Key Insights

The India thermic fluid market, projected to expand at a 3% CAGR, is driven by robust industrial expansion and increasing adoption across various sectors including petrochemicals, power generation, and manufacturing. This growth is supported by the demand for efficient heat transfer solutions and the push for energy efficiency through advanced thermic fluids with improved thermal properties and reduced environmental impact. Key players such as Bharat Petroleum Corporation Limited, Indian Oil Corporation Ltd, and Shell plc are prominent in the competitive landscape. Challenges include raw material price volatility and supply chain disruptions. Nonetheless, sustained industrial growth and technological advancements in thermic fluid formulations ensure a positive long-term outlook. The market is segmented by fluid type (synthetic, mineral), application (heating, cooling), and region, with significant growth potential in emerging industrial hubs.

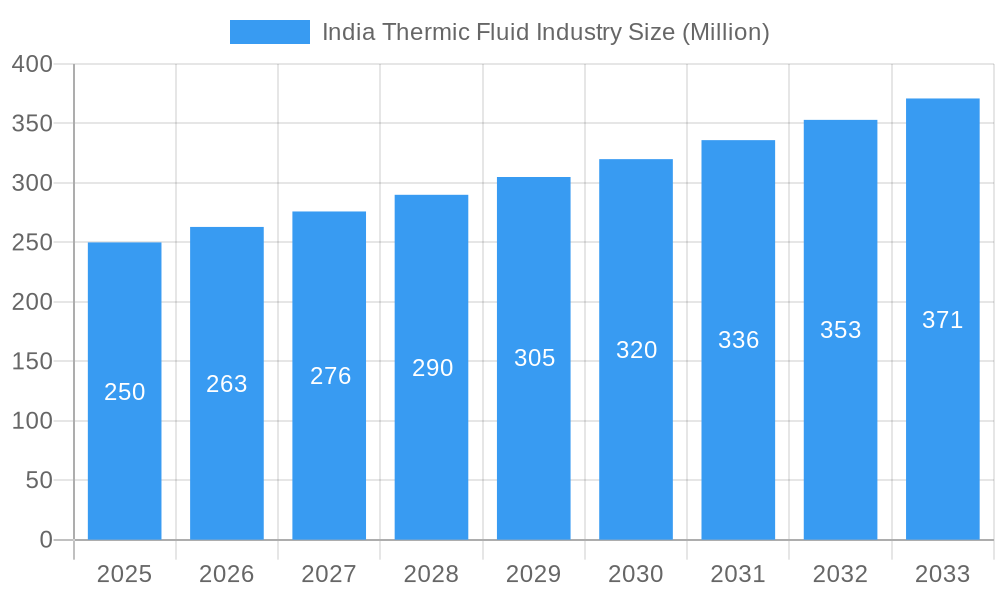

India Thermic Fluid Industry Market Size (In Billion)

The market size is estimated at 11.8 billion in the base year of 2025. This projection reflects continued positive momentum, fueled by infrastructure development investments and a burgeoning manufacturing sector. The forecast period of 2025-2033 indicates sustained growth, influenced by advanced technology adoption and optimized industrial processes. The synthetic thermic fluid segment is expected to lead this expansion due to its superior performance over mineral-based alternatives.

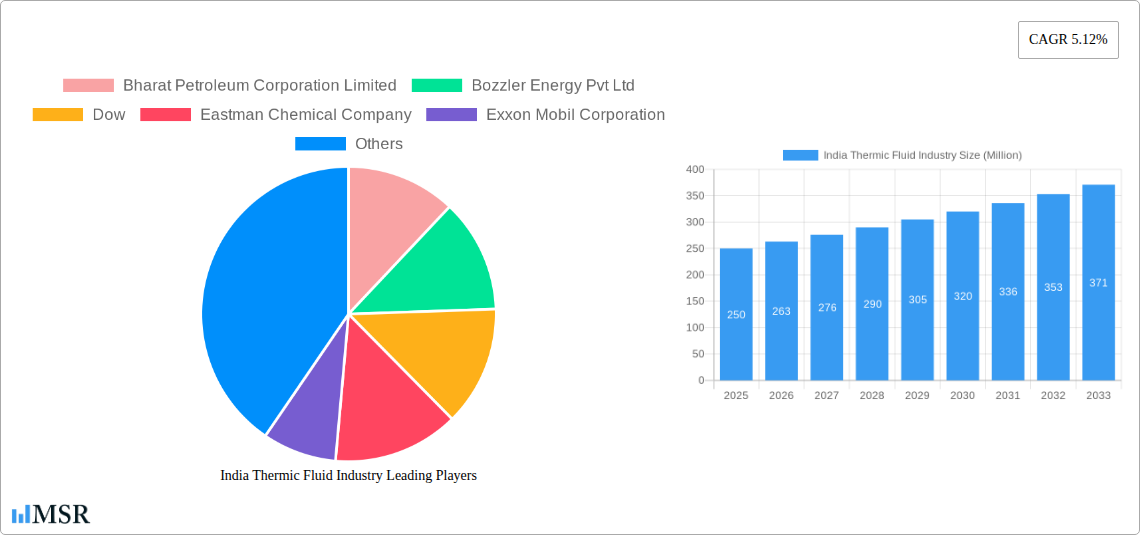

India Thermic Fluid Industry Company Market Share

India Thermic Fluid Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the India thermic fluid industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and emerging opportunities. Expect detailed analysis of market size (in Millions), CAGR, market share, and key industry developments.

India Thermic Fluid Industry Market Concentration & Dynamics

The India thermic fluid market exhibits a moderately concentrated landscape, with key players such as Bharat Petroleum Corporation Limited, Dow, Exxon Mobil Corporation, Shell plc, and Indian Oil Corporation Ltd holding significant market share. The exact market share distribution for 2024 is currently unavailable (xx%), but analysis suggests a dynamic shift towards consolidation driven by mergers and acquisitions (M&A) activities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share (2024).

- Innovation Ecosystem: A growing ecosystem driven by both domestic and multinational companies investing in R&D for sustainable and high-performance thermic fluids.

- Regulatory Framework: The regulatory landscape is evolving, with a focus on environmental regulations and safety standards impacting product formulations and manufacturing processes.

- Substitute Products: Competition exists from alternative heat transfer fluids, but thermic fluids maintain a strong position due to their superior performance in specific applications.

- End-User Trends: Growing demand from diverse sectors like power generation, chemical processing, and manufacturing is driving market expansion.

- M&A Activities: A moderate level of M&A activity has been observed in the historical period (2019-2024), with xx deals recorded, primarily aimed at expanding market reach and product portfolios.

India Thermic Fluid Industry Industry Insights & Trends

The Indian thermic fluid market is witnessing robust growth, driven by the nation's expanding industrial sector and increasing investments in infrastructure projects. The market size in 2024 is estimated at INR xx Million, exhibiting a CAGR of xx% during the historical period (2019-2024). This growth is fueled by rising demand across various end-use industries. Technological advancements, such as the development of eco-friendly thermic fluids and improved heat transfer technologies, are further propelling market expansion. Changing consumer preferences towards sustainable and high-efficiency solutions are also playing a significant role. The forecast period (2025-2033) anticipates continued growth, reaching an estimated market size of INR xx Million by 2033, driven by factors including rising industrial output, government initiatives supporting infrastructure development, and the adoption of sustainable technologies.

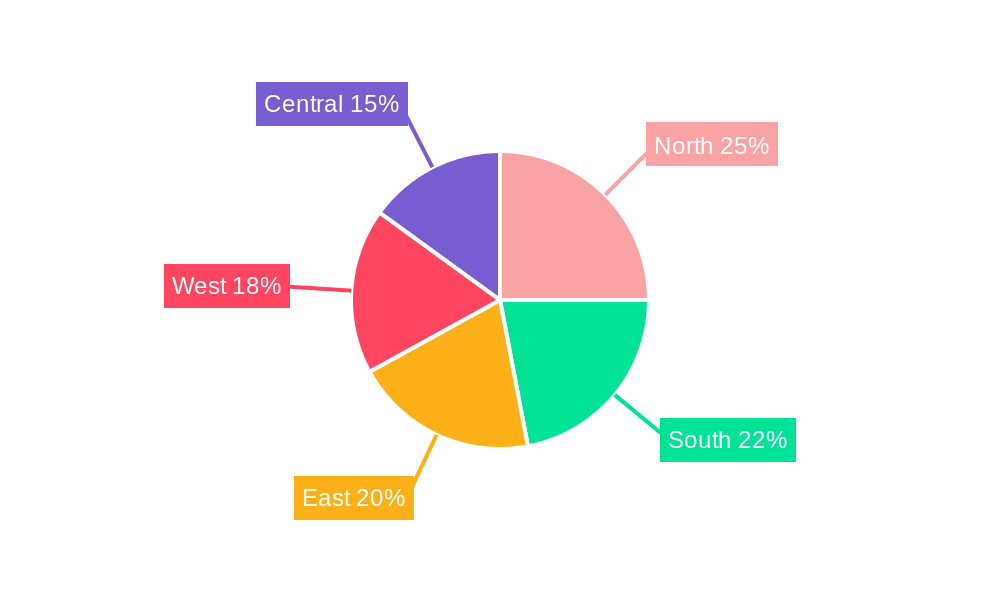

Key Markets & Segments Leading India Thermic Fluid Industry

The Indian thermic fluid market is geographically diverse, with significant demand across various regions. However, the Western and Southern regions currently dominate due to the high concentration of industrial activity and infrastructure projects. The industrial sector (including manufacturing, power generation, and chemical processing) remains the leading end-use segment, fueled by growing industrial capacity and expansion plans.

- Regional Drivers:

- Western Region: High industrial concentration, robust infrastructure development, and favorable government policies.

- Southern Region: Rapid industrialization, expanding manufacturing base, and investments in power generation.

- Segmental Drivers:

- Industrial Sector: Continuous growth in manufacturing, power generation, and chemical processing driving consistent demand.

- Other sectors: Emerging applications in other sectors present significant growth opportunities.

India Thermic Fluid Industry Product Developments

Recent years have witnessed significant product innovations in the Indian thermic fluid market. Companies are focusing on developing environmentally friendly, high-performance thermic fluids with improved heat transfer capabilities and extended lifespans. This includes the introduction of biodegradable and sustainable formulations, addressing environmental concerns and meeting stricter regulatory requirements. These advancements are enhancing product competitiveness and expanding application possibilities across diverse industries.

Challenges in the India Thermic Fluid Industry Market

The Indian thermic fluid market faces several challenges, including stringent environmental regulations, increasing raw material costs, and intense competition from both domestic and international players. Supply chain disruptions and fluctuating crude oil prices also pose significant challenges. These factors impact profitability and require companies to adopt efficient strategies to mitigate risks and maintain competitiveness. The impact of these challenges on the market size is estimated to be approximately xx% (predicted).

Forces Driving India Thermic Fluid Industry Growth

Several key factors are driving the growth of the Indian thermic fluid market. These include the government's focus on infrastructure development, rising industrial production, and increased investments in renewable energy sources. The growing adoption of advanced technologies, particularly in manufacturing and power generation, is also creating new opportunities. Furthermore, favorable government policies supporting industrial growth and environmental sustainability are fostering market expansion.

Long-Term Growth Catalysts in the India Thermic Fluid Industry

Long-term growth in the Indian thermic fluid industry will be driven by continued innovation in product formulations, strategic partnerships between domestic and international players, and expansion into new and emerging markets. The development of more sustainable and efficient thermic fluids, along with advancements in heat transfer technologies, will play a crucial role in shaping future market dynamics. Strategic alliances and collaborations will also contribute significantly to accelerating market growth and technological advancements.

Emerging Opportunities in India Thermic Fluid Industry

Emerging opportunities in the Indian thermic fluid market include the growing demand for electric vehicle battery coolants, the increasing adoption of renewable energy technologies, and the rising need for energy-efficient solutions across diverse industrial sectors. The development of customized thermic fluids for specific applications will also present new growth avenues. Expanding into underserved markets and leveraging digital technologies to optimize supply chains and enhance customer engagement will further shape future opportunities.

Leading Players in the India Thermic Fluid Industry Sector

- Bharat Petroleum Corporation Limited

- Bozzler Energy Pvt Ltd

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- GS Caltex India

- Hitech Solution (Generation Four Engitech Ltd)

- HP Lubricants

- Indian Oil Corporation Ltd

- Paras Lubricants Ltd

- Shell plc

- Savita Oil Technologies Limited

- Tide Water Oil Co (India) Ltd

- *List Not Exhaustive

Key Milestones in India Thermic Fluid Industry Industry

- September 2022: Bozzler Energy Pvt Ltd showcased new thermic fluid heater designs at Boiler India 2022, emphasizing environmental friendliness. This highlights the growing focus on sustainable solutions within the industry.

- August 2022: Shell Lubricants announced the launch of electric vehicle battery coolants in India, indicating the expanding application of thermic fluids in the burgeoning EV market. This signifies a significant market diversification for existing players.

Strategic Outlook for India Thermic Fluid Industry Market

The Indian thermic fluid market presents significant growth potential over the forecast period (2025-2033). Strategic opportunities exist for companies focusing on innovation, sustainable product development, and expansion into new market segments. Collaboration with government agencies and participation in industry initiatives promoting sustainable development will provide a competitive edge. Capitalizing on the increasing demand for energy-efficient and environmentally friendly solutions will be key to achieving sustained growth and profitability.

India Thermic Fluid Industry Segmentation

-

1. Type

- 1.1. Mineral Oil

- 1.2. Silicon And Aromatics

- 1.3. Glycols

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Chemicals

- 2.3. Pharmaceuticals

- 2.4. Oil and Gas

- 2.5. Concentrated Solar Power

- 2.6. Other End-user Industries

India Thermic Fluid Industry Segmentation By Geography

- 1. India

India Thermic Fluid Industry Regional Market Share

Geographic Coverage of India Thermic Fluid Industry

India Thermic Fluid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.3. Market Restrains

- 3.3.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.4. Market Trends

- 3.4.1. Rising Demand for Mineral Oil Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Thermic Fluid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mineral Oil

- 5.1.2. Silicon And Aromatics

- 5.1.3. Glycols

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Chemicals

- 5.2.3. Pharmaceuticals

- 5.2.4. Oil and Gas

- 5.2.5. Concentrated Solar Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bharat Petroleum Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bozzler Energy Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eastman Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exxon Mobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Caltex India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitech Solution (Generation Four Engitech Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HP Lubricants

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indian Oil Corporation Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Paras Lubricants Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shell plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savita Oil Technologies Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tide Water Oil Co (India) Ltd *List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Bharat Petroleum Corporation Limited

List of Figures

- Figure 1: India Thermic Fluid Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Thermic Fluid Industry Share (%) by Company 2025

List of Tables

- Table 1: India Thermic Fluid Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Thermic Fluid Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: India Thermic Fluid Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Thermic Fluid Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: India Thermic Fluid Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Thermic Fluid Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Thermic Fluid Industry?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the India Thermic Fluid Industry?

Key companies in the market include Bharat Petroleum Corporation Limited, Bozzler Energy Pvt Ltd, Dow, Eastman Chemical Company, Exxon Mobil Corporation, GS Caltex India, Hitech Solution (Generation Four Engitech Ltd), HP Lubricants, Indian Oil Corporation Ltd, Paras Lubricants Ltd, Shell plc, Savita Oil Technologies Limited, Tide Water Oil Co (India) Ltd *List Not Exhaustive.

3. What are the main segments of the India Thermic Fluid Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

6. What are the notable trends driving market growth?

Rising Demand for Mineral Oil Segment.

7. Are there any restraints impacting market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

8. Can you provide examples of recent developments in the market?

September 2022: Bozzler Energy Pvt Ltd announced that the company would be showcasing its new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition organized by Orangebeak Technologies, which was to be held at CIDCO Exhibition Centre, Navi Mumbai. The new designs are expected to be highly suitable for environmental health and eco-friendly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Thermic Fluid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Thermic Fluid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Thermic Fluid Industry?

To stay informed about further developments, trends, and reports in the India Thermic Fluid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence