Key Insights

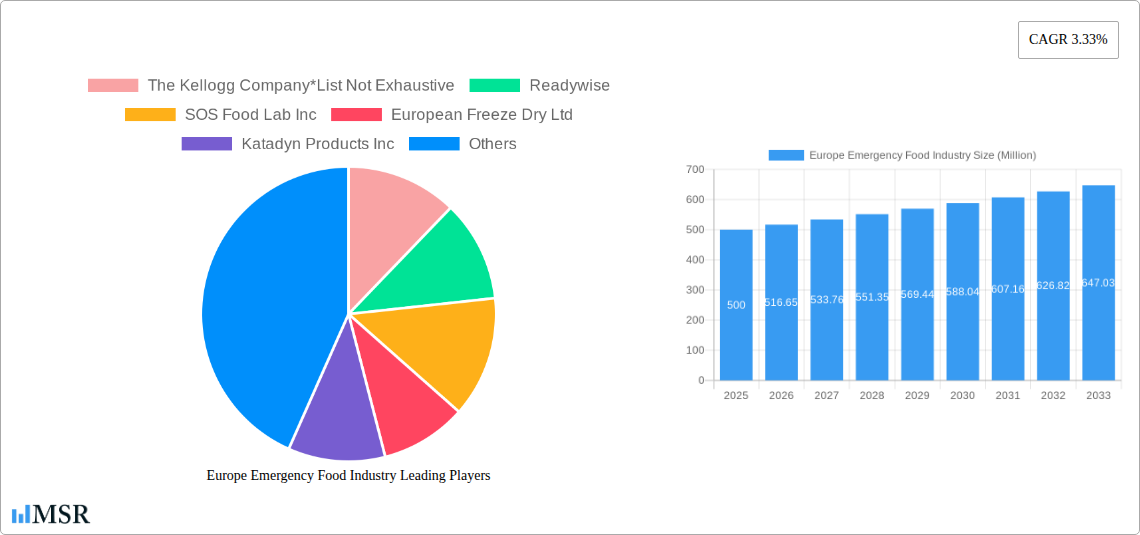

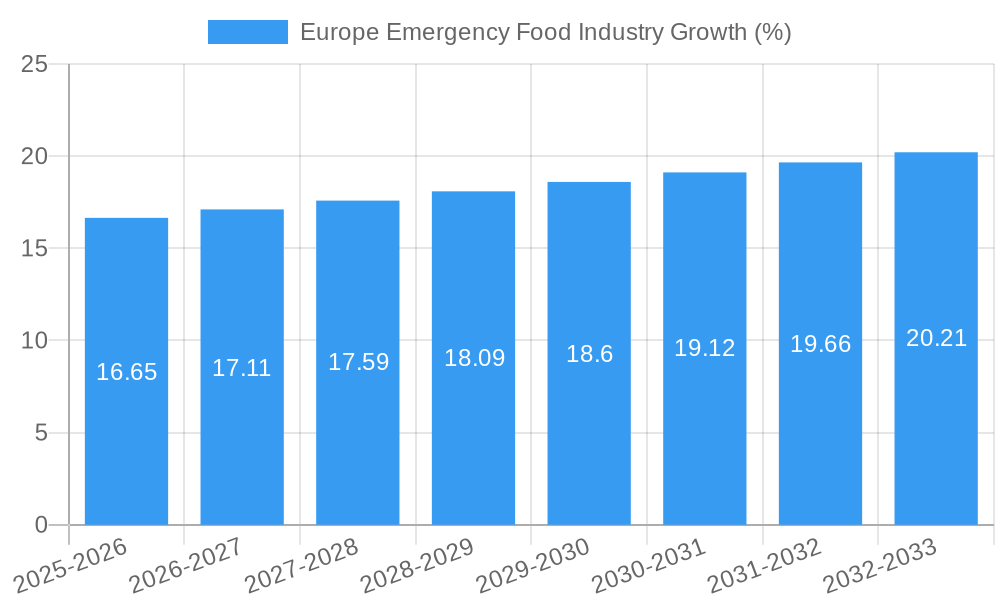

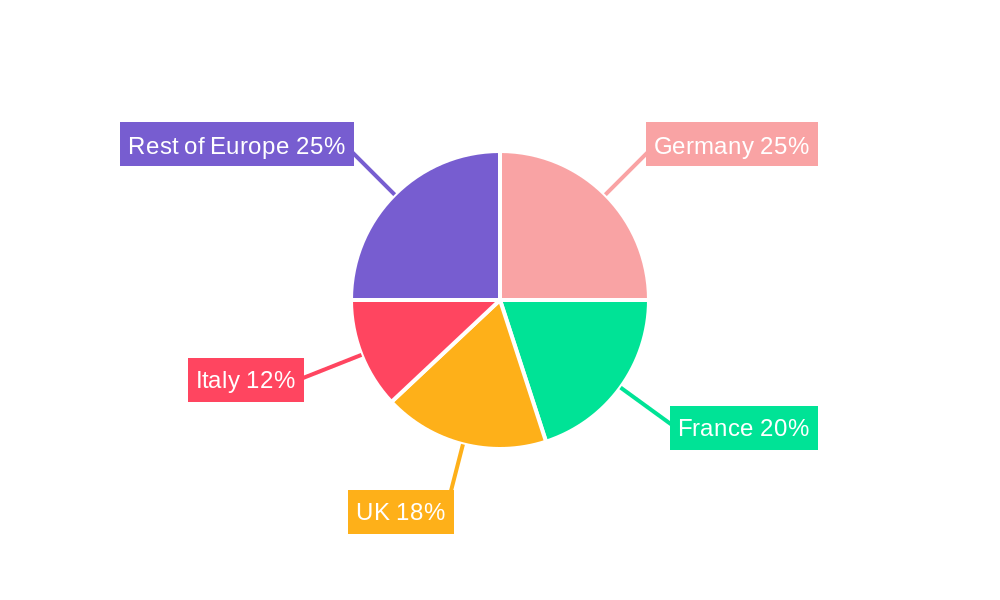

The European emergency food market, valued at approximately €500 million in 2025, is projected to experience steady growth, driven by increasing awareness of preparedness for natural disasters and unforeseen events. A compound annual growth rate (CAGR) of 3.33% from 2025 to 2033 indicates a market expansion fueled by several key factors. The rising popularity of outdoor activities like camping and hiking is boosting demand for lightweight, shelf-stable options like freeze-dried meals and snack bars. Government initiatives promoting food security and disaster preparedness also contribute significantly to market growth. Furthermore, a growing elderly population, often more vulnerable during emergencies, necessitates a reliable supply of emergency food provisions. The market segmentation reveals a diverse product landscape, with freeze-dried fruits and vegetables, ready meals, and snack bars holding substantial market shares. However, pricing remains a significant constraint, limiting access for some consumers. Competition among established players like Kellogg's and smaller specialized companies like Readywise and SOS Food Lab Inc. further shapes the market dynamics. The geographical analysis points to strong market presence in Western European countries like Germany, France, and the UK, reflective of higher disposable incomes and established preparedness cultures.

The forecast period from 2025 to 2033 anticipates continued growth, although the rate might fluctuate due to economic conditions and evolving consumer preferences. Innovation in product offerings, such as enhanced nutritional profiles and more palatable flavors in freeze-dried options, will be vital for continued market penetration. Expansion into Eastern European markets holds potential for future growth as awareness of emergency food provisions increases. The presence of various product types allows for catering to diverse needs, from individual preparedness kits to large-scale disaster relief supplies. The industry's focus should remain on balancing affordability with quality and nutritional value to ensure wider market accessibility and sustainable growth.

Europe Emergency Food Industry Market Report: 2019-2033

Dive deep into the €XX Million Europe Emergency Food Industry with this comprehensive market analysis, covering the period 2019-2033. This report offers invaluable insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic sector. We meticulously analyze market trends, growth drivers, competitive landscapes, and future opportunities, providing actionable data for strategic decision-making.

Key highlights include:

- Market Size & Growth: Discover the current market size (€XX Million in 2025), projected growth (CAGR of xx% from 2025-2033), and historical performance (2019-2024).

- Segment Analysis: Deep dive into key product segments including Freeze-dried/Canned Fruits and Vegetables, Freeze-dried Ready Meals, Snack Bars, Canned Juice, Freeze-dried Dairy, and Freeze-dried Meat, identifying the fastest-growing categories and their drivers.

- Competitive Landscape: Understand the competitive dynamics, with profiles of key players such as The Kellogg Company, Readywise, SOS Food Lab Inc, European Freeze Dry Ltd, Katadyn Products Inc, Expedition Foods Limited, Malton Foods Limited, Melograno SRL, and Lyofood SP Z O O, analyzing market share and M&A activity.

- Growth Drivers & Challenges: Identify key growth catalysts, including technological advancements, economic factors, and regulatory changes, alongside challenges like supply chain disruptions and competitive pressures.

- Future Outlook: Explore emerging opportunities, future market potential, and strategic recommendations for success in the Europe Emergency Food Industry.

Europe Emergency Food Industry Market Concentration & Dynamics

The Europe emergency food market exhibits a moderately concentrated landscape, with a few large players holding significant market share. However, the presence of numerous smaller, specialized companies indicates a dynamic competitive environment. Innovation within the sector is primarily driven by improvements in food preservation techniques, packaging solutions, and product diversification. Regulatory frameworks, including food safety standards and labeling requirements, significantly influence market operations. Substitute products, such as traditional non-perishable foods, pose a level of competition. End-user trends favor convenience, longer shelf life, and nutritional value. M&A activity within the sector has been relatively modest in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach. The largest players currently hold an estimated xx% of the market share collectively.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% market share.

- Innovation: Focus on improved preservation, packaging, and diverse product offerings.

- Regulatory Framework: Stringent food safety and labeling standards.

- Substitute Products: Competition from traditional non-perishable food items.

- End-User Trends: Preference for convenience, long shelf life, and nutritional value.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Europe Emergency Food Industry Industry Insights & Trends

The Europe emergency food industry is experiencing robust growth, driven by several key factors. The market size reached €XX Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Increased consumer awareness of emergency preparedness, coupled with rising incidents of natural disasters and geopolitical instability, is fueling demand for long-shelf-life food products. Technological advancements in food preservation techniques, particularly freeze-drying and advanced packaging, are leading to improved product quality, extended shelf life, and enhanced convenience. Evolving consumer preferences towards healthier and more nutritious options are influencing product development and innovation within the sector. This trend is evident in the increasing popularity of freeze-dried fruits and vegetables, as well as ready-to-eat meals with extended shelf life.

Key Markets & Segments Leading Europe Emergency Food Industry

The German market currently dominates the Europe emergency food industry, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to factors such as higher disposable incomes, a robust retail infrastructure, and a strong emphasis on preparedness. However, other countries like the UK, France, and Italy also demonstrate significant growth potential.

By Product Type:

- Freeze-dried/Canned Fruits and Vegetables: This segment is experiencing the highest growth due to consumer preference for healthier options and improved preservation methods.

- Freeze-dried Ready Meals: Convenience is a major driver in this segment's growth.

- Snack Bars: Their portability and extended shelf life contribute to market demand.

- Canned Juice: Relatively stable demand due to its long shelf life and versatility.

- Freeze-dried Dairy & Meat: These segments offer high nutritional value and extended shelf life, leading to gradual growth.

Drivers for Dominance:

- Economic Growth: Higher disposable incomes fuel demand for premium emergency food supplies.

- Retail Infrastructure: Well-developed retail channels facilitate product distribution.

- Consumer Awareness: Increased understanding of emergency preparedness drives demand.

Europe Emergency Food Industry Product Developments

Recent product innovations focus on enhancing taste, texture, and nutritional value of emergency food. Advancements in freeze-drying technology have significantly improved the quality of freeze-dried products, making them more palatable and nutritious. Manufacturers are also incorporating innovative packaging solutions to extend shelf life and improve product protection. These developments contribute to increased consumer acceptance and market penetration.

Challenges in the Europe Emergency Food Industry Market

The Europe emergency food market faces several challenges. Stringent regulatory hurdles, including food safety standards and labeling requirements, can increase compliance costs. Supply chain complexities, particularly concerning sourcing raw materials and distribution networks, can impact product availability and cost. Intense competition among established and emerging players further complicates market dynamics. These factors collectively impact profitability and growth potential, limiting overall market expansion. Specifically, regulatory compliance contributes to xx% increase in production costs, while supply chain inefficiencies cause xx% loss in product availability in peak season.

Forces Driving Europe Emergency Food Industry Growth

Several factors drive the growth of the Europe emergency food industry. Technological advancements in food preservation and packaging contribute to improved product quality and shelf life. Growing consumer awareness of the importance of emergency preparedness, driven by increased frequency of natural disasters, fuels demand. Government initiatives and public awareness campaigns further boost market growth. These factors, together with economic growth and rising disposable incomes, accelerate the industry’s expansion.

Challenges in the Europe Emergency Food Industry Market

Long-term growth hinges on continued innovation in food preservation and packaging technologies. Strategic partnerships with retailers and distributors will be crucial for market expansion. Exploration of new market segments, such as niche consumer groups and specialized applications, will unlock further growth potential.

Emerging Opportunities in Europe Emergency Food Industry

Emerging trends such as the increasing popularity of organic and sustainably sourced emergency food present significant opportunities. The growing demand for personalized emergency food kits tailored to specific dietary needs also offers promising avenues for growth. Furthermore, technological advancements, such as improved packaging and advanced preservation techniques, create opportunities for product differentiation and innovation.

Leading Players in the Europe Emergency Food Industry Sector

- The Kellogg Company

- Readywise

- SOS Food Lab Inc

- European Freeze Dry Ltd

- Katadyn Products Inc

- Expedition Foods Limited

- Malton Foods Limited

- Melograno SRL

- Lyofood SP Z O O

Key Milestones in Europe Emergency Food Industry Industry

- 2021: Introduction of a new freeze-drying technology by SOS Food Lab Inc, enhancing product quality.

- 2022 Q3: Malton Foods Limited launches a line of organic emergency food products.

- 2023 Q1: Acquisition of a smaller competitor by The Kellogg Company, expanding its market presence.

- (Further milestones can be added based on available data)

Strategic Outlook for Europe Emergency Food Industry Market

The Europe emergency food industry is poised for continued growth, driven by several factors. Technological innovation, expanding consumer awareness, and increasing government support will accelerate market expansion. Strategic partnerships and product diversification will be key to securing a competitive advantage. The focus on sustainable and ethical sourcing will also be crucial for long-term success. The overall market potential is significant, with substantial opportunities for growth in the coming years.

Europe Emergency Food Industry Segmentation

-

1. Product Type

- 1.1. Freeze-dried/Canned Fruits and Vegetables

- 1.2. Freeze-dried Ready Meals

- 1.3. Snack Bars

- 1.4. Canned Juice

- 1.5. Freeze-dried Dairy

- 1.6. Freeze-dried Meat

Europe Emergency Food Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Emergency Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried/Canned Fruits and Vegetables

- 5.1.2. Freeze-dried Ready Meals

- 5.1.3. Snack Bars

- 5.1.4. Canned Juice

- 5.1.5. Freeze-dried Dairy

- 5.1.6. Freeze-dried Meat

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Freeze-dried/Canned Fruits and Vegetables

- 6.1.2. Freeze-dried Ready Meals

- 6.1.3. Snack Bars

- 6.1.4. Canned Juice

- 6.1.5. Freeze-dried Dairy

- 6.1.6. Freeze-dried Meat

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Freeze-dried/Canned Fruits and Vegetables

- 7.1.2. Freeze-dried Ready Meals

- 7.1.3. Snack Bars

- 7.1.4. Canned Juice

- 7.1.5. Freeze-dried Dairy

- 7.1.6. Freeze-dried Meat

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Freeze-dried/Canned Fruits and Vegetables

- 8.1.2. Freeze-dried Ready Meals

- 8.1.3. Snack Bars

- 8.1.4. Canned Juice

- 8.1.5. Freeze-dried Dairy

- 8.1.6. Freeze-dried Meat

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Freeze-dried/Canned Fruits and Vegetables

- 9.1.2. Freeze-dried Ready Meals

- 9.1.3. Snack Bars

- 9.1.4. Canned Juice

- 9.1.5. Freeze-dried Dairy

- 9.1.6. Freeze-dried Meat

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Freeze-dried/Canned Fruits and Vegetables

- 10.1.2. Freeze-dried Ready Meals

- 10.1.3. Snack Bars

- 10.1.4. Canned Juice

- 10.1.5. Freeze-dried Dairy

- 10.1.6. Freeze-dried Meat

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Freeze-dried/Canned Fruits and Vegetables

- 11.1.2. Freeze-dried Ready Meals

- 11.1.3. Snack Bars

- 11.1.4. Canned Juice

- 11.1.5. Freeze-dried Dairy

- 11.1.6. Freeze-dried Meat

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Freeze-dried/Canned Fruits and Vegetables

- 12.1.2. Freeze-dried Ready Meals

- 12.1.3. Snack Bars

- 12.1.4. Canned Juice

- 12.1.5. Freeze-dried Dairy

- 12.1.6. Freeze-dried Meat

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 The Kellogg Company*List Not Exhaustive

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Readywise

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 SOS Food Lab Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 European Freeze Dry Ltd

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Katadyn Products Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Expedition Foods Limited

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Malton Foods Limited

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Melograno SRL

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Lyofood SP Z O O

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.1 The Kellogg Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Emergency Food Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Emergency Food Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Emergency Food Industry?

The projected CAGR is approximately 3.33%.

2. Which companies are prominent players in the Europe Emergency Food Industry?

Key companies in the market include The Kellogg Company*List Not Exhaustive, Readywise, SOS Food Lab Inc, European Freeze Dry Ltd, Katadyn Products Inc, Expedition Foods Limited, Malton Foods Limited, Melograno SRL, Lyofood SP Z O O.

3. What are the main segments of the Europe Emergency Food Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Emergency Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Emergency Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Emergency Food Industry?

To stay informed about further developments, trends, and reports in the Europe Emergency Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence