Key Insights

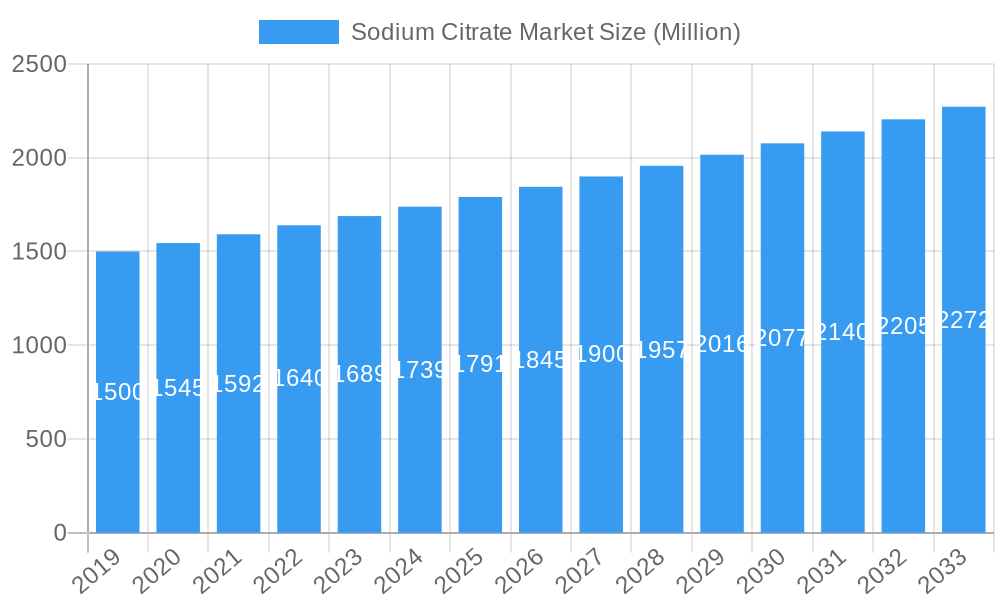

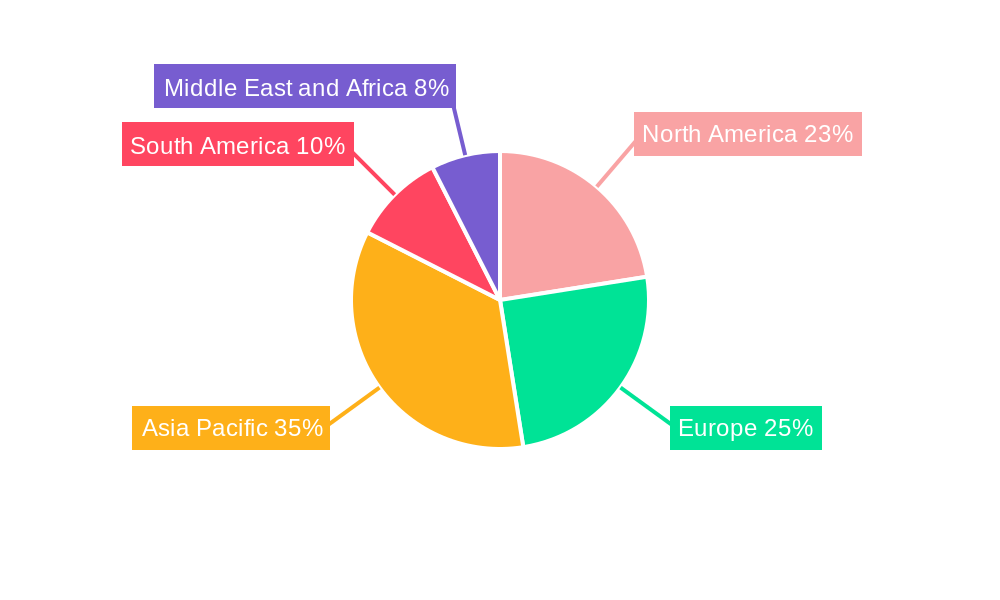

The global Sodium Citrate market is poised for robust growth, projected to reach an estimated market size of approximately $1,800 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) exceeding 3.00%. This sustained expansion is primarily driven by the increasing demand for sodium citrate across a diverse range of applications, notably in the food and beverage sector, where its emulsifying, buffering, and flavor-enhancing properties are highly valued. The pharmaceutical industry also presents a significant growth avenue, leveraging sodium citrate's anticoagulant and effervescent properties. Furthermore, rising consumer awareness regarding hygiene and the growing demand for personal care products are boosting its use in cosmetics and soaps and detergents. Emerging economies, particularly in the Asia Pacific region, are expected to be key growth engines due to rapid industrialization, expanding food processing capabilities, and an increasing focus on pharmaceutical production.

Sodium Citrate Market Market Size (In Billion)

The market dynamics are further shaped by several key trends. The escalating demand for natural and clean-label ingredients is pushing manufacturers to adopt more sustainable production methods for sodium citrate. Innovations in production technology aimed at improving efficiency and reducing environmental impact are also gaining traction. Conversely, the market faces certain restraints, including price volatility of raw materials and stringent regulatory landscapes in certain regions, which can impact production costs and market access. However, the broad spectrum of applications, coupled with ongoing research and development to explore novel uses, is expected to mitigate these challenges. Major players are actively involved in strategic partnerships, mergers, and acquisitions to expand their geographical reach and product portfolios, further consolidating their market positions. The competitive landscape is characterized by a mix of established global giants and emerging regional manufacturers, all vying for market share in this dynamic and growing industry.

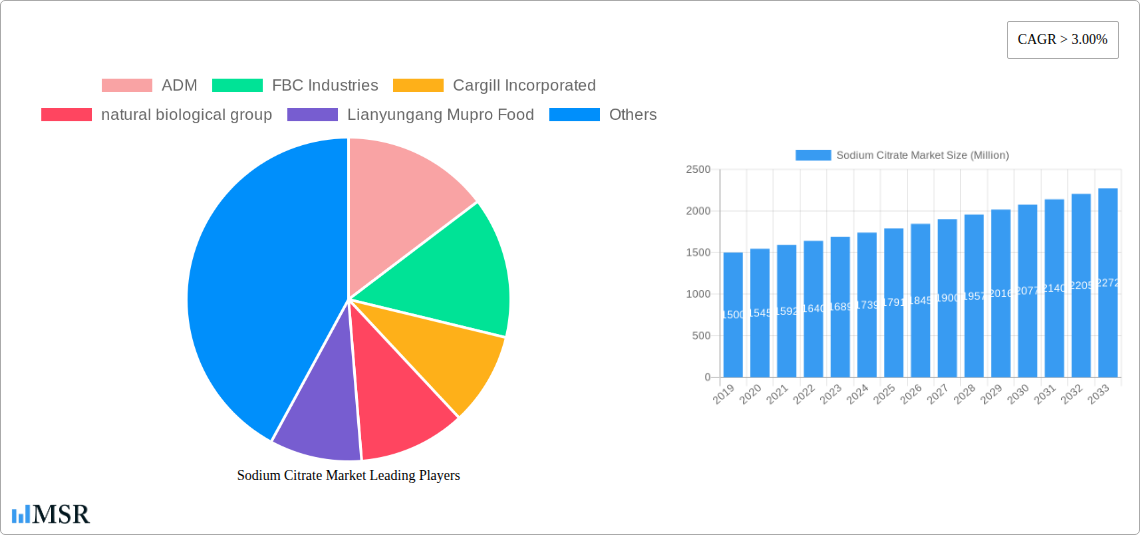

Sodium Citrate Market Company Market Share

Sodium Citrate Market Report: Unlocking Growth and Innovation in a Vital Ingredient Sector (2019-2033)

This comprehensive Sodium Citrate Market report delves into the dynamic landscape of this essential ingredient, forecasting market growth from 2019 to 2033 with a base year of 2025. Discover critical insights into market size, CAGR, key drivers, emerging trends, and competitive strategies shaping the global sodium citrate market. Essential for stakeholders including food and beverage manufacturers, pharmaceutical companies, cosmetic formulators, and detergent producers, this report provides an in-depth analysis of food grade sodium citrate, pharmaceutical grade sodium citrate, and industrial grade sodium citrate.

Sodium Citrate Market Market Concentration & Dynamics

The sodium citrate market exhibits a moderate to high level of concentration, with a few key players holding significant market share. ADM, FBC Industries, Cargill Incorporated, and Jungbunzlauer Suisse AG are prominent entities driving innovation and supply chain efficiency. The innovation ecosystem is fueled by a growing demand for natural and sustainable ingredients, prompting companies to invest in research and development for bio-based production methods, particularly focusing on fermentation of renewable raw materials like corn. Regulatory frameworks, while generally supportive of food and pharmaceutical applications, are increasingly scrutinizing environmental impact and sustainability claims, influencing production processes. Substitute products, such as other chelating agents and pH regulators, present a competitive challenge, but sodium citrate's versatility and safety profile maintain its market dominance in numerous applications. End-user trends indicate a rising preference for clean-label ingredients and products with enhanced shelf-life and stability, directly benefiting sodium citrate demand. Mergers and acquisitions (M&A) activities, exemplified by ADM's acquisition of Comhan, are strategically employed to expand geographical reach, diversify product portfolios, and strengthen supply chains. The market is projected to see continued consolidation and strategic partnerships to capitalize on evolving consumer preferences and stringent quality standards.

Sodium Citrate Market Industry Insights & Trends

The sodium citrate market size is anticipated to witness robust growth, driven by a confluence of factors across its diverse application segments. A significant market growth driver stems from the ever-expanding food and beverage industry, where sodium citrate serves as a crucial emulsifier, sequestrant, and pH regulator, enhancing product texture, flavor, and shelf-life. The increasing global population and evolving dietary habits, particularly the demand for processed and convenience foods, directly translate to higher consumption of sodium citrate. In the pharmaceutical sector, its role as an anticoagulant in blood collection and as an excipient in various drug formulations, particularly for effervescent tablets and as a buffer, is a consistent growth catalyst. Technological disruptions are primarily focused on optimizing production processes, with a strong emphasis on sustainable and cost-effective fermentation techniques. Companies are actively exploring the use of advanced biotechnologies to improve yields and reduce the environmental footprint of sodium citrate production. Evolving consumer behaviors, marked by a growing awareness of health and wellness, are indirectly boosting the demand for sodium citrate in functional foods and beverages, as well as in hypoallergenic cosmetic formulations. The "clean label" trend also favors sodium citrate due to its natural origin and perceived safety. Furthermore, the growing industrial applications, including in soaps and detergents for water softening and in metal finishing for rust removal, contribute to the market's upward trajectory. The CAGR of the sodium citrate market is projected to be approximately 5.2% during the forecast period.

Key Markets & Segments Leading Sodium Citrate Market

The Food Grade Sodium Citrate segment stands out as the dominant force in the global market, propelled by widespread application in the food and beverage industry. Asia Pacific, particularly China and India, represents a key region for growth, fueled by burgeoning populations, rising disposable incomes, and an expanding food processing sector.

Food Grade Sodium Citrate: This segment's dominance is anchored by its extensive use in:

- Food and Beverages: Acting as an emulsifier, pH regulator, flavor enhancer, and preservative in dairy products, jams, jellies, processed meats, baked goods, and soft drinks. The increasing demand for convenience foods and beverages globally is a significant driver.

- Economic Growth: Rising middle-class populations in emerging economies are increasing their consumption of processed foods, directly impacting demand for food-grade sodium citrate.

- Health and Wellness Trends: Its use in sports drinks and functional beverages as an electrolyte source and pH buffer further supports growth.

Pharmaceutical Grade Sodium Citrate: This segment also commands a substantial market share, owing to its critical role in:

- Pharmaceuticals: Primarily used as an anticoagulant in blood transfusions and dialysis, and as an excipient in solid dosage forms like effervescent tablets and as a buffer. The growing healthcare sector globally and increased demand for blood products are key contributors.

- Infrastructure: Advancements in healthcare infrastructure and the expansion of pharmaceutical manufacturing facilities, especially in developing nations, create a conducive environment for growth.

Industrial Grade Sodium Citrate: While smaller in market share compared to food and pharmaceutical grades, this segment is experiencing steady growth due to:

- Cosmetics: Utilized as a chelating agent and pH adjuster in skincare and haircare products.

- Soaps and Detergents: Acts as a builder and water softener in cleaning products, enhancing their efficacy.

- Other Applications: Including metal cleaning, textile processing, and as a buffering agent in chemical processes. The increasing focus on eco-friendly cleaning solutions is a notable driver.

The dominance of the Food Grade segment is further solidified by its broad applicability and relatively lower price points compared to specialized pharmaceutical grades. Asia Pacific's large manufacturing base and consumption power make it the leading geographical market.

Sodium Citrate Market Product Developments

Product innovation in the sodium citrate market is increasingly focused on enhancing sustainability and purity. Companies are investing in advanced fermentation technologies to derive sodium citrate from renewable carbohydrate sources, such as corn, leading to more environmentally friendly production. These advancements aim to improve product yield, reduce energy consumption, and minimize waste. Furthermore, efforts are underway to develop higher-purity grades of sodium citrate for niche applications in advanced pharmaceutical formulations and specialized industrial processes, offering a competitive edge through superior quality and performance.

Challenges in the Sodium Citrate Market Market

Despite its robust growth, the sodium citrate market faces several challenges. Volatility in raw material prices, particularly for corn and other carbohydrate sources, can impact production costs and profit margins. Stringent regulatory requirements for food and pharmaceutical applications, encompassing quality control, purity standards, and labeling, necessitate significant investment in compliance. Furthermore, intense competition among existing players and the threat of substitute products with similar functionalities can put pressure on pricing. Supply chain disruptions, exacerbated by geopolitical events or natural disasters, can also impede market access and timely delivery.

Forces Driving Sodium Citrate Market Growth

The sodium citrate market is propelled by several key growth forces. The burgeoning global food and beverage industry, driven by population growth and changing consumer lifestyles, is a primary engine. The pharmaceutical sector's consistent demand for anticoagulants and excipients further solidifies its growth trajectory. Technological advancements in fermentation processes are improving production efficiency and sustainability, making sodium citrate a more attractive ingredient. Growing consumer awareness and preference for natural and clean-label ingredients also favor sodium citrate's market position.

Challenges in the Sodium Citrate Market Market

Long-term growth catalysts for the sodium citrate market include ongoing research and development into novel applications. Exploring its potential in new areas, such as biodegradable plastics or advanced material science, could unlock significant market expansion. Strategic partnerships and collaborations between ingredient manufacturers and end-product companies can foster innovation and tailor sodium citrate solutions to meet specific industry needs. Furthermore, continued investment in sustainable production methods will be crucial for long-term market viability and to meet increasing environmental regulations.

Emerging Opportunities in Sodium Citrate Market

Emerging opportunities in the sodium citrate market are diverse. The growing demand for plant-based and vegan food products presents a significant avenue, as sodium citrate plays a role in enhancing texture and stability in these formulations. The expansion of the global pharmaceutical industry, particularly in emerging economies, coupled with increased demand for blood products and specialized drug delivery systems, offers substantial growth potential. Advancements in biodegradable and eco-friendly cleaning solutions are also creating new opportunities for industrial-grade sodium citrate. The increasing consumer focus on health and wellness is driving demand for its use in functional foods and beverages.

Leading Players in the Sodium Citrate Market Sector

- ADM

- FBC Industries

- Cargill Incorporated

- natural biological group

- Lianyungang Mupro Food

- Jungbunzlauer Suisse AG

- HUNAN DONGTING CITRIC ACID CHEMICALS CO LTD

- HUANGSHI XINGHUA BIOCHEMICAL CO LTD

- Pan Chem Corporation

- FUSO CHEMICAL CO LTD

- Juxian Hongde Citric Acid Co Ltd

- COFCO

- Foodchem International Corporation

- ATPGroup

- S A Citrique Belge N V

- Gadot Biochemical Industries LTD

- Tate & Lyle

Key Milestones in Sodium Citrate Market Industry

- February 2023: Jungbunzlauer Suisse AG, driven by its vision "From nature to ingredients," focused on manufacturing safer and more sustainable products. The company initiated citric acid production through renewable raw materials fermentation, such as carbohydrates from corn, enabling effective rust removal while preserving base metal integrity.

- February 2022: ADM acquired Comhan, a leading South African flavor distributor. This acquisition significantly expanded ADM's presence in South Africa, strengthening its production and supply chains for innovative flavored products.

Strategic Outlook for Sodium Citrate Market Market

The strategic outlook for the sodium citrate market is highly positive, driven by continuous innovation and expanding applications. Growth accelerators include the increasing demand for natural and sustainable ingredients across food, pharmaceutical, and cosmetic industries. Strategic opportunities lie in further optimizing bio-based production methods to reduce costs and environmental impact, thereby catering to the growing consumer preference for eco-friendly products. Expansion into emerging markets, coupled with targeted product development for niche applications, will be crucial for sustained market leadership. Collaboration with end-users to develop customized solutions will also play a pivotal role in capturing market share and ensuring long-term profitability.

Sodium Citrate Market Segmentation

-

1. Grade

- 1.1. Food

- 1.2. Pharmaceutical

- 1.3. Industrial

-

2. Application

- 2.1. Food and Beverages

- 2.2. Pharmaceuticals

- 2.3. Cosmetics

- 2.4. Soaps and Detergents

- 2.5. Other Applications

Sodium Citrate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Sodium Citrate Market Regional Market Share

Geographic Coverage of Sodium Citrate Market

Sodium Citrate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Packed Food & Beverages; Increasing Demand from the Medical Industry

- 3.3. Market Restrains

- 3.3.1. Health Issues Associated with Long-term Usage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Food and Beverages Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Food

- 5.1.2. Pharmaceutical

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.2. Pharmaceuticals

- 5.2.3. Cosmetics

- 5.2.4. Soaps and Detergents

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Food

- 6.1.2. Pharmaceutical

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.2. Pharmaceuticals

- 6.2.3. Cosmetics

- 6.2.4. Soaps and Detergents

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Food

- 7.1.2. Pharmaceutical

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.2. Pharmaceuticals

- 7.2.3. Cosmetics

- 7.2.4. Soaps and Detergents

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Food

- 8.1.2. Pharmaceutical

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.2. Pharmaceuticals

- 8.2.3. Cosmetics

- 8.2.4. Soaps and Detergents

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Food

- 9.1.2. Pharmaceutical

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.2. Pharmaceuticals

- 9.2.3. Cosmetics

- 9.2.4. Soaps and Detergents

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Sodium Citrate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Food

- 10.1.2. Pharmaceutical

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.2. Pharmaceuticals

- 10.2.3. Cosmetics

- 10.2.4. Soaps and Detergents

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FBC Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cargill Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 natural biological group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lianyungang Mupro Food

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jungbunzlauer Suisse AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HUNAN DONGTING CITRIC ACID CHEMICALS CO LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HUANGSHI XINGHUA BIOCHEMICAL CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pan Chem Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FUSO CHEMICAL CO LTD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Juxian Hongde Citric Acid Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 COFCO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Foodchem International Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ATPGroup

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 S A Citrique Belge N V

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Gadot Biochemical Industries LTD

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tate & Lyle*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Sodium Citrate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Sodium Citrate Market Revenue (Million), by Grade 2025 & 2033

- Figure 3: Asia Pacific Sodium Citrate Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: Asia Pacific Sodium Citrate Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Sodium Citrate Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Sodium Citrate Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Sodium Citrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Sodium Citrate Market Revenue (Million), by Grade 2025 & 2033

- Figure 9: North America Sodium Citrate Market Revenue Share (%), by Grade 2025 & 2033

- Figure 10: North America Sodium Citrate Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Sodium Citrate Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Sodium Citrate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Sodium Citrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sodium Citrate Market Revenue (Million), by Grade 2025 & 2033

- Figure 15: Europe Sodium Citrate Market Revenue Share (%), by Grade 2025 & 2033

- Figure 16: Europe Sodium Citrate Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Sodium Citrate Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Sodium Citrate Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Sodium Citrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Sodium Citrate Market Revenue (Million), by Grade 2025 & 2033

- Figure 21: South America Sodium Citrate Market Revenue Share (%), by Grade 2025 & 2033

- Figure 22: South America Sodium Citrate Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Sodium Citrate Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Sodium Citrate Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Sodium Citrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sodium Citrate Market Revenue (Million), by Grade 2025 & 2033

- Figure 27: Middle East and Africa Sodium Citrate Market Revenue Share (%), by Grade 2025 & 2033

- Figure 28: Middle East and Africa Sodium Citrate Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Sodium Citrate Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Sodium Citrate Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sodium Citrate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Sodium Citrate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 5: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Sodium Citrate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 13: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Sodium Citrate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 19: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Sodium Citrate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 27: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Sodium Citrate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Sodium Citrate Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 33: Global Sodium Citrate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Sodium Citrate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Sodium Citrate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Citrate Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Sodium Citrate Market?

Key companies in the market include ADM, FBC Industries, Cargill Incorporated, natural biological group, Lianyungang Mupro Food, Jungbunzlauer Suisse AG, HUNAN DONGTING CITRIC ACID CHEMICALS CO LTD, HUANGSHI XINGHUA BIOCHEMICAL CO LTD, Pan Chem Corporation, FUSO CHEMICAL CO LTD, Juxian Hongde Citric Acid Co Ltd, COFCO, Foodchem International Corporation, ATPGroup, S A Citrique Belge N V, Gadot Biochemical Industries LTD, Tate & Lyle*List Not Exhaustive.

3. What are the main segments of the Sodium Citrate Market?

The market segments include Grade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Packed Food & Beverages; Increasing Demand from the Medical Industry.

6. What are the notable trends driving market growth?

Food and Beverages Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Issues Associated with Long-term Usage; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Jungbunzlauer Suisse AG, based on its vision "From nature to ingredients'', aimed to help its customers by manufacturing safer and more sustainable products. The company started citric acid production by renewable raw materials fermentation, such as carbohydrates from corn, to effectively remove rust while maintaining the base metal integrity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Citrate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Citrate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Citrate Market?

To stay informed about further developments, trends, and reports in the Sodium Citrate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence