Key Insights

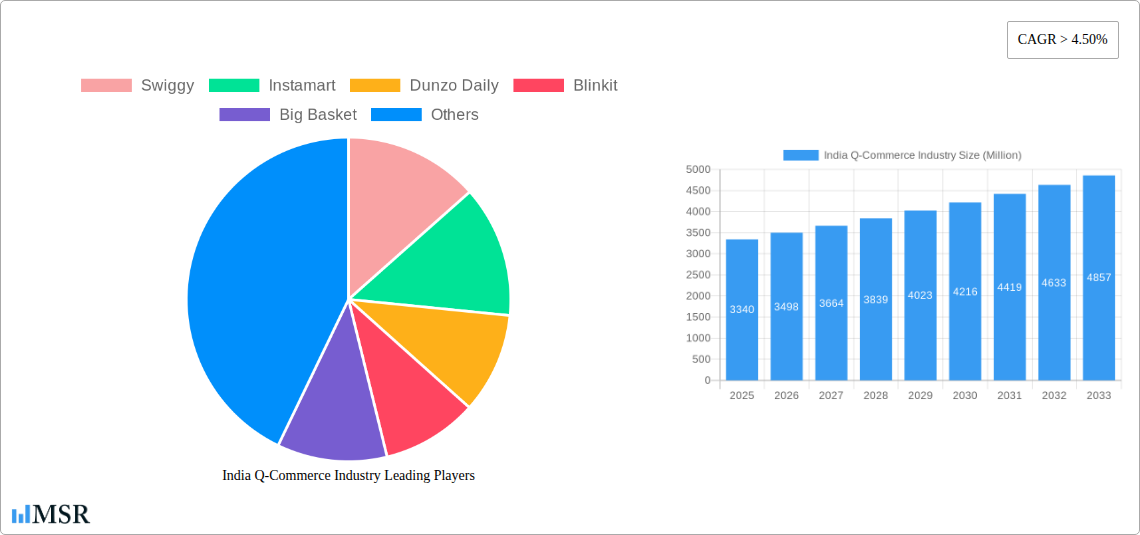

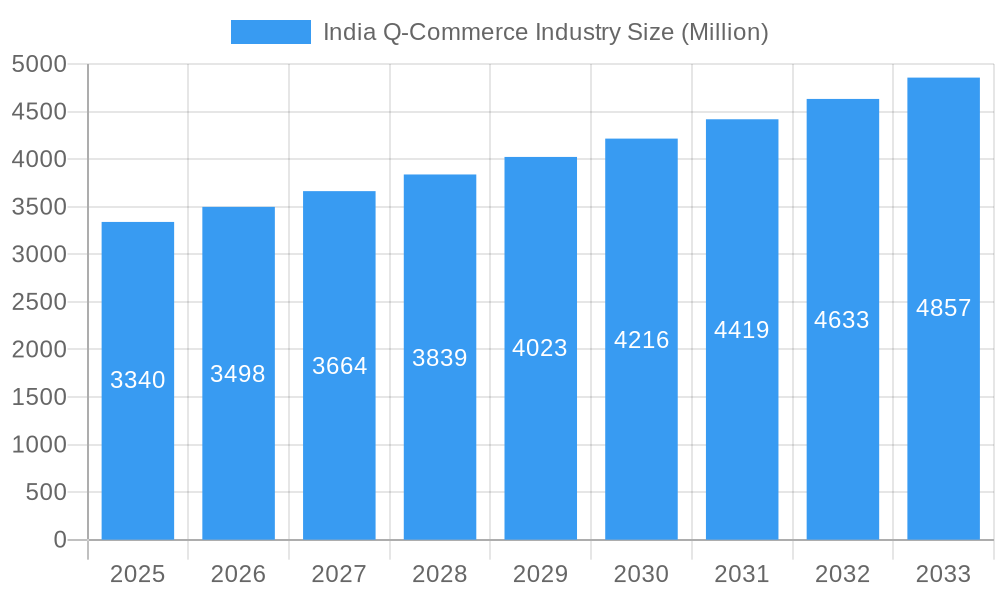

The Indian quick-commerce (Q-commerce) market, valued at $3.34 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2025 to 2033. This explosive growth is fueled by several key drivers. Rising smartphone penetration and internet access, particularly in urban areas, are creating a large pool of potential customers accustomed to on-demand services. Changing consumer lifestyles and preferences, characterized by a growing preference for convenience and speed, are further boosting demand. Aggressive marketing campaigns by major players, coupled with attractive discounts and promotions, have played a significant role in driving market penetration. Furthermore, the increasing adoption of advanced technologies like hyperlocal delivery networks and sophisticated inventory management systems is enabling faster and more efficient deliveries, enhancing the overall customer experience.

India Q-Commerce Industry Market Size (In Billion)

However, the Q-commerce sector faces challenges. Profitability remains a concern for many players, due to high operating costs related to logistics, warehousing, and last-mile delivery. Competition is fierce, with numerous established players and new entrants vying for market share, leading to price wars and pressure on margins. Sustaining consistent delivery speeds, particularly during peak hours, while maintaining high levels of order accuracy, presents a logistical hurdle. Regulatory changes and evolving consumer expectations also necessitate ongoing adaptation and investment. Despite these challenges, the long-term growth outlook remains positive, given India's expanding middle class, increasing urbanization, and the ongoing evolution of the e-commerce landscape. The market is expected to see further consolidation as players optimize operations and focus on sustainable business models.

India Q-Commerce Industry Company Market Share

India Q-Commerce Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Q-commerce industry, offering invaluable insights for investors, stakeholders, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The report covers key players like Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, and Zomato (list not exhaustive), examining market dynamics, competitive landscapes, and future potential.

India Q-Commerce Industry Market Concentration & Dynamics

This section analyzes the competitive landscape of the Indian Q-commerce market, examining market concentration, innovation, regulatory aspects, and key market activities.

The Indian Q-commerce market is characterized by intense competition, with a few major players holding significant market share. While precise market share data for each player fluctuates rapidly, Swiggy, Blinkit, and Zepto are estimated to hold a combined market share of approximately xx%. The market demonstrates high dynamism, with frequent mergers and acquisitions (M&A). The historical period (2019-2024) witnessed approximately xx M&A deals, indicating significant consolidation and investment in the sector.

- Market Concentration: Oligopolistic, with a few dominant players.

- Innovation Ecosystems: Rapid innovation in areas like technology, logistics, and customer experience.

- Regulatory Frameworks: Evolving regulatory landscape impacting delivery operations and data privacy.

- Substitute Products: Traditional grocery stores and online retailers pose some competition.

- End-User Trends: Increasing preference for convenience, speed, and wider selection driving growth.

- M&A Activities: High level of M&A activity, reflecting strong investor interest and consolidation trends.

India Q-Commerce Industry Industry Insights & Trends

The Indian Q-commerce market exhibits robust growth, driven by a confluence of factors including rising smartphone penetration, increasing internet connectivity, and changing consumer preferences. The market size in 2025 is estimated at $xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fuelled by several key market drivers:

- Technological Disruptions: Advancements in mobile technology, logistics optimization, and AI-powered delivery systems are revolutionizing the sector.

- Evolving Consumer Behaviors: Consumers increasingly favor the convenience and speed offered by Q-commerce platforms, especially in urban areas.

- Market Growth Drivers: Rising disposable incomes, expanding middle class, and increasing urbanization contribute significantly.

Key Markets & Segments Leading India Q-Commerce Industry

The dominant segment within the India Q-commerce industry is grocery delivery, accounting for approximately xx% of the total market value in 2025. Tier 1 and Tier 2 cities are the primary growth engines, driven by higher internet penetration and disposable incomes.

- Drivers of Dominance:

- Economic Growth: Rapid economic growth in urban centers fuels higher consumer spending.

- Infrastructure: Improved infrastructure, including transportation networks, supports efficient delivery.

- Technological Advancements: Improved technology facilitates seamless ordering and delivery processes.

India Q-Commerce Industry Product Developments

Significant product innovations are shaping the Q-commerce landscape. Dark stores are becoming prevalent, optimizing delivery times, while technology like AI-powered inventory management and predictive analytics improves efficiency. Companies are also focusing on expanding product categories beyond groceries, introducing curated selections and personalized experiences to enhance customer loyalty and drive sales. This constant innovation is crucial for maintaining a competitive edge in a rapidly evolving market.

Challenges in the India Q-Commerce Industry Market

The industry faces challenges, including regulatory uncertainties, high logistics costs, and intense competition. Maintaining profitability amid fierce price wars and fluctuating fuel costs presents significant operational hurdles. The need for robust supply chain management and efficient last-mile delivery further complicates operations. These factors collectively impact the industry’s overall growth trajectory.

Forces Driving India Q-Commerce Industry Growth

Key growth drivers include rising smartphone penetration, increasing internet adoption, favorable demographics, and government initiatives supporting digital commerce. Technological advancements, such as AI-powered delivery optimization, are also crucial for enhancing efficiency and profitability. Furthermore, the expanding middle class and increasing disposable incomes significantly fuel the market's expansion.

Long-Term Growth Catalysts in the India Q-Commerce Industry

Long-term growth hinges on strategic partnerships, technological innovation, and expansion into new markets. Investing in advanced technologies like drone delivery and autonomous vehicles can significantly reduce costs and enhance delivery speeds. Expanding into underserved regions and exploring new product categories will unlock further growth potential.

Emerging Opportunities in India Q-Commerce Industry

Emerging opportunities include the expansion into smaller towns and cities, the integration of AR/VR technologies for enhanced shopping experiences, and the introduction of subscription models for regular deliveries. Hyperlocal delivery services focusing on niche products and personalized offerings are also poised for significant growth.

Leading Players in the India Q-Commerce Industry Sector

- Swiggy

- Instamart

- Dunzo Daily

- Blinkit

- Big Basket

- Zepto

- Grofers

- Flipkart Quick

- Supr Daily

- Zomato

Key Milestones in India Q-Commerce Industry Industry

- February 2023: Zomato launched Zomato Instant, a quick commerce delivery service focusing on affordable home-style food.

- December 2023: Walmart's acquisition of Flipkart marked a significant entry into the Indian Q-commerce market, launching services in 20 cities.

Strategic Outlook for India Q-Commerce Industry Market

The future of the Indian Q-commerce market is bright, driven by sustained technological advancements, expanding consumer base, and strategic partnerships. Companies that prioritize efficient logistics, innovative product offerings, and data-driven decision-making will be best positioned to capitalize on the significant growth opportunities. The market is poised for substantial expansion, presenting lucrative opportunities for investors and industry players alike.

India Q-Commerce Industry Segmentation

-

1. Product Type

- 1.1. Groceries

- 1.2. Personal Care

- 1.3. Fresh Food

- 1.4. Other Product Types

-

2. Company Type

- 2.1. Pureplay

- 2.2. Non-pureplay

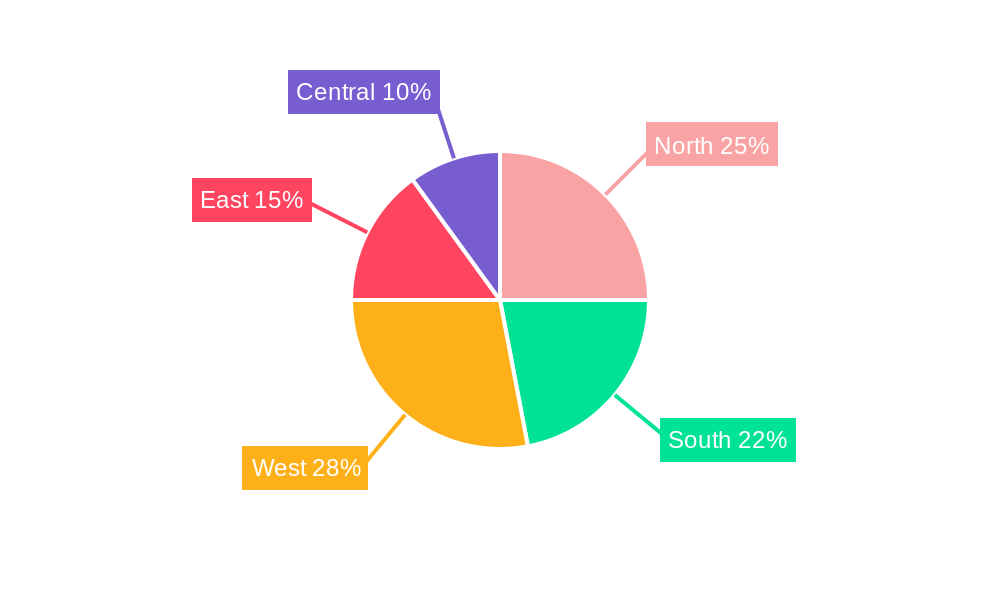

India Q-Commerce Industry Segmentation By Geography

- 1. India

India Q-Commerce Industry Regional Market Share

Geographic Coverage of India Q-Commerce Industry

India Q-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.4. Market Trends

- 3.4.1. Rising Entry of Startups into the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Q-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Groceries

- 5.1.2. Personal Care

- 5.1.3. Fresh Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Company Type

- 5.2.1. Pureplay

- 5.2.2. Non-pureplay

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiggy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Instamart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dunzo Daily

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blinkit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Big Basket

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zepto

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grofers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flipkart Quick

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supr Daily

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zomato**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Swiggy

List of Figures

- Figure 1: India Q-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Q-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 4: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 5: India Q-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Q-Commerce Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 10: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 11: India Q-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Q-Commerce Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Q-Commerce Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the India Q-Commerce Industry?

Key companies in the market include Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, Zomato**List Not Exhaustive.

3. What are the main segments of the India Q-Commerce Industry?

The market segments include Product Type, Company Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

6. What are the notable trends driving market growth?

Rising Entry of Startups into the Market.

7. Are there any restraints impacting market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Zomato launched a quick commerce delivery service known as Zomato Instant. The aim is to provide customers with home-style cooked food at affordable prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Q-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Q-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Q-Commerce Industry?

To stay informed about further developments, trends, and reports in the India Q-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence