Key Insights

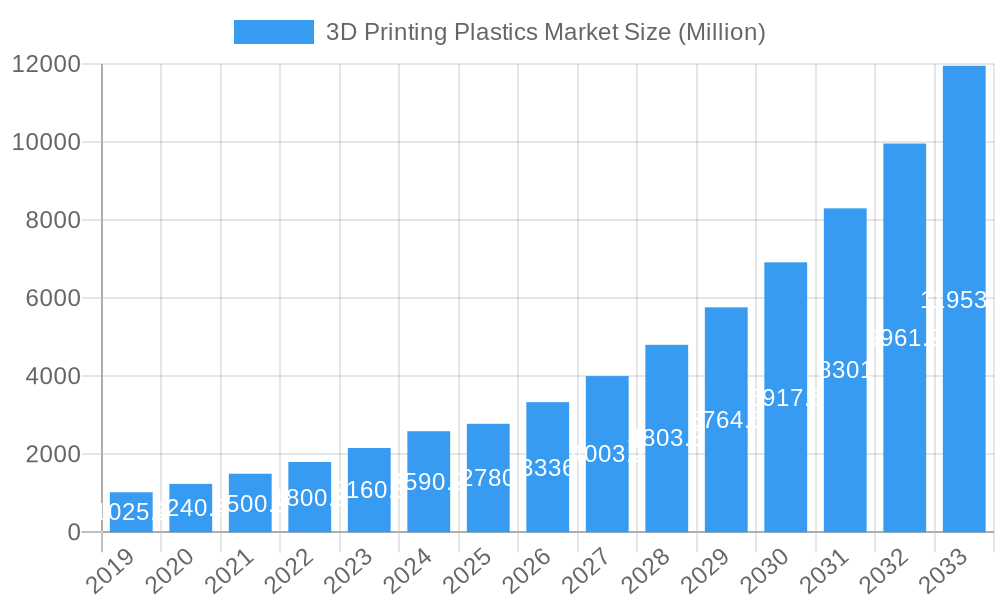

The global 3D printing plastics market is poised for robust expansion, projected to reach a significant market size of $2.78 billion by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 20.00%, indicating a dynamic and rapidly evolving industry. The surge in demand for additive manufacturing solutions across diverse sectors, including automotive, medical, aerospace, and consumer electronics, is a primary driver. Advancements in material science, leading to the development of high-performance and specialized plastics like Acrylonitrile Butadiene Styrene (ABS), Polylactic Acid (PLA), Nylon, Polyamide, and Polycarbonates, are further accelerating market penetration. The increasing adoption of 3D printing for prototyping, customized part production, and low-volume manufacturing is creating substantial opportunities for plastic material suppliers. The ease of use, cost-effectiveness, and design flexibility offered by 3D printing technologies, especially with the advent of advanced printing forms like filament and powder, are compelling businesses to integrate these solutions into their production workflows.

3D Printing Plastics Market Market Size (In Billion)

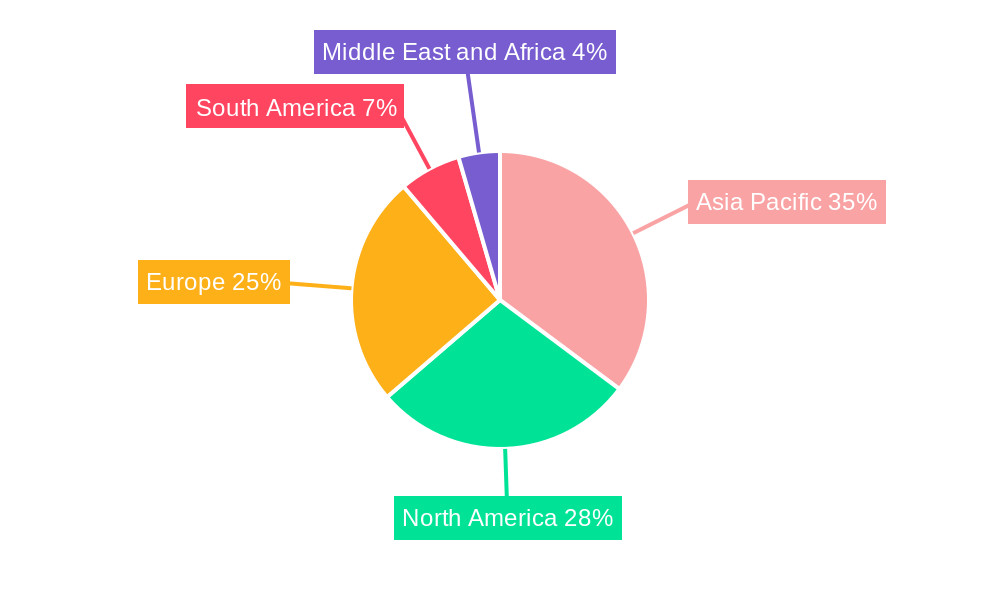

The market is characterized by a variety of material types, with plastics dominating due to their versatility, affordability, and adaptability for 3D printing processes. Emerging trends such as the development of biodegradable and sustainable plastics, along with the continuous innovation in printing technologies, are set to shape the market's future trajectory. Key players like 3D Systems Inc., Arkema, BASF SE, Stratasys, and Evonik Industries AG are actively investing in research and development to offer a wider range of advanced polymer materials. Despite the optimistic outlook, certain restraints, such as the initial high cost of industrial-grade 3D printers and the need for specialized technical expertise, might temper rapid widespread adoption in some segments. However, the strong growth potential in regions like Asia Pacific, driven by manufacturing advancements and increasing R&D investments, coupled with North America and Europe's established additive manufacturing ecosystems, underscores the global significance of this market.

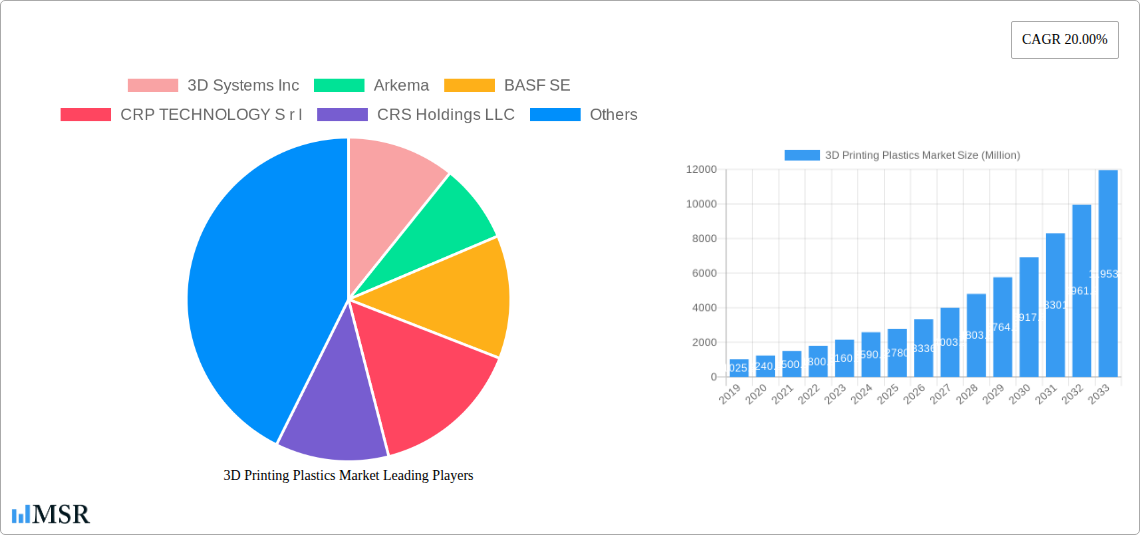

3D Printing Plastics Market Company Market Share

Unlock the Future of Manufacturing: Comprehensive 3D Printing Plastics Market Report (2019-2033)

Gain unparalleled insights into the dynamic 3D printing plastics market. This definitive report offers a deep dive into market size, growth trajectories, and emerging trends shaping the additive manufacturing materials landscape. With a focus on plastics for 3D printing, including ABS, PLA, Nylon, Polyamide, and Polycarbonates, this analysis is essential for 3D printer material suppliers, end-users, and industry stakeholders seeking to capitalize on this rapidly expanding sector.

3D Printing Plastics Market Market Concentration & Dynamics

The 3D printing plastics market exhibits a moderately concentrated landscape, with key players investing heavily in research and development to fuel innovation and expand their product portfolios. The innovation ecosystem thrives on continuous advancements in material science and processing technologies, driving the development of high-performance 3D printable plastics. Regulatory frameworks, particularly concerning material safety and application-specific certifications, are evolving, influencing market access and product development. The threat of substitute products, while present, is diminishing as the unique advantages of 3D printed plastic components become more pronounced across various industries. End-user trends are strongly influenced by the demand for customized solutions, rapid prototyping, and on-demand manufacturing, pushing the adoption of advanced 3D printing materials. Mergers and acquisitions (M&A) activities are a significant dynamic, with companies strategically acquiring complementary businesses to enhance their material offerings and market reach. In 2023 alone, the market witnessed a significant acquisition, highlighting consolidation efforts and a focus on expanding capabilities within the 3D printing consumables space.

- Market Share: While precise figures vary, leading companies hold significant shares in specialized segments.

- M&A Deal Counts: Driven by strategic growth, M&A activity remains robust, especially in material science and technology integration.

- Innovation Ecosystem: Collaborative research and development initiatives are key to developing novel plastic filaments and 3D printing resins.

- Regulatory Landscape: Evolving standards for biocompatibility and industrial applications are shaping material development.

- End-User Demand: Customization, lightweighting, and functional integration are primary drivers for 3D printed plastic parts.

3D Printing Plastics Market Industry Insights & Trends

The 3D printing plastics market is poised for substantial growth, projected to reach an estimated XX Million by 2033, with a robust Compound Annual Growth Rate (CAGR) of XX% from the base year 2025. This impressive expansion is fueled by an intricate interplay of technological advancements, evolving consumer behaviors, and the increasing need for flexible and efficient manufacturing processes. The proliferation of 3D printing technologies, from fused deposition modeling (FDM) to stereolithography (SLA) and selective laser sintering (SLS), has broadened the application scope for plastic 3D printing materials. Key growth drivers include the relentless pursuit of lightweight yet durable components in the automotive and aerospace sectors, the demand for highly customized and biocompatible implants in the medical industry, and the rapid iteration cycles essential for new product development in consumer electronics. Furthermore, the increasing affordability and accessibility of professional-grade 3D printers are democratizing additive manufacturing, encouraging small and medium-sized enterprises (SMEs) to integrate 3D printing into their production workflows. The shift towards decentralized manufacturing and on-demand production also significantly bolsters the market for 3D printing plastic filaments and powders. Technological disruptions, such as the development of multi-material printing capabilities and advanced post-processing techniques for plastic parts, are continuously pushing the boundaries of what is possible, creating new avenues for innovation and market penetration. Evolving consumer behaviors, characterized by a growing preference for personalized products and sustainable manufacturing, further accelerate the adoption of 3D printed plastic solutions. The market's trajectory is not just about producing prototypes but increasingly about manufacturing end-use parts with enhanced functional properties, further solidifying the importance of high-performance 3D printing plastics. The ongoing exploration of novel plastic resins with improved mechanical, thermal, and chemical resistance properties is a testament to the market's dynamic nature and its commitment to meeting diverse industrial demands.

Key Markets & Segments Leading 3D Printing Plastics Market

The 3D printing plastics market is experiencing robust growth across various geographical regions and industry segments. North America and Europe currently lead due to established additive manufacturing ecosystems, significant investment in R&D, and strong adoption by key end-user industries like aerospace and defense and medical. Asia-Pacific is emerging as a significant growth hub, driven by increasing manufacturing capabilities, government initiatives promoting advanced technologies, and a burgeoning automotive sector.

Within the Material Type segment, Plastics are unequivocally dominant, accounting for the largest market share. This dominance is further subdivided:

- Acrylonitrile Butadiene Styrene (ABS): Remains a popular choice for its balance of impact resistance, durability, and ease of printing, widely used in prototyping and functional parts for consumer electronics and automotive.

- Polylactic Acid (PLA): Continues to be a go-to material for hobbyists and educational institutions due to its biodegradability and ease of use, with increasing applications in short-run production and consumer goods.

- Nylon (Polyamide): Offers excellent mechanical strength, flexibility, and chemical resistance, making it ideal for robust functional parts in automotive, aerospace, and industrial applications.

- Polycarbonates: Valued for their high strength, impact resistance, and transparency, used in demanding applications requiring structural integrity and optical clarity.

- Other Plastics: Encompasses a range of specialized polymers tailored for specific performance requirements.

The Form segment sees Filament as the leading format, primarily driven by the widespread adoption of FDM technology in both professional and consumer markets. Powder is crucial for SLS and other powder-bed fusion technologies, vital for high-precision industrial applications. Liquid resins are primarily used in SLA and DLP technologies, favored for their high resolution and surface finish.

The End-user Industry landscape is diverse:

- Automotive: Driving demand for lightweight, customized components, interior parts, and rapid prototyping of complex designs.

- Medical: A critical sector for biocompatible 3D printing plastics, used for prosthetics, surgical guides, dental models, and anatomical replicas.

- Aerospace and Defense: Utilizes high-performance 3D printed plastic parts for functional components, tooling, and lightweight structural elements.

- Consumer Electronics: Leverages 3D printing for rapid prototyping, custom enclosures, and intricate internal components.

- Other End-user Industries: Includes sectors like industrial machinery, education, and architecture, each contributing to market growth.

Economic growth, particularly in developing regions, coupled with increasing investment in advanced manufacturing infrastructure, are significant drivers for regional dominance. The demand for bespoke solutions and rapid product development cycles in industries like automotive and consumer electronics will continue to propel the dominance of plastic-based 3D printing materials.

3D Printing Plastics Market Product Developments

Product developments in the 3D printing plastics market are characterized by a continuous drive for enhanced material properties and novel functionalities. Companies are investing in the creation of 3D printable plastics with improved mechanical strength, higher temperature resistance, enhanced chemical inertness, and greater flexibility. Innovations include the development of advanced plastic filaments and resins capable of mimicking the properties of traditional engineering materials, enabling the production of functional end-use parts. This includes the introduction of composite materials incorporating carbon fiber or glass fiber for increased stiffness and strength, as well as flame-retardant formulations for safety-critical applications. Furthermore, advancements in multi-material printing are opening doors to creating complex, multi-functional components with integrated properties, pushing the boundaries of design and application.

Challenges in the 3D Printing Plastics Market Market

Despite its rapid growth, the 3D printing plastics market faces several significant challenges. A primary concern remains the cost of high-performance 3D printing materials, which can be substantially higher than conventional plastics, impacting the economic viability of mass production for some applications. Supply chain disruptions, particularly for specialized plastic filaments and powders, can lead to production delays and increased costs. Furthermore, ensuring consistent quality and repeatability of printed parts across different machines and environments requires stringent process control and material standardization. Regulatory hurdles, especially in highly sensitive industries like medical and aerospace, necessitate extensive testing and certification for 3D printed plastic components, adding time and expense to product development cycles. Finally, a shortage of skilled professionals with expertise in additive manufacturing and material science can hinder adoption and innovation.

Forces Driving 3D Printing Plastics Market Growth

The 3D printing plastics market is propelled by a confluence of powerful forces. Technological advancements in 3D printing machines and materials are continuously expanding application possibilities, from rapid prototyping to the production of complex end-use parts. The increasing demand for customization and personalization across various industries, including automotive, medical, and consumer goods, directly fuels the adoption of 3D printable plastics. Economic incentives, such as reduced lead times and lower tooling costs for low-volume production runs, make 3D printing an attractive alternative to traditional manufacturing methods. Furthermore, growing awareness of the environmental benefits of additive manufacturing, such as reduced material waste and the potential for localized production, are also contributing to its growth. Government initiatives and investments in promoting advanced manufacturing technologies further accelerate the market's expansion.

Challenges in the 3D Printing Plastics Market Market

The long-term growth catalysts for the 3D printing plastics market lie in overcoming existing limitations and embracing emerging trends. Continued innovation in material science will be crucial, focusing on developing 3D printing plastics with superior mechanical properties, improved thermal and chemical resistance, and enhanced biocompatibility for advanced medical applications. The development of more sustainable and recyclable plastic materials for 3D printing will also be a significant growth accelerator, aligning with global environmental initiatives. Furthermore, the standardization of 3D printing processes and materials will build greater confidence among industrial users, paving the way for wider adoption in critical applications. Strategic partnerships between material manufacturers, 3D printer developers, and end-users will foster a more integrated ecosystem, driving innovation and market penetration. Expanding into new geographic markets and catering to emerging industries will also provide substantial long-term growth opportunities.

Emerging Opportunities in 3D Printing Plastics Market

Emerging opportunities in the 3D printing plastics market are abundant and diverse. The increasing demand for lightweight and high-strength 3D printed plastic components in the automotive and aerospace sectors presents a significant avenue for growth, particularly with the development of advanced composite plastic filaments. The medical industry continues to be a fertile ground for innovation, with growing applications in personalized implants, prosthetics, and drug delivery systems utilizing specialized biocompatible 3D printing resins. The expansion of 3D printing into the consumer electronics market for custom casings and intricate internal parts offers considerable potential. Furthermore, the development of novel plastic materials with unique properties, such as self-healing capabilities or embedded electronics, is opening up entirely new application frontiers. The growing focus on circular economy principles and sustainable manufacturing also presents an opportunity for the development and adoption of bio-based and recyclable 3D printing plastics.

Leading Players in the 3D Printing Plastics Market Sector

- 3D Systems Inc

- Arkema

- BASF SE

- CRP TECHNOLOGY S r l

- CRS Holdings LLC

- ENVISIONTEC US LLC

- EOS

- Evonik Industries AG

- General Electric

- Henkel AG & Co KGaA

- Höganäs AB

- Materialise

- Sandvik AB

- Solvay

- Stratasys

Key Milestones in 3D Printing Plastics Market Industry

- April 2023: Stratasys acquired Covestro AG's additive manufacturing materials business. This strategic acquisition, encompassing nearly 60 additive manufacturing materials, R&D facilities, global development and sales teams, and a robust IP portfolio, significantly expanded Stratasys's product offerings in 3D printing materials, reinforcing its market position.

- September 2022: SABIC announced the launch of its new flame-retardant 3D printing material, LNP THERMOCOMP AM DC0041XA51, specifically designed for the railway industry. Debuted at InnoTrans 2022, this development highlights the growing focus on specialized plastic materials for safety-critical industrial applications and expands the range of high-performance 3D printing consumables.

Strategic Outlook for 3D Printing Plastics Market Market

The strategic outlook for the 3D printing plastics market is exceptionally bright, driven by continuous innovation and expanding applications. Key growth accelerators include the development of advanced plastic materials with superior performance characteristics, such as higher strength-to-weight ratios, increased thermal stability, and improved chemical resistance, catering to demanding industries like aerospace and automotive. The ongoing trend towards mass customization and on-demand manufacturing will further boost the adoption of 3D printable plastics for end-use parts. Strategic opportunities lie in the expansion of the medical industry applications, particularly in personalized implants and complex surgical tools, and the increasing integration of 3D printing into the consumer electronics supply chain. Furthermore, the focus on sustainability will drive the demand for bio-based and recyclable 3D printing plastics, presenting a significant market advantage. Companies that invest in R&D for novel material formulations and forge strategic partnerships across the value chain will be best positioned to capitalize on the future potential of this dynamic market.

3D Printing Plastics Market Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 1.1.2. Polylactic Acid (PLA)

- 1.1.3. Nylon

- 1.1.4. Polyamide

- 1.1.5. Polycarbonates

- 1.1.6. Other Plastics

- 1.2. Ceramics

- 1.3. Metals

- 1.4. Other Material Types

-

1.1. Plastics

-

2. Form

- 2.1. Powder

- 2.2. Filament

- 2.3. Liquid

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Medical

- 3.3. Aerospace and Defense

- 3.4. Consumer Electronics

- 3.5. Other End-user Industries

3D Printing Plastics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Singapore

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

3D Printing Plastics Market Regional Market Share

Geographic Coverage of 3D Printing Plastics Market

3D Printing Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Surge in Demand in Automotive Application

- 3.3. Market Restrains

- 3.3.1. Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Surge in Demand in Automotive Application

- 3.4. Market Trends

- 3.4.1. Increasing Applications in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 5.1.1.2. Polylactic Acid (PLA)

- 5.1.1.3. Nylon

- 5.1.1.4. Polyamide

- 5.1.1.5. Polycarbonates

- 5.1.1.6. Other Plastics

- 5.1.2. Ceramics

- 5.1.3. Metals

- 5.1.4. Other Material Types

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Powder

- 5.2.2. Filament

- 5.2.3. Liquid

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Medical

- 5.3.3. Aerospace and Defense

- 5.3.4. Consumer Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Asia Pacific 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastics

- 6.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 6.1.1.2. Polylactic Acid (PLA)

- 6.1.1.3. Nylon

- 6.1.1.4. Polyamide

- 6.1.1.5. Polycarbonates

- 6.1.1.6. Other Plastics

- 6.1.2. Ceramics

- 6.1.3. Metals

- 6.1.4. Other Material Types

- 6.1.1. Plastics

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Powder

- 6.2.2. Filament

- 6.2.3. Liquid

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Medical

- 6.3.3. Aerospace and Defense

- 6.3.4. Consumer Electronics

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. North America 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastics

- 7.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 7.1.1.2. Polylactic Acid (PLA)

- 7.1.1.3. Nylon

- 7.1.1.4. Polyamide

- 7.1.1.5. Polycarbonates

- 7.1.1.6. Other Plastics

- 7.1.2. Ceramics

- 7.1.3. Metals

- 7.1.4. Other Material Types

- 7.1.1. Plastics

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Powder

- 7.2.2. Filament

- 7.2.3. Liquid

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Medical

- 7.3.3. Aerospace and Defense

- 7.3.4. Consumer Electronics

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastics

- 8.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 8.1.1.2. Polylactic Acid (PLA)

- 8.1.1.3. Nylon

- 8.1.1.4. Polyamide

- 8.1.1.5. Polycarbonates

- 8.1.1.6. Other Plastics

- 8.1.2. Ceramics

- 8.1.3. Metals

- 8.1.4. Other Material Types

- 8.1.1. Plastics

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Powder

- 8.2.2. Filament

- 8.2.3. Liquid

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Medical

- 8.3.3. Aerospace and Defense

- 8.3.4. Consumer Electronics

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. South America 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastics

- 9.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 9.1.1.2. Polylactic Acid (PLA)

- 9.1.1.3. Nylon

- 9.1.1.4. Polyamide

- 9.1.1.5. Polycarbonates

- 9.1.1.6. Other Plastics

- 9.1.2. Ceramics

- 9.1.3. Metals

- 9.1.4. Other Material Types

- 9.1.1. Plastics

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Powder

- 9.2.2. Filament

- 9.2.3. Liquid

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Medical

- 9.3.3. Aerospace and Defense

- 9.3.4. Consumer Electronics

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa 3D Printing Plastics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastics

- 10.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

- 10.1.1.2. Polylactic Acid (PLA)

- 10.1.1.3. Nylon

- 10.1.1.4. Polyamide

- 10.1.1.5. Polycarbonates

- 10.1.1.6. Other Plastics

- 10.1.2. Ceramics

- 10.1.3. Metals

- 10.1.4. Other Material Types

- 10.1.1. Plastics

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Powder

- 10.2.2. Filament

- 10.2.3. Liquid

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Medical

- 10.3.3. Aerospace and Defense

- 10.3.4. Consumer Electronics

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3D Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CRP TECHNOLOGY S r l

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CRS Holdings LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ENVISIONTEC US LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EOS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henkel AG & Co KGaA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Höganäs AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Materialise

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sandvik AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solvay

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Stratasys*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 3D Systems Inc

List of Figures

- Figure 1: Global 3D Printing Plastics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global 3D Printing Plastics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 4: Asia Pacific 3D Printing Plastics Market Volume (Billion), by Material Type 2025 & 2033

- Figure 5: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: Asia Pacific 3D Printing Plastics Market Volume Share (%), by Material Type 2025 & 2033

- Figure 7: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by Form 2025 & 2033

- Figure 8: Asia Pacific 3D Printing Plastics Market Volume (Billion), by Form 2025 & 2033

- Figure 9: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by Form 2025 & 2033

- Figure 10: Asia Pacific 3D Printing Plastics Market Volume Share (%), by Form 2025 & 2033

- Figure 11: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific 3D Printing Plastics Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific 3D Printing Plastics Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: Asia Pacific 3D Printing Plastics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Asia Pacific 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific 3D Printing Plastics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America 3D Printing Plastics Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 20: North America 3D Printing Plastics Market Volume (Billion), by Material Type 2025 & 2033

- Figure 21: North America 3D Printing Plastics Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: North America 3D Printing Plastics Market Volume Share (%), by Material Type 2025 & 2033

- Figure 23: North America 3D Printing Plastics Market Revenue (undefined), by Form 2025 & 2033

- Figure 24: North America 3D Printing Plastics Market Volume (Billion), by Form 2025 & 2033

- Figure 25: North America 3D Printing Plastics Market Revenue Share (%), by Form 2025 & 2033

- Figure 26: North America 3D Printing Plastics Market Volume Share (%), by Form 2025 & 2033

- Figure 27: North America 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: North America 3D Printing Plastics Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 29: North America 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: North America 3D Printing Plastics Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: North America 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: North America 3D Printing Plastics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: North America 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America 3D Printing Plastics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe 3D Printing Plastics Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 36: Europe 3D Printing Plastics Market Volume (Billion), by Material Type 2025 & 2033

- Figure 37: Europe 3D Printing Plastics Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Europe 3D Printing Plastics Market Volume Share (%), by Material Type 2025 & 2033

- Figure 39: Europe 3D Printing Plastics Market Revenue (undefined), by Form 2025 & 2033

- Figure 40: Europe 3D Printing Plastics Market Volume (Billion), by Form 2025 & 2033

- Figure 41: Europe 3D Printing Plastics Market Revenue Share (%), by Form 2025 & 2033

- Figure 42: Europe 3D Printing Plastics Market Volume Share (%), by Form 2025 & 2033

- Figure 43: Europe 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Europe 3D Printing Plastics Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 45: Europe 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe 3D Printing Plastics Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe 3D Printing Plastics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe 3D Printing Plastics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America 3D Printing Plastics Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 52: South America 3D Printing Plastics Market Volume (Billion), by Material Type 2025 & 2033

- Figure 53: South America 3D Printing Plastics Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 54: South America 3D Printing Plastics Market Volume Share (%), by Material Type 2025 & 2033

- Figure 55: South America 3D Printing Plastics Market Revenue (undefined), by Form 2025 & 2033

- Figure 56: South America 3D Printing Plastics Market Volume (Billion), by Form 2025 & 2033

- Figure 57: South America 3D Printing Plastics Market Revenue Share (%), by Form 2025 & 2033

- Figure 58: South America 3D Printing Plastics Market Volume Share (%), by Form 2025 & 2033

- Figure 59: South America 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 60: South America 3D Printing Plastics Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 61: South America 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South America 3D Printing Plastics Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South America 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: South America 3D Printing Plastics Market Volume (Billion), by Country 2025 & 2033

- Figure 65: South America 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America 3D Printing Plastics Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 68: Middle East and Africa 3D Printing Plastics Market Volume (Billion), by Material Type 2025 & 2033

- Figure 69: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 70: Middle East and Africa 3D Printing Plastics Market Volume Share (%), by Material Type 2025 & 2033

- Figure 71: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by Form 2025 & 2033

- Figure 72: Middle East and Africa 3D Printing Plastics Market Volume (Billion), by Form 2025 & 2033

- Figure 73: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by Form 2025 & 2033

- Figure 74: Middle East and Africa 3D Printing Plastics Market Volume Share (%), by Form 2025 & 2033

- Figure 75: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa 3D Printing Plastics Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa 3D Printing Plastics Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa 3D Printing Plastics Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa 3D Printing Plastics Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa 3D Printing Plastics Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa 3D Printing Plastics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 3: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 4: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 5: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global 3D Printing Plastics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global 3D Printing Plastics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 10: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 11: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 12: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 13: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global 3D Printing Plastics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Japan 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Singapore 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Singapore 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 30: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 31: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 32: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 33: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global 3D Printing Plastics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United States 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United States 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Canada 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Canada 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Mexico 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Mexico 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 44: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 45: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 46: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 47: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 48: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 49: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global 3D Printing Plastics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Germany 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Germany 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: United Kingdom 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: United Kingdom 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Italy 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Italy 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: France 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: France 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Russia 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Russia 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 64: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 65: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 66: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 67: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 68: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 69: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global 3D Printing Plastics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Brazil 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Brazil 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Argentina 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Argentina 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of South America 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Rest of South America 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Global 3D Printing Plastics Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 78: Global 3D Printing Plastics Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 79: Global 3D Printing Plastics Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 80: Global 3D Printing Plastics Market Volume Billion Forecast, by Form 2020 & 2033

- Table 81: Global 3D Printing Plastics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 82: Global 3D Printing Plastics Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 83: Global 3D Printing Plastics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Global 3D Printing Plastics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 85: Saudi Arabia 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Saudi Arabia 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: South Africa 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: South Africa 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Rest of Middle East and Africa 3D Printing Plastics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Rest of Middle East and Africa 3D Printing Plastics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing Plastics Market?

The projected CAGR is approximately 18%.

2. Which companies are prominent players in the 3D Printing Plastics Market?

Key companies in the market include 3D Systems Inc, Arkema, BASF SE, CRP TECHNOLOGY S r l, CRS Holdings LLC, ENVISIONTEC US LLC, EOS, Evonik Industries AG, General Electric, Henkel AG & Co KGaA, Höganäs AB, Materialise, Sandvik AB, Solvay, Stratasys*List Not Exhaustive.

3. What are the main segments of the 3D Printing Plastics Market?

The market segments include Material Type, Form, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Surge in Demand in Automotive Application.

6. What are the notable trends driving market growth?

Increasing Applications in the Automotive Industry.

7. Are there any restraints impacting market growth?

Growing Usage in Manufacturing Applications; Mass Customization Associated with 3D Printing; Surge in Demand in Automotive Application.

8. Can you provide examples of recent developments in the market?

April 2023: Stratasys acquired Covestro AG's additive manufacturing materials business. The acquisition comprises of product portfolio of nearly 60 additive manufacturing materials, R&D facilities, global development and sales teams across Asia, the U.S., and Europe, and a wide range of IP portfolios, including hundreds of patents and pending patents. This acquisition helped the company to expand its product portfolio of 3D printing materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing Plastics Market?

To stay informed about further developments, trends, and reports in the 3D Printing Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence