Key Insights

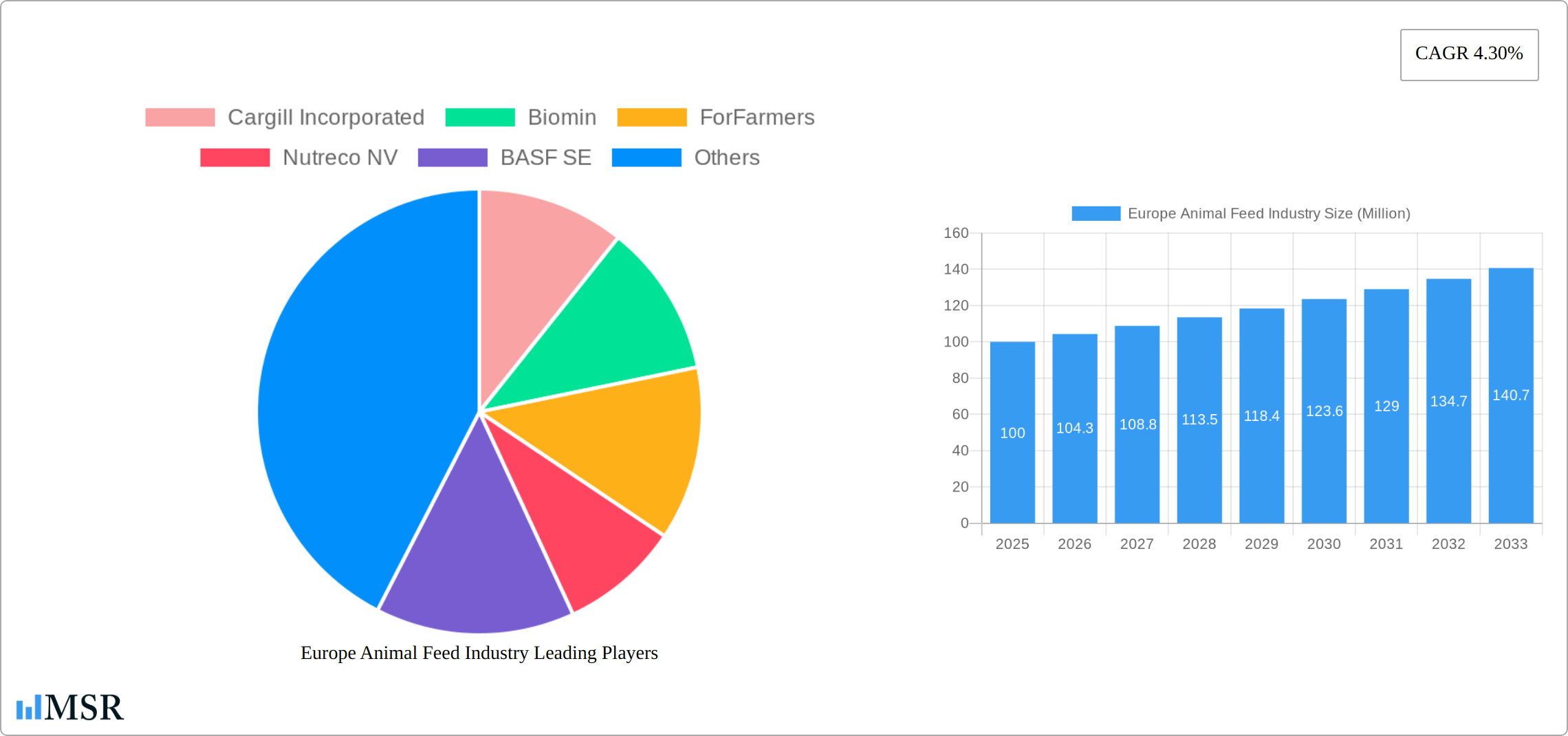

The European animal feed market, valued at €158.2 billion in 2025, is projected for robust expansion with a Compound Annual Growth Rate (CAGR) of 4.3% from 2025 to 2033. Key growth drivers include escalating demand for animal protein, influenced by population growth and evolving dietary preferences. Innovations in feed formulation, emphasizing enhanced efficiency and environmental sustainability through responsible sourcing and reduced reliance on conventional ingredients, are also significant contributors. The sector is increasingly focused on specialized feed solutions for diverse animal types and life stages, aiming to optimize animal health and productivity. This trend aligns with heightened consumer awareness regarding animal welfare and the demand for high-quality, ethically produced animal products. Leading industry players like Cargill, Biomin, ForFarmers, Nutreco, BASF, Altech, Kemin Industries, Yara International, and ADM Animal Nutrition are spearheading innovation and market consolidation.

Europe Animal Feed Industry Market Size (In Billion)

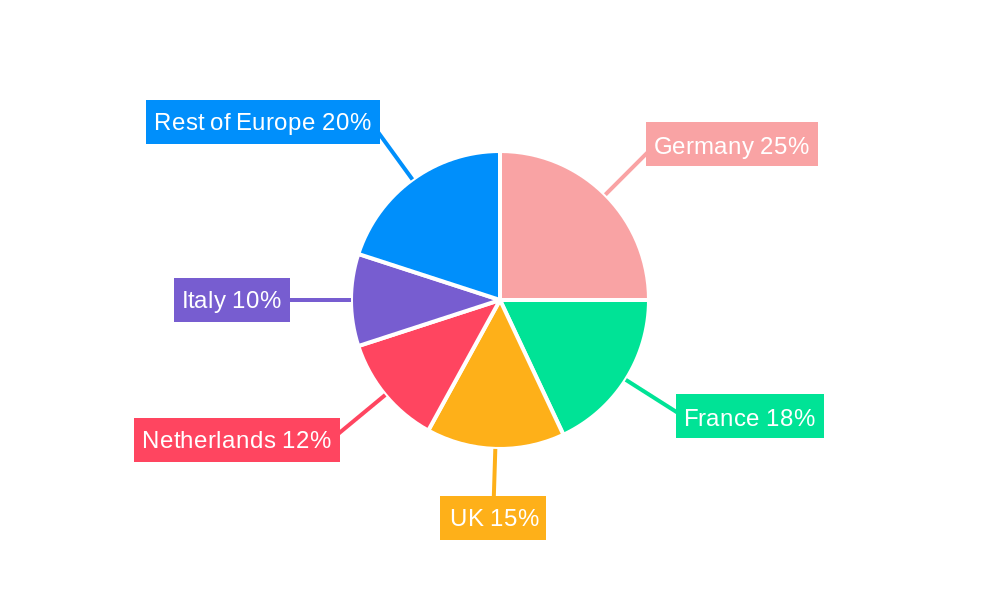

Despite its positive trajectory, the European animal feed industry encounters several challenges. Volatile raw material prices, especially for cereals and agricultural commodities, impact profitability and price consistency. Stringent environmental regulations governing feed production and waste management necessitate ongoing investments in sustainable practices, thereby increasing operational expenses. Furthermore, intensified competition from both established corporations and emerging enterprises, particularly within specialized market segments, requires persistent product innovation and streamlined supply chain management to retain market share. While major European economies such as Germany, France, the UK, and the Netherlands are expected to remain strongholds, expansion opportunities are emerging in regions like the Nordics and Southern Europe, driven by evolving consumer tastes and animal husbandry practices. The forecast for 2025-2033 indicates a promising market landscape that demands agile strategies to address challenges and capitalize on emerging opportunities.

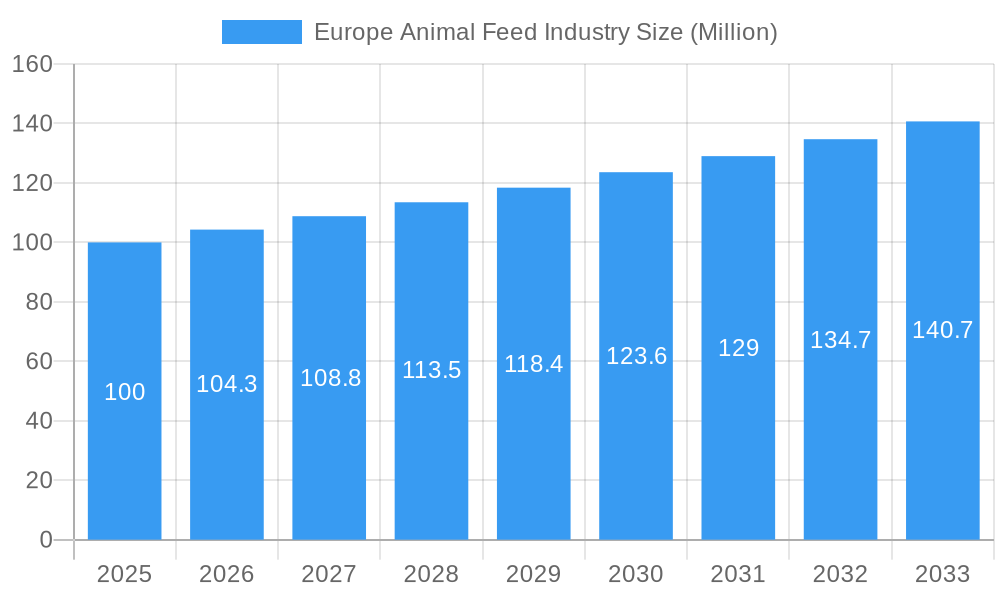

Europe Animal Feed Industry Company Market Share

Europe Animal Feed Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe animal feed industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key trends, and future growth prospects. The report meticulously analyzes market concentration, leading players, key segments (ruminants, poultry, swine, aquaculture, other animal types; cereals, cakes & meals, by-products, supplements), and emerging opportunities, equipping you with the knowledge to navigate this dynamic sector effectively.

Europe Animal Feed Industry Market Concentration & Dynamics

The European animal feed industry is characterized by a moderately concentrated market structure, where a few dominant multinational corporations, including Cargill Incorporated, Nutreco NV, and ADM Animal Nutrition, hold substantial market sway. Alongside these giants, a vibrant ecosystem of smaller, specialized companies thrives, catering to specific niche markets and emerging demands. Innovation remains a cornerstone, propelled by significant investments in Research & Development (R&D). This focus is particularly directed towards developing sustainable, technologically advanced feed solutions that address both performance and environmental concerns. The industry operates within a robust regulatory framework, emphasizing paramount importance on animal welfare, stringent feed safety standards, and overarching environmental sustainability goals, which collectively shape industry practices and product development. The emergence of substitute products, notably alternative protein sources, presents a dual landscape of challenges and significant opportunities for market evolution. Furthermore, evolving consumer trends, with an increasing emphasis on ethical animal welfare practices and enhanced product traceability throughout the supply chain, are becoming powerful influencers of purchasing decisions and industry strategies.

The historical period (2019-2024) has been marked by a notable volume of Mergers & Acquisitions (M&A) activities, with approximately xx deals recorded, reflecting ongoing consolidation efforts and strategic realignments within the industry. Projections for 2025 indicate that the top 5 players are estimated to command a market share of approximately xx%, underscoring the continued influence of major market participants.

- Market Concentration: The market exhibits moderate concentration, with a few large-scale enterprises holding significant influence, complemented by a diverse array of specialized smaller firms.

- Innovation Drivers: Driven by substantial R&D investments, the industry is prioritizing the development of sustainable, technologically advanced feed solutions and novel ingredients.

- Regulatory Landscape: A stringent regulatory environment is in place, with a strong focus on ensuring animal welfare, maintaining rigorous feed safety standards, and promoting environmental sustainability across all operations.

- Substitute Products & Opportunities: The growing exploration and adoption of alternative protein sources are creating both competitive pressures and new avenues for growth and diversification.

- M&A Trends: The historical period saw considerable M&A activity (xx deals), signaling a trend towards industry consolidation and strategic expansion among key players.

Europe Animal Feed Industry Industry Insights & Trends

The European animal feed industry is navigating a complex and dynamic landscape, shaped by a confluence of robust market growth drivers, accelerating technological advancements, and evolving consumer preferences. The market size for 2025 is estimated at a substantial €xx Billion, with projections indicating a Compound Annual Growth Rate (CAGR) of xx% anticipated over the forecast period (2025-2033). This anticipated growth is primarily propelled by the escalating global demand for meat products, particularly in developing economies. Technological innovations are playing a pivotal role, with advancements in precision feeding techniques and sophisticated data analytics optimizing feed efficiency, minimizing waste, and significantly reducing the environmental footprint of animal agriculture. Concurrently, a growing consumer consciousness and preference for sustainably produced animal products are directly fueling the demand for eco-friendly and ethically sourced feed solutions. Despite these positive trends, the industry faces persistent challenges, including the volatility of raw material prices, the complexities of adhering to increasingly stringent regulatory requirements, and intense competition from emerging markets. Nevertheless, the industry's commitment to continuous innovation and the formation of strategic partnerships are poised to ensure sustained and robust growth in the long term.

Key Markets & Segments Leading Europe Animal Feed Industry

The European animal feed market is comprehensively segmented based on animal type (including ruminants, poultry, swine, aquaculture, and other animal categories) and ingredient type (such as cereals, cakes & meals, by-products, and supplements). Currently, poultry feed commands the largest market share, a testament to the high and consistent consumption of poultry products across the European continent. Within the ingredient segment, cereals are the dominant component, constituting a substantial portion of the overall feed volume due to their availability and cost-effectiveness.

Dominant Segments:

- Animal Type: Poultry consistently leads the market due to widespread consumption patterns.

- Ingredient Type: Cereals are the predominant ingredient, followed closely by cakes & meals.

Key Growth Drivers by Segment:

- Poultry: Sustained by high meat consumption and favorable production economics, making it a cornerstone of the feed market.

- Swine: Experiencing increased demand driven by the rising popularity and consumption of pork products across various European nations.

- Ruminants: While demand for dairy and beef products continues to grow, this segment's expansion is increasingly influenced by environmental considerations and the imperative for sustainable production practices.

- Cereals: Their continued dominance is attributed to their cost-effectiveness and widespread availability as a primary feed component.

- Supplements: A growing emphasis on enhancing animal health and optimizing nutritional profiles is driving the demand for specialized feed supplements.

Europe Animal Feed Industry Product Developments

Recent product innovations focus on enhancing feed efficiency, improving animal health, and reducing environmental impact. This involves the development of precision-feeding technologies, functional feed additives, and sustainable feed ingredients. Competition is intense, with companies investing heavily in R&D to develop unique product offerings and gain a competitive edge. Technological advancements, such as the use of data analytics and artificial intelligence, are revolutionizing feed formulation and management.

Challenges in the Europe Animal Feed Industry Market

The European animal feed industry is confronted by a complex web of significant challenges that impact its operational efficiency and profitability. Volatile raw material prices pose a constant threat, leading to unpredictable input costs and affecting profit margins. Navigating and ensuring compliance with stringent regulatory frameworks across different European nations demands substantial resources and continuous adaptation. Furthermore, the industry is susceptible to supply chain disruptions, which can arise from geopolitical events, logistical hurdles, or unforeseen environmental factors, leading to delays and increased costs. The competitive landscape is intensifying, with both established domestic players and emerging international companies vying for market share, thereby exerting downward pressure on prices and margins. Added to these operational and market pressures are the growing environmental concerns associated with feed production, including resource utilization and the management of animal waste, which necessitates further investment in sustainable practices and technologies. These multifaceted challenges collectively influence market expansion strategies and the overall sustainability of the industry.

Forces Driving Europe Animal Feed Industry Growth

Several factors drive growth in the European animal feed industry. Technological advancements in feed formulation and animal nutrition enhance productivity and efficiency. Economic growth and rising disposable incomes fuel the demand for animal protein. Favorable government policies supporting the livestock sector further contribute to the industry's expansion. The increasing adoption of sustainable agricultural practices and a growing awareness of environmental issues drive demand for eco-friendly feed solutions.

Long-Term Growth Catalysts in Europe Animal Feed Industry

Long-term growth in the European animal feed market hinges on strategic partnerships, technological innovation, and market expansion. Investments in R&D for sustainable feed solutions are crucial. Collaborations across the value chain, including farmers, feed producers, and retailers, promote sustainability and efficiency. Exploring new markets and adapting to evolving consumer preferences are essential for sustained growth. The focus on precision livestock farming and data-driven decision-making will remain key drivers for long-term growth.

Emerging Opportunities in Europe Animal Feed Industry

Emerging opportunities lie in developing sustainable feed solutions, tapping into new technologies such as precision feeding and data analytics, and catering to growing consumer demands for animal welfare and traceability. The increasing focus on alternative protein sources, such as insect-based and single-cell protein, opens new avenues for innovation. Expansion into emerging markets and diversification of product offerings also present significant growth potential.

Leading Players in the Europe Animal Feed Industry Sector

Key Milestones in Europe Animal Feed Industry Industry

- February 2021: ForFarmers' Pavo brand acquired Mühldorfer Pferdefutter, expanding its German horse feed market share by over 40%.

- November 2021: ADM acquired Sojaprotein, strengthening its plant-based protein capabilities in European animal nutrition.

- April 2022: Cargill invested USD 50 Million in R&D for animal nutrition and feeds in China, Minnesota, and the Netherlands.

Strategic Outlook for Europe Animal Feed Industry Market

The future of the European animal feed industry is bright, driven by technological innovation, sustainable practices, and increasing consumer demand for high-quality animal products. Strategic partnerships, investments in R&D, and a focus on sustainability will be crucial for success. Companies that embrace innovation and adapt to evolving market trends will be well-positioned to capitalize on the significant growth opportunities in this dynamic sector.

Europe Animal Feed Industry Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

Europe Animal Feed Industry Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Animal Feed Industry Regional Market Share

Geographic Coverage of Europe Animal Feed Industry

Europe Animal Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Growing Demand for Meat and Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Germany

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Spain Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.2.4.1. Vitamins

- 6.2.4.2. Amino Acid

- 6.2.4.3. Enzymes

- 6.2.4.4. Prebiotics and Probiotics

- 6.2.4.5. Acidifiers

- 6.2.4.6. Other Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. United Kingdom Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.2.4.1. Vitamins

- 7.2.4.2. Amino Acid

- 7.2.4.3. Enzymes

- 7.2.4.4. Prebiotics and Probiotics

- 7.2.4.5. Acidifiers

- 7.2.4.6. Other Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. France Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.2.4.1. Vitamins

- 8.2.4.2. Amino Acid

- 8.2.4.3. Enzymes

- 8.2.4.4. Prebiotics and Probiotics

- 8.2.4.5. Acidifiers

- 8.2.4.6. Other Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Germany Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.2.4.1. Vitamins

- 9.2.4.2. Amino Acid

- 9.2.4.3. Enzymes

- 9.2.4.4. Prebiotics and Probiotics

- 9.2.4.5. Acidifiers

- 9.2.4.6. Other Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Russia Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.2.4.1. Vitamins

- 10.2.4.2. Amino Acid

- 10.2.4.3. Enzymes

- 10.2.4.4. Prebiotics and Probiotics

- 10.2.4.5. Acidifiers

- 10.2.4.6. Other Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Italy Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 11.1.1. Ruminants

- 11.1.2. Poultry

- 11.1.3. Swine

- 11.1.4. Aquaculture

- 11.1.5. Other Animal Types

- 11.2. Market Analysis, Insights and Forecast - by Ingredient

- 11.2.1. Cereals

- 11.2.2. Cakes & Meals

- 11.2.3. By-products

- 11.2.4. Supplements

- 11.2.4.1. Vitamins

- 11.2.4.2. Amino Acid

- 11.2.4.3. Enzymes

- 11.2.4.4. Prebiotics and Probiotics

- 11.2.4.5. Acidifiers

- 11.2.4.6. Other Supplements

- 11.1. Market Analysis, Insights and Forecast - by Animal Type

- 12. Rest of Europe Europe Animal Feed Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 12.1.1. Ruminants

- 12.1.2. Poultry

- 12.1.3. Swine

- 12.1.4. Aquaculture

- 12.1.5. Other Animal Types

- 12.2. Market Analysis, Insights and Forecast - by Ingredient

- 12.2.1. Cereals

- 12.2.2. Cakes & Meals

- 12.2.3. By-products

- 12.2.4. Supplements

- 12.2.4.1. Vitamins

- 12.2.4.2. Amino Acid

- 12.2.4.3. Enzymes

- 12.2.4.4. Prebiotics and Probiotics

- 12.2.4.5. Acidifiers

- 12.2.4.6. Other Supplements

- 12.1. Market Analysis, Insights and Forecast - by Animal Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Biomin

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 ForFarmers

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nutreco NV

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Altech

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kemin Industries Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yara International AS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ADM Animal Nutrition

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Animal Feed Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Animal Feed Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: Europe Animal Feed Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 5: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 8: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 9: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 12: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 14: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 15: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 17: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 18: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 20: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 21: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Animal Feed Industry Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Europe Animal Feed Industry Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 24: Europe Animal Feed Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Animal Feed Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Europe Animal Feed Industry?

Key companies in the market include Cargill Incorporated, Biomin, ForFarmers, Nutreco NV, BASF SE, Altech, Kemin Industries Inc, Yara International AS, ADM Animal Nutrition.

3. What are the main segments of the Europe Animal Feed Industry?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 158.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Growing Demand for Meat and Aquaculture Products.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

April 2022: Cargill invested USD 50 million towards developing R&D in China, near Elk River, Minnesota, and a facility in the Netherlands, Europe, to research and develop animal nutrition and feeds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Animal Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Animal Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Animal Feed Industry?

To stay informed about further developments, trends, and reports in the Europe Animal Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence