Key Insights

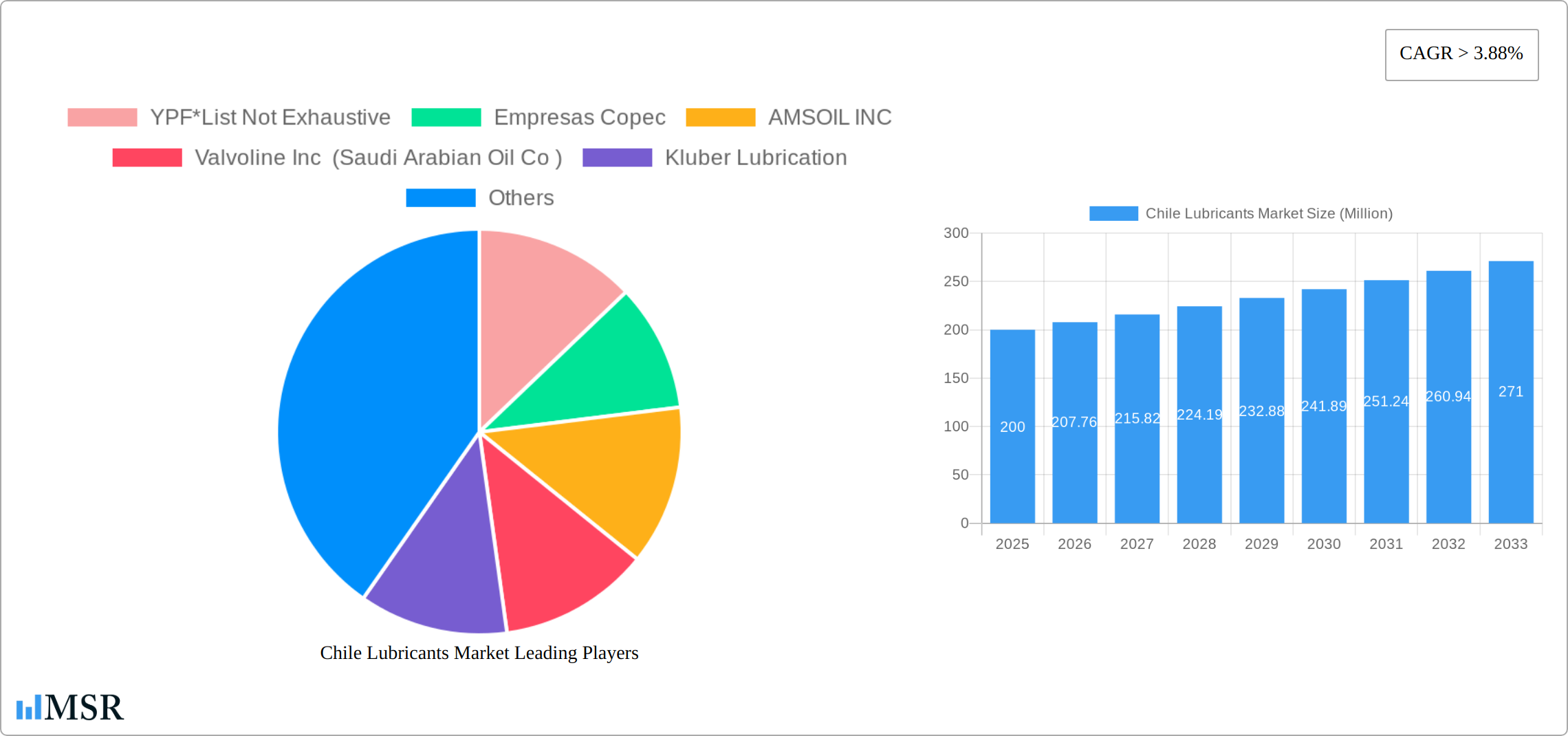

The Chilean lubricants market, valued at approximately $XXX million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.88% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning automotive sector, particularly the increasing demand for passenger vehicles and commercial transport, significantly contributes to the market's expansion. Furthermore, the robust growth in the heavy equipment and construction industries, driven by infrastructure development projects within Chile, necessitates a consistent supply of high-quality lubricants. The mining and metallurgy sectors also play a vital role, relying heavily on specialized lubricants for efficient operations. Expanding industrialization and a growing focus on maintenance and repair activities further bolster market demand. While precise figures for segment-wise market share are unavailable, engine oils and greases are likely the dominant product types, given their widespread application across various end-user industries. However, increasing demand for specialized lubricants, such as hydraulic and metalworking fluids, is expected to drive segment diversification in the coming years. The competitive landscape is characterized by a mix of international and domestic players, including YPF, Empresas Copec, AMSOIL INC, Valvoline Inc, Kluber Lubrication, Shell PLC, FUCHS, Motul, Petrobras, Carl Bechem GmbH, TotalEnergies SE, BP PLC, and Chevron Corporation. These companies compete based on product quality, pricing strategies, and distribution networks.

Chile Lubricants Market Market Size (In Million)

Challenges to market growth include fluctuating crude oil prices, which directly impact lubricant production costs, and the potential for economic downturns affecting end-user industries. However, the long-term outlook remains positive, driven by ongoing industrial development and a growing focus on preventative maintenance strategies across various sectors. The increasing adoption of environmentally friendly lubricants is also anticipated to shape market dynamics in the future, compelling companies to invest in research and development of sustainable alternatives. Government regulations aimed at improving environmental sustainability and promoting energy efficiency are also expected to influence product development and market expansion. The Chilean lubricants market presents significant opportunities for both established players and new entrants with innovative product offerings and strategic distribution networks.

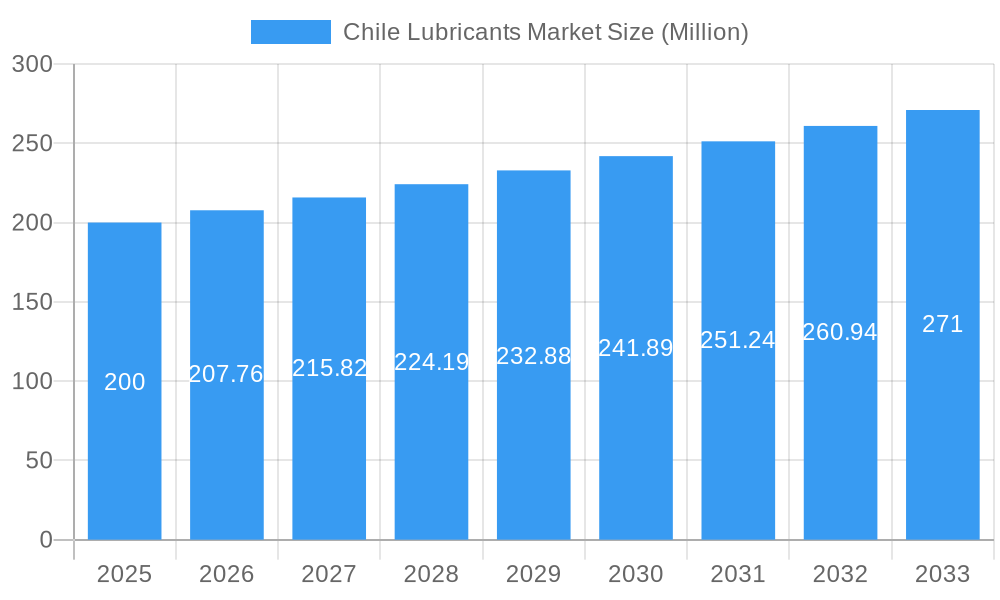

Chile Lubricants Market Company Market Share

Chile Lubricants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Chile lubricants market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, leading players, and future growth prospects, leveraging extensive data and expert analysis. The report is crucial for understanding the current state and future trajectory of this dynamic market.

Chile Lubricants Market Market Concentration & Dynamics

The Chilean lubricants market exhibits a moderately concentrated landscape, with several multinational and local players vying for market share. Key players such as YPF, Empresas Copec, and Shell PLC (ENEX) hold significant positions, but smaller players contribute substantially to the overall market volume. The market's dynamics are shaped by several factors:

Market Concentration: While precise market share data for each company is proprietary, the market is not dominated by a single entity, allowing for competitive intensity. We estimate the top 5 players control approximately xx% of the market, leaving room for smaller players to thrive.

Innovation Ecosystem: The market displays a moderate level of innovation, driven by the introduction of advanced lubricant formulations catering to specific needs within automotive and industrial sectors. The focus on energy efficiency and environmental regulations influences ongoing R&D efforts.

Regulatory Frameworks: Chilean environmental regulations are increasingly stringent, compelling lubricant manufacturers to prioritize sustainable and biodegradable products. This pushes innovation towards eco-friendly alternatives.

Substitute Products: The market faces competition from substitute products such as biolubricants and specialized greases, especially in environmentally conscious sectors like mining and renewable energy.

End-User Trends: Growing demand from the automotive and heavy equipment sectors are key market drivers. Increased adoption of advanced vehicles and industrial machinery fuels the demand for high-performance lubricants.

M&A Activities: The number of mergers and acquisitions (M&A) deals in the Chilean lubricants market is estimated to average xx per year during the historical period (2019-2024), indicating moderate consolidation. Future M&A activity is predicted to increase as larger players look to secure market share and expand their product portfolios.

Chile Lubricants Market Industry Insights & Trends

The Chilean lubricants market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This growth is primarily attributed to several factors: Expansion of the automotive sector, particularly in commercial vehicles, and growth in construction and mining activities which require large volumes of industrial lubricants. Technological advancements leading to higher-performance lubricants that extend equipment lifespan and enhance operational efficiency also play a significant role. Evolving consumer preferences, particularly towards environmentally friendly and cost-effective solutions, are influencing market trends. Furthermore, the increasing adoption of advanced lubricants in the industrial sector, focusing on efficiency and environmental responsibility, drives the market's growth. We project a CAGR of xx% for the forecast period (2025-2033), indicating continued growth potential. The overall market size in 2025 is estimated to reach approximately xx Million USD.

Key Markets & Segments Leading Chile Lubricants Market

The Chilean lubricants market is segmented by product type and end-user industry.

Dominant Product Type: Engine oil maintains its dominant position within the product type segment, due to its extensive application across automotive and industrial settings. The large-scale use of this product type in passenger and heavy-duty vehicles leads to substantial market share. Greases also hold a significant market share owing to their use in various industrial applications.

Dominant End-user Industry: The automotive sector dominates the end-user industry segment, driven by the growing vehicle population and the increasing demand for high-performance lubricants. The heavy equipment sector, particularly mining and construction, constitutes another significant segment, exhibiting strong growth due to large-scale infrastructure projects and mining activities.

Drivers for Key Segments:

- Automotive: Rapid urbanization, rising disposable incomes, and increased vehicle ownership propel demand.

- Heavy Equipment: Robust mining and construction activities create substantial demand for high-performance lubricants.

- Metallurgy and Metalworking: Industrial growth and manufacturing activities drive demand for specialized lubricants.

- Power Generation: Growth in energy production, particularly from renewable sources, creates a need for lubricants designed for specific equipment.

Chile Lubricants Market Product Developments

The Chilean lubricants market is experiencing a dynamic evolution characterized by a strong emphasis on advanced product development. Manufacturers are prioritizing the creation of high-performance lubricants that not only enhance energy efficiency and extend drain intervals but also demonstrate improved environmental compatibility. The strategic integration of advanced additive packages within synthetic lubricant formulations is a key trend, leading to superior machinery performance and extended operational lifespans, thereby offering a significant competitive advantage. These innovations are crucial for meeting the escalating demands of increasingly stringent environmental regulations and the persistent pursuit of enhanced operational efficiency across various industries. For instance, the recent launch of specialized synthetic lubricants for UTVs and ATVs by AMSOIL exemplifies this progressive trajectory towards highly specialized, performance-driven lubricant solutions.

Challenges in the Chile Lubricants Market Market

The Chilean lubricants market navigates a complex landscape of challenges, including:

- Supply Chain Vulnerabilities: Persistent global supply chain volatility presents a significant hurdle, impacting the consistent availability and fluctuating costs of essential raw materials, which in turn can influence lubricant production volumes and final market pricing.

- Crude Oil Price Volatility: The inherent unpredictability of global crude oil prices has a direct and substantial impact on lubricant manufacturing expenses and the overall profitability of the market.

- Intense Market Competition: The presence of a robust mix of established multinational corporations and agile local players fosters an intensely competitive market environment, demanding continuous innovation and strategic differentiation.

- Evolving Environmental Mandates: Increasingly stringent environmental regulations necessitate substantial investments in research and development for eco-friendly lubricant alternatives, inevitably leading to augmented operational costs.

Forces Driving Chile Lubricants Market Growth

Several factors drive the growth of the Chilean lubricants market:

- Economic Growth: Chile's relatively stable economy fuels growth across various sectors, particularly construction, mining, and transportation, which are major lubricant consumers.

- Infrastructure Development: Government investments in infrastructure projects boost the demand for lubricants across construction and transportation.

- Technological Advancements: The introduction of advanced lubricant formulations with improved efficiency and environmental performance contributes to market growth.

Challenges in the Chile Lubricants Market Market

The Chilean lubricants market navigates a complex landscape of challenges, including:

- Supply Chain Vulnerabilities: Persistent global supply chain volatility presents a significant hurdle, impacting the consistent availability and fluctuating costs of essential raw materials, which in turn can influence lubricant production volumes and final market pricing.

- Crude Oil Price Volatility: The inherent unpredictability of global crude oil prices has a direct and substantial impact on lubricant manufacturing expenses and the overall profitability of the market.

- Intense Market Competition: The presence of a robust mix of established multinational corporations and agile local players fosters an intensely competitive market environment, demanding continuous innovation and strategic differentiation.

- Evolving Environmental Mandates: Increasingly stringent environmental regulations necessitate substantial investments in research and development for eco-friendly lubricant alternatives, inevitably leading to augmented operational costs.

Emerging Opportunities in Chile Lubricants Market

The Chilean lubricants market is ripe with emerging opportunities. Expansion into specialized niche markets, including the burgeoning renewable energy sector, presents a significant avenue. Leveraging the escalating demand for tailored lubricant solutions within critical industries such as mining and agriculture is another key opportunity. The strategic adoption of digital technologies to optimize supply chain efficiencies and deepen customer engagement offers substantial potential for enhanced operational effectiveness and market reach. Moreover, the growing global consciousness surrounding environmental sustainability is creating a robust demand for lubricant formulations that are demonstrably eco-friendly and contribute to a reduced ecological footprint.

Leading Players in the Chile Lubricants Market Sector

- YPF

- Empresas Copec

- AMSOIL INC

- Valvoline Inc (Saudi Arabian Oil Co)

- Kluber Lubrication

- Shell PLC (ENEX)

- FUCHS

- Motul

- Petrobras

- Carl Bechem GmbH

- TotalEnergies SE

- BP PLC

- Chevron Corporation (Esmax)

Key Milestones in Chile Lubricants Market Industry

- September 2022: AMSOIL Inc. strategically expanded its product portfolio by launching two advanced synthetic lubricants specifically designed for UTV and ATV applications, effectively targeting and strengthening its presence in a specialized market segment.

- October 2022: TotalEnergies SE solidified its market position and product offerings in Chile through a significant partnership with MG Motor, collaborating on the development of a new, innovative range of lubricants tailored for the Chilean automotive sector.

Strategic Outlook for Chile Lubricants Market Market

The Chilean lubricants market presents significant growth potential, driven by factors such as economic growth, infrastructure development, and technological advancements. Strategic players should focus on product innovation, particularly in eco-friendly and high-performance lubricants, to capitalize on this potential. Building strong relationships with OEMs and expanding into niche markets will be crucial for sustained growth in the coming years. Companies with a focus on sustainability and innovation are expected to gain a competitive advantage in this rapidly evolving market.

Chile Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Metalworking Fluids

- 1.5. Transmission & Gear Oil

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Heavy Equipment

- 2.3. Metallurgy and Metalworking

- 2.4. Power Generation

- 2.5. Other End-user Industries

Chile Lubricants Market Segmentation By Geography

- 1. Chile

Chile Lubricants Market Regional Market Share

Geographic Coverage of Chile Lubricants Market

Chile Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lubricants from the Mining Industry; Growing Demand for Lubricants in the Automotive Aftermarket

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Metalworking Fluids

- 5.1.5. Transmission & Gear Oil

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Heavy Equipment

- 5.2.3. Metallurgy and Metalworking

- 5.2.4. Power Generation

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 YPF*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empresas Copec

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AMSOIL INC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Valvoline Inc (Saudi Arabian Oil Co )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kluber Lubrication

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shell PLC (ENEX)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FUCHS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Motul

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petrobras

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carl Bechem GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TotalEnergies SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BP PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Chevron Corporation (Esmax)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 YPF*List Not Exhaustive

List of Figures

- Figure 1: Chile Lubricants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Lubricants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Chile Lubricants Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Chile Lubricants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Chile Lubricants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Chile Lubricants Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Chile Lubricants Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Lubricants Market?

The projected CAGR is approximately > 3.88%.

2. Which companies are prominent players in the Chile Lubricants Market?

Key companies in the market include YPF*List Not Exhaustive, Empresas Copec, AMSOIL INC, Valvoline Inc (Saudi Arabian Oil Co ), Kluber Lubrication, Shell PLC (ENEX), FUCHS, Motul, Petrobras, Carl Bechem GmbH, TotalEnergies SE, BP PLC, Chevron Corporation (Esmax).

3. What are the main segments of the Chile Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lubricants from the Mining Industry; Growing Demand for Lubricants in the Automotive Aftermarket.

6. What are the notable trends driving market growth?

Growing Demand from the Automotive Industry.

7. Are there any restraints impacting market growth?

Growing Adoption of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

October 2022: TotalEnergies SE signed an agreement with MG Motor to develop a new range of lubricants in Chile. The new product is expected to be named MG Oil, the first MG Motor oil specially formulated for automobiles. This new product is expected to be manufactured entirely in Chile, which will likely help TotalEnergies strengthen its geographical presence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Lubricants Market?

To stay informed about further developments, trends, and reports in the Chile Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence