Key Insights

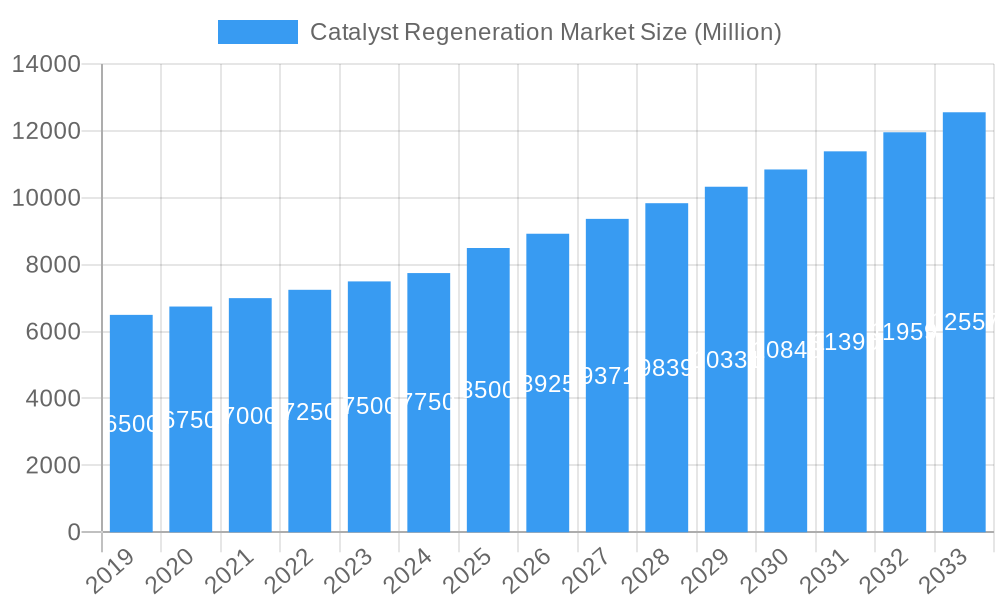

The global Catalyst Regeneration Market is projected for substantial growth, estimated to reach $43.6 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This expansion is fueled by the increasing demand for refined fuels and petrochemicals, emphasizing the critical need for efficient catalyst utilization. Stringent environmental regulations, focused on emissions reduction and sustainability, are further stimulating the adoption of catalyst regeneration as a cost-effective and eco-friendly alternative to catalyst replacement. The "In Situ" regeneration method is expected to see increased adoption due to its operational efficiency and minimal downtime, particularly in large-scale refineries and petrochemical facilities. Additionally, growing emphasis on energy security and the development of new energy sources present emerging opportunities for catalyst regeneration services within the energy and power sector.

Catalyst Regeneration Market Market Size (In Billion)

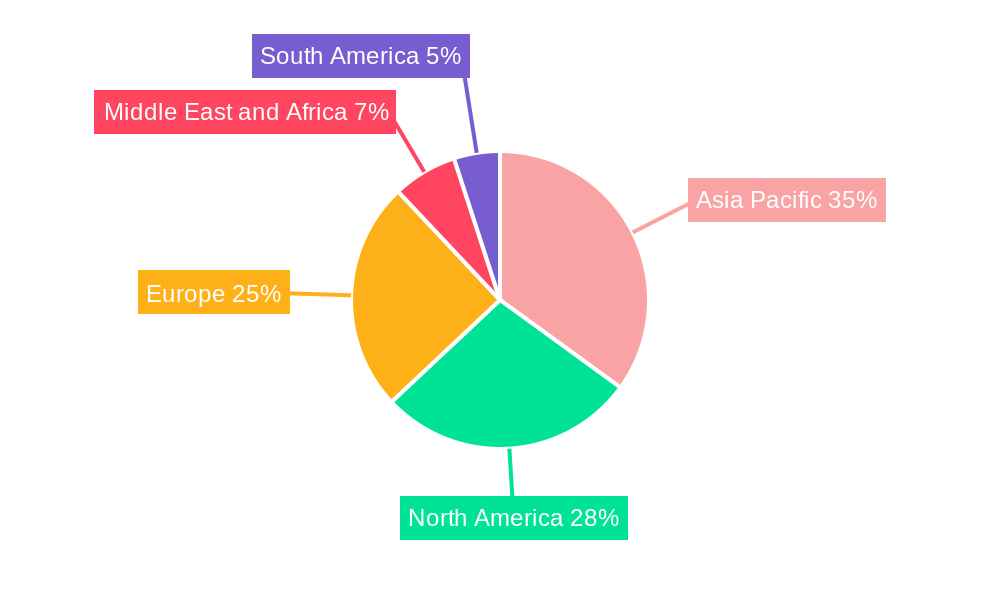

Evolving technological advancements, including the development of more efficient and specialized regeneration techniques capable of handling diverse catalyst types and contaminants, are shaping market dynamics. Leading companies are actively investing in R&D to optimize regeneration processes, reduce energy consumption, and enhance the performance of regenerated catalysts. Challenges include the initial capital investment for regeneration infrastructure and potential reductions in catalyst activity post-regeneration for certain applications. Nevertheless, the significant economic benefits derived from extending catalyst lifespan and minimizing waste disposal costs are anticipated to propel market growth. Regionally, Asia Pacific is expected to lead market performance, driven by rapid industrialization and expanding refining capacities, followed by North America and Europe, supported by established industrial infrastructure and robust environmental mandates.

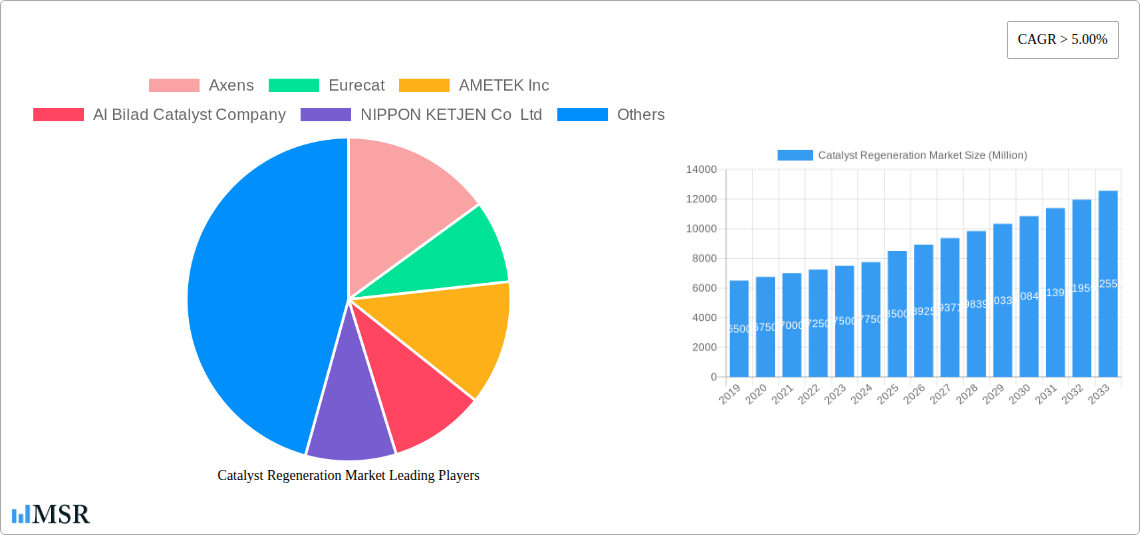

Catalyst Regeneration Market Company Market Share

Catalyst Regeneration Market Analysis: Driving Sustainable Industrial Efficiency (2019–2033)

This in-depth catalyst regeneration market report offers a comprehensive analysis of global market size, trends, and forecasts from 2019 to 2033, with 2025 as the base year. Fueled by rising demand for sustainable industrial practices and stringent environmental regulations, the catalyst regeneration industry is experiencing significant upward momentum. Gain critical insights into market dynamics, key players, technological innovations, and future prospects within this essential resource for stakeholders in refineries and petrochemical complexes, environmental, energy & power, and related sectors. Our analysis includes the catalyst regeneration market value, catalyst regeneration market size, and catalyst regeneration market CAGR.

Catalyst Regeneration Market Market Concentration & Dynamics

The catalyst regeneration market exhibits a moderate to high concentration, with leading companies like BASF SE, Evonik Industries AG (Porocel), Axens, and AMETEK Inc. holding significant market share. Innovation ecosystems are flourishing, driven by R&D in advanced regeneration techniques and materials. Regulatory frameworks, particularly concerning emissions and waste reduction, are pivotal in shaping market trends, encouraging the adoption of in situ and ex situ catalyst regeneration methods. The threat of substitute products is relatively low due to the specialized nature of catalyst applications. End-user trends are heavily influenced by the drive for operational efficiency and reduced environmental impact in refineries and petrochemical complexes. Mergers and acquisitions (M&A) activities are a key dynamic, with recent strategic moves aimed at expanding service offerings and geographical reach. For instance, the acquisition of Zodiac Enterprises LLC by BASF SE in July 2021 underscores the consolidation and strategic expansion occurring within the sector. Analyzing these dynamics is crucial for understanding the competitive landscape and identifying potential M&A deal counts and their impact on market share.

Catalyst Regeneration Market Industry Insights & Trends

The global catalyst regeneration market is projected to reach an estimated market size of $XX Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by the growing imperative for sustainable industrial practices and the increasing stringency of environmental regulations worldwide. Industries such as refineries and petrochemical complexes, environmental, energy & power, and various other applications are continuously seeking cost-effective and environmentally responsible solutions for catalyst management. The traditional practice of disposing of spent catalysts, which are often laden with valuable or hazardous materials, is becoming increasingly unsustainable due to environmental concerns and rising disposal costs. Catalyst regeneration offers a viable and economically attractive alternative, extending the lifespan of catalysts and significantly reducing the need for virgin catalyst production. This, in turn, minimizes resource depletion and lowers the carbon footprint associated with catalyst manufacturing.

Technological disruptions are playing a crucial role in shaping the catalyst regeneration industry. Advancements in ex situ and in situ regeneration techniques are enabling higher recovery rates, improved catalyst performance, and the ability to regenerate a wider range of catalyst types. Innovations in areas like plasma regeneration, supercritical fluid regeneration, and advanced thermal methods are contributing to more efficient and environmentally benign processes. Furthermore, the development of sophisticated analytical tools and monitoring systems allows for better prediction of catalyst deactivation and optimization of regeneration cycles, leading to enhanced operational efficiency for end-users.

Evolving consumer behaviors, driven by corporate social responsibility (CSR) initiatives and a global shift towards a circular economy, are also influencing market growth. Companies are increasingly prioritizing partners who can demonstrate a commitment to sustainability, making catalyst regeneration services a critical component of their supply chain management. The economic benefits, including reduced capital expenditure on new catalysts and lower operating costs, further incentivize the adoption of regeneration services. The market also benefits from government incentives and subsidies aimed at promoting green technologies and sustainable industrial development. The estimated market size and CAGR are key indicators of the strong upward trajectory of this vital sector.

Key Markets & Segments Leading Catalyst Regeneration Market

The Catalyst Regeneration Market is predominantly led by the Refineries and Petrochemical Complexes application segment, accounting for a significant portion of the global market revenue. This dominance is driven by several key factors.

- High Catalyst Consumption: Refineries and petrochemical plants are massive consumers of catalysts, utilizing them in numerous crucial processes such as cracking, reforming, hydrotreating, and polymerization. The continuous operation of these facilities necessitates frequent catalyst replacement or regeneration to maintain optimal efficiency and product quality.

- Economic Viability: The cost savings associated with regenerating spent catalysts versus purchasing new ones are substantial in these large-scale operations. Extending catalyst life through regeneration directly impacts profitability, making it a highly attractive proposition.

- Environmental Regulations: Stringent environmental regulations concerning emissions and waste disposal in the refining and petrochemical sectors push companies to adopt more sustainable practices, with catalyst regeneration being a prime example. The hazardous nature of spent catalysts makes their disposal problematic and costly, further bolstering the demand for regeneration services.

- Technological Advancements: The development and refinement of both ex situ and in situ regeneration methods are particularly well-suited to the demands of these industries. Ex situ regeneration offers centralized expertise and specialized equipment, while in situ regeneration provides on-site convenience and reduced downtime.

Geographically, North America and Europe currently represent the leading markets for catalyst regeneration. This leadership is attributed to the presence of mature refining and petrochemical infrastructures, well-established regulatory frameworks promoting environmental sustainability, and a strong emphasis on technological innovation within these regions. Economic growth in developing regions, coupled with increasing investments in industrial infrastructure, is poised to drive significant growth in the Catalyst Regeneration Market in the Asia-Pacific and Middle East & Africa regions in the coming years. The increasing focus on energy transition and the demand for cleaner fuels further amplify the importance of efficient catalyst management in these evolving industrial landscapes.

Catalyst Regeneration Market Product Developments

The Catalyst Regeneration Market is characterized by continuous innovation in regeneration technologies and services. Companies are investing heavily in developing more efficient and environmentally friendly regeneration processes, including advanced thermal treatments, supercritical fluid regeneration, and plasma-based methods. These advancements aim to improve catalyst performance, extend catalyst lifespan, and broaden the scope of regenerable catalyst types. The focus is on maximizing metal recovery and minimizing environmental impact, offering clients enhanced operational efficiency and cost savings. Product developments also encompass enhanced analytical capabilities for pre-regeneration assessment and post-regeneration validation, ensuring optimal catalyst performance and reliability.

Challenges in the Catalyst Regeneration Market Market

The Catalyst Regeneration Market faces several significant challenges that can impede its growth trajectory. Regulatory hurdles and the complexity of international environmental compliance can create barriers to entry and increase operational costs for service providers. Supply chain disruptions, particularly concerning the availability of specialized regeneration equipment and trained personnel, can impact service delivery and timelines. Furthermore, competitive pressures from both established players and emerging technologies necessitate continuous investment in R&D and service improvement. The economic feasibility of regenerating highly deactivated or contaminated catalysts can also be a restraint, leading to instances where replacement remains the more viable option. The need for substantial initial capital investment in advanced regeneration facilities can also be a limiting factor for smaller players.

Forces Driving Catalyst Regeneration Market Growth

The Catalyst Regeneration Market is propelled by a confluence of powerful growth drivers. The escalating global demand for petrochemicals and refined fuels necessitates optimized catalytic processes, making catalyst regeneration a critical factor for operational efficiency and cost reduction. Increasingly stringent environmental regulations worldwide, aimed at curbing industrial emissions and promoting sustainable practices, are a major catalyst for adoption. The growing emphasis on a circular economy and the drive to minimize waste further incentivize the reuse and regeneration of valuable catalyst materials. Technological advancements in regeneration techniques, leading to higher recovery rates and improved catalyst performance, are making regeneration a more attractive and viable option for a wider range of applications. Economic benefits, including significant cost savings compared to the purchase of new catalysts, remain a primary driver for industrial adoption.

Challenges in the Catalyst Regeneration Market Market

Long-term growth in the Catalyst Regeneration Market is underpinned by continuous innovation and strategic market expansion. The development of novel regeneration techniques capable of handling increasingly complex catalyst compositions and deactivation mechanisms will be crucial. Partnerships and collaborations between catalyst manufacturers, service providers, and end-users are essential for developing customized regeneration solutions and ensuring seamless integration into industrial workflows. Expanding into emerging markets with burgeoning industrial sectors and increasing environmental awareness presents significant growth opportunities. Furthermore, the integration of digital technologies for real-time catalyst monitoring and predictive maintenance will enhance the value proposition of regeneration services, driving further market penetration and solidifying the sustainable future of catalyst management.

Emerging Opportunities in Catalyst Regeneration Market

Emerging opportunities in the Catalyst Regeneration Market are diverse and promising. The growing demand for catalysts in renewable energy sectors, such as hydrogen production and biofuels, presents new avenues for regeneration services. Advancements in materials science are leading to the development of novel catalysts that may benefit from specialized regeneration processes, creating niche markets. The increasing global focus on environmental remediation and the need to manage spent catalysts from diverse industrial processes, beyond traditional refining, opens up new application areas. Furthermore, the development of mobile or modular regeneration units could offer flexible and cost-effective solutions for geographically dispersed industrial sites, expanding market reach and accessibility. The exploration of advanced recycling techniques to recover critical metals from spent catalysts also represents a significant opportunity.

Leading Players in the Catalyst Regeneration Market Sector

- Axens

- Eurecat

- AMETEK Inc.

- Al Bilad Catalyst Company

- NIPPON KETJEN Co Ltd

- Advanced Catalyst Systems LLC

- Yokogawa Corporation of America

- CORMETECH

- BASF SE

- Zibo Hengji chemical Co Ltd

- EBINGER Katalysatorservice GmbH & Co KG

- Evonik Industries AG (Porocel)

Key Milestones in Catalyst Regeneration Market Industry

- July 2021: BASF has expanded its chemical catalyst recycling capacity and capability with the acquisition of Zodiac Enterprises LLC in Caldwell, Texas, significantly strengthening its position in the global catalyst services market.

- 2020: Evonik Industries AG (Porocel) continued to invest in its global network of catalyst regeneration facilities, enhancing its service offerings for a broad range of catalysts used in the petrochemical and refining industries.

- 2019: Axens introduced new regeneration technologies aimed at improving efficiency and reducing the environmental footprint of catalyst regeneration processes, catering to evolving industry demands.

- 2022: AMETEK Inc. acquired certain assets related to catalyst regeneration services, signaling strategic growth and expansion within this niche but critical market segment.

- 2023 (Estimated): Continued consolidation and technological advancements are expected to drive further strategic partnerships and service enhancements across leading players in the catalyst regeneration sector.

Strategic Outlook for Catalyst Regeneration Market Market

The Catalyst Regeneration Market is poised for sustained growth, driven by the unwavering global push towards sustainable industrial practices and stricter environmental mandates. The increasing complexity of industrial processes and the growing economic imperative to reduce operational costs will continue to favor efficient catalyst lifecycle management solutions. Strategic opportunities lie in the development of advanced regeneration technologies capable of handling novel catalyst materials and addressing emerging contaminants. Furthermore, expanding service offerings to include comprehensive catalyst management programs, encompassing on-site assessment, logistics, and performance monitoring, will be crucial for market leaders. Collaborations with key industry stakeholders and a focus on geographic expansion into high-growth regions will solidify the market's trajectory towards a more circular and environmentally responsible industrial future.

Catalyst Regeneration Market Segmentation

-

1. Method

- 1.1. Ex Situ

- 1.2. In Situ

-

2. Application

- 2.1. Refineries and Petrochemical Complexes

- 2.2. Environmental

- 2.3. Energy & Power

- 2.4. Other Applications

Catalyst Regeneration Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Catalyst Regeneration Market Regional Market Share

Geographic Coverage of Catalyst Regeneration Market

Catalyst Regeneration Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of New Catalyst and Regulations Related to the Disposal of Spent Catalyst; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Refineries and Petrochemical Complexes Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Method

- 5.1.1. Ex Situ

- 5.1.2. In Situ

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Refineries and Petrochemical Complexes

- 5.2.2. Environmental

- 5.2.3. Energy & Power

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Method

- 6. Asia Pacific Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Method

- 6.1.1. Ex Situ

- 6.1.2. In Situ

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Refineries and Petrochemical Complexes

- 6.2.2. Environmental

- 6.2.3. Energy & Power

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Method

- 7. North America Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Method

- 7.1.1. Ex Situ

- 7.1.2. In Situ

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Refineries and Petrochemical Complexes

- 7.2.2. Environmental

- 7.2.3. Energy & Power

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Method

- 8. Europe Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Method

- 8.1.1. Ex Situ

- 8.1.2. In Situ

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Refineries and Petrochemical Complexes

- 8.2.2. Environmental

- 8.2.3. Energy & Power

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Method

- 9. South America Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Method

- 9.1.1. Ex Situ

- 9.1.2. In Situ

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Refineries and Petrochemical Complexes

- 9.2.2. Environmental

- 9.2.3. Energy & Power

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Method

- 10. Middle East and Africa Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Method

- 10.1.1. Ex Situ

- 10.1.2. In Situ

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Refineries and Petrochemical Complexes

- 10.2.2. Environmental

- 10.2.3. Energy & Power

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Axens

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurecat

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMETEK Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Bilad Catalyst Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NIPPON KETJEN Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Advanced Catalyst Systems LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yokogawa Corporation of America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CORMETECH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zibo Hengji chemical Co Ltd *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EBINGER Katalysatorservice GmbH & Co KG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Evonik Industries AG (Porocel)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Axens

List of Figures

- Figure 1: Global Catalyst Regeneration Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 3: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 4: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 9: North America Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 10: North America Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 15: Europe Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 16: Europe Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 21: South America Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 22: South America Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 27: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 28: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 2: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Catalyst Regeneration Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 5: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 14: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 20: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Russia Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 29: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 35: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: South Africa Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Catalyst Regeneration Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Catalyst Regeneration Market?

Key companies in the market include Axens, Eurecat, AMETEK Inc, Al Bilad Catalyst Company, NIPPON KETJEN Co Ltd, Advanced Catalyst Systems LLC, Yokogawa Corporation of America, CORMETECH, BASF SE, Zibo Hengji chemical Co Ltd *List Not Exhaustive, EBINGER Katalysatorservice GmbH & Co KG, Evonik Industries AG (Porocel).

3. What are the main segments of the Catalyst Regeneration Market?

The market segments include Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.6 billion as of 2022.

5. What are some drivers contributing to market growth?

High Cost of New Catalyst and Regulations Related to the Disposal of Spent Catalyst; Other Drivers.

6. What are the notable trends driving market growth?

Refineries and Petrochemical Complexes Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

In July 2021, BASF has expanded its chemical catalyst recycling capacity and capability with the acquisition of Zodiac Enterprises LLC in Caldwell, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Catalyst Regeneration Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Catalyst Regeneration Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Catalyst Regeneration Market?

To stay informed about further developments, trends, and reports in the Catalyst Regeneration Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence