Key Insights

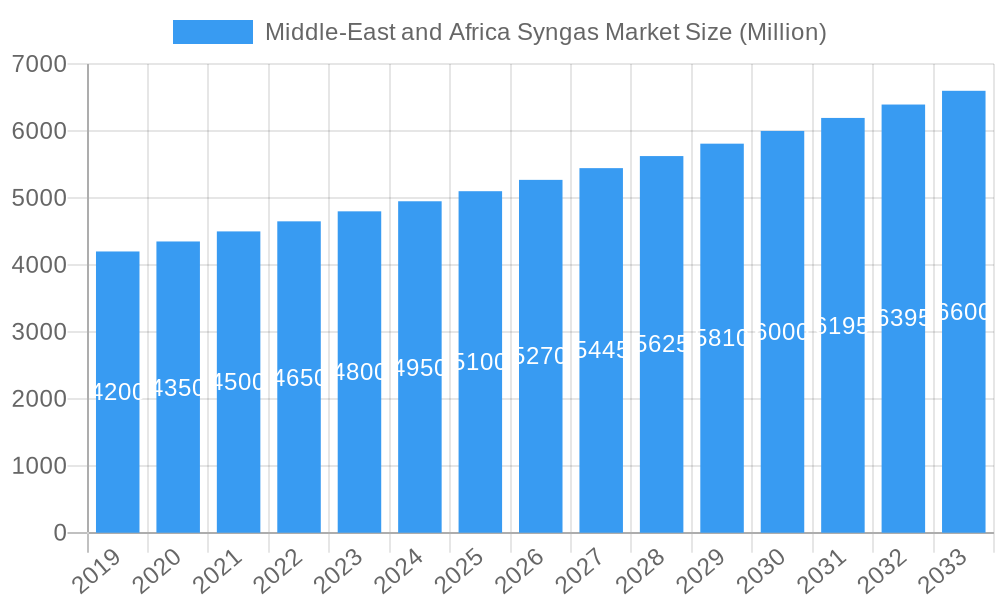

The Middle East and Africa (MEA) syngas market is projected for substantial expansion, reaching a market size of 258.1 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8% through the forecast period ending in 2033. This growth is primarily fueled by the region's abundant and cost-effective coal and natural gas feedstocks. Key growth drivers include increasing demand for syngas in power generation, driven by rising energy needs and diversification efforts. Furthermore, escalating production of essential chemicals like methanol and ammonia, vital for agricultural fertilizers and industrial applications, is boosting syngas consumption. Emerging applications in liquid and gaseous fuels also contribute to market dynamism.

Middle-East and Africa Syngas Market Market Size (In Billion)

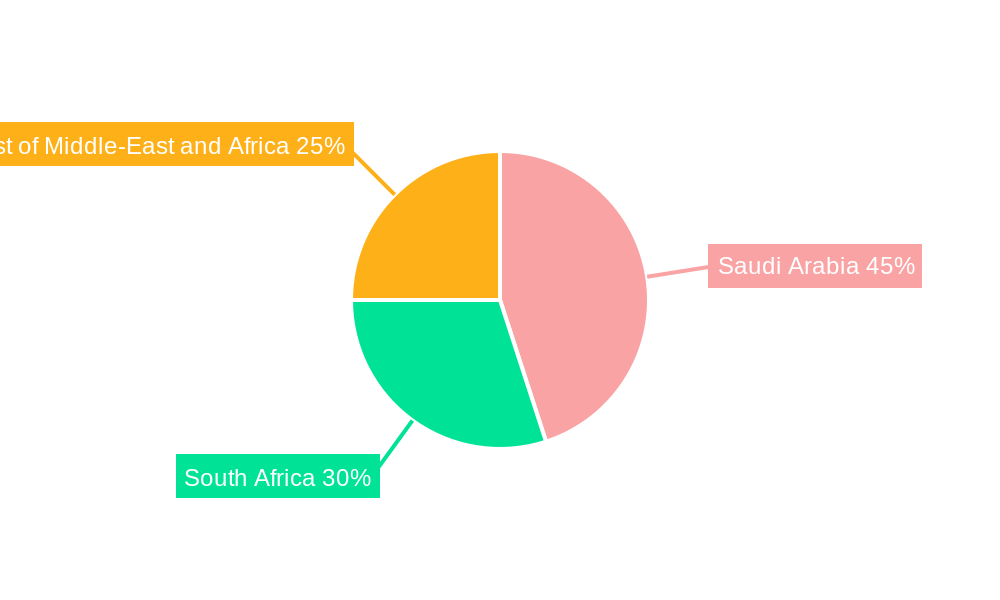

The MEA syngas market features diverse technologies, with steam reforming and partial oxidation currently dominating. However, advancements in biomass gasification, particularly utilizing fixed-bed and fluidized-bed gasifiers, are gaining traction, aligning with the region's focus on sustainable energy and waste-to-energy initiatives. Geographically, Saudi Arabia leads due to its extensive oil and gas infrastructure and ongoing industrial development. South Africa is also a significant market, leveraging its coal reserves and evolving energy landscape. The rest of MEA is anticipated to experience steady growth, driven by industrialization and energy security investments. Market restraints include the capital-intensive nature of syngas facilities and fluctuating raw material prices. Nevertheless, persistent demand for energy and chemicals, coupled with technological innovation, is expected to overcome these challenges.

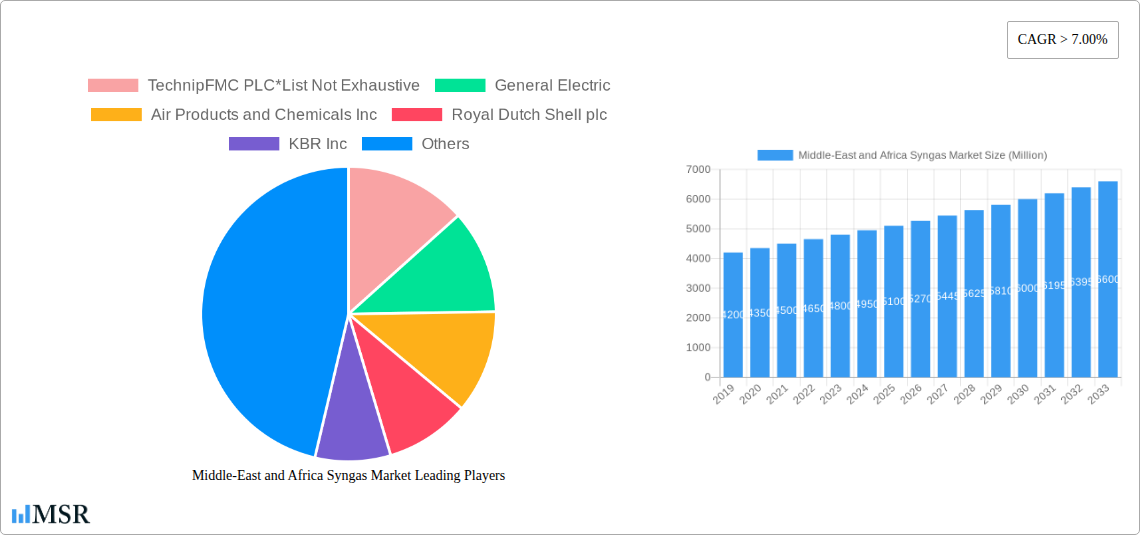

Middle-East and Africa Syngas Market Company Market Share

Gain critical insights into the burgeoning Middle East and Africa syngas market. This report details feedstock evolution, technological advancements, dominant applications, and strategic growth drivers shaping this dynamic sector. With a forecast for 2025–2033 and a base year of 2025, it provides actionable intelligence for stakeholders capitalizing on the region's energy transition and industrial expansion.

Middle-East and Africa Syngas Market Market Concentration & Dynamics

The Middle-East and Africa syngas market exhibits a moderate to high concentration, characterized by the presence of several large, established global players and a growing number of regional entities. Innovation ecosystems are actively developing, with a strong emphasis on improving syngas production efficiency and exploring novel applications. Regulatory frameworks are evolving, with governments increasingly recognizing syngas as a key component of their clean energy strategies and industrial diversification efforts. The availability of abundant and cost-effective feedstocks like natural gas and petroleum presents a significant advantage, while biomass is emerging as a sustainable alternative in specific sub-regions. End-user trends are shifting towards cleaner fuel alternatives and the production of high-value chemicals. Merger and acquisition (M&A) activities are observed, particularly concerning the acquisition of smaller technology providers by larger corporations to consolidate market position and access specialized expertise. While specific market share figures vary by segment and year, key players are strategically positioning themselves to secure a substantial portion of this growing market. M&A deal counts are expected to rise as companies seek to expand their regional footprint and technological capabilities.

Middle-East and Africa Syngas Market Industry Insights & Trends

The Middle-East and Africa syngas market is poised for substantial growth, driven by a confluence of factors including increasing demand for clean energy, a growing chemical industry, and advancements in syngas production technology. The market size is projected to reach approximately XX Billion USD by 2033, exhibiting a compound annual growth rate (CAGR) of around XX% during the forecast period (2025–2033). Historically, the market, valued at approximately XX Billion USD in 2019 and reaching XX Billion USD by the end of the historical period in 2024, has seen steady expansion. Key growth drivers include government initiatives aimed at reducing reliance on fossil fuels and promoting hydrogen production for various industrial applications. The region's abundant reserves of natural gas and petroleum continue to be primary feedstocks, offering cost-effective syngas generation. Technological disruptions are focused on enhancing the efficiency and sustainability of syngas production, with significant investments in carbon capture and utilization (CCU) technologies. Evolving consumer behaviors and industrial demand for cleaner alternatives are further propelling the adoption of syngas-based solutions. The report analyzes how these trends are shaping investment strategies, driving innovation, and creating new market opportunities across the Middle-East and Africa.

Key Markets & Segments Leading Middle-East and Africa Syngas Market

The Middle-East and Africa syngas market is significantly influenced by the dominance of Saudi Arabia and South Africa, with the "Rest of Middle-East and Africa" segment also showing considerable growth potential.

- Dominant Geography: Saudi Arabia

- Drivers: Abundant natural gas and petroleum reserves, substantial government investments in industrial diversification and petrochemicals, and a strategic focus on becoming a hub for hydrogen production. The country's established infrastructure and large-scale industrial projects create a strong demand for syngas applications.

- Significant Contributor: South Africa

- Drivers: Rich coal reserves, driving significant coal gasification activities for power generation and chemicals. Increasing focus on cleaner energy alternatives and the development of biomass gasification projects are also contributing to its growth.

- Emerging Regions: Rest of Middle-East and Africa

- Drivers: Growing industrialization in countries like Egypt, Nigeria, and the UAE, coupled with the exploration of new natural gas fields and the increasing interest in renewable energy sources, are fostering syngas market expansion.

Feedstock Dominance:

- Natural Gas: Remains the dominant feedstock due to its widespread availability and cost-effectiveness, primarily used for producing hydrogen, methanol, and ammonia.

- Petroleum: Crucial for producing syngas in regions with significant refining capacities, serving as a feedstock for various petrochemicals.

- Coal: A key feedstock in South Africa, vital for power generation and the production of synthetic fuels.

Technology Leadership:

- Steam Reforming: Predominantly used for natural gas and other light hydrocarbons, it remains a cornerstone technology for producing high-purity hydrogen and syngas for chemical synthesis.

- Partial Oxidation (POX) and Auto-thermal Reforming (ATR): Increasingly adopted for heavier feedstocks and in integrated gasification combined cycle (IGCC) power plants due to their flexibility.

- Biomass Gasification: Gaining traction in specific regions as a sustainable alternative, contributing to a circular economy and reducing carbon footprints.

Application Landscape:

- Chemicals: This segment holds the largest market share, driven by the massive demand for methanol, ammonia, and hydrogen in fertilizers, fuels, and industrial processes. The production of oxochemicals and n-butanol also contributes significantly.

- Power Generation: Syngas plays a critical role in IGCC plants and as a fuel for turbines, particularly in regions with abundant coal and gas resources.

- Liquid and Gaseous Fuels: The production of synthetic fuels and natural gas substitutes from syngas is a growing application, aligning with energy security goals.

Middle-East and Africa Syngas Market Product Developments

Product developments in the Middle-East and Africa syngas market are largely centered on enhancing syngas production efficiency, reducing operational costs, and improving the environmental profile of the process. Innovations in catalyst technology for steam reforming and partial oxidation are leading to higher yields and lower energy consumption. Significant R&D is also focused on advanced gasifier designs, particularly for biomass gasification, to handle a wider range of feedstocks and improve fuel flexibility. The integration of carbon capture and utilization (CCU) technologies with syngas production is a major area of development, aiming to create low-carbon or carbon-neutral fuels and chemicals, thereby increasing the market relevance of syngas as a sustainable energy solution.

Challenges in the Middle-East and Africa Syngas Market Market

The Middle-East and Africa syngas market faces several challenges, including the high initial capital investment required for syngas production facilities, particularly for advanced gasification technologies. Regulatory hurdles and the lack of standardized environmental regulations across different countries can also impede market growth. Supply chain complexities for specialized equipment and catalysts, coupled with the volatile pricing of feedstock like natural gas and petroleum, can impact project economics. Furthermore, competitive pressures from established conventional energy sources and the ongoing transition to renewable energy technologies necessitate continuous innovation and cost optimization to maintain market competitiveness. The economic viability of biomass syngas can also be constrained by feedstock availability and logistics.

Forces Driving Middle-East and Africa Syngas Market Growth

Several key forces are driving the growth of the Middle-East and Africa syngas market. Government initiatives promoting energy diversification and the development of a hydrogen economy are paramount. The increasing demand for cleaner fuels and industrial chemicals, coupled with the region's vast reserves of natural gas and petroleum, provides a strong economic incentive for syngas production. Technological advancements in gasification and reforming processes are enhancing efficiency and reducing costs, making syngas a more attractive option. Furthermore, growing investments in downstream chemical industries, such as fertilizers and methanol production, directly stimulate demand for syngas. The pursuit of energy security and reducing reliance on imported fuels are also significant growth accelerators.

Challenges in the Middle-East and Africa Syngas Market Market

Long-term growth catalysts in the Middle-East and Africa syngas market are deeply rooted in innovation and strategic market expansion. Continued investments in research and development for more efficient and cost-effective syngas production technologies, particularly those that can utilize a wider range of feedstocks including waste materials and emerging renewable sources, are crucial. The strategic development and implementation of carbon capture and utilization (CCU) technologies will be a major differentiator, addressing environmental concerns and opening up new revenue streams. The formation of strategic partnerships and joint ventures between technology providers and end-users will facilitate technology transfer and project financing. Moreover, the proactive development of robust infrastructure for syngas distribution and utilization will be key to unlocking its full market potential, especially for hydrogen applications in transportation and industry.

Emerging Opportunities in Middle-East and Africa Syngas Market

Emerging opportunities in the Middle-East and Africa syngas market are abundant and diverse. The growing global focus on decarbonization presents a significant opportunity for the production of blue hydrogen and green hydrogen via syngas routes coupled with CCU. The expansion of the petrochemical industry in the region creates a sustained demand for syngas as a feedstock for methanol, ammonia, and other valuable chemicals. There is also a growing opportunity in utilizing biomass and agricultural waste for syngas production, contributing to a circular economy and providing decentralized energy solutions, particularly in the "Rest of Middle-East and Africa" segment. The potential for producing synthetic liquid fuels from syngas as alternatives to conventional fuels is another emerging area, aligning with national energy security objectives. Furthermore, increasing interest in small-scale and modular syngas plants for distributed power generation and industrial use is creating new market niches.

Leading Players in the Middle-East and Africa Syngas Market Sector

- TechnipFMC PLC

- General Electric

- Air Products and Chemicals Inc

- Royal Dutch Shell plc

- KBR Inc

- BASF SE

- Linde plc

- Air Liquide

- BP p l c

- SABIC

Key Milestones in Middle-East and Africa Syngas Market Industry

- 2021: Major partnership announced between a leading petrochemical company and a technology provider for developing advanced syngas purification technologies for ammonia production.

- 2022: A significant acquisition of a smaller gasification technology firm by a global energy major, aimed at consolidating their position in the syngas market.

- 2023: Investments in R&D for carbon capture and utilization technologies for syngas plants received substantial funding from both private and public sectors, focusing on enhanced efficiency and economic viability.

- 2024: Government initiatives in several Middle Eastern countries were launched to promote the adoption of syngas as a clean energy source, including incentives for co-firing syngas in power plants and supporting hydrogen production projects.

- 2024: A key milestone was the successful demonstration of a novel biomass gasification process, paving the way for wider adoption of sustainable syngas production.

Strategic Outlook for Middle-East and Africa Syngas Market Market

The strategic outlook for the Middle-East and Africa syngas market is highly positive, driven by a clear trajectory towards greater utilization of syngas for both energy and chemical feedstock purposes. The region's rich endowment of hydrocarbon resources, coupled with increasing global and regional demand for cleaner energy and essential chemicals like methanol and ammonia, positions syngas as a critical enabler of industrial growth and energy transition. Strategic investments will continue to focus on enhancing technological efficiencies, reducing production costs, and integrating carbon capture and utilization (CCU) to meet stringent environmental regulations and achieve carbon neutrality goals. Partnerships and acquisitions will remain key strategies for market players to consolidate their expertise and expand their geographical reach. The growing emphasis on a hydrogen economy further amplifies the strategic importance of syngas production in the region.

Middle-East and Africa Syngas Market Segmentation

-

1. Feedstock

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Petroleum

- 1.4. Pet-coke

- 1.5. Biomass

-

2. Technology

- 2.1. Steam Reforming

- 2.2. Partial Oxidation

- 2.3. Auto-thermal Reforming

- 2.4. Combined or Two-step Reforming

- 2.5. Biomass Gasification

-

3. Gasifier Type

- 3.1. Fixed Bed

- 3.2. Entrained Flow

- 3.3. Fluidized Bed

-

4. Application

- 4.1. Power Generation

-

4.2. Chemicals

- 4.2.1. Methanol

- 4.2.2. Ammonia

- 4.2.3. Oxo Chemicals

- 4.2.4. n-Butanol

- 4.2.5. Hydrogen

- 4.2.6. Dimethyl Ether

- 4.3. Liquid Fuels

- 4.4. Gaseous Fuels

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle-East and Africa

Middle-East and Africa Syngas Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle-East and Africa Syngas Market Regional Market Share

Geographic Coverage of Middle-East and Africa Syngas Market

Middle-East and Africa Syngas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Electricity; Growing Chemical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Funding

- 3.4. Market Trends

- 3.4.1. Increasing Usage in Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Petroleum

- 5.1.4. Pet-coke

- 5.1.5. Biomass

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Reforming

- 5.2.2. Partial Oxidation

- 5.2.3. Auto-thermal Reforming

- 5.2.4. Combined or Two-step Reforming

- 5.2.5. Biomass Gasification

- 5.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 5.3.1. Fixed Bed

- 5.3.2. Entrained Flow

- 5.3.3. Fluidized Bed

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Power Generation

- 5.4.2. Chemicals

- 5.4.2.1. Methanol

- 5.4.2.2. Ammonia

- 5.4.2.3. Oxo Chemicals

- 5.4.2.4. n-Butanol

- 5.4.2.5. Hydrogen

- 5.4.2.6. Dimethyl Ether

- 5.4.3. Liquid Fuels

- 5.4.4. Gaseous Fuels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. South Africa

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Saudi Arabia Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Petroleum

- 6.1.4. Pet-coke

- 6.1.5. Biomass

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Steam Reforming

- 6.2.2. Partial Oxidation

- 6.2.3. Auto-thermal Reforming

- 6.2.4. Combined or Two-step Reforming

- 6.2.5. Biomass Gasification

- 6.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 6.3.1. Fixed Bed

- 6.3.2. Entrained Flow

- 6.3.3. Fluidized Bed

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.2.1. Methanol

- 6.4.2.2. Ammonia

- 6.4.2.3. Oxo Chemicals

- 6.4.2.4. n-Butanol

- 6.4.2.5. Hydrogen

- 6.4.2.6. Dimethyl Ether

- 6.4.3. Liquid Fuels

- 6.4.4. Gaseous Fuels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. South Africa

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. South Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Petroleum

- 7.1.4. Pet-coke

- 7.1.5. Biomass

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Steam Reforming

- 7.2.2. Partial Oxidation

- 7.2.3. Auto-thermal Reforming

- 7.2.4. Combined or Two-step Reforming

- 7.2.5. Biomass Gasification

- 7.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 7.3.1. Fixed Bed

- 7.3.2. Entrained Flow

- 7.3.3. Fluidized Bed

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Power Generation

- 7.4.2. Chemicals

- 7.4.2.1. Methanol

- 7.4.2.2. Ammonia

- 7.4.2.3. Oxo Chemicals

- 7.4.2.4. n-Butanol

- 7.4.2.5. Hydrogen

- 7.4.2.6. Dimethyl Ether

- 7.4.3. Liquid Fuels

- 7.4.4. Gaseous Fuels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. South Africa

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. Rest of Middle East and Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Petroleum

- 8.1.4. Pet-coke

- 8.1.5. Biomass

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Steam Reforming

- 8.2.2. Partial Oxidation

- 8.2.3. Auto-thermal Reforming

- 8.2.4. Combined or Two-step Reforming

- 8.2.5. Biomass Gasification

- 8.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 8.3.1. Fixed Bed

- 8.3.2. Entrained Flow

- 8.3.3. Fluidized Bed

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Power Generation

- 8.4.2. Chemicals

- 8.4.2.1. Methanol

- 8.4.2.2. Ammonia

- 8.4.2.3. Oxo Chemicals

- 8.4.2.4. n-Butanol

- 8.4.2.5. Hydrogen

- 8.4.2.6. Dimethyl Ether

- 8.4.3. Liquid Fuels

- 8.4.4. Gaseous Fuels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. South Africa

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 General Electric

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Air Products and Chemicals Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Royal Dutch Shell plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 KBR Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Linde plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Air Liquide

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BP p l c

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SABIC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Syngas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Syngas Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 2: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 3: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 6: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 7: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Middle-East and Africa Syngas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 14: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 15: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 18: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 19: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 26: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 27: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 30: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 31: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 38: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 39: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 40: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 41: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 42: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 43: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Syngas Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Middle-East and Africa Syngas Market?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP p l c, SABIC.

3. What are the main segments of the Middle-East and Africa Syngas Market?

The market segments include Feedstock, Technology, Gasifier Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 258.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Electricity; Growing Chemical Industry.

6. What are the notable trends driving market growth?

Increasing Usage in Power Generation Industry.

7. Are there any restraints impacting market growth?

; High Capital Investment and Funding.

8. Can you provide examples of recent developments in the market?

Partnerships between companies for syngas technology development

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Syngas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Syngas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Syngas Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Syngas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence