Key Insights

The Asia-Pacific cement market is poised for significant expansion, projected to reach $178.4 billion by 2025. This dynamic market anticipates a robust Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. Key growth drivers include accelerating urbanization and extensive infrastructure development across major economies such as China, India, and Indonesia. Increased construction of residential, commercial, and industrial facilities, complemented by substantial government investment in infrastructure like roads, bridges, and power plants, are elevating cement demand. Growing disposable incomes across Asia are also stimulating private real estate investment, further fueling market growth. The market faces challenges from fluctuating raw material costs, stringent environmental regulations on carbon emissions, and potential geopolitical instability. Segmentation covers product type (Blended, Fiber, Ordinary Portland, White, Others), country (Australia, China, India, Indonesia, Japan, Malaysia, South Korea, Thailand, Vietnam, Rest of Asia-Pacific), and end-use sectors (Commercial, Industrial & Institutional, Infrastructure, Residential). Leading players like UltraTech Cement Ltd, China National Building Material Group Corporation, and Anhui Conch Cement Company Limited are strategically expanding, innovating, and engaging in mergers and acquisitions.

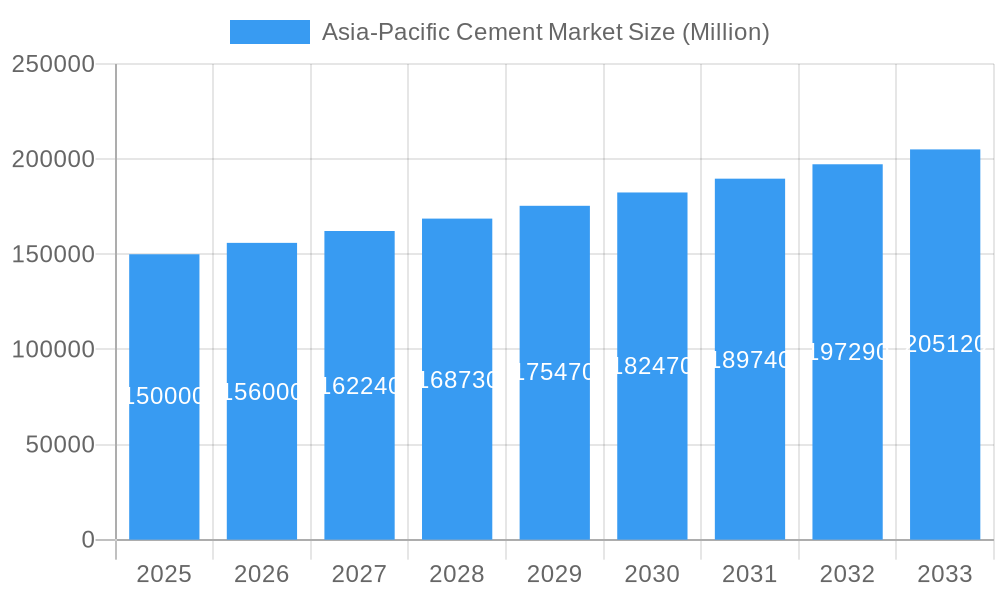

Asia-Pacific Cement Market Market Size (In Billion)

The Asia-Pacific region's diversity offers both opportunities and hurdles. While China and India exhibit exceptional growth driven by large-scale infrastructure and urbanization, other nations' growth varies with their economic development and construction activity. Therefore, understanding the distinct dynamics of each market segment within the region is critical for successful market entry and strategic planning. The adoption of sustainable cement production practices, including alternative fuels and reduced carbon emissions, will be pivotal. Companies adept at balancing environmental responsibility with escalating cement demand are strategically positioned for success in this evolving market. Future growth will hinge on economic performance, governmental policies, technological advancements, and environmental sustainability initiatives.

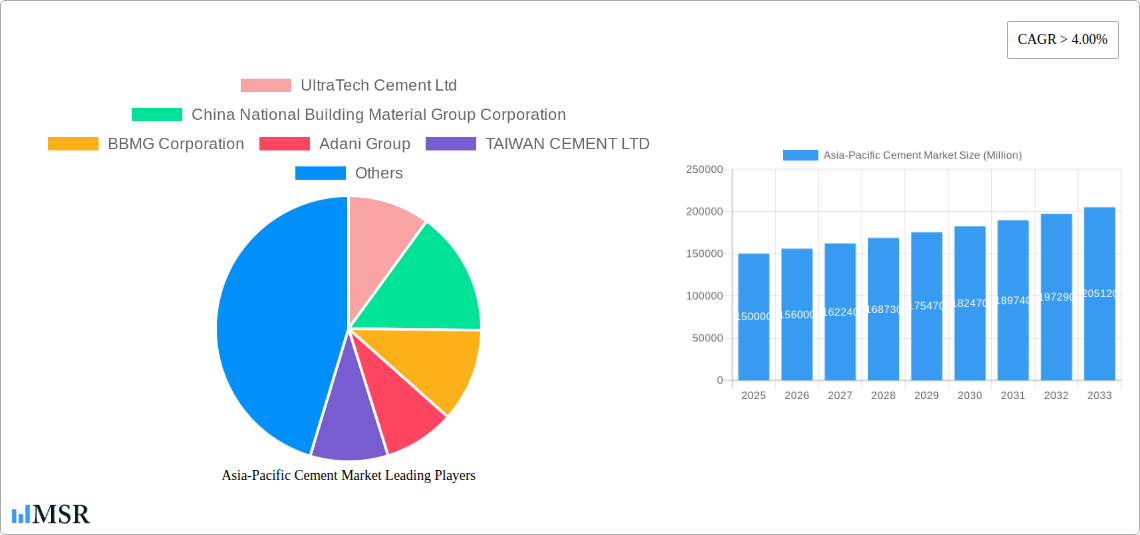

Asia-Pacific Cement Market Company Market Share

Asia-Pacific Cement Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific cement market, covering the period from 2019 to 2033. It offers crucial insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic market. The report leverages extensive data analysis, identifying key trends, challenges, and opportunities within the cement industry across various segments and countries in the Asia-Pacific region. The base year for this analysis is 2025, with forecasts extending to 2033.

Asia-Pacific Cement Market Concentration & Dynamics

The Asia-Pacific cement market exhibits a moderately concentrated landscape, dominated by a few large players alongside numerous regional and smaller companies. Market share data reveals that the top five players account for approximately xx% of the total market, indicating significant consolidation. The presence of several state-owned enterprises further shapes the market dynamics.

Innovation Ecosystems: Innovation in the sector focuses on enhancing cement quality, reducing environmental impact (reducing carbon emissions), and improving production efficiency. The adoption of advanced technologies, such as AI and IoT, is gradually increasing, albeit at varying paces across different countries.

Regulatory Frameworks: Varying national regulations concerning environmental standards and construction practices directly influence market dynamics. Stringent emission control norms, along with construction codes, affect production costs and product specifications.

Substitute Products: While concrete remains the dominant construction material, alternative building materials like prefabricated structures and sustainable alternatives are gaining traction, although they currently pose a relatively low threat to overall cement demand.

End-User Trends: The residential and infrastructure sectors are primary drivers of cement demand, closely linked to economic growth and urbanization rates. The commercial and industrial sectors contribute significantly, particularly in rapidly developing economies.

M&A Activities: The cement industry has witnessed several significant mergers and acquisitions (M&A) in recent years. The number of M&A deals increased by xx% between 2021 and 2022, suggesting industry consolidation. Key drivers for these activities include expansion of manufacturing capacity, market share gain, and diversification.

Asia-Pacific Cement Market Industry Insights & Trends

The Asia-Pacific cement market is experiencing robust growth, driven primarily by the region's rapid urbanization, industrialization, and infrastructure development. The market size reached xx Million USD in 2024 and is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million USD by 2033. This growth is unevenly distributed across the region, with countries experiencing higher economic growth typically showing stronger cement demand. Technological advancements, such as the adoption of more efficient production processes and the development of new cement types with improved properties, are adding to the market expansion. However, rising environmental concerns and increasing regulatory scrutiny related to carbon emissions pose potential challenges. Changing consumer preferences towards eco-friendly and sustainable building materials are also beginning to subtly shape market demand, though the pace of change is slow.

Key Markets & Segments Leading Asia-Pacific Cement Market

Dominant Regions/Countries:

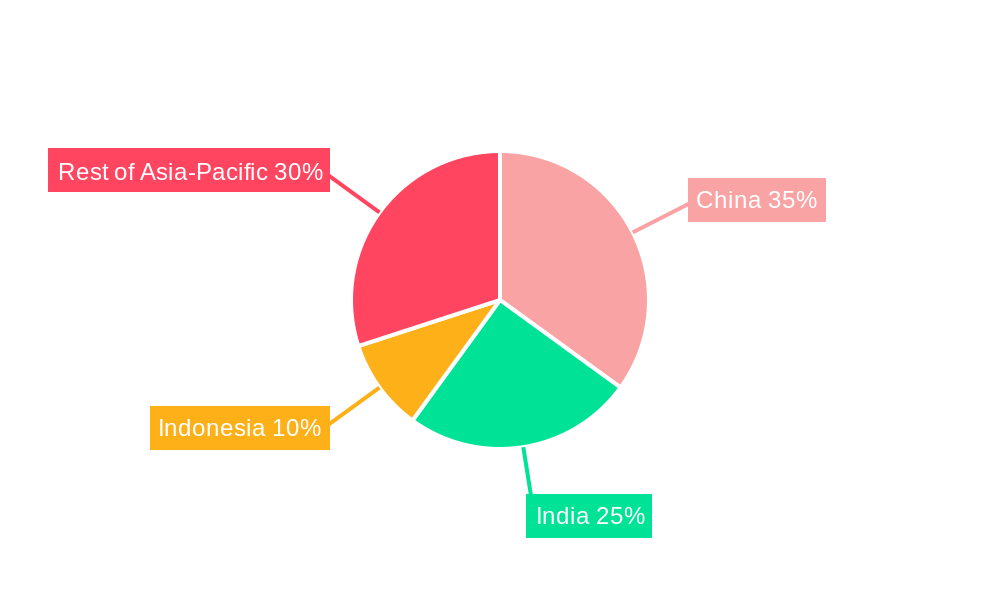

China, India, and Indonesia represent the largest cement markets in the Asia-Pacific region. China’s massive infrastructure projects and ongoing urbanization continue to fuel substantial demand. India’s expanding economy and housing sector boost its cement consumption. Indonesia’s growth is driven by infrastructure development and rising construction activities.

Dominant Product Segments:

- Ordinary Portland Cement (OPC): Remains the dominant segment due to its cost-effectiveness and wide applications.

- Blended Cement: Growing in popularity due to its enhanced performance and environmental benefits compared to OPC.

- Other Types: This segment includes specialized cements like white cement and high-strength cements, experiencing moderate growth, driven by niche applications.

Dominant End-Use Sectors:

- Infrastructure: The largest cement consumer, driven by government initiatives related to transportation, energy, and water management projects.

- Residential: A significant segment, particularly in rapidly urbanizing areas with expanding housing markets. Increased disposable incomes and preference for modern housing are fueling demand.

- Commercial and Industrial: This segment’s cement demand is tied to manufacturing, warehouse development, and commercial building construction.

Drivers for Growth:

- Strong economic growth in many Asia-Pacific countries.

- Government initiatives to boost infrastructure development.

- Rapid urbanization and population growth.

- Increasing construction activities in both residential and commercial sectors.

Asia-Pacific Cement Market Product Developments

Recent product innovations focus on enhancing durability, reducing environmental impact, and offering superior performance. The development of high-performance concrete mixes, blended cements with lower carbon footprints, and the exploration of alternative raw materials are noteworthy examples. These innovations grant cement manufacturers a competitive edge by catering to sustainability concerns and providing solutions with improved properties.

Challenges in the Asia-Pacific Cement Market Market

The Asia-Pacific cement market faces several challenges. Stricter environmental regulations increase production costs and necessitate technological upgrades for compliance. Supply chain disruptions and fluctuations in raw material prices pose significant operational challenges. Intense competition among existing players and the entry of new entrants exert pressure on profit margins. Furthermore, rising energy costs, particularly in certain regions, increase production expenses significantly. For example, the recent increase in energy prices impacted production costs by approximately xx% in [Country].

Forces Driving Asia-Pacific Cement Market Growth

Several factors fuel the Asia-Pacific cement market's long-term growth. Continued government investments in infrastructure projects across numerous countries act as a major driver. Expanding urbanization and rising middle-class incomes increase demand from the residential and commercial construction sectors. Technological advancements like improved production techniques and the development of sustainable cement types reduce environmental impact, making the cement industry more attractive to investors.

Long-Term Growth Catalysts in the Asia-Pacific Cement Market

Long-term growth will depend on innovation in sustainable cement technologies, strategic partnerships fostering knowledge sharing and technological advancements, and expansion into new markets within the Asia-Pacific region. Government policies supporting green infrastructure projects and the development of new cement production methods with minimized environmental impacts are crucial for sustained market expansion.

Emerging Opportunities in Asia-Pacific Cement Market

Emerging opportunities lie in eco-friendly cement production, meeting growing demand for sustainable building materials, and adopting advanced technologies to enhance productivity and reduce costs. Expansion into underserved markets and offering specialized cement solutions for niche applications present significant growth potential. Developing new distribution channels and strengthening logistics networks, especially in remote areas, can provide significant competitive advantages.

Leading Players in the Asia-Pacific Cement Market Sector

- UltraTech Cement Ltd

- China National Building Material Group Corporation

- BBMG Corporation

- Adani Group

- TAIWAN CEMENT LTD

- Vietnam National Cement Corporation

- Anhui Conch Cement Company Limited

- SCG

- China Resource Cement Holdings

- SIG

Key Milestones in Asia-Pacific Cement Market Industry

- August 2023: Ambuja Cements Ltd (Adani Group) acquired a 57% stake in Sanghi Industries Ltd for USD 606.5 Million, significantly expanding its Indian market presence and production capacity.

- June 2023: SIG's subsidiary, PT Semen Baturaja Tbk, announced plans to expand its cement production capacity in Indonesia by 3.8 Million tons annually.

- January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, adding 14.8 Million tons/year of cement production capacity to its Indonesian operations.

Strategic Outlook for Asia-Pacific Cement Market Market

The Asia-Pacific cement market holds significant potential for growth, driven by robust infrastructure development and rising construction activities. Companies focusing on sustainable production practices, technological advancements, and strategic partnerships are well-positioned to capitalize on these opportunities. Adapting to evolving environmental regulations and diversifying product offerings to cater to diverse market needs are crucial for long-term success in this dynamic market.

Asia-Pacific Cement Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Blended Cement

- 2.2. Fiber Cement

- 2.3. Ordinary Portland Cement

- 2.4. White Cement

- 2.5. Other Types

Asia-Pacific Cement Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. Southeast Asia

- 1.7. Rest of Asia Pacific

Asia-Pacific Cement Market Regional Market Share

Geographic Coverage of Asia-Pacific Cement Market

Asia-Pacific Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash

- 3.3. Market Restrains

- 3.3.1. Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blended Cement

- 5.2.2. Fiber Cement

- 5.2.3. Ordinary Portland Cement

- 5.2.4. White Cement

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UltraTech Cement Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China National Building Material Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BBMG Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adani Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TAIWAN CEMENT LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam National Cement Corporatio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Anhui Conch Cement Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SCG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Resource Cement Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SIG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UltraTech Cement Ltd

List of Figures

- Figure 1: Asia-Pacific Cement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Cement Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Cement Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Cement Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Asia-Pacific Cement Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: Asia-Pacific Cement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Cement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Cement Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Cement Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Asia-Pacific Cement Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: Asia-Pacific Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Cement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Southeast Asia Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Southeast Asia Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Asia-Pacific Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Asia-Pacific Cement Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Cement Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Cement Market?

Key companies in the market include UltraTech Cement Ltd, China National Building Material Group Corporation, BBMG Corporation, Adani Group, TAIWAN CEMENT LTD, Vietnam National Cement Corporatio, Anhui Conch Cement Company Limited, SCG, China Resource Cement Holdings, SIG.

3. What are the main segments of the Asia-Pacific Cement Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions.

8. Can you provide examples of recent developments in the market?

August 2023: The Adani Group's subsidiary, Ambuja Cements Ltd, announced the purchase of a 57% promoter stake in Indian cement manufacturer Sanghi Industries Ltd at an enterprise value of USD 606.5 million to expand its manufacturing capacity and market presence.June 2023: SIG's subsidiary PT Semen Baturaja Tbk announced to expand its cement production capacity to 3.8 million tons of cement per year through three factories in Palembang and Baturaja City, Ogan Komering Ulu (OKU) Regency, South Sumatra, Panjang, Bandar Lampung in Indonesia.January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, which has a 14.8 Mt/yr of cement production capacity, strengthening its cement business in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Cement Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence