Key Insights

The European sterol market, projected at 368.67 million in 2024, is set to grow at a robust Compound Annual Growth Rate (CAGR) of 7.9% between 2024 and 2033. This expansion is propelled by rising chronic disease prevalence, particularly cardiovascular conditions, boosting demand for phytosterols in functional foods and dietary supplements. Growing consumer health consciousness and the adoption of plant-based diets further fuel market growth. The pharmaceutical sector's reliance on sterols for drug formulations also contributes significantly. Key markets include Germany, France, and the UK, supported by substantial populations and advanced healthcare systems. Emerging markets within the "Rest of Europe" also present considerable growth potential. The market is segmented by source (vegetable oil, pine), type (phytosterols, zoosterols), and end-user industry (pharmaceutical, food & beverage, dietary supplements, cosmetics). The competitive landscape features major players like Roche, Cargill, and BASF, alongside specialized niche providers. While regulatory complexities and raw material price volatility pose challenges, innovation and escalating demand for health-enhancing products ensure a positive market outlook.

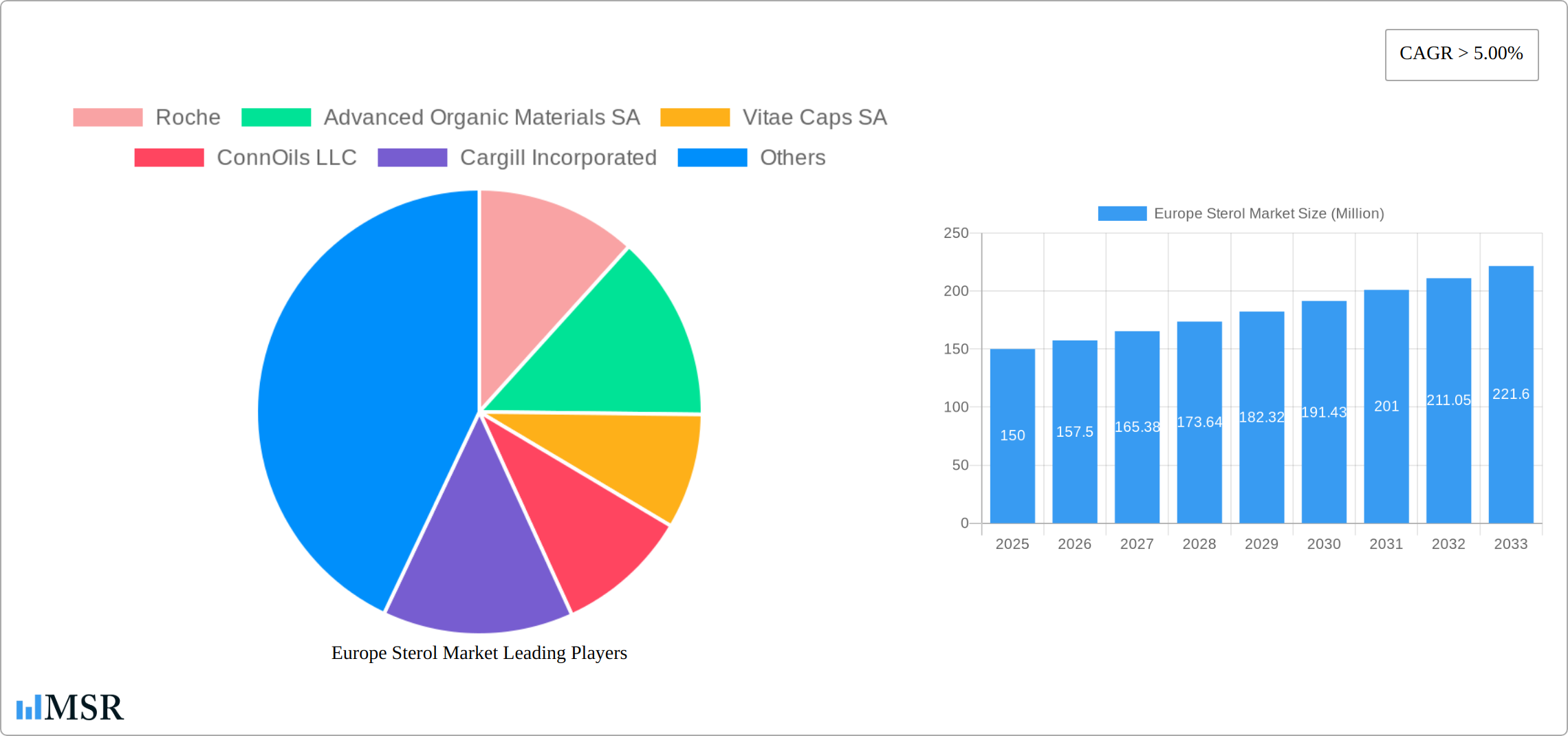

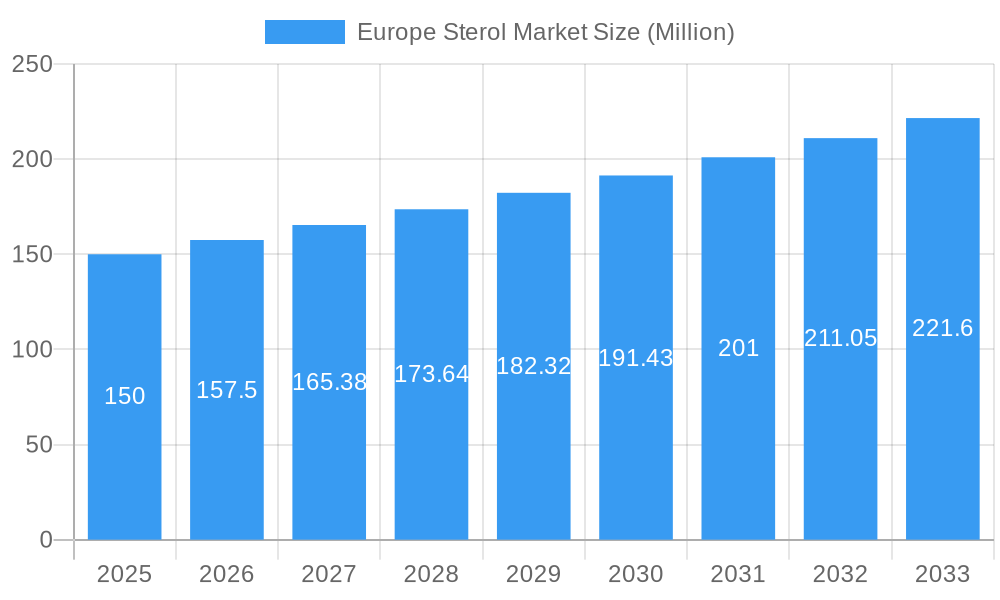

Europe Sterol Market Market Size (In Million)

The forecast period (2024-2033) anticipates intensified competition. Companies specializing in vegetable oil extraction and processing are poised to expand their phytosterol portfolios. Innovations in sterol delivery systems, focusing on improved solubility and bioavailability, are expected to accelerate market growth. The development of novel sterol-based cosmetic and personal care products will also contribute to expansion. The dietary supplement sector is predicted to experience significant growth, driven by consumer interest in cardiovascular health and cholesterol management. Ongoing research and development investments by leading companies will be crucial for adopting sterols across various applications.

Europe Sterol Market Company Market Share

Europe Sterol Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe sterol market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. This in-depth analysis is crucial for businesses operating within the pharmaceutical, food & beverage, dietary supplements, and cosmetics industries, looking to navigate the complexities of this dynamic market.

Europe Sterol Market Concentration & Dynamics

The Europe sterol market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise market share data for each company is proprietary and unavailable for direct inclusion here, key players such as Roche, Cargill Incorporated, BASF SE, and Merck & Co Inc. hold substantial positions, driven by their extensive production capabilities and established distribution networks. The market’s dynamics are shaped by several factors, including:

- Innovation Ecosystems: Continuous research and development efforts focused on enhancing sterol extraction methods, exploring novel applications, and improving product purity drive market innovation. The development of sustainable and cost-effective extraction techniques is a particular area of focus.

- Regulatory Frameworks: Stringent regulations governing food additives, pharmaceuticals, and cosmetics influence product formulation and market entry strategies. Compliance with these regulations is paramount for market participants.

- Substitute Products: The presence of substitute ingredients in certain applications presents a competitive challenge. However, the unique functional properties of sterols, particularly their cholesterol-lowering benefits, maintain their relevance.

- End-User Trends: Growing consumer awareness of health and wellness, coupled with rising demand for functional foods and dietary supplements, significantly fuels market growth. The increasing adoption of plant-based diets further contributes to this trend.

- M&A Activities: The market has witnessed several mergers and acquisitions (M&As) in recent years. For example, the acquisition of Vitae Naturals by Kensing LLC in June 2022 strengthened the latter's European presence. While the exact number of M&A deals over the study period is unavailable (xx), these activities indicate the ongoing consolidation of the market.

Europe Sterol Market Industry Insights & Trends

The Europe sterol market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at €xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by:

- Rising consumer demand for health-conscious products: The increasing focus on heart health and cholesterol management is a significant driver, boosting demand for sterols in functional foods and dietary supplements.

- Technological advancements in extraction and purification: Improved extraction methods lead to higher yields and reduced costs, making sterols more accessible and affordable.

- Expansion into new applications: Beyond traditional applications, sterols are finding increasing use in cosmetics and personal care products, further widening the market scope.

- Growing prevalence of chronic diseases: The increasing incidence of cardiovascular diseases in Europe necessitates solutions for cholesterol management, propelling sterol demand.

Key Markets & Segments Leading Europe Sterol Market

The largest segment by source is Vegetable Oil, due to its cost-effectiveness and scalability of production. Phytosterols constitute the most prominent type within the market, reflecting their widespread use across various applications. The Pharmaceutical segment dominates the end-user industry due to the recognized cholesterol-lowering benefits of sterols in pharmaceuticals and their integration into numerous drug formulations.

- Drivers for Vegetable Oil Source:

- Cost-effectiveness compared to pine-derived sterols.

- Abundant availability of vegetable oils as raw material.

- Sustainable sourcing options available for many vegetable oils.

- Drivers for Phytosterols Type:

- Established efficacy in cholesterol reduction.

- Wide range of applications across various industries.

- Regulatory approvals in multiple regions.

- Drivers for Pharmaceutical End-User Industry:

- Strong evidence base supporting cholesterol-lowering effects.

- Established distribution channels within the pharmaceutical sector.

- Integration into various drug formulations for cardiovascular health.

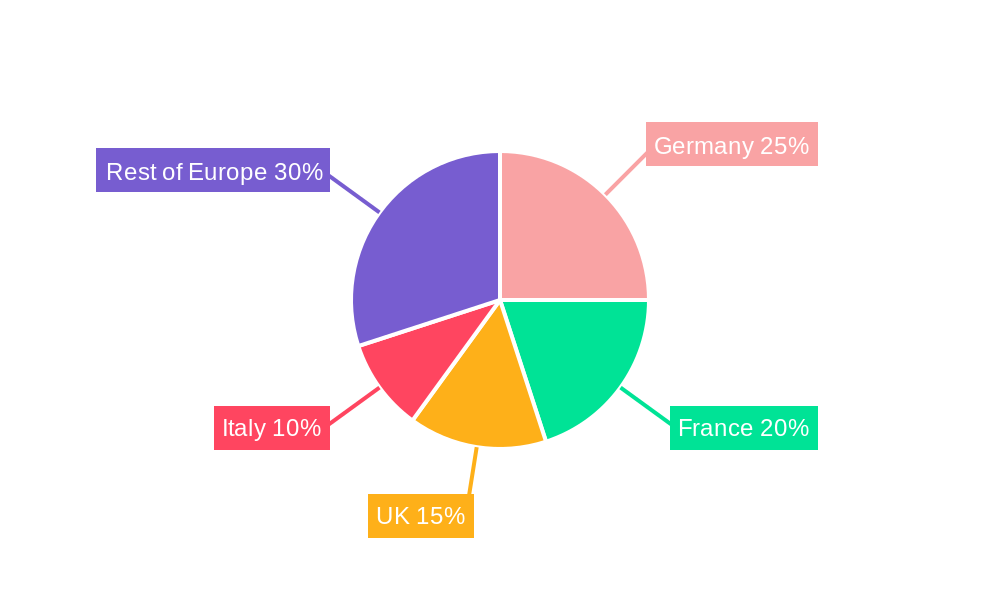

Germany and France are leading European countries in the sterol market due to their robust healthcare infrastructure, significant pharmaceutical industries and increasing consumer awareness around heart health.

Europe Sterol Market Product Developments

Significant advancements in sterol extraction and purification technologies have resulted in higher purity products with enhanced efficacy. The development of novel formulations and delivery systems is expanding the applications of sterols beyond traditional uses. Furthermore, companies are focusing on developing sustainable and environmentally friendly extraction methods to cater to the growing demand for eco-conscious products. These innovations contribute to a competitive advantage in the market.

Challenges in the Europe Sterol Market Market

The European sterol market faces a complex interplay of challenges impacting profitability and growth. Fluctuating raw material prices, particularly those of plant-based sterols, create significant volatility in production costs. Stringent regulatory compliance within the EU, including those related to food safety and labeling, necessitate substantial investment and ongoing adherence. Furthermore, intense competition among established players and the emergence of new entrants contributes to pressure on pricing and margins. Supply chain disruptions, exacerbated by geopolitical instability and increased global demand, further complicate production and timely delivery, impacting both availability and customer satisfaction. These combined factors create a need for robust supply chain management, diversification of sourcing strategies, and efficient cost optimization. The estimated annual revenue impact due to these challenges is approximately xx Million Euros (or specify currency). This figure requires further clarification and should be updated with precise data.

Forces Driving Europe Sterol Market Growth

Key growth drivers include rising health awareness among consumers, technological advancements in extraction and purification, and increasing demand from the pharmaceutical and food & beverage industries. Government initiatives promoting heart health also stimulate market growth. For example, public health campaigns emphasizing dietary changes and cholesterol management directly benefit the sterol market.

Long-Term Growth Catalysts in the Europe Sterol Market

Long-term growth is expected to be fueled by strategic partnerships, research and development initiatives leading to novel applications, and expansion into emerging markets. The continued development of sustainable and eco-friendly sterol extraction methods will play a crucial role in market expansion.

Emerging Opportunities in Europe Sterol Market

Despite the challenges, the European sterol market presents several promising opportunities for growth. The expanding cosmetics and personal care sector is driving demand for sterols with skin-conditioning and moisturizing properties. The market is witnessing increased interest in functional foods and beverages enriched with sterols, driven by a growing consumer focus on health and wellness. The personalized nutrition trend, which emphasizes tailored dietary approaches based on individual needs, further fuels this demand. Expansion into emerging markets within Europe, particularly those with increasing disposable incomes and health awareness, offers significant untapped potential. Finally, ongoing research and development into novel applications of sterols, particularly in pharmaceuticals and nutraceuticals, could unlock new avenues for market expansion.

Leading Players in the Europe Sterol Market Sector

- Roche

- Advanced Organic Materials SA

- Vitae Caps SA

- ConnOils LLC

- Cargill Incorporated

- Merck & Co Inc

- AstraZeneca

- Ashland

- BASF SE

- Elementa

- ADM (Archer Daniels Midland)

- Sanofi-Aventis

- Bayer

Key Milestones in Europe Sterol Market Industry

- June 2022: Kensing LLC's acquisition of Vitae Naturals significantly strengthened its position in the European plant sterols and food ingredients market. This acquisition is expected to increase Kensing's market share and potentially influence pricing dynamics within the sector. Further analysis should be conducted to assess the long-term impact of this acquisition.

- November 2022: AstraZeneca's acquisition of Neogene Therapeutics, while not directly related to sterols, signifies increased investment in the biotechnology sector and cell-based therapies. This indirect investment suggests a broader trend of increased spending in related healthcare areas, potentially driving future demand for sterols in pharmaceutical applications. Further research is needed to quantify this potential impact.

- [Add other relevant milestones here, including dates, companies involved, and a brief description of their significance to the market. Include quantifiable data where possible.]

Strategic Outlook for Europe Sterol Market Market

The Europe sterol market presents considerable future potential, driven by continuous innovation, strategic partnerships, and expanding applications across various industries. Companies focusing on sustainable sourcing and product development are poised to capture significant market share. The market's growth trajectory is expected to remain strong throughout the forecast period, driven by the underlying trends of health consciousness and technological advancements.

Europe Sterol Market Segmentation

-

1. Source

- 1.1. Vegetable Oil

- 1.2. Pine

-

2. Type

-

2.1. Phytosterols

- 2.1.1. Campesterol

- 2.1.2. Beta-Sitosterol

- 2.1.3. Stigmasterol

- 2.1.4. Other Phytosterols

- 2.2. Zoosterols (Cholesterol)

- 2.3. Other Types

-

2.1. Phytosterols

-

3. End-User Industry

- 3.1. Pharmaceutical

- 3.2. Food and Beverage

- 3.3. Dietary Supplements

- 3.4. Cosmetics

- 3.5. Other End-User Industry

Europe Sterol Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Nordic Countries

- 7. Rest of Europe

Europe Sterol Market Regional Market Share

Geographic Coverage of Europe Sterol Market

Europe Sterol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need in the Medical Industry; Growing Applications in the Food Industry

- 3.3. Market Restrains

- 3.3.1. High Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Strong Demand from the Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Vegetable Oil

- 5.1.2. Pine

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Phytosterols

- 5.2.1.1. Campesterol

- 5.2.1.2. Beta-Sitosterol

- 5.2.1.3. Stigmasterol

- 5.2.1.4. Other Phytosterols

- 5.2.2. Zoosterols (Cholesterol)

- 5.2.3. Other Types

- 5.2.1. Phytosterols

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Food and Beverage

- 5.3.3. Dietary Supplements

- 5.3.4. Cosmetics

- 5.3.5. Other End-User Industry

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Nordic Countries

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Germany Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Vegetable Oil

- 6.1.2. Pine

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Phytosterols

- 6.2.1.1. Campesterol

- 6.2.1.2. Beta-Sitosterol

- 6.2.1.3. Stigmasterol

- 6.2.1.4. Other Phytosterols

- 6.2.2. Zoosterols (Cholesterol)

- 6.2.3. Other Types

- 6.2.1. Phytosterols

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Food and Beverage

- 6.3.3. Dietary Supplements

- 6.3.4. Cosmetics

- 6.3.5. Other End-User Industry

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. United Kingdom Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Vegetable Oil

- 7.1.2. Pine

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Phytosterols

- 7.2.1.1. Campesterol

- 7.2.1.2. Beta-Sitosterol

- 7.2.1.3. Stigmasterol

- 7.2.1.4. Other Phytosterols

- 7.2.2. Zoosterols (Cholesterol)

- 7.2.3. Other Types

- 7.2.1. Phytosterols

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Food and Beverage

- 7.3.3. Dietary Supplements

- 7.3.4. Cosmetics

- 7.3.5. Other End-User Industry

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. France Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Vegetable Oil

- 8.1.2. Pine

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Phytosterols

- 8.2.1.1. Campesterol

- 8.2.1.2. Beta-Sitosterol

- 8.2.1.3. Stigmasterol

- 8.2.1.4. Other Phytosterols

- 8.2.2. Zoosterols (Cholesterol)

- 8.2.3. Other Types

- 8.2.1. Phytosterols

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Food and Beverage

- 8.3.3. Dietary Supplements

- 8.3.4. Cosmetics

- 8.3.5. Other End-User Industry

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Italy Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Vegetable Oil

- 9.1.2. Pine

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Phytosterols

- 9.2.1.1. Campesterol

- 9.2.1.2. Beta-Sitosterol

- 9.2.1.3. Stigmasterol

- 9.2.1.4. Other Phytosterols

- 9.2.2. Zoosterols (Cholesterol)

- 9.2.3. Other Types

- 9.2.1. Phytosterols

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Food and Beverage

- 9.3.3. Dietary Supplements

- 9.3.4. Cosmetics

- 9.3.5. Other End-User Industry

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Spain Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Vegetable Oil

- 10.1.2. Pine

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Phytosterols

- 10.2.1.1. Campesterol

- 10.2.1.2. Beta-Sitosterol

- 10.2.1.3. Stigmasterol

- 10.2.1.4. Other Phytosterols

- 10.2.2. Zoosterols (Cholesterol)

- 10.2.3. Other Types

- 10.2.1. Phytosterols

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Food and Beverage

- 10.3.3. Dietary Supplements

- 10.3.4. Cosmetics

- 10.3.5. Other End-User Industry

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Nordic Countries Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Source

- 11.1.1. Vegetable Oil

- 11.1.2. Pine

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Phytosterols

- 11.2.1.1. Campesterol

- 11.2.1.2. Beta-Sitosterol

- 11.2.1.3. Stigmasterol

- 11.2.1.4. Other Phytosterols

- 11.2.2. Zoosterols (Cholesterol)

- 11.2.3. Other Types

- 11.2.1. Phytosterols

- 11.3. Market Analysis, Insights and Forecast - by End-User Industry

- 11.3.1. Pharmaceutical

- 11.3.2. Food and Beverage

- 11.3.3. Dietary Supplements

- 11.3.4. Cosmetics

- 11.3.5. Other End-User Industry

- 11.1. Market Analysis, Insights and Forecast - by Source

- 12. Rest of Europe Europe Sterol Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Source

- 12.1.1. Vegetable Oil

- 12.1.2. Pine

- 12.2. Market Analysis, Insights and Forecast - by Type

- 12.2.1. Phytosterols

- 12.2.1.1. Campesterol

- 12.2.1.2. Beta-Sitosterol

- 12.2.1.3. Stigmasterol

- 12.2.1.4. Other Phytosterols

- 12.2.2. Zoosterols (Cholesterol)

- 12.2.3. Other Types

- 12.2.1. Phytosterols

- 12.3. Market Analysis, Insights and Forecast - by End-User Industry

- 12.3.1. Pharmaceutical

- 12.3.2. Food and Beverage

- 12.3.3. Dietary Supplements

- 12.3.4. Cosmetics

- 12.3.5. Other End-User Industry

- 12.1. Market Analysis, Insights and Forecast - by Source

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Roche

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Advanced Organic Materials SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vitae Caps SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ConnOils LLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cargill Incorporated

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Merck & Co Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AstraZeneca

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ashland

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BASF SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Elementa

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 ADM (Archer Deniels Midland)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Sanofi-Aventis

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Bayer

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Roche

List of Figures

- Figure 1: Europe Sterol Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Sterol Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 2: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 3: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 7: Europe Sterol Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Europe Sterol Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 10: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 11: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 13: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 14: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 15: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 18: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 19: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 22: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 23: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 26: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 27: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 28: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 30: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 31: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 34: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 35: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 36: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 38: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 39: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 42: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 43: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 45: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 46: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 47: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 50: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 51: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 52: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 54: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 55: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 56: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Europe Sterol Market Revenue million Forecast, by Source 2020 & 2033

- Table 58: Europe Sterol Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 59: Europe Sterol Market Revenue million Forecast, by Type 2020 & 2033

- Table 60: Europe Sterol Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 61: Europe Sterol Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 62: Europe Sterol Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 63: Europe Sterol Market Revenue million Forecast, by Country 2020 & 2033

- Table 64: Europe Sterol Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sterol Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Europe Sterol Market?

Key companies in the market include Roche, Advanced Organic Materials SA, Vitae Caps SA, ConnOils LLC, Cargill Incorporated, Merck & Co Inc, AstraZeneca, Ashland, BASF SE, Elementa, ADM (Archer Deniels Midland), Sanofi-Aventis, Bayer.

3. What are the main segments of the Europe Sterol Market?

The market segments include Source, Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 368.67 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need in the Medical Industry; Growing Applications in the Food Industry.

6. What are the notable trends driving market growth?

Strong Demand from the Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

High Raw Material Cost.

8. Can you provide examples of recent developments in the market?

November 2022: AstraZeneca announced that it will purchase the biotechnology firm Neogene Therapeutics for up to USD 320 million to expand its line-up of cell-based cancer therapies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sterol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sterol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sterol Market?

To stay informed about further developments, trends, and reports in the Europe Sterol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence