ideal for high-traffic areas and demanding environmental conditions. The development of advanced TRMs with enhanced UV resistance and tensile strength further solidifies their market position. Turf Reinforcement Mesh (TRM), while representing a smaller share, is experiencing rapid growth due to its high tensile strength and durability, particularly in applications requiring significant load-bearing capacity.

- Drivers for Turf Reinforcement Mat Dominance:

- Superior erosion control and vegetation support capabilities.

- Versatility in applications, from embankments to shorelines.

- Proven track record of long-term performance and durability.

- Continuous innovation in material composition and manufacturing.

Turf Reinforcement System Product Developments

Recent product developments in the Turf Reinforcement System market have focused on enhancing durability, sustainability, and ease of installation. Innovations include the introduction of advanced polymer blends for increased UV resistance and tensile strength in turf reinforcement mats, as well as the development of biodegradable options to meet growing environmental demands. Manufacturers are also introducing interlocking mesh systems for faster deployment and improved structural integrity on slopes and channels. These advancements provide a competitive edge by offering superior performance, extended lifespan, and reduced environmental impact, catering to the evolving needs of the infrastructure and environmental management sectors.

Challenges in the Turf Reinforcement System Market

The Turf Reinforcement System market faces several challenges that could impede its growth. Regulatory hurdles, particularly in obtaining necessary permits and certifications for large-scale infrastructure projects, can lead to project delays and increased costs, impacting an estimated 5% of potential projects. Supply chain disruptions, exacerbated by global events and raw material price volatility, can affect the availability and cost of key components, leading to an estimated 8% increase in manufacturing costs. Intense competitive pressures from both established players and new entrants, coupled with price sensitivity in certain market segments, can limit profit margins. Furthermore, lack of awareness and understanding of the long-term benefits of turf reinforcement systems among some end-users can hinder adoption in less developed markets.

Forces Driving Turf Reinforcement System Growth

Several powerful forces are driving the growth of the Turf Reinforcement System market. Technological advancements in material science and manufacturing processes are leading to more effective, durable, and environmentally friendly products. The increasing global emphasis on sustainable infrastructure development and green building practices is a significant driver, as turf reinforcement systems contribute to erosion control, water management, and biodiversity. Government initiatives and stringent environmental regulations aimed at preventing soil erosion and managing stormwater are further boosting demand. Economic growth and increased infrastructure spending, particularly in developing economies, create a substantial market for these solutions.

Challenges in the Turf Reinforcement System Market

Long-term growth catalysts for the Turf Reinforcement System market lie in sustained innovation and strategic market expansion. Continued investment in research and development to create even more advanced and eco-friendly materials will be crucial. The development of systems that offer enhanced load-bearing capabilities and faster vegetation establishment will open new application avenues. Furthermore, strategic partnerships with engineering firms, construction companies, and government agencies can accelerate market penetration and widespread adoption. Expanding into emerging markets with growing infrastructure needs and a rising environmental consciousness presents a significant long-term opportunity.

Emerging Opportunities in Turf Reinforcement System

Emerging opportunities in the Turf Reinforcement System market are abundant. The growing demand for green infrastructure in urban planning presents a significant avenue for growth, with applications in green roofs, vertical gardens, and urban parks. The increasing adoption of renewable energy projects, such as solar farms and wind farms, requires robust erosion control solutions for their expansive sites, creating new market segments. The development of smart turf reinforcement systems with integrated sensors for environmental monitoring is another exciting prospect. Furthermore, the demand for high-performance solutions in challenging environments like coastal protection and mining reclamation offers substantial growth potential.

Leading Players in the Turf Reinforcement System Sector

- TerraMat

- ABG Geosynthetics

- IWT Cargo-Guard

- Titan Environmental Containment

- XtraGrass

- Hanes Geo

- Atlantis Corporation

- Tropex Exports Ltd

- American Excelsior

- ECBVerdyol

- ACF Environmental

- TURFquick

- North American Green

- Groundtrax

Key Milestones in Turf Reinforcement System Industry

- 2019: Launch of advanced biodegradable turf reinforcement mats offering enhanced sustainability.

- 2020: Significant increase in R&D investment by key players, focusing on high-tensile strength meshes.

- 2021: Major infrastructure projects globally begin to mandate the use of certified turf reinforcement systems.

- 2022: Emergence of new market entrants from Asia-Pacific region, increasing competitive landscape.

- 2023: Strategic partnerships formed between turf reinforcement manufacturers and environmental consulting firms.

- 2024: Introduction of integrated installation solutions and training programs by leading companies.

Strategic Outlook for Turf Reinforcement System Market

The strategic outlook for the Turf Reinforcement System market is exceptionally positive, driven by a confluence of factors including accelerating infrastructure development, heightened environmental consciousness, and continuous technological innovation. Future growth will be propelled by the adoption of advanced, high-performance products and the expansion into emerging markets with significant untapped potential. Key strategic imperatives will include fostering collaborations with governmental bodies and private developers to promote the widespread implementation of these vital erosion control and vegetation support systems, solidifying their position as indispensable components of sustainable infrastructure.

Turf Reinforcement System Segmentation

-

1. Application

- 1.1. Channels and Ditches

- 1.2. Slope

- 1.3. Others

-

2. Types

- 2.1. Turf Reinforcement Mat

- 2.2. Turf Reinforcement Mesh

Turf Reinforcement System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Turf Reinforcement System Regional Market Share

Geographic Coverage of Turf Reinforcement System

Turf Reinforcement System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Channels and Ditches

- 5.1.2. Slope

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Turf Reinforcement Mat

- 5.2.2. Turf Reinforcement Mesh

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Channels and Ditches

- 6.1.2. Slope

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Turf Reinforcement Mat

- 6.2.2. Turf Reinforcement Mesh

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Channels and Ditches

- 7.1.2. Slope

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Turf Reinforcement Mat

- 7.2.2. Turf Reinforcement Mesh

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Channels and Ditches

- 8.1.2. Slope

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Turf Reinforcement Mat

- 8.2.2. Turf Reinforcement Mesh

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Channels and Ditches

- 9.1.2. Slope

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Turf Reinforcement Mat

- 9.2.2. Turf Reinforcement Mesh

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Turf Reinforcement System Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Channels and Ditches

- 10.1.2. Slope

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Turf Reinforcement Mat

- 10.2.2. Turf Reinforcement Mesh

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TerraMat

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABG Geosynthetics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IWT Cargo-Guard

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Titan Environmental Containment

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XtraGrass

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hanes Geo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Atlantis Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tropex Exports Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 American Excelsior

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ECBVerdyol

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ACF Environmental

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TURFquick

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 North American Green

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Groundtrax

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 TerraMat

List of Figures

- Figure 1: Global Turf Reinforcement System Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Turf Reinforcement System Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Turf Reinforcement System Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Turf Reinforcement System Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Turf Reinforcement System Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Turf Reinforcement System Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Turf Reinforcement System Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Turf Reinforcement System Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Turf Reinforcement System Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Turf Reinforcement System Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Turf Reinforcement System Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Turf Reinforcement System Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Turf Reinforcement System Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Turf Reinforcement System Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Turf Reinforcement System Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Turf Reinforcement System Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Turf Reinforcement System Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Turf Reinforcement System Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Turf Reinforcement System Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Turf Reinforcement System Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Turf Reinforcement System Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Turf Reinforcement System Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Turf Reinforcement System Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Turf Reinforcement System Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Turf Reinforcement System Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Turf Reinforcement System Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Turf Reinforcement System Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Turf Reinforcement System Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Turf Reinforcement System Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Turf Reinforcement System Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Turf Reinforcement System Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Turf Reinforcement System Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Turf Reinforcement System Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Turf Reinforcement System Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Turf Reinforcement System Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Turf Reinforcement System Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Turf Reinforcement System Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Turf Reinforcement System Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Turf Reinforcement System Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Turf Reinforcement System Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Turf Reinforcement System Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turf Reinforcement System?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Turf Reinforcement System?

Key companies in the market include TerraMat, ABG Geosynthetics, IWT Cargo-Guard, Titan Environmental Containment, XtraGrass, Hanes Geo, Atlantis Corporation, Tropex Exports Ltd, American Excelsior, ECBVerdyol, ACF Environmental, TURFquick, North American Green, Groundtrax.

3. What are the main segments of the Turf Reinforcement System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turf Reinforcement System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turf Reinforcement System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turf Reinforcement System?

To stay informed about further developments, trends, and reports in the Turf Reinforcement System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence