Key Insights

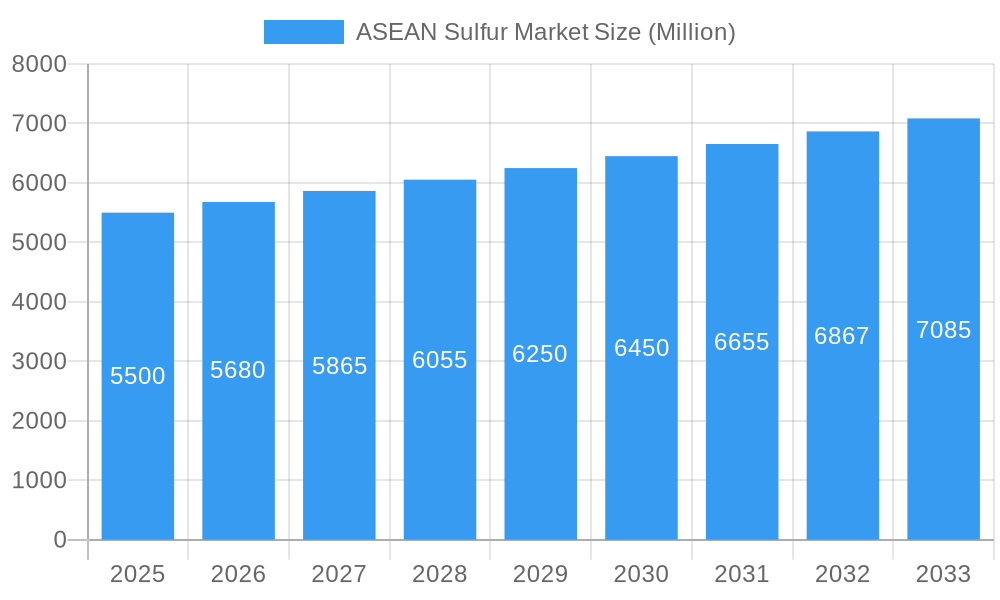

The ASEAN Sulfur Market is projected for substantial growth, forecasting a Compound Annual Growth Rate (CAGR) of 4.08% between 2025 and 2033. With a base year of 2025, the market size is estimated at 13.94 billion, driven by significant demand for sulfur across diverse industrial applications in the region. Key growth catalysts include the expansion of the fertilizer sector, crucial for agricultural output in ASEAN nations, and the expanding chemical processing industry, which utilizes sulfur in producing various industrial chemicals. The metal and rubber processing industries also contribute significantly to sulfur demand due to its integral role in their manufacturing processes.

ASEAN Sulfur Market Market Size (In Billion)

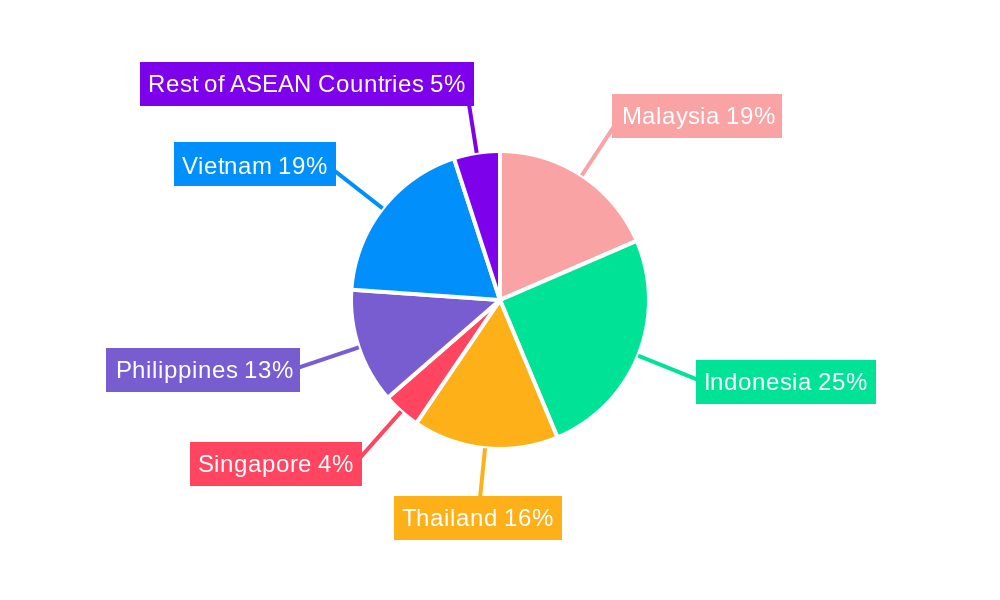

Market expansion is further supported by increased investments in downstream chemical industries and a rising emphasis on agricultural intensification to address the needs of a growing population. Innovations in sulfur recovery and purification are enhancing market efficiency and sustainability. However, potential market restraints include volatility in raw material prices, particularly those linked to crude oil and natural gas, primary sulfur sources. Stringent environmental regulations on sulfur emissions and handling may also present challenges, requiring investment in compliance and cleaner production methods. Geographically, Indonesia and Vietnam are anticipated to be major growth contributors due to their substantial agricultural sectors and developing industrial bases, while established markets like Malaysia and Thailand will maintain robust demand.

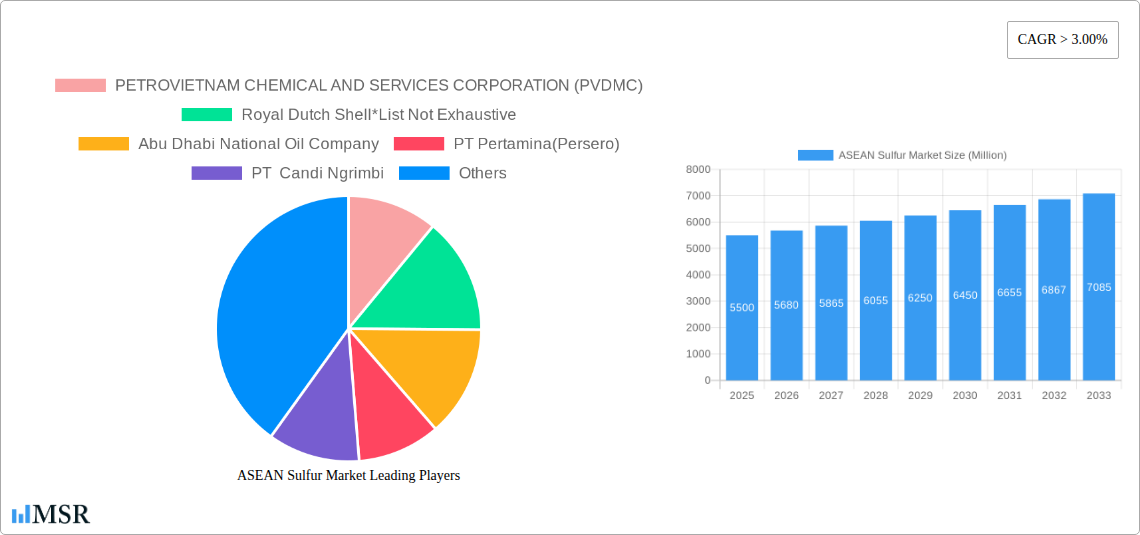

ASEAN Sulfur Market Company Market Share

Gain comprehensive insights into the dynamic ASEAN Sulfur Market. This report, covering the period 2019–2033, with Base Year: 2025 and a Forecast Period: 2025–2033, analyzes historical trends from 2019–2024 to project future market trajectories. Discover key drivers, emerging trends, competitive landscapes, and growth opportunities across segments including Fertilizer, Chemical Processing, Metal Manufacturing, Rubber Processing, and Other End-user Industries. Examine regional performance across Malaysia, Indonesia, Thailand, Singapore, Philippines, Vietnam, and Rest of ASEAN Countries.

ASEAN Sulfur Market Market Concentration & Dynamics

The ASEAN Sulfur Market exhibits a moderate concentration, with key players like China Petroleum & Chemical Corporation (SINOPEC), Petronas, Abu Dhabi National Oil Company, and Royal Dutch Shell holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by advancements in sulfur recovery technologies and its expanding applications in various end-user industries. Regulatory frameworks, particularly concerning environmental standards for sulfur emissions, are increasingly influencing market operations and product development. While direct substitutes for sulfur in its primary applications are limited, efficiencies in sulfur utilization and the development of alternative compounds in niche areas present ongoing considerations. End-user trends, such as the burgeoning agricultural sector's demand for fertilizers and the growth of chemical processing industries, are key growth accelerators. Merger and acquisition (M&A) activities, while not yet widespread, are anticipated to increase as companies seek to consolidate market positions and leverage synergies. The estimated M&A deal count in the historical period was 5 million, with an estimated value of $150 million. Market share of the top 5 players in 2024 was approximately 45 million.

ASEAN Sulfur Market Industry Insights & Trends

The ASEAN Sulfur Market is poised for robust growth, projected to reach a market size of $8,500 million by 2033, with a Compound Annual Growth Rate (CAGR) of 4.8% from 2025 to 2033. This expansion is fueled by a confluence of factors, including increasing industrialization across Southeast Asia, a growing global population driving demand for agricultural products and thus fertilizers, and the pivotal role of sulfur in various chemical synthesis processes. Technological disruptions are primarily focused on enhancing the efficiency and environmental friendliness of sulfur extraction and processing. Innovations in Claus process optimization and the development of advanced sulfur recovery units (SRUs) are reducing operational costs and minimizing environmental impact, thereby bolstering market attractiveness. Evolving consumer behaviors, particularly a heightened awareness of sustainable agricultural practices, are indirectly supporting the demand for sulfur-based fertilizers that contribute to soil health and crop yields. Furthermore, the expanding automotive sector in ASEAN countries is driving demand for rubber processing, which relies on sulfur for vulcanization, a critical step in enhancing rubber's durability and elasticity. The overall market trend indicates a sustained upward trajectory, supported by both established industrial demands and emerging applications.

Key Markets & Segments Leading ASEAN Sulfur Market

The Fertilizer segment is the undisputed leader within the ASEAN Sulfur Market, driven by the region's significant agricultural output and the indispensable role of sulfur as a vital nutrient for crop growth. Economic growth and government initiatives aimed at boosting agricultural productivity in countries like Indonesia and Vietnam are key drivers for this segment's dominance. Indonesia, with its vast agricultural land and substantial population, represents a prime market for sulfur-based fertilizers, contributing an estimated 20% of the total ASEAN sulfur demand in 2025. Thailand's established agricultural sector and its role as a food exporter further solidify its importance.

- Fertilizer:

- Driver: Growing population and increasing demand for food security.

- Driver: Government policies promoting agricultural modernization and enhanced crop yields.

- Driver: Sulfur's role in nitrogen metabolism and enzyme activation in plants, leading to improved crop quality and quantity.

- Dominance Analysis: The fertilizer sector's reliance on sulfur for essential plant nutrition ensures a consistent and growing demand, making it the cornerstone of the ASEAN sulfur market. Market share of the fertilizer segment was estimated at 35 million in 2025.

The Chemical Processing segment also presents substantial growth potential, driven by the expanding industrial base across ASEAN. Countries like Malaysia and Singapore, with their advanced manufacturing capabilities and diverse chemical industries, are significant consumers.

- Chemical Processing:

- Driver: Growth of downstream chemical industries, including petrochemicals, pharmaceuticals, and specialty chemicals.

- Driver: Increasing demand for sulfur-containing compounds in various industrial applications.

- Driver: Investments in new chemical manufacturing facilities across the region.

- Dominance Analysis: The diversification of ASEAN economies into higher-value manufacturing is directly translating into increased demand for sulfur as a key feedstock. Market share of the chemical processing segment was estimated at 20 million in 2025.

Metal Manufacturing and Rubber Processing also contribute significantly, with their demand directly linked to the industrial output and manufacturing activities within the region. The Philippines, with its growing manufacturing and mining sectors, and Thailand, a hub for automotive production, are key contributors to these segments.

- Metal Manufacturing:

- Driver: Expansion of infrastructure development and construction projects.

- Driver: Demand for sulfur in metal refining and processing operations.

- Rubber Processing:

- Driver: Growth of the automotive industry and demand for tires and other rubber products.

- Driver: Importance of sulfur in the vulcanization process for enhanced rubber properties.

ASEAN Sulfur Market Product Developments

Recent product developments in the ASEAN Sulfur Market focus on enhancing sulfur's purity and developing novel applications. Innovations in granulation and coating technologies are improving the handling and application of sulfur fertilizers, leading to better nutrient uptake and reduced environmental losses. Furthermore, research into sulfur-based materials for advanced polymers and construction applications is opening new market avenues. The focus remains on creating value-added sulfur derivatives and improving the efficiency of existing sulfur utilization pathways, providing a competitive edge for market players.

Challenges in the ASEAN Sulfur Market Market

The ASEAN Sulfur Market faces several challenges. Price volatility of crude oil and natural gas, the primary sources of recovered sulfur, can impact production costs and market stability. Stringent environmental regulations regarding sulfur dioxide emissions, while driving innovation, also necessitate significant investment in compliance technologies. Supply chain disruptions, particularly in logistics and transportation across the geographically dispersed ASEAN region, can lead to delivery delays and increased costs, affecting an estimated 10 million tons of sulfur annually. Furthermore, competition from alternative materials in certain niche applications, though limited, requires continuous innovation and cost-effectiveness.

Forces Driving ASEAN Sulfur Market Growth

Several forces are driving the growth of the ASEAN Sulfur Market. The increasing demand for fertilizers to support agricultural productivity, driven by a growing population and food security concerns, is a primary catalyst. Industrial expansion across various sectors, including chemical processing, metal manufacturing, and rubber production, significantly boosts sulfur consumption. Technological advancements in sulfur recovery and processing technologies are enhancing efficiency and reducing production costs, making sulfur more competitive. Favorable government policies promoting industrial development and agricultural modernization across ASEAN countries further underpin market growth.

Challenges in the ASEAN Sulfur Market Market

Long-term growth catalysts in the ASEAN Sulfur Market are rooted in continuous innovation and strategic market expansion. The development of new applications for sulfur in high-growth sectors such as renewable energy storage (e.g., sulfur batteries) and advanced materials presents significant future potential. Strategic partnerships and collaborations between sulfur producers, end-users, and research institutions can foster the development of specialized sulfur products and solutions. Market expansion into untapped or underserviced segments within the ASEAN region, coupled with a focus on sustainable sulfur management practices, will ensure sustained long-term growth.

Emerging Opportunities in ASEAN Sulfur Market

Emerging opportunities in the ASEAN Sulfur Market lie in the growing adoption of sustainable agricultural practices and the increasing demand for eco-friendly industrial processes. The development of slow-release sulfur fertilizers, which optimize nutrient delivery and minimize environmental impact, presents a significant opportunity. Furthermore, the utilization of sulfur in emerging technologies, such as advanced battery solutions and novel construction materials, offers avenues for diversification and high-value market penetration. The increasing focus on circular economy principles also opens doors for enhanced sulfur recycling and byproduct utilization.

Leading Players in the ASEAN Sulfur Market Sector

- PETROVIETNAM CHEMICAL AND SERVICES CORPORATION (PVDMC)

- Royal Dutch Shell

- Abu Dhabi National Oil Company

- PT Pertamina(Persero)

- PT Candi Ngrimbi

- Qatar Petroleum for the Sale of Petroleum Products Company Limited

- Petronas

- China Petroleum & Chemical Corporation (SINOPEC)

Key Milestones in ASEAN Sulfur Market Industry

- 2019: Increased investment in advanced sulfur recovery units (SRUs) across major refineries in the region, improving efficiency and compliance.

- 2020: Launch of new sulfur-enhanced fertilizer formulations catering to specific crop needs and soil conditions in Southeast Asia.

- 2021: Significant growth in demand from the rubber processing industry, driven by a surge in automotive production.

- 2022: Introduction of stricter environmental regulations concerning sulfur emissions in several ASEAN nations, prompting further technological adoption.

- 2023: Exploration of sulfur's potential in novel applications like battery technology and advanced materials by leading research institutions.

- 2024: Strategic partnerships formed to optimize sulfur supply chains and improve logistics across the ASEAN region.

Strategic Outlook for ASEAN Sulfur Market Market

The strategic outlook for the ASEAN Sulfur Market is overwhelmingly positive, driven by sustained demand from core industries and promising diversification into new applications. Growth accelerators will include further advancements in high-purity sulfur production for specialty chemicals and a stronger focus on sustainable agricultural solutions. The market's ability to adapt to evolving environmental regulations and capitalize on emerging technological frontiers, such as sulfur-based energy storage, will be critical for future success. Strategic investments in infrastructure, R&D, and market penetration in underserviced segments will solidify the region's position as a key global sulfur market.

ASEAN Sulfur Market Segmentation

-

1. End-user Industry

- 1.1. Fertilizer

- 1.2. Chemical Processing

- 1.3. Metal Manufacturing

- 1.4. Rubber Processing

- 1.5. Other End-user Industries

-

2. Geography

- 2.1. Malaysia

- 2.2. Indonesia

- 2.3. Thailand

- 2.4. Singapore

- 2.5. Philippines

- 2.6. Vietnam

- 2.7. Rest of ASEAN Countries

ASEAN Sulfur Market Segmentation By Geography

- 1. Malaysia

- 2. Indonesia

- 3. Thailand

- 4. Singapore

- 5. Philippines

- 6. Vietnam

- 7. Rest of ASEAN Countries

ASEAN Sulfur Market Regional Market Share

Geographic Coverage of ASEAN Sulfur Market

ASEAN Sulfur Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand from the Fertilizer Manufacturing Sector; Increasing Usage of Sulfur for the Vulcanization of Rubber

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations Regarding Emissions; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Growing Demand from Fertilizer Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Fertilizer

- 5.1.2. Chemical Processing

- 5.1.3. Metal Manufacturing

- 5.1.4. Rubber Processing

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Malaysia

- 5.2.2. Indonesia

- 5.2.3. Thailand

- 5.2.4. Singapore

- 5.2.5. Philippines

- 5.2.6. Vietnam

- 5.2.7. Rest of ASEAN Countries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.3.2. Indonesia

- 5.3.3. Thailand

- 5.3.4. Singapore

- 5.3.5. Philippines

- 5.3.6. Vietnam

- 5.3.7. Rest of ASEAN Countries

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Malaysia ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Fertilizer

- 6.1.2. Chemical Processing

- 6.1.3. Metal Manufacturing

- 6.1.4. Rubber Processing

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Malaysia

- 6.2.2. Indonesia

- 6.2.3. Thailand

- 6.2.4. Singapore

- 6.2.5. Philippines

- 6.2.6. Vietnam

- 6.2.7. Rest of ASEAN Countries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Indonesia ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Fertilizer

- 7.1.2. Chemical Processing

- 7.1.3. Metal Manufacturing

- 7.1.4. Rubber Processing

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Malaysia

- 7.2.2. Indonesia

- 7.2.3. Thailand

- 7.2.4. Singapore

- 7.2.5. Philippines

- 7.2.6. Vietnam

- 7.2.7. Rest of ASEAN Countries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Thailand ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Fertilizer

- 8.1.2. Chemical Processing

- 8.1.3. Metal Manufacturing

- 8.1.4. Rubber Processing

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Malaysia

- 8.2.2. Indonesia

- 8.2.3. Thailand

- 8.2.4. Singapore

- 8.2.5. Philippines

- 8.2.6. Vietnam

- 8.2.7. Rest of ASEAN Countries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Singapore ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Fertilizer

- 9.1.2. Chemical Processing

- 9.1.3. Metal Manufacturing

- 9.1.4. Rubber Processing

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Malaysia

- 9.2.2. Indonesia

- 9.2.3. Thailand

- 9.2.4. Singapore

- 9.2.5. Philippines

- 9.2.6. Vietnam

- 9.2.7. Rest of ASEAN Countries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Philippines ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Fertilizer

- 10.1.2. Chemical Processing

- 10.1.3. Metal Manufacturing

- 10.1.4. Rubber Processing

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Malaysia

- 10.2.2. Indonesia

- 10.2.3. Thailand

- 10.2.4. Singapore

- 10.2.5. Philippines

- 10.2.6. Vietnam

- 10.2.7. Rest of ASEAN Countries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Vietnam ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11.1.1. Fertilizer

- 11.1.2. Chemical Processing

- 11.1.3. Metal Manufacturing

- 11.1.4. Rubber Processing

- 11.1.5. Other End-user Industries

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Malaysia

- 11.2.2. Indonesia

- 11.2.3. Thailand

- 11.2.4. Singapore

- 11.2.5. Philippines

- 11.2.6. Vietnam

- 11.2.7. Rest of ASEAN Countries

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 12. Rest of ASEAN Countries ASEAN Sulfur Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by End-user Industry

- 12.1.1. Fertilizer

- 12.1.2. Chemical Processing

- 12.1.3. Metal Manufacturing

- 12.1.4. Rubber Processing

- 12.1.5. Other End-user Industries

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Malaysia

- 12.2.2. Indonesia

- 12.2.3. Thailand

- 12.2.4. Singapore

- 12.2.5. Philippines

- 12.2.6. Vietnam

- 12.2.7. Rest of ASEAN Countries

- 12.1. Market Analysis, Insights and Forecast - by End-user Industry

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 PETROVIETNAM CHEMICAL AND SERVICES CORPORATION (PVDMC)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Royal Dutch Shell*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Abu Dhabi National Oil Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PT Pertamina(Persero)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PT Candi Ngrimbi

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Qatar Petroleum for the Sale of Petroleum Products Company Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Petronas

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 China Petroleum & Chemical Corporation (SINOPEC)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 PETROVIETNAM CHEMICAL AND SERVICES CORPORATION (PVDMC)

List of Figures

- Figure 1: ASEAN Sulfur Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: ASEAN Sulfur Market Share (%) by Company 2025

List of Tables

- Table 1: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: ASEAN Sulfur Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: ASEAN Sulfur Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 23: ASEAN Sulfur Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: ASEAN Sulfur Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Sulfur Market?

The projected CAGR is approximately 4.08%.

2. Which companies are prominent players in the ASEAN Sulfur Market?

Key companies in the market include PETROVIETNAM CHEMICAL AND SERVICES CORPORATION (PVDMC), Royal Dutch Shell*List Not Exhaustive, Abu Dhabi National Oil Company, PT Pertamina(Persero), PT Candi Ngrimbi, Qatar Petroleum for the Sale of Petroleum Products Company Limited, Petronas, China Petroleum & Chemical Corporation (SINOPEC).

3. What are the main segments of the ASEAN Sulfur Market?

The market segments include End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.94 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand from the Fertilizer Manufacturing Sector; Increasing Usage of Sulfur for the Vulcanization of Rubber.

6. What are the notable trends driving market growth?

Growing Demand from Fertilizer Industry.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations Regarding Emissions; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Sulfur Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Sulfur Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Sulfur Market?

To stay informed about further developments, trends, and reports in the ASEAN Sulfur Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence