Key Insights

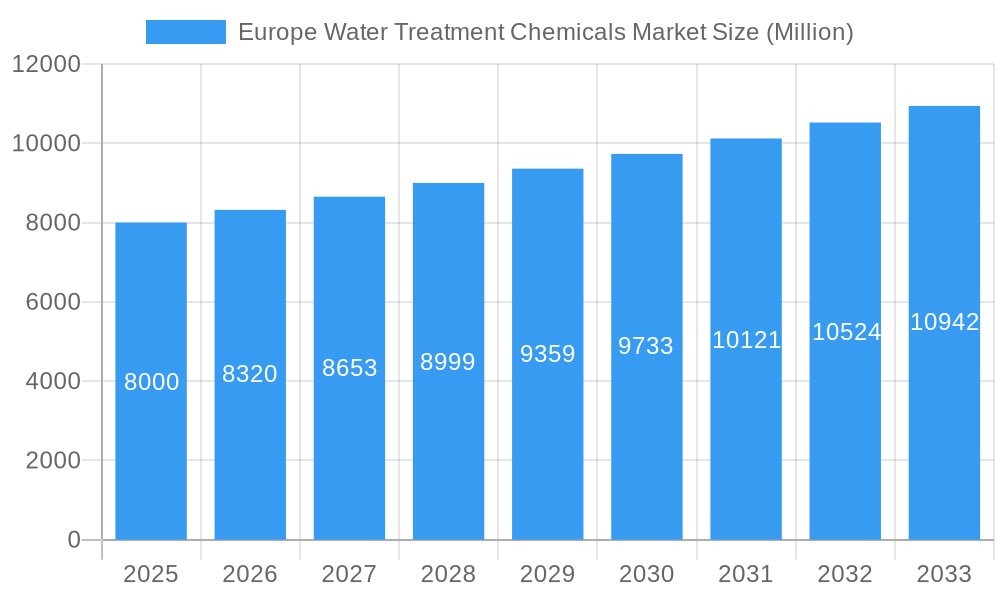

The European water treatment chemicals market is poised for significant expansion, fueled by escalating industrial activities, rigorous environmental mandates, and an intensified emphasis on water conservation across key sectors. Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.11%, the market is anticipated to reach a valuation of €7.64 billion by 2025. Key growth catalysts include the increasing demand for effective water treatment solutions in industries such as power generation, manufacturing, and food & beverage, alongside substantial investments in wastewater treatment infrastructure. Growing concerns over water scarcity and the adoption of advanced treatment technologies, including membrane filtration and reverse osmosis, are further propelling market growth. The market is segmented by chemical type (coagulants, flocculants, disinfectants), application (municipal, industrial), and geographical region, with robust growth expected across Europe.

Europe Water Treatment Chemicals Market Market Size (In Billion)

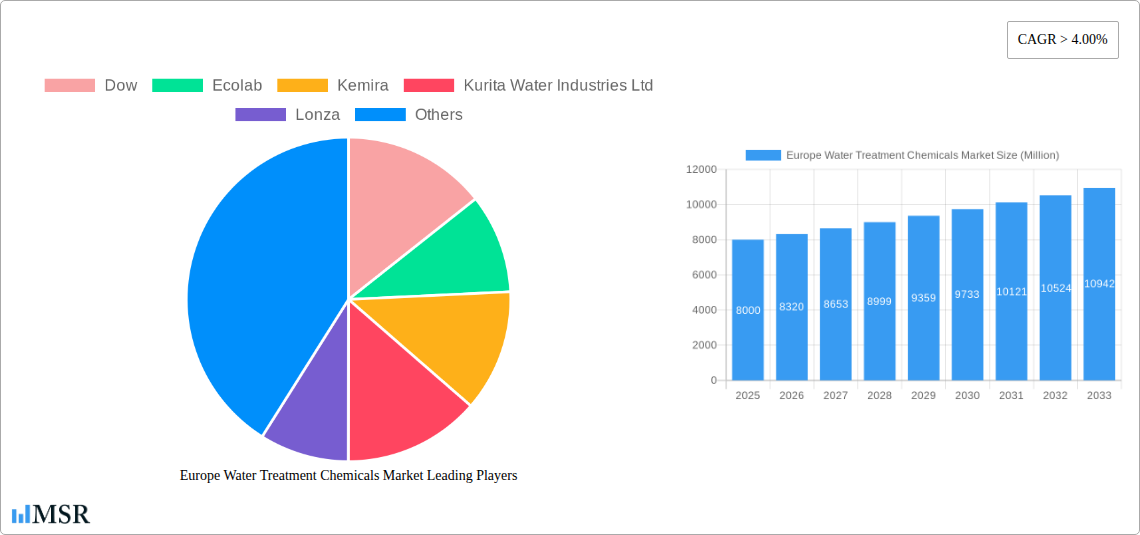

Leading market participants including Dow, Ecolab, Kemira, Kurita Water Industries, Lonza, SNF, Solenis, Solvay, Suez Group, and Veolia are actively driving market dynamics through innovation, strategic alliances, and mergers. The competitive environment is defined by the presence of global enterprises and niche chemical providers, fostering intense competition centered on product innovation, quality assurance, and service excellence. Despite robust growth prospects, challenges persist, such as volatile raw material costs, complex regulatory compliance, and potential economic disruptions. Nevertheless, the long-term outlook for the European water treatment chemicals market remains optimistic, underpinned by the perpetual need for clean and safe water across various industries.

Europe Water Treatment Chemicals Market Company Market Share

Europe Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Water Treatment Chemicals Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this study unveils market dynamics, growth drivers, key players, and future opportunities within this vital sector. The report's meticulous research incorporates extensive data analysis, expert opinions, and up-to-date industry developments to deliver actionable intelligence. Expect detailed breakdowns of market segments, competitive landscapes, and emerging trends shaping the future of water treatment in Europe. The market size is predicted to reach xx Million by 2025.

Europe Water Treatment Chemicals Market Market Concentration & Dynamics

The European water treatment chemicals market exhibits a moderately concentrated landscape, with several major players holding significant market share. Dow, Ecolab, Kemira, Kurita Water Industries Ltd, Lonza, SNF, Solenis, Solvay, Suez Group, and Veolia are among the key players, though the market also includes numerous smaller regional players. The market share distribution is dynamic, influenced by mergers and acquisitions (M&A) activities. In the past five years, the M&A deal count has averaged approximately xx per year, demonstrating significant consolidation efforts. This has led to increased market concentration, with the top 5 companies collectively holding an estimated xx% market share in 2024.

Innovation plays a pivotal role, with companies investing significantly in R&D to develop sustainable and high-performance chemicals. The regulatory framework, particularly regarding environmental regulations (e.g., REACH), significantly influences product development and market competition. Substitute products, such as membrane filtration technologies, present some competitive pressure, although chemical treatments still dominate many applications. End-user trends towards sustainability and stricter environmental standards are driving demand for eco-friendly solutions.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- M&A Activity: Average xx deals per year (2019-2024).

- Regulatory Landscape: Stringent environmental regulations (REACH, etc.) driving innovation.

- Substitute Products: Membrane filtration technologies offer some competition.

- End-User Trends: Growing demand for sustainable and high-performance solutions.

Europe Water Treatment Chemicals Market Industry Insights & Trends

The European water treatment chemicals market is experiencing robust growth, driven by factors such as increasing industrialization, urbanization, and stricter environmental regulations. The market size is projected to reach xx Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the development of advanced oxidation processes (AOPs) and membrane bioreactors (MBRs), are revolutionizing water treatment practices, driving efficiency and cost-effectiveness. Consumer behavior is shifting towards environmentally conscious choices, boosting demand for sustainable water treatment solutions. The rising focus on water scarcity and water quality issues further fuels market growth. This growth is unevenly distributed across Europe, with some regions experiencing faster growth than others due to varying levels of industrial development and infrastructural investment. Further growth is also expected due to government investments in water infrastructure projects across different regions.

Key Markets & Segments Leading Europe Water Treatment Chemicals Market

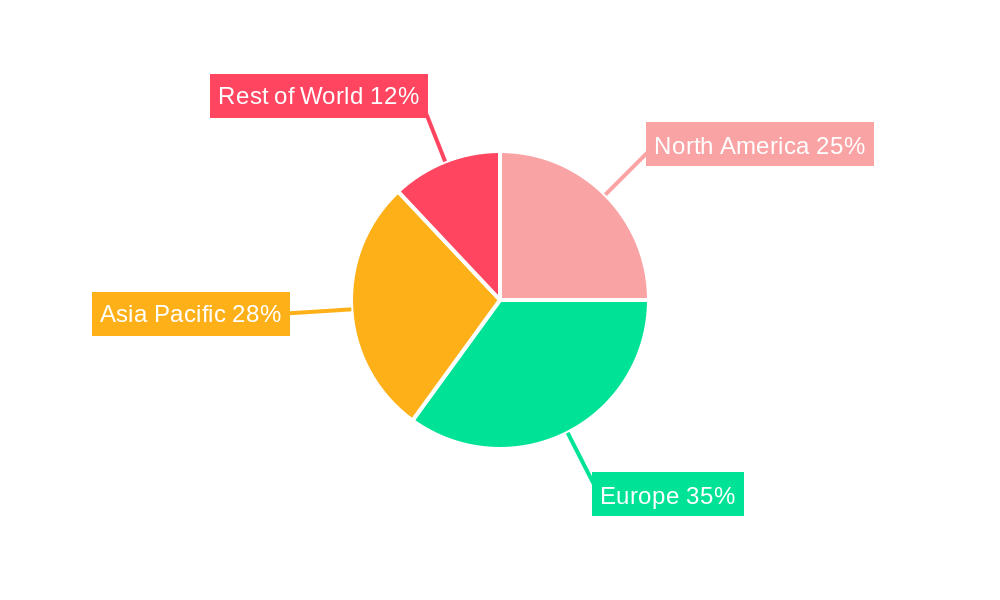

While the entire European market is experiencing growth, certain regions and segments are particularly dominant. Germany, France, and the UK represent the largest national markets, driven by robust industrial activity and established infrastructure. The industrial segment (including power generation, manufacturing, and oil & gas) remains the largest consumer of water treatment chemicals, owing to stringent regulatory requirements and the need for efficient water management. The municipal segment is also a significant contributor and is seeing increased growth due to efforts to improve drinking water quality and wastewater treatment.

- Dominant Regions: Germany, France, and the UK.

- Drivers in Dominant Regions:

- Robust industrial activity.

- Established water infrastructure.

- Stringent environmental regulations.

- High levels of government investment.

- Dominant Segment: Industrial segment (power generation, manufacturing, oil & gas).

Europe Water Treatment Chemicals Market Product Developments

Recent product innovations focus on developing more efficient, sustainable, and cost-effective water treatment chemicals. Emphasis is placed on reducing environmental impact and improving treatment efficacy. Advanced oxidation processes (AOPs), membrane bioreactors (MBRs), and other technological advancements are shaping the product landscape, enabling the treatment of increasingly complex wastewater streams. These developments offer competitive advantages by improving efficiency and reducing the overall cost of water treatment operations. New applications are emerging in areas such as desalination and industrial water reuse, expanding the market potential.

Challenges in the Europe Water Treatment Chemicals Market Market

The European water treatment chemicals market is navigating a complex landscape characterized by several significant challenges. Stringent and evolving environmental regulations, while crucial for sustainability, often translate into increased production costs and can necessitate significant investment in compliance, potentially limiting the adoption of certain chemical formulations. Furthermore, the global nature of raw material sourcing exposes the market to vulnerabilities from supply chain disruptions, leading to price volatility and production uncertainties. Intense competition is a pervasive force, with established, long-standing players consistently innovating, while the emergence of novel technologies and specialized solutions by agile newcomers adds further pressure. Economic fluctuations and geopolitical uncertainties can also impact investment appetite and influence overall demand for water treatment solutions across various sectors.

Forces Driving Europe Water Treatment Chemicals Market Growth

The European water treatment chemicals market is experiencing robust growth, propelled by a confluence of powerful driving forces. Paramount among these are the increasingly stringent environmental regulations enacted across the continent, which mandate higher standards for water quality and wastewater discharge. This regulatory push directly fuels the demand for more efficient, advanced, and sustainable water treatment chemicals and solutions. The ongoing trends of industrialization and urbanization in many European nations are contributing to a significant increase in the volume and complexity of wastewater generated, necessitating more sophisticated treatment processes. Technological advancements are playing a pivotal role, with innovations in chemical formulations, application techniques, and integrated treatment systems enhancing both efficiency and cost-effectiveness, thereby attracting substantial investment. Moreover, proactive government initiatives aimed at modernizing water infrastructure, promoting water reuse, and championing circular economy principles further catalyze market expansion.

Long-Term Growth Catalysts in Europe Water Treatment Chemicals Market

Long-term growth will be fueled by continued innovation in water treatment technologies, strategic partnerships between chemical manufacturers and water treatment companies, and expansion into new markets. The growing focus on water reuse and desalination offers significant opportunities for market expansion. Companies are increasingly adopting sustainable manufacturing practices and developing eco-friendly chemicals to meet the growing demand for environmentally responsible solutions.

Emerging Opportunities in Europe Water Treatment Chemicals Market

Emerging opportunities lie in developing and adopting sustainable and biodegradable water treatment chemicals, expanding into new applications like desalination and water reuse, and tapping into growing markets in Eastern Europe. The rising focus on circular economy principles presents opportunities for chemical recycling and waste reduction. Advancements in digitalization, such as the application of AI and IoT in water management, offer opportunities for optimizing water treatment processes and improving efficiency.

Leading Players in the Europe Water Treatment Chemicals Market Sector

- Dow (Dow)

- Ecolab (Ecolab)

- Kemira (Kemira)

- Kurita Water Industries Ltd (Kurita Water Industries Ltd)

- Lonza (Lonza)

- SNF (SNF)

- Solenis (Solenis)

- Solvay (Solvay)

- Suez Group (Suez Group)

- Veolia (Veolia)

- List Not Exhaustive

Key Milestones in Europe Water Treatment Chemicals Market Industry

- January 2022: Solenis announced the strategic acquisition of SCL GmbH, a move that significantly bolstered its polyacrylamide portfolio and expanded its capabilities in wastewater purification and other critical industrial applications.

- May 2022: Solenis further expanded its geographic footprint and market penetration by completing the acquisition of Neu Kimya, enhancing its presence in Turkey, Southeast Europe, and the broader Middle East region.

- September 2022: Solenis solidified its position in the recreational water treatment segment with the successful acquisition of Clearon Corp., further diversifying its product offerings and strengthening its market leadership.

Strategic Outlook for Europe Water Treatment Chemicals Market Market

The strategic outlook for the Europe water treatment chemicals market is exceptionally positive, underpinned by persistent growth in industrial output, ongoing urbanization, and the unwavering commitment to stringent environmental stewardship. The market presents abundant strategic opportunities for forward-thinking companies. Investing in cutting-edge research and development to create novel, environmentally friendly chemical solutions will be paramount. Expanding into underserved or emerging markets within Europe and beyond offers significant growth potential. Furthermore, a keen focus on developing sustainable and circular economy-aligned products and processes, coupled with the forging of strategic partnerships and collaborations, will be indispensable for achieving sustained long-term success in this dynamic and evolving market landscape.

Europe Water Treatment Chemicals Market Segmentation

-

1. Product Type

- 1.1. Flocculants and Coagulants

- 1.2. Biocide and Disinfectant

- 1.3. Defoamers and Defoaming Agents

- 1.4. pH and Adjuster and Softener

- 1.5. Corrosion and Scale Inhibitor

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil and Gas

- 2.3. Chemical Manufcaturing

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Food and Beverage

- 2.7. Pulp and Paper

- 2.8. Other End-user Industries

Europe Water Treatment Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Russia

- 6. Rest of Europe

Europe Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Europe Water Treatment Chemicals Market

Europe Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations to Produce and Dispose Wastewater; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations to Produce and Dispose Wastewater; Other Drivers

- 3.4. Market Trends

- 3.4.1. Power Generation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flocculants and Coagulants

- 5.1.2. Biocide and Disinfectant

- 5.1.3. Defoamers and Defoaming Agents

- 5.1.4. pH and Adjuster and Softener

- 5.1.5. Corrosion and Scale Inhibitor

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufcaturing

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Food and Beverage

- 5.2.7. Pulp and Paper

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Flocculants and Coagulants

- 6.1.2. Biocide and Disinfectant

- 6.1.3. Defoamers and Defoaming Agents

- 6.1.4. pH and Adjuster and Softener

- 6.1.5. Corrosion and Scale Inhibitor

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil and Gas

- 6.2.3. Chemical Manufcaturing

- 6.2.4. Mining and Mineral Processing

- 6.2.5. Municipal

- 6.2.6. Food and Beverage

- 6.2.7. Pulp and Paper

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Flocculants and Coagulants

- 7.1.2. Biocide and Disinfectant

- 7.1.3. Defoamers and Defoaming Agents

- 7.1.4. pH and Adjuster and Softener

- 7.1.5. Corrosion and Scale Inhibitor

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil and Gas

- 7.2.3. Chemical Manufcaturing

- 7.2.4. Mining and Mineral Processing

- 7.2.5. Municipal

- 7.2.6. Food and Beverage

- 7.2.7. Pulp and Paper

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Flocculants and Coagulants

- 8.1.2. Biocide and Disinfectant

- 8.1.3. Defoamers and Defoaming Agents

- 8.1.4. pH and Adjuster and Softener

- 8.1.5. Corrosion and Scale Inhibitor

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil and Gas

- 8.2.3. Chemical Manufcaturing

- 8.2.4. Mining and Mineral Processing

- 8.2.5. Municipal

- 8.2.6. Food and Beverage

- 8.2.7. Pulp and Paper

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Flocculants and Coagulants

- 9.1.2. Biocide and Disinfectant

- 9.1.3. Defoamers and Defoaming Agents

- 9.1.4. pH and Adjuster and Softener

- 9.1.5. Corrosion and Scale Inhibitor

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power

- 9.2.2. Oil and Gas

- 9.2.3. Chemical Manufcaturing

- 9.2.4. Mining and Mineral Processing

- 9.2.5. Municipal

- 9.2.6. Food and Beverage

- 9.2.7. Pulp and Paper

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Flocculants and Coagulants

- 10.1.2. Biocide and Disinfectant

- 10.1.3. Defoamers and Defoaming Agents

- 10.1.4. pH and Adjuster and Softener

- 10.1.5. Corrosion and Scale Inhibitor

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power

- 10.2.2. Oil and Gas

- 10.2.3. Chemical Manufcaturing

- 10.2.4. Mining and Mineral Processing

- 10.2.5. Municipal

- 10.2.6. Food and Beverage

- 10.2.7. Pulp and Paper

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Flocculants and Coagulants

- 11.1.2. Biocide and Disinfectant

- 11.1.3. Defoamers and Defoaming Agents

- 11.1.4. pH and Adjuster and Softener

- 11.1.5. Corrosion and Scale Inhibitor

- 11.1.6. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Power

- 11.2.2. Oil and Gas

- 11.2.3. Chemical Manufcaturing

- 11.2.4. Mining and Mineral Processing

- 11.2.5. Municipal

- 11.2.6. Food and Beverage

- 11.2.7. Pulp and Paper

- 11.2.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ecolab

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kemira

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kurita Water Industries Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Lonza

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SNF

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Solenis

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Solvay

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Suez Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Veolia*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Europe Water Treatment Chemicals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Germany Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Germany Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: France Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: France Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: France Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: France Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Italy Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Italy Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Russia Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Russia Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Russia Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Water Treatment Chemicals Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the Europe Water Treatment Chemicals Market?

Key companies in the market include Dow, Ecolab, Kemira, Kurita Water Industries Ltd, Lonza, SNF, Solenis, Solvay, Suez Group, Veolia*List Not Exhaustive.

3. What are the main segments of the Europe Water Treatment Chemicals Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations to Produce and Dispose Wastewater; Other Drivers.

6. What are the notable trends driving market growth?

Power Generation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations to Produce and Dispose Wastewater; Other Drivers.

8. Can you provide examples of recent developments in the market?

September 2022: Solenis announced the acquisition completion of Clearon Corp., which will help Solenis expand its product offering. It will also strengthen its ability to supply cost-effective, sustainable solutions for recreational pool and spa customers, providing clean, clear, safer water.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence