Key Insights

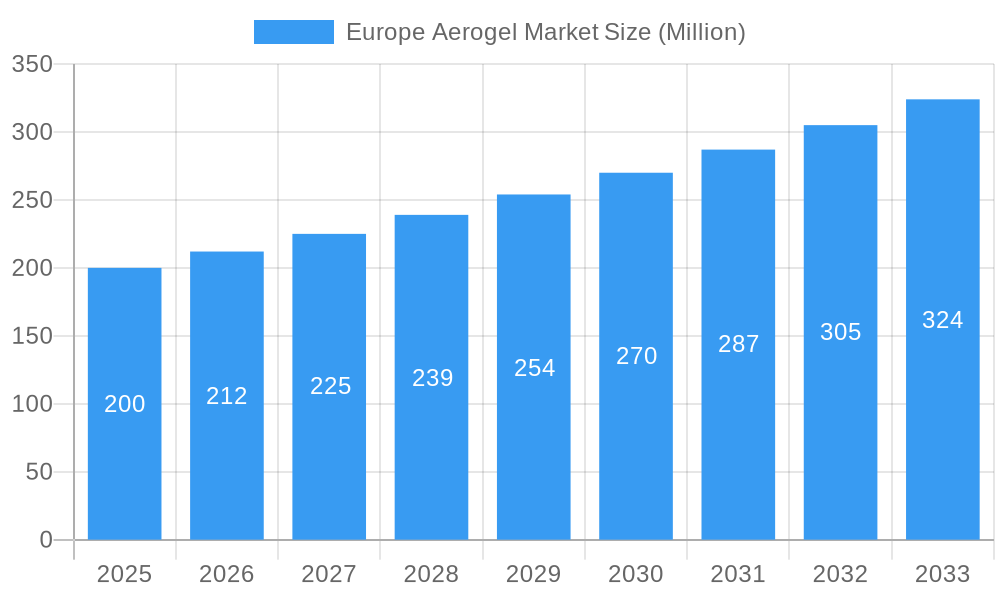

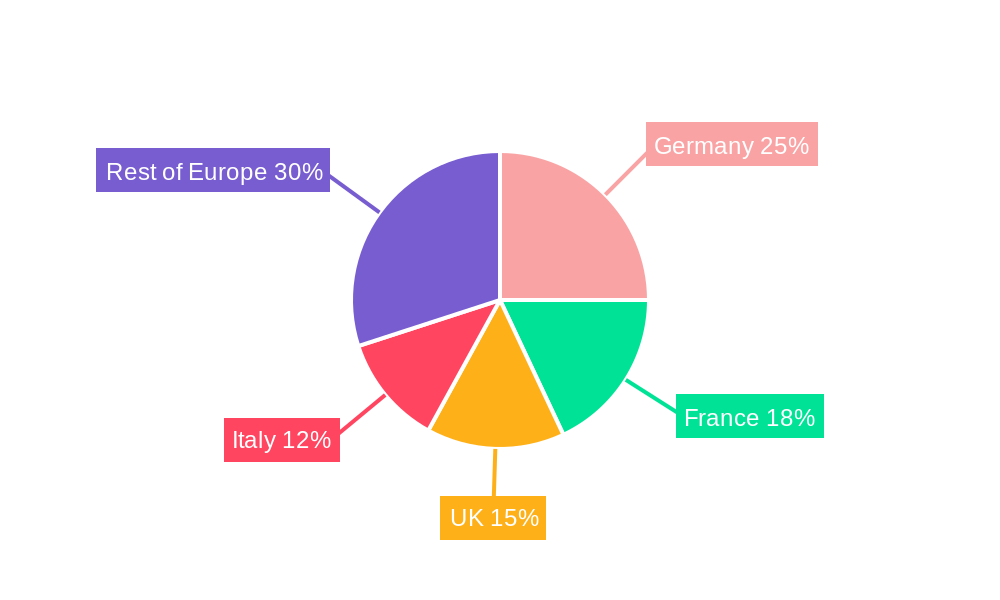

The European aerogel market is poised for significant expansion, projected to reach 1.33 billion by 2025, with a compound annual growth rate (CAGR) of 15.8% through 2033. This growth is fueled by escalating demand across key industries. The construction sector benefits from aerogels' exceptional thermal insulation capabilities, enhancing building energy efficiency in alignment with stringent European environmental mandates. The burgeoning renewable energy sector is integrating aerogel technologies for optimized thermal management in solar panels and energy storage solutions. Additionally, the increasing application of aerogels in advanced materials for aerospace and automotive sectors further propels market expansion. Currently, silica aerogels lead the market due to their cost-effectiveness and adaptability, with blanket form factors being the predominant choice for ease of implementation. Germany, France, and the United Kingdom are major contributors to the European market, supported by their strong industrial foundations and extensive research and development in material science.

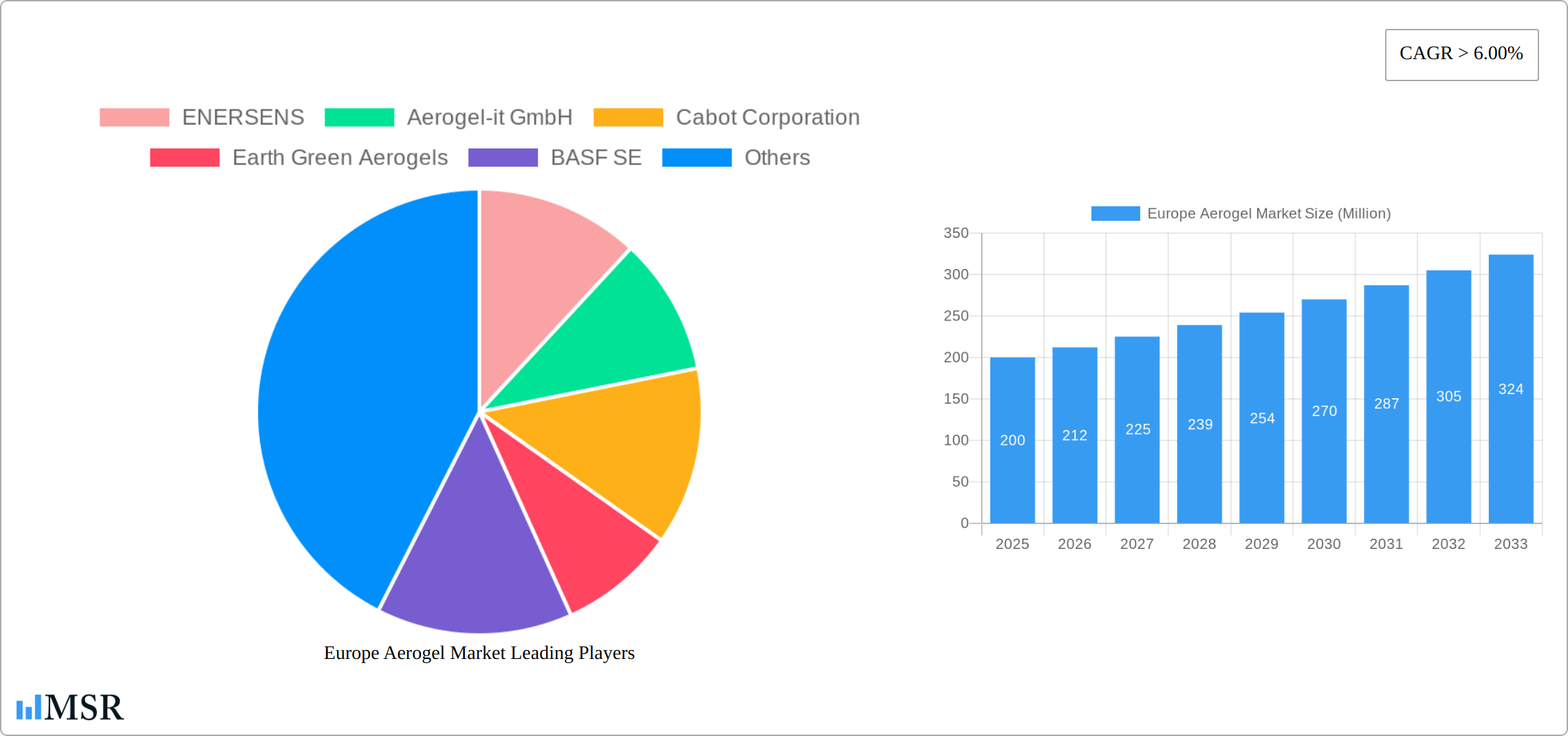

Europe Aerogel Market Market Size (In Billion)

Despite the positive outlook, the market encounters certain limitations. The high cost of aerogel manufacturing and the requirement for specialized handling present ongoing challenges. Competition from alternative insulation materials and the emerging nature of some niche applications also influence market penetration. Nevertheless, continuous technological innovation aimed at reducing costs and enhancing material performance, alongside growing recognition of aerogels' environmental and economic advantages, are expected to overcome these obstacles. The diversification of aerogel applications into high-value areas such as advanced composites and electronics will be crucial in shaping the market's future direction.

Europe Aerogel Market Company Market Share

Europe Aerogel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Aerogel Market, offering invaluable insights for industry stakeholders. With a detailed examination of market dynamics, key segments, leading players, and future trends, this report is an essential resource for strategic decision-making. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report covers a range of aerogel types (silica, carbon, alumina, others), forms (blanket, particles, blocks, panels), and end-user industries (industrial, textiles, marine, oil and gas, others).

Europe Aerogel Market Market Concentration & Dynamics

The European aerogel market presents a moderately consolidated structure, dominated by key players such as ENERSENS, Aerogel-it GmbH, Cabot Corporation, Earth Green Aerogels, BASF SE, KEEY Aerogel, SVENSKA AEROGEL AB, and Aerogel UK Ltd. These companies hold a significant portion of the market share. However, a dynamic competitive landscape is evident due to the presence of numerous smaller players and emerging companies, constantly vying for market position. Market concentration is significantly influenced by several factors, including advancements in material science, the evolving regulatory landscape emphasizing environmental sustainability, and the availability of alternative materials.

- Market Share & Projections: While precise figures are commercially sensitive, the leading five companies collectively held an estimated [Insert Percentage]% market share in 2025. This share is projected to increase to [Insert Percentage]% by 2033, reflecting anticipated growth and potential consolidation within the industry. More granular data on individual company performance can be found in our detailed market report.

- Mergers & Acquisitions (M&A) Activity: The period from 2019 to 2024 witnessed [Insert Number] M&A transactions. These transactions largely focused on expanding product portfolios and broadening geographical reach. The forecast period (2025-2033) anticipates a surge in M&A activity, driven primarily by the exponential growth of the electric vehicle (EV) sector and the increasing demand for improved energy efficiency solutions.

- Innovation and R&D: Continuous investment in research and development is a defining characteristic of this market. Companies are actively focusing on enhancing aerogel properties, including thermal conductivity, flexibility, and cost-effectiveness. These improvements are realized through advancements in manufacturing processes and the exploration of diverse applications, driving innovation and fostering competition.

- Regulatory Landscape and Sustainability: The stringent environmental regulations within the European Union are creating a highly favorable market environment for energy-efficient materials like aerogels. This regulatory push is a key driver for market growth. However, companies must navigate specific regulations concerning material handling, processing, and disposal to ensure compliance and maintain sustainability.

- Competitive Landscape and Substitute Products: While aerogels offer unique and superior properties in many applications, competition from alternative insulation materials, such as polyurethane foams and vacuum insulation panels (VIPs), remains a factor. However, aerogel's unmatched performance in extreme temperature conditions and specific niche applications secures its competitive advantage.

- End-User Demand and Market Drivers: The robust growth of the construction, automotive, and oil & gas sectors is a major catalyst for the European aerogel market. Stringent energy efficiency requirements and increasingly stringent environmental regulations across these sectors are driving the demand for superior insulation materials like aerogels.

Europe Aerogel Market Industry Insights & Trends

The Europe aerogel market is experiencing significant growth, driven by increasing demand for high-performance insulation materials across various sectors. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is largely attributed to the rising awareness of energy efficiency, stringent environmental regulations, and technological advancements in aerogel production and applications.

Several factors contribute to this upward trajectory. The escalating demand for energy-efficient building materials in the construction sector is a major driver. Similarly, the booming electric vehicle (EV) market fuels demand for advanced thermal management solutions, with aerogels playing a crucial role in battery thermal management and fire protection. Moreover, advancements in manufacturing technologies are making aerogels more cost-effective and accessible, further boosting market expansion. The rising need for efficient insulation in industrial processes and oil & gas pipelines, especially in light of recent geopolitical events, contributes significantly to market growth.

Key Markets & Segments Leading Europe Aerogel Market

The European aerogel market exhibits strong regional variations. Germany, France, and the UK are currently the leading national markets due to their well-established industrial base and substantial investments in renewable energy and energy efficiency projects. The silica aerogel type dominates the market due to its cost-effectiveness and versatility, followed by other types like alumina and carbon aerogels for specialized applications.

- By Type:

- Silica: Dominates due to its versatility and cost-effectiveness.

- Alumina: Used in high-temperature applications.

- Carbon: Primarily used in aerospace and defense sectors.

- Other Types: Represent a niche but growing segment.

- By Form:

- Blanket: The leading form, especially for insulation applications.

- Particles: Used in composite materials and specialized applications.

- Blocks & Panels: Suitable for specific structural applications.

- By End-user Industries:

- Industrial: Significant growth driven by energy efficiency requirements.

- Oil & Gas: Demand driven by pipeline insulation and equipment protection.

- Textiles: Growing demand for specialized performance fabrics. The marine sector shows a rising preference for aerogel-enhanced protective gear.

- Other End-User Industries: This includes aerospace, construction, and electronics. Growth here is fuelled by demand for lightweight, high-performance materials.

Drivers:

- Robust economic growth across major European countries

- Growing investments in renewable energy and sustainable infrastructure projects

- Stringent environmental regulations promoting energy efficiency

Europe Aerogel Market Product Developments

Recent years have witnessed significant product innovations in the aerogel market, focused on enhancing performance and expanding applications. The introduction of flexible aerogels, like AlkeGel, opens new avenues in the EV market and other flexible insulation applications. Advancements in manufacturing processes are leading to more cost-effective production methods, making aerogels more accessible to a wider range of industries. Companies are also focusing on developing tailored aerogel products that meet specific end-user needs and requirements, increasing their competitive advantage.

Challenges in the Europe Aerogel Market Market

The Europe aerogel market faces challenges related to high production costs, potential environmental concerns associated with certain manufacturing processes, and competition from other insulation materials. Supply chain disruptions, particularly concerning raw materials, can impact production and pricing. Furthermore, the complexity of aerogel handling and installation can also pose a barrier to adoption. The market faces xx% loss in revenue due to supply chain issues in 2024.

Forces Driving Europe Aerogel Market Growth

The Europe aerogel market is propelled by several key factors: The stringent energy efficiency regulations imposed across the EU are a major driver. The growing construction sector, with its increasing emphasis on sustainable building practices, is another significant catalyst. Furthermore, the burgeoning electric vehicle market and the urgent need for efficient thermal management in EVs create a substantial demand for aerogel materials. Finally, the increasing focus on reducing carbon footprints across numerous sectors fuels adoption of superior insulation materials like aerogels.

Long-Term Growth Catalysts in the Europe Aerogel Market

Long-term growth hinges on continuous innovation in aerogel manufacturing, resulting in reduced costs and improved performance characteristics. Strategic partnerships and collaborations between aerogel producers and end-user industries are crucial for market expansion. Exploring new applications and expanding into untapped markets (like wearable technology and medical applications) will further stimulate growth. Government incentives and support for sustainable technologies are also important drivers.

Emerging Opportunities in Europe Aerogel Market

Emerging opportunities lie in the expansion into new applications, such as advanced thermal insulation for aerospace, protective clothing, and specialized filters. The development of sustainable and eco-friendly manufacturing processes is vital. Furthermore, focusing on niche market segments with specific needs (e.g., specialized composites for construction) presents lucrative opportunities. Market expansion in Eastern European countries, with their growing construction and industrial sectors, also holds considerable potential.

Leading Players in the Europe Aerogel Market Sector

- ENERSENS

- Aerogel-it GmbH

- Cabot Corporation

- Earth Green Aerogels

- BASF SE

- KEEY Aerogel

- SVENSKA AEROGEL AB

- Aerogel UK Ltd

Key Milestones in Europe Aerogel Market Industry

- October 2022: Spain and France announced the construction of 226 long underwater gas pipelines, boosting demand for aerogel blankets in pipeline thermal insulation. This was a direct response to the energy crisis brought on by the Ukraine-Russia war.

- April 2022: Alkegen introduced AlkeGel, a flexible, next-generation aerogel material for electric vehicles (EVs), improving thermal management and fire safety. This highlights the growing demand for innovative materials in the EV sector.

Strategic Outlook for Europe Aerogel Market Market

The Europe aerogel market presents significant growth potential. Strategic opportunities include investing in R&D to develop innovative aerogel products catering to specific market needs and partnering with key players across various end-user industries. Focusing on sustainable and cost-effective production methods will be crucial for achieving long-term market leadership. Expansion into emerging applications and markets, supported by effective marketing and distribution strategies, will further enhance growth prospects.

Europe Aerogel Market Segmentation

-

1. Type

- 1.1. Silica

- 1.2. Carbon

- 1.3. Alumina

- 1.4. Other Types

-

2. Form

- 2.1. Blanket

- 2.2. Particles

- 2.3. Blocks

- 2.4. Panels

-

3. End-user Industries

-

3.1. Industrial

- 3.1.1. Building and Construction

- 3.1.2. Automotive

- 3.1.3. Electrical and Electronics

- 3.1.4. Textiles

- 3.2. Marine

- 3.3. Oil and Gas

- 3.4. Other End-user Industries

-

3.1. Industrial

Europe Aerogel Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. NORDIC Countries

- 7. Rest of Europe

Europe Aerogel Market Regional Market Share

Geographic Coverage of Europe Aerogel Market

Europe Aerogel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Lighter and Thinner Alternatives to Conventional Insulations

- 3.3. Market Restrains

- 3.3.1. High Cost of Production

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Silica

- 5.1.2. Carbon

- 5.1.3. Alumina

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Blanket

- 5.2.2. Particles

- 5.2.3. Blocks

- 5.2.4. Panels

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Industrial

- 5.3.1.1. Building and Construction

- 5.3.1.2. Automotive

- 5.3.1.3. Electrical and Electronics

- 5.3.1.4. Textiles

- 5.3.2. Marine

- 5.3.3. Oil and Gas

- 5.3.4. Other End-user Industries

- 5.3.1. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Spain

- 5.4.6. NORDIC Countries

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Silica

- 6.1.2. Carbon

- 6.1.3. Alumina

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Blanket

- 6.2.2. Particles

- 6.2.3. Blocks

- 6.2.4. Panels

- 6.3. Market Analysis, Insights and Forecast - by End-user Industries

- 6.3.1. Industrial

- 6.3.1.1. Building and Construction

- 6.3.1.2. Automotive

- 6.3.1.3. Electrical and Electronics

- 6.3.1.4. Textiles

- 6.3.2. Marine

- 6.3.3. Oil and Gas

- 6.3.4. Other End-user Industries

- 6.3.1. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Silica

- 7.1.2. Carbon

- 7.1.3. Alumina

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Blanket

- 7.2.2. Particles

- 7.2.3. Blocks

- 7.2.4. Panels

- 7.3. Market Analysis, Insights and Forecast - by End-user Industries

- 7.3.1. Industrial

- 7.3.1.1. Building and Construction

- 7.3.1.2. Automotive

- 7.3.1.3. Electrical and Electronics

- 7.3.1.4. Textiles

- 7.3.2. Marine

- 7.3.3. Oil and Gas

- 7.3.4. Other End-user Industries

- 7.3.1. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Italy Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Silica

- 8.1.2. Carbon

- 8.1.3. Alumina

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Blanket

- 8.2.2. Particles

- 8.2.3. Blocks

- 8.2.4. Panels

- 8.3. Market Analysis, Insights and Forecast - by End-user Industries

- 8.3.1. Industrial

- 8.3.1.1. Building and Construction

- 8.3.1.2. Automotive

- 8.3.1.3. Electrical and Electronics

- 8.3.1.4. Textiles

- 8.3.2. Marine

- 8.3.3. Oil and Gas

- 8.3.4. Other End-user Industries

- 8.3.1. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Silica

- 9.1.2. Carbon

- 9.1.3. Alumina

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Blanket

- 9.2.2. Particles

- 9.2.3. Blocks

- 9.2.4. Panels

- 9.3. Market Analysis, Insights and Forecast - by End-user Industries

- 9.3.1. Industrial

- 9.3.1.1. Building and Construction

- 9.3.1.2. Automotive

- 9.3.1.3. Electrical and Electronics

- 9.3.1.4. Textiles

- 9.3.2. Marine

- 9.3.3. Oil and Gas

- 9.3.4. Other End-user Industries

- 9.3.1. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Silica

- 10.1.2. Carbon

- 10.1.3. Alumina

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Blanket

- 10.2.2. Particles

- 10.2.3. Blocks

- 10.2.4. Panels

- 10.3. Market Analysis, Insights and Forecast - by End-user Industries

- 10.3.1. Industrial

- 10.3.1.1. Building and Construction

- 10.3.1.2. Automotive

- 10.3.1.3. Electrical and Electronics

- 10.3.1.4. Textiles

- 10.3.2. Marine

- 10.3.3. Oil and Gas

- 10.3.4. Other End-user Industries

- 10.3.1. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. NORDIC Countries Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Silica

- 11.1.2. Carbon

- 11.1.3. Alumina

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Form

- 11.2.1. Blanket

- 11.2.2. Particles

- 11.2.3. Blocks

- 11.2.4. Panels

- 11.3. Market Analysis, Insights and Forecast - by End-user Industries

- 11.3.1. Industrial

- 11.3.1.1. Building and Construction

- 11.3.1.2. Automotive

- 11.3.1.3. Electrical and Electronics

- 11.3.1.4. Textiles

- 11.3.2. Marine

- 11.3.3. Oil and Gas

- 11.3.4. Other End-user Industries

- 11.3.1. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Aerogel Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Silica

- 12.1.2. Carbon

- 12.1.3. Alumina

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Form

- 12.2.1. Blanket

- 12.2.2. Particles

- 12.2.3. Blocks

- 12.2.4. Panels

- 12.3. Market Analysis, Insights and Forecast - by End-user Industries

- 12.3.1. Industrial

- 12.3.1.1. Building and Construction

- 12.3.1.2. Automotive

- 12.3.1.3. Electrical and Electronics

- 12.3.1.4. Textiles

- 12.3.2. Marine

- 12.3.3. Oil and Gas

- 12.3.4. Other End-user Industries

- 12.3.1. Industrial

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 ENERSENS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Aerogel-it GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cabot Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Earth Green Aerogels

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KEEY Aerogel

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SVENSKA AEROGEL AB*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aerogel UK Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 ENERSENS

List of Figures

- Figure 1: Europe Aerogel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Aerogel Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 3: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 4: Europe Aerogel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 8: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 11: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 12: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 15: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 16: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 19: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 23: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 24: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 27: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 28: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Europe Aerogel Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Europe Aerogel Market Revenue billion Forecast, by Form 2020 & 2033

- Table 31: Europe Aerogel Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 32: Europe Aerogel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aerogel Market?

The projected CAGR is approximately 15.8%.

2. Which companies are prominent players in the Europe Aerogel Market?

Key companies in the market include ENERSENS, Aerogel-it GmbH, Cabot Corporation, Earth Green Aerogels, BASF SE, KEEY Aerogel, SVENSKA AEROGEL AB*List Not Exhaustive, Aerogel UK Ltd.

3. What are the main segments of the Europe Aerogel Market?

The market segments include Type, Form, End-user Industries .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Lighter and Thinner Alternatives to Conventional Insulations.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

High Cost of Production.

8. Can you provide examples of recent developments in the market?

October 2022: Spain and France announced building 226 long underwater gas pipelines. This was the latest development after the Ukraine-Russia war and Russian gas supply issues in 2022. The new project will boost aerogel blankets for pipeline thermal insulation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aerogel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aerogel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aerogel Market?

To stay informed about further developments, trends, and reports in the Europe Aerogel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence