Key Insights

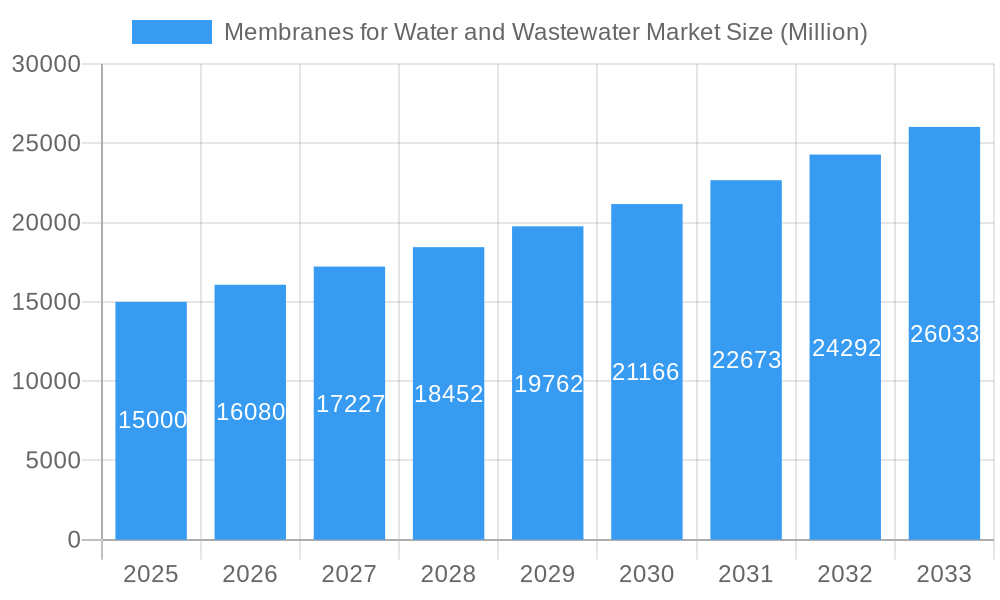

The global Membranes for Water and Wastewater market is poised for substantial expansion, with an estimated market size of 19405 million by 2033, growing at a CAGR of 7.8% from the base year 2025. This growth is primarily propelled by escalating global water scarcity and increasingly stringent environmental regulations, compelling both municipal and industrial sectors to invest in advanced water treatment solutions. The escalating demand for purified water across industries such as food and beverage, pharmaceuticals, and power generation further underpins this market surge. Technological innovations in membrane filtration, leading to more efficient and durable membrane products, are also significant contributors. Notably, the widespread adoption of Reverse Osmosis (RO) membranes for their exceptional salt rejection capabilities and the increasing utilization of Nanofiltration (NF) membranes due to their energy efficiency are key drivers. The Asia-Pacific region, led by China and India, is anticipated to lead the market, driven by rapid urbanization, industrialization, and augmented investments in water infrastructure. However, challenges such as high initial capital expenditure for membrane systems and the requirement for skilled operational personnel may temper growth. Additionally, membrane fouling and the necessity for frequent maintenance present operational constraints. Despite these hurdles, the long-term market trajectory remains optimistic, fueled by ongoing innovation and the critical global imperative for effective water treatment.

Membranes for Water and Wastewater Market Market Size (In Billion)

Market segmentation highlights significant opportunities across diverse technologies and end-user segments. Reverse Osmosis (RO) currently dominates the technology landscape, followed by Ultrafiltration (UF) and Microfiltration (MF). Within end-user industries, municipal water treatment constitutes a considerable market share, trailed by the chemicals, food and beverage, and power sectors. Expansion is projected across all segments, with the uptake of advanced membrane technologies in emerging economies expected to drive considerable growth. The competitive arena features a blend of established global corporations and specialized niche players, fostering innovation and offering a broad spectrum of solutions for varied applications. Future market expansion will be influenced by technological advancements, supportive government policies for water conservation, and a heightened awareness of sustainable water management practices.

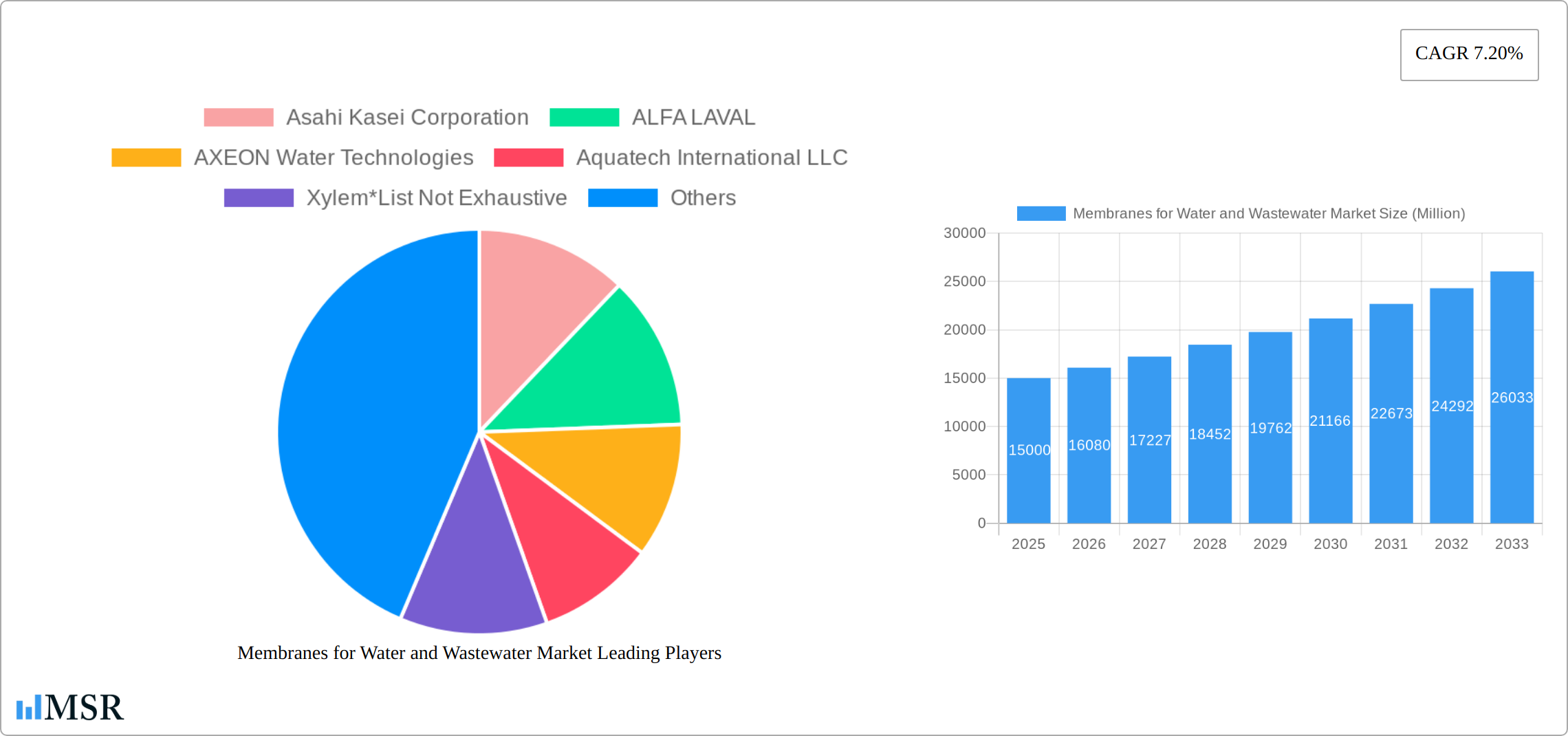

Membranes for Water and Wastewater Market Company Market Share

Membranes for Water and Wastewater Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Membranes for Water and Wastewater Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, technological advancements, key players, and future growth prospects, equipping stakeholders with actionable intelligence to navigate this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025.

Membranes for Water and Wastewater Market Market Concentration & Dynamics

The global membranes for water and wastewater market demonstrates a moderately concentrated landscape, with several major players holding significant market share. Key players like Asahi Kasei Corporation, Alfa Laval, and DuPont compete alongside specialized companies such as Koch Membrane Systems Inc. and NX Filtration BV. Market share dynamics are influenced by factors such as technological innovation, M&A activity, and regulatory changes. Innovation ecosystems are robust, driven by continuous advancements in membrane technologies and materials science. Stringent environmental regulations across various regions are crucial drivers, while substitute technologies like advanced oxidation processes pose a competitive challenge. End-user trends toward sustainable water management practices fuel market demand.

- Market Concentration: A few major players hold approximately xx% of the market share in 2025.

- M&A Activity: A significant number of mergers and acquisitions (xx in the past five years) have reshaped the market landscape. For instance, the recent acquisition of Evoqua Water Technologies by Xylem significantly expanded the latter's footprint.

- Regulatory Framework: Stringent regulations regarding water quality and discharge standards are key drivers of market growth.

- Substitute Products: Alternative technologies, such as advanced oxidation processes (AOPs) and biological treatment, present limited competition to membrane technology.

Membranes for Water and Wastewater Market Industry Insights & Trends

The global membranes for water and wastewater market is experiencing robust growth, primarily fueled by increasing industrialization, urbanization, and stringent environmental regulations. The rising demand for clean water across various end-use sectors, including municipal, industrial, and commercial applications, is a significant growth driver. Technological advancements such as the development of advanced membrane materials with enhanced efficiency and durability are further propelling market expansion. Changing consumer behaviors emphasizing sustainable practices and water conservation also contribute to market growth. The market size was valued at xx Million in 2025 and is expected to reach xx Million by 2033, with a CAGR of xx%. Technological disruptions, such as the emergence of direct nanofiltration (dNF) technology, are reshaping the market, creating new opportunities for market participants.

Key Markets & Segments Leading Membranes for Water and Wastewater Market

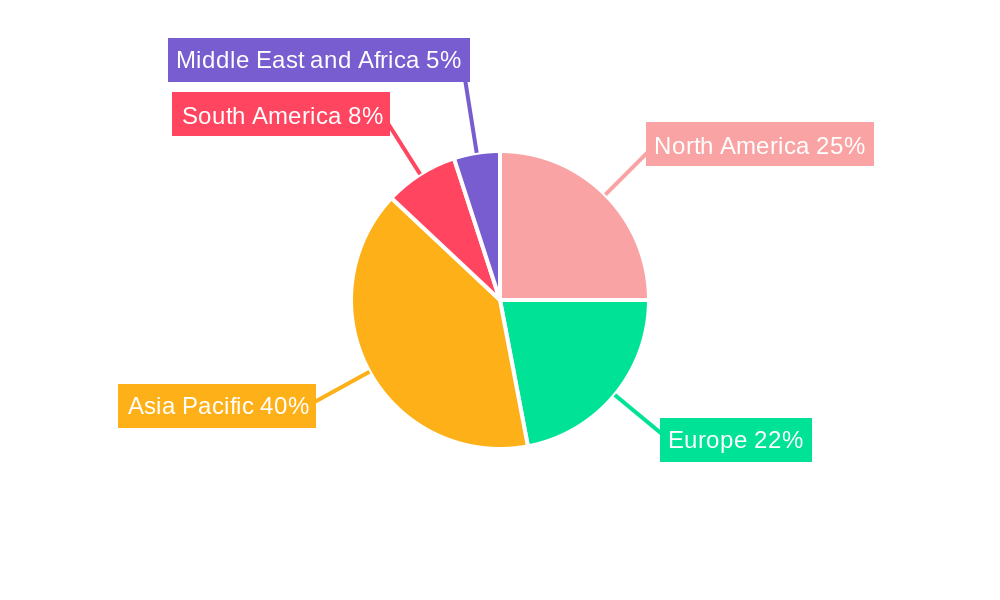

The municipal sector represents the dominant end-user industry, driven by the increasing need for safe and reliable drinking water in urban areas. Geographically, North America and Europe hold a significant market share, due to strong environmental regulations and well-established water infrastructure. However, the Asia-Pacific region is emerging as a high-growth market, fueled by rapid industrialization and urbanization.

Dominant Segments:

- Technology: Reverse Osmosis (RO) and Ultrafiltration (UF) currently dominate the market due to their established applications and maturity level.

- End-User Industry: Municipal water treatment holds the largest market share, followed by industrial applications (e.g., chemical, food & beverage, and power).

Key Drivers:

- Municipal Sector: Growing urbanization, rising population, and stringent water quality regulations drive high demand for effective water treatment.

- Industrial Sector: Stringent environmental norms and the need for water reuse/recycling across various industries drive adoption.

- Technological Advancements: Continuous innovation in membrane materials and system design improves efficiency and reduces costs.

Membranes for Water and Wastewater Market Product Developments

The membranes for water and wastewater treatment market is experiencing a period of rapid innovation. Recent advancements in membrane technology encompass the development of novel materials boasting superior performance characteristics, including significantly higher flux rates, enhanced selectivity, and dramatically improved fouling resistance. These improvements are achieved through advancements in membrane materials science and manufacturing processes. Innovative membrane designs, such as hollow fiber and spiral wound configurations, are optimizing efficiency and minimizing operational costs. Furthermore, the integration of sophisticated technologies like artificial intelligence (AI) and machine learning (ML) is revolutionizing membrane system operation, enabling predictive maintenance, real-time performance optimization, and the identification of potential issues before they impact treatment efficacy. These combined advancements deliver significant competitive advantages, leading to improved overall efficiency and substantially reduced life-cycle costs for water and wastewater treatment facilities.

Challenges in the Membranes for Water and Wastewater Market Market

The market faces challenges including high initial investment costs for membrane systems, the need for skilled labor for operation and maintenance, and potential supply chain disruptions affecting membrane material availability. Regulatory hurdles and varying environmental standards across different regions create complexity for manufacturers and operators. Furthermore, intense competition among established and emerging players puts pressure on profit margins. These factors contribute to a complex market environment that requires continuous adaptation and innovation to overcome.

Forces Driving Membranes for Water and Wastewater Market Growth

Robust market growth is fueled by a confluence of factors. Escalating government investments in modernizing water infrastructure, coupled with increasingly stringent regulations aimed at ensuring superior water quality, are key drivers. The burgeoning demand for efficient water reuse and recycling strategies further propels market expansion. Technological advancements, particularly the development of more efficient and durable membranes with extended operational lifespans, are also crucial drivers. A growing global awareness of water scarcity, its profound environmental consequences, and the urgent need for sustainable water management practices is significantly accelerating the adoption of advanced water treatment technologies, including membrane-based systems. The increasing prevalence of water contamination from industrial and agricultural sources adds further impetus to market growth.

Challenges in the Membranes for Water and Wastewater Market Market

Long-term growth will depend on sustained investments in R&D to develop advanced membrane materials with improved performance and reduced costs. Strategic partnerships between membrane manufacturers and water treatment companies will be crucial to accelerate market adoption. Expansion into emerging markets with growing water demands, particularly in developing economies, presents significant opportunities for market expansion.

Emerging Opportunities in Membranes for Water and Wastewater Market

The growing demand for desalination technologies to address water scarcity in coastal regions represents a significant market opportunity. The development of sustainable and environmentally friendly membrane materials (e.g., bio-based membranes) is gaining traction. Integration of membrane technologies with other advanced water treatment processes (e.g., AOPs) offers synergistic benefits. Furthermore, the increasing focus on digitalization and smart water management provides opportunities for the development of intelligent membrane systems with predictive maintenance capabilities.

Leading Players in the Membranes for Water and Wastewater Market Sector

- Asahi Kasei Corporation

- Alfa Laval

- Axeon Water Technologies

- Aquatech International LLC

- Xylem

- MANN+HUMMEL

- Pall Corporation (now part of Danaher Corporation)

- DuPont Water Solutions

- Koch Membrane Systems Inc.

- Toray Industries, Inc.

- Suez

- Veolia

- Toyobo Co., Ltd.

- NX Filtration BV

- Vontron Technology Co., Ltd.

Key Milestones in Membranes for Water and Wastewater Market Industry

- May 2023: Xylem's acquisition of Evoqua Water Technologies significantly expanded its market reach and product portfolio, strengthening its position in the water treatment sector.

- March 2023: NX Filtration BV's collaboration with GreenTech Environmental on a direct nanofiltration (dNF)-based water treatment plant highlighted the increasing adoption of advanced membrane technologies for sustainable water solutions.

- [Add other relevant recent milestones here with dates and brief descriptions]

Strategic Outlook for Membranes for Water and Wastewater Market Market

The membranes for water and wastewater market exhibits a highly promising long-term growth trajectory, driven by a multitude of factors. These include continuous technological innovation resulting in improved membrane performance and cost-effectiveness, heightened global environmental awareness, and the escalating demand for sustainable and resilient water management solutions. Strategic collaborations, robust investments in research and development (R&D) focused on innovative materials and processes, and expansion into rapidly developing emerging markets will be critical for companies seeking to capitalize on the substantial growth opportunities within this sector. The development of environmentally benign and economically viable membrane technologies will serve as a pivotal success factor for market players aiming to achieve sustainable and profitable growth.

Membranes for Water and Wastewater Market Segmentation

-

1. Technology

- 1.1. Microfiltration (MF)

- 1.2. Ultrafiltration (UF)

- 1.3. Nanofiltration (NF)

- 1.4. Reverse Osmosis (RO)

-

2. End-User Industry

- 2.1. Municipal

- 2.2. Pulp and Paper

- 2.3. Chemicals

- 2.4. Food and Beverage

- 2.5. Healthcare

- 2.6. Power

- 2.7. Other End-User Industries

Membranes for Water and Wastewater Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Membranes for Water and Wastewater Market Regional Market Share

Geographic Coverage of Membranes for Water and Wastewater Market

Membranes for Water and Wastewater Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Low-pressure Membrane Technologies; Increasing Water Pollution; Stringent Regulation Regarding Water Treatment

- 3.3. Market Restrains

- 3.3.1. Poor Fouling Resistance of Nano porous Membranes; Non-Compliance with Regulations by Emerging Countries

- 3.4. Market Trends

- 3.4.1. Municipal Industry to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Microfiltration (MF)

- 5.1.2. Ultrafiltration (UF)

- 5.1.3. Nanofiltration (NF)

- 5.1.4. Reverse Osmosis (RO)

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Municipal

- 5.2.2. Pulp and Paper

- 5.2.3. Chemicals

- 5.2.4. Food and Beverage

- 5.2.5. Healthcare

- 5.2.6. Power

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Asia Pacific Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Microfiltration (MF)

- 6.1.2. Ultrafiltration (UF)

- 6.1.3. Nanofiltration (NF)

- 6.1.4. Reverse Osmosis (RO)

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Municipal

- 6.2.2. Pulp and Paper

- 6.2.3. Chemicals

- 6.2.4. Food and Beverage

- 6.2.5. Healthcare

- 6.2.6. Power

- 6.2.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. North America Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Microfiltration (MF)

- 7.1.2. Ultrafiltration (UF)

- 7.1.3. Nanofiltration (NF)

- 7.1.4. Reverse Osmosis (RO)

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Municipal

- 7.2.2. Pulp and Paper

- 7.2.3. Chemicals

- 7.2.4. Food and Beverage

- 7.2.5. Healthcare

- 7.2.6. Power

- 7.2.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Europe Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Microfiltration (MF)

- 8.1.2. Ultrafiltration (UF)

- 8.1.3. Nanofiltration (NF)

- 8.1.4. Reverse Osmosis (RO)

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Municipal

- 8.2.2. Pulp and Paper

- 8.2.3. Chemicals

- 8.2.4. Food and Beverage

- 8.2.5. Healthcare

- 8.2.6. Power

- 8.2.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Microfiltration (MF)

- 9.1.2. Ultrafiltration (UF)

- 9.1.3. Nanofiltration (NF)

- 9.1.4. Reverse Osmosis (RO)

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Municipal

- 9.2.2. Pulp and Paper

- 9.2.3. Chemicals

- 9.2.4. Food and Beverage

- 9.2.5. Healthcare

- 9.2.6. Power

- 9.2.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Membranes for Water and Wastewater Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Microfiltration (MF)

- 10.1.2. Ultrafiltration (UF)

- 10.1.3. Nanofiltration (NF)

- 10.1.4. Reverse Osmosis (RO)

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Municipal

- 10.2.2. Pulp and Paper

- 10.2.3. Chemicals

- 10.2.4. Food and Beverage

- 10.2.5. Healthcare

- 10.2.6. Power

- 10.2.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Asahi Kasei Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ALFA LAVAL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AXEON Water Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aquatech International LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xylem*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MANN+HUMMEL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pall Water

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DuPont

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koch Membrane Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TORAY INDUSTRIES INC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Suez

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veolia

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TOYOBO CO LTD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NX Filtration BV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 VONTRON TECHNOLOGY CO LTD

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Asahi Kasei Corporation

List of Figures

- Figure 1: Global Membranes for Water and Wastewater Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Membranes for Water and Wastewater Market Revenue (million), by Technology 2025 & 2033

- Figure 3: Asia Pacific Membranes for Water and Wastewater Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: Asia Pacific Membranes for Water and Wastewater Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 5: Asia Pacific Membranes for Water and Wastewater Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: Asia Pacific Membranes for Water and Wastewater Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Membranes for Water and Wastewater Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Membranes for Water and Wastewater Market Revenue (million), by Technology 2025 & 2033

- Figure 9: North America Membranes for Water and Wastewater Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Membranes for Water and Wastewater Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 11: North America Membranes for Water and Wastewater Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: North America Membranes for Water and Wastewater Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Membranes for Water and Wastewater Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Membranes for Water and Wastewater Market Revenue (million), by Technology 2025 & 2033

- Figure 15: Europe Membranes for Water and Wastewater Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Europe Membranes for Water and Wastewater Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 17: Europe Membranes for Water and Wastewater Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Europe Membranes for Water and Wastewater Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Membranes for Water and Wastewater Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Membranes for Water and Wastewater Market Revenue (million), by Technology 2025 & 2033

- Figure 21: South America Membranes for Water and Wastewater Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Membranes for Water and Wastewater Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 23: South America Membranes for Water and Wastewater Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: South America Membranes for Water and Wastewater Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Membranes for Water and Wastewater Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Membranes for Water and Wastewater Market Revenue (million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Membranes for Water and Wastewater Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Membranes for Water and Wastewater Market Revenue (million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Membranes for Water and Wastewater Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Membranes for Water and Wastewater Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Membranes for Water and Wastewater Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 5: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 13: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 19: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: France Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Italy Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 27: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Technology 2020 & 2033

- Table 33: Global Membranes for Water and Wastewater Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Membranes for Water and Wastewater Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Membranes for Water and Wastewater Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Membranes for Water and Wastewater Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Membranes for Water and Wastewater Market?

Key companies in the market include Asahi Kasei Corporation, ALFA LAVAL, AXEON Water Technologies, Aquatech International LLC, Xylem*List Not Exhaustive, MANN+HUMMEL, Pall Water, DuPont, Koch Membrane Systems Inc, TORAY INDUSTRIES INC, Suez, Veolia, TOYOBO CO LTD, NX Filtration BV, VONTRON TECHNOLOGY CO LTD.

3. What are the main segments of the Membranes for Water and Wastewater Market?

The market segments include Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 19405 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Low-pressure Membrane Technologies; Increasing Water Pollution; Stringent Regulation Regarding Water Treatment.

6. What are the notable trends driving market growth?

Municipal Industry to dominate the Market.

7. Are there any restraints impacting market growth?

Poor Fouling Resistance of Nano porous Membranes; Non-Compliance with Regulations by Emerging Countries.

8. Can you provide examples of recent developments in the market?

May 2023: Xylem completed the acquisition of Evoqua Water Technologies LLC, which is a global provider of various products and technologies for water and wastewater treatment. Through this acquisition, Xylem aims to expand its global reach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Membranes for Water and Wastewater Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Membranes for Water and Wastewater Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Membranes for Water and Wastewater Market?

To stay informed about further developments, trends, and reports in the Membranes for Water and Wastewater Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence