Key Insights

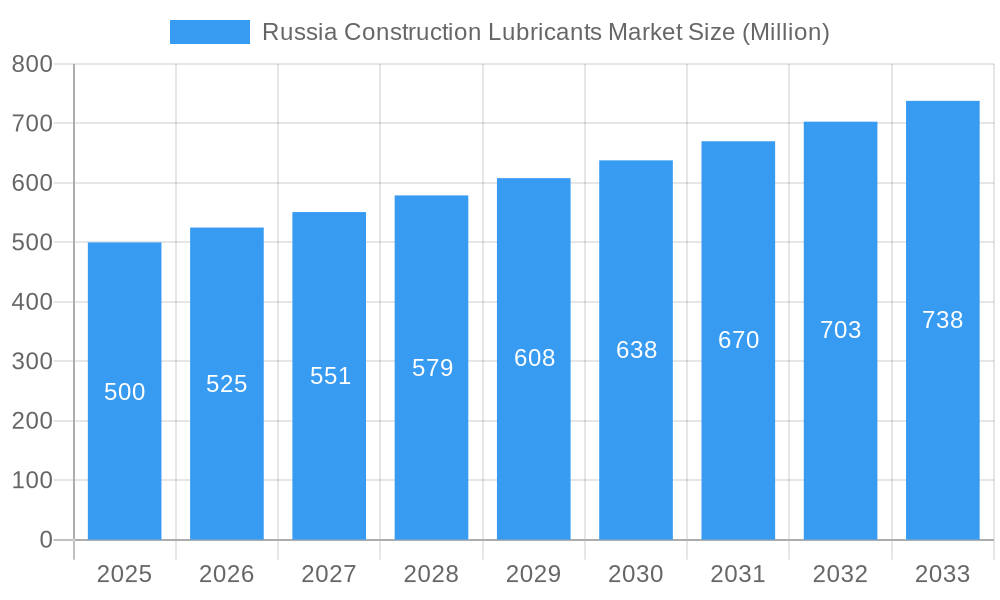

The Russia Construction Lubricants Market is poised for significant growth, driven by robust infrastructure development initiatives and a burgeoning construction sector. While precise market size figures for 2019-2024 are unavailable, industry reports suggest a considerable market, and considering the global trends and Russia's substantial construction activity, a reasonable estimate for the market size in 2025 would be around $500 million. A Compound Annual Growth Rate (CAGR) of 5% is plausible for the forecast period (2025-2033), reflecting both economic fluctuations and ongoing investment in large-scale projects like road and bridge construction. Key growth drivers include government investments in infrastructure modernization, increasing urbanization leading to heightened construction activity, and a focus on improving construction efficiency through the use of high-performance lubricants. However, factors such as economic sanctions, geopolitical instability, and fluctuations in oil prices could act as potential restraints on market growth. The market is segmented by lubricant type (engine oils, gear oils, hydraulic fluids, greases), application (heavy construction equipment, light construction equipment), and region (Western Russia, Eastern Russia, and Siberia). Major players in the market include both international giants like BP, ExxonMobil, and Shell, and domestic companies such as Lukoil, Gazprom, and Rosneft, each vying for market share through product differentiation and strategic partnerships.

Russia Construction Lubricants Market Market Size (In Million)

The projected CAGR of 5% suggests a steady expansion of the Russia Construction Lubricants Market over the coming years. This growth is anticipated despite potential headwinds. The market's segmentation allows for targeted marketing strategies, and the presence of both international and domestic players ensures a competitive landscape. Further market research is needed to delve deeper into the specific regional variations and the precise impact of geopolitical factors on market dynamics. However, the current indicators suggest a promising outlook for companies operating within this sector. The focus on sustainable and eco-friendly lubricants is expected to gain traction, influencing product development and marketing strategies in the near future. The market's resilience in the face of challenges highlights its inherent importance to the Russian economy.

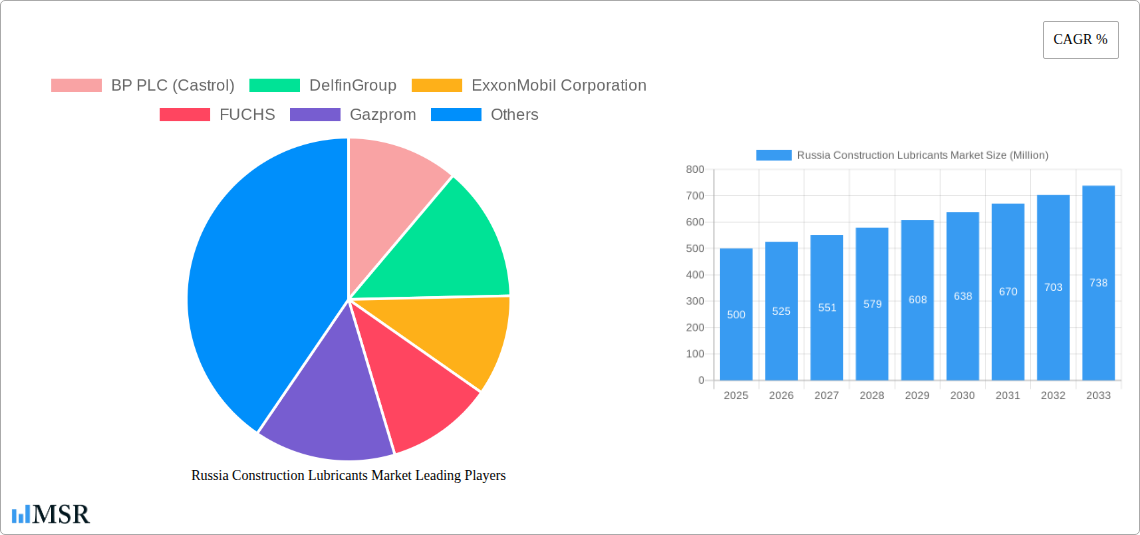

Russia Construction Lubricants Market Company Market Share

Russia Construction Lubricants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia Construction Lubricants Market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report meticulously examines market dynamics, trends, and growth opportunities within the Russian construction sector. The report features detailed analyses of key players such as BP PLC (Castrol), DelfinGroup, ExxonMobil Corporation, FUCHS, Gazprom, Liqui Moly, Lukoil, Obninskorgsintez (SINTEC GROUP), Rosneft, and Royal Dutch Shell plc, revealing market share, competitive landscapes, and future growth projections. The total market size is estimated at xx Million in 2025, with a CAGR of xx% projected for the forecast period.

Russia Construction Lubricants Market Market Concentration & Dynamics

The Russia construction lubricants market exhibits a moderately concentrated structure, with a few major international and domestic players holding significant market share. Market concentration is influenced by factors such as economies of scale, brand recognition, and technological advancements. Innovation within the sector centers around developing environmentally friendly, high-performance lubricants that meet stringent regulatory requirements. The regulatory framework plays a critical role, impacting product standards, environmental regulations, and import/export policies. Substitute products, such as greases and other specialized lubricants, present a degree of competition. End-user trends, particularly a growing preference for sustainable and high-efficiency construction practices, are shaping demand. The number of M&A activities in the sector has been relatively modest in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Share: Leading players hold approximately xx% of the market share collectively.

- M&A Activity: The historical period (2019-2024) witnessed xx merger and acquisition deals.

- Innovation: Focus is shifting towards eco-friendly and high-performance lubricants.

- Regulatory Landscape: Stringent regulations on environmental impact and product quality are in place.

Russia Construction Lubricants Market Industry Insights & Trends

The Russia Construction Lubricants Market is experiencing significant growth, driven by robust infrastructure development projects across the country. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is fueled by factors such as government investments in infrastructure, urbanization, and industrial expansion. Technological disruptions, including the adoption of advanced lubricant formulations and improved dispensing systems, are also influencing market dynamics. Evolving consumer behaviors, particularly a growing emphasis on sustainability and reduced environmental impact, are impacting product preferences. The construction industry's increasing adoption of sophisticated machinery necessitates high-quality lubricants, further driving market growth.

Key Markets & Segments Leading Russia Construction Lubricants Market

The dominant segment within the Russia Construction Lubricants Market is currently the [Insert Dominant Segment Here, e.g., heavy-duty construction equipment lubricants]. This dominance is attributed to [Insert Reason, e.g., the large-scale use of heavy equipment in infrastructure projects].

- Drivers for Segment Dominance:

- Strong infrastructure development activities.

- Government investments in large-scale construction projects.

- Increased demand for high-performance lubricants for heavy machinery.

- Growing urbanization and industrialization.

The [Insert Dominant Region/Country] region exhibits the highest growth potential due to [Insert Reasons, e.g., robust economic growth and concentrated construction activity].

Russia Construction Lubricants Market Product Developments

Recent product innovations in the Russia Construction Lubricants Market focus on enhancing performance, extending lubricant lifespan, and minimizing environmental impact. Formulations incorporating advanced additives improve lubrication efficiency, reducing friction and wear. The development of biodegradable and eco-friendly lubricants is gaining traction, catering to the growing demand for sustainable construction practices. These advancements provide manufacturers with a competitive edge, enabling them to meet the evolving needs of the construction industry.

Challenges in the Russia Construction Lubricants Market Market

The Russia Construction Lubricants Market faces several challenges. Fluctuations in oil prices directly impact the cost of production and pricing strategies. Supply chain disruptions, particularly concerning raw material sourcing, can impact production and availability. Intense competition from both domestic and international players also presents a significant hurdle. Furthermore, stringent environmental regulations impose compliance costs, adding to the operational expenses. These factors collectively impact market growth and profitability.

Forces Driving Russia Construction Lubricants Market Growth

The Russia Construction Lubricants Market's growth is primarily driven by the government's substantial investments in infrastructure development, including road construction, housing projects, and industrial expansion. This drives a significant demand for high-quality construction equipment and, consequently, specialized lubricants. Technological advancements in lubricant formulations, enhancing performance and extending lifespan, also contribute to market growth. Furthermore, a growing awareness of environmental concerns is encouraging the adoption of eco-friendly lubricants, further stimulating the market.

Challenges in the Russia Construction Lubricants Market Market

Long-term growth hinges on successful adaptation to changing market dynamics. Continued innovation in lubricant formulations, focusing on higher efficiency and sustainability, is critical. Strategic partnerships with equipment manufacturers can unlock access to new markets and applications. Expansion into new geographical regions within Russia, targeting emerging construction hubs, can also unlock significant growth opportunities.

Emerging Opportunities in Russia Construction Lubricants Market

Emerging trends point towards increased demand for specialized lubricants catering to niche applications within the construction sector. This includes lubricants specifically designed for electric and hybrid construction equipment. The adoption of advanced technologies, such as digital lubrication management systems, offers opportunities for enhancing efficiency and reducing operational costs. Furthermore, exploring partnerships with environmental organizations can help establish the market for eco-friendly construction lubricants.

Leading Players in the Russia Construction Lubricants Market Sector

- BP PLC (Castrol)

- DelfinGroup

- ExxonMobil Corporation

- FUCHS

- Gazprom

- Liqui Moly

- Lukoil

- Obninskorgsintez (SINTEC GROUP)

- Rosneft

- Shell plc

Key Milestones in Russia Construction Lubricants Market Industry

- January 2022: Royal Dutch Shell plc changes its name to Shell plc. This rebranding may influence market perception and brand positioning.

- January 2022: ExxonMobil Corporation reorganizes into three business lines: Upstream Company, Product Solutions, and Low Carbon Solutions. This restructuring may impact investment in and development of lubricants.

- March 2022: ExxonMobil Corporation appoints Jay Hooley as lead managing director. This leadership change could potentially influence strategic decisions within the company's lubricants division.

Strategic Outlook for Russia Construction Lubricants Market Market

The Russia Construction Lubricants Market presents significant long-term growth potential, driven by continued infrastructure development, technological advancements, and the growing importance of sustainability. Strategic opportunities exist for companies focusing on innovative lubricant formulations, efficient supply chain management, and strong partnerships within the construction ecosystem. By adapting to evolving regulatory requirements and consumer preferences, players can capitalize on the market's growth trajectory and secure a strong competitive position.

Russia Construction Lubricants Market Segmentation

-

1. End User

- 1.1. Automotive

- 1.2. Heavy Equipment

- 1.3. Metallurgy & Metalworking

- 1.4. Power Generation

- 1.5. Other End-user Industries

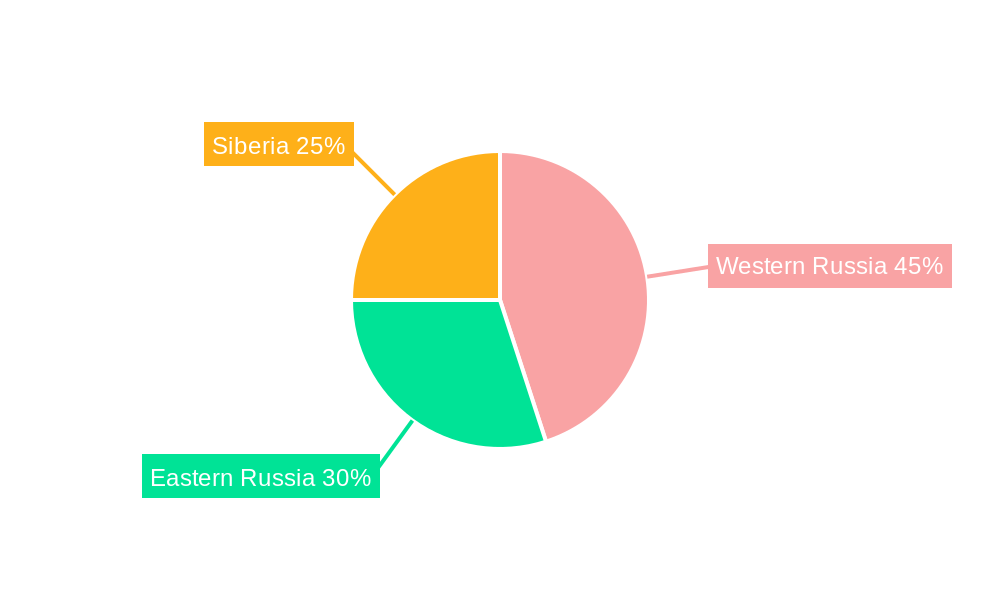

Russia Construction Lubricants Market Segmentation By Geography

- 1. Russia

Russia Construction Lubricants Market Regional Market Share

Geographic Coverage of Russia Construction Lubricants Market

Russia Construction Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of % from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Construction Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Automotive

- 5.1.2. Heavy Equipment

- 5.1.3. Metallurgy & Metalworking

- 5.1.4. Power Generation

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DelfinGroup

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUCHS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gazprom

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liqui Moly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lukoil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Obninskorgsintez (SINTEC GROUP)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rosneft

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Dutch Shell Pl

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Russia Construction Lubricants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Construction Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Construction Lubricants Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Russia Construction Lubricants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Russia Construction Lubricants Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Russia Construction Lubricants Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Construction Lubricants Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Russia Construction Lubricants Market?

Key companies in the market include BP PLC (Castrol), DelfinGroup, ExxonMobil Corporation, FUCHS, Gazprom, Liqui Moly, Lukoil, Obninskorgsintez (SINTEC GROUP), Rosneft, Royal Dutch Shell Pl.

3. What are the main segments of the Russia Construction Lubricants Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By End User : Automotive.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: ExxonMobil Corporation company has appointed Jay Hooley as lead managing director of the company.January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.January 2022: Effective January 21, 2022, Royal Dutch Shell plc changes its name to Shell plc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Construction Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Construction Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Construction Lubricants Market?

To stay informed about further developments, trends, and reports in the Russia Construction Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence