Key Insights

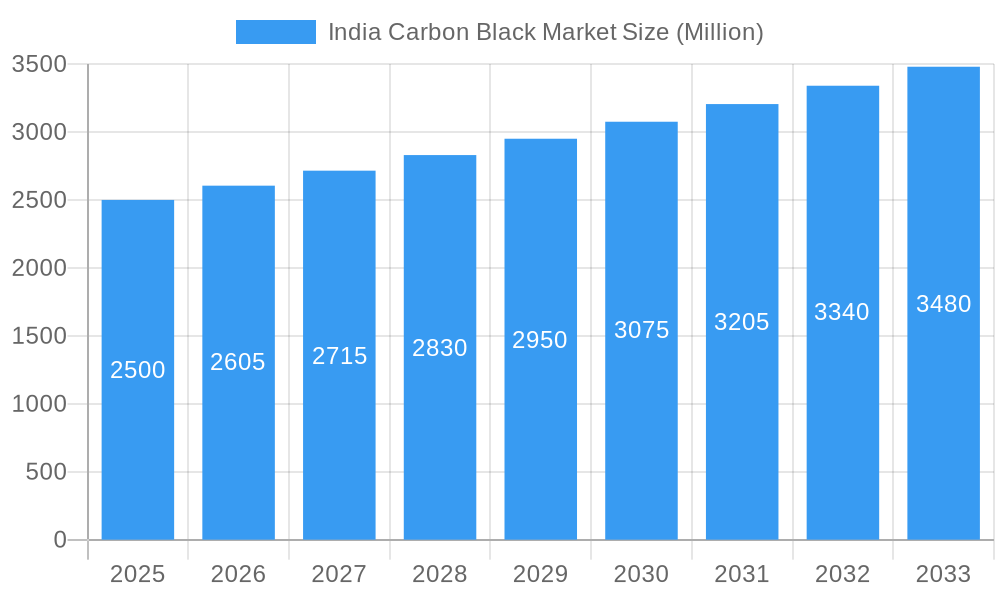

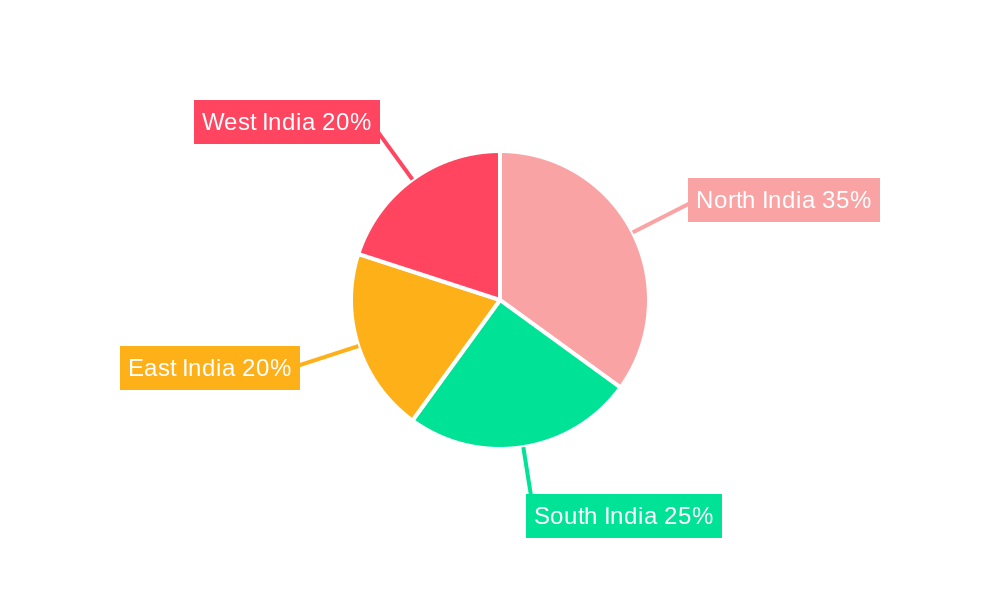

The India carbon black market is poised for substantial expansion, driven by key sectors including automotive, tire manufacturing, and plastics. With a projected Compound Annual Growth Rate (CAGR) of 4.7%, the market, valued at approximately $25.54 billion in the base year 2025, is expected to witness significant growth. This upward trend is primarily attributed to increasing vehicle production, heightened demand for advanced, high-performance tires, and the robust expansion of the plastics industry, particularly in packaging and consumer goods applications. The growing utilization of carbon black in printing inks and coatings further bolsters market momentum. While North and West India are anticipated to lead market share due to concentrated industrial activity, other regions will experience considerable growth fueled by ongoing infrastructural development and industrialization.

India Carbon Black Market Market Size (In Billion)

Key growth avenues include the development and adoption of carbon black in specialized applications, such as high-performance specialty rubber and advanced material formulations. Nevertheless, the market encounters challenges such as volatile raw material pricing, stringent environmental regulations pertaining to emissions and waste management, and potential supply chain volatility. Competitive pressures stem from both established global enterprises and an increasing number of domestic manufacturers, fostering an environment of intense competition that emphasizes cost efficiency and product innovation. Market segmentation by production process (e.g., furnace black, gas black) and end-use application reveals distinct growth trajectories, with furnace black holding a dominant position due to its broad applicability and economic viability across diverse uses. A comprehensive understanding of these market dynamics is essential for strategic decision-making and navigating this evolving and competitive landscape.

India Carbon Black Market Company Market Share

India Carbon Black Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India carbon black market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, and future potential. The report leverages extensive research to provide actionable intelligence across various segments, including furnace black, gas black, lamp black, and thermal black, and applications like tires, plastics, inks, coatings, and more. Key players such as Birla Carbon, Cabot Corporation, and Phillips Carbon Black Limited are analyzed, revealing market share dynamics and competitive landscapes. Download this report to gain a decisive advantage in the thriving Indian carbon black market.

India Carbon Black Market Concentration & Dynamics

The Indian carbon black market exhibits a moderately concentrated structure, with a few major players holding significant market share. Birla Carbon and Phillips Carbon Black Limited (PCBL) are prominent examples. However, the presence of several smaller regional players creates a dynamic competitive landscape. Market share data for 2025 shows Birla Carbon holding approximately xx% market share, followed by PCBL with xx%, and Cabot Corporation with xx%. The remaining share is divided among other players including Jiangxi Heimao Carbon Black Co Ltd, OCI COMPANY Ltd, Continental Carbon Company, Epsilon Carbon Private Limited, Himadri Speciality Chemical Ltd, Atlas Organics Private Limited, BKT Carbon.

Innovation within the industry primarily focuses on improving carbon black properties like conductivity, reinforcing capabilities, and reducing environmental impact. The regulatory framework, primarily governed by environmental protection regulations, influences production processes and emissions standards. Substitute products, such as silica and other fillers, pose competitive challenges, particularly in specific applications. End-user trends towards lighter and more fuel-efficient vehicles in the automotive sector and increased demand for high-performance plastics are impacting demand for specific types of carbon black. Mergers and acquisitions (M&A) activity in the Indian carbon black market has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

India Carbon Black Market Industry Insights & Trends

The India carbon black market is projected to witness robust growth during the forecast period (2025-2033), driven primarily by the expanding automotive and tire industries. The market size in 2025 is estimated at xx Million USD, with a compound annual growth rate (CAGR) of xx% projected for the forecast period. This growth is fueled by several factors including rising disposable incomes, increasing vehicle ownership, and infrastructural development. Technological advancements, such as the development of specialized carbon blacks with enhanced properties, are further boosting market growth. Consumer behavior is shifting towards higher-quality products, demanding superior performance and durability in various applications. Furthermore, the increasing demand for sustainable and environmentally friendly carbon black production methods is shaping industry trends. The shift towards electric vehicles presents both challenges and opportunities, as the demand for carbon black in traditional automotive applications may decrease, while new applications within EV components might emerge.

Key Markets & Segments Leading India Carbon Black Market

Dominant Segment Analysis:

Process Type: Furnace black overwhelmingly dominates the Indian carbon black market, accounting for over xx% of the total market share in 2025. This is due to its superior properties and cost-effectiveness compared to other types such as gas black, lamp black, and thermal black.

Application: The tire and industrial rubber products segment is the largest consumer of carbon black in India, driven by the booming automotive industry and increasing demand for rubber-based products. This segment holds approximately xx% of the market share in 2025.

Growth Drivers:

- Economic Growth: India's strong economic growth fuels demand across various sectors, including automotive, plastics, and coatings, thereby boosting the demand for carbon black.

- Infrastructure Development: Ongoing infrastructure projects significantly contribute to the demand for carbon black in road construction, building materials, and related applications.

- Automotive Industry Expansion: The expanding automotive sector and rising vehicle production are significant drivers of carbon black consumption, particularly in tire manufacturing.

India Carbon Black Market Product Developments

Recent innovations in carbon black technology focus on improving particle size distribution, surface area, and structure to enhance product performance. New grades of carbon black are being developed to meet the specific requirements of diverse applications, such as high-performance tires and specialty plastics. These advancements enhance product properties, enabling better reinforcement, improved conductivity, and enhanced UV resistance. This leads to improved product quality and ultimately enhances the competitive edge for manufacturers.

Challenges in the India Carbon Black Market

The India carbon black market faces several challenges, including stringent environmental regulations that impact production costs and require investments in emission control technologies. Supply chain disruptions, particularly those related to raw material availability and transportation, can impact production output. Furthermore, intense competition from both domestic and international players puts pressure on pricing and margins. These combined factors can reduce profitability and hinder market growth.

Forces Driving India Carbon Black Market Growth

Several factors contribute to the growth of the Indian carbon black market. Technological advancements leading to specialized carbon blacks cater to specific application needs. Strong economic growth and rising disposable incomes fuel demand across various industries. Government initiatives focusing on infrastructure development, particularly road construction, boost consumption. Favorable government policies supporting the automotive sector contribute to the market's growth.

Long-Term Growth Catalysts in the India Carbon Black Market

Long-term growth is expected through continuous innovation in carbon black technology, focusing on sustainability and improved performance. Strategic partnerships between carbon black producers and end-users will facilitate the development of tailor-made products. Expansion into new markets, such as renewable energy and electronics, offer promising opportunities for growth.

Emerging Opportunities in India Carbon Black Market

Emerging opportunities lie in the development of specialized carbon blacks for high-performance applications, including electric vehicle components and advanced materials. Growing demand for sustainable and environmentally friendly production methods presents opportunities for companies investing in cleaner technologies. The expansion into new and untapped markets, like the construction and packaging industries, presents significant growth potential.

Leading Players in the India Carbon Black Market Sector

- Birla Carbon

- Cabot Corporation

- PCBL (Phillips Carbon Black Limited)

- Jiangxi Heimao Carbon Black Co Ltd

- OCI COMPANY Ltd

- Continental Carbon Company

- Epsilon Carbon Private Limited

- Himadri Speciality Chemical Ltd

- Atlas Organics Private Limited

- BKT Carbon

Key Milestones in India Carbon Black Market Industry

- 2020: Introduction of a new, high-performance carbon black grade by Birla Carbon targeting the tire industry.

- 2022: Acquisition of a smaller carbon black producer by PCBL, expanding their market reach.

- 2023: Implementation of stricter environmental regulations impacting production processes.

- 2024: Launch of a new sustainable carbon black production facility by a major player, reducing environmental impact.

Strategic Outlook for India Carbon Black Market

The India carbon black market is poised for significant growth driven by the expanding automotive and industrial sectors, technological advancements, and favorable government policies. Strategic investments in research and development, along with sustainable production practices, will be crucial for success. Focus on developing specialized carbon blacks for niche applications and expanding into new and emerging markets will unlock substantial growth opportunities.

India Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

- 2.2. Plastics

- 2.3. Toners and Printing Inks

- 2.4. Coatings

- 2.5. Textile Fibers

- 2.6. Other Application

India Carbon Black Market Segmentation By Geography

- 1. India

India Carbon Black Market Regional Market Share

Geographic Coverage of India Carbon Black Market

India Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment

- 3.3. Market Restrains

- 3.3.1. Rising Prominence of Green Tires; Volatility In Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Furnace Process Type to Dominate the Carbon Black Market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Carbon Black Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.3. Toners and Printing Inks

- 5.2.4. Coatings

- 5.2.5. Textile Fibers

- 5.2.6. Other Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OCI COMPANY Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Carbon Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cabot Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Epsilon Carbon Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Himadri Speciality Chemical Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atlas Organics Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PCBL (Phillips Carbon Black Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BKT Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Birla Carbon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jiangxi Heimao Carbon Black Co Ltd

List of Figures

- Figure 1: India Carbon Black Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Carbon Black Market Share (%) by Company 2025

List of Tables

- Table 1: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 3: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: India Carbon Black Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Carbon Black Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Carbon Black Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 8: India Carbon Black Market Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 9: India Carbon Black Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: India Carbon Black Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: India Carbon Black Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Carbon Black Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Carbon Black Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the India Carbon Black Market?

Key companies in the market include Jiangxi Heimao Carbon Black Co Ltd, OCI COMPANY Ltd, Continental Carbon Company, Cabot Corporation, Epsilon Carbon Private Limited, Himadri Speciality Chemical Ltd, Atlas Organics Private Limited, PCBL (Phillips Carbon Black Limited), BKT Carbon, Birla Carbon.

3. What are the main segments of the India Carbon Black Market?

The market segments include Process Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Tire Industry; Increasing Market Penetration of Specialty Black; Growing Applications In the Batteries Segment.

6. What are the notable trends driving market growth?

Furnace Process Type to Dominate the Carbon Black Market in India.

7. Are there any restraints impacting market growth?

Rising Prominence of Green Tires; Volatility In Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Carbon Black Market?

To stay informed about further developments, trends, and reports in the India Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence