Key Insights

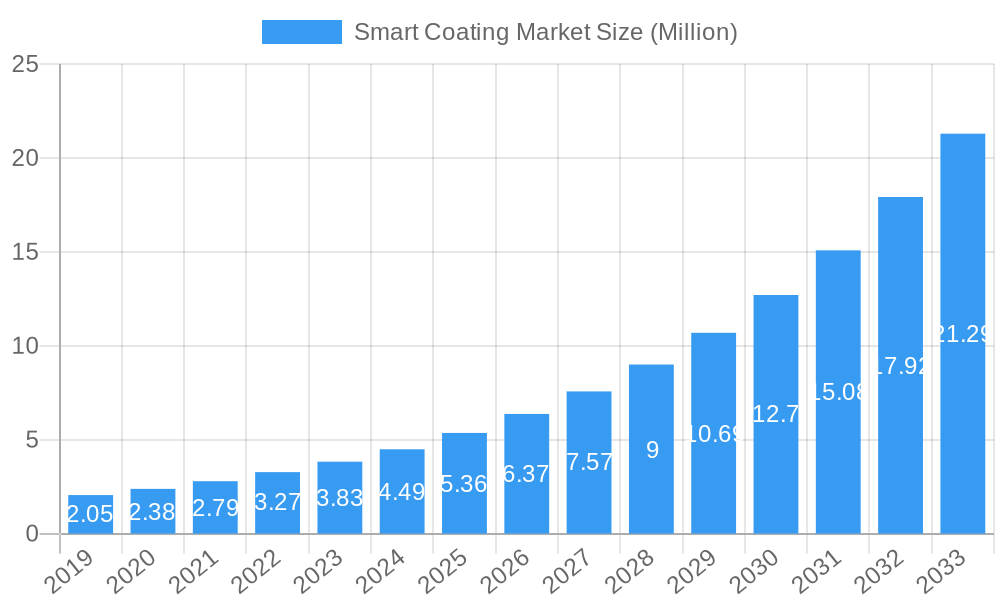

The global Smart Coating Market is poised for substantial growth, projected to reach USD 5.36 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 16.95% during the forecast period of 2025-2033. This robust expansion is primarily driven by an increasing demand for advanced protective and functional surfaces across diverse end-user industries. Key drivers include the growing need for enhanced durability, improved performance, and innovative functionalities like self-cleaning, anti-microbial, and anti-corrosion properties in building and construction, automotive, marine, and aerospace sectors. The development of novel materials and sophisticated application techniques further fuels market penetration.

Smart Coating Market Market Size (In Million)

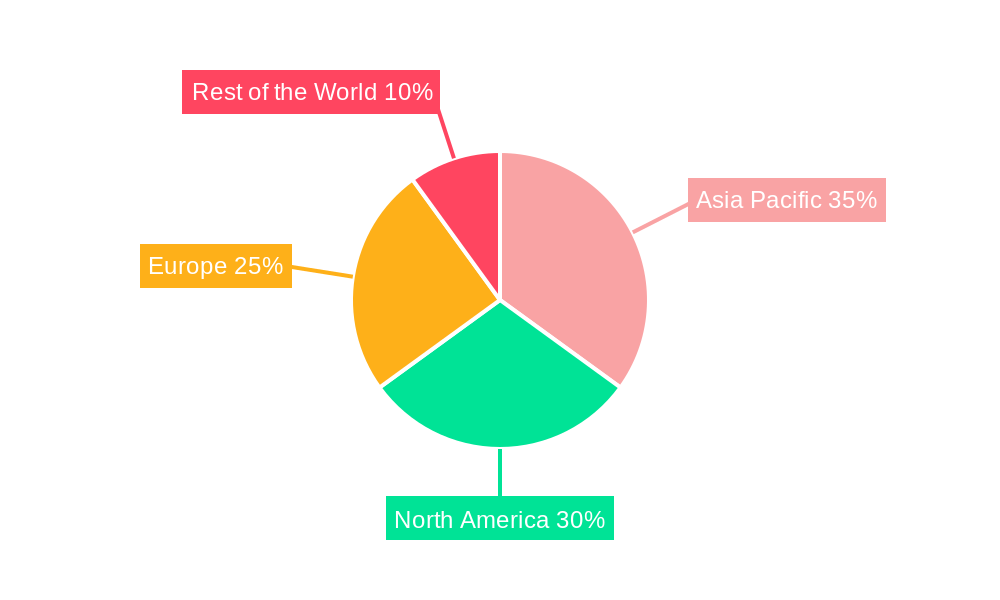

The market is segmented by function, with anti-fouling, anti-microbial, anti-corrosion, and self-cleaning coatings witnessing significant adoption due to their ability to extend product lifespan and reduce maintenance costs. Color-shifting and other advanced functionalities are also gaining traction as technological capabilities advance. Geographically, Asia Pacific is expected to lead the market, driven by rapid industrialization, expanding infrastructure projects, and increasing adoption of smart technologies in countries like China and India. North America and Europe also represent significant markets due to the presence of key players and a strong emphasis on research and development. However, the high cost of initial implementation and the need for specialized application expertise may pose some restraints to market growth, which the industry is actively addressing through innovation and economies of scale.

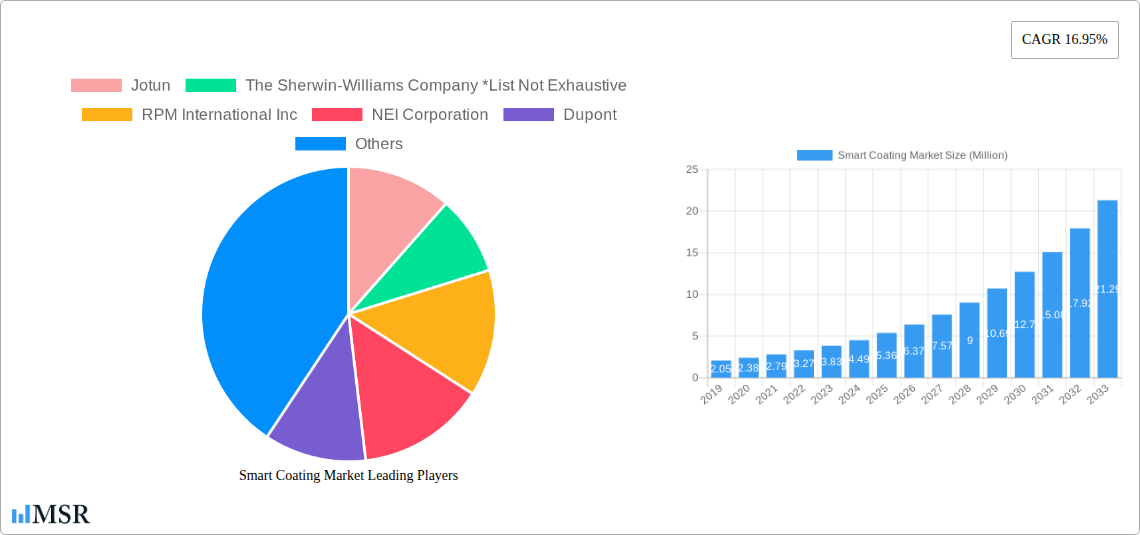

Smart Coating Market Company Market Share

Gain unparalleled insights into the rapidly evolving Smart Coating Market with our comprehensive industry report. Spanning the historical period of 2019–2024 and projecting growth through 2033, this report provides essential data, analysis, and strategic foresight for manufacturers, investors, and stakeholders. Discover how advanced functional coatings are revolutionizing industries and shaping the future of material science.

Smart Coating Market Market Concentration & Dynamics

The Smart Coating Market is characterized by a moderate to high concentration, with a few key players dominating significant market share, estimated at over 60% collectively. Innovation ecosystems are vibrant, driven by continuous research and development into novel functionalities like anti-icing and self-cleaning coatings. Regulatory frameworks are evolving to support sustainability and performance standards, impacting material sourcing and application processes. Substitute products, such as traditional coatings and advanced material alternatives, pose a competitive challenge, but the unique value proposition of smart coatings – enhanced durability, reduced maintenance, and added functionalities – continues to drive adoption. End-user trends are leaning towards increased demand for environmentally friendly, high-performance solutions across all sectors. Mergers and acquisitions (M&A) are a significant dynamic, with an estimated XX M&A deal count in the historical period (2019-2024), reflecting consolidation and strategic expansion.

- Key Competitive Factors: Product innovation, technological integration, cost-effectiveness, regulatory compliance.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios and geographical reach.

- Regulatory Influence: Growing emphasis on eco-friendly formulations and performance certifications.

- End-User Demands: Prioritization of longevity, reduced operational costs, and specialized functionalities.

Smart Coating Market Industry Insights & Trends

The global Smart Coating Market is poised for substantial growth, projected to reach an estimated market size of $XX Billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This upward trajectory is primarily fueled by increasing demand for enhanced performance, durability, and specialized functionalities across a wide array of end-user industries. Technological disruptions, particularly in material science and nanotechnology, are enabling the development of coatings with unique properties such as self-healing, anti-microbial, and energy-harvesting capabilities. Evolving consumer behaviors, including a growing preference for sustainable and low-maintenance solutions, further accelerate market penetration. The integration of smart coatings into everyday products and infrastructure signifies a paradigm shift, moving beyond mere surface protection to active performance enhancement. Key growth drivers include the expanding applications in the automotive sector for improved aesthetics and fuel efficiency, the marine industry for anti-fouling and corrosion resistance, and the building and construction sector for energy-efficient and self-cleaning surfaces. The aerospace and defense sector also presents significant opportunities due to the stringent requirements for extreme environment protection and stealth technologies.

Key Markets & Segments Leading Smart Coating Market

The Smart Coating Market is experiencing robust growth driven by several key segments and regions. The Anti-corrosion function is a dominant segment, holding an estimated market share of XX%, due to its critical role in extending the lifespan of infrastructure and assets across various industries. The Building and Construction end-user industry is a leading market, projected to account for over XX% of the total market revenue by 2025, fueled by increasing urbanization, infrastructure development projects, and the demand for energy-efficient and aesthetically pleasing buildings.

- Dominant Functions:

- Anti-corrosion: Essential for infrastructure, automotive, and marine applications, providing significant cost savings and extending asset life.

- Anti-fouling: Crucial for the marine industry to prevent biofouling, reduce drag, and improve fuel efficiency.

- Self-cleaning: Gaining traction in architectural and automotive applications for reduced maintenance and improved aesthetics.

- Leading End-User Industries:

- Building and Construction: Driven by global infrastructure investments, sustainable building initiatives, and the need for enhanced material durability.

- Automotive: Fueled by demand for scratch-resistant, self-healing, and aesthetically superior finishes, as well as lightweighting initiatives.

- Marine: Characterized by a strong need for anti-corrosion and anti-fouling solutions to combat harsh marine environments and operational costs.

- Regional Dominance: North America and Europe are currently the dominant regions due to advanced technological adoption and strong industrial bases. However, Asia Pacific is projected to witness the fastest growth due to rapid industrialization and increasing infrastructure spending.

Smart Coating Market Product Developments

Product development in the Smart Coating Market is characterized by continuous innovation in nanotechnology and advanced material science. Innovations are focused on creating coatings with multi-functional properties, such as combining anti-microbial and self-cleaning capabilities for healthcare and public spaces, or developing highly durable, anti-icing coatings for aerospace and wind energy applications. The market relevance of these developments is high, offering solutions that reduce maintenance costs, enhance safety, improve energy efficiency, and extend the lifespan of various products and structures. Companies are investing heavily in research to create coatings that respond to environmental stimuli, such as changes in temperature or light, for dynamic color-shifting effects or enhanced thermal management.

Challenges in the Smart Coating Market Market

The Smart Coating Market faces several challenges that may impede its growth. Regulatory hurdles related to the environmental impact and safety of novel chemical formulations can slow down product approvals and market entry. Supply chain disruptions, particularly for specialized raw materials, can impact production volumes and cost-effectiveness. Furthermore, intense competitive pressures from both established players and emerging innovators necessitate significant R&D investment to maintain a competitive edge. The relatively higher initial cost of smart coatings compared to traditional alternatives can also be a barrier to widespread adoption in price-sensitive markets.

- Regulatory Compliance: Navigating complex environmental and safety regulations for new formulations.

- Supply Chain Volatility: Ensuring a stable and cost-effective supply of specialized raw materials.

- Cost of Implementation: Higher upfront investment can be a barrier for certain applications.

- Technical Skill Gap: Need for skilled applicators and understanding of specialized coating technologies.

Forces Driving Smart Coating Market Growth

The growth of the Smart Coating Market is propelled by several key forces. Technological advancements in nanotechnology and material science are enabling the creation of coatings with unprecedented functionalities, such as enhanced durability, self-healing properties, and antimicrobial resistance. Increasing demand for sustainable and eco-friendly solutions, driven by stringent environmental regulations and consumer awareness, favors the development of low-VOC and long-lasting smart coatings. Economic growth and substantial investments in infrastructure development across sectors like automotive, aerospace, and construction are creating a strong market pull for high-performance coating solutions that extend asset life and reduce maintenance costs. The pursuit of enhanced safety and efficiency in critical applications, such as aerospace and defense, further fuels the adoption of specialized smart coatings.

Challenges in the Smart Coating Market Market

Long-term growth catalysts for the Smart Coating Market are intrinsically linked to ongoing innovation and strategic market expansion. Continued research into bio-inspired and nanotechnology-driven coatings, promising enhanced self-healing, anti-corrosion, and energy-harvesting capabilities, will be crucial. Strategic partnerships and collaborations between coating manufacturers, material suppliers, and end-user industries will accelerate the development and adoption of customized solutions. Furthermore, the expanding applications in emerging economies, driven by industrialization and infrastructure growth, will present significant opportunities for market penetration and revenue diversification.

Emerging Opportunities in Smart Coating Market

Emerging opportunities in the Smart Coating Market are diverse and promising. The development of "smart" coatings for wearable technology and flexible electronics represents a nascent but rapidly growing segment. Increased adoption of smart coatings in the renewable energy sector, particularly for enhancing the efficiency and lifespan of solar panels and wind turbines, is a significant opportunity. Furthermore, the growing demand for intelligent building materials that can regulate temperature, harvest energy, and monitor structural integrity offers substantial potential. The integration of IoT capabilities within coatings, enabling real-time data collection and diagnostics, will also unlock new avenues for growth and value creation.

Leading Players in the Smart Coating Market Sector

- Jotun

- The Sherwin-Williams Company

- RPM International Inc

- NEI Corporation

- Dupont

- Akzo Nobel NV

- 3M

- PPG Industries Inc

- Axalta Coating Systems LLC

- Hempel AS

Key Milestones in Smart Coating Market Industry

- April 2022: The Sherwin-Williams Company acquired the European industrial coatings business of Sika AG. This acquisition bolstered their portfolio with Sika AG's corrosion-resistant coating systems, integrated into Sherwin-Williams' Performance Coatings segment. These coatings find application in critical infrastructure, including steel infrastructure, bridges, airports, rails, wind and energy systems, chemicals, power transmission, and various interior linings for oil and gas tanks, vessels, pipework, and water and wastewater applications.

- April 2021: AkzoNobel collaborated with Qlayers, a startup, and acquired a stake in their innovative industrial coating application technology. Qlayers' fully automated solution offers a safer, more consistent, and faster alternative to traditional manual coating processes, significantly impacting efficiency and quality in industrial coating applications.

Strategic Outlook for Smart Coating Market Market

The strategic outlook for the Smart Coating Market is highly optimistic, driven by a confluence of technological innovation and evolving industry needs. Future growth will be accelerated by the continued development of coatings with advanced functionalities such as self-healing, energy harvesting, and environmental sensing capabilities. Expansion into new market segments, including smart textiles and biomedical applications, presents significant untapped potential. Strategic partnerships aimed at co-development and market penetration, especially in emerging economies, will be crucial for sustained growth. Furthermore, an increasing focus on sustainable and circular economy principles in coating formulation and application will shape future market trends and competitive advantages.

Smart Coating Market Segmentation

-

1. Function

- 1.1. Anti-fouling

- 1.2. Anti-microbial

- 1.3. Anti-corrosion

- 1.4. Anti-icing

- 1.5. Self-cleaning

- 1.6. Color-shifting

- 1.7. Other Functions

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Automotive

- 2.3. Marine

- 2.4. Aerospace and Defense

- 2.5. Other End-user Industries

Smart Coating Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Smart Coating Market Regional Market Share

Geographic Coverage of Smart Coating Market

Smart Coating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Superior Properties Over Traditional Coatings; Growing Demand from the Construction Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Smart Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Anti-fouling

- 5.1.2. Anti-microbial

- 5.1.3. Anti-corrosion

- 5.1.4. Anti-icing

- 5.1.5. Self-cleaning

- 5.1.6. Color-shifting

- 5.1.7. Other Functions

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Automotive

- 5.2.3. Marine

- 5.2.4. Aerospace and Defense

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Asia Pacific Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Anti-fouling

- 6.1.2. Anti-microbial

- 6.1.3. Anti-corrosion

- 6.1.4. Anti-icing

- 6.1.5. Self-cleaning

- 6.1.6. Color-shifting

- 6.1.7. Other Functions

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Automotive

- 6.2.3. Marine

- 6.2.4. Aerospace and Defense

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. North America Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Anti-fouling

- 7.1.2. Anti-microbial

- 7.1.3. Anti-corrosion

- 7.1.4. Anti-icing

- 7.1.5. Self-cleaning

- 7.1.6. Color-shifting

- 7.1.7. Other Functions

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Automotive

- 7.2.3. Marine

- 7.2.4. Aerospace and Defense

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Anti-fouling

- 8.1.2. Anti-microbial

- 8.1.3. Anti-corrosion

- 8.1.4. Anti-icing

- 8.1.5. Self-cleaning

- 8.1.6. Color-shifting

- 8.1.7. Other Functions

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Automotive

- 8.2.3. Marine

- 8.2.4. Aerospace and Defense

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Rest of the World Smart Coating Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Anti-fouling

- 9.1.2. Anti-microbial

- 9.1.3. Anti-corrosion

- 9.1.4. Anti-icing

- 9.1.5. Self-cleaning

- 9.1.6. Color-shifting

- 9.1.7. Other Functions

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Automotive

- 9.2.3. Marine

- 9.2.4. Aerospace and Defense

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jotun

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Sherwin-Williams Company *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 RPM International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEI Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dupont

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Akzo Nobel NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 3M

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PPG Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Axalta Coating Systems LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hempel AS

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Jotun

List of Figures

- Figure 1: Global Smart Coating Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 3: Asia Pacific Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: Asia Pacific Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 9: North America Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 10: North America Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 15: Europe Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Smart Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Smart Coating Market Revenue (Million), by Function 2025 & 2033

- Figure 21: Rest of the World Smart Coating Market Revenue Share (%), by Function 2025 & 2033

- Figure 22: Rest of the World Smart Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Smart Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Smart Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Smart Coating Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Smart Coating Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 13: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 19: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Smart Coating Market Revenue Million Forecast, by Function 2020 & 2033

- Table 27: Global Smart Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Smart Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Smart Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Coating Market?

The projected CAGR is approximately 16.95%.

2. Which companies are prominent players in the Smart Coating Market?

Key companies in the market include Jotun, The Sherwin-Williams Company *List Not Exhaustive, RPM International Inc, NEI Corporation, Dupont, Akzo Nobel NV, 3M, PPG Industries Inc, Axalta Coating Systems LLC, Hempel AS.

3. What are the main segments of the Smart Coating Market?

The market segments include Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Superior Properties Over Traditional Coatings; Growing Demand from the Construction Sector.

6. What are the notable trends driving market growth?

Increasing Demand from Building and Construction Industry.

7. Are there any restraints impacting market growth?

High Cost of Smart Coatings.

8. Can you provide examples of recent developments in the market?

On April 2022, The Sherwin-Williams Company acquired the European industrial coatings business of Sika AG. Sika AG manufactures and sells coating systems that are corrosion-resistant. These coatings are included in the Performance Coatings segment of the company. They are used in interior and exterior steel infrastructure, bridges, airports and rails, wind and energy, chemicals, power transmission, interior linings for oil and gas tanks, vessels, pipework, and water and wastewater applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Coating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Coating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Coating Market?

To stay informed about further developments, trends, and reports in the Smart Coating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence