Key Insights

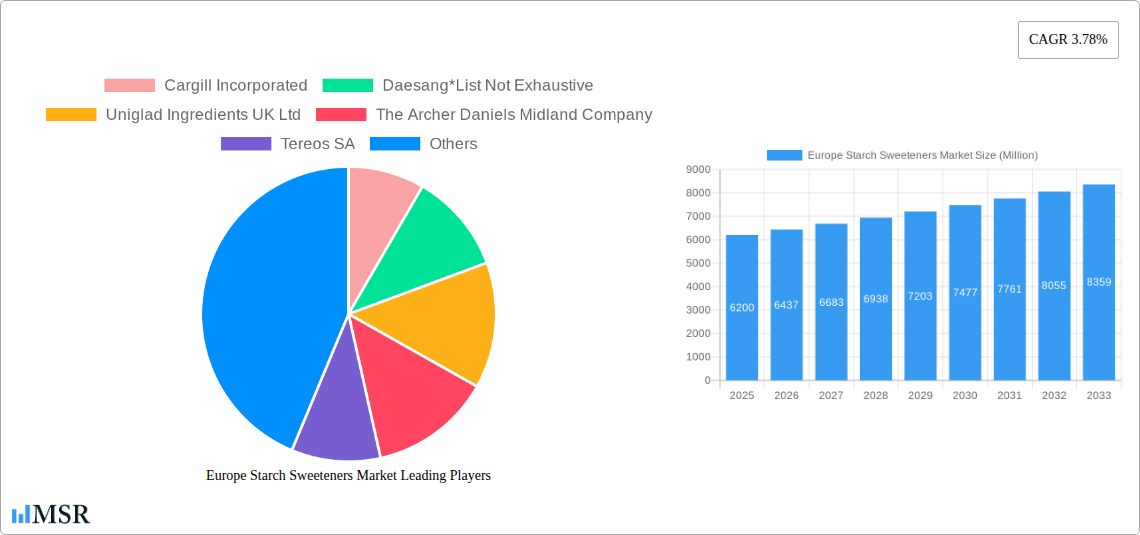

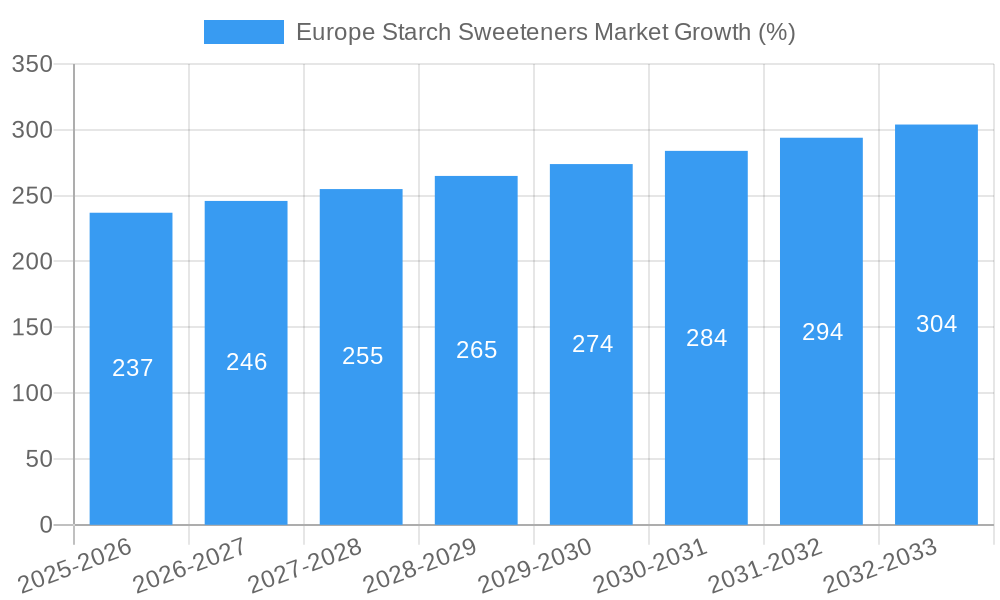

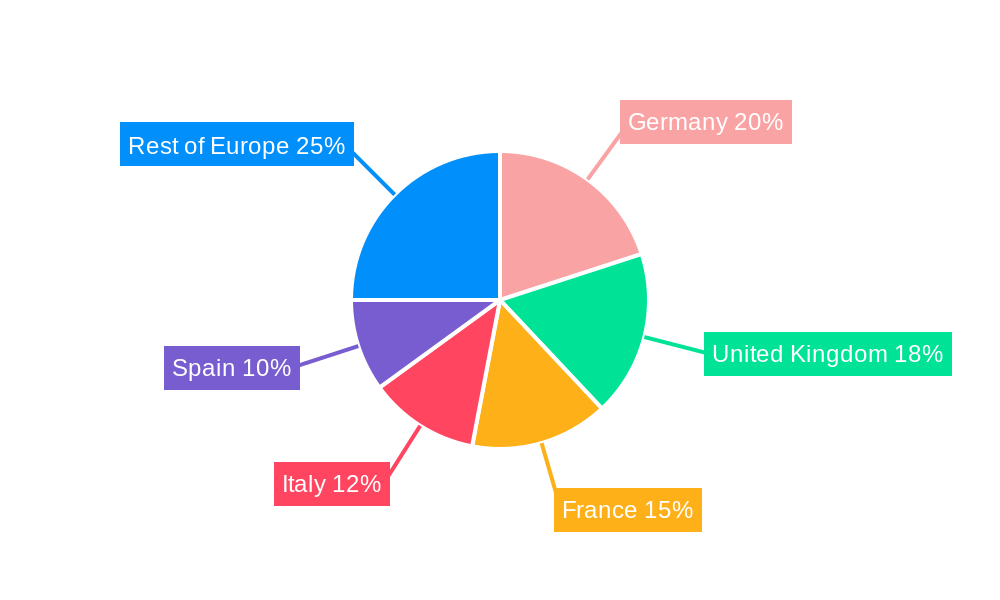

The European starch sweeteners market, valued at €6.20 billion in 2025, is projected to experience steady growth, driven by increasing demand from the food and beverage industry. A Compound Annual Growth Rate (CAGR) of 3.78% from 2025 to 2033 indicates a robust market outlook. Key application segments like bakery, dairy & desserts, and beverages are major contributors to this growth, fueled by consumer preference for sweet-tasting products and the functional properties of starch sweeteners in enhancing texture and shelf life. Germany, the United Kingdom, and France represent significant regional markets, benefiting from established food processing industries and high per capita consumption of processed foods. The market's growth trajectory is further supported by continuous innovation in product types, with glucose syrups, high-fructose corn syrup, and dextrin witnessing strong demand due to their versatility in various applications. However, increasing health concerns related to sugar consumption and the rising popularity of alternative sweeteners could pose challenges to the market's growth in the long term. The competitive landscape comprises both large multinational corporations and specialized ingredient suppliers, indicating opportunities for both consolidation and specialized niche players.

Despite potential restraints, the market's positive growth trajectory is expected to continue. The increasing demand for convenient and ready-to-eat foods in Europe will likely fuel the consumption of starch sweeteners. Furthermore, the advancements in starch sweetener technology, leading to the development of healthier and more functional alternatives, may mitigate some of the concerns about sugar consumption. The continued expansion of the food processing industry in developing European countries, coupled with the rising disposable income, will also boost market growth. Strategic collaborations and mergers and acquisitions amongst key players are likely to shape the competitive landscape, further driving market expansion. The market's overall future hinges on balancing consumer demand for sweet tastes with growing health consciousness.

Europe Starch Sweeteners Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe starch sweeteners market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this report examines market dynamics, key segments, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Starch Sweeteners Market Market Concentration & Dynamics

The Europe starch sweeteners market exhibits a moderately concentrated landscape, with several major players holding significant market share. Cargill Incorporated, Ingredion Inc, Tate & Lyle PLC, and Tereos SA are among the leading companies, competing fiercely based on product innovation, pricing strategies, and supply chain efficiency. Market share analysis reveals that the top five players collectively account for approximately xx% of the market. The market's innovation ecosystem is dynamic, driven by continuous research and development efforts focused on clean label ingredients, functional starches, and sustainable production processes. Regulatory frameworks, particularly those concerning food safety and labeling, play a crucial role in shaping market dynamics. Substitute products, such as high-intensity sweeteners and sugar alternatives, pose a competitive threat, impacting market growth. Evolving consumer preferences towards healthier and more natural food products are influencing demand. M&A activity within the starch sweeteners industry has been relatively moderate in recent years, with xx mergers and acquisitions recorded between 2019 and 2024. This activity is anticipated to increase as companies seek to expand their product portfolios and geographic reach.

Europe Starch Sweeteners Market Industry Insights & Trends

The European starch sweeteners market is experiencing robust growth, driven by several key factors. The increasing demand for processed foods and beverages across the region is a primary growth driver. The rising disposable incomes and changing lifestyles have led to increased consumption of convenience foods, which heavily utilize starch sweeteners as key ingredients. Technological advancements in starch processing and modification are also impacting market growth, enabling the creation of innovative, functional ingredients. Consumer preferences for clean-label products and sustainable sourcing practices are influencing industry trends. The market size is estimated at xx Million in 2025, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Key Markets & Segments Leading Europe Starch Sweeteners Market

The report identifies Germany, the United Kingdom, and France as the leading national markets within Europe for starch sweeteners, accounting for a combined xx% of the total market. The robust food and beverage industries in these countries, coupled with high consumer spending, drive substantial demand.

Key Drivers:

- Strong Food and Beverage Industry: The substantial presence of food processing and beverage manufacturing facilities is a crucial factor in driving demand.

- High Consumer Spending: Increased disposable incomes in key European countries fuel demand for processed foods and beverages containing starch sweeteners.

- Favorable Regulatory Environment: Regulatory frameworks that support the safe use of starch sweeteners in food applications contribute to market growth.

Dominant Segments:

- Application: The bakery, dairy and desserts, and beverages segments demonstrate the highest demand for starch sweeteners, accounting for over xx% of the total application volume.

- Product Type: Glucose syrups and high-fructose corn syrup are currently the most widely used starch sweeteners. However, increasing demand for clean-label ingredients is driving interest in alternative products like dextrin and sugar alcohols.

- Country: Germany’s robust food and beverage manufacturing sector leads the country-specific segment.

Europe Starch Sweeteners Market Product Developments

Recent years have witnessed significant innovation in starch sweetener technology. Companies are focusing on developing clean-label, functional starches with enhanced textural properties and improved digestibility. The introduction of non-GMO and organic starch sweeteners caters to growing consumer demand for natural and sustainable products. These innovations are providing manufacturers with competitive advantages and opening up new market opportunities. For instance, Ingredion's launch of NOVATION Indulge 2940 starch highlights the focus on clean-label texturizers.

Challenges in the Europe Starch Sweeteners Market Market

The Europe starch sweeteners market faces challenges such as stringent regulations related to food safety and labeling, which increase compliance costs for manufacturers. Fluctuations in raw material prices (e.g., corn) also impact profitability. Intense competition among established players and the emergence of substitute sweeteners create further challenges. Supply chain disruptions have posed significant challenges in recent years, leading to price volatility and potential production delays. These factors collectively affect market growth and profitability.

Forces Driving Europe Starch Sweeteners Market Growth

Several factors are driving growth in the European starch sweeteners market. The increasing demand for processed foods and beverages is a key driver. Advances in starch processing technologies, allowing for the creation of functional starches with tailored properties, are also contributing to growth. Government policies supporting sustainable agricultural practices and environmentally friendly production methods are influencing the market. The growing preference for clean-label ingredients is further stimulating demand for innovative starch-based products.

Challenges in the Europe Starch Sweeteners Market Market

Long-term growth catalysts include strategic partnerships and collaborations to leverage R&D capabilities and expand market reach. Continuous innovation in starch processing technologies, focusing on improved functionalities and sustainability, will sustain growth. Expansion into new markets within Europe, and exploration of new product applications, also promise significant growth opportunities.

Emerging Opportunities in Europe Starch Sweeteners Market

Emerging opportunities lie in the growing demand for specialized functional starches for specific applications, such as plant-based meat alternatives and novel food products. The rise of personalized nutrition and functional foods creates opportunities for customized starch sweeteners. Sustainable sourcing and production practices are gaining importance, creating demand for certified and traceable starch sweeteners. Increased focus on health and wellness will continue to drive demand for low-calorie and functional starch sweeteners.

Leading Players in the Europe Starch Sweeteners Market Sector

- Cargill Incorporated

- Daesang

- Uniglad Ingredients UK Ltd

- The Archer Daniels Midland Company

- Tereos SA

- Ingredion Inc

- Tate & Lyle PLC

- Novasep

- E I du Pont de Nemours and Company

- VOGELBUSCH Biocommodities GmbH

Key Milestones in Europe Starch Sweeteners Market Industry

- August 2022: Cargill invested USD 50 Million to build a corn syrup refinery, aiming to meet growing demand sustainably.

- February 2024: Ingredion Incorporated launched NOVATION Indulge 2940 starch, a non-GMO functional native corn starch for dairy and alternative dairy products.

- April 2024: Tereos opened a new Customer Innovation Centre in Aalst, Belgium, to foster collaboration and innovation.

Strategic Outlook for Europe Starch Sweeteners Market Market

The future of the European starch sweeteners market appears promising, driven by ongoing innovation, increasing consumer demand for processed foods and beverages, and a growing focus on clean label and sustainable ingredients. Companies that can successfully adapt to evolving consumer preferences and regulatory changes while maintaining operational efficiency and sustainable practices are poised for long-term success. Strategic partnerships and collaborations will play a crucial role in shaping the future of the market, fostering innovation, and expanding market reach.

Europe Starch Sweeteners Market Segmentation

-

1. Product Type

- 1.1. Dextrin

- 1.2. Fructose

- 1.3. High-fructose Corn Syrup

- 1.4. Glucose Syrups

-

1.5. Sugar Alcohols

- 1.5.1. Sorbitol

- 1.5.2. Maltitol

- 1.5.3. Xylitol

- 1.5.4. Erythritol

- 1.5.5. Other Sugar Alcohols

-

2. Application

- 2.1. Bakery

- 2.2. Dairy and Desserts

- 2.3. Beverages

- 2.4. Meat and Meat Products

- 2.5. Soups, Sauces, and Dressings

- 2.6. Confectionery

- 2.7. Dietary Supplements

- 2.8. Other Applications

Europe Starch Sweeteners Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Starch Sweeteners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for processed food

- 3.3. Market Restrains

- 3.3.1. Rising awareness related to health and fitness

- 3.4. Market Trends

- 3.4.1. Increasing Application of Sweeteners in Processed food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dextrin

- 5.1.2. Fructose

- 5.1.3. High-fructose Corn Syrup

- 5.1.4. Glucose Syrups

- 5.1.5. Sugar Alcohols

- 5.1.5.1. Sorbitol

- 5.1.5.2. Maltitol

- 5.1.5.3. Xylitol

- 5.1.5.4. Erythritol

- 5.1.5.5. Other Sugar Alcohols

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy and Desserts

- 5.2.3. Beverages

- 5.2.4. Meat and Meat Products

- 5.2.5. Soups, Sauces, and Dressings

- 5.2.6. Confectionery

- 5.2.7. Dietary Supplements

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Starch Sweeteners Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Daesang*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Uniglad Ingredients UK Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Archer Daniels Midland Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tereos SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ingredion Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Tate & Lyle PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Novasep

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 E I du Pont de Nemours and Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 VOGELBUSCH Biocommodities GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Starch Sweeteners Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Starch Sweeteners Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Starch Sweeteners Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Starch Sweeteners Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Starch Sweeteners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Starch Sweeteners Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Starch Sweeteners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Starch Sweeteners Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Starch Sweeteners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Starch Sweeteners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Starch Sweeteners Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Starch Sweeteners Market?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Europe Starch Sweeteners Market?

Key companies in the market include Cargill Incorporated, Daesang*List Not Exhaustive, Uniglad Ingredients UK Ltd, The Archer Daniels Midland Company, Tereos SA, Ingredion Inc, Tate & Lyle PLC, Novasep, E I du Pont de Nemours and Company, VOGELBUSCH Biocommodities GmbH.

3. What are the main segments of the Europe Starch Sweeteners Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for processed food.

6. What are the notable trends driving market growth?

Increasing Application of Sweeteners in Processed food.

7. Are there any restraints impacting market growth?

Rising awareness related to health and fitness.

8. Can you provide examples of recent developments in the market?

April 2024: Tereos, a leading global player in the sugar, alcohol, and starch market, announced the opening of its new Customer Innovation Centre in Aalst, Belgium. This cutting-edge facility is designed to foster innovation and deepen collaboration with customers by offering an extensive range of new services and solidifying its role as a central hub for customer support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Starch Sweeteners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Starch Sweeteners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Starch Sweeteners Market?

To stay informed about further developments, trends, and reports in the Europe Starch Sweeteners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence