Key Insights

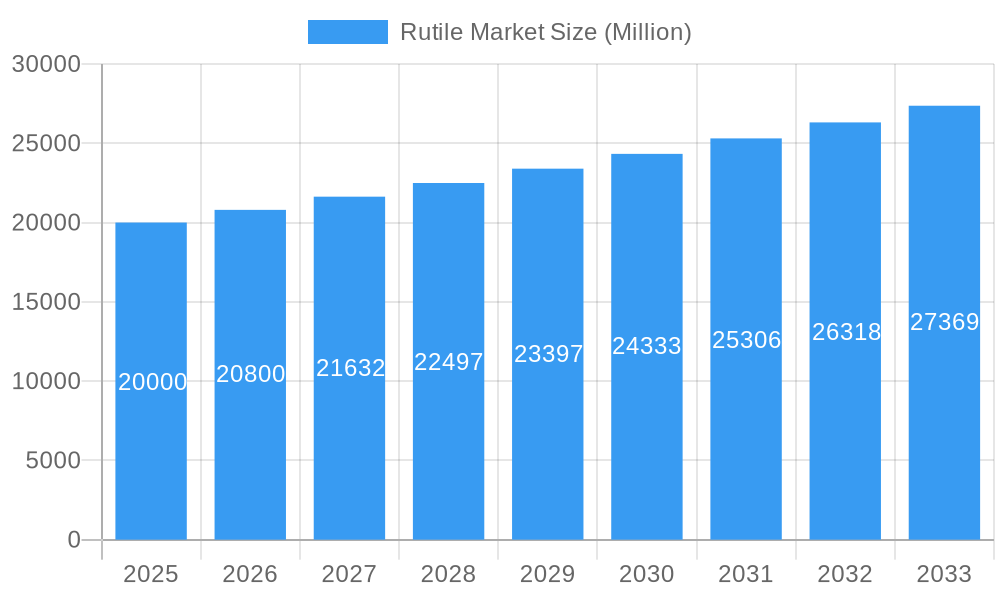

The global rutile market is poised for significant expansion, driven by robust demand from the titanium dioxide (TiO2) pigment industry. This key sector, integral to construction, coatings, and plastics, fuels rutile consumption. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.28% from 2025 to 2033. The market size was valued at 1401.75 million in the base year of 2025. Key growth catalysts include global population increase, infrastructure development, particularly in emerging economies, and technological advancements enhancing TiO2 pigment production. Conversely, fluctuating raw material costs, stringent environmental regulations, and the potential for pigment substitution present market challenges.

Rutile Market Market Size (In Billion)

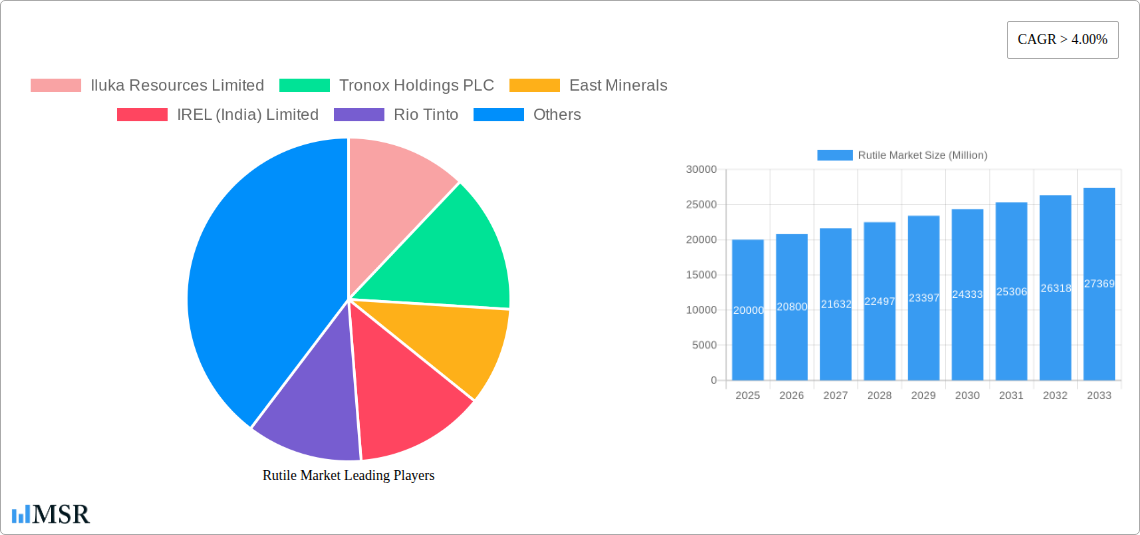

The market is segmented by grade, application, and region. Leading players such as Iluka Resources Limited, Tronox Holdings PLC, and Rio Tinto dominate market share, actively participating in both upstream rutile extraction and downstream TiO2 manufacturing, contributing to market consolidation.

Rutile Market Company Market Share

The forecast period (2025-2033) predicts sustained growth, supported by persistent demand across critical industries. Asia-Pacific and the Middle East are anticipated to lead expansion due to rapid industrialization and urbanization. Emphasis on sustainable TiO2 production will shape market dynamics, favoring companies with environmentally conscious technologies. Research into novel TiO2 pigment applications may further unlock market potential. The competitive environment is characterized by a blend of multinational corporations and specialized firms, fostering a dynamic landscape of collaboration and competition.

Rutile Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global Rutile market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities within the Rutile sector. The report leverages robust data analysis to project future trends and provide actionable recommendations for navigating the evolving Rutile landscape.

Rutile Market Market Concentration & Dynamics

The global Rutile market exhibits a moderately concentrated structure, with key players like Iluka Resources Limited, Tronox Holdings PLC, and Rio Tinto holding significant market share. However, the presence of several regional players and emerging companies indicates a dynamic competitive landscape. Market concentration is further influenced by factors such as access to raw materials, technological advancements, and geographical distribution of production facilities. The xx% market share held by the top three players in 2024 is expected to slightly decrease to xx% by 2033 due to the emergence of new players and increased competition.

Innovation within the Rutile sector is driven by ongoing research and development in extraction techniques, processing technologies, and application development. Stringent environmental regulations and increasing sustainability concerns are also shaping the innovation ecosystem. Substitute products, such as synthetic rutile and alternative pigments, pose a competitive threat, demanding continuous innovation to maintain market share.

End-user trends, particularly within the titanium dioxide pigment industry, significantly influence market demand for Rutile. Growth in construction, automotive, and paint & coatings industries drives Rutile consumption. Recent M&A activities, including xx deals in the past five years, indicate a drive towards consolidation and expansion within the sector. These activities aim to enhance production capacity, diversify product portfolios, and secure access to raw materials.

Rutile Market Industry Insights & Trends

The global Rutile market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by robust growth in the titanium dioxide pigment industry and increasing demand from key end-use sectors. The market size is estimated at $xx Million in 2025 and is anticipated to reach $xx Million by 2033. Growth is further fueled by factors such as infrastructure development, particularly in emerging economies, and the expansion of the construction and automotive industries.

Technological disruptions are transforming the Rutile market. Advancements in extraction and processing technologies improve efficiency and reduce environmental impact. Evolving consumer preferences towards sustainable products are influencing market trends, pushing companies to adopt eco-friendly practices. Increased awareness of the environmental footprint of titanium dioxide pigment production is a key factor driving the adoption of sustainable extraction and processing methods.

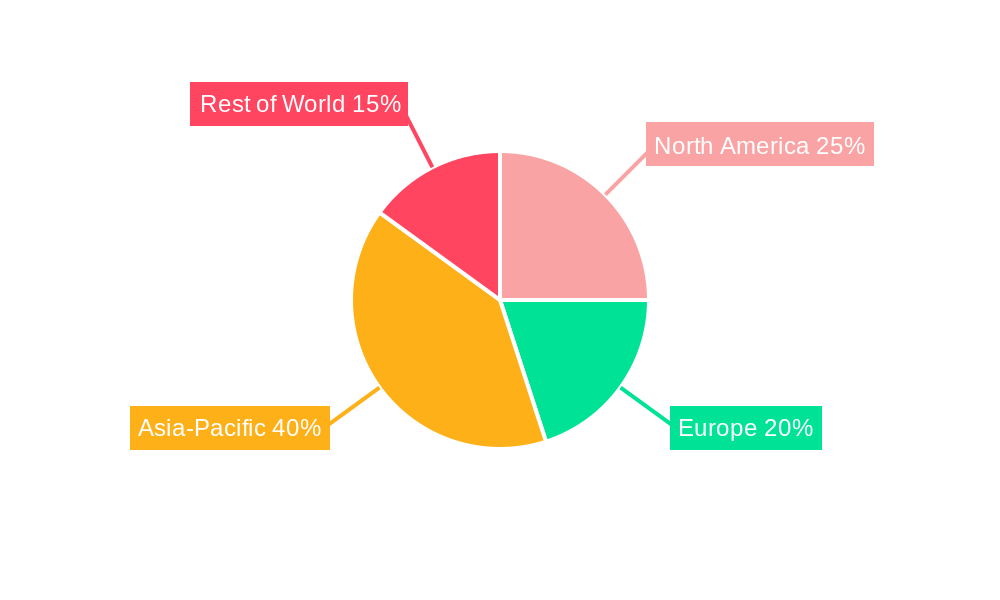

Key Markets & Segments Leading Rutile Market

The Asia-Pacific region dominates the global Rutile market, accounting for approximately xx% of global consumption in 2024. This dominance is primarily driven by:

- Rapid economic growth: High infrastructure spending and industrialization in countries like China and India significantly boost demand.

- Growing construction sector: The burgeoning construction industry fuels demand for titanium dioxide pigments, a primary application of Rutile.

- Expanding automotive industry: Increased vehicle production requires large quantities of titanium dioxide pigments for automotive paints.

Europe and North America also hold significant market share, although their growth rates are comparatively lower than the Asia-Pacific region. Market saturation and stringent environmental regulations in these regions partly account for the slower growth. Detailed dominance analysis of specific countries within each region further clarifies these trends.

Rutile Market Product Developments

Recent advancements in Rutile processing technologies have led to the development of high-purity Rutile with improved characteristics such as enhanced brightness and whiteness. These improvements expand the range of applications, enhancing the overall market appeal and competitiveness of the product. Innovations focus on enhancing the properties of Rutile to meet the evolving needs of different industries. The resulting products provide superior performance and contribute to the overall value proposition.

Challenges in the Rutile Market Market

The Rutile market faces significant challenges, including:

- Fluctuating raw material prices: Variations in the cost of raw materials impact profitability and pricing strategies.

- Stringent environmental regulations: Compliance with environmental regulations adds operational costs and complexity.

- Supply chain disruptions: Geopolitical instability and unforeseen events can disrupt the supply chain, impacting production and availability.

- Intense competition: The market's competitive landscape presents challenges to maintaining market share and profitability.

These factors collectively impact the market's overall growth trajectory and require proactive strategies for mitigation.

Forces Driving Rutile Market Growth

Several factors drive Rutile market growth:

- Technological advancements: Innovations in extraction and processing enhance efficiency and reduce costs.

- Economic growth in emerging markets: Rising infrastructure investment and industrialization fuel Rutile demand.

- Favorable government policies: Government support for infrastructure projects and industrial development further accelerates market growth.

These factors synergistically contribute to the market's expansion and present significant opportunities for industry players.

Long-Term Growth Catalysts in the Rutile Market

Long-term growth in the Rutile market hinges on continuous innovation in processing technologies, strategic partnerships between raw material suppliers and pigment manufacturers, and expansion into new geographical markets. Exploration of new applications for Rutile and the development of sustainable and eco-friendly processing methods will be crucial for sustained growth in the years to come.

Emerging Opportunities in Rutile Market

Emerging opportunities include:

- Sustainable Rutile production: Increased focus on environmentally friendly practices offers significant opportunities for market penetration.

- High-performance Rutile applications: Developing new applications for Rutile in niche markets will drive demand.

- Strategic partnerships and collaborations: Collaborations can improve supply chain efficiency and product development.

These opportunities present significant potential for market players to achieve sustainable growth and gain a competitive edge.

Leading Players in the Rutile Market Sector

- Iluka Resources Limited

- Tronox Holdings PLC

- East Minerals

- IREL (India) Limited

- Rio Tinto

- V V Mineral

- TOR Minerals

- Kerala Minerals & Metals Ltd

- Yucheng Jinhe Industrial Co Ltd

- *List Not Exhaustive

Key Milestones in Rutile Market Industry

- November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) signed an updated agreement, strengthening ties and improving social and economic outcomes for the Yindjibarndi people. This improves the company's social license to operate and strengthens community relations.

- October 2022: Rio Tinto announced the modernization of its Sorel-Tracy site in Quebec, boosting mineral supply while reducing emissions. This enhances Rio Tinto's competitiveness and addresses environmental concerns.

Strategic Outlook for Rutile Market Market

The Rutile market presents significant growth potential, particularly in emerging economies. Strategic opportunities include investing in advanced processing technologies, expanding into new markets, and focusing on sustainable and eco-friendly production practices. Companies that adapt to the changing market dynamics, embrace innovation, and prioritize sustainability will be well-positioned to capitalize on the future growth of the Rutile market.

Rutile Market Segmentation

-

1. Type

- 1.1. Natural Rutile

- 1.2. Synthetic Rutile

-

2. Variety

- 2.1. Ilmenorutile

- 2.2. Rutilated Quartz

- 2.3. Sagenite

- 2.4. Struverite

- 2.5. Venus Hairstone

- 2.6. Other Varieties

-

3. Application

- 3.1. Titanium Metal

- 3.2. Pigment in Paints

- 3.3. Refractory Ceramic

- 3.4. Optical Equipment

- 3.5. Other Applications

Rutile Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Rutile Market Regional Market Share

Geographic Coverage of Rutile Market

Rutile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific

- 3.4. Market Trends

- 3.4.1. Growing Demand for Rutile from the Production of Titanium Metal

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rutile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Rutile

- 5.1.2. Synthetic Rutile

- 5.2. Market Analysis, Insights and Forecast - by Variety

- 5.2.1. Ilmenorutile

- 5.2.2. Rutilated Quartz

- 5.2.3. Sagenite

- 5.2.4. Struverite

- 5.2.5. Venus Hairstone

- 5.2.6. Other Varieties

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Titanium Metal

- 5.3.2. Pigment in Paints

- 5.3.3. Refractory Ceramic

- 5.3.4. Optical Equipment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Rutile Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Rutile

- 6.1.2. Synthetic Rutile

- 6.2. Market Analysis, Insights and Forecast - by Variety

- 6.2.1. Ilmenorutile

- 6.2.2. Rutilated Quartz

- 6.2.3. Sagenite

- 6.2.4. Struverite

- 6.2.5. Venus Hairstone

- 6.2.6. Other Varieties

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Titanium Metal

- 6.3.2. Pigment in Paints

- 6.3.3. Refractory Ceramic

- 6.3.4. Optical Equipment

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Rutile Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Rutile

- 7.1.2. Synthetic Rutile

- 7.2. Market Analysis, Insights and Forecast - by Variety

- 7.2.1. Ilmenorutile

- 7.2.2. Rutilated Quartz

- 7.2.3. Sagenite

- 7.2.4. Struverite

- 7.2.5. Venus Hairstone

- 7.2.6. Other Varieties

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Titanium Metal

- 7.3.2. Pigment in Paints

- 7.3.3. Refractory Ceramic

- 7.3.4. Optical Equipment

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Rutile Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Rutile

- 8.1.2. Synthetic Rutile

- 8.2. Market Analysis, Insights and Forecast - by Variety

- 8.2.1. Ilmenorutile

- 8.2.2. Rutilated Quartz

- 8.2.3. Sagenite

- 8.2.4. Struverite

- 8.2.5. Venus Hairstone

- 8.2.6. Other Varieties

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Titanium Metal

- 8.3.2. Pigment in Paints

- 8.3.3. Refractory Ceramic

- 8.3.4. Optical Equipment

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Rutile Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Rutile

- 9.1.2. Synthetic Rutile

- 9.2. Market Analysis, Insights and Forecast - by Variety

- 9.2.1. Ilmenorutile

- 9.2.2. Rutilated Quartz

- 9.2.3. Sagenite

- 9.2.4. Struverite

- 9.2.5. Venus Hairstone

- 9.2.6. Other Varieties

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Titanium Metal

- 9.3.2. Pigment in Paints

- 9.3.3. Refractory Ceramic

- 9.3.4. Optical Equipment

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Rutile Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural Rutile

- 10.1.2. Synthetic Rutile

- 10.2. Market Analysis, Insights and Forecast - by Variety

- 10.2.1. Ilmenorutile

- 10.2.2. Rutilated Quartz

- 10.2.3. Sagenite

- 10.2.4. Struverite

- 10.2.5. Venus Hairstone

- 10.2.6. Other Varieties

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Titanium Metal

- 10.3.2. Pigment in Paints

- 10.3.3. Refractory Ceramic

- 10.3.4. Optical Equipment

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Iluka Resources Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tronox Holdings PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 East Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IREL (India) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rio Tinto

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 V V Mineral

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TOR Minerals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerala Minerals & Metals Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Iluka Resources Limited

List of Figures

- Figure 1: Global Rutile Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 3: Asia Pacific Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 5: Asia Pacific Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 6: Asia Pacific Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 11: North America Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 13: North America Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 14: North America Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 15: North America Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 21: Europe Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 22: Europe Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 23: Europe Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 27: South America Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 29: South America Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 30: South America Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 31: South America Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Rutile Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Rutile Market Revenue (million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Rutile Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Rutile Market Revenue (million), by Variety 2025 & 2033

- Figure 37: Middle East and Africa Rutile Market Revenue Share (%), by Variety 2025 & 2033

- Figure 38: Middle East and Africa Rutile Market Revenue (million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Rutile Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Rutile Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Rutile Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 3: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Rutile Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 7: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 16: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 22: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 23: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 32: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Rutile Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Rutile Market Revenue million Forecast, by Variety 2020 & 2033

- Table 39: Global Rutile Market Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Rutile Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Rutile Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rutile Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Rutile Market?

Key companies in the market include Iluka Resources Limited, Tronox Holdings PLC, East Minerals, IREL (India) Limited, Rio Tinto, V V Mineral, TOR Minerals, Kerala Minerals & Metals Ltd, Yucheng Jinhe Industrial Co Ltd*List Not Exhaustive.

3. What are the main segments of the Rutile Market?

The market segments include Type, Variety, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1401.75 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

6. What are the notable trends driving market growth?

Growing Demand for Rutile from the Production of Titanium Metal.

7. Are there any restraints impacting market growth?

Growing Demand for Rutile from the Production of Titanium Metal; Surging Construction Activities in the Asia Pacific.

8. Can you provide examples of recent developments in the market?

November 2022: Rio Tinto and Yindjibarndi Aboriginal Corporation (YAC) have signed an updated agreement to strengthen ties and deliver improved social and economic outcomes for the Yindjibarndi people for generations to come.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rutile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rutile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rutile Market?

To stay informed about further developments, trends, and reports in the Rutile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence