Key Insights

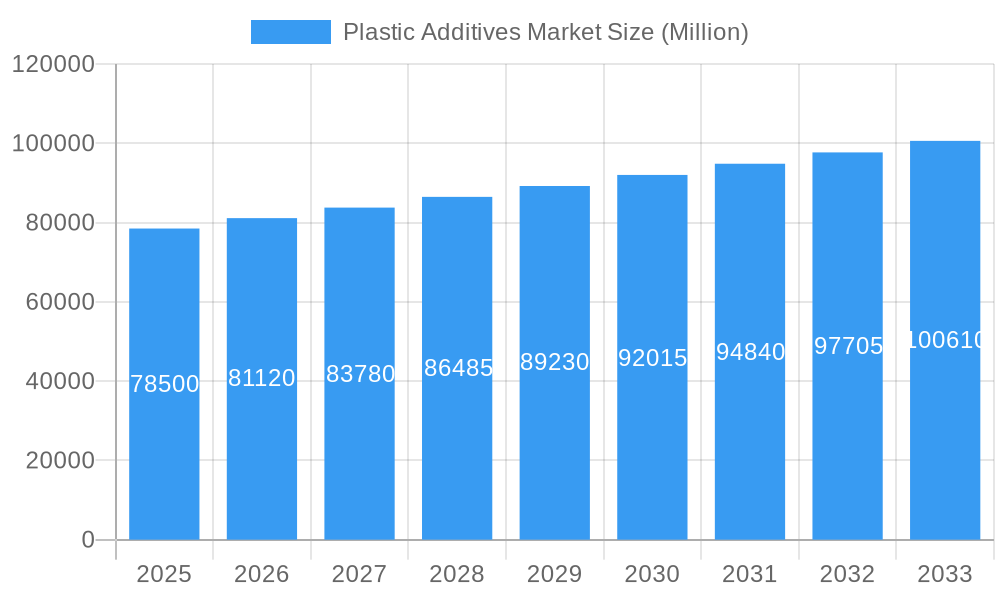

The global Plastic Additives Market is poised for robust growth, projected to reach a substantial market size of approximately USD 78,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) exceeding 3.50% through 2033. This expansion is primarily fueled by escalating demand from key end-use sectors such as packaging, consumer goods, and automotive, driven by the increasing global consumption of plastics. The market's dynamism is further shaped by significant trends including the growing emphasis on sustainable and eco-friendly plastic additives, driven by stringent environmental regulations and a rising consumer preference for green products. Innovations in high-performance additives that enhance durability, UV resistance, and flame retardancy are also contributing to market penetration. Furthermore, advancements in polymer processing technologies are creating new avenues for specialized additives that improve manufacturing efficiency and product quality. The growing adoption of recycled plastics in various applications also necessitates the use of advanced additives to restore performance properties, thereby acting as a significant growth catalyst.

Plastic Additives Market Market Size (In Billion)

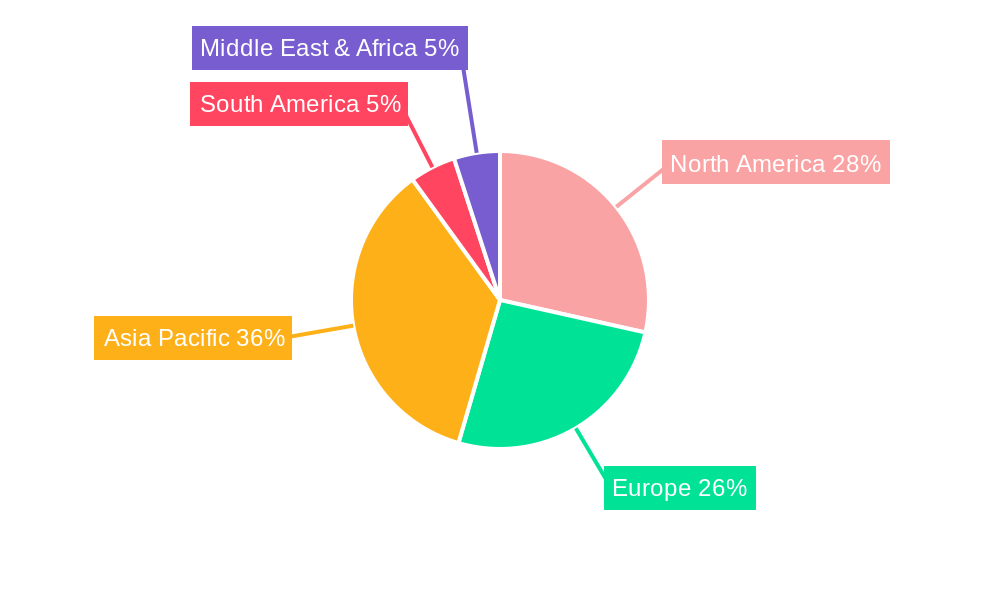

Despite the positive outlook, the Plastic Additives Market faces certain restraints. Fluctuations in raw material prices, particularly those derived from petrochemicals, can impact profitability and influence market pricing strategies. Stringent regulatory landscapes concerning the health and environmental impact of certain additive compounds also present challenges, necessitating continuous research and development for safer alternatives. However, the market is actively addressing these challenges through innovation and strategic collaborations. The diverse segmentation of the market, with key segments like Lubricants, Processing Aids, Flow Improvers, and various plastic types such as Polyethylene (PE), Polypropylene (PP), and Polyvinyl Chloride (PVC), offers considerable opportunities for specialized players. Key regions like Asia Pacific, led by China and India, and North America are anticipated to remain dominant markets due to their extensive manufacturing bases and high plastic consumption. Europe also represents a significant market, driven by its advanced automotive and packaging industries.

Plastic Additives Market Company Market Share

Plastic Additives Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Plastic Additives Market, offering critical insights into market dynamics, key trends, growth drivers, challenges, and emerging opportunities. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025 and a forecast period extending to 2033, this study is an indispensable resource for industry stakeholders seeking to understand and capitalize on the evolving landscape of plastic additives. Discover market size projections, segmentation analysis by type, plastic, and application, and gain an understanding of the competitive environment shaped by leading players and recent industry developments.

Plastic Additives Market Market Concentration & Dynamics

The plastic additives market exhibits moderate to high concentration, driven by the significant market share held by a few key global players such as BASF SE, Dow, and Clariant. Innovation ecosystems are robust, with continuous investment in R&D to develop novel additives that enhance plastic performance, sustainability, and processing efficiency. Regulatory frameworks, particularly concerning environmental impact and health safety, are increasingly influential, driving demand for eco-friendly and compliant additive solutions. Substitute products, while present, often struggle to match the cost-effectiveness and performance enhancements offered by specialized plastic additives across diverse applications. End-user trends favoring lightweighting in automotive, sustainable packaging, and durable construction materials are significantly shaping demand. Mergers and acquisitions (M&A) activities, with an estimated xx deal counts historically, continue to be a strategic avenue for market consolidation and expansion, with companies seeking to broaden their product portfolios and geographical reach.

Plastic Additives Market Industry Insights & Trends

The global plastic additives market is projected to reach approximately $XX Billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This substantial growth is fueled by several interconnected factors. Firstly, the burgeoning demand for plastics across diverse sectors, including packaging, automotive, construction, and consumer goods, directly translates into an increased need for performance-enhancing and processing-facilitating additives. The continuous drive towards lightweighting in the automotive industry, for instance, necessitates specialized additives to maintain structural integrity and durability in lighter plastic components, thereby reducing fuel consumption. In the packaging sector, evolving consumer preferences for extended shelf life, enhanced aesthetics, and sustainable materials are propelling the adoption of advanced additives such as antioxidants, UV stabilizers, and barrier improvers.

Technological disruptions are playing a pivotal role in reshaping the market. The development of novel additive chemistries, including bio-based and biodegradable plastic additives, is gaining momentum in response to growing environmental concerns and stringent regulations. Advanced processing aids are enabling manufacturers to achieve higher throughput and improved surface finish in plastic production, leading to cost efficiencies. Furthermore, the integration of smart functionalities into plastics, such as antistatic properties for electronics packaging or flame retardancy for construction materials, is creating new avenues for additive innovation.

Evolving consumer behaviors, particularly the heightened awareness of environmental sustainability, are a significant trend. This is translating into increased demand for recycled plastics and, consequently, for additives that can improve the performance and processability of post-consumer recycled (PCR) materials. The push towards a circular economy is creating a demand for additives that facilitate recyclability and reduce the environmental footprint of plastic products throughout their lifecycle. The market is also witnessing a shift towards customized additive solutions tailored to specific polymer types and end-use applications, demanding greater agility and innovation from additive manufacturers.

Key Markets & Segments Leading Plastic Additives Market

The plastic additives market is characterized by significant regional and segmental dominance, driven by localized industrial growth and specific application demands.

Dominant Regions and Countries: Asia Pacific currently leads the global plastic additives market, driven by rapid industrialization, a burgeoning manufacturing base, and substantial investments in infrastructure and automotive production in countries like China and India. North America and Europe also represent significant markets, characterized by mature economies, stringent environmental regulations that foster innovation in sustainable additives, and a strong presence of key end-use industries such as automotive and construction.

Dominant Segments:

By Type:

- Plasticizers: These additives remain a cornerstone of the market, particularly for enhancing the flexibility and durability of PVC in applications ranging from cables and flooring to medical devices. The sheer volume of PVC consumption globally ensures continued strong demand for plasticizers.

- Lubricants: Crucial for improving melt flow and processing efficiency, lubricants are essential across a wide range of plastic types, especially in high-volume applications like Polyethylene (PE) and Polypropylene (PP) production for packaging films and molded goods.

- Processing Aids: This broad category, encompassing flow improvers and fluro-polymer-based aids, is critical for optimizing manufacturing processes, reducing cycle times, and enhancing the surface quality of plastic products. Their importance is amplified in applications requiring intricate designs and high precision.

- Stabilizers (Antioxidants and Light Stabilizers): Driven by the need to enhance the lifespan and performance of plastics exposed to environmental degradation (heat, UV radiation), these additives are indispensable across all major plastic types and applications. Their inclusion is vital for products in outdoor construction, automotive exteriors, and long-lasting consumer goods.

By Plastic Type:

- Polyethylene (PE) and Polypropylene (PP): These polyolefins dominate the plastic additives market due to their widespread use in packaging, consumer goods, and automotive components. The vast volumes produced necessitate a significant consumption of various additives, including lubricants, processing aids, and stabilizers.

- Polyvinyl Chloride (PVC): Despite some environmental concerns, PVC remains a significant plastic for construction, wires & cables, and flooring, driving a substantial demand for plasticizers and heat stabilizers.

- Other Plastic Types (Polyamides (PA), Polyethylene Terephthalate (PET), Polycarbonate (PC)): While consumed in lower volumes compared to PE and PP, these engineering plastics require specialized additives to achieve specific performance characteristics for demanding applications in automotive, electronics, and durable goods.

By Application:

- Packaging: This remains the largest application segment, encompassing flexible and rigid packaging for food, beverages, and consumer products. Additives are crucial for enhancing barrier properties, extending shelf life, improving aesthetics, and ensuring the safety and integrity of packaged goods.

- Construction: Growing global urbanization and infrastructure development fuel demand for plastic additives in construction materials like pipes, profiles, insulation, and flooring, where durability, weather resistance, and flame retardancy are paramount.

- Automotive: Lightweighting initiatives, coupled with the increasing use of plastics in interiors, exteriors, and under-the-hood components, drive demand for high-performance additives that enhance mechanical properties, UV resistance, and flame retardancy.

- Consumer Goods: From appliances and electronics to furniture and toys, a wide array of consumer goods rely on plastic additives to improve durability, aesthetics, and safety.

Plastic Additives Market Product Developments

Product innovation in the plastic additives market is increasingly focused on sustainability and enhanced performance. Recent developments include novel bio-based additives derived from renewable resources, offering a more environmentally friendly alternative to traditional petrochemical-based solutions. Furthermore, advancements in additive formulations are enabling improved recyclability of plastics, aligning with the growing global push towards a circular economy. Companies are also developing specialized additives that impart unique properties such as enhanced flame retardancy, improved UV stability for extended outdoor use, and superior processing characteristics, allowing manufacturers to create lighter, stronger, and more durable plastic products across diverse applications.

Challenges in the Plastic Additives Market Market

The plastic additives market faces several key challenges that impact its growth trajectory. Stringent and evolving regulatory landscapes globally, particularly concerning environmental impact, health effects, and end-of-life management of plastics, necessitate continuous adaptation and investment in compliant additive solutions. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can lead to increased production costs and lead times, affecting profitability and delivery schedules. Intense competitive pressure among established players and emerging manufacturers also drives down margins and requires constant innovation to maintain market share. Furthermore, the perception of certain plastic additives as harmful, even when proven safe under specified conditions, can hinder market acceptance and adoption.

Forces Driving Plastic Additives Market Growth

Several powerful forces are propelling the growth of the plastic additives market. Technological advancements in additive chemistry are creating novel solutions that enhance plastic performance, durability, and processability, opening up new application possibilities. The global economic recovery and increased industrial output, particularly in emerging economies, are driving demand for plastics across key sectors like packaging, construction, and automotive. Furthermore, growing regulatory support for sustainable materials and circular economy initiatives is indirectly boosting the market for additives that facilitate recycling and improve the environmental profile of plastics. The increasing demand for lightweight materials in industries like automotive and aerospace, to improve fuel efficiency and reduce emissions, is a significant growth catalyst.

Challenges in the Plastic Additives Market Market

The plastic additives market is poised for sustained long-term growth, fueled by several key catalysts. The accelerating global shift towards a circular economy and the increasing adoption of recycled plastics are creating a significant demand for additives that improve the quality and processability of post-consumer recycled (PCR) materials. Innovations in bio-based and biodegradable additives offer promising alternatives to conventional options, catering to growing consumer and regulatory pressure for sustainable solutions. Strategic partnerships and collaborations between additive manufacturers and polymer producers are fostering the development of integrated solutions, enhancing performance and driving market penetration. Furthermore, expanding end-use applications in sectors like electric vehicles, renewable energy infrastructure, and advanced medical devices present substantial growth opportunities for specialized additive solutions.

Emerging Opportunities in Plastic Additives Market

Emerging opportunities within the plastic additives market are significant and multifaceted. The growing consumer and regulatory demand for sustainable and eco-friendly plastic solutions is creating a substantial market for bio-based, biodegradable, and recyclable additives. The development of smart additives, capable of imparting self-healing, antimicrobial, or sensing properties to plastics, presents a frontier of innovation with high growth potential. The expansion of electric vehicle (EV) production necessitates specialized additives for lightweighting, thermal management, and flame retardancy in battery components and vehicle interiors. Furthermore, increasing urbanization and infrastructure development in developing regions are driving demand for durable and weather-resistant plastic additives in construction materials. The digitalization of manufacturing processes also opens avenues for additive solutions that enhance automation and real-time process monitoring.

Leading Players in the Plastic Additives Market Sector

- Struktol Company of America LLC

- Clariant

- Arkema

- Nouryon

- KANEKA CORPORATION

- Solvay

- Exxon Mobil Corporation

- Peter Greven GmbH & Co KG

- ADEKA CORPORATION

- Mitsui & Co Plastics Ltd

- Evonik Industries AG

- LANXESS

- Croda International PLC

- Kemipex

- Emery Oleochemicals

- BASF SE

- Dow

- SABO SpA

- SONGWON

- Baerlocher GmbH

Key Milestones in Plastic Additives Market Industry

- September 2022: BASF showcased VALERAS, a new portfolio for its plastic additives, offering sustainability benefits and accelerating the journey towards a circular economy and net-zero emissions through technical solutions and services. This initiative includes several advanced antioxidants and light stabilizers.

- March 2022: BASF announced an expansion of production capacity for its hindered amine light stabilizers (HALS) at its facilities in Italy and Germany. These HALS, including well-known brands like Tinuvin, Chimassorb, and Uvinul, are vital for protecting polymers from UV radiation and inhibiting free-radical-induced degradation, thereby extending the lifespan of plastic products.

Strategic Outlook for Plastic Additives Market Market

The strategic outlook for the plastic additives market is one of robust and sustained growth, driven by a confluence of technological innovation, evolving regulatory landscapes, and increasing end-user demand for enhanced plastic performance and sustainability. Key growth accelerators include the escalating adoption of recycled plastics, necessitating specialized additives for improved quality and processability, and the burgeoning demand for bio-based and biodegradable alternatives to conventional plastic additives. Companies that prioritize investment in R&D for these sustainable solutions, coupled with strategic partnerships to expand their product portfolios and market reach, will be best positioned for future success. The market's trajectory is intrinsically linked to the broader trends in polymer consumption and the global imperative for a circular economy, presenting significant opportunities for additive manufacturers to innovate and lead.

Plastic Additives Market Segmentation

-

1. Type

- 1.1. Lubricants

- 1.2. Processing Aids (Fluro-polymer-based)

- 1.3. Flow Improvers

- 1.4. Slip Additives

- 1.5. Antistatic Additives

- 1.6. Pigment Wetting Agents

- 1.7. Filler Dispersants

- 1.8. Antifog Additives

- 1.9. Plasticizers

- 1.10. Other Types

-

2. Plastic Type

- 2.1. Polyethylene (PE)

- 2.2. Polystyrene (PS)

- 2.3. Polypropylene (PP)

- 2.4. Polyamides (PA)

- 2.5. Polyethylene Terephthalate (PET)

- 2.6. Polyvinyl Chloride (PVC)

- 2.7. Polycarbonate (PC)

- 2.8. Other Plastic Types

-

3. Application

- 3.1. Packaging

- 3.2. Consumer Goods

- 3.3. Construction

- 3.4. Automotive

- 3.5. Other Applications

Plastic Additives Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Additives Market Regional Market Share

Geographic Coverage of Plastic Additives Market

Plastic Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Conventional Materials by Plastics in Several Applications; Increasing Demand for Plastics Due to Rapid Urbanization and Rising Purchasing Power Among Consumers

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations on Plastic Usage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Packaging to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lubricants

- 5.1.2. Processing Aids (Fluro-polymer-based)

- 5.1.3. Flow Improvers

- 5.1.4. Slip Additives

- 5.1.5. Antistatic Additives

- 5.1.6. Pigment Wetting Agents

- 5.1.7. Filler Dispersants

- 5.1.8. Antifog Additives

- 5.1.9. Plasticizers

- 5.1.10. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Plastic Type

- 5.2.1. Polyethylene (PE)

- 5.2.2. Polystyrene (PS)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polyamides (PA)

- 5.2.5. Polyethylene Terephthalate (PET)

- 5.2.6. Polyvinyl Chloride (PVC)

- 5.2.7. Polycarbonate (PC)

- 5.2.8. Other Plastic Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Packaging

- 5.3.2. Consumer Goods

- 5.3.3. Construction

- 5.3.4. Automotive

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lubricants

- 6.1.2. Processing Aids (Fluro-polymer-based)

- 6.1.3. Flow Improvers

- 6.1.4. Slip Additives

- 6.1.5. Antistatic Additives

- 6.1.6. Pigment Wetting Agents

- 6.1.7. Filler Dispersants

- 6.1.8. Antifog Additives

- 6.1.9. Plasticizers

- 6.1.10. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Plastic Type

- 6.2.1. Polyethylene (PE)

- 6.2.2. Polystyrene (PS)

- 6.2.3. Polypropylene (PP)

- 6.2.4. Polyamides (PA)

- 6.2.5. Polyethylene Terephthalate (PET)

- 6.2.6. Polyvinyl Chloride (PVC)

- 6.2.7. Polycarbonate (PC)

- 6.2.8. Other Plastic Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Packaging

- 6.3.2. Consumer Goods

- 6.3.3. Construction

- 6.3.4. Automotive

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lubricants

- 7.1.2. Processing Aids (Fluro-polymer-based)

- 7.1.3. Flow Improvers

- 7.1.4. Slip Additives

- 7.1.5. Antistatic Additives

- 7.1.6. Pigment Wetting Agents

- 7.1.7. Filler Dispersants

- 7.1.8. Antifog Additives

- 7.1.9. Plasticizers

- 7.1.10. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Plastic Type

- 7.2.1. Polyethylene (PE)

- 7.2.2. Polystyrene (PS)

- 7.2.3. Polypropylene (PP)

- 7.2.4. Polyamides (PA)

- 7.2.5. Polyethylene Terephthalate (PET)

- 7.2.6. Polyvinyl Chloride (PVC)

- 7.2.7. Polycarbonate (PC)

- 7.2.8. Other Plastic Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Packaging

- 7.3.2. Consumer Goods

- 7.3.3. Construction

- 7.3.4. Automotive

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lubricants

- 8.1.2. Processing Aids (Fluro-polymer-based)

- 8.1.3. Flow Improvers

- 8.1.4. Slip Additives

- 8.1.5. Antistatic Additives

- 8.1.6. Pigment Wetting Agents

- 8.1.7. Filler Dispersants

- 8.1.8. Antifog Additives

- 8.1.9. Plasticizers

- 8.1.10. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Plastic Type

- 8.2.1. Polyethylene (PE)

- 8.2.2. Polystyrene (PS)

- 8.2.3. Polypropylene (PP)

- 8.2.4. Polyamides (PA)

- 8.2.5. Polyethylene Terephthalate (PET)

- 8.2.6. Polyvinyl Chloride (PVC)

- 8.2.7. Polycarbonate (PC)

- 8.2.8. Other Plastic Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Packaging

- 8.3.2. Consumer Goods

- 8.3.3. Construction

- 8.3.4. Automotive

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lubricants

- 9.1.2. Processing Aids (Fluro-polymer-based)

- 9.1.3. Flow Improvers

- 9.1.4. Slip Additives

- 9.1.5. Antistatic Additives

- 9.1.6. Pigment Wetting Agents

- 9.1.7. Filler Dispersants

- 9.1.8. Antifog Additives

- 9.1.9. Plasticizers

- 9.1.10. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Plastic Type

- 9.2.1. Polyethylene (PE)

- 9.2.2. Polystyrene (PS)

- 9.2.3. Polypropylene (PP)

- 9.2.4. Polyamides (PA)

- 9.2.5. Polyethylene Terephthalate (PET)

- 9.2.6. Polyvinyl Chloride (PVC)

- 9.2.7. Polycarbonate (PC)

- 9.2.8. Other Plastic Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Packaging

- 9.3.2. Consumer Goods

- 9.3.3. Construction

- 9.3.4. Automotive

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Plastic Additives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lubricants

- 10.1.2. Processing Aids (Fluro-polymer-based)

- 10.1.3. Flow Improvers

- 10.1.4. Slip Additives

- 10.1.5. Antistatic Additives

- 10.1.6. Pigment Wetting Agents

- 10.1.7. Filler Dispersants

- 10.1.8. Antifog Additives

- 10.1.9. Plasticizers

- 10.1.10. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Plastic Type

- 10.2.1. Polyethylene (PE)

- 10.2.2. Polystyrene (PS)

- 10.2.3. Polypropylene (PP)

- 10.2.4. Polyamides (PA)

- 10.2.5. Polyethylene Terephthalate (PET)

- 10.2.6. Polyvinyl Chloride (PVC)

- 10.2.7. Polycarbonate (PC)

- 10.2.8. Other Plastic Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Packaging

- 10.3.2. Consumer Goods

- 10.3.3. Construction

- 10.3.4. Automotive

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Struktol Company of America LLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arkema

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nouryon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KANEKA CORPORATION

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solvay

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Exxon Mobil Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Peter Greven GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ADEKA CORPORATION

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsui & Co Plastics Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Evonik Industries AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LANXESS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Croda International PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kemipex

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Emery Oleochemicals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BASF SE

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dow

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 SABO SpA

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SONGWON

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Baerlocher GmbH

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Struktol Company of America LLC*List Not Exhaustive

List of Figures

- Figure 1: Global Plastic Additives Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Plastic Additives Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Plastic Additives Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Plastic Additives Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 5: North America Plastic Additives Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 6: North America Plastic Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Plastic Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Plastic Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Plastic Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Plastic Additives Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Plastic Additives Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Plastic Additives Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 13: South America Plastic Additives Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 14: South America Plastic Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Plastic Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Plastic Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Plastic Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Plastic Additives Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe Plastic Additives Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Plastic Additives Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 21: Europe Plastic Additives Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 22: Europe Plastic Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe Plastic Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Plastic Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Plastic Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Plastic Additives Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East & Africa Plastic Additives Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Plastic Additives Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 29: Middle East & Africa Plastic Additives Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 30: Middle East & Africa Plastic Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East & Africa Plastic Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa Plastic Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Plastic Additives Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Plastic Additives Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Asia Pacific Plastic Additives Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Plastic Additives Market Revenue (undefined), by Plastic Type 2025 & 2033

- Figure 37: Asia Pacific Plastic Additives Market Revenue Share (%), by Plastic Type 2025 & 2033

- Figure 38: Asia Pacific Plastic Additives Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: Asia Pacific Plastic Additives Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific Plastic Additives Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Plastic Additives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 3: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Plastic Additives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 7: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Plastic Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 14: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Plastic Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 21: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Plastic Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 34: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Plastic Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Plastic Additives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 43: Global Plastic Additives Market Revenue undefined Forecast, by Plastic Type 2020 & 2033

- Table 44: Global Plastic Additives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 45: Global Plastic Additives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Plastic Additives Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Additives Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Plastic Additives Market?

Key companies in the market include Struktol Company of America LLC*List Not Exhaustive, Clariant, Arkema, Nouryon, KANEKA CORPORATION, Solvay, Exxon Mobil Corporation, Peter Greven GmbH & Co KG, ADEKA CORPORATION, Mitsui & Co Plastics Ltd, Evonik Industries AG, LANXESS, Croda International PLC, Kemipex, Emery Oleochemicals, BASF SE, Dow, SABO SpA, SONGWON, Baerlocher GmbH.

3. What are the main segments of the Plastic Additives Market?

The market segments include Type, Plastic Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Conventional Materials by Plastics in Several Applications; Increasing Demand for Plastics Due to Rapid Urbanization and Rising Purchasing Power Among Consumers.

6. What are the notable trends driving market growth?

Packaging to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations on Plastic Usage; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: BASF showcased VALERAS for its plastic additives portfolio. VALERAS adds value to plastic applications by delivering sustainability benefits with additive technical solutions and services, such as accelerating the plastic journey to a circular economy and net zero emissions. Also, these include several antioxidants and light stabilizers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Additives Market?

To stay informed about further developments, trends, and reports in the Plastic Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence