Key Insights

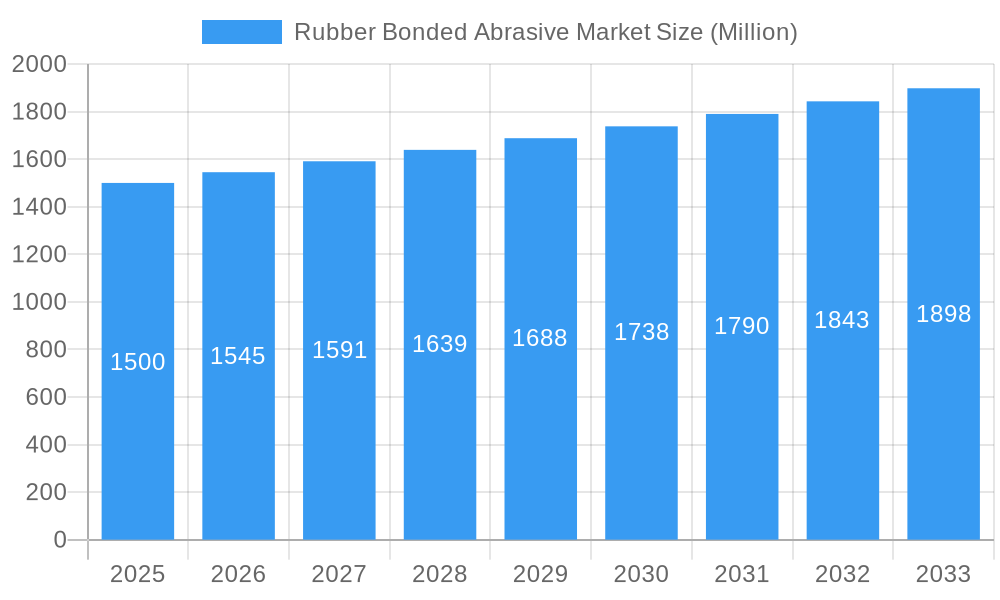

The global rubber bonded abrasive market is experiencing robust growth, driven by increasing demand across diverse industrial sectors. The market, valued at approximately $XX million in 2025, is projected to exhibit a compound annual growth rate (CAGR) exceeding 3.00% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the expanding automotive and industrial machinery sectors are major consumers of rubber bonded abrasives for applications like surface finishing, deburring, and polishing. The rise of automation in manufacturing processes further boosts demand for consistent, high-performance abrasive products. Secondly, advancements in abrasive technology are leading to the development of more efficient and durable products, enhancing productivity and reducing overall costs for end-users. Specifically, innovations in binder systems and abrasive grain formulations are contributing to improved cutting performance, longer lifespan, and greater versatility in applications. Finally, the increasing focus on precision engineering and surface quality across various industries necessitates the use of high-quality rubber bonded abrasives to meet stringent performance standards.

Rubber Bonded Abrasive Market Market Size (In Billion)

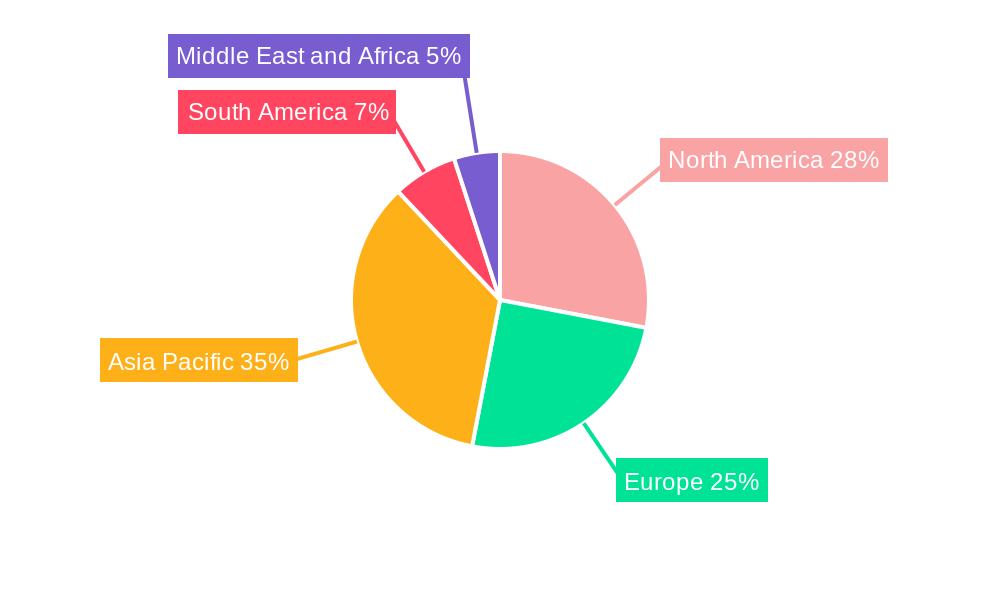

However, certain market restraints are present. Fluctuations in raw material prices, particularly natural rubber, can impact profitability and overall market growth. Moreover, environmental regulations regarding abrasive waste disposal and the potential for hazardous materials in certain abrasive formulations present challenges. Nevertheless, ongoing research and development efforts are focused on creating more environmentally friendly and sustainable alternatives to mitigate these concerns. The market is segmented by application (powertrain, gear, bearing, turbines, others) and end-user industry (industrial machinery, automotive, electrical & electronics, healthcare, others). Significant regional markets include North America, Europe, and Asia Pacific, with China and India anticipated as key growth drivers due to their expanding manufacturing sectors and increasing industrial output.

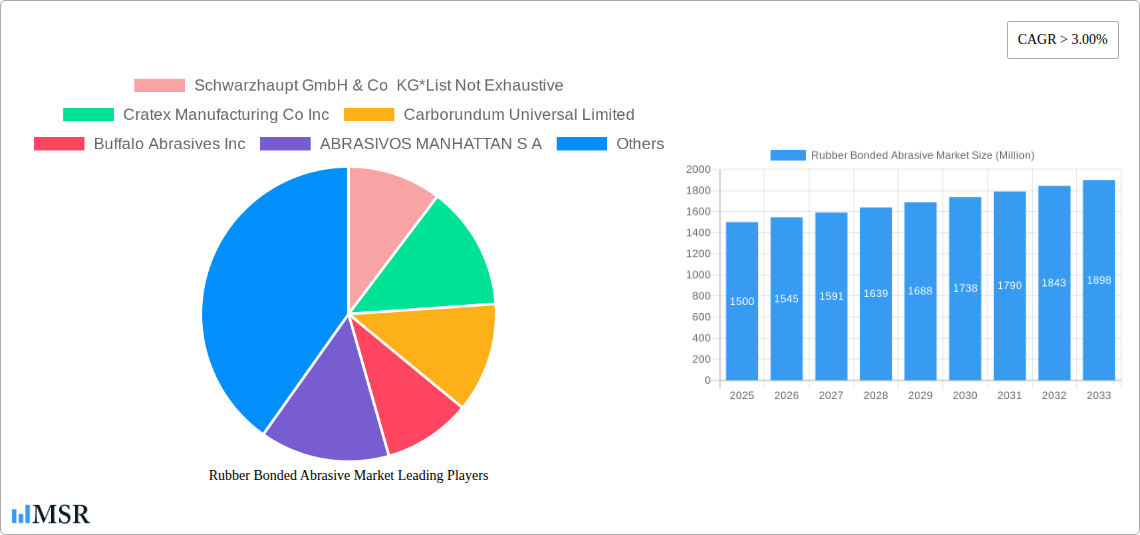

Rubber Bonded Abrasive Market Company Market Share

Rubber Bonded Abrasive Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Rubber Bonded Abrasive market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this study meticulously examines market dynamics, growth drivers, key segments, leading players, and emerging opportunities. The report leverages extensive research and data analysis to deliver actionable intelligence for navigating the complexities of this dynamic market. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Rubber Bonded Abrasive Market Market Concentration & Dynamics

The Rubber Bonded Abrasive market exhibits a moderately concentrated landscape, with a few key players holding significant market share. The top five companies, including Schwarzhaupt GmbH & Co KG, Cratex Manufacturing Co Inc, Carborundum Universal Limited, Buffalo Abrasives Inc, and ABRASIVOS MANHATTAN S A, collectively account for approximately xx% of the global market in 2025. However, the market also features a considerable number of smaller players, fostering competition and innovation.

Market Dynamics:

- Innovation Ecosystem: Continuous advancements in abrasive materials, bonding techniques, and manufacturing processes are driving market innovation. The development of high-performance rubber bonded abrasives with enhanced durability and cutting efficiency is a key trend.

- Regulatory Frameworks: Environmental regulations pertaining to abrasive dust and waste management are influencing manufacturing practices and product development. Compliance with these regulations is crucial for market participation.

- Substitute Products: While rubber bonded abrasives dominate certain applications, they face competition from other abrasive technologies, such as coated abrasives and superabrasives. The choice of abrasive technology depends on the specific application requirements.

- End-User Trends: The increasing demand for precision finishing and surface treatment across various industries is fueling the growth of the rubber bonded abrasive market. The adoption of advanced manufacturing techniques further enhances demand.

- M&A Activities: The past five years have witnessed xx M&A deals in the rubber bonded abrasive industry, primarily focused on expanding product portfolios, geographic reach, and technological capabilities. Consolidation is expected to continue shaping the market landscape.

Rubber Bonded Abrasive Market Industry Insights & Trends

The Rubber Bonded Abrasive market is experiencing robust growth, driven by several key factors. The increasing adoption of advanced manufacturing processes in industries like automotive and aerospace, the demand for high-precision surface finishing, and the rising need for efficient deburring solutions are major growth catalysts. Technological advancements, such as the development of innovative abrasive materials and improved bonding techniques, are enhancing the performance and applications of rubber bonded abrasives. Furthermore, evolving consumer preferences for superior quality and long-lasting products are driving demand. The market is witnessing a shift towards customized solutions, with manufacturers focusing on catering to specific end-user requirements. This trend is expected to further propel market growth in the coming years. The market size in 2024 was approximately xx Million, and is projected to reach xx Million by 2033, representing a CAGR of xx%.

Key Markets & Segments Leading Rubber Bonded Abrasive Market

The automotive industry continues to be a cornerstone of the Rubber Bonded Abrasive market. This sustained demand is driven by the robust global production of vehicles, coupled with an escalating need for superior surface finishing across a wide array of automotive components, from engine parts to aesthetic trims. The industrial machinery sector also represents a critical end-user, where the precision, durability, and adaptability of rubber bonded abrasives are indispensable for intricate machining processes, surface preparation, and the manufacturing of high-tolerance components.

Dominant Segments and Growth Catalysts:

- Application Focus: Within the automotive sphere, powertrain applications, including the finishing of engine blocks, crankshafts, and camshafts, lead the market. These areas demand exceptional surface quality for optimal performance and longevity. Gear and bearing applications, vital for both automotive and industrial machinery, also constitute significant market segments due to their requirement for smooth, precise surfaces.

- End-user Industry Dynamics: The automotive sector unequivocally commands the largest market share. However, the industrial machinery sector is experiencing rapid expansion, propelled by increasing industrial production rates and the pervasive drive towards automation across manufacturing facilities.

Regional Market Landscape: Asia-Pacific is emerging as a powerhouse in the rubber bonded abrasive market. This surge is primarily attributed to rapid industrialization, significant investments in manufacturing infrastructure, and the expansion of automotive and heavy machinery production capacities across countries like China, India, and Southeast Asian nations. North America and Europe remain substantial markets due to their established automotive and industrial bases and a strong emphasis on precision engineering.

- Drivers Fueling Automotive Growth: The continued expansion of vehicle production globally, coupled with increasingly stringent quality mandates for automotive components (especially in areas like electric vehicle powertrains), and the adoption of advanced manufacturing techniques are key growth accelerators.

- Drivers Propelling Industrial Machinery Growth: The pervasive trend of industrial automation, the persistent demand for highly accurate and defect-free components across diverse manufacturing verticals, and substantial investments in upgrading and expanding manufacturing infrastructure worldwide are critical drivers.

Rubber Bonded Abrasive Market Product Developments

Recent product innovations focus on enhancing the durability, performance, and environmental friendliness of rubber bonded abrasives. Manufacturers are developing abrasives with improved cutting efficiency, longer lifespan, and reduced dust generation. These advancements cater to the evolving needs of various industries, particularly those with stringent quality and environmental regulations. The integration of advanced materials and manufacturing techniques is creating a competitive edge for manufacturers, enabling them to offer superior products to meet the diverse demands of the market.

Challenges in the Rubber Bonded Abrasive Market Market

The Rubber Bonded Abrasive market faces challenges related to fluctuating raw material prices, stringent environmental regulations impacting manufacturing processes, and intense competition from substitute products. Supply chain disruptions can also lead to production delays and increased costs, affecting profitability. The increasing pressure to reduce manufacturing costs while maintaining high product quality adds another layer of complexity. These factors, if not addressed effectively, can impede market growth. For example, a xx% increase in raw material prices in 2022 impacted production costs by approximately xx Million.

Forces Driving Rubber Bonded Abrasive Market Growth

Key growth drivers include the increasing demand for precision surface finishing across diverse industries, the adoption of advanced manufacturing techniques, and ongoing technological innovations in abrasive materials and bonding techniques. Government initiatives promoting industrial automation and the growth of the automotive and aerospace industries are also contributing to market expansion. Furthermore, the growing focus on sustainable manufacturing practices is driving the development of eco-friendly rubber bonded abrasives, further stimulating market growth.

Long-Term Growth Catalysts in Rubber Bonded Abrasive Market

Long-term growth will be fueled by continued innovation in abrasive materials, the development of specialized abrasives for niche applications, and strategic partnerships to expand market reach and access new technologies. Expansion into emerging markets with growing manufacturing sectors, particularly in Asia and South America, will also contribute to sustained market growth. Investment in research and development to improve abrasive performance and reduce environmental impact will be crucial for long-term success.

Emerging Opportunities in Rubber Bonded Abrasive Market

The rubber bonded abrasive market is ripe with emerging opportunities. A significant area of growth lies in the development of highly specialized and customized rubber bonded abrasives tailored to niche applications, such as those found in aerospace, medical device manufacturing, and advanced electronics. Expansion into high-growth emerging markets, particularly those focused on renewable energy infrastructure (e.g., wind turbine component manufacturing) and advanced materials processing, presents substantial untapped potential. The integration of cutting-edge manufacturing technologies, including additive manufacturing (3D printing) for producing complex abrasive structures and AI-driven quality control systems, offers pathways for innovation and enhanced production efficiency. Furthermore, the global push for sustainability is creating a robust demand for eco-friendly and recyclable rubber bonded abrasives, opening doors for manufacturers who can develop and market environmentally conscious product lines.

Leading Players in the Rubber Bonded Abrasive Market Sector

- Schwarzhaupt GmbH & Co KG

- Cratex Manufacturing Co Inc

- Carborundum Universal Limited

- Buffalo Abrasives Inc

- ABRASIVOS MANHATTAN S A

- Atto Abrasive Ltd

- Buehler

- 3M

- Marrose Abrasives

- PACER Industries Inc

- PFERD INC

Key Milestones in Rubber Bonded Abrasive Market Industry

- 2020: 3M launched an innovative range of high-performance rubber bonded abrasives designed for critical industrial applications, setting a new benchmark for precision finishing.

- 2021: Carborundum Universal Limited strategically acquired a prominent smaller abrasive manufacturer, significantly broadening its product portfolio and strengthening its market presence in specialized abrasive solutions.

- 2022: A notable trend emerged with several key players introducing environmentally friendly and sustainable rubber bonded abrasives, responding to growing market demand for eco-conscious products.

- 2023: Major industry leaders demonstrated a strong commitment to future innovation by making substantial investments in Research and Development to enhance abrasive performance, durability, and application-specific capabilities.

- 2024 (Projected/Recent): Significant advancements in composite material technology are expected to lead to the introduction of next-generation rubber bonded abrasives with improved wear resistance and thermal stability.

Strategic Outlook for Rubber Bonded Abrasive Market Market

The Rubber Bonded Abrasive market is poised for continued growth, driven by technological advancements, expanding industrialization, and increasing demand for high-quality surface finishing. Strategic opportunities exist for companies to invest in R&D, expand their product portfolios, and explore new market segments. Focusing on sustainability and developing environmentally friendly products will also be crucial for long-term success in this evolving market. Partnerships and collaborations will play an increasingly important role in fostering innovation and market expansion.

Rubber Bonded Abrasive Market Segmentation

-

1. Application

- 1.1. Powertrain

- 1.2. Gear

- 1.3. Bearing

- 1.4. Turbines

- 1.5. Others

-

2. End-user Industry

- 2.1. Industrial Machinery

- 2.2. Automotive

- 2.3. Electrical & Electronics

- 2.4. Healthcare

- 2.5. Others

Rubber Bonded Abrasive Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rubber Bonded Abrasive Market Regional Market Share

Geographic Coverage of Rubber Bonded Abrasive Market

Rubber Bonded Abrasive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Metal and Steel Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Environmental Constraints; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Industrial Machinery Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Powertrain

- 5.1.2. Gear

- 5.1.3. Bearing

- 5.1.4. Turbines

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Industrial Machinery

- 5.2.2. Automotive

- 5.2.3. Electrical & Electronics

- 5.2.4. Healthcare

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Powertrain

- 6.1.2. Gear

- 6.1.3. Bearing

- 6.1.4. Turbines

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Industrial Machinery

- 6.2.2. Automotive

- 6.2.3. Electrical & Electronics

- 6.2.4. Healthcare

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Powertrain

- 7.1.2. Gear

- 7.1.3. Bearing

- 7.1.4. Turbines

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Industrial Machinery

- 7.2.2. Automotive

- 7.2.3. Electrical & Electronics

- 7.2.4. Healthcare

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Powertrain

- 8.1.2. Gear

- 8.1.3. Bearing

- 8.1.4. Turbines

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Industrial Machinery

- 8.2.2. Automotive

- 8.2.3. Electrical & Electronics

- 8.2.4. Healthcare

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Powertrain

- 9.1.2. Gear

- 9.1.3. Bearing

- 9.1.4. Turbines

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Industrial Machinery

- 9.2.2. Automotive

- 9.2.3. Electrical & Electronics

- 9.2.4. Healthcare

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Rubber Bonded Abrasive Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Powertrain

- 10.1.2. Gear

- 10.1.3. Bearing

- 10.1.4. Turbines

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Industrial Machinery

- 10.2.2. Automotive

- 10.2.3. Electrical & Electronics

- 10.2.4. Healthcare

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Schwarzhaupt GmbH & Co KG*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cratex Manufacturing Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Carborundum Universal Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Buffalo Abrasives Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ABRASIVOS MANHATTAN S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atto Abrasive Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Buehler

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3M

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marrose Abrasives

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PACER Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PFERD INC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Schwarzhaupt GmbH & Co KG*List Not Exhaustive

List of Figures

- Figure 1: Global Rubber Bonded Abrasive Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Rubber Bonded Abrasive Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific Rubber Bonded Abrasive Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Rubber Bonded Abrasive Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Rubber Bonded Abrasive Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Rubber Bonded Abrasive Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Rubber Bonded Abrasive Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Rubber Bonded Abrasive Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Rubber Bonded Abrasive Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Rubber Bonded Abrasive Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Rubber Bonded Abrasive Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Rubber Bonded Abrasive Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Rubber Bonded Abrasive Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Rubber Bonded Abrasive Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Rubber Bonded Abrasive Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Rubber Bonded Abrasive Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Rubber Bonded Abrasive Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Rubber Bonded Abrasive Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Rubber Bonded Abrasive Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Rubber Bonded Abrasive Market Revenue (Million), by Application 2025 & 2033

- Figure 21: South America Rubber Bonded Abrasive Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Rubber Bonded Abrasive Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Rubber Bonded Abrasive Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Rubber Bonded Abrasive Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Rubber Bonded Abrasive Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Rubber Bonded Abrasive Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Rubber Bonded Abrasive Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Rubber Bonded Abrasive Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Rubber Bonded Abrasive Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Rubber Bonded Abrasive Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Rubber Bonded Abrasive Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Rubber Bonded Abrasive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Rubber Bonded Abrasive Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rubber Bonded Abrasive Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Rubber Bonded Abrasive Market?

Key companies in the market include Schwarzhaupt GmbH & Co KG*List Not Exhaustive, Cratex Manufacturing Co Inc, Carborundum Universal Limited, Buffalo Abrasives Inc, ABRASIVOS MANHATTAN S A, Atto Abrasive Ltd, Buehler, 3M, Marrose Abrasives, PACER Industries Inc, PFERD INC.

3. What are the main segments of the Rubber Bonded Abrasive Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Metal and Steel Industries; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Industrial Machinery Industry.

7. Are there any restraints impacting market growth?

; Environmental Constraints; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rubber Bonded Abrasive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rubber Bonded Abrasive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rubber Bonded Abrasive Market?

To stay informed about further developments, trends, and reports in the Rubber Bonded Abrasive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence