Key Insights

The global Polyolefin Shrink Film market is projected to reach $8.94 billion by 2031, exhibiting a Compound Annual Growth Rate (CAGR) of 4.65% from the base year 2024. This growth is propelled by increasing demand across key sectors, notably food and beverage, owing to superior clarity, strength, and tamper-evident features. Industrial packaging also contributes significantly, driven by the need for secure product bundling. Personal care, cosmetics, and pharmaceuticals increasingly utilize these films for protection and aesthetic appeal. Innovations in material science, including cross-linked formulations, are enhancing performance, expanding applications, and driving market penetration.

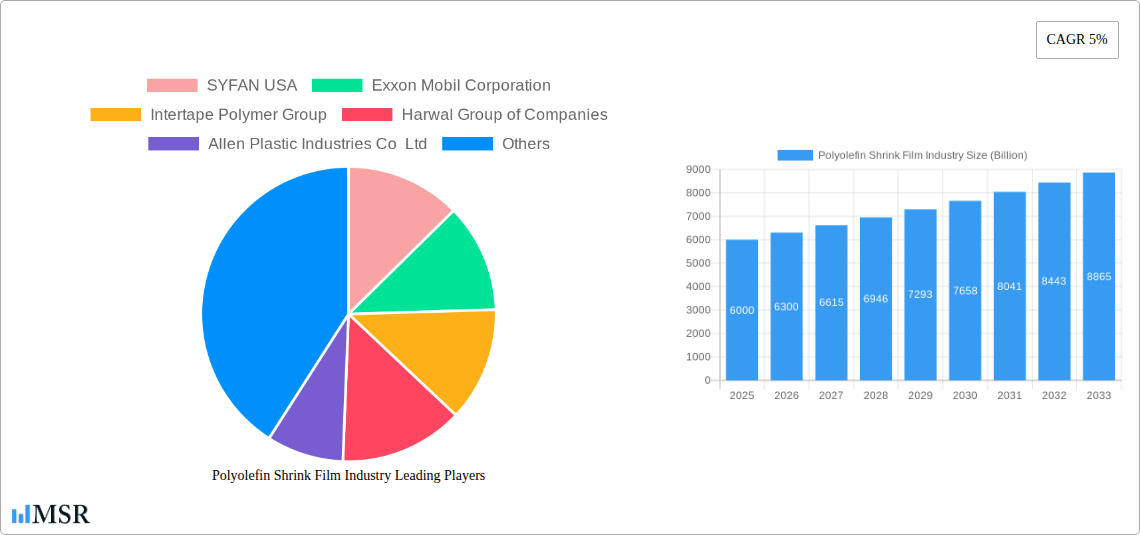

Polyolefin Shrink Film Industry Market Size (In Billion)

Key market drivers include a rising consumer preference for sustainable packaging, spurring the development of bio-based and recyclable alternatives. Advanced manufacturing technologies are boosting production efficiency and cost-effectiveness. Geographically, the Asia Pacific region, particularly China and India, is a leading market due to robust manufacturing and increasing packaged goods consumption. Market restraints include raw material price volatility and intense competition, necessitating continuous innovation and strategic partnerships. Major players like Berry Global Inc., Exxon Mobil Corporation, and SABIC are investing in R&D to meet evolving market demands and regulatory requirements.

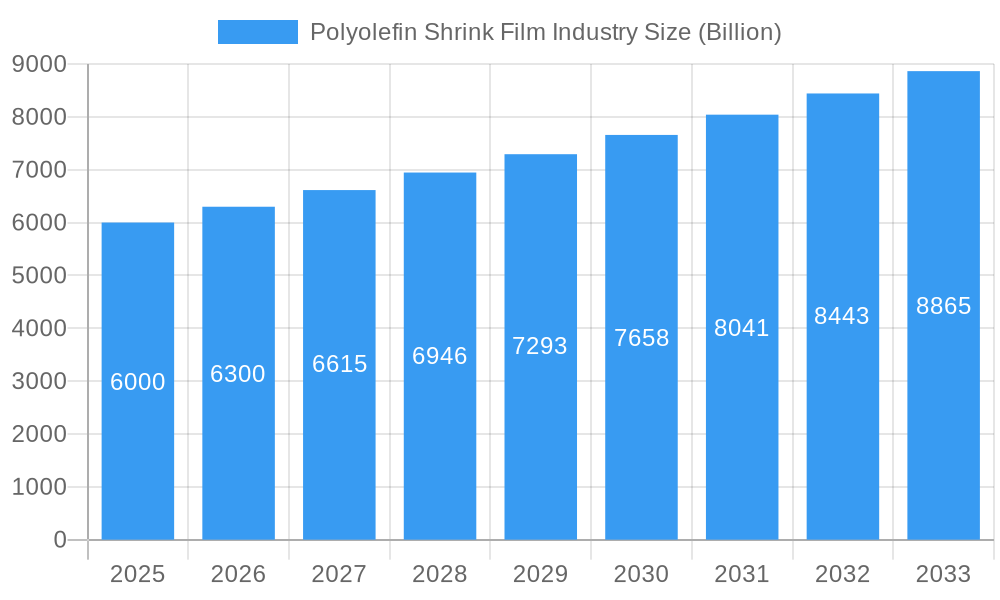

Polyolefin Shrink Film Industry Company Market Share

Polyolefin Shrink Film Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report offers a comprehensive analysis of the global polyolefin shrink film market, providing invaluable insights for packaging companies, material suppliers, and industry stakeholders. Delve into market dynamics, growth drivers, emerging trends, and competitive landscapes shaping the polyolefin shrink film industry. Our detailed study covers the historical period (2019-2024), base year (2025), and projects significant growth through the forecast period (2025-2033). Discover key market segments including General Shrink Film and Cross-Linked Shrink Film, alongside material types like Polyethylene (PE) and Polypropylene (PP). Explore critical applications such as Food and Beverage, Industrial Packaging, Personal Care and Cosmetics, Pharmaceutical, and Printing and Stationery. Gain a competitive edge with actionable intelligence on market concentration, product developments, challenges, and opportunities within this dynamic sector.

Polyolefin Shrink Film Industry Market Concentration & Dynamics

The polyolefin shrink film market exhibits a moderate level of concentration, with a significant portion of the market share held by a few leading global players. Innovation ecosystems are flourishing, driven by advancements in material science and processing technologies, leading to the development of specialized films with enhanced properties like higher clarity, improved puncture resistance, and greater shrink ratios. Regulatory frameworks surrounding packaging materials, particularly concerning recyclability and sustainability, are increasingly influencing market strategies and product development. Substitute products, such as stretch wrap and other flexible packaging solutions, present a competitive challenge, though polyolefin shrink films retain their dominance in specific applications due to their unique performance characteristics. End-user trends are leaning towards lighter-weight, more sustainable packaging options, which is spurring innovation in film formulations and manufacturing processes. Mergers and acquisitions (M&A) activities, though not consistently high, have played a role in market consolidation and expansion of product portfolios. For instance, strategic acquisitions by major players have aimed to bolster their presence in key geographic regions and diversify their offerings. The market share of the top five companies is estimated to be around 50-60%, with M&A deal counts averaging 2-4 per year over the historical period.

Polyolefin Shrink Film Industry Industry Insights & Trends

The global polyolefin shrink film market is poised for substantial growth, projected to reach an estimated USD 25 Billion by 2025, and is anticipated to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. This expansion is primarily fueled by the escalating demand for efficient and protective packaging solutions across a wide spectrum of industries. The food and beverage sector remains a cornerstone of demand, driven by increasing global consumption, the need for extended shelf life, and the convenience offered by shrink-wrapped products. As populations grow and urbanization continues, the requirement for securely packaged food items, from individual servings to bulk goods, will only intensify. Furthermore, the industrial packaging segment is witnessing significant traction, with polyolefin shrink films being indispensable for bundling, palletizing, and protecting goods during transit and storage. The resilience and adaptability of these films make them ideal for a diverse range of industrial products, from electronics and machinery to construction materials.

Technological disruptions are playing a pivotal role in shaping the polyolefin shrink film industry. Innovations in film extrusion technologies, such as multilayer co-extrusion, are enabling the creation of films with tailored properties, including superior barrier capabilities, enhanced aesthetics, and improved sustainability profiles. The development of high-performance Cross-Linked Shrink Films is particularly noteworthy, offering exceptional strength and dimensional stability, making them suitable for demanding applications. Advancements in material science are also leading to the development of thinner yet stronger films, contributing to weight reduction and material savings, aligning with global sustainability initiatives.

Evolving consumer behaviors are also a significant influence. Consumers are increasingly conscious of product presentation and protection. The clarity and tamper-evident nature of polyolefin shrink films enhance product appeal on retail shelves and provide assurance of product integrity. The growing preference for convenience in packaging, especially in the personal care and cosmetics and pharmaceutical sectors, further bolsters demand for shrink films that offer an aesthetically pleasing and secure wrap. The e-commerce boom has also indirectly benefited the polyolefin shrink film market, as these films are often used as secondary packaging for protection during shipping.

The polyolefin shrink film market size is estimated to be around USD 22 Billion in the base year of 2025, with projections indicating a significant upward trajectory. The increasing focus on lightweight packaging to reduce transportation costs and environmental impact, coupled with the versatility of polyolefin shrink films in adapting to various product shapes and sizes, underscores their continued relevance and growth potential in the global packaging landscape.

Key Markets & Segments Leading Polyolefin Shrink Film Industry

The polyolefin shrink film industry is experiencing robust growth across its key markets and segments, driven by a confluence of economic, technological, and consumer-centric factors. Dominance is observed in several areas, with specific segments and regions outperforming others due to tailored demand and advantageous market conditions.

Type: General Shrink Film Dominance

- Economic Growth: Expanding economies globally translate to increased manufacturing and consumption, directly boosting the demand for general shrink film in packaging diverse products.

- Cost-Effectiveness: General shrink films, primarily made from Polyethylene (PE) and Polypropylene (PP), offer a cost-effective solution for a wide array of packaging needs, making them the default choice for many mass-produced goods.

- Versatility: Their adaptability to various shapes and sizes, coupled with good clarity and shrink properties, makes them ideal for everyday consumer goods.

Detailed Dominance Analysis: General Shrink Film is currently the most dominant segment within the polyolefin shrink film market. This is largely attributed to its widespread application in the Food and Beverage and Industrial Packaging sectors, which represent the largest end-use industries. The inherent cost-effectiveness of general shrink films, often produced from readily available Polyethylene (PE) and Polypropylene (PP), makes them a preferred choice for high-volume packaging needs. The ease of processing and the balance of physical properties, such as clarity, strength, and shrink performance, allow these films to cater to a vast range of products, from individual food items and multipacks to industrial components and consumer electronics. Economic growth in emerging economies, coupled with the consistent demand from mature markets, underpins the leading position of general shrink film.

Application: Food and Beverage Sector Leadership

- Consumer Demand: The ever-growing global population and increasing demand for convenience foods and beverages drive consistent need for shrink-wrapped packaging.

- Shelf-Life Extension: Shrink films provide excellent product protection, maintaining freshness and extending the shelf-life of perishable goods.

- Retail Appeal: High clarity and excellent aesthetics of shrink films enhance product visibility and appeal on retail shelves.

Detailed Dominance Analysis: The Food and Beverage application segment is a clear leader in the polyolefin shrink film market. The intrinsic need for product protection, hygiene, and extended shelf-life in this sector makes polyolefin shrink films an indispensable packaging material. From wrapping fresh produce and meats to securing multipacks of beverages and processed foods, these films play a critical role in maintaining product integrity from production to consumption. The visual appeal provided by clear shrink films also significantly influences consumer purchasing decisions at the point of sale, making it a vital component of product marketing.

Material Type: Polyethylene (PE) Broad Adoption

- Abundance and Cost: PE is a widely available and relatively inexpensive polymer, making it a cost-effective choice for a broad range of shrink film applications.

- Flexibility and Toughness: PE offers good flexibility, puncture resistance, and impact strength, which are crucial for protective packaging.

- Processing Ease: PE-based shrink films are generally easy to process on standard packaging equipment.

Detailed Dominance Analysis: Within the material types, Polyethylene (PE)-based shrink films currently hold the largest market share. PE’s abundance, cost-effectiveness, and desirable physical properties, including excellent flexibility, puncture resistance, and impact strength, make it a versatile choice for a broad spectrum of applications. While Polypropylene (PP) offers certain advantages like higher clarity and stiffness, PE’s overall balance of performance and cost often makes it the preferred material for general-purpose shrink film needs across various industries.

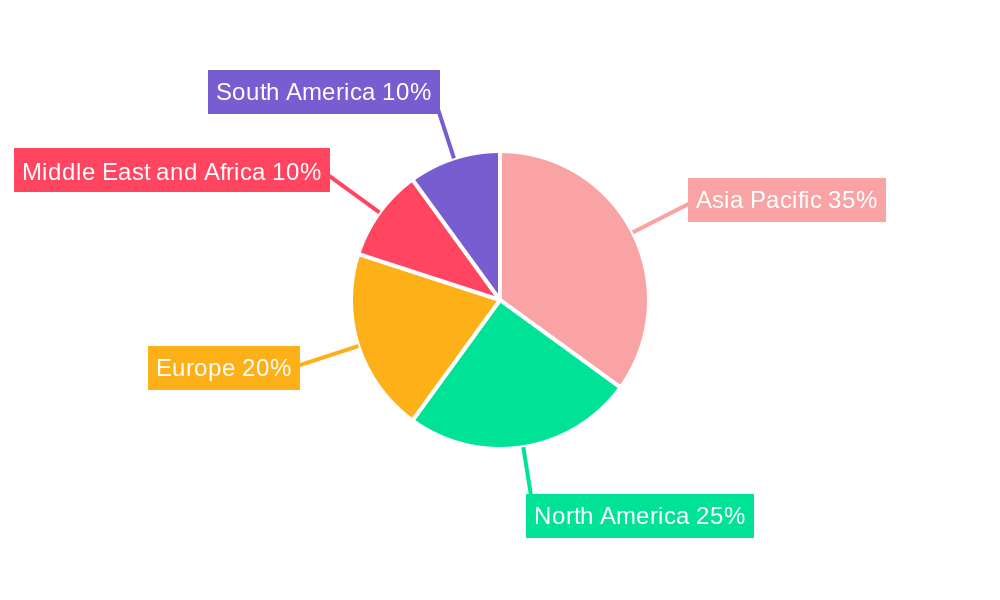

Key Region: North America and Asia-Pacific Growth

- Developed Markets (North America): Established industrial base, high consumer spending, and advanced packaging technology drive steady demand.

- Emerging Markets (Asia-Pacific): Rapid industrialization, growing middle class, and increasing disposable incomes fuel significant growth opportunities.

- Infrastructure Development: Investment in logistics and supply chains across both regions necessitates robust and reliable packaging solutions.

Detailed Dominance Analysis: Geographically, North America and Asia-Pacific are the leading regions for polyolefin shrink film consumption. North America benefits from a mature and sophisticated packaging industry, a high level of consumer spending, and a strong presence of key end-use industries like food and beverage and industrial manufacturing. Asia-Pacific, on the other hand, is experiencing the most rapid growth due to its burgeoning economies, increasing disposable incomes, and a massive population driving demand for packaged goods across all sectors. The ongoing industrialization and infrastructure development in countries like China and India further accelerate the adoption of efficient packaging solutions.

Other Segments Contributing to Growth:

- Personal Care and Cosmetics: Demand for attractive, tamper-evident packaging drives adoption.

- Pharmaceutical: Strict requirements for product integrity and sterility favor high-performance shrink films.

- Printing and Stationery: Bundling and protection of diverse paper products.

- Cross-Linked Shrink Film: Emerging applications requiring superior strength and durability, particularly in industrial and specialized food packaging.

Polyolefin Shrink Film Industry Product Developments

Product innovation in the polyolefin shrink film industry is focused on enhancing performance and sustainability. Advancements include the development of high-clarity films for superior product visibility, multi-layer structures offering improved barrier properties against moisture and oxygen, and films with increased puncture and tear resistance for robust industrial applications. Furthermore, there's a significant push towards thinner yet stronger films, reducing material usage and environmental impact. The introduction of films with enhanced shrink properties, allowing for tighter and more secure packaging of irregular shapes, is also a key development. Innovations in Cross-Linked Shrink Film technology are yielding materials with exceptional toughness and dimensional stability, expanding their use in demanding sectors. These product developments are crucial for maintaining a competitive edge and meeting evolving end-user requirements for efficiency, protection, and eco-friendliness.

Challenges in the Polyolefin Shrink Film Industry Market

The polyolefin shrink film market faces several challenges that can impact its growth trajectory. Regulatory hurdles related to plastic waste and single-use packaging are a significant concern, pushing for increased recyclability and the development of biodegradable alternatives. Supply chain disruptions, stemming from raw material price volatility and geopolitical events, can affect production costs and availability. Intense competitive pressures from alternative packaging materials and the presence of numerous small-scale manufacturers can lead to price wars and margin erosion. Moreover, the need for continuous investment in R&D to develop more sustainable and high-performance films requires substantial capital expenditure.

Forces Driving Polyolefin Shrink Film Industry Growth

Several key forces are propelling the growth of the polyolefin shrink film industry. Technological advancements in extrusion and material science enable the creation of films with superior properties, such as enhanced clarity, strength, and barrier capabilities, catering to diverse application needs. The expanding global population and rising disposable incomes, particularly in emerging economies, are driving increased consumption of packaged goods, directly boosting demand for protective packaging solutions like polyolefin shrink films. Furthermore, the growing e-commerce sector necessitates efficient and robust secondary packaging to ensure product integrity during transit. Regulatory support for industries that rely on effective packaging for product safety and shelf-life extension also indirectly fuels market expansion.

Challenges in the Polyolefin Shrink Film Industry Market

While facing challenges, the polyolefin shrink film industry is also influenced by long-term growth catalysts. The increasing global focus on sustainability is driving innovation in recyclable and biodegradable polyolefin shrink films, creating new market opportunities. Strategic partnerships and collaborations between film manufacturers, material suppliers, and end-users are fostering the development of customized solutions and expanding market reach. The ongoing expansion of infrastructure in developing nations is creating a larger addressable market for packaged goods, thereby increasing the demand for reliable shrink film solutions. Furthermore, advancements in automated packaging machinery are enhancing the efficiency and adoption of shrink film technologies across various industries.

Emerging Opportunities in Polyolefin Shrink Film Industry

Emerging opportunities within the polyolefin shrink film industry are diverse and promising. The growing demand for sustainable packaging presents a significant avenue for growth, with opportunities in developing biodegradable or high-recycled content shrink films. The expansion of the e-commerce sector continues to fuel demand for protective and tamper-evident packaging. Furthermore, the increasing sophistication of the pharmaceutical and personal care and cosmetics industries, with their stringent packaging requirements, offers a niche for high-performance, specialized shrink films. The exploration of novel applications in areas such as smart packaging and active packaging integrated with polyolefin shrink films also represents a significant future growth prospect.

Leading Players in the Polyolefin Shrink Film Industry Sector

- SYFAN USA

- Exxon Mobil Corporation

- Intertape Polymer Group

- Harwal Group of Companies

- Allen Plastic Industries Co Ltd

- Flexi Pack

- Sigma Plastics Group

- SABIC

- KYUNG WON CHEMICAL CO LTD

- Bollor Films

- Clysar LLC

- Berry Global Inc

- Hubei HYF Packaging Co Ltd

Key Milestones in Polyolefin Shrink Film Industry Industry

- 2019: Introduction of new high-clarity PE shrink films for enhanced product visibility in the food sector.

- 2020: Increased R&D focus on recyclable polyolefin formulations in response to growing environmental concerns.

- 2021: Major players announce investments in advanced co-extrusion technology for thinner and stronger films.

- 2022: Launch of specialized cross-linked shrink films with superior puncture resistance for industrial packaging.

- 2023: Significant M&A activity as larger companies acquire niche players to expand product portfolios and market reach.

- 2024: Growing adoption of shrink films with anti-microbial properties for sensitive applications in food and healthcare.

Strategic Outlook for Polyolefin Shrink Film Industry Market

The strategic outlook for the polyolefin shrink film market is highly positive, driven by continued innovation and expanding applications. Growth accelerators include the development of advanced, eco-friendly films that address sustainability concerns, such as those with higher recycled content or improved recyclability. The increasing demand for specialized films tailored to specific industry needs, like high-barrier films for food preservation or robust films for industrial goods, presents significant growth potential. Strategic partnerships and investments in advanced manufacturing technologies will be crucial for companies to maintain a competitive edge. The market's ability to adapt to evolving regulatory landscapes and consumer preferences for convenience and protection will be key to unlocking future growth opportunities and solidifying its indispensable role in the global packaging ecosystem.

Polyolefin Shrink Film Industry Segmentation

-

1. Type

- 1.1. General Shrink Film

- 1.2. Cross-Linked Shrink Film

-

2. Material Type

- 2.1. Polyethylene (PE)

- 2.2. Polypropylene (PP)

-

3. Application

- 3.1. Food and Beverage

- 3.2. Industrial Packaging

- 3.3. Personal Care and Cosmetics

- 3.4. Pharmaceutical

- 3.5. Printing and Stationery

- 3.6. Other Applications

Polyolefin Shrink Film Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyolefin Shrink Film Industry Regional Market Share

Geographic Coverage of Polyolefin Shrink Film Industry

Polyolefin Shrink Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Superior Properties of POF Shrink Films; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Impact of COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Serves to be the Major Material Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Shrink Film

- 5.1.2. Cross-Linked Shrink Film

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Polyethylene (PE)

- 5.2.2. Polypropylene (PP)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Industrial Packaging

- 5.3.3. Personal Care and Cosmetics

- 5.3.4. Pharmaceutical

- 5.3.5. Printing and Stationery

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General Shrink Film

- 6.1.2. Cross-Linked Shrink Film

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Polyethylene (PE)

- 6.2.2. Polypropylene (PP)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverage

- 6.3.2. Industrial Packaging

- 6.3.3. Personal Care and Cosmetics

- 6.3.4. Pharmaceutical

- 6.3.5. Printing and Stationery

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General Shrink Film

- 7.1.2. Cross-Linked Shrink Film

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Polyethylene (PE)

- 7.2.2. Polypropylene (PP)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverage

- 7.3.2. Industrial Packaging

- 7.3.3. Personal Care and Cosmetics

- 7.3.4. Pharmaceutical

- 7.3.5. Printing and Stationery

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General Shrink Film

- 8.1.2. Cross-Linked Shrink Film

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Polyethylene (PE)

- 8.2.2. Polypropylene (PP)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverage

- 8.3.2. Industrial Packaging

- 8.3.3. Personal Care and Cosmetics

- 8.3.4. Pharmaceutical

- 8.3.5. Printing and Stationery

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General Shrink Film

- 9.1.2. Cross-Linked Shrink Film

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Polyethylene (PE)

- 9.2.2. Polypropylene (PP)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food and Beverage

- 9.3.2. Industrial Packaging

- 9.3.3. Personal Care and Cosmetics

- 9.3.4. Pharmaceutical

- 9.3.5. Printing and Stationery

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Polyolefin Shrink Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General Shrink Film

- 10.1.2. Cross-Linked Shrink Film

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Polyethylene (PE)

- 10.2.2. Polypropylene (PP)

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food and Beverage

- 10.3.2. Industrial Packaging

- 10.3.3. Personal Care and Cosmetics

- 10.3.4. Pharmaceutical

- 10.3.5. Printing and Stationery

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SYFAN USA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Exxon Mobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertape Polymer Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Harwal Group of Companies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allen Plastic Industries Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flexi Pack

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sigma Plastics Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SABIC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KYUNG WON CHEMICAL CO LTD

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bollor Films

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Clysar LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hubei HYF Packaging Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SYFAN USA

List of Figures

- Figure 1: Global Polyolefin Shrink Film Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Polyolefin Shrink Film Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Polyolefin Shrink Film Industry Revenue (billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Polyolefin Shrink Film Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Polyolefin Shrink Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Polyolefin Shrink Film Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Polyolefin Shrink Film Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 8: Asia Pacific Polyolefin Shrink Film Industry Volume (K Tons), by Material Type 2025 & 2033

- Figure 9: Asia Pacific Polyolefin Shrink Film Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Asia Pacific Polyolefin Shrink Film Industry Volume Share (%), by Material Type 2025 & 2033

- Figure 11: Asia Pacific Polyolefin Shrink Film Industry Revenue (billion), by Application 2025 & 2033

- Figure 12: Asia Pacific Polyolefin Shrink Film Industry Volume (K Tons), by Application 2025 & 2033

- Figure 13: Asia Pacific Polyolefin Shrink Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Asia Pacific Polyolefin Shrink Film Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: Asia Pacific Polyolefin Shrink Film Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Asia Pacific Polyolefin Shrink Film Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Polyolefin Shrink Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Polyolefin Shrink Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Polyolefin Shrink Film Industry Revenue (billion), by Type 2025 & 2033

- Figure 20: North America Polyolefin Shrink Film Industry Volume (K Tons), by Type 2025 & 2033

- Figure 21: North America Polyolefin Shrink Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: North America Polyolefin Shrink Film Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: North America Polyolefin Shrink Film Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 24: North America Polyolefin Shrink Film Industry Volume (K Tons), by Material Type 2025 & 2033

- Figure 25: North America Polyolefin Shrink Film Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 26: North America Polyolefin Shrink Film Industry Volume Share (%), by Material Type 2025 & 2033

- Figure 27: North America Polyolefin Shrink Film Industry Revenue (billion), by Application 2025 & 2033

- Figure 28: North America Polyolefin Shrink Film Industry Volume (K Tons), by Application 2025 & 2033

- Figure 29: North America Polyolefin Shrink Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: North America Polyolefin Shrink Film Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: North America Polyolefin Shrink Film Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: North America Polyolefin Shrink Film Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Polyolefin Shrink Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Polyolefin Shrink Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Polyolefin Shrink Film Industry Revenue (billion), by Type 2025 & 2033

- Figure 36: Europe Polyolefin Shrink Film Industry Volume (K Tons), by Type 2025 & 2033

- Figure 37: Europe Polyolefin Shrink Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe Polyolefin Shrink Film Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe Polyolefin Shrink Film Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 40: Europe Polyolefin Shrink Film Industry Volume (K Tons), by Material Type 2025 & 2033

- Figure 41: Europe Polyolefin Shrink Film Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Europe Polyolefin Shrink Film Industry Volume Share (%), by Material Type 2025 & 2033

- Figure 43: Europe Polyolefin Shrink Film Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Europe Polyolefin Shrink Film Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: Europe Polyolefin Shrink Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Europe Polyolefin Shrink Film Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Europe Polyolefin Shrink Film Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Polyolefin Shrink Film Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Polyolefin Shrink Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Polyolefin Shrink Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Polyolefin Shrink Film Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: South America Polyolefin Shrink Film Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: South America Polyolefin Shrink Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Polyolefin Shrink Film Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Polyolefin Shrink Film Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 56: South America Polyolefin Shrink Film Industry Volume (K Tons), by Material Type 2025 & 2033

- Figure 57: South America Polyolefin Shrink Film Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 58: South America Polyolefin Shrink Film Industry Volume Share (%), by Material Type 2025 & 2033

- Figure 59: South America Polyolefin Shrink Film Industry Revenue (billion), by Application 2025 & 2033

- Figure 60: South America Polyolefin Shrink Film Industry Volume (K Tons), by Application 2025 & 2033

- Figure 61: South America Polyolefin Shrink Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: South America Polyolefin Shrink Film Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: South America Polyolefin Shrink Film Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Polyolefin Shrink Film Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Polyolefin Shrink Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Polyolefin Shrink Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Polyolefin Shrink Film Industry Revenue (billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Polyolefin Shrink Film Industry Volume (K Tons), by Type 2025 & 2033

- Figure 69: Middle East and Africa Polyolefin Shrink Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Polyolefin Shrink Film Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Polyolefin Shrink Film Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 72: Middle East and Africa Polyolefin Shrink Film Industry Volume (K Tons), by Material Type 2025 & 2033

- Figure 73: Middle East and Africa Polyolefin Shrink Film Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 74: Middle East and Africa Polyolefin Shrink Film Industry Volume Share (%), by Material Type 2025 & 2033

- Figure 75: Middle East and Africa Polyolefin Shrink Film Industry Revenue (billion), by Application 2025 & 2033

- Figure 76: Middle East and Africa Polyolefin Shrink Film Industry Volume (K Tons), by Application 2025 & 2033

- Figure 77: Middle East and Africa Polyolefin Shrink Film Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: Middle East and Africa Polyolefin Shrink Film Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: Middle East and Africa Polyolefin Shrink Film Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Polyolefin Shrink Film Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Polyolefin Shrink Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Polyolefin Shrink Film Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 5: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 13: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 30: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 31: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: United States Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Canada Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Mexico Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 44: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 45: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 47: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Germany Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Italy Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Italy Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: France Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: France Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 60: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 61: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 62: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 63: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 64: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Brazil Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Brazil Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Argentina Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Argentina Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 75: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 76: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Material Type 2020 & 2033

- Table 77: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 78: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Polyolefin Shrink Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Global Polyolefin Shrink Film Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: Saudi Arabia Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Saudi Arabia Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: South Africa Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: South Africa Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Polyolefin Shrink Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Polyolefin Shrink Film Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyolefin Shrink Film Industry?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Polyolefin Shrink Film Industry?

Key companies in the market include SYFAN USA, Exxon Mobil Corporation, Intertape Polymer Group, Harwal Group of Companies, Allen Plastic Industries Co Ltd, Flexi Pack, Sigma Plastics Group, SABIC, KYUNG WON CHEMICAL CO LTD, Bollor Films, Clysar LLC, Berry Global Inc, Hubei HYF Packaging Co Ltd.

3. What are the main segments of the Polyolefin Shrink Film Industry?

The market segments include Type, Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.94 billion as of 2022.

5. What are some drivers contributing to market growth?

; Superior Properties of POF Shrink Films; Other Drivers.

6. What are the notable trends driving market growth?

Polyethylene (PE) Serves to be the Major Material Type.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Impact of COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyolefin Shrink Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyolefin Shrink Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyolefin Shrink Film Industry?

To stay informed about further developments, trends, and reports in the Polyolefin Shrink Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence