Key Insights

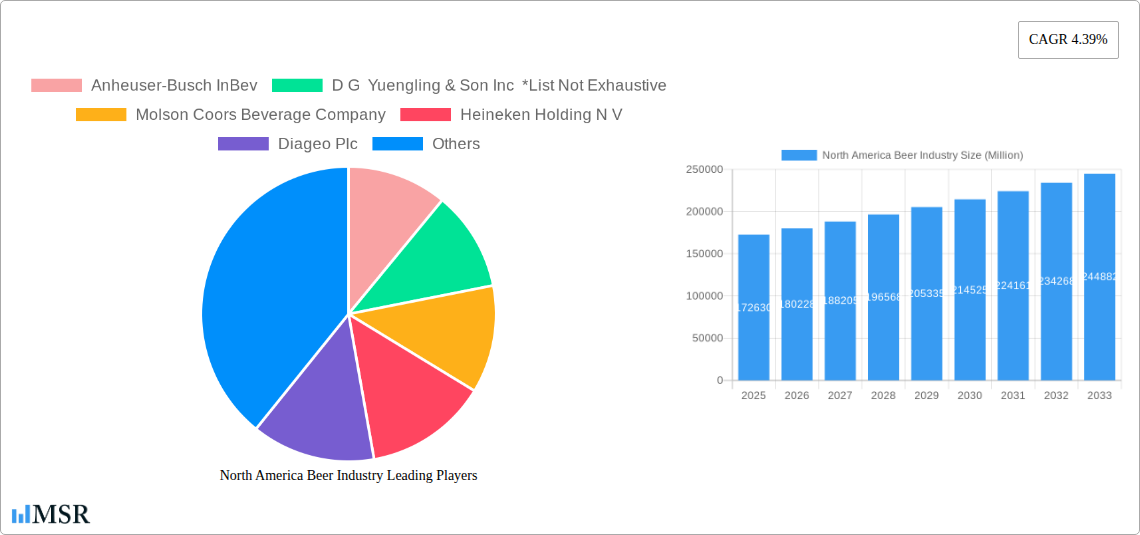

The North American beer market, valued at $172.63 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of craft beers and premium imported varieties fuels market expansion, appealing to consumers seeking diverse flavor profiles and higher-quality ingredients. Furthermore, the growing trend of ready-to-drink (RTD) alcoholic beverages, including canned cocktails and flavored malt beverages, contributes to market dynamism. The on-trade segment (bars, restaurants) is expected to recover gradually from pandemic-related disruptions, while the off-trade segment (grocery stores, liquor stores) maintains robust growth driven by convenience and home consumption. Competition remains intense, with established giants like Anheuser-Busch InBev and Molson Coors facing pressure from smaller craft breweries and international players. Regional variations exist, with the United States representing the largest market share, followed by Canada and Mexico. Consumer preferences are shifting towards healthier options, potentially leading to increased demand for low-calorie and gluten-free beers. However, regulatory changes concerning alcohol content and marketing, along with concerns about responsible consumption, could pose challenges to future growth. The overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 4.39% from 2025 to 2033, reflecting the enduring appeal of beer within the North American beverage landscape.

North America Beer Industry Market Size (In Billion)

Despite the challenges, the market's growth is expected to be sustained by several strategic initiatives. Brewers are continuously innovating with new product lines, flavors, and packaging formats to cater to evolving consumer demands. Strategic partnerships and mergers and acquisitions are also reshaping the competitive landscape. Companies are investing heavily in marketing and distribution networks to enhance brand visibility and reach wider consumer segments. The increasing adoption of e-commerce and direct-to-consumer sales channels further contributes to market expansion. While economic fluctuations and potential changes in consumer spending habits could affect sales, the long-term outlook remains positive, particularly in segments catering to premiumization and convenience. The industry’s focus on sustainability and responsible drinking practices is also influencing growth, reflecting evolving consumer values and industry commitments.

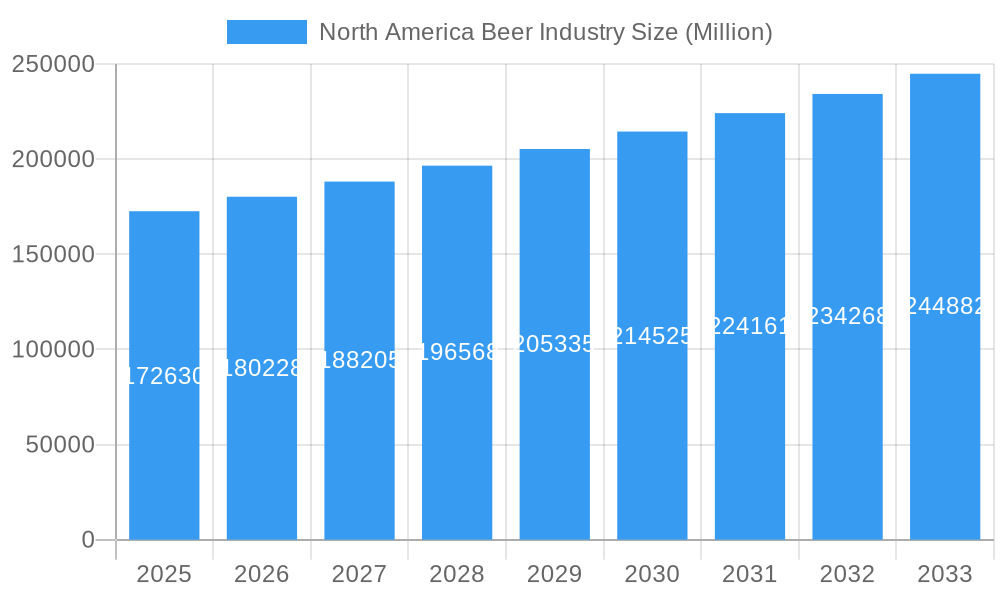

North America Beer Industry Company Market Share

North America Beer Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America beer industry, covering market dynamics, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report includes detailed analysis of the beer market across the United States, Canada, Mexico, and the Rest of North America, encompassing Lager, Ale, and Other beer types, distributed through both On-Trade and Off-Trade channels. Market size is projected to reach xx Million by 2033, showcasing a significant CAGR of xx%.

North America Beer Industry Market Concentration & Dynamics

The North American beer market exhibits a complex interplay of established giants and emerging craft breweries. Anheuser-Busch InBev, Molson Coors Beverage Company, and Heineken Holding N.V. dominate the market, holding a combined market share of approximately xx%, based on 2024 data. However, the craft beer segment demonstrates significant growth, fueled by consumer preference for diverse flavors and local brands. The regulatory landscape varies across North America, influencing pricing, distribution, and marketing strategies. Substitute products, such as hard seltzers and ready-to-drink cocktails, pose a competitive challenge, demanding constant innovation from beer manufacturers. Consumer trends reveal a rising demand for premiumization, health-conscious options (e.g., low-calorie beers), and sustainable practices. Mergers and acquisitions (M&A) remain a prominent feature, with an estimated xx M&A deals recorded between 2019 and 2024.

- Market Share: Anheuser-Busch InBev (xx%), Molson Coors (xx%), Heineken (xx%), Others (xx%).

- M&A Activity: An average of xx deals per year between 2019-2024.

- Key Innovation Areas: Flavor experimentation, low/no alcohol options, sustainable packaging.

- Regulatory Landscape: Differing alcohol regulations across states/provinces impacting distribution and pricing.

North America Beer Industry Industry Insights & Trends

The North American beer market is experiencing significant transformation, driven by evolving consumer preferences, technological advancements, and economic factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is fueled by several key factors: increasing disposable incomes, particularly in emerging markets, coupled with a growing preference for premium and craft beers. The rise of e-commerce and direct-to-consumer sales channels is disrupting traditional distribution models, enhancing consumer convenience. Technological advancements in brewing processes and supply chain management are driving efficiency and product innovation. Consumer behavior reflects a clear shift toward experience-driven consumption, with craft breweries and unique offerings gaining popularity. Health consciousness is also impacting preferences, with low-calorie and healthier options gaining traction.

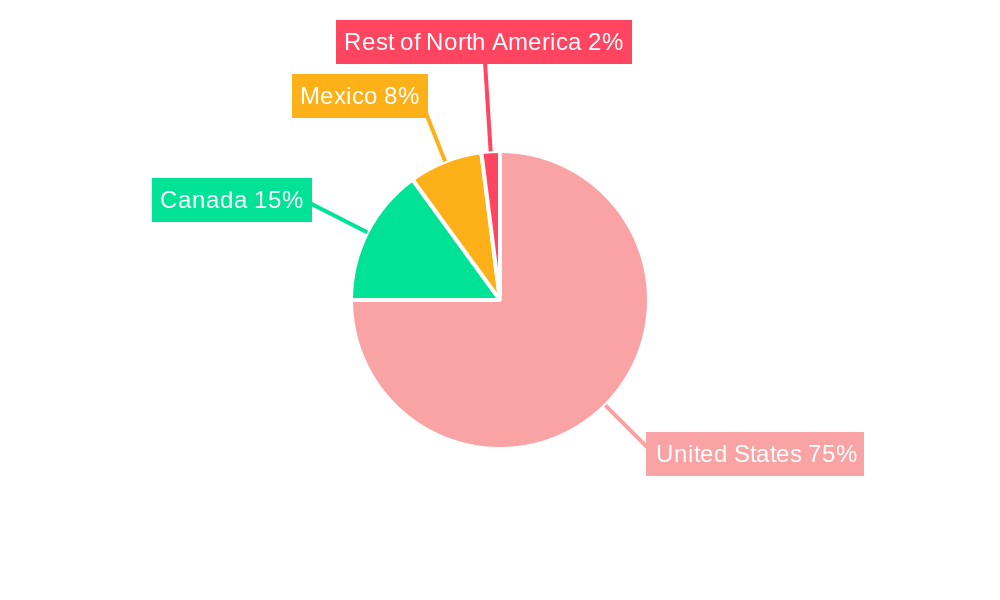

Key Markets & Segments Leading North America Beer Industry

The United States remains the largest beer market in North America, accounting for approximately xx% of total volume. Mexico shows strong growth in specific segments, particularly premium light beers. Within product types, Lager remains the dominant segment, however, Ale and other specialty beers are witnessing accelerated growth, driven by increasing consumer interest in diverse flavors and unique brewing techniques. The Off-Trade channel (retail sales) maintains a larger market share than On-Trade (restaurants, bars), reflecting changing consumption patterns.

- Dominant Region: United States

- Fastest-Growing Segment: Ale and other specialty beers

- Key Drivers:

- United States: Strong economic growth, well-established distribution networks.

- Mexico: Growing middle class, rising disposable incomes.

- Canada: Increasing tourism and a diverse consumer base.

- Lager: Established consumer base, wide availability.

- Ale: Rising demand for craft beers and unique flavor profiles.

- Off-Trade: Convenience, broader selection.

North America Beer Industry Product Developments

Recent years have witnessed considerable innovation in the North American beer market. Brewers are focusing on premiumization, introducing higher-quality ingredients, unique flavors, and innovative packaging. The rise of craft breweries is driving experimentation with different styles and ingredients, attracting consumers seeking unique and flavorful experiences. Technological advancements in brewing processes are enabling greater consistency and efficiency, while also supporting the creation of new and innovative products. The emphasis on sustainability is also influencing product development, with breweries focusing on eco-friendly packaging and reducing their environmental footprint. For example, Goose Island's Bourbon County Stout launch exemplifies the focus on premium offerings.

Challenges in the North America Beer Industry Market

The North American beer industry faces several key challenges. Intense competition from established players and emerging craft breweries creates pressure on pricing and profitability. Fluctuating raw material costs and supply chain disruptions can impact production and profitability. Strict regulations surrounding alcohol production and distribution, varying across regions, can limit growth and expansion. Changes in consumer preferences and the rise of substitute beverages require constant product innovation and adaptability. The market estimates a xx Million loss annually due to supply chain issues alone.

Forces Driving North America Beer Industry Growth

Several key factors are driving the growth of the North American beer industry. Rising disposable incomes, particularly among younger demographics, fuel demand for premium and specialty beers. Evolving consumer preferences, embracing diverse flavors and unique experiences, are driving innovation and expansion in the craft beer sector. Technological advancements in brewing processes and supply chain management enhance efficiency and enable the creation of new products. The increasing adoption of e-commerce and direct-to-consumer sales channels provides new avenues for growth and market penetration. Government policies supporting the growth of local breweries further contribute to the industry's expansion.

Long-Term Growth Catalysts in the North America Beer Industry

Long-term growth in the North American beer market will depend on several key factors. Continued innovation in product development, incorporating diverse flavors, premium ingredients, and healthier options, is crucial. Strategic partnerships, mergers, and acquisitions can help companies expand their market reach and diversify their product portfolio. Expansion into new markets and customer segments is also key, with further growth expected in both established and emerging markets across North America.

Emerging Opportunities in North America Beer Industry

Several emerging opportunities are shaping the future of the North American beer market. The growing demand for non-alcoholic and low-alcohol beverages presents a significant opportunity for brewers to innovate and cater to health-conscious consumers. The integration of technology, such as personalized recommendations and targeted advertising, presents new ways to engage with customers and increase sales. The expansion into new markets, like ready-to-drink cocktails and other alcoholic beverages, allows breweries to diversify and capitalize on growing trends.

Leading Players in the North America Beer Industry Sector

- Anheuser-Busch InBev

- D G Yuengling & Son Inc

- Molson Coors Beverage Company

- Heineken Holding N.V.

- Diageo Plc

- Constellation Brands Inc

- Suntory Beverage & Food Limited

- FIFCO USA

- Carlsberg Group

- Boston Beer Company

Key Milestones in North America Beer Industry Industry

- November 2022: Goose Island Beer Company launches 2022 Bourbon County Stout in the US.

- July 2022: Royal Unibrew acquires Amsterdam Brewery Co. Ltd., expanding its Canadian capacity.

- March 2022: Modelo launches Modelo Oro premium light beer in Mexico.

Strategic Outlook for North America Beer Industry Market

The North American beer market is poised for sustained growth, driven by a confluence of factors, including rising disposable incomes, changing consumer preferences, and technological advancements. Opportunities exist for breweries to leverage these factors by focusing on premiumization, product innovation, and strategic partnerships. Expanding into new markets and customer segments remains vital, necessitating adaptability and continuous innovation to address evolving consumer demands.

North America Beer Industry Segmentation

-

1. Type

- 1.1. Lager

- 1.2. Ale

- 1.3. Others

-

2. Distribution Channel

- 2.1. On-Trade

- 2.2. Off-Trade

North America Beer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Beer Industry Regional Market Share

Geographic Coverage of North America Beer Industry

North America Beer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Growing Demand for Beer Across the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Beer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lager

- 5.1.2. Ale

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anheuser-Busch InBev

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 D G Yuengling & Son Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Molson Coors Beverage Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heineken Holding N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Diageo Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constellation Brands Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Suntory Beverage & Food Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIFCO USA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Carlsberg Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boston Beer Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: North America Beer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Beer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Beer Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Beer Industry Volume liter Forecast, by Type 2020 & 2033

- Table 3: North America Beer Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Beer Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Beer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Beer Industry Volume liter Forecast, by Region 2020 & 2033

- Table 7: North America Beer Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Beer Industry Volume liter Forecast, by Type 2020 & 2033

- Table 9: North America Beer Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Beer Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Beer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Beer Industry Volume liter Forecast, by Country 2020 & 2033

- Table 13: United States North America Beer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Beer Industry Volume (liter ) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Beer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Beer Industry Volume (liter ) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Beer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Beer Industry Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Beer Industry?

The projected CAGR is approximately 4.39%.

2. Which companies are prominent players in the North America Beer Industry?

Key companies in the market include Anheuser-Busch InBev, D G Yuengling & Son Inc *List Not Exhaustive, Molson Coors Beverage Company, Heineken Holding N V, Diageo Plc, Constellation Brands Inc, Suntory Beverage & Food Limited, FIFCO USA, Carlsberg Group, Boston Beer Company.

3. What are the main segments of the North America Beer Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Growing Demand for Beer Across the United States.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In November 2022, Goose Island Beer Company's Canada branch announced the launch of the 2022 edition of Bourbon County Stout. It was officially introduced in the United States on Black Friday. The 2022 Original Bourbon County Stout was aged in a mix of bourbon barrels from Buffalo Trace, Heaven Hill, and Wild Turkey distilleries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Beer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Beer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Beer Industry?

To stay informed about further developments, trends, and reports in the North America Beer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence