Key Insights

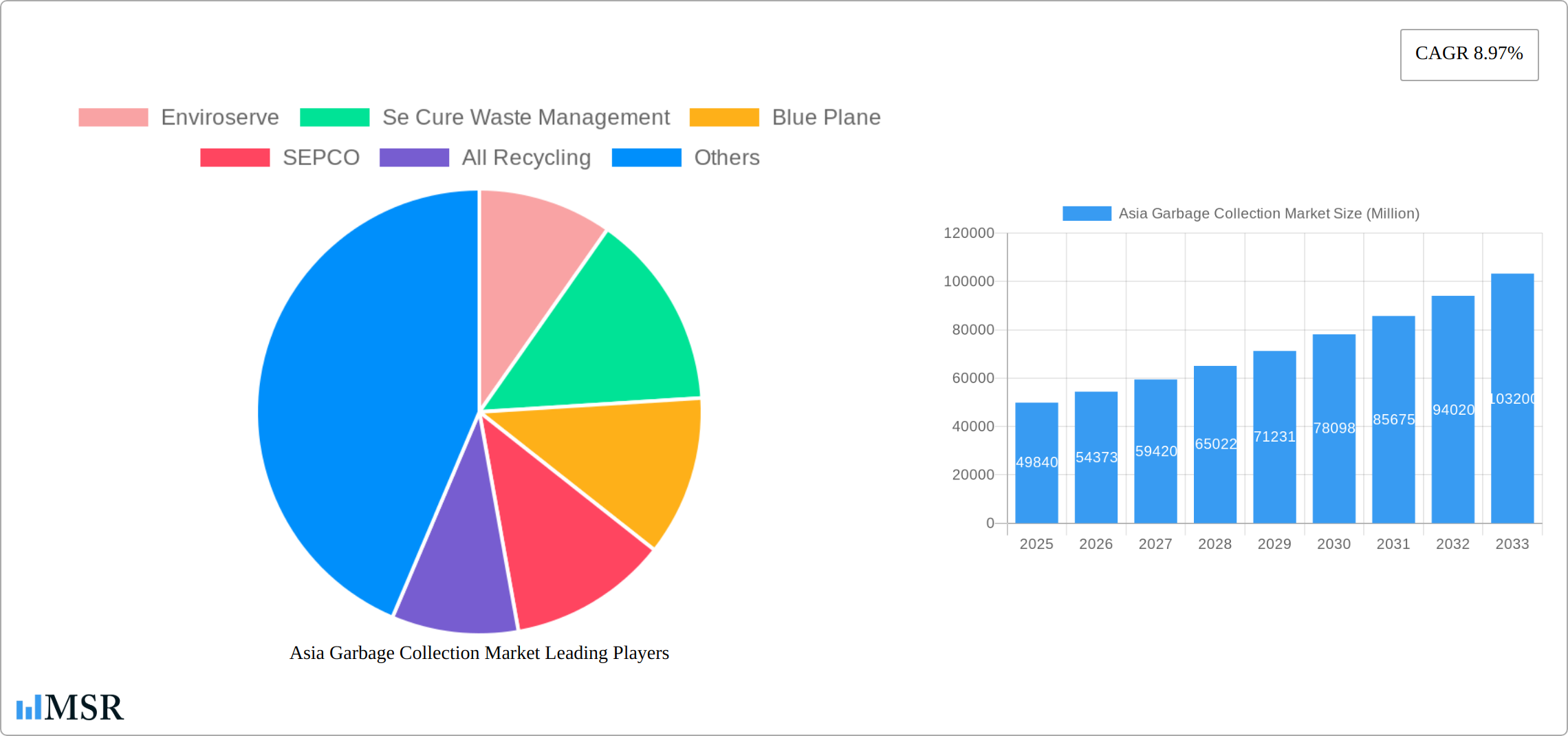

The Asia garbage collection market, valued at $49.84 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental concerns, and stringent government regulations on waste management. A compound annual growth rate (CAGR) of 8.97% from 2025 to 2033 indicates a significant expansion of this market. Key growth drivers include the escalating generation of both hazardous and non-hazardous waste in rapidly developing economies like China and India, coupled with rising disposable incomes leading to increased consumption and waste generation. The market is segmented by waste type (hazardous and non-hazardous), collection type (curbside, door-to-door, community programs), end-user (municipal, healthcare, chemical, mining), and region (China, Japan, India, and the Rest of Asia). The prevalence of curbside collection, particularly in urban areas, is driving a large segment of the market. However, challenges remain, including inadequate infrastructure in certain regions, a lack of awareness about proper waste disposal practices, and inconsistent enforcement of waste management regulations. This creates opportunities for companies offering advanced waste management solutions, including waste-to-energy technologies and smart waste management systems. The increasing adoption of these technologies, coupled with ongoing investments in infrastructure development, is expected to further propel market growth throughout the forecast period. Leading players like Enviroserve, Se Cure Waste Management, and others are actively contributing to this expansion through technological advancements and strategic partnerships.

Asia Garbage Collection Market Market Size (In Billion)

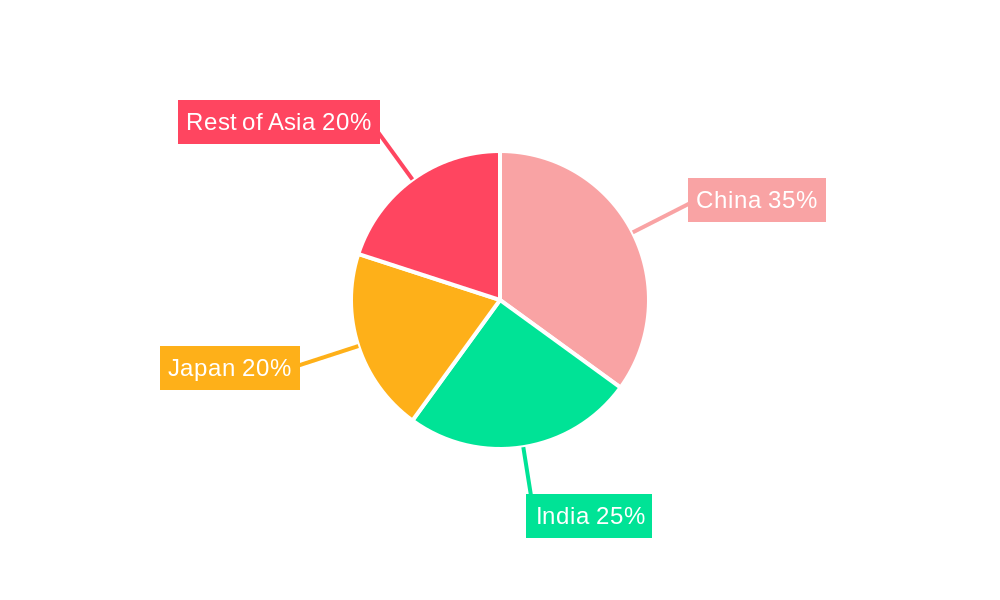

The significant growth in the Asia Pacific region is primarily fueled by the expanding economies of China and India. China’s robust industrial sector contributes significantly to hazardous waste generation, creating demand for specialized collection and disposal services. Simultaneously, India’s rapidly urbanizing population generates a large volume of municipal solid waste, driving the need for efficient collection systems. Japan, on the other hand, represents a more mature market with established infrastructure, although ongoing efforts to improve recycling rates and manage hazardous waste continue to drive market expansion. The "Rest of Asia" segment exhibits considerable growth potential, driven by increasing urbanization and economic development across Southeast Asia. Competition within the market is intense, characterized by both established international players and regional companies vying for market share. This competition is expected to intensify further, driving innovation and improvements in service offerings and efficiency.

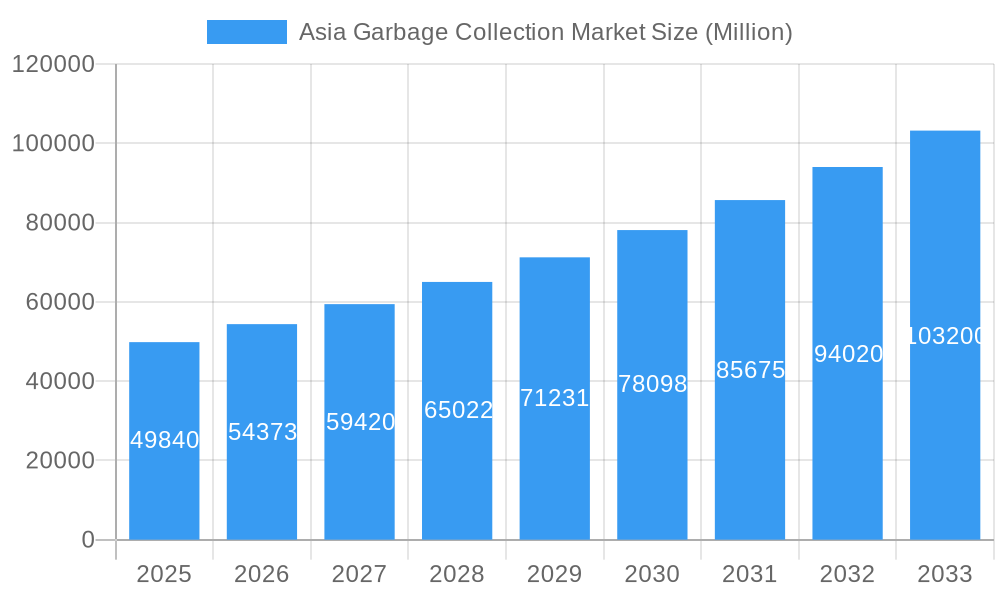

Asia Garbage Collection Market Company Market Share

Asia Garbage Collection Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Garbage Collection Market, offering crucial insights for industry stakeholders, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, segment performance, and competitive dynamics. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia Garbage Collection Market Market Concentration & Dynamics

The Asia garbage collection market is characterized by a dynamic and evolving competitive landscape. While it exhibits a moderately consolidated structure with a blend of established large-scale operators and agile regional players, the market is undergoing significant transformation. This shift is largely propelled by a surge in mergers and acquisitions (M&A), which have been instrumental in reshaping market share and expanding geographical footprints. The number of M&A deals in the sector has seen a notable increase, reflecting a strategic imperative for consolidation and synergy. Key players are actively pursuing expansion of their service portfolios and geographical reach, intensifying competition and driving innovation.

The innovation ecosystem is vibrant, with a strong emphasis on adopting cutting-edge technologies. This includes the integration of AI-powered waste sorting systems for enhanced efficiency and accuracy, alongside the exploration and deployment of autonomous waste collection vehicles. These advancements aim to optimize operational logistics, reduce labor costs, and improve overall service delivery. Concurrently, regulatory frameworks across Asian nations are becoming increasingly stringent, mandating adherence to sustainable waste management practices and encouraging substantial investments in advanced infrastructure. The emergence of viable substitute products and technologies, such as advanced waste-to-energy solutions, further diversifies the competitive arena and influences strategic decision-making. A significant shift in end-user trends is also evident, with a growing demand for robust recycling initiatives and a strong preference for sustainable waste management solutions, creating fertile ground for companies offering eco-conscious and technologically advanced services.

- Market Concentration: Moderately consolidated, with an accelerating trend of consolidation driven by M&A activity.

- M&A Activity: Significant increase in M&A deals, reflecting strategic consolidation and market expansion efforts. (Specific figures for xx deals in 2024 and xx% increase from 2019 can be inserted here if available).

- Innovation Ecosystem: Robust focus on adopting AI for waste sorting, developing autonomous collection vehicles, and exploring advanced waste-to-energy technologies.

- Regulatory Framework: Increasingly stringent regulations are a key driver for companies to adopt sustainable practices and invest in modern waste management infrastructure.

- Substitute Products: Waste-to-energy technologies are gaining prominence as viable alternatives, influencing market dynamics.

- End-User Trends: A pronounced shift towards prioritizing recycling and embracing sustainable waste management practices across various sectors.

Asia Garbage Collection Market Industry Insights & Trends

The Asia garbage collection market is experiencing robust growth driven by factors such as rapid urbanization, rising environmental awareness, and increasing government initiatives promoting sustainable waste management. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033. Technological disruptions, such as the adoption of smart waste management systems and automation technologies, are transforming the industry, leading to increased efficiency and reduced operational costs. Evolving consumer behaviors, including heightened awareness of environmental issues and a growing preference for recycling and composting, are further bolstering market expansion. These factors collectively contribute to a significant market growth trajectory, with a projected CAGR of xx% during the forecast period. The increasing adoption of smart bins and waste tracking systems is further driving market growth.

Key Markets & Segments Leading Asia Garbage Collection Market

The Asia garbage collection market is segmented by waste type (hazardous and non-hazardous), collection type (curbside pickup, door-to-door collection, and community recycling programs), end-user (municipal waste management, healthcare, chemical, and mining), region (China, Japan, India, and Rest of Asia), and product type (waste disposal equipment, waste recycling equipment, and sorting equipment).

- Dominant Regions: China and India are the largest markets, driven by rapid urbanization and increasing waste generation.

- Dominant Waste Type: Non-hazardous waste accounts for the largest share, while the hazardous waste segment is witnessing growth due to stricter regulations.

- Dominant Collection Type: Curbside pickup is the most prevalent collection method, with door-to-door collection gaining popularity in urban areas.

- Dominant End-User: Municipal waste management is the key end-user segment, followed by the healthcare and chemical industries.

- Drivers:

- Rapid Urbanization

- Rising Environmental Awareness

- Stringent Government Regulations

- Increasing Industrialization

- Growing Tourism

- Infrastructure Development

China's robust economic growth and large population contribute significantly to its dominance in the market. Japan, with its advanced waste management infrastructure and strong focus on recycling, holds a substantial share. India's rapidly developing urban centers and rising environmental consciousness are driving significant market expansion.

Asia Garbage Collection Market Product Developments

The Asia garbage collection market is being profoundly reshaped by a wave of significant product innovations. At the forefront are advanced sorting technologies, intelligently leveraging AI and machine learning to achieve highly efficient and precise separation of recyclable materials. This not only enhances resource recovery but also streamlines the recycling process. Complementing these advancements are the growing deployments of autonomous waste collection vehicles, which promise to revolutionize operational efficiency by reducing human intervention and associated labor costs. The market is also witnessing a surge in the development and adoption of durable and sustainable waste disposal equipment, directly addressing the escalating demand for environmentally responsible solutions. These technological leaps are crucial for companies seeking to establish and maintain competitive advantages, enabling them to deliver superior performance and meet the evolving needs of the market.

Challenges in the Asia Garbage Collection Market Market

The Asia garbage collection market navigates a complex terrain of challenges that can impede its growth and efficiency. A persistent issue is the inconsistent development of waste management infrastructure across diverse regions, leading to disparities in service quality and accessibility. Effectively enforcing waste segregation regulations often proves difficult, coupled with varying levels of public awareness regarding proper waste disposal practices among different demographics. The market also grapples with a shortage of skilled labor, a critical factor for operating and maintaining advanced systems. Furthermore, managing hazardous waste presents significant operational hurdles. A considerable barrier to the widespread adoption of advanced technologies is the high upfront investment required, which can be particularly challenging for smaller companies with limited financial resources, thus potentially slowing down the pace of modernization and sustainable practices.

Forces Driving Asia Garbage Collection Market Growth

Key drivers include the increasing government emphasis on sustainable waste management practices, rapid urbanization leading to higher waste generation, rising environmental consciousness among citizens, and significant investments in waste management infrastructure. Technological advancements such as AI-powered waste sorting and autonomous collection vehicles also play a crucial role. Furthermore, the growing adoption of Public-Private Partnerships (PPPs) is facilitating large-scale projects and infrastructural development.

Long-Term Growth Catalysts in Asia Garbage Collection Market

Long-term growth will be fueled by continued technological advancements, strategic partnerships between private sector companies and local governments, and expansion into underserved markets. The growing focus on circular economy principles will create opportunities for innovative waste-to-energy solutions and advanced recycling technologies. The development of robust regulatory frameworks supporting sustainable waste management practices will further stimulate market expansion.

Emerging Opportunities in Asia Garbage Collection Market

The Asia garbage collection market is ripe with emerging opportunities for forward-thinking entities. A significant avenue lies in the development and implementation of smart waste management systems, integrating IoT and data analytics for optimized collection routes and resource allocation. The deployment of advanced recycling technologies, including innovative approaches like chemical recycling, presents a substantial growth potential for transforming waste into valuable resources. Expanding services into rural areas that currently have limited or no waste management infrastructure offers a vast untapped market. The burgeoning demand for innovative waste-to-energy solutions, capable of converting waste into clean energy, is another key area for development. Moreover, the growing global focus on sustainable packaging solutions creates related opportunities for waste management providers. Crucially, a concentrated effort on improving waste segregation practices at the source and undertaking comprehensive public awareness campaigns will unlock further potential and foster a more responsible waste management culture.

Leading Players in the Asia Garbage Collection Market Sector

- Enviroserve

- Se Cure Waste Management

- Blue Plane

- SEPCO

- All Recycling

- Cleanco Waste Treatment

- Attero

- Averda

- Remondis

Key Milestones in Asia Garbage Collection Market Industry

- September 2023: Project STOP inaugurates one of Indonesia's largest Material Recovery Facilities, showcasing a significant advancement in circular waste management.

- March 2023: ALBA Group Asia and VietCycle partner to establish Vietnam's largest food-grade PET/HDPE plastic recycling facility, highlighting a commitment to sustainable solutions.

Strategic Outlook for Asia Garbage Collection Market Market

The Asia garbage collection market is poised for substantial growth, underpinned by enduring drivers such as rapid urbanization, increasing environmental consciousness, and continuous technological innovation. The strategic outlook emphasizes capitalizing on these powerful trends. Key opportunities lie in the proactive adoption and integration of emerging technologies, allowing companies to enhance efficiency and service offerings. Forging strategic partnerships with technology providers, local governments, and other stakeholders can facilitate market penetration and collaborative problem-solving. A paramount focus on embedding sustainable waste management practices into core business strategies will not only align with regulatory demands but also resonate with increasingly eco-conscious end-users. Companies that demonstrate agility in navigating evolving regulatory landscapes and a keen ability to adapt to changing consumer preferences are strategically positioned to capture significant market share and lead the transformation of waste management in the region.

Asia Garbage Collection Market Segmentation

-

1. Product Type

- 1.1. Waste Disposal Equipment

- 1.2. Waste Recycling

- 1.3. Sorting Equipment

-

2. Waste Type

- 2.1. Hazardous Waste

- 2.2. Non-Hazardous Waste

-

3. Collection Type

- 3.1. Curbside Pickup

- 3.2. Door-to-door Collection

- 3.3. Community Recycling Programs

-

4. End User

- 4.1. Municipal Waste Management

- 4.2. Healthcare

- 4.3. Chemical

- 4.4. Mining

Asia Garbage Collection Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Garbage Collection Market Regional Market Share

Geographic Coverage of Asia Garbage Collection Market

Asia Garbage Collection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environment concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Non Hazardous segment dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Garbage Collection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Waste Disposal Equipment

- 5.1.2. Waste Recycling

- 5.1.3. Sorting Equipment

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Hazardous Waste

- 5.2.2. Non-Hazardous Waste

- 5.3. Market Analysis, Insights and Forecast - by Collection Type

- 5.3.1. Curbside Pickup

- 5.3.2. Door-to-door Collection

- 5.3.3. Community Recycling Programs

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Municipal Waste Management

- 5.4.2. Healthcare

- 5.4.3. Chemical

- 5.4.4. Mining

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Enviroserve

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Se Cure Waste Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Plane

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SEPCO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 All Recycling

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanco Waste Treatment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Attero

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Averda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remondis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Enviroserve

List of Figures

- Figure 1: Asia Garbage Collection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Garbage Collection Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 4: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 5: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 6: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 7: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 9: Asia Garbage Collection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia Garbage Collection Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 14: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 15: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 16: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 17: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 19: Asia Garbage Collection Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia Garbage Collection Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: China Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: India Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Bangladesh Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Bangladesh Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Pakistan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Pakistan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Garbage Collection Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Asia Garbage Collection Market?

Key companies in the market include Enviroserve, Se Cure Waste Management, Blue Plane, SEPCO, All Recycling, Cleanco Waste Treatment, Attero, Averda, Remondis.

3. What are the main segments of the Asia Garbage Collection Market?

The market segments include Product Type, Waste Type, Collection Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environment concerns and sustainability.

6. What are the notable trends driving market growth?

Non Hazardous segment dominating the market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

September 2023: Project STOP, in collaboration with Regent Ipuk Feliiantiandani, inaugurated one of Indonesia's largest Material Recovery Facilities in Songgon Town. This significant milestone, achieved in partnership with the Banyuwan Provincial Government, marks a major stride toward establishing Indonesia as the pioneer in regency-run systems for circular waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Garbage Collection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Garbage Collection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Garbage Collection Market?

To stay informed about further developments, trends, and reports in the Asia Garbage Collection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence