Key Insights

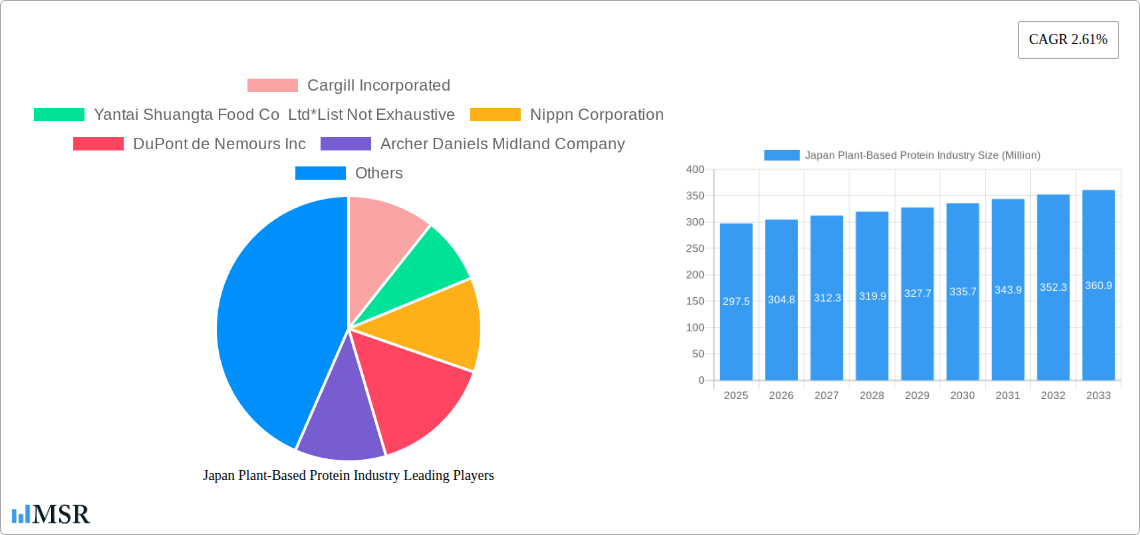

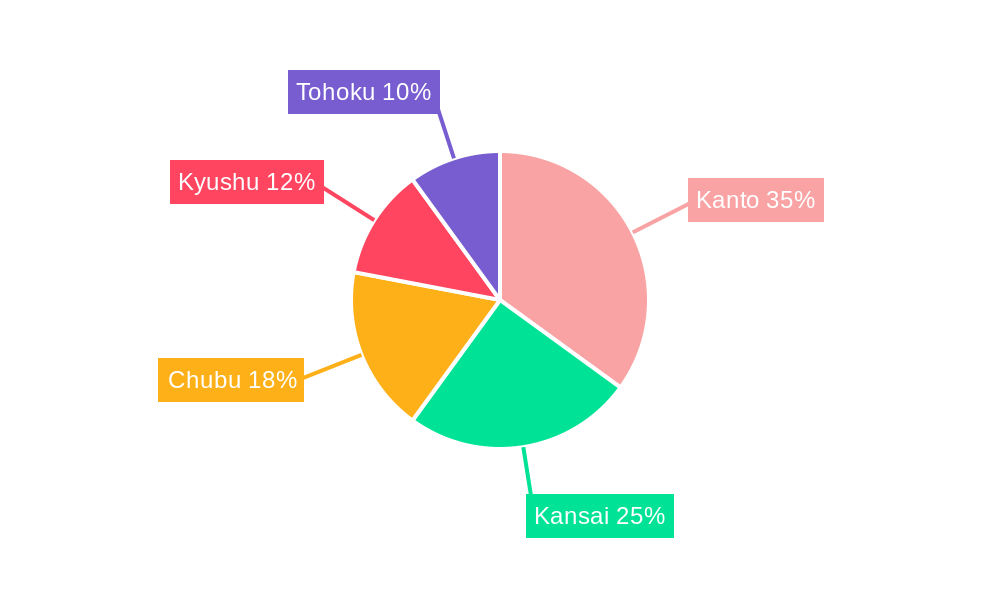

The Japan plant-based protein market, valued at $297.5 million in 2025, is projected to experience steady growth, driven by increasing consumer awareness of health and environmental benefits. The rising popularity of veganism and vegetarianism, coupled with growing concerns about animal welfare and the environmental impact of meat production, are significant factors fueling this market expansion. Key protein sources include soy, pea, and hemp, which are incorporated into various food and beverage products, supplements, animal feed, and personal care items. The food and beverage segment currently dominates the market, reflecting the increasing demand for plant-based alternatives to traditional meat and dairy products. However, the personal care and cosmetics sectors are also witnessing substantial growth, driven by the incorporation of plant-based proteins in skincare and haircare products for their moisturizing and conditioning properties. Regional variations exist, with the Kanto region likely leading in consumption due to higher population density and economic activity. Competitive intensity is moderate, with both international players like Cargill and DuPont and domestic companies like Yantai Shuangta Food and Fuji Oil Group vying for market share.

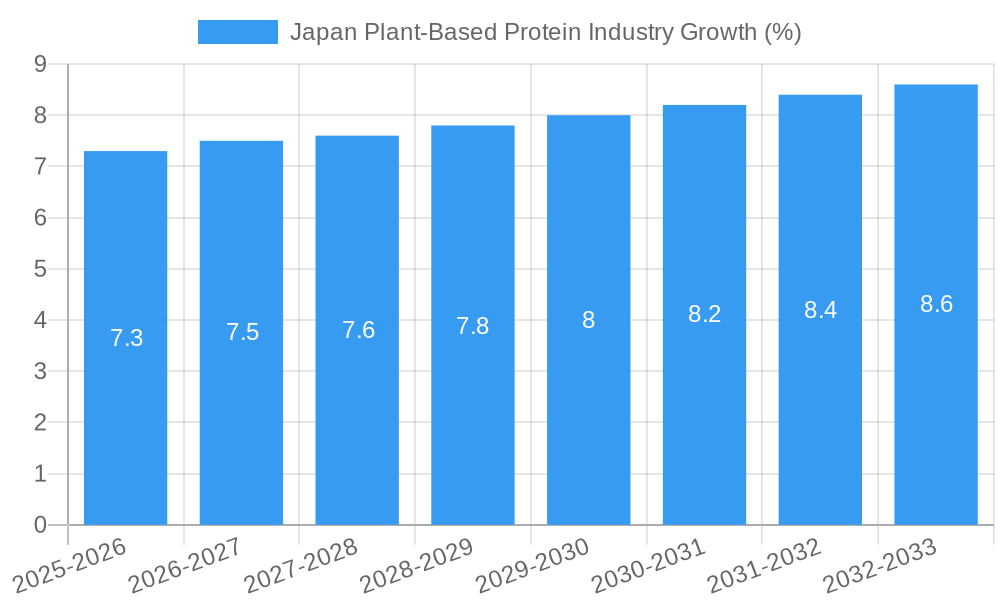

The projected CAGR of 2.61% indicates a consistent, albeit moderate, growth trajectory for the forecast period (2025-2033). This growth is expected to be influenced by several factors, including ongoing product innovation, expanding distribution channels, and government initiatives promoting sustainable food systems. However, potential restraints include price sensitivity among consumers, limited awareness of certain plant-based proteins compared to more established options like soy, and the need for continuous improvements in taste and texture of plant-based alternatives to achieve wider consumer acceptance. Future growth will likely depend on successful marketing campaigns highlighting the nutritional and functional benefits of plant-based protein and overcoming consumer perceptions regarding taste and texture. The market's diversification into new applications and further regional expansion within Japan will also be crucial for realizing its full growth potential.

Japan Plant-Based Protein Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Japan plant-based protein industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market dynamics, key segments, leading players, and future growth potential, revealing opportunities and challenges within this rapidly evolving sector. The report’s findings are supported by robust data analysis and expert insights. The market size in 2025 is estimated at XX Million USD, with a CAGR of XX% projected for 2025-2033.

Japan Plant-Based Protein Industry Market Concentration & Dynamics

The Japan plant-based protein market exhibits a moderately concentrated landscape, with several multinational corporations and domestic players holding significant market share. Key players such as Cargill Incorporated, Archer Daniels Midland Company, and DuPont de Nemours Inc. contribute substantially to the overall market volume. However, the presence of numerous smaller, specialized companies fosters innovation and competition.

Market share data for 2024 suggests:

- Cargill Incorporated: XX%

- Archer Daniels Midland Company: XX%

- DuPont de Nemours Inc: XX%

- Others: XX%

Innovation is driven by a dynamic ecosystem encompassing research institutions, startups (like DAIZ Inc.), and established players focused on developing novel protein sources and processing technologies. Regulatory frameworks, while generally supportive of food innovation, require careful navigation. Substitute products, including conventional animal proteins, compete for market share, although the growing preference for plant-based alternatives presents significant opportunities. End-user trends are witnessing a robust shift towards healthier, more sustainable food choices, fueling the demand for plant-based proteins in food and beverages, supplements, and animal feed. M&A activity is moderate but shows promising potential for consolidation and expansion within the industry. For the period 2019-2024, approximately xx M&A deals were recorded, indicating a growing trend of strategic partnerships and acquisitions.

Japan Plant-Based Protein Industry Industry Insights & Trends

The Japan plant-based protein industry is experiencing significant growth, driven primarily by increasing consumer awareness of health and environmental benefits. Shifting dietary preferences, coupled with rising disposable incomes and a growing health-conscious population, are key market growth drivers. The market size reached approximately XX Million USD in 2024, reflecting this upward trend. Technological advancements in plant protein extraction, processing, and formulation are leading to improved product quality, taste, and texture, making plant-based alternatives more appealing to consumers. These innovations are also addressing concerns regarding the nutritional profile of plant-based proteins, particularly amino acid content. Evolving consumer behaviors reveal a preference for sustainable, ethical, and transparently sourced ingredients, impacting sourcing and production practices. The rising demand for convenient and ready-to-eat plant-based products further contributes to the overall market expansion.

Key Markets & Segments Leading Japan Plant-Based Protein Industry

The Japanese market for plant-based proteins is broadly spread across various segments. However, the Food and Beverages segment commands the largest market share, driven by the increasing popularity of plant-based meat alternatives, dairy substitutes, and protein-rich beverages. The Supplements segment is also showing strong growth.

By Protein Type: Soy protein currently holds the largest market share, followed by pea protein, with rice and other plant proteins gaining traction.

By End-User:

- Food and Beverages: This segment is the largest, fueled by the increasing adoption of vegan and vegetarian diets. The demand for plant-based meat alternatives, dairy replacements (like soy milk), and protein-enriched beverages is surging.

- Animal Feed: This segment offers a significant growth opportunity, with the increasing demand for sustainable and cost-effective animal feed alternatives.

- Personal Care and Cosmetics: Plant-based proteins are gaining popularity as natural and sustainable ingredients in cosmetics and personal care products. This segment's growth is relatively smaller compared to others.

Drivers:

- Growing health consciousness among consumers

- Increasing demand for sustainable and ethical food products

- Technological advancements leading to improved product quality and taste

- Government support for the plant-based food industry (though specific initiatives require further research)

Japan Plant-Based Protein Industry Product Developments

Recent product developments highlight advancements in enhancing the taste, texture, and nutritional profile of plant-based proteins. Innovations like Roquette's investment in DAIZ Inc. (using seed germination and extrusion) are aimed at improving the sensory characteristics of plant-based foods. DSM's Vertis CanolaPRO, a complete amino acid profile canola protein isolate, demonstrates progress in addressing nutritional limitations. Roquette's expansion of its NUTRALYS® range provides more diverse and accessible plant-protein options. These developments are key to expanding the appeal and market penetration of plant-based proteins.

Challenges in the Japan Plant-Based Protein Industry Market

The Japan plant-based protein market faces several challenges, including:

- High production costs: Compared to conventional animal proteins, production costs for certain types of plant proteins can remain relatively high, affecting affordability and market accessibility.

- Supply chain limitations: Ensuring a consistent and reliable supply chain for various plant protein raw materials may be challenging, particularly for less common protein sources. This can impact production and pricing.

- Consumer perception: While acceptance is rising, overcoming lingering consumer perceptions about the taste, texture, and nutritional value of plant-based alternatives compared to conventional sources still presents a challenge.

Forces Driving Japan Plant-Based Protein Industry Growth

Several factors are driving the growth of the Japan plant-based protein market:

- Health & Wellness Trends: Increased awareness of health benefits associated with plant-based diets, including reduced risk of chronic diseases.

- Sustainability Concerns: Growing consumer preference for environmentally friendly and ethically sourced food products.

- Technological Advancements: Constant innovation in plant protein extraction, processing, and formulation leading to improved product quality.

- Government Initiatives: Though not explicitly detailed, potential government support for sustainable agriculture and food innovation could further accelerate growth.

Long-Term Growth Catalysts in the Japan Plant-Based Protein Industry

Long-term growth will be propelled by continued innovation in plant protein technologies. Strategic collaborations between established food companies and innovative startups, coupled with strategic market expansions and product diversification, will be vital. Growing consumer demand for plant-based alternatives and government promotion of sustainable agriculture will serve as long-term catalysts. The expansion into new applications, like specialized functional foods and pet foods, will contribute to sustained market expansion.

Emerging Opportunities in Japan Plant-Based Protein Industry

Emerging opportunities reside in the development of novel plant protein sources with enhanced nutritional and functional properties. The application of plant proteins in functional foods and beverages targeted at specific health needs, as well as the expansion into the pet food industry, presents significant growth potential. Furthermore, exploring new market segments and tailoring products to meet specific consumer preferences in different demographics will unlock further growth.

Leading Players in the Japan Plant-Based Protein Industry Sector

- Cargill Incorporated

- Yantai Shuangta Food Co Ltd

- Nippn Corporation

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Bunge Limited

- Fuji Oil Group

- Nagata Group Holdings ltd

- Roquette Frère

- Asahi Group Holdings, Ltd.

Key Milestones in Japan Plant-Based Protein Industry Industry

- June 2022: Roquette expands its NUTRALYS® plant protein range, offering non-GMO and gluten-free options, responding to consumer demand for healthier choices. This broadened the product portfolio and market reach.

- December 2022: DSM introduces Vertis CanolaPRO, a high-quality canola protein isolate with a complete amino acid profile, enhancing the nutritional value of plant-based protein options. This addresses a key limitation of plant proteins and expands consumer choices.

- January 2023: Roquette invests in DAIZ Inc., a Japanese food tech startup, leveraging innovative technology for improved texture and flavor in plant-based foods. This strategic move enhances product quality and pushes innovation boundaries.

Strategic Outlook for Japan Plant-Based Protein Industry Market

The future of the Japan plant-based protein market appears bright. Continued technological advancements, coupled with growing consumer demand for sustainable and healthy food choices, will drive significant growth. Strategic partnerships, innovations in product development, and expansion into new market segments will be crucial for achieving long-term success. The market is poised for substantial expansion, fueled by a convergence of consumer trends and technological breakthroughs.

Japan Plant-Based Protein Industry Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Proteins

-

2. End User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sports/Performance Nutrition

Japan Plant-Based Protein Industry Segmentation By Geography

- 1. Japan

Japan Plant-Based Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer Inclination Toward Protein-rich Food; Growing Inclination Towards Plant-based Protein Sources

- 3.3. Market Restrains

- 3.3.1. Associated Allergies With Plant Proteins

- 3.4. Market Trends

- 3.4.1. Soy Protein Held the largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Proteins

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sports/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Kanto Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Plant-Based Protein Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yantai Shuangta Food Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippn Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont de Nemours Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Archer Daniels Midland Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bunge Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fuji Oil Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nagata Group Holdings ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Roquette Frère

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Asahi Group Holdings Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Japan Plant-Based Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Plant-Based Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Plant-Based Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Japan Plant-Based Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 4: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 5: Japan Plant-Based Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Japan Plant-Based Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: Japan Plant-Based Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Japan Plant-Based Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Plant-Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Plant-Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Plant-Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Plant-Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Plant-Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Plant-Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Plant-Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Plant-Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Plant-Based Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Plant-Based Protein Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Japan Plant-Based Protein Industry Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 22: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 23: Japan Plant-Based Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Japan Plant-Based Protein Industry Volume K Tons Forecast, by End User 2019 & 2032

- Table 25: Japan Plant-Based Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Plant-Based Protein Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Plant-Based Protein Industry?

The projected CAGR is approximately 2.61%.

2. Which companies are prominent players in the Japan Plant-Based Protein Industry?

Key companies in the market include Cargill Incorporated, Yantai Shuangta Food Co Ltd*List Not Exhaustive, Nippn Corporation, DuPont de Nemours Inc, Archer Daniels Midland Company, Bunge Limited, Fuji Oil Group, Nagata Group Holdings ltd, Roquette Frère, Asahi Group Holdings, Ltd..

3. What are the main segments of the Japan Plant-Based Protein Industry?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 297.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer Inclination Toward Protein-rich Food; Growing Inclination Towards Plant-based Protein Sources.

6. What are the notable trends driving market growth?

Soy Protein Held the largest Market Share.

7. Are there any restraints impacting market growth?

Associated Allergies With Plant Proteins.

8. Can you provide examples of recent developments in the market?

January 2023: Roquette, a renowned global leader in plant-based ingredients and a pioneering force in plant proteins, proudly announced its strategic investment in DAIZ Inc., a cutting-edge Japanese food tech startup. DAIZ Inc. has harnessed groundbreaking technology that leverages the germination of plant seeds in conjunction with an advanced extrusion process. This innovation aims to elevate the texture, flavor, and nutritional profile of plant-based foods, ushering in a new era of culinary possibilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Plant-Based Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Plant-Based Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Plant-Based Protein Industry?

To stay informed about further developments, trends, and reports in the Japan Plant-Based Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence