Key Insights

The United Kingdom luxury goods market, valued at approximately £18.08 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 2.29% from 2025 to 2033. Key growth drivers include a growing affluent population with increasing disposable income, fueling demand across apparel, footwear, and accessories. The UK's standing as a premier global luxury retail destination attracts high-net-worth individuals, while the rise of online luxury retail broadens market accessibility. However, economic uncertainties and exchange rate volatility present potential challenges. The market is segmented by product type and distribution channel, with online sales demonstrating significant growth. Leading players such as LVMH, Kering, Richemont, and Estee Lauder are actively innovating. The market forecast indicates sustained value growth, positioning the UK as a key market for luxury goods enterprises.

United Kingdom Luxury Goods Market Market Size (In Billion)

The competitive landscape features both established international brands and emerging domestic players, with strategic partnerships and collaborations enhancing market reach. Sustainability and ethical sourcing are increasingly influencing consumer choices, prompting brands to adopt responsible practices. Personalization and experiential offerings are vital for cultivating customer loyalty. While counterfeit goods and economic volatility persist, the long-term outlook for the UK luxury goods market remains positive, driven by brand appeal and evolving consumer demands. Sustained growth necessitates navigating economic fluctuations, adapting to consumer preferences, prioritizing sustainability, and elevating the overall brand experience.

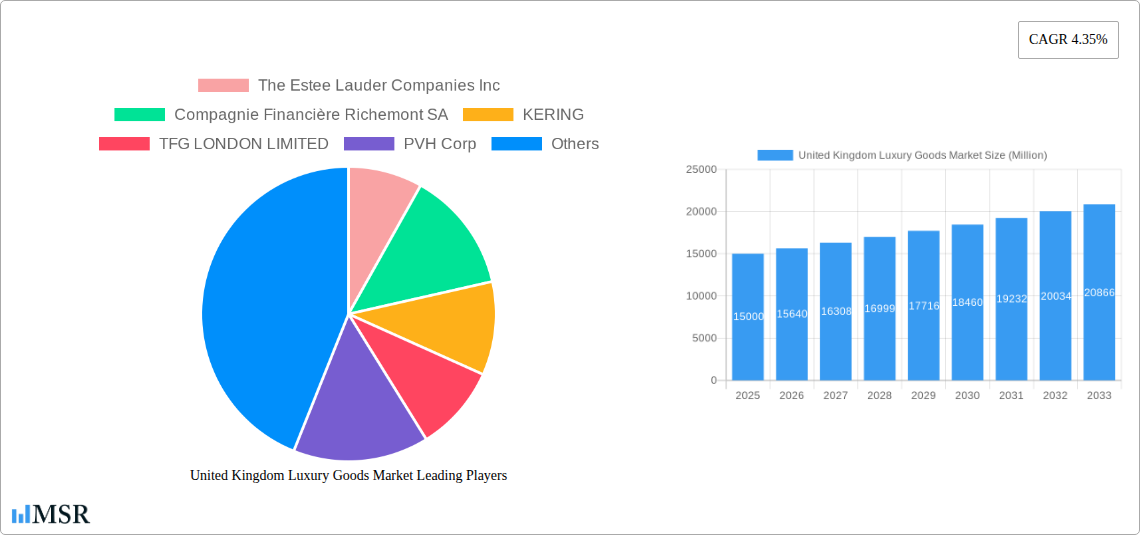

United Kingdom Luxury Goods Market Company Market Share

United Kingdom Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom luxury goods market, encompassing market dynamics, key segments, leading players, and future growth opportunities. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on this dynamic market. The UK luxury goods market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United Kingdom Luxury Goods Market Market Concentration & Dynamics

The UK luxury goods market is characterized by a high degree of concentration, with a few major players holding significant market share. The Estee Lauder Companies Inc, LVMH Moët Hennessy Louis Vuitton, KERING, and Richemont are amongst the leading companies, collectively controlling a substantial portion (xx%) of the market. However, a significant number of smaller, niche brands also contribute to the market's diversity.

- Market Concentration: High, with top players controlling xx% of market share.

- Innovation Ecosystems: Robust, driven by collaborations and technological advancements.

- Regulatory Frameworks: Well-established, but subject to evolving consumer protection and sustainability regulations.

- Substitute Products: Limited, due to the unique value proposition of luxury goods.

- End-User Trends: Increasing demand for sustainable and ethically sourced products, personalization, and experiences.

- M&A Activities: Moderate levels of M&A activity driven by expansion and consolidation efforts in the last five years, with xx deals recorded from 2019 to 2024.

United Kingdom Luxury Goods Market Industry Insights & Trends

The UK luxury goods market is witnessing robust growth fueled by several factors. Rising disposable incomes among affluent consumers, coupled with a growing preference for high-quality, aspirational products, are key drivers. Furthermore, the increasing influence of social media and celebrity endorsements contributes to brand awareness and demand. Technological advancements, such as personalized shopping experiences and e-commerce platforms, are transforming the market landscape. The market size is estimated to be xx Million in 2025, and the growing popularity of online retail channels is also driving the market growth. Changing consumer preferences towards sustainable practices and ethically sourced products are also presenting new opportunities for luxury brands.

Key Markets & Segments Leading United Kingdom Luxury Goods Market

The UK luxury goods market is segmented by product type (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and distribution channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other Distribution Channels).

Dominant Segments:

- By Type: Clothing and Apparel currently hold the largest market share, followed by Bags and Watches. This is driven by strong consumer demand for high-quality garments and accessories.

- By Distribution Channel: Single-brand stores remain the dominant distribution channel, offering a premium brand experience. However, online stores are experiencing rapid growth, driven by convenience and accessibility.

Drivers:

- Economic Growth: A stable economy boosts consumer spending on luxury goods.

- Tourism: London's status as a global tourism hub attracts significant luxury spending.

- Infrastructure: A well-developed retail infrastructure supports luxury sales.

United Kingdom Luxury Goods Market Product Developments

Recent years have witnessed significant product innovations in the UK luxury goods market. Brands are increasingly focusing on sustainability, utilizing eco-friendly materials and production processes. Technological advancements, such as personalized customization options and augmented reality experiences, are enhancing the shopping journey. The emphasis on unique designs and storytelling also contributes to brand differentiation.

Challenges in the United Kingdom Luxury Goods Market Market

The UK luxury goods market faces challenges including economic downturns, which can significantly impact consumer spending. Brexit has created uncertainties surrounding trade and supply chains. Intense competition from both established and emerging brands necessitates continuous innovation and brand differentiation. Increasing concerns regarding sustainability and ethical sourcing also require proactive measures by companies.

Forces Driving United Kingdom Luxury Goods Market Growth

Several factors drive growth in the UK luxury goods market. The growing affluence of the UK population fuels demand. Strong tourism inflow and London's reputation as a luxury shopping destination further boost sales. Technological advancements, particularly in e-commerce and personalized experiences, are expanding market access.

Challenges in the United Kingdom Luxury Goods Market Market

Long-term growth hinges on adapting to evolving consumer preferences and sustainability concerns. Strategic partnerships and collaborations can unlock new markets and resources. Investing in technological innovation will be crucial for staying competitive and enhancing customer experiences.

Emerging Opportunities in United Kingdom Luxury Goods Market

Emerging opportunities lie in the growing demand for personalized luxury experiences. The rise of e-commerce and social media provides new avenues for brand building and customer engagement. The increasing focus on sustainability offers opportunities for brands to showcase ethical and eco-friendly practices.

Leading Players in the United Kingdom Luxury Goods Market Sector

- The Estee Lauder Companies Inc

- Compagnie Financière Richemont SA

- KERING

- TFG LONDON LIMITED

- PVH Corp

- Ralph Lauren Corporation

- L'OREAL

- LVMH Moët Hennessy Louis Vuitton

- MAX MARA SRL

- CHANEL

Key Milestones in United Kingdom Luxury Goods Market Industry

- September 2021: Estée Lauder launched a new collection of luxury perfumes with ScentCapture Fragrance Extender technology.

- April 2020: Burberry released a sustainable collection featuring cutting-edge materials.

- January 2020: Versace opened a new flagship store in London.

Strategic Outlook for United Kingdom Luxury Goods Market Market

The UK luxury goods market holds significant future potential. Brands that successfully adapt to evolving consumer preferences, embrace sustainability, and leverage technological advancements will thrive. Strategic partnerships and investments in innovation will be key to securing a competitive edge and capitalizing on emerging market opportunities.

United Kingdom Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

United Kingdom Luxury Goods Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Luxury Goods Market Regional Market Share

Geographic Coverage of United Kingdom Luxury Goods Market

United Kingdom Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Beauty and Personal Care Products

- 3.4. Market Trends

- 3.4.1. Rising Affinity for Vegan Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KERING

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TFG LONDON LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PVH Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ralph Lauren Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'OREAL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LVMH Moët Hennessy Louis Vuitton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAX MARA SRL*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CHANEL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: United Kingdom Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: United Kingdom Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: United Kingdom Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Luxury Goods Market?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the United Kingdom Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL*List Not Exhaustive, CHANEL.

3. What are the main segments of the United Kingdom Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Natural and Organic Formulations.

6. What are the notable trends driving market growth?

Rising Affinity for Vegan Leather Goods.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Beauty and Personal Care Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Estée Lauder launched a new collection of luxury perfumes, featuring the brand's exclusive technology - ScentCapture Fragrance Extender which allows the fragrance to last for aroundnd 12 hours after a single application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Luxury Goods Market?

To stay informed about further developments, trends, and reports in the United Kingdom Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence