Key Insights

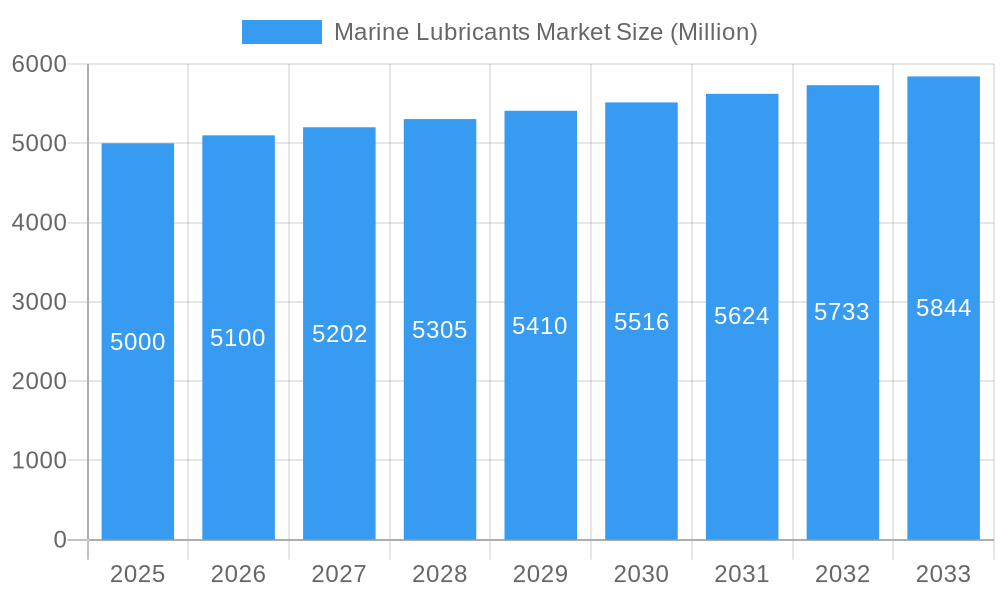

The global marine lubricants market is projected to reach approximately 6.2 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 1.5% from the base year 2025. This growth is propelled by escalating global maritime trade, stringent environmental regulations mandating eco-friendly lubricant adoption, and the increasing need for high-performance lubricants to boost engine efficiency and reduce operational expenses. The market is segmented by lubricant type (engine oils, gear oils), application (two-stroke engines, four-stroke engines), and vessel type (tankers, container ships). Key industry leaders, including ADNOC Distribution, BP PLC (Castrol), Chevron Corporation, and Shell PLC, are at the forefront of developing and supplying advanced marine lubricants, fostering innovation and market competition.

Marine Lubricants Market Market Size (In Billion)

Challenges within the market include the impact of volatile crude oil prices on production costs and profitability. Furthermore, the emergence of alternative fuels and propulsion systems, such as LNG and hybrid technologies, presents both opportunities and hurdles, requiring novel lubricant formulations. The dynamic regulatory environment, particularly concerning sulfur content and environmental emissions, necessitates ongoing innovation in lubricant development to meet international standards. Despite these challenges, the marine lubricants market anticipates sustained growth, driven by continuous expansion in global shipping and persistent demand for efficient and sustainable lubrication solutions. Regional market expansion will be shaped by trade patterns, economic development, and localized environmental regulations.

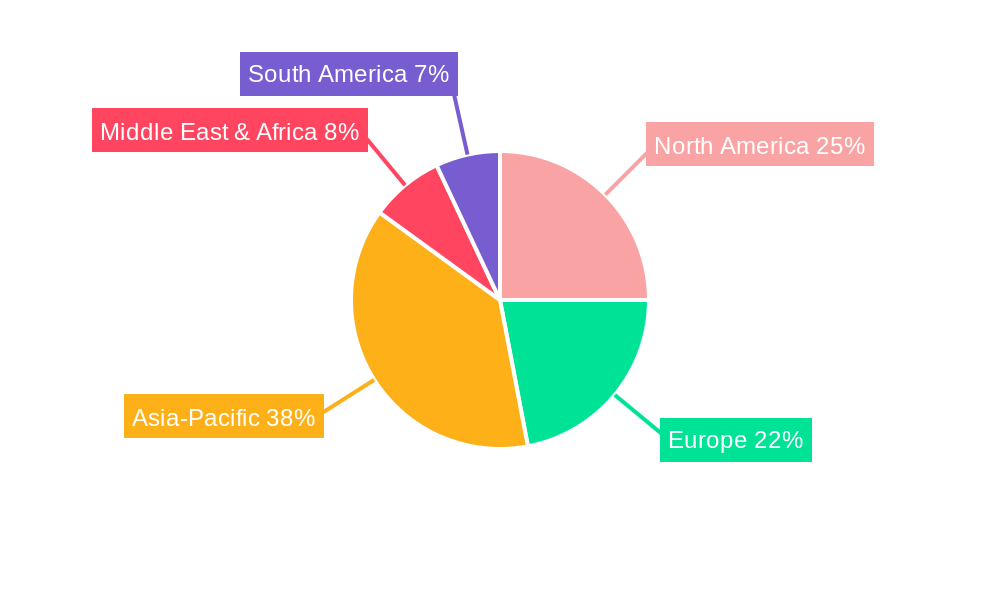

Marine Lubricants Market Company Market Share

Marine Lubricants Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global Marine Lubricants Market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key trends, and future opportunities within this crucial sector. The report incorporates extensive data and analysis, providing actionable intelligence for strategic decision-making. Download now to gain a competitive edge!

Marine Lubricants Market Concentration & Dynamics

The Marine Lubricants market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. These include ADNOC Distribution, BP PLC (Castrol), Chevron Corporation, China Petrochemical Corporation (SINOPEC), ENEOS Corporation, Exxon Mobil Corporation, FUCHS, Gazprom Neft PJSC, Gulf Oil International Ltd, Idemitsu Kosan Co Ltd, Indian Oil Corporation Ltd, LUKOIL, Shell PLC, and Total Energies SE. However, the market also accommodates numerous smaller, specialized players, particularly in niche segments. The market share of the top 5 players is estimated at xx%.

Innovation Ecosystems: The market is characterized by ongoing innovation in lubricant formulations, driven by stricter environmental regulations and the need for improved engine efficiency. This includes the development of bio-based lubricants and lubricants optimized for alternative fuels like LNG and methanol.

Regulatory Frameworks: International Maritime Organization (IMO) regulations concerning sulfur content in marine fuels significantly impact lubricant formulations and demand. Compliance requirements drive innovation and influence market trends.

Substitute Products: While few direct substitutes exist for marine lubricants, alternative technologies, such as improved engine designs focusing on fuel efficiency, pose indirect competitive pressures.

End-User Trends: Growing global shipping volumes and the increasing adoption of advanced engine technologies are key drivers of market growth. The demand for high-performance, environmentally friendly lubricants is also increasing.

M&A Activities: The number of mergers and acquisitions in the marine lubricants sector has remained relatively stable in recent years, with approximately xx M&A deals recorded between 2019 and 2024. These activities often focus on expanding geographical reach or integrating complementary technologies.

Marine Lubricants Market Industry Insights & Trends

The global marine lubricants market is experiencing robust growth, driven by a confluence of factors. The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) projected at xx% from 2025 to 2033. This growth is fueled by several key drivers:

Increasing Global Shipping Activity: The continuous expansion of global trade and commerce directly translates into higher demand for marine transportation, thereby driving up lubricant consumption.

Stringent Environmental Regulations: The IMO's stricter emission standards necessitate the use of advanced, low-sulfur lubricants, stimulating market growth in this segment.

Technological Advancements: Innovations in engine technology and the adoption of alternative fuels, such as LNG and methanol, are generating demand for specialized marine lubricants.

Economic Growth in Emerging Markets: Expanding economies in developing regions are contributing to increased maritime trade and consequently higher lubricant demand.

Key Markets & Segments Leading Marine Lubricants Market

The Asia-Pacific region currently dominates the marine lubricants market, driven by robust economic growth, expanding port infrastructure, and a significant concentration of shipping activities.

Drivers of Dominance in Asia-Pacific:

- Rapid Economic Growth: Sustained economic expansion in countries like China and India fuels high demand for maritime transportation.

- Extensive Shipping Networks: The region boasts a large and well-established network of ports and shipping routes.

- Government Initiatives: Supportive government policies promoting maritime trade further bolster market growth.

While the Asia-Pacific region holds a leading position, other regions such as Europe and North America also contribute substantially to the market, though at a smaller scale. The detailed market share analysis of each region will be elaborated in the complete report.

Marine Lubricants Market Product Developments

Recent product innovations include the development of environmentally friendly bio-based lubricants and specialized oils optimized for alternative fuels such as LNG and methanol. Castrol's launch of Cyltech 40 XDC in March 2023, a marine cylinder oil designed for both traditional and cleaner fuels, exemplifies this trend. These advancements not only enhance engine performance and reliability but also contribute to the marine industry's environmental sustainability goals, giving manufacturers a significant competitive advantage.

Challenges in the Marine Lubricants Market Market

The marine lubricants market faces several challenges, including fluctuating crude oil prices, which directly impact production costs and pricing strategies. Supply chain disruptions and intense competition from established and emerging players also present significant obstacles. Stricter environmental regulations, while driving innovation, also increase the cost of compliance for manufacturers. These challenges collectively impact profitability and market expansion.

Forces Driving Marine Lubricants Market Growth

Several key factors are accelerating growth in the marine lubricants market. These include the robust global trade growth, which requires more ships and hence lubricants; stricter environmental regulations, pushing demand for specialized, eco-friendly products; and continuous technological advancements leading to higher-performance engine oils. The increasing adoption of alternative fuels in shipping also creates opportunities for manufacturers specializing in these segments.

Long-Term Growth Catalysts in Marine Lubricants Market

Long-term growth hinges on strategic partnerships between lubricant manufacturers and shipping companies, fostering the development and adoption of new technologies. This includes further research into bio-based and sustainable lubricants, exploring alternative fuel options beyond LNG and methanol, and expanding into emerging markets where infrastructure development is underway.

Emerging Opportunities in Marine Lubricants Market

Emerging opportunities lie in the development of lubricants tailored for next-generation fuels and engines. The expanding adoption of digital technologies in shipping operations, including predictive maintenance, also creates opportunities for lubricant manufacturers to offer value-added services. Furthermore, focusing on sustainability and offering solutions that adhere to and exceed stringent environmental regulations presents significant potential for market expansion.

Leading Players in the Marine Lubricants Market Sector

- ADNOC Distribution

- BP PLC (Castrol)

- Chevron Corporation

- China Petrochemical Corporation (SINOPEC)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International Ltd

- Idemitsu Kosan Co Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- Shell PLC

- Total Energies SE

- List Not Exhaustive

Key Milestones in Marine Lubricants Market Industry

- April 2024: AD Ports Group partners with ADNOC Distribution to expand global marine lubricant distribution.

- March 2023: Castrol launches Castrol Cyltech 40 XDC, a marine cylinder oil for LNG, methanol, and traditional fuels.

- February 2023: Luberef expands its base oil plant in Yanbu, Saudi Arabia, increasing capacity by 230,000 metric tons annually.

Strategic Outlook for Marine Lubricants Market Market

The marine lubricants market holds significant long-term growth potential, driven by the continuous expansion of global trade and the increasing emphasis on environmental sustainability. Strategic opportunities for manufacturers lie in developing innovative, eco-friendly lubricants that meet and exceed evolving regulatory standards, forging strong partnerships with key industry players, and capitalizing on the growing demand for specialized lubricants in emerging markets. Early adoption of advanced technologies and proactive adaptation to changing market dynamics will be crucial for sustained success in this sector.

Marine Lubricants Market Segmentation

-

1. Lubricant Type

- 1.1. System Oil

- 1.2. Marine Cylinder Lubricant

- 1.3. Trunk Piston Engine Oil

- 1.4. Other Lubricant Types

-

2. Ship Type

- 2.1. Bulker

- 2.2. Tanker

- 2.3. Container

- 2.4. Other Ship Types

Marine Lubricants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Marine Lubricants Market Regional Market Share

Geographic Coverage of Marine Lubricants Market

Marine Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers

- 3.4. Market Trends

- 3.4.1. Marine Cylinder Lubricant Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 5.1.1. System Oil

- 5.1.2. Marine Cylinder Lubricant

- 5.1.3. Trunk Piston Engine Oil

- 5.1.4. Other Lubricant Types

- 5.2. Market Analysis, Insights and Forecast - by Ship Type

- 5.2.1. Bulker

- 5.2.2. Tanker

- 5.2.3. Container

- 5.2.4. Other Ship Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 6. Asia Pacific Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 6.1.1. System Oil

- 6.1.2. Marine Cylinder Lubricant

- 6.1.3. Trunk Piston Engine Oil

- 6.1.4. Other Lubricant Types

- 6.2. Market Analysis, Insights and Forecast - by Ship Type

- 6.2.1. Bulker

- 6.2.2. Tanker

- 6.2.3. Container

- 6.2.4. Other Ship Types

- 6.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 7. North America Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 7.1.1. System Oil

- 7.1.2. Marine Cylinder Lubricant

- 7.1.3. Trunk Piston Engine Oil

- 7.1.4. Other Lubricant Types

- 7.2. Market Analysis, Insights and Forecast - by Ship Type

- 7.2.1. Bulker

- 7.2.2. Tanker

- 7.2.3. Container

- 7.2.4. Other Ship Types

- 7.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 8. Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 8.1.1. System Oil

- 8.1.2. Marine Cylinder Lubricant

- 8.1.3. Trunk Piston Engine Oil

- 8.1.4. Other Lubricant Types

- 8.2. Market Analysis, Insights and Forecast - by Ship Type

- 8.2.1. Bulker

- 8.2.2. Tanker

- 8.2.3. Container

- 8.2.4. Other Ship Types

- 8.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 9. South America Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 9.1.1. System Oil

- 9.1.2. Marine Cylinder Lubricant

- 9.1.3. Trunk Piston Engine Oil

- 9.1.4. Other Lubricant Types

- 9.2. Market Analysis, Insights and Forecast - by Ship Type

- 9.2.1. Bulker

- 9.2.2. Tanker

- 9.2.3. Container

- 9.2.4. Other Ship Types

- 9.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 10. Middle East and Africa Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 10.1.1. System Oil

- 10.1.2. Marine Cylinder Lubricant

- 10.1.3. Trunk Piston Engine Oil

- 10.1.4. Other Lubricant Types

- 10.2. Market Analysis, Insights and Forecast - by Ship Type

- 10.2.1. Bulker

- 10.2.2. Tanker

- 10.2.3. Container

- 10.2.4. Other Ship Types

- 10.1. Market Analysis, Insights and Forecast - by Lubricant Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADNOC Distribution

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BP PLC (Castrol)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Petrochemical Corporation (SINOPEC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENEOS Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Exxon Mobil Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FUCHS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gazprom Neft PJSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gulf Oil International Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Idemitsu Kosan Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Indian Oil Corporation Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LUKOIL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shell PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Total Energies SE*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ADNOC Distribution

List of Figures

- Figure 1: Global Marine Lubricants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 3: Asia Pacific Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 4: Asia Pacific Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 5: Asia Pacific Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 6: Asia Pacific Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 9: North America Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 10: North America Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 11: North America Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 12: North America Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 15: Europe Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 16: Europe Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 17: Europe Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 18: Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 21: South America Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 22: South America Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 23: South America Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 24: South America Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Marine Lubricants Market Revenue (billion), by Lubricant Type 2025 & 2033

- Figure 27: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Lubricant Type 2025 & 2033

- Figure 28: Middle East and Africa Marine Lubricants Market Revenue (billion), by Ship Type 2025 & 2033

- Figure 29: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Ship Type 2025 & 2033

- Figure 30: Middle East and Africa Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 2: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 3: Global Marine Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 5: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 6: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Thailand Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 17: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 18: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 23: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 24: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: NORDIC Countries Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Turkey Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 35: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 36: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Colombia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Global Marine Lubricants Market Revenue billion Forecast, by Lubricant Type 2020 & 2033

- Table 42: Global Marine Lubricants Market Revenue billion Forecast, by Ship Type 2020 & 2033

- Table 43: Global Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Qatar Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Arab Emirates Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Egypt Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Africa Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Marine Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Lubricants Market?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the Marine Lubricants Market?

Key companies in the market include ADNOC Distribution, BP PLC (Castrol), Chevron Corporation, China Petrochemical Corporation (SINOPEC), ENEOS Corporation, Exxon Mobil Corporation, FUCHS, Gazprom Neft PJSC, Gulf Oil International Ltd, Idemitsu Kosan Co Ltd, Indian Oil Corporation Ltd, LUKOIL, Shell PLC, Total Energies SE*List Not Exhaustive.

3. What are the main segments of the Marine Lubricants Market?

The market segments include Lubricant Type, Ship Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers.

6. What are the notable trends driving market growth?

Marine Cylinder Lubricant Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Rising Demand for Marine Transport; Growing Shipbuilding Activities; Other Drivers.

8. Can you provide examples of recent developments in the market?

April 2024: AD Ports Group, a key player in global trade, logistics, and industry, revealed that its Ports Cluster was broadening its scope to include the worldwide distribution of marine lubricants. This move follows a strategic partnership formed with ADNOC Distribution, the foremost manufacturer of marine and automotive lubricants in the United Arab Emirates. As per the agreement, Ports Cluster will utilize its established connections and state-of-the-art infrastructure to distribute globally recognized lubricants to customers in the United Arab Emirates. It plans to widen this distribution network globally.March 2023: Castrol unveiled its latest offering: the marine cylinder oil, Castrol Cyltech 40 XDC (eXtra Deposit Control). This new oil is designed for LNG and methanol-fueled vessels but is equally compatible with ships utilizing traditional marine fuels. The introduction of Castrol Cyltech 40 XDC underscores Castrol's dedication to aiding the marine sector's shift toward cleaner fuels and advanced engine technologies while guaranteeing optimal engine performance and reliability.February 2023: Luberef, a subsidiary of Saudi Aramco, revealed plans to expand its base oil plant in Yanbu' al Bahr, Saudi Arabia, boosting its capacity by 230,000 metric tons annually. The project will upgrade the facility, allowing it to produce API Group III base stocks. The expansion will elevate the Yanbu plant to a size nearly matching that of the Pearl gas-to-liquids joint venture, the largest base oil plant in the Middle East.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marine Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marine Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marine Lubricants Market?

To stay informed about further developments, trends, and reports in the Marine Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence