Key Insights

The global Polyester Tire Cord Fabrics market is poised for substantial expansion, projected to reach $9.3 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.1%. This growth is primarily fueled by increasing automotive production worldwide and the consistent demand for replacement tires. Key growth factors include the industry's shift towards lighter, more fuel-efficient vehicles, where polyester tire cords offer superior strength-to-weight ratios. Advancements in tire technology, enhancing durability and performance, also contribute significantly to market demand. The rising production of commercial vehicles for logistics and transportation, alongside a growing aftermarket for tire replacements, further supports this positive market outlook. The development of high-performance tires for specialized automotive segments is also stimulating innovation and market penetration.

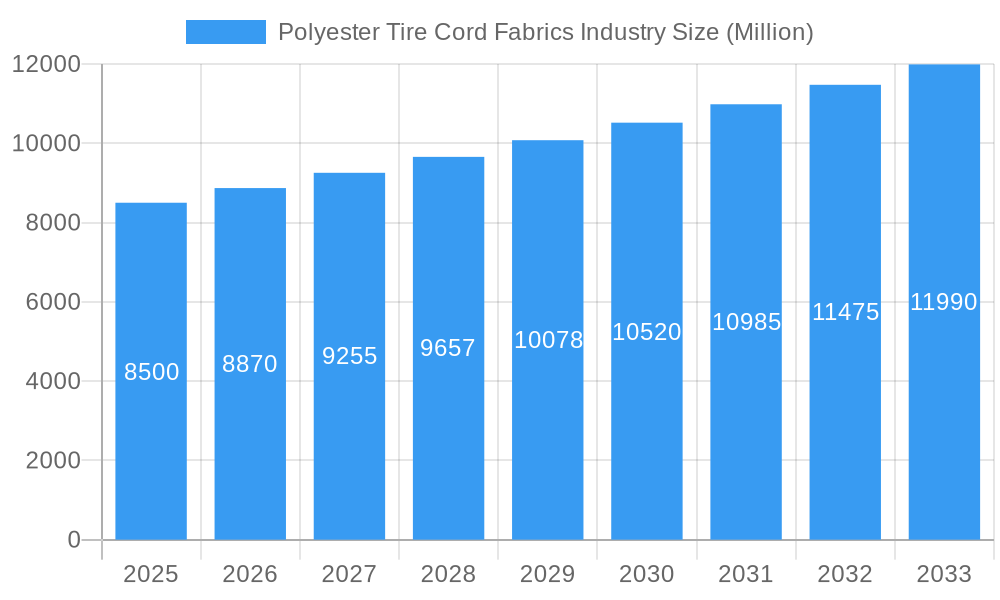

Polyester Tire Cord Fabrics Industry Market Size (In Billion)

While the polyester tire cord fabrics market presents a promising growth trajectory, manufacturers face challenges such as price volatility of polyester precursors and potential supply chain disruptions due to geopolitical factors. Nevertheless, the inherent advantages of polyester tire cord fabrics, including excellent dimensional stability, high tensile strength, and superior adhesion properties, solidify their indispensable role in tire manufacturing. The market is segmented by tire type (Radial, Bias) and application (Passenger Cars, Commercial Vehicles, Other), highlighting its diverse landscape. Leading companies are actively investing in research and development to drive innovation and meet evolving industry standards, ensuring the continued vitality of the polyester tire cord fabrics sector.

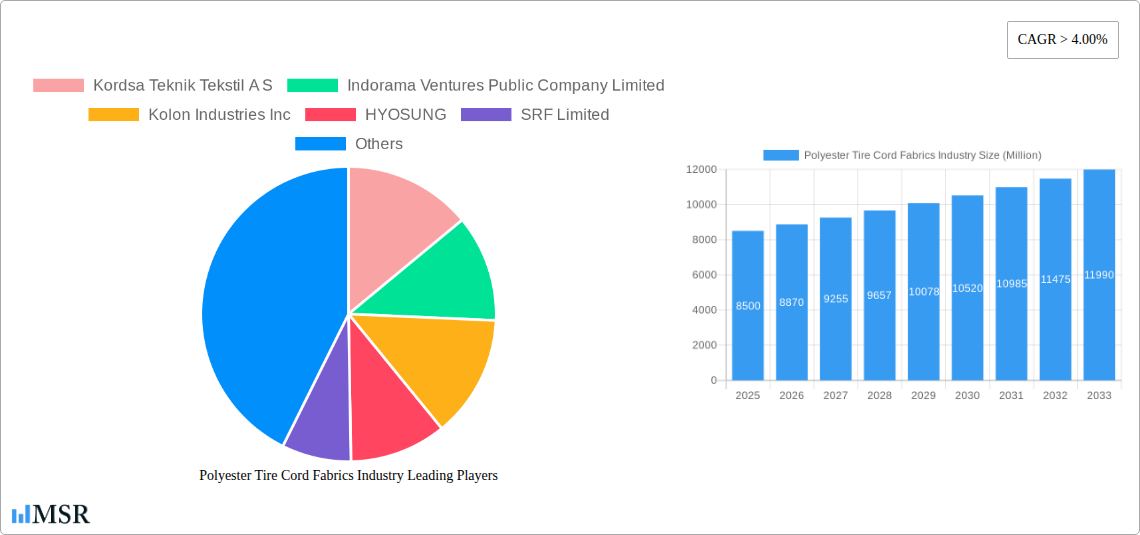

Polyester Tire Cord Fabrics Industry Company Market Share

Gain critical intelligence on the global Polyester Tire Cord Fabrics market. This comprehensive report, spanning 2019-2033 with a base year of 2025, provides actionable insights for stakeholders navigating market dynamics, technological advancements, and emerging opportunities. Understand market size, CAGR, key players, and strategic imperatives shaping the future of polyester tire cord fabric production and consumption.

Polyester Tire Cord Fabrics Industry Market Concentration & Dynamics

The Polyester Tire Cord Fabrics industry exhibits a moderate level of market concentration, with a few key global players dominating a significant portion of the market share. Innovation ecosystems are thriving, driven by advancements in polymer science and manufacturing technologies aimed at enhancing tire performance, durability, and fuel efficiency. Regulatory frameworks, particularly concerning tire safety and environmental standards, play a crucial role in shaping product development and market access. The threat of substitute products, while present from materials like nylon and steel cord, is mitigated by polyester's cost-effectiveness and favorable performance characteristics for specific tire types. End-user trends are heavily influenced by the automotive sector's demand for lighter, stronger, and more sustainable tire components. Merger and acquisition (M&A) activities are strategic tools for consolidation, market expansion, and technological integration, with recent years witnessing several impactful deals. For instance, Indorama Ventures Public Company Limited and Kordsa Teknik Tekstil A.S. are prominent players actively involved in market expansion and innovation. The market share of the top 5 players is estimated to be around 65-70%, with an average of 5-7 M&A deals annually in the last five years, indicating a dynamic and competitive landscape.

Polyester Tire Cord Fabrics Industry Industry Insights & Trends

The global Polyester Tire Cord Fabrics market is projected for robust growth, driven by several interconnected factors. The burgeoning automotive industry, particularly in emerging economies, is a primary growth engine, fueling increased demand for tires and, consequently, tire cord fabrics. The shift towards radial tire technology, which offers superior performance and fuel efficiency compared to biased tires, significantly bolsters the demand for high-quality polyester tire cord fabrics. Technological advancements in manufacturing processes, including innovations in yarn extrusion, dipping, and weaving, are leading to enhanced product properties such as higher tensile strength, improved dimensional stability, and better adhesion to rubber compounds. These improvements are critical for meeting the stringent performance requirements of modern tires used in passenger cars, commercial vehicles, and specialized applications. Furthermore, the increasing emphasis on tire longevity, safety, and sustainability is pushing manufacturers to develop advanced polyester tire cord solutions. The market size in the base year of 2025 is estimated at approximately $8,500 Million, with a projected Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period of 2025-2033. This growth is supported by the rising global vehicle production numbers, estimated to reach over 90 Million units annually by 2025, and a sustained demand for replacement tires. Consumer preferences are also evolving, with a growing awareness of the role tire cord fabrics play in overall vehicle performance and safety, leading to a higher demand for premium and technologically advanced options. The increasing adoption of electric vehicles (EVs), which often require tires with specific performance characteristics like low rolling resistance and enhanced durability, also presents a significant opportunity for specialized polyester tire cord fabrics.

Key Markets & Segments Leading Polyester Tire Cord Fabrics Industry

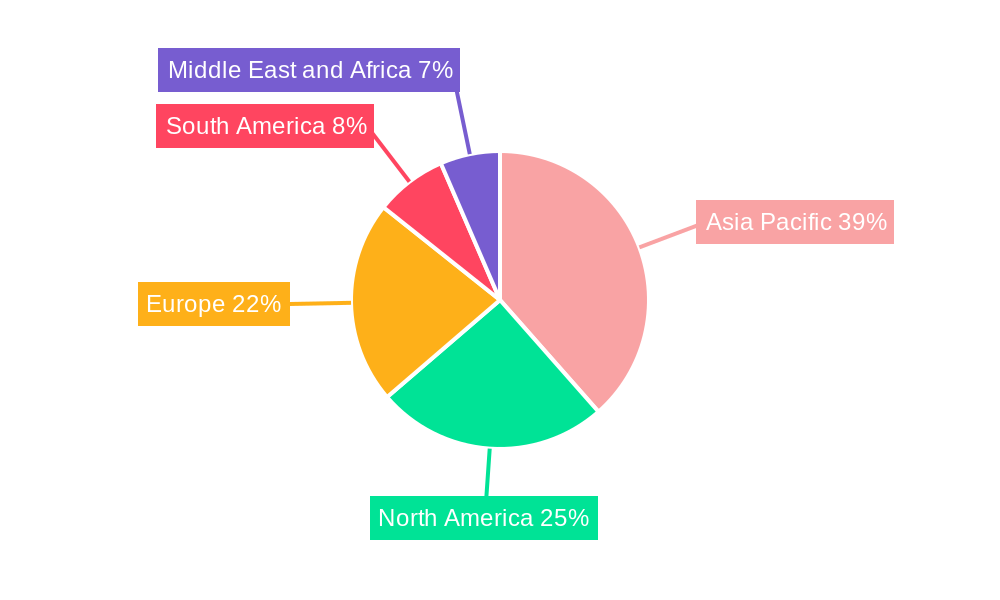

The Radial Tire segment, particularly for Passenger Cars and Commercial Vehicles, is the dominant force within the Polyester Tire Cord Fabrics industry. Asia-Pacific, spearheaded by China and India, is the leading geographical market, driven by its status as a global automotive manufacturing hub and a substantial consumer base for vehicles.

Dominance of Radial Tires:

- Economic Growth: Rising disposable incomes and increased vehicle ownership in developing nations directly translate to higher demand for new vehicles equipped with radial tires.

- Infrastructure Development: Government investments in road infrastructure across emerging economies facilitate the use of vehicles that benefit from the superior performance of radial tires.

- Technological Superiority: Radial tires offer better handling, improved fuel efficiency, and extended tread life compared to biased tires, making them the preferred choice for both original equipment manufacturers (OEMs) and the replacement market.

- Fuel Efficiency Mandates: Increasingly stringent fuel efficiency regulations globally incentivize the adoption of radial tires, which contribute to lower fuel consumption.

Leading Application Segments:

- Passenger Cars: This segment represents the largest application due to the sheer volume of passenger vehicles produced and in operation worldwide. The demand is driven by trends like urbanization, the rise of the middle class, and the increasing preference for personal mobility.

- Commercial Vehicles: The continuous growth of the logistics and transportation sector, coupled with the need for durable and high-performance tires in heavy-duty applications, makes commercial vehicles a significant segment. Increased global trade and e-commerce are key drivers here.

- Other Applications: This includes tires for motorcycles, agricultural machinery, and industrial equipment. While smaller in volume compared to passenger and commercial vehicles, these segments contribute to market diversification and offer niche growth opportunities.

The dominance of Asia-Pacific is further amplified by the presence of major tire manufacturers and a robust supply chain for raw materials. The region's rapid industrialization and increasing per capita vehicle ownership ensure a sustained demand for polyester tire cord fabrics. In 2025, the Asia-Pacific region is estimated to account for approximately 55% of the global market share, with China alone contributing over 30%. The radial tire segment is projected to hold over 90% of the market by tire type.

Polyester Tire Cord Fabrics Industry Product Developments

Product development in the Polyester Tire Cord Fabrics industry is focused on enhancing key performance indicators critical for modern tire manufacturing. Innovations include the development of high-tenacity yarns with superior strength-to-weight ratios, improved dimensional stability for better tire uniformity, and advanced dipping technologies for enhanced adhesion to rubber compounds. These advancements are crucial for meeting the demands of high-performance tires, including those for electric vehicles, which require specialized properties like low rolling resistance and high load-bearing capacity. The market relevance is underscored by the continuous drive for lighter, stronger, and more fuel-efficient tires, where polyester tire cord fabrics play an indispensable role.

Challenges in the Polyester Tire Cord Fabrics Industry Market

The Polyester Tire Cord Fabrics industry faces several challenges that can impact its growth trajectory. Fluctuations in raw material prices, particularly for petrochemical derivatives like PTA and MEG, can lead to price volatility and affect profit margins. Intense competition among global and regional manufacturers, coupled with the presence of established substitutes, necessitates continuous innovation and cost optimization. Stringent environmental regulations concerning chemical usage and waste disposal in the manufacturing process add to operational costs and compliance burdens. Furthermore, supply chain disruptions, as witnessed in recent global events, can impact the availability and timely delivery of raw materials and finished products, posing a significant restraint on market expansion.

Forces Driving Polyester Tire Cord Fabrics Industry Growth

Several key forces are propelling the growth of the Polyester Tire Cord Fabrics market. The sustained global demand for automotive vehicles, driven by population growth and urbanization, is a primary catalyst. Technological advancements in tire design, focusing on enhanced safety, fuel efficiency, and durability, directly translate to increased demand for high-performance polyester tire cord fabrics. The ongoing shift towards radial tires, offering superior performance characteristics, is a significant growth driver. Furthermore, the expansion of the automotive manufacturing sector in emerging economies, coupled with government initiatives supporting industrial development, is creating substantial market opportunities. The increasing adoption of electric vehicles, which often require specialized tire constructions, further fuels the demand for advanced polyester tire cord solutions.

Challenges in the Polyester Tire Cord Fabrics Industry Market

Long-term growth catalysts for the Polyester Tire Cord Fabrics industry are firmly rooted in innovation and market expansion. The continuous development of advanced polyester yarns with superior mechanical properties, such as enhanced modulus and thermal stability, will cater to the evolving demands of high-performance and sustainable tires. Strategic partnerships between tire cord manufacturers and tire companies are crucial for co-developing bespoke solutions for next-generation tires, including those designed for autonomous and electric vehicles. Expanding production capacities in key growth regions and diversifying product portfolios to cater to niche applications will also serve as significant growth accelerators. The ongoing research into bio-based polyester alternatives could also present a long-term sustainable growth avenue.

Emerging Opportunities in Polyester Tire Cord Fabrics Industry

Emerging opportunities in the Polyester Tire Cord Fabrics industry are diverse and promising. The rapidly expanding electric vehicle (EV) market presents a significant avenue, as EVs often require tires with specific characteristics like low rolling resistance, quiet operation, and high torque resistance, which can be achieved through advanced polyester tire cord constructions. The growing demand for sustainable and eco-friendly products is driving interest in recycled polyester tire cord fabrics and novel manufacturing processes that minimize environmental impact. Furthermore, the increasing use of tires in non-automotive applications, such as aerospace, industrial machinery, and conveyor belts, offers new market segments for specialized polyester tire cord fabrics. The continued growth of the global e-commerce sector is also indirectly boosting demand by increasing the volume of commercial vehicle traffic.

Leading Players in the Polyester Tire Cord Fabrics Industry Sector

- Kordsa Teknik Tekstil A.S.

- Indorama Ventures Public Company Limited

- Kolon Industries Inc.

- HYOSUNG

- SRF Limited

- TEIJIN FRONTIER (U S A )INC

- TORAY INDUSTRIES INC

- Madura Industrial Textiles Ltd

- KORDRNA Plus a s

- Zhejiang Hailide New Material Co Ltd

- Firestone Fibers & Textiles

Key Milestones in Polyester Tire Cord Fabrics Industry Industry

- March 2021: Zhejiang Hailide New Material Co. Ltd unveiled plans for a significant capacity addition, aiming to establish the largest production capacity of polyester tire cord fabric in China. This expansion is poised to significantly influence regional supply dynamics and competitive pricing.

- January 2021: Kolon Industries Inc. announced its intention to expand its polyester tire cord plant in Vietnam. This expansion aims to boost its annual production capacity by 19,200 tons, catering to the growing demand in Southeast Asia and solidifying its market presence.

Strategic Outlook for Polyester Tire Cord Fabrics Industry Market

The strategic outlook for the Polyester Tire Cord Fabrics market is characterized by sustained growth and evolving opportunities. Key growth accelerators include the increasing global vehicle production, the ongoing transition to radial tire technology, and the burgeoning demand for electric vehicle tires. Manufacturers that focus on technological innovation, particularly in developing high-performance and sustainable tire cord solutions, will be well-positioned to capture market share. Strategic partnerships with tire manufacturers for co-development of next-generation tire materials and expansion into emerging geographical markets with strong automotive growth projections will be crucial for long-term success. Furthermore, investing in research and development for environmentally friendly production processes and materials will align with global sustainability trends and enhance brand reputation.

Polyester Tire Cord Fabrics Industry Segmentation

-

1. Tire Type

- 1.1. Radial Tire

- 1.2. Biased Tire

-

2. Application

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

- 2.3. Other Applications

Polyester Tire Cord Fabrics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyester Tire Cord Fabrics Industry Regional Market Share

Geographic Coverage of Polyester Tire Cord Fabrics Industry

Polyester Tire Cord Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Passenger Cars in the Emerging Economies; Increasing Preference for Fuel Efficient Tires

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Passenger Cars in the Emerging Economies; Increasing Preference for Fuel Efficient Tires

- 3.4. Market Trends

- 3.4.1. Rising Demand for Passenger Cars in the Emerging Economies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tire Type

- 5.1.1. Radial Tire

- 5.1.2. Biased Tire

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Tire Type

- 6. Asia Pacific Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tire Type

- 6.1.1. Radial Tire

- 6.1.2. Biased Tire

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Tire Type

- 7. North America Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tire Type

- 7.1.1. Radial Tire

- 7.1.2. Biased Tire

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Tire Type

- 8. Europe Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tire Type

- 8.1.1. Radial Tire

- 8.1.2. Biased Tire

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Tire Type

- 9. South America Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tire Type

- 9.1.1. Radial Tire

- 9.1.2. Biased Tire

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Tire Type

- 10. Middle East and Africa Polyester Tire Cord Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Tire Type

- 10.1.1. Radial Tire

- 10.1.2. Biased Tire

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Tire Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kordsa Teknik Tekstil A S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Indorama Ventures Public Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kolon Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HYOSUNG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SRF Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TEIJIN FRONTIER(U S A )INC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TORAY INDUSTRIES INC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Madura Industrial Textiles Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KORDRNA Plus a s

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zhejiang Hailide New Material Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Firestone Fibers & Textiles*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Kordsa Teknik Tekstil A S

List of Figures

- Figure 1: Global Polyester Tire Cord Fabrics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue (billion), by Tire Type 2025 & 2033

- Figure 3: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue Share (%), by Tire Type 2025 & 2033

- Figure 4: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Polyester Tire Cord Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Polyester Tire Cord Fabrics Industry Revenue (billion), by Tire Type 2025 & 2033

- Figure 9: North America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Tire Type 2025 & 2033

- Figure 10: North America Polyester Tire Cord Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Polyester Tire Cord Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Polyester Tire Cord Fabrics Industry Revenue (billion), by Tire Type 2025 & 2033

- Figure 15: Europe Polyester Tire Cord Fabrics Industry Revenue Share (%), by Tire Type 2025 & 2033

- Figure 16: Europe Polyester Tire Cord Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Polyester Tire Cord Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Polyester Tire Cord Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Polyester Tire Cord Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Polyester Tire Cord Fabrics Industry Revenue (billion), by Tire Type 2025 & 2033

- Figure 21: South America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Tire Type 2025 & 2033

- Figure 22: South America Polyester Tire Cord Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Polyester Tire Cord Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Polyester Tire Cord Fabrics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue (billion), by Tire Type 2025 & 2033

- Figure 27: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue Share (%), by Tire Type 2025 & 2033

- Figure 28: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 2: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 5: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 13: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 19: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 27: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Tire Type 2020 & 2033

- Table 33: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Polyester Tire Cord Fabrics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Polyester Tire Cord Fabrics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyester Tire Cord Fabrics Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Polyester Tire Cord Fabrics Industry?

Key companies in the market include Kordsa Teknik Tekstil A S, Indorama Ventures Public Company Limited, Kolon Industries Inc, HYOSUNG, SRF Limited, TEIJIN FRONTIER(U S A )INC, TORAY INDUSTRIES INC, Madura Industrial Textiles Ltd, KORDRNA Plus a s, Zhejiang Hailide New Material Co Ltd, Firestone Fibers & Textiles*List Not Exhaustive.

3. What are the main segments of the Polyester Tire Cord Fabrics Industry?

The market segments include Tire Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Passenger Cars in the Emerging Economies; Increasing Preference for Fuel Efficient Tires.

6. What are the notable trends driving market growth?

Rising Demand for Passenger Cars in the Emerging Economies.

7. Are there any restraints impacting market growth?

Rising Demand for Passenger Cars in the Emerging Economies; Increasing Preference for Fuel Efficient Tires.

8. Can you provide examples of recent developments in the market?

In March 2021, Zhejiang Hailide New Material Co. Ltd unveiled plans of capacity addition, which will result in the largest production capacity of polyester tire cord fabric in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyester Tire Cord Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyester Tire Cord Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyester Tire Cord Fabrics Industry?

To stay informed about further developments, trends, and reports in the Polyester Tire Cord Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence