Key Insights

The France silica sand market, projected to reach €11.69 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 10.92% through 2033, is poised for significant expansion. Key growth drivers include the thriving construction industry, increasing demand from glass manufacturing and chemical production, and the burgeoning renewable energy sector, particularly solar panel production requiring high-purity silica sand. While challenges such as raw material price volatility and environmental regulations exist, robust underlying demand is expected to mitigate their impact. The market is segmented by end-user industries, with glass manufacturing, construction, and chemical production representing the largest segments. Leading players including Quartzwerke GmbH, Mitsubishi Corporation, and Imerys S.A. are driving innovation through technological advancements, strategic collaborations, and new application development. A focused analysis of the French market provides critical insights for targeted investment and strategic planning.

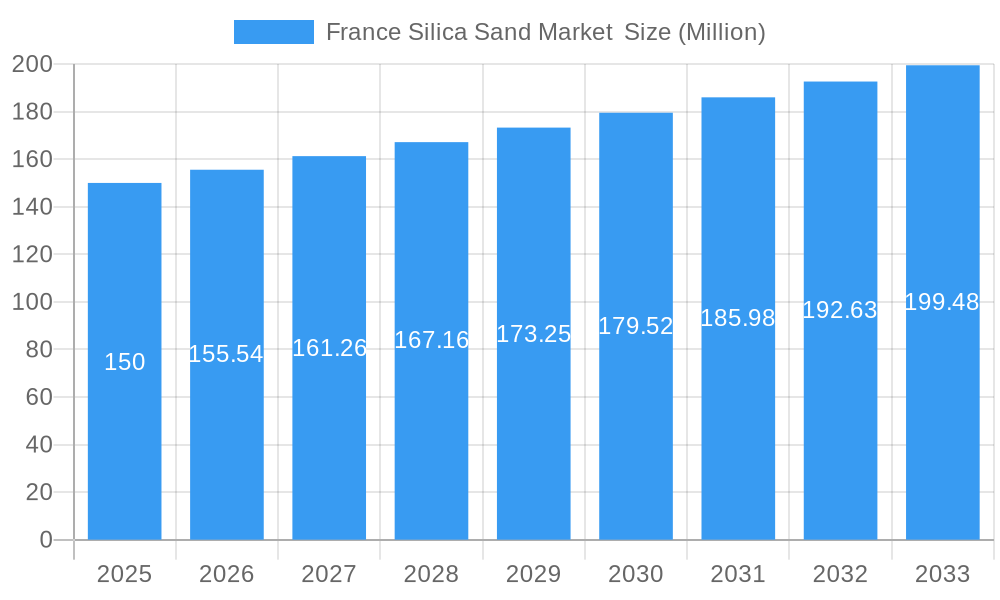

France Silica Sand Market Market Size (In Billion)

The projected 10.92% CAGR signifies a dynamic growth trajectory, presenting opportunities for both established and emerging market participants. Success will depend on adaptability and innovation, with a focus on sustainable sourcing and specialized silica sand products for high-growth sectors like renewable energy and advanced materials. The competitive environment features both global corporations and regional specialists, offering diverse opportunities for various business models. Ongoing vigilance regarding regulatory shifts and raw material cost fluctuations is essential for navigating the market effectively.

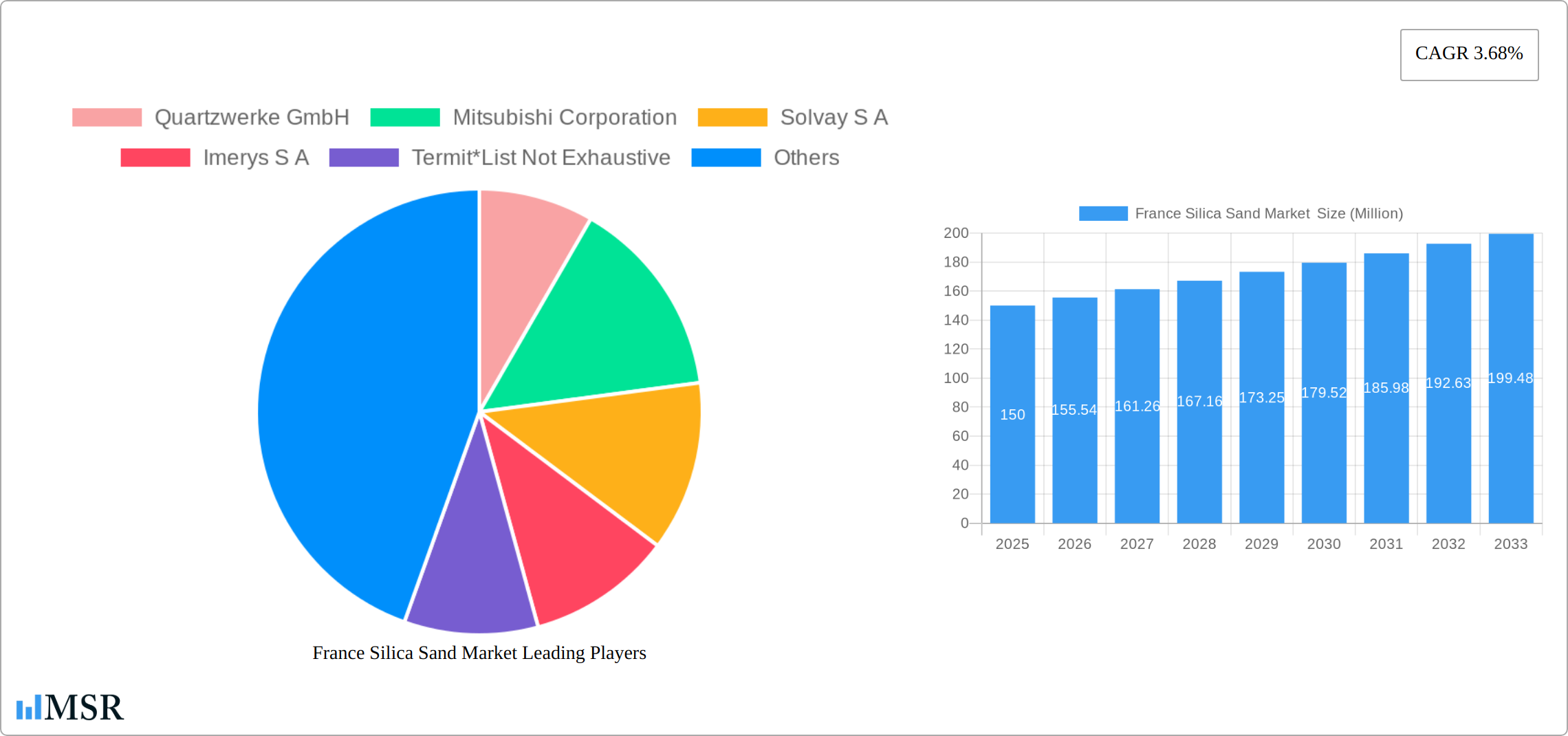

France Silica Sand Market Company Market Share

France Silica Sand Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France silica sand market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

France Silica Sand Market Market Concentration & Dynamics

The France silica sand market exhibits a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as economies of scale, access to raw materials, and technological advancements. The market is characterized by a complex innovation ecosystem, with ongoing research and development efforts focused on improving silica sand quality, production efficiency, and sustainability.

Regulatory frameworks concerning mining, environmental protection, and product safety significantly influence market operations. Substitute products, such as alternative binding agents in construction or different materials in glass manufacturing, pose a degree of competitive pressure, although the unique properties of silica sand continue to secure its dominant position in many applications.

End-user trends, particularly in the construction and glass manufacturing sectors, drive demand. The recent surge in construction activity and infrastructure projects within France has contributed to the market's growth. Mergers and acquisitions (M&A) are prominent, reflecting industry consolidation and expansion strategies. The number of M&A deals in the period 2019-2024 was xx, with an average deal size of xx Million. Major players are actively pursuing acquisitions to gain access to new markets, technologies, and resources. For example, Sibelco’s acquisitions demonstrate a strategic expansion of its footprint. The market share of the top 5 players is estimated at xx%.

France Silica Sand Market Industry Insights & Trends

The France silica sand market has demonstrated robust growth in recent years, fueled by a dynamic interplay of industrial demand and technological advancements. Between 2019 and 2024, the market experienced a significant Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR here]**%. This upward trajectory is primarily driven by the insatiable demand from the burgeoning construction industry, the continuous expansion of the glass manufacturing sector for both industrial and consumer products, and the increasing utilization of silica sand in a diverse range of chemical applications. Technological disruptions are playing a pivotal role, with advancements in sophisticated mining techniques and innovative processing technologies significantly enhancing operational efficiency and overall productivity. Furthermore, evolving consumer behavior, characterized by a heightened focus on sustainability and the preference for environmentally friendly products, is actively influencing market dynamics and shaping the industry's future. The market size in 2025 is projected to reach approximately **[Insert 2025 Market Size in Million]** Million, with an optimistic forecast to ascend to **[Insert 2033 Market Size in Million]** Million by 2033. It is crucial to note that demand fluctuations are intrinsically linked to the prevailing economic climate and the strategic execution of large-scale infrastructure development projects across the nation.

Key Markets & Segments Leading France Silica Sand Market

The glass manufacturing segment unequivocally stands as the dominant end-user industry for silica sand in France, commanding an impressive share of approximately **[Insert Glass Manufacturing Share]%** of the total market in 2025. Following closely behind, the construction sector remains a cornerstone of demand, with the chemical production and foundry industries also contributing significantly to the market's overall performance.

Drivers for Dominant Segments:

- Glass Manufacturing: The sustained boom in the construction sector, coupled with the ever-increasing demand for packaging glass, continues to be the primary driver for silica sand consumption in this segment.

- Construction: Ongoing significant infrastructure development initiatives and a robust housing market are fueling substantial growth, making construction a key consumer of silica sand in various applications like concrete, mortar, and asphalt.

- Chemical Production: The versatile nature of silica sand leads to its increasing use in a wide array of chemical processes, ensuring a consistent and reliable demand stream across diverse chemical manufacturing operations.

The preeminence of the glass manufacturing segment is directly attributable to the irreplaceable and fundamental role that high-purity silica sand plays in the intricate process of glass production. The construction sector's substantial influence stems from the pervasive and widespread application of silica sand in the formulation of concrete, cement, and a multitude of other essential building materials. Similarly, chemical applications, encompassing a broad spectrum of industrial processes, also contribute a significant and steady demand to the market. It is also important to acknowledge that regional variations in market demand are evident, with notable concentrations of demand observed around major industrial hubs and densely populated urban centers.

France Silica Sand Market Product Developments

Recent advancements in the processing of silica sand in France have been predominantly focused on achieving higher levels of purity, ensuring greater consistency in product quality, and exerting precise control over particle size distribution. These advancements are critical to meticulously meeting the specific and often stringent requirements of a diverse array of end-use industries. Innovations in beneficiation techniques are not only improving the overall quality and performance of the silica sand but are also contributing to a reduction in environmental impacts associated with extraction and processing. These cutting-edge technological advancements are instrumental in providing companies with a significant competitive edge, empowering them to offer superior products and attract a discerning customer base that actively seeks high-performance materials. Furthermore, the continuous exploration of novel applications for silica sand is actively widening its market reach, extending its utility well beyond its traditional and well-established uses.

Challenges in the France Silica Sand Market Market

The France silica sand market faces several challenges, including stringent environmental regulations that increase operational costs and compliance complexities. Fluctuations in raw material prices and potential supply chain disruptions, particularly given global economic uncertainties, present risks to profitability. Intense competition among existing players, further exacerbated by the entry of new participants, requires constant innovation and competitive pricing strategies. These factors can impact the overall market growth trajectory.

Forces Driving France Silica Sand Market Growth

Several key factors drive growth in the France silica sand market. Technological advancements in mining and processing are enhancing efficiency and sustainability. Robust economic growth and significant investments in infrastructure projects contribute significantly to demand. Favorable government policies and supportive regulatory frameworks foster a positive business environment.

Long-Term Growth Catalysts in the France Silica Sand Market

Long-term growth in the France silica sand market is fueled by continued innovation in processing and application technologies. Strategic partnerships and collaborations between industry players facilitate resource sharing and technological advancements. The expansion into new geographic markets and the exploration of emerging applications diversify revenue streams and mitigate market risks.

Emerging Opportunities in France Silica Sand Market

The future of the France silica sand market is bright with emerging opportunities, particularly in the development of high-value silica sand products meticulously tailored for specialized applications. The exploration and adoption of sustainable mining and processing practices represent a significant avenue to appeal to an increasingly environmentally conscious customer base, thereby creating a strong market differentiator. Furthermore, strategic expansion into niche markets, such as those for specialized coatings, advanced ceramics, and the burgeoning electronics sector, offers substantial and promising growth potential, promising to diversify revenue streams and foster innovation within the industry.

Leading Players in the France Silica Sand Market Sector

- Quartzwerke GmbH

- Mitsubishi Corporation

- Solvay S.A.

- Imerys S.A.

- Termit

- Sibelco

- Argeco Développement

- Fulchiron Industrielle

- Equoquarz GmbH

- SAMIN (Saint-Gobain)

Key Milestones in France Silica Sand Market Industry

- April 2022: Sibelco announced the acquisition of Krynicki Recykling S.A. (Poland) and Recyverre (France), expanding its silica sand and glass recycling operations. This acquisition significantly strengthened Sibelco's market position and broadened its product portfolio. Further acquisitions of Kremer (Netherlands), Echave (Spain), and Bassanetti (Italy) consolidated Sibelco’s dominance within the silica sand market.

Strategic Outlook for France Silica Sand Market Market

The France silica sand market holds significant potential for continued growth, driven by technological advancements, infrastructure development, and the expanding applications of silica sand across various industries. Strategic partnerships, investments in sustainable practices, and expansion into new markets are key for companies seeking to capitalize on these opportunities and achieve long-term success within this competitive landscape.

France Silica Sand Market Segmentation

-

1. End-User Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas Recovery

- 1.9. Other En

France Silica Sand Market Segmentation By Geography

- 1. France

France Silica Sand Market Regional Market Share

Geographic Coverage of France Silica Sand Market

France Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Industry; Increasing Consumption in the Glass and Ceramics Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Illegal Mining of Sand

- 3.4. Market Trends

- 3.4.1. Construction Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas Recovery

- 5.1.9. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quartzwerke GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solvay S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Imerys S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Termit*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sibelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Argeco Développement

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fulchiron Industrielle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Equoquarz GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAMIN (Saint-Gobain)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Quartzwerke GmbH

List of Figures

- Figure 1: France Silica Sand Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Silica Sand Market Share (%) by Company 2025

List of Tables

- Table 1: France Silica Sand Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 2: France Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 3: France Silica Sand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Silica Sand Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: France Silica Sand Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: France Silica Sand Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 7: France Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: France Silica Sand Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Silica Sand Market ?

The projected CAGR is approximately 10.92%.

2. Which companies are prominent players in the France Silica Sand Market ?

Key companies in the market include Quartzwerke GmbH, Mitsubishi Corporation, Solvay S A, Imerys S A, Termit*List Not Exhaustive, Sibelco, Argeco Développement, Fulchiron Industrielle, Equoquarz GmbH, SAMIN (Saint-Gobain).

3. What are the main segments of the France Silica Sand Market ?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Industry; Increasing Consumption in the Glass and Ceramics Industry; Other Drivers.

6. What are the notable trends driving market growth?

Construction Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Illegal Mining of Sand.

8. Can you provide examples of recent developments in the market?

April 2022: Sibelco announced the acquisition of Krynicki Recykling S.A., one of the leading glass recyclers in Poland, after acquiring 100% of Recyverre, a flat glass recycler in France. This announcement came in addition to Sibelco announcing the acquisition of Kremer (Netherlands), Echave (Spain), and Bassanetti (Italy) silica sand operations. Both the glass and silica sand business units have helped in the expansion of Sibelco's operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Silica Sand Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Silica Sand Market ?

To stay informed about further developments, trends, and reports in the France Silica Sand Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence