Key Insights

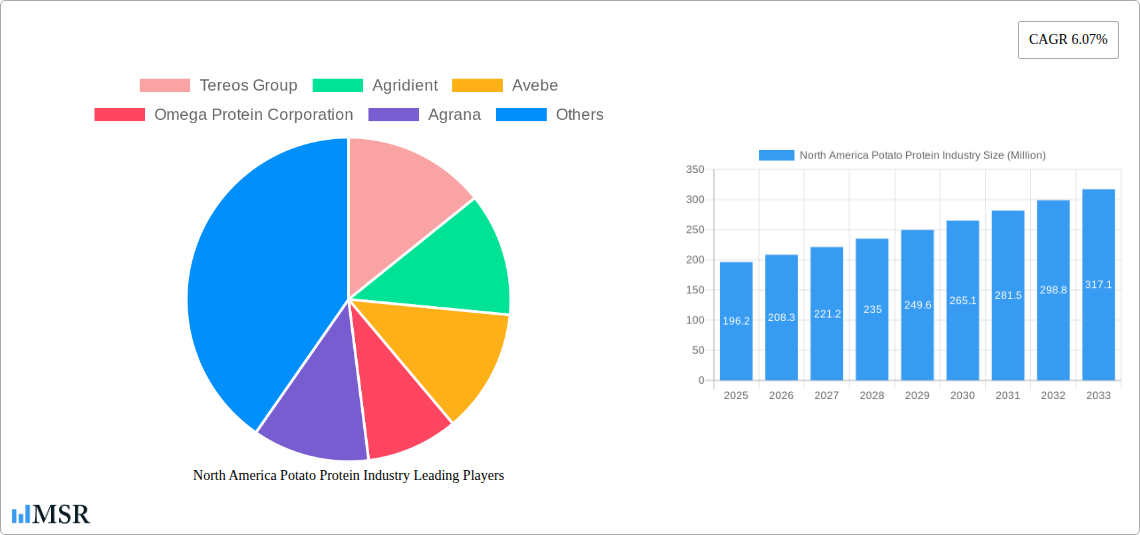

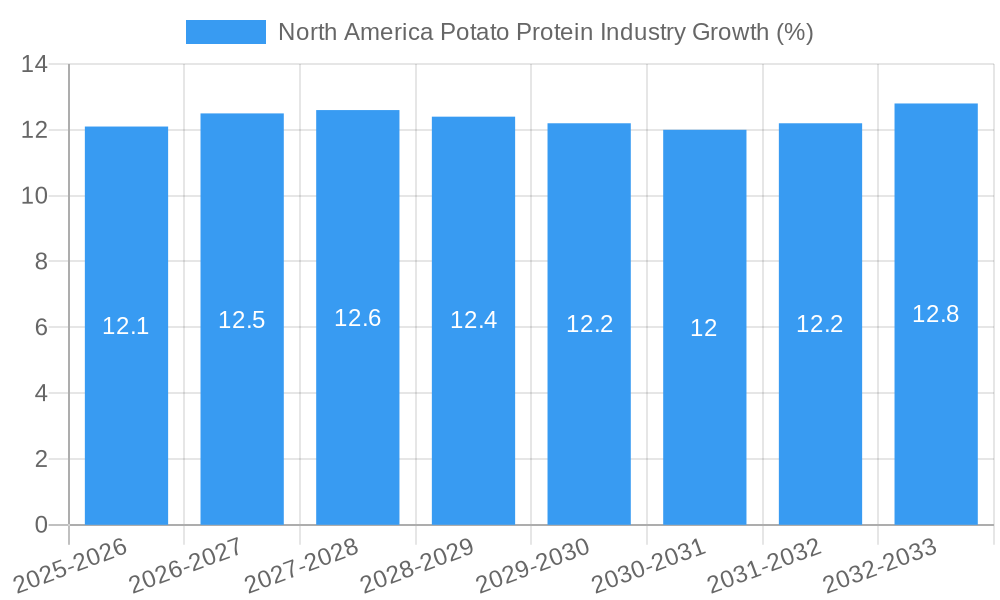

The North American potato protein market, valued at approximately $196.2 million in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.07% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for plant-based protein alternatives, driven by health consciousness and a growing vegan/vegetarian population, is a significant factor. Furthermore, the functional properties of potato protein—its ability to enhance texture, bind, and foam in food applications—make it attractive to food manufacturers seeking to improve product quality and reduce reliance on traditional protein sources. The burgeoning snack and beverage industries are key application areas, with potato protein finding use in protein bars, drinks, and other processed foods. The animal nutrition segment also presents a substantial opportunity, as potato protein offers a sustainable and cost-effective alternative to traditional animal feed ingredients. However, challenges remain, including the relatively high cost of production compared to soy or pea protein, and the need for further technological advancements to optimize extraction and processing efficiency to reduce overall cost of production. Market expansion is expected to be significantly driven by ongoing innovation focused on improving the functionality and cost-competitiveness of potato protein.

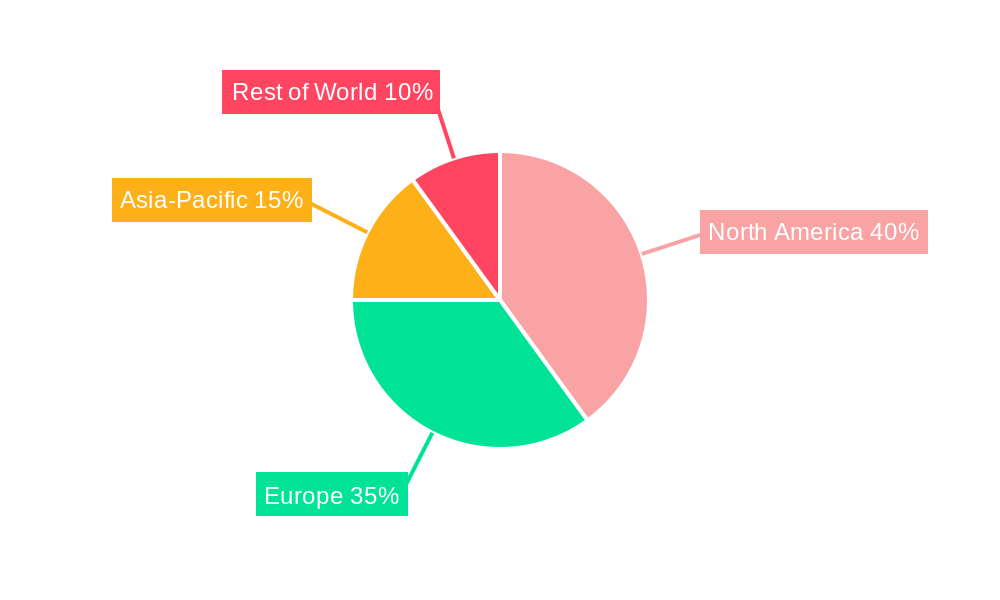

The North American market, a key region for this industry, benefits from established agricultural infrastructure and strong consumer demand for plant-based products. Specific segments within North America show varied growth potential. The potato protein isolate segment is likely to experience faster growth than the concentrate segment due to its higher protein content and improved functional properties. Within applications, the beverage and snack & bar segments will probably lead the way, driven by product innovation and expanding consumer preference for healthier, plant-based options. Major players such as Tereos Group, Avebe, and ADM are actively investing in research and development, and strategic partnerships to expand their market share and meet the rising demand. The competitive landscape is dynamic, with both established players and emerging companies vying for market dominance, resulting in a potentially high level of innovation and product diversity in the coming years. This combination of factors paints a positive picture for the continued growth and evolution of the North American potato protein market.

North America Potato Protein Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America potato protein industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, and future growth prospects. The report projects a market valued at xx Million in 2025, experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

North America Potato Protein Industry Market Concentration & Dynamics

The North American potato protein market exhibits a moderately concentrated landscape, with key players like Tereos Group, Agridient, Avebe, Omega Protein Corporation, Agrana, Roquette Foods, ADM (Archer Daniels Midland Company), Roquette Frères, AGT Foods, and Cargill holding significant market share. However, the entry of new players and innovative startups is gradually increasing competition.

Market share distribution is dynamic, with leading companies continuously striving for market dominance through strategic acquisitions, new product launches, and partnerships. The historical period (2019-2024) witnessed approximately xx M&A deals, indicating a high level of consolidation. The regulatory framework, while generally supportive of the food industry, faces ongoing scrutiny regarding labeling and sustainability claims. Substitute products, such as soy and pea protein, pose a competitive challenge, requiring potato protein producers to differentiate through innovation and value-added products. End-user trends indicate a growing demand for plant-based protein sources, fueled by health and sustainability concerns, creating a favorable environment for potato protein's growth.

North America Potato Protein Industry Industry Insights & Trends

The North American potato protein market is experiencing robust growth, driven by the increasing demand for plant-based protein alternatives. This surge is fueled by several factors, including rising health consciousness, growing vegan and vegetarian populations, and increasing awareness of the environmental impact of traditional protein sources. The market size is estimated at xx Million in 2025, and is projected to reach xx Million by 2033. Technological advancements in extraction and processing techniques are improving the functionality and cost-effectiveness of potato protein, further stimulating market expansion. Consumers are increasingly seeking cleaner labels and sustainable ingredients, driving the demand for sustainably produced potato protein. This trend has led to innovations in processing techniques that minimize environmental impact. The overall market is characterized by a high level of innovation, with companies continually exploring new applications for potato protein and developing value-added products.

Key Markets & Segments Leading North America Potato Protein Industry

Dominant Segments:

- By Type: Potato protein isolate currently holds a larger market share compared to potato protein concentrate due to its higher protein content and superior functional properties. However, the concentrate segment is projected to witness significant growth fueled by its cost-effectiveness.

- By Application: The animal nutrition segment dominates the market, owing to the high demand for sustainable and cost-effective animal feed ingredients. However, the beverage and snacks & bar segments are showcasing rapid growth, driven by increasing consumer interest in plant-based products.

Market Drivers by Segment:

- Animal Nutrition: Strong demand from the livestock industry, growing awareness of sustainable feed solutions, and favorable regulatory environments are key drivers.

- Beverage: Increasing preference for plant-based protein drinks, rising health consciousness among consumers, and the development of functional beverages are driving segment growth.

- Snacks & Bars: The growing popularity of plant-based snacks and the demand for healthy, convenient, and protein-rich food options are propelling this segment's expansion.

North America Potato Protein Industry Product Developments

Recent years have witnessed significant advancements in potato protein technology, leading to the development of products with enhanced functionality and improved organoleptic properties. Companies are focusing on optimizing extraction processes to enhance protein yield and reduce production costs. The introduction of new potato varieties with higher protein content is also contributing to product improvement. These developments, coupled with increasing consumer demand for plant-based proteins, are driving the market forward.

Challenges in the North America Potato Protein Industry Market

The North American potato protein industry faces several challenges, including fluctuations in potato supply and pricing, stringent regulatory requirements impacting product development and labeling, and intense competition from established and emerging players offering alternative plant-based proteins. Supply chain disruptions, particularly during peak seasons, can lead to production bottlenecks and impact market stability. Furthermore, the need for consistent quality and standardization of potato protein products poses a significant hurdle.

Forces Driving North America Potato Protein Industry Growth

Key growth drivers include the rising consumer preference for plant-based diets, increasing demand for sustainable and ethical food sources, ongoing technological advancements resulting in improved product quality and functionalities, and supportive government regulations promoting the use of plant-based proteins. The growing awareness of the environmental and health benefits of plant-based proteins is further bolstering industry expansion.

Long-Term Growth Catalysts in the North America Potato Protein Industry

Long-term growth will be driven by strategic partnerships among ingredient suppliers, food manufacturers, and research institutions; breakthroughs in improving the functionality and taste profiles of potato protein; and market expansion into new geographical regions and application areas. Innovation focused on developing value-added products with enhanced functionalities and improved flavor profiles will also stimulate growth.

Emerging Opportunities in North America Potato Protein Industry

Emerging opportunities include the development of novel potato protein-based products targeting specific dietary needs, expansion into new applications such as meat alternatives and functional foods, and leveraging the growing demand for sustainable and environmentally friendly food solutions. Exploring new markets in developing countries with increasing demand for plant-based protein will also offer lucrative growth prospects.

Leading Players in the North America Potato Protein Industry Sector

- Tereos Group

- Agridient

- Avebe

- Omega Protein Corporation

- Agrana

- Roquette Foods

- ADM (Archer Daniels Midland Company)

- Roquette Frères

- AGT Foods

- Cargill

Key Milestones in North America Potato Protein Industry Industry

- 2021: Omega Protein Corporation acquires Veramaris, expanding its presence in the sustainable protein market.

- 2022: Roquette Foods launches a new line of potato protein-based meat alternatives, broadening the application of potato protein in food products.

- 2023: Tereos Group and Avril partner to establish a new plant dedicated to pea and potato protein production, increasing the overall supply capacity.

- Ongoing: Several government grants and investments are supporting research and development efforts aimed at enhancing the functionality and reducing the cost of potato protein production.

Strategic Outlook for North America Potato Protein Industry Market

The North American potato protein industry holds significant promise for future growth. Strategic investments in research and development, coupled with innovative product development and strategic partnerships, will be crucial for sustaining long-term market expansion. The industry's focus on sustainability and consumer health will be key competitive advantages, driving continued growth throughout the forecast period.

North America Potato Protein Industry Segmentation

-

1. Type

- 1.1. Potato Protein Concentrate

- 1.2. Potato Protein Isolate

-

2. Application

- 2.1. Beverage

- 2.2. Snacks & Bar

- 2.3. Animal Nutrition

- 2.4. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Potato Protein Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Potato Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. Growing Application of Potato Protein in Sports Nutrition

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Potato Protein Concentrate

- 5.1.2. Potato Protein Isolate

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Snacks & Bar

- 5.2.3. Animal Nutrition

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Potato Protein Concentrate

- 6.1.2. Potato Protein Isolate

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Beverage

- 6.2.2. Snacks & Bar

- 6.2.3. Animal Nutrition

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Potato Protein Concentrate

- 7.1.2. Potato Protein Isolate

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Beverage

- 7.2.2. Snacks & Bar

- 7.2.3. Animal Nutrition

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Potato Protein Concentrate

- 8.1.2. Potato Protein Isolate

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Beverage

- 8.2.2. Snacks & Bar

- 8.2.3. Animal Nutrition

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Potato Protein Concentrate

- 9.1.2. Potato Protein Isolate

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Beverage

- 9.2.2. Snacks & Bar

- 9.2.3. Animal Nutrition

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Potato Protein Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Tereos Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Agridient

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Avebe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Omega Protein Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Agrana

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Roquette Foods*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 ADM (Archer Daniels Midland Company) Roquette Frères x

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Roquette Frères

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 AGT Foods

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Cargill

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Tereos Group

List of Figures

- Figure 1: North America Potato Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Potato Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Potato Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Potato Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Potato Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Potato Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: North America Potato Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Potato Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Potato Protein Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Potato Protein Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: North America Potato Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Potato Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: North America Potato Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Potato Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Potato Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Potato Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Potato Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Potato Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Potato Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Potato Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Potato Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Potato Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: North America Potato Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Potato Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 23: North America Potato Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Potato Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: North America Potato Protein Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Potato Protein Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: North America Potato Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Potato Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: North America Potato Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Potato Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 31: North America Potato Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Potato Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: North America Potato Protein Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Potato Protein Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 35: North America Potato Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Potato Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: North America Potato Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Potato Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 39: North America Potato Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Potato Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: North America Potato Protein Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Potato Protein Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 43: North America Potato Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Potato Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 45: North America Potato Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Potato Protein Industry Volume K Tons Forecast, by Type 2019 & 2032

- Table 47: North America Potato Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: North America Potato Protein Industry Volume K Tons Forecast, by Application 2019 & 2032

- Table 49: North America Potato Protein Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Potato Protein Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 51: North America Potato Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Potato Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Potato Protein Industry?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the North America Potato Protein Industry?

Key companies in the market include Tereos Group, Agridient, Avebe, Omega Protein Corporation, Agrana, Roquette Foods*List Not Exhaustive, ADM (Archer Daniels Midland Company) Roquette Frères x, Roquette Frères , AGT Foods , Cargill.

3. What are the main segments of the North America Potato Protein Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 196.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

Growing Application of Potato Protein in Sports Nutrition.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

Acquisitions and mergers, e.g., Omega Protein Corporation's acquisition of Veramaris

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Potato Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Potato Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Potato Protein Industry?

To stay informed about further developments, trends, and reports in the North America Potato Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence