Key Insights

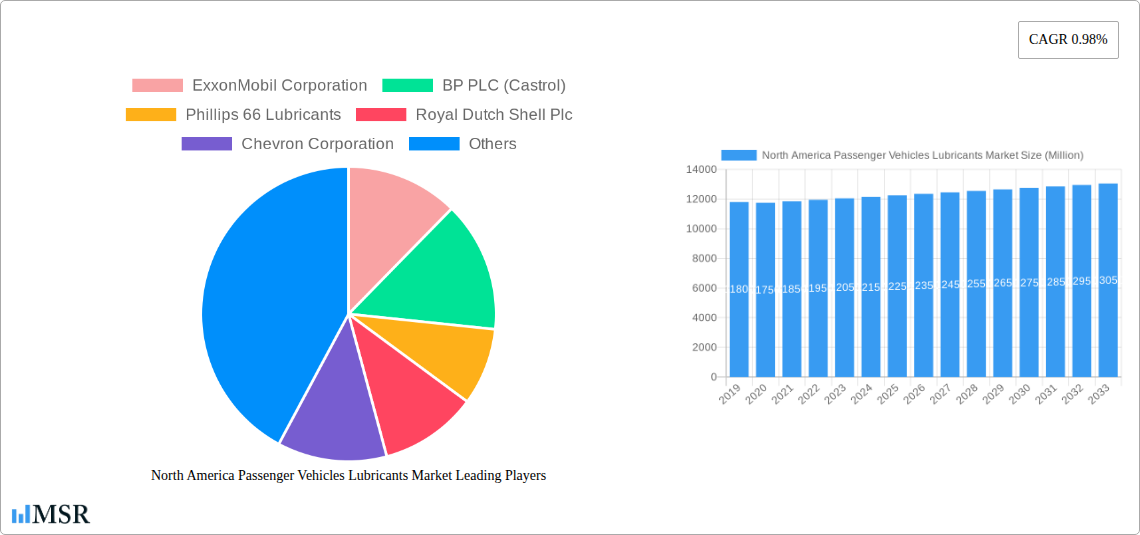

The North America Passenger Vehicles Lubricants Market is poised for steady, albeit modest, growth, projected to reach an estimated USD 12,500 million in 2025. This growth is underpinned by a compound annual growth rate (CAGR) of 0.98% over the forecast period of 2025-2033. While the market is mature, key drivers such as the persistent and substantial passenger vehicle parc in the region, coupled with the ongoing need for regular maintenance and replacement of lubricants, ensure a stable demand. Furthermore, advancements in lubricant technology, focusing on enhanced fuel efficiency, extended drain intervals, and improved engine protection against wear and tear, will continue to influence product adoption. The increasing adoption of synthetic and semi-synthetic engine oils, driven by their superior performance characteristics, is a significant trend shaping the market landscape. This shift caters to evolving engine designs and increasingly stringent emission standards, necessitating lubricants that can withstand higher operating temperatures and pressures while minimizing friction.

North America Passenger Vehicles Lubricants Market Market Size (In Billion)

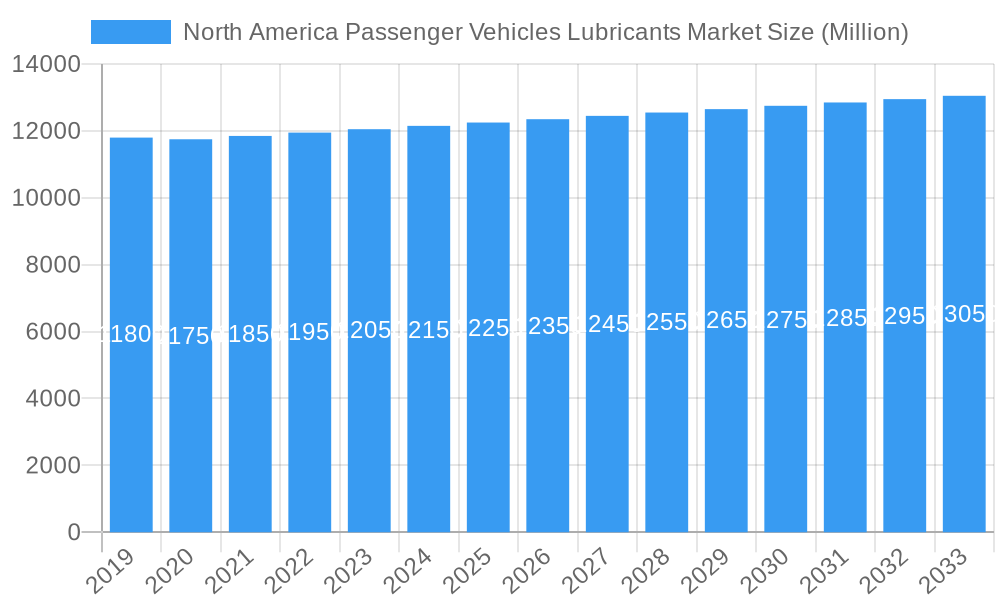

Despite the stable demand, the market faces certain restraints that temper more aggressive growth projections. The increasing average age of passenger vehicles, while driving replacement demand, also signifies a segment that may be less inclined towards premium, higher-priced synthetic lubricants. Moreover, the growing trend of vehicle electrification, though still in its nascent stages for widespread lubricant demand, represents a long-term challenge as electric vehicles typically require significantly less traditional engine oil. However, hybrid vehicles continue to necessitate lubricants, providing a transitional demand. The market is segmented into Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, with Engine Oils dominating due to their critical role in internal combustion engines. Key players like ExxonMobil Corporation, BP PLC (Castrol), Phillips 66 Lubricants, Royal Dutch Shell Plc, and Chevron Corporation are actively engaged in innovation and strategic partnerships to maintain their market share in this competitive environment.

North America Passenger Vehicles Lubricants Market Company Market Share

Gain unparalleled insights into the North America passenger vehicles lubricants market with this definitive report. Covering the study period from 2019 to 2033, with 2025 as the base and estimated year, this analysis delves deep into market dynamics, key trends, and future opportunities. Our expert research forecasts the market's trajectory from 2025 to 2033, building upon a robust understanding of the historical period of 2019-2024. Discover critical information on engine oils, greases, hydraulic fluids, and transmission & gear oils, crucial for automotive aftermarket, OEMs, and lubricant manufacturers. This report is essential for stakeholders seeking to understand market concentration, innovation, and strategic imperatives within the lucrative North American automotive lubricant sector.

North America Passenger Vehicles Lubricants Market Market Concentration & Dynamics

The North America passenger vehicles lubricants market exhibits a moderate to high market concentration, characterized by the significant presence of major global players who dominate market share. These industry titans leverage extensive R&D capabilities and established distribution networks to maintain their competitive edge. The innovation ecosystem is vibrant, driven by the continuous demand for higher performance, greater fuel efficiency, and extended drain intervals in passenger vehicle lubricants. Regulatory frameworks, including emission standards and product safety regulations, play a crucial role in shaping product development and market entry strategies. While the market is mature, the emergence of substitute products, such as advanced greases and specialized synthetic fluids, presents an evolving landscape. End-user trends are shifting towards environmentally friendly and performance-enhanced lubricants, fueled by increasing consumer awareness and vehicle technological advancements. Mergers and acquisitions (M&A) activities, though not consistently high, are strategic moves by key players to consolidate market positions, acquire new technologies, or expand their product portfolios. The M&A deal count is estimated at approximately 5-10 significant transactions over the historical period.

- Market Share Dominance: Top 5 players collectively hold over 60% market share.

- Innovation Focus: Lubricant formulation for electric vehicles (EVs) and advanced engine technologies.

- Regulatory Impact: Stringent environmental regulations driving demand for low-viscosity and bio-based lubricants.

- Substitute Products: Growing interest in advanced greases and solid lubricants for specialized applications.

- End-User Preferences: Emphasis on extended service life, fuel economy, and reduced emissions.

North America Passenger Vehicles Lubricants Market Industry Insights & Trends

The North America passenger vehicles lubricants market is poised for steady growth, driven by several interconnected factors. The market size in the base year 2025 is estimated at $XX Billion. A significant growth driver is the continued presence of a large and aging passenger vehicle parc, necessitating regular maintenance and fluid replacement. Furthermore, the increasing adoption of sophisticated engine technologies, such as turbocharging and direct injection, demands higher-performance lubricants capable of withstanding extreme temperatures and pressures, thus boosting the demand for synthetic and semi-synthetic formulations. Technological disruptions are largely centered around the burgeoning electric vehicle (EV) sector. While EVs may have different lubrication needs compared to internal combustion engine (ICE) vehicles, the development of specialized e-fluids for thermal management, gearboxes, and bearings presents a substantial growth opportunity. Evolving consumer behaviors also play a crucial role. There is a growing demand for lubricants that offer enhanced fuel efficiency, extended drain intervals, and reduced environmental impact, reflecting a greater consciousness towards sustainability and cost savings. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 3.5% during the forecast period 2025–2033. The ongoing innovation in lubricant additives and base oils, coupled with a deeper understanding of tribology, will continue to refine product offerings and cater to the evolving demands of the passenger vehicle segment. The increasing complexity of modern engines and transmissions also necessitates specialized fluids, further solidifying the market's reliance on advanced lubricant solutions.

- Market Size (2025): Estimated at $XX Billion.

- CAGR (2025-2033): Approximately 3.5%.

- Key Growth Drivers: Large vehicle parc, sophisticated engine technologies, growing EV adoption, consumer demand for performance and sustainability.

- Technological Advancements: Development of advanced synthetic lubricants, additives, and specialized e-fluids for EVs.

- Consumer Behavior: Shift towards fuel efficiency, extended drain intervals, and eco-friendly products.

Key Markets & Segments Leading North America Passenger Vehicles Lubricants Market

The United States stands as the dominant market within North America for passenger vehicles lubricants, driven by its extensive vehicle parc, high disposable incomes, and a well-established automotive aftermarket. Canada and Mexico also contribute significantly, with their respective automotive industries and consumer bases. Among the product types, Engine Oils represent the largest and most crucial segment, accounting for a substantial portion of the market revenue due to their universal application in all internal combustion engine vehicles. However, Transmission & Gear Oils are also experiencing robust growth, fueled by the increasing complexity of automatic and continuously variable transmissions (CVTs).

- Dominant Region: United States, followed by Canada and Mexico.

- Leading Segment: Engine Oils.

- Drivers for Engine Oil Dominance:

- Ubiquitous use in all ICE passenger vehicles.

- Regular replacement cycles mandated by manufacturers.

- Continuous innovation in formulations for enhanced performance and fuel economy.

- Demand for synthetic and semi-synthetic variants.

- Drivers for Engine Oil Dominance:

- Growing Segment: Transmission & Gear Oils.

- Drivers for Transmission & Gear Oil Growth:

- Increasing adoption of automatic and CVT transmissions.

- Demand for specialized fluids to ensure optimal performance and longevity of complex gear systems.

- Integration of advanced additive technologies for smoother shifting and reduced wear.

- Drivers for Transmission & Gear Oil Growth:

- Other Significant Segments:

- Hydraulic Fluids: Essential for power steering systems and convertible tops, contributing to steady demand.

- Greases: Crucial for various chassis components, bearings, and electrical connectors, with specialized applications in high-performance vehicles.

North America Passenger Vehicles Lubricants Market Product Developments

Product innovation in the North America passenger vehicles lubricants market is largely driven by the push for enhanced performance, extended drain intervals, and compatibility with evolving automotive technologies, particularly electric vehicles. Key developments include the introduction of advanced synthetic engine oils formulated with superior base stocks and cutting-edge additive packages to maximize fuel efficiency, reduce wear, and operate effectively under extreme conditions. The burgeoning EV market has spurred the creation of specialized e-fluids, such as e-thermal fluids for battery cooling, e-transmission fluids for electric drivetrains, and e-greases for electric motor components. These products are designed to meet the unique thermal, electrical, and mechanical demands of electric powertrains, offering improved performance and longevity.

Challenges in the North America Passenger Vehicles Lubricants Market Market

Despite robust growth, the North America passenger vehicles lubricants market faces several challenges. The increasing popularity of electric vehicles, while presenting new opportunities, also poses a long-term threat to the traditional engine oil segment. Fluctuations in crude oil prices can impact the cost of base oils, directly affecting lubricant pricing and profit margins. Furthermore, stringent environmental regulations and the growing demand for sustainable products necessitate continuous investment in research and development for bio-based or biodegradable lubricants. Supply chain disruptions, as witnessed in recent years, can also affect the availability and cost of raw materials and finished products.

- EV Adoption: Potential cannibalization of the traditional engine oil market.

- Raw Material Price Volatility: Dependence on crude oil prices for base oil production.

- Environmental Regulations: Increasing pressure for sustainable and eco-friendly lubricant solutions.

- Supply Chain Disruptions: Impact on availability and cost of raw materials and finished goods.

Forces Driving North America Passenger Vehicles Lubricants Market Growth

Several powerful forces are propelling the North America passenger vehicles lubricants market forward. The sheer volume of the existing passenger vehicle fleet necessitates ongoing lubricant replacement, forming a stable demand base. Technological advancements in automotive engineering, leading to more complex and high-performance engines and transmissions, require specialized lubricants with superior protective capabilities, driving the demand for premium synthetic formulations. The growing emphasis on fuel efficiency and reduced emissions by both consumers and regulatory bodies pushes manufacturers to develop lubricants that optimize engine performance. Moreover, the expanding automotive aftermarket, encompassing service centers and quick-lube facilities, provides a robust channel for lubricant sales and distribution.

Challenges in the North America Passenger Vehicles Lubricants Market Market

While the market is experiencing positive growth, long-term challenges persist. The transition towards electric vehicles (EVs) represents a significant long-term challenge for traditional lubricant providers, as EVs require fundamentally different fluid solutions. Continued investment in R&D for EV-specific lubricants is crucial to adapt to this evolving landscape. Furthermore, intensifying competition among established players and the emergence of new entrants, particularly from regions with lower production costs, can put pressure on pricing and market share. The increasing complexity of lubricant formulations to meet diverse OEM specifications also adds to R&D costs and manufacturing complexity.

Emerging Opportunities in North America Passenger Vehicles Lubricants Market

The North America passenger vehicles lubricants market is ripe with emerging opportunities. The rapid growth of the electric vehicle (EV) sector presents a significant opportunity for the development and marketing of specialized e-fluids, including e-transmission fluids, e-thermal management fluids, and e-greases. These fluids cater to the unique lubrication and cooling needs of EV powertrains. Additionally, the increasing demand for sustainable and environmentally friendly products opens avenues for bio-based and biodegradable lubricants. The growing aftermarket segment, particularly the demand for convenient and efficient maintenance services, provides opportunities for bundled lubricant and service packages. Furthermore, the continuous innovation in additive technology offers the potential to create lubricants with even greater performance benefits, such as extended drain intervals and enhanced protection under extreme operating conditions.

Leading Players in the North America Passenger Vehicles Lubricants Market Sector

- ExxonMobil Corporation

- BP PLC (Castrol)

- Phillips 66 Lubricants

- Royal Dutch Shell Plc

- Chevron Corporation

- TotalEnergies

- HollyFrontier (PetroCanada lubricants)

- Valvoline Inc

- Bardahl

- AMSOIL Inc

Key Milestones in North America Passenger Vehicles Lubricants Market Industry

- July 2021: Mighty Distributing System (Mighty Auto Parts) announced a new relationship with Total Specialties USA, targeting the Quartz Ineo and Quartz 9000 sub-ranges for light automobiles meeting stringent European OEM criteria.

- June 2021: TotalEnergies and Stellantis group renewed their partnership, extending cooperation to Opel and Vauxhall, including lubricant development, first-fill recommendations, and shared usage of TotalEnergies charging stations.

- June 2021: Castrol launched Castrol ON TM, a new line of e-fluids for electric vehicles, encompassing e-greases, e-thermal fluids, and e-transmission fluids.

Strategic Outlook for North America Passenger Vehicles Lubricants Market Market

The strategic outlook for the North America passenger vehicles lubricants market is characterized by adaptation and innovation. Key growth accelerators include the continued development of high-performance synthetic lubricants for internal combustion engines, designed to meet increasingly stringent fuel economy and emission standards. Simultaneously, a significant strategic focus will be on capitalizing on the burgeoning electric vehicle market through the development and promotion of specialized e-fluids. Partnerships with automotive OEMs to secure first-fill approvals and OEM recommendations will remain crucial for market penetration. Furthermore, embracing sustainable practices and offering environmentally friendly lubricant options will be vital for long-term market relevance and brand reputation. The market is expected to witness continued consolidation and strategic alliances as players strive to maintain competitive advantage in this dynamic sector.

North America Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

North America Passenger Vehicles Lubricants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of North America Passenger Vehicles Lubricants Market

North America Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants

- 3.3. Market Restrains

- 3.3.1. Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Phillips 66 Lubricants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HollyFrontier (PetroCanada lubricants)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valvoline Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bardahl

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMSOIL Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: North America Passenger Vehicles Lubricants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: North America Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Passenger Vehicles Lubricants Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: North America Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Passenger Vehicles Lubricants Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: North America Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Passenger Vehicles Lubricants Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: North America Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Passenger Vehicles Lubricants Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States North America Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada North America Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Passenger Vehicles Lubricants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico North America Passenger Vehicles Lubricants Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 0.98%.

2. Which companies are prominent players in the North America Passenger Vehicles Lubricants Market?

Key companies in the market include ExxonMobil Corporation, BP PLC (Castrol), Phillips 66 Lubricants, Royal Dutch Shell Plc, Chevron Corporation, TotalEnergies, HollyFrontier (PetroCanada lubricants), Valvoline Inc, Bardahl, AMSOIL Inc.

3. What are the main segments of the North America Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future.

8. Can you provide examples of recent developments in the market?

July 2021: Mighty Distributing System (Mighty Auto Parts), a pioneer in automotive aftermarket goods and services, announced a new relationship with Total Specialties USA. It would target the Quartz Ineo and Quartz 9000 sub-ranges, geared for light automobiles and meet European OEMs' most stringent criteria.June 2021: TotalEnergies and Stellantis group renewed their partnership for cooperation across different segments. Along with the renewal of partnerships with Peugeot, Citroën, and DS Automobiles, the new collaboration extends to Opel, and Vauxhall as well. This partnership includes the development and innovation of lubricants, first-fill in Stellantis group vehicles, recommendation of Quartz lubricants, and shared usage of charging stations operated by TotalEnergies, among others.June 2021: Castrol launched Castrol ON TM, a new line of e-fluids for electric vehicles. It includes e-greases, e-thermal fluids, and e-transmission fluids, all of which are employed in different electrical vehicle applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the North America Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence