Key Insights

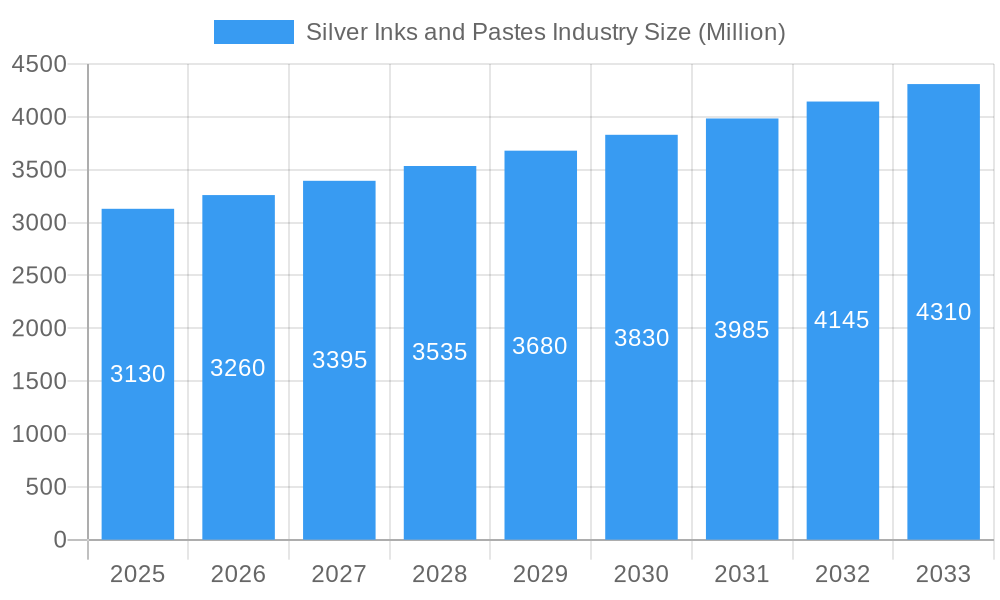

The global Silver Inks and Pastes market is poised for robust growth, currently valued at approximately $3.13 billion and projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.00% over the forecast period of 2025-2033. This sustained expansion is driven by a confluence of factors, most notably the burgeoning demand from the photovoltaics sector, where silver inks and pastes are indispensable for creating conductive elements in solar cells, capitalizing on the global push towards renewable energy. The expanding applications in radio frequency identification (RFID) for supply chain management and inventory tracking, coupled with the increasing adoption of advanced sensors in industrial automation, healthcare, and consumer electronics, are also significant growth catalysts. Furthermore, the evolution of touchscreens and displays, demanding enhanced conductivity and durability, and the persistent need for efficient printed circuit boards (PCBs) in a wide array of electronic devices, underscore the critical role of these conductive materials. Emerging trends like the development of flexible electronics, wearable technology, and the integration of smart functionalities into everyday objects are further propelling innovation and market penetration.

Silver Inks and Pastes Industry Market Size (In Billion)

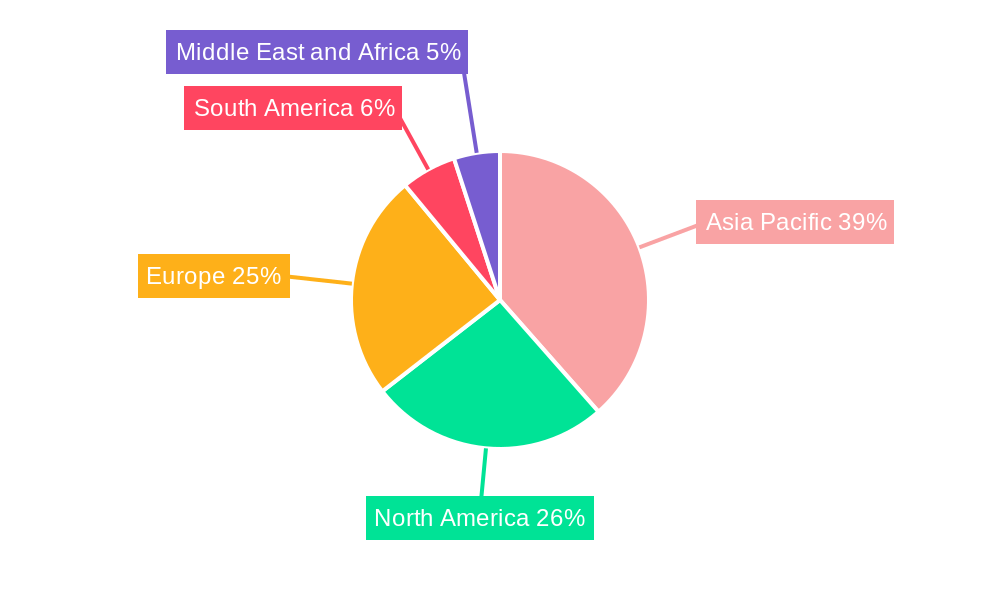

Despite the positive trajectory, the market faces certain restraints. The inherent volatility and cost fluctuations of silver, a primary raw material, can impact pricing strategies and profitability for manufacturers. Additionally, the development and increasing adoption of alternative conductive materials, such as copper-based inks and advanced conductive polymers, pose a competitive challenge. However, the superior conductivity and established reliability of silver-based materials ensure their continued dominance in high-performance applications. The market is segmented by type, with Silver-based and Copper-based inks and pastes leading in volume and value, followed by Graphene-based, Carbon Nanotubes, and Dielectric materials. Application segments are dominated by Photovoltaics and Printed Circuit Boards, with significant contributions from Sensors and Touchscreens and Displays. Geographically, the Asia Pacific region, particularly China and South Korea, is expected to be the largest and fastest-growing market, driven by strong manufacturing capabilities in electronics and a burgeoning renewable energy sector. North America and Europe also represent significant markets due to advanced technological adoption and established industrial bases.

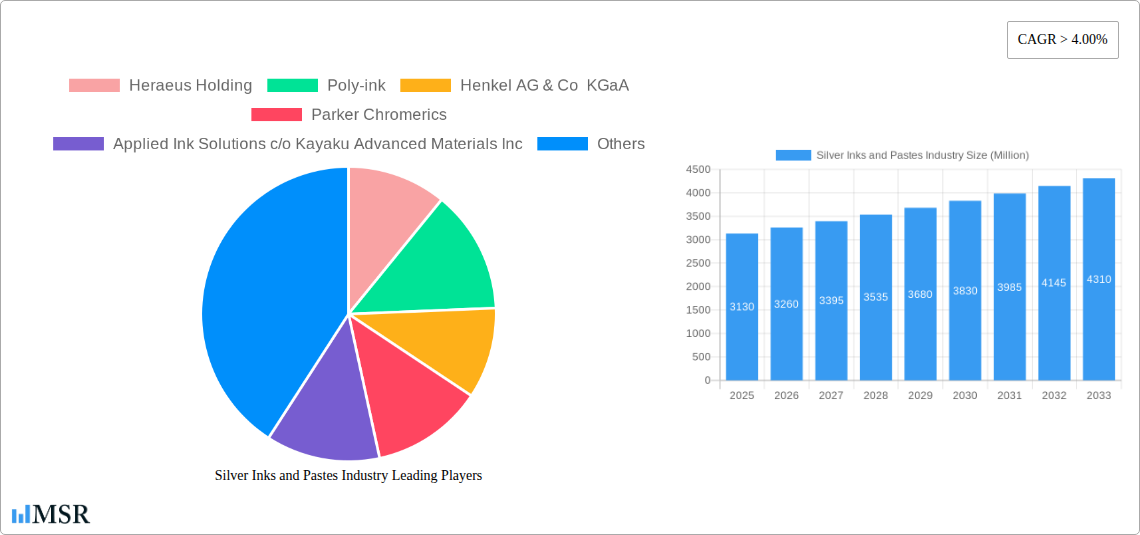

Silver Inks and Pastes Industry Company Market Share

Here is an SEO-optimized and engaging report description for the Silver Inks and Pastes Industry, crafted without placeholders and ready for immediate use.

Report Title: Global Silver Inks and Pastes Market Analysis: Trends, Opportunities, and Forecast (2019-2033)

Report Description:

Unlock critical insights into the burgeoning Silver Inks and Pastes Industry with our comprehensive market report. This in-depth analysis spans the Study Period: 2019–2033, with a focus on the Base Year: 2025 and an Estimated Year: 2025, followed by a robust Forecast Period: 2025–2033. Delve into the historical trajectory from 2019–2024 to understand the foundational growth of this dynamic sector.

The Silver Inks and Pastes market is experiencing significant expansion, driven by advancements in printed electronics, the demand for high-performance conductive inks, and innovative applications in photovoltaics, sensors, RFID, touchscreens, and printed circuit boards. Discover the latest market dynamics, industry developments, and the strategic moves of leading players like Heraeus Holding, Poly-ink, Henkel AG & Co KGaA, Parker Chromerics, Applied Ink Solutions, Sun Chemical, Celanese Corporation, DuPont, Daicel Corporation, Vorbeck Materials, Johnson Matthey, Creative Materials Inc, Ad-Nano Technologies Private Limited, InkTec Co Ltd, and NovaCentrix.

This report provides an unparalleled view of market concentration, innovation ecosystems, regulatory landscapes, and the competitive forces shaping the future of silver inks, copper-based inks, graphene-based inks, carbon nanotubes, dielectric materials, conductive polymers, and other types such as gold and platinum-based inks. Gain actionable intelligence on key market segments, growth drivers, challenges, and emerging opportunities within this high-growth industry.

Silver Inks and Pastes Industry Market Concentration & Dynamics

The global Silver Inks and Pastes industry exhibits a moderately concentrated market landscape, characterized by the presence of a few dominant players alongside a growing number of specialized and emerging manufacturers. Innovation ecosystems are vibrant, with significant investment in research and development focused on enhancing conductivity, improving printability, and developing sustainable material formulations. Regulatory frameworks are evolving, particularly concerning environmental impact and material safety, influencing product development and market entry strategies. Substitute products, such as other conductive materials and advanced composite inks, are gaining traction, necessitating continuous innovation from silver ink and paste manufacturers. End-user trends are shifting towards miniaturization, flexibility, and the integration of electronics into everyday objects, driving demand for sophisticated printing techniques and specialized ink formulations. Mergers and acquisition (M&A) activities are notable, with strategic consolidations aimed at expanding product portfolios, gaining market share, and acquiring novel technologies. For instance, the market has seen approximately 8-12 significant M&A deals annually over the past five years, demonstrating a consolidation drive among key industry participants. Market share for the top 5 players currently hovers around 45-55%, indicating a competitive yet consolidated structure.

Silver Inks and Pastes Industry Industry Insights & Trends

The Silver Inks and Pastes industry is poised for remarkable growth, projected to reach a market size of approximately $12,500 Million by 2033, expanding from an estimated $6,800 Million in 2025. This robust expansion is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). Key market growth drivers include the escalating demand for advanced electronics across various sectors, the ongoing miniaturization trend in electronic devices, and the inherent advantages offered by printable electronics, such as lower manufacturing costs, design flexibility, and the ability to integrate circuitry onto diverse substrates. Technological disruptions are at the forefront, with continuous advancements in nanoparticle synthesis, binder technologies, and printing methodologies like inkjet and screen printing enabling higher resolution, finer line widths, and enhanced performance characteristics of conductive inks and pastes. Evolving consumer behaviors, such as the desire for smart, connected products and the increasing adoption of wearable technology, are further fueling the demand for innovative printed electronic solutions. The rise of the Internet of Things (IoT) and the subsequent proliferation of connected devices across industries like healthcare, automotive, and consumer electronics are significant contributors to this growth trajectory. Furthermore, the increasing focus on sustainability and the development of eco-friendly conductive inks are also shaping market trends, appealing to environmentally conscious consumers and businesses. The growing adoption of flexible electronics and the development of novel applications in areas like advanced displays, flexible sensors, and smart packaging are also significant contributors to the industry's upward momentum.

Key Markets & Segments Leading Silver Inks and Pastes Industry

The global Silver Inks and Pastes industry's leadership is a multifaceted phenomenon, with dominance stemming from specific geographic regions, countries, and material/application segments.

Dominant Regions & Countries:

Asia Pacific currently leads the market and is expected to maintain its strong position throughout the forecast period. This dominance is driven by the region's robust manufacturing base for electronics, significant investments in research and development, and the presence of major technology hubs.

- Drivers for Asia Pacific Dominance:

- Extensive manufacturing capabilities for consumer electronics and components.

- Government initiatives promoting technological innovation and local production.

- Growing demand for smart devices and wearable technology.

- Advancements in the photovoltaic sector, a major consumer of silver inks and pastes.

- Rapid industrialization and infrastructure development.

- Drivers for Asia Pacific Dominance:

North America and Europe are also significant contributors, with strong research institutions, a focus on high-value applications like medical sensors and advanced RFID, and increasing adoption of printed electronics in niche markets.

Dominant Segments:

Type:

- Silver-based inks and pastes continue to be the dominant segment due to their excellent conductivity and established reliability, making them crucial for applications demanding high performance. The market size for silver-based formulations is estimated to be around $5,200 Million in 2025.

- Copper-based inks and pastes are gaining traction due to their cost-effectiveness and comparable conductivity in certain applications, projected to reach approximately $1,500 Million by 2033.

- Graphene-based inks and Carbon Nanotubes are emerging as disruptive forces, offering unique properties for flexible and transparent electronics, with a combined market size projected to exceed $1,000 Million by 2033.

- Conductive Polymers are crucial for flexible and stretchable electronics.

Application:

- Photovoltaics remains a cornerstone application, driving significant demand for high-quality silver conductive pastes used in solar cells. This segment alone is estimated to contribute over $2,000 Million to the market by 2033.

- Touchscreens and Displays represent another major application, fueled by the ubiquitous nature of smartphones, tablets, and other display devices.

- Sensors (including medical, environmental, and industrial sensors) are witnessing exponential growth, requiring precise and reliable conductive inks for their fabrication.

- Printed Circuit Boards (PCBs) are a foundational application, benefiting from the efficiency and cost-effectiveness of printed conductive materials.

- Radio Frequency Identification (RFID) tags and labels are increasingly being printed for logistics, inventory management, and asset tracking.

The interplay of these regional and segment-specific factors creates a dynamic market where innovation in material science and manufacturing processes directly translates into market leadership.

Silver Inks and Pastes Industry Product Developments

Product innovation in the Silver Inks and Pastes industry is characterized by a strong focus on enhancing electrical conductivity, improving adhesion to various substrates, and developing materials suitable for advanced printing techniques like inkjet and gravure. Manufacturers are actively developing inks with finer particle sizes for higher resolution printing and lower firing temperatures for compatibility with flexible and temperature-sensitive substrates. The development of conductive polymer blends and nanocomposite inks, incorporating materials like graphene and carbon nanotubes, is creating new market opportunities for flexible, transparent, and stretchable electronic applications. These advancements are crucial for enabling next-generation devices in areas such as wearable technology, advanced displays, and embedded sensors, providing a significant competitive edge for companies at the forefront of material science innovation.

Challenges in the Silver Inks and Pastes Industry Market

The Silver Inks and Pastes industry faces several key challenges that can impede market growth. The high cost of silver, a primary raw material, significantly impacts the overall price of these conductive materials, making them less competitive in cost-sensitive applications compared to alternatives. Supply chain disruptions, particularly those affecting the availability and price volatility of precious metals like silver, can lead to production delays and increased operational costs. Furthermore, the stringent environmental regulations surrounding the use and disposal of certain chemicals and heavy metals can impose additional compliance burdens on manufacturers, potentially increasing R&D and manufacturing expenses. Competitive pressures from emerging conductive materials and alternative manufacturing processes also pose a continuous challenge, demanding ongoing innovation and differentiation from established players.

Forces Driving Silver Inks and Pastes Industry Growth

Several powerful forces are propelling the growth of the Silver Inks and Pastes industry. The relentless demand for miniaturization and increased functionality in electronic devices, particularly in consumer electronics and the burgeoning IoT sector, is a primary driver. Advancements in printing technologies, enabling higher precision, faster production speeds, and the ability to print on a wider range of substrates, are making printable electronics more viable and cost-effective. The expanding applications in renewable energy, especially in the photovoltaic sector, where silver pastes are indispensable for efficient solar cell manufacturing, represent a significant growth catalyst. Furthermore, the increasing adoption of flexible and wearable electronics, requiring conductive materials that can conform to complex shapes and withstand bending, is opening up new avenues for market expansion. Government initiatives supporting the growth of advanced manufacturing and emerging technologies also contribute to the positive growth trajectory.

Challenges in the Silver Inks and Pastes Industry Market

Long-term growth in the Silver Inks and Pastes industry is intricately linked to continuous innovation and strategic market adaptation. The development of cost-effective alternatives or highly efficient silver utilization remains a critical long-term challenge and opportunity. Continued research into novel conductive materials, such as advanced metal alloys, conductive polymers with enhanced properties, and more efficient nanoparticle formulations, is essential to broaden the application scope and reduce reliance on pure silver. Strategic partnerships and collaborations between ink manufacturers, equipment providers, and end-users are vital for accelerating the adoption of new technologies and addressing complex application requirements. Market expansion into new geographical regions and untapped application areas, driven by ongoing technological advancements and evolving consumer needs, will also be crucial for sustained growth.

Emerging Opportunities in Silver Inks and Pastes Industry

Emerging opportunities in the Silver Inks and Pastes industry are abundant, driven by technological innovation and evolving market demands. The rapid expansion of the Internet of Things (IoT) ecosystem is creating significant demand for conductive inks and pastes in smart sensors, wearable devices, and connected infrastructure. The growing emphasis on sustainable energy solutions, particularly advancements in flexible solar cells and energy storage devices, presents lucrative prospects for specialized conductive materials. Furthermore, the increasing use of conductive inks in medical devices, diagnostics, and point-of-care testing offers a high-growth potential market. The development of printed electronics for smart packaging, enabling functionalities like anti-counterfeiting and temperature monitoring, also represents a promising new frontier.

Leading Players in the Silver Inks and Pastes Industry Sector

- Heraeus Holding

- Poly-ink

- Henkel AG & Co KGaA

- Parker Chromerics

- Applied Ink Solutions c/o Kayaku Advanced Materials Inc

- Sun Chemical

- Celanese Corporation

- DuPont

- Daicel Corporation

- Vorbeck Materials

- Johnson Matthey

- Creative Materials Inc

- Ad-Nano Technologies Private Limited

- InkTec Co Ltd

- NovaCentrix

Key Milestones in Silver Inks and Pastes Industry Industry

- January 2023: Celanese Corporation announced the launch of nine new product grades for the printed electronics market under the conductive ink brand Micromax at the IPC APEX EXPO. This expansion aims to cater to the growing demand for high-performance materials in printed electronic applications.

- November 2022: Henkel AG & Co. KGaA and LAIIER (LAIIER) announced a partnership to print electronics solutions for smart-scale novel building applications. This collaboration signifies a push towards integrating printed electronics into architectural and construction sectors.

Strategic Outlook for Silver Inks and Pastes Industry Market

The strategic outlook for the Silver Inks and Pastes industry is overwhelmingly positive, driven by a confluence of technological advancements and expanding market applications. Growth accelerators include the continued innovation in conductive material formulations, leading to enhanced performance and cost-effectiveness. Strategic opportunities lie in the burgeoning markets for flexible and wearable electronics, the growing demand for efficient solar energy solutions, and the expanding use of printed sensors in healthcare and industrial monitoring. Companies that can effectively leverage R&D to develop next-generation conductive inks and pastes, while forging strong partnerships across the value chain, will be best positioned for sustained success. The industry's ability to adapt to evolving regulatory landscapes and embrace sustainable manufacturing practices will also be critical for long-term market leadership and value creation.

Silver Inks and Pastes Industry Segmentation

-

1. Type

- 1.1. Silver-based

- 1.2. Copper-based

- 1.3. Graphene-based

- 1.4. Carbon Nanotubes

- 1.5. Dielectric

- 1.6. Conductive Polymers

- 1.7. Other Types ( Gold and Platinum Based, etc)

-

2. Application

- 2.1. Photovoltaics

- 2.2. Radio Frequency Identification (RFID)

- 2.3. Sensors

- 2.4. Touchscreens and Displays

- 2.5. Printed Circuit Boards

- 2.6. Other Ap

Silver Inks and Pastes Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Silver Inks and Pastes Industry Regional Market Share

Geographic Coverage of Silver Inks and Pastes Industry

Silver Inks and Pastes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Installation of Solar Panels; Increasing Demand for Printed Circuit Boards; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Photovoltaic Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Silver-based

- 5.1.2. Copper-based

- 5.1.3. Graphene-based

- 5.1.4. Carbon Nanotubes

- 5.1.5. Dielectric

- 5.1.6. Conductive Polymers

- 5.1.7. Other Types ( Gold and Platinum Based, etc)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Photovoltaics

- 5.2.2. Radio Frequency Identification (RFID)

- 5.2.3. Sensors

- 5.2.4. Touchscreens and Displays

- 5.2.5. Printed Circuit Boards

- 5.2.6. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Silver-based

- 6.1.2. Copper-based

- 6.1.3. Graphene-based

- 6.1.4. Carbon Nanotubes

- 6.1.5. Dielectric

- 6.1.6. Conductive Polymers

- 6.1.7. Other Types ( Gold and Platinum Based, etc)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Photovoltaics

- 6.2.2. Radio Frequency Identification (RFID)

- 6.2.3. Sensors

- 6.2.4. Touchscreens and Displays

- 6.2.5. Printed Circuit Boards

- 6.2.6. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Silver-based

- 7.1.2. Copper-based

- 7.1.3. Graphene-based

- 7.1.4. Carbon Nanotubes

- 7.1.5. Dielectric

- 7.1.6. Conductive Polymers

- 7.1.7. Other Types ( Gold and Platinum Based, etc)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Photovoltaics

- 7.2.2. Radio Frequency Identification (RFID)

- 7.2.3. Sensors

- 7.2.4. Touchscreens and Displays

- 7.2.5. Printed Circuit Boards

- 7.2.6. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Silver-based

- 8.1.2. Copper-based

- 8.1.3. Graphene-based

- 8.1.4. Carbon Nanotubes

- 8.1.5. Dielectric

- 8.1.6. Conductive Polymers

- 8.1.7. Other Types ( Gold and Platinum Based, etc)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Photovoltaics

- 8.2.2. Radio Frequency Identification (RFID)

- 8.2.3. Sensors

- 8.2.4. Touchscreens and Displays

- 8.2.5. Printed Circuit Boards

- 8.2.6. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Silver-based

- 9.1.2. Copper-based

- 9.1.3. Graphene-based

- 9.1.4. Carbon Nanotubes

- 9.1.5. Dielectric

- 9.1.6. Conductive Polymers

- 9.1.7. Other Types ( Gold and Platinum Based, etc)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Photovoltaics

- 9.2.2. Radio Frequency Identification (RFID)

- 9.2.3. Sensors

- 9.2.4. Touchscreens and Displays

- 9.2.5. Printed Circuit Boards

- 9.2.6. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Silver Inks and Pastes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Silver-based

- 10.1.2. Copper-based

- 10.1.3. Graphene-based

- 10.1.4. Carbon Nanotubes

- 10.1.5. Dielectric

- 10.1.6. Conductive Polymers

- 10.1.7. Other Types ( Gold and Platinum Based, etc)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Photovoltaics

- 10.2.2. Radio Frequency Identification (RFID)

- 10.2.3. Sensors

- 10.2.4. Touchscreens and Displays

- 10.2.5. Printed Circuit Boards

- 10.2.6. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heraeus Holding

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Poly-ink

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel AG & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Parker Chromerics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applied Ink Solutions c/o Kayaku Advanced Materials Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Chemical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Celanese Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DuPont

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Daicel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vorbeck Materials*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Johnson Matthey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Creative Materials Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ad-Nano Technologies Private Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 InkTec Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NovaCentrix

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Heraeus Holding

List of Figures

- Figure 1: Global Silver Inks and Pastes Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Silver Inks and Pastes Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Silver Inks and Pastes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Silver Inks and Pastes Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Silver Inks and Pastes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Silver Inks and Pastes Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Silver Inks and Pastes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Silver Inks and Pastes Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Silver Inks and Pastes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Silver Inks and Pastes Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Silver Inks and Pastes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Silver Inks and Pastes Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Silver Inks and Pastes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Silver Inks and Pastes Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Silver Inks and Pastes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Silver Inks and Pastes Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Silver Inks and Pastes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Silver Inks and Pastes Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Silver Inks and Pastes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Silver Inks and Pastes Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Silver Inks and Pastes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Silver Inks and Pastes Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Silver Inks and Pastes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Silver Inks and Pastes Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Silver Inks and Pastes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Silver Inks and Pastes Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Silver Inks and Pastes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Silver Inks and Pastes Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Silver Inks and Pastes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Silver Inks and Pastes Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Silver Inks and Pastes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Silver Inks and Pastes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Silver Inks and Pastes Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silver Inks and Pastes Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Silver Inks and Pastes Industry?

Key companies in the market include Heraeus Holding, Poly-ink, Henkel AG & Co KGaA, Parker Chromerics, Applied Ink Solutions c/o Kayaku Advanced Materials Inc, Sun Chemical, Celanese Corporation, DuPont, Daicel Corporation, Vorbeck Materials*List Not Exhaustive, Johnson Matthey, Creative Materials Inc, Ad-Nano Technologies Private Limited, InkTec Co Ltd, NovaCentrix.

3. What are the main segments of the Silver Inks and Pastes Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Installation of Solar Panels; Increasing Demand for Printed Circuit Boards; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from Photovoltaic Segment.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2023: Celanese Corporation announced the launch of nine new product grades for the printed electronics market under the conductive ink brand Micromax at the IPC APEX EXPO.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silver Inks and Pastes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silver Inks and Pastes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silver Inks and Pastes Industry?

To stay informed about further developments, trends, and reports in the Silver Inks and Pastes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence