Key Insights

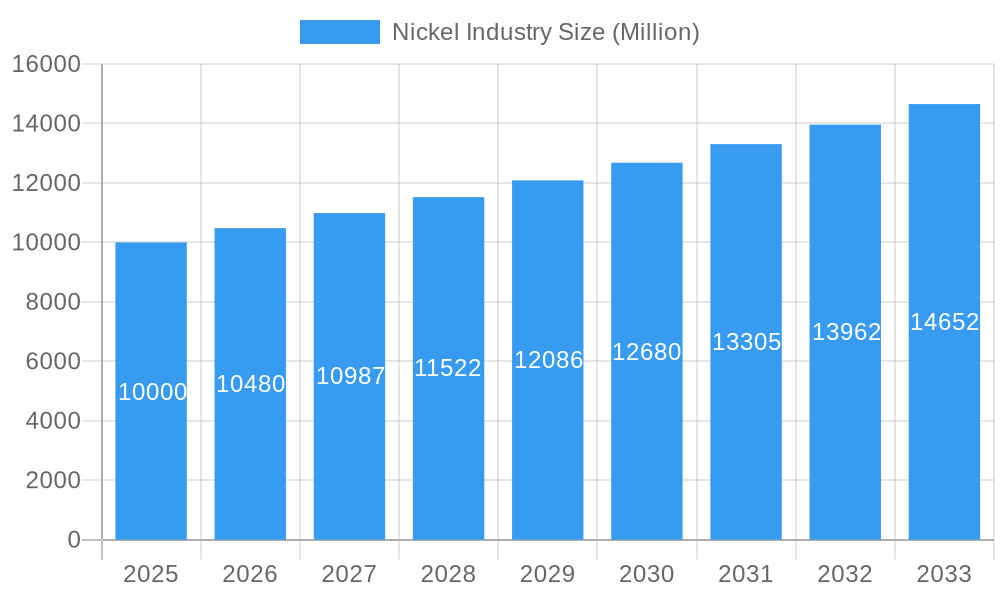

The nickel industry, currently valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.80% through 2033. This expansion is fueled by several key drivers. The burgeoning electric vehicle (EV) market is a significant contributor, with nickel playing a crucial role in EV batteries. Increasing demand for stainless steel, another major application of nickel, further propels market growth. Furthermore, advancements in nickel extraction technologies and a growing focus on sustainable sourcing practices are contributing to a more efficient and environmentally responsible industry. While challenges remain, such as price volatility tied to global supply chain dynamics and potential environmental concerns associated with mining, these are being mitigated through technological innovation and greater regulatory oversight. The market is largely dominated by Class 1 nickel (99.8%), reflecting the high demand for high-purity nickel in specialized applications. The forecast period of 2025-2033 presents significant opportunities for market players, particularly those focused on innovation, sustainability, and diversification across various nickel applications.

Nickel Industry Market Size (In Billion)

The market segmentation reveals a clear dominance of Class 1 nickel, accounting for almost the entirety of the market share (99.8%). This highlights the premium placed on high-purity nickel, primarily used in high-value applications like battery production. The remaining minor share (0.2%) likely represents Class 2 nickel, which caters to less demanding applications. This market structure is likely to persist, although technological advancements could potentially drive a slight increase in Class 2 nickel usage in the coming years. However, given the substantial projected growth across the industry, this relatively small segment is unlikely to significantly alter the overall market dynamics. Future market performance will hinge on effective management of supply chain disruptions, responsible sourcing practices, and continuous innovation to meet the evolving demands of key industries such as electric vehicles and advanced manufacturing. Strategic partnerships, investment in research and development, and an unwavering focus on environmental sustainability will likely be pivotal for success in this dynamic market.

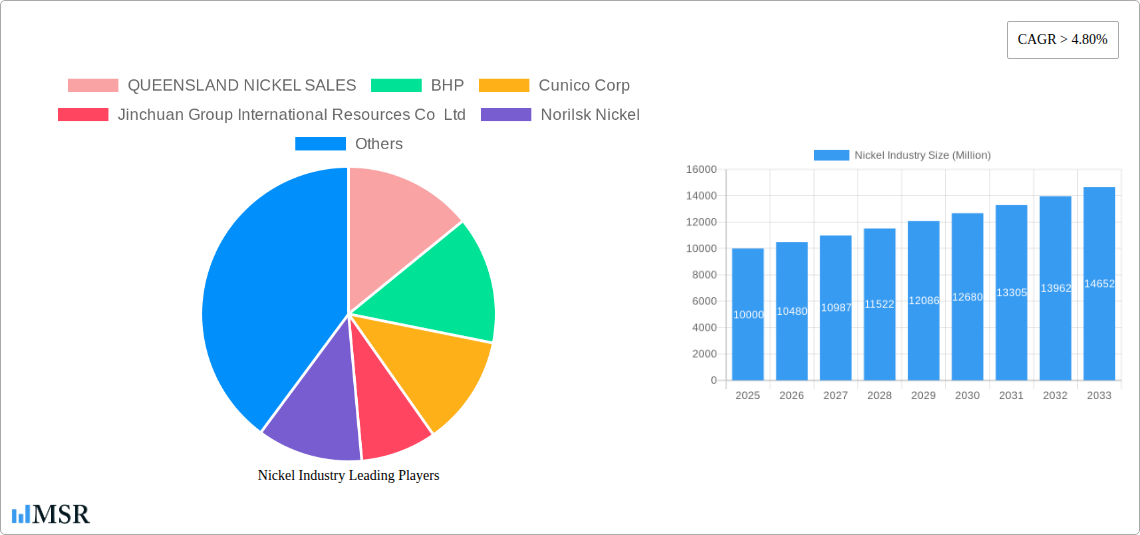

Nickel Industry Company Market Share

Nickel Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global nickel industry, offering valuable insights for stakeholders seeking to navigate the evolving market landscape. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report incorporates historical data from 2019-2024 and utilizes a projected market size of xx Million for the estimated year 2025. This report is designed to be used without modification and contains no placeholders.

Nickel Industry Market Concentration & Dynamics

The global nickel market exhibits moderate concentration, with a handful of major players dominating production and sales. Key players like BHP, Norilsk Nickel, Glencore, and Vale control a significant market share, estimated at xx% collectively in 2025. However, the emergence of smaller, agile companies like QUEENSLAND NICKEL SALES and INDEPENDENCE GROUP NL is challenging the established order.

Innovation is driven by a growing need for sustainable nickel production and the development of high-purity nickel products for the burgeoning electric vehicle (EV) battery market. Regulatory frameworks vary across regions, influencing production costs and environmental compliance. Substitute materials like cobalt and other battery chemistries pose a competitive threat, while end-user trends heavily favor nickel's use in stainless steel and EV batteries. Mergers and acquisitions (M&A) activity has been robust in recent years, with xx M&A deals recorded between 2019 and 2024, primarily driven by consolidation and securing access to key resources.

- Market Share: BHP: xx%, Norilsk Nickel: xx%, Glencore: xx%, Vale: xx%, Others: xx%.

- M&A Activity: xx deals between 2019-2024, driven by resource consolidation and strategic expansion.

- Innovation Focus: Sustainable production, high-purity nickel for EV batteries.

- Regulatory Landscape: Varies significantly across regions, impacting production costs and environmental standards.

Nickel Industry Industry Insights & Trends

The nickel market is experiencing significant growth, driven by the increasing demand from the stainless steel industry and the rapidly expanding EV battery sector. The global market size is estimated at xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, particularly in hydrometallurgical processing and the development of more efficient battery technologies, are reshaping the industry landscape. Consumer preference shifts towards electric vehicles and sustainable technologies are further fueling the demand for nickel.

Key Markets & Segments Leading Nickel Industry

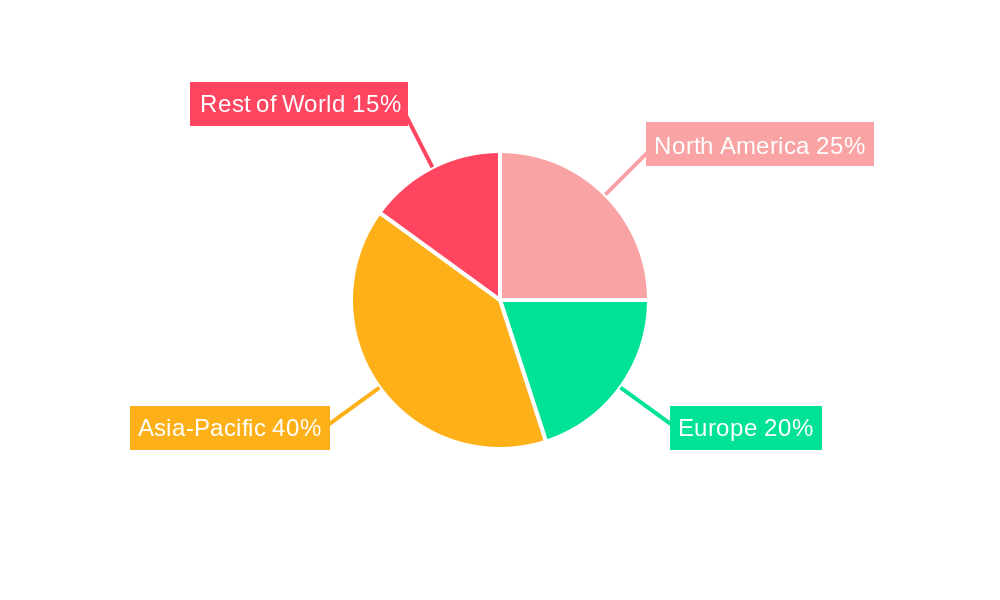

The dominant segment within the nickel industry is Class 1 nickel (99.8% purity), which commands the lion's share of the market. Geographically, xx is the leading region, owing to its substantial production capacity and proximity to major end-use markets.

Nickel Industry Product Developments

Significant advancements are being made in nickel processing techniques, focusing on enhancing purity, reducing environmental impact, and improving efficiency. This includes innovations in hydrometallurgy, which is becoming increasingly important for the production of high-purity nickel sulfate for EV batteries. Companies are actively developing new nickel-based alloys with enhanced properties, improving their competitive edge in various applications.

Challenges in the Nickel Industry Market

The nickel industry faces several challenges, including volatile nickel prices, supply chain disruptions, environmental regulations, and intense competition. These factors collectively impact profitability and constrain market growth. Supply chain issues, particularly during periods of high demand, can lead to production delays and increased costs. Stringent environmental regulations increase the operational costs for nickel producers, potentially impacting their competitiveness.

Forces Driving Nickel Industry Growth

The primary drivers of growth include the expanding EV sector's insatiable demand for nickel in batteries, increased stainless steel production globally and government initiatives promoting sustainable transportation. Technological advancements in hydrometallurgy and battery technology are improving nickel extraction and utilization efficiency.

Challenges in the Nickel Industry Market

Long-term growth hinges on sustained investment in research and development, fostering collaboration between industry players and academia, and successfully navigating evolving environmental regulations. Expansion into new markets and exploring alternative nickel sources are also critical for ensuring long-term sustainability.

Emerging Opportunities in Nickel Industry

Emerging trends and opportunities lie in the development of high-energy density batteries, exploring new nickel-rich deposits, and promoting circular economy approaches to recycling nickel from end-of-life products. The growing demand for sustainable and ethically sourced nickel presents significant opportunities for companies committed to responsible mining and processing practices.

Leading Players in the Nickel Industry Sector

- QUEENSLAND NICKEL SALES

- BHP

- Cunico Corp

- Jinchuan Group International Resources Co Ltd

- Norilsk Nickel

- INDEPENDENCE GROUP NL

- Votorantim

- Anglo American

- Terrafame

- Eramet

- Sumitomo Metal Mining Co Ltd

- Glencore

- Sherritt International Corporation

- Pacific Metal Company

- Vale

Key Milestones in Nickel Industry Industry

- July 2021: BHP announced a nickel supply agreement with Tesla Inc.

- October 2021: Renault Group signed a Memorandum of Understanding (MoU) with Terrafame for nickel sulphate supply.

- December 2021: Mitsui & Co. and Sojitz sold their shares in CBNC to Sumitomo Metal Mining Co. Ltd.

- August 2022: NMDC Ltd. announced plans to explore lithium, nickel, and cobalt mining opportunities overseas.

Strategic Outlook for Nickel Industry Market

The nickel industry is poised for significant growth, driven by the escalating demand for batteries and stainless steel. Strategic opportunities exist for companies that can effectively manage supply chain risks, embrace sustainable practices, and invest in technological advancements to enhance efficiency and reduce environmental impact. A focus on innovation, strategic partnerships, and responsible resource management will be crucial for long-term success.

Nickel Industry Segmentation

-

1. Application

- 1.1. Stainless Steel

- 1.2. Alloys

- 1.3. Plating

- 1.4. Casting

- 1.5. Batteries

- 1.6. Other Applications

Nickel Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Nickel Industry Regional Market Share

Geographic Coverage of Nickel Industry

Nickel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Corrosion Resistant Alloys in the Oil and Gas Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Volatility in the Supply Demand Scenario; Environmental Considerations During Mining Activities

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Stainless Steel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Stainless Steel

- 5.1.2. Alloys

- 5.1.3. Plating

- 5.1.4. Casting

- 5.1.5. Batteries

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Stainless Steel

- 6.1.2. Alloys

- 6.1.3. Plating

- 6.1.4. Casting

- 6.1.5. Batteries

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Stainless Steel

- 7.1.2. Alloys

- 7.1.3. Plating

- 7.1.4. Casting

- 7.1.5. Batteries

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Stainless Steel

- 8.1.2. Alloys

- 8.1.3. Plating

- 8.1.4. Casting

- 8.1.5. Batteries

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Stainless Steel

- 9.1.2. Alloys

- 9.1.3. Plating

- 9.1.4. Casting

- 9.1.5. Batteries

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Nickel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Stainless Steel

- 10.1.2. Alloys

- 10.1.3. Plating

- 10.1.4. Casting

- 10.1.5. Batteries

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 QUEENSLAND NICKEL SALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BHP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cunico Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jinchuan Group International Resources Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Norilsk Nickel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 INDEPENDENCE GROUP NL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Votorantim

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anglo American

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terrafame

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eramet

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sumitomo Metal Mining Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Glencore

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sherritt International Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pacific Metal Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Vale

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 QUEENSLAND NICKEL SALES

List of Figures

- Figure 1: Global Nickel Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Nickel Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Nickel Industry Revenue (Million), by Application 2025 & 2033

- Figure 4: Asia Pacific Nickel Industry Volume (K Tons), by Application 2025 & 2033

- Figure 5: Asia Pacific Nickel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Nickel Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: Asia Pacific Nickel Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: Asia Pacific Nickel Industry Volume (K Tons), by Country 2025 & 2033

- Figure 9: Asia Pacific Nickel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Nickel Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: North America Nickel Industry Revenue (Million), by Application 2025 & 2033

- Figure 12: North America Nickel Industry Volume (K Tons), by Application 2025 & 2033

- Figure 13: North America Nickel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Nickel Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Nickel Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Nickel Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Nickel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Nickel Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Nickel Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Nickel Industry Volume (K Tons), by Application 2025 & 2033

- Figure 21: Europe Nickel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Nickel Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Nickel Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Nickel Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Nickel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Nickel Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Nickel Industry Revenue (Million), by Application 2025 & 2033

- Figure 28: South America Nickel Industry Volume (K Tons), by Application 2025 & 2033

- Figure 29: South America Nickel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Nickel Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: South America Nickel Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Nickel Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America Nickel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Nickel Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Nickel Industry Revenue (Million), by Application 2025 & 2033

- Figure 36: Middle East and Africa Nickel Industry Volume (K Tons), by Application 2025 & 2033

- Figure 37: Middle East and Africa Nickel Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Nickel Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa Nickel Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Nickel Industry Volume (K Tons), by Country 2025 & 2033

- Figure 41: Middle East and Africa Nickel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Nickel Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Global Nickel Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Nickel Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: Global Nickel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Nickel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: China Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: China Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: India Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Japan Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: South Korea Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Korea Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Global Nickel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Nickel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 23: United States Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United States Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Canada Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Canada Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Mexico Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 31: Global Nickel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Nickel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Germany Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Italy Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: France Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: France Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Global Nickel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Nickel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: Brazil Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Brazil Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Argentina Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Argentina Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Nickel Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Nickel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 55: Global Nickel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Nickel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: South Africa Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Nickel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Nickel Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nickel Industry?

The projected CAGR is approximately > 4.80%.

2. Which companies are prominent players in the Nickel Industry?

Key companies in the market include QUEENSLAND NICKEL SALES, BHP, Cunico Corp, Jinchuan Group International Resources Co Ltd, Norilsk Nickel, INDEPENDENCE GROUP NL, Votorantim, Anglo American, Terrafame, Eramet, Sumitomo Metal Mining Co Ltd, Glencore, Sherritt International Corporation, Pacific Metal Company, Vale.

3. What are the main segments of the Nickel Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Corrosion Resistant Alloys in the Oil and Gas Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand for Stainless Steel.

7. Are there any restraints impacting market growth?

Volatility in the Supply Demand Scenario; Environmental Considerations During Mining Activities.

8. Can you provide examples of recent developments in the market?

August 2022: NMDC Ltd. announced its decision to explore opportunities overseas in a bid to mine lithium, nickel, and cobalt in order to meet the growing demand in India. The state-run iron-ore producer is planning to start mining in Australia, as it holds a 90.02% stake in the country's Legacy Iron Ore Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nickel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nickel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nickel Industry?

To stay informed about further developments, trends, and reports in the Nickel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence