Key Insights

The South American compound feed market, currently valued at approximately $XX million (estimated based on provided CAGR and market size data), is projected to experience robust growth, driven by a rising demand for animal protein in a region with a burgeoning population and expanding middle class. Key drivers include increasing poultry and swine farming activities, particularly in Brazil and Argentina, along with government initiatives promoting sustainable and efficient livestock production. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, others) and ingredient type (cereals, cakes & meals, by-products, supplements). Poultry and swine feed are expected to dominate the market due to the high consumption of poultry and pork in the region. The increasing adoption of technologically advanced feed formulations focusing on improved animal health and productivity further fuels market expansion. However, challenges like fluctuating raw material prices, feed safety regulations, and environmental concerns related to livestock production act as potential restraints on growth.

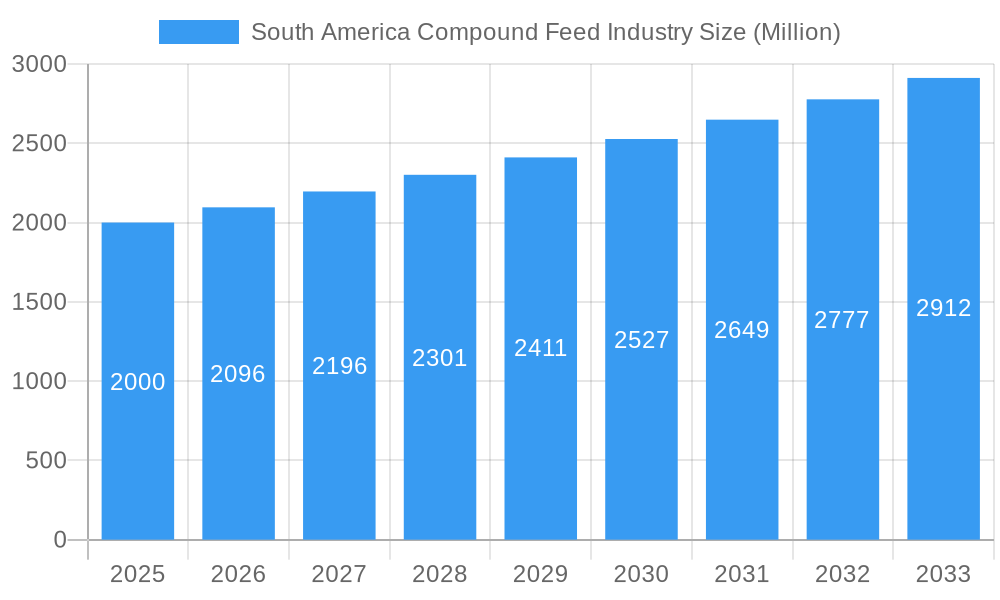

South America Compound Feed Industry Market Size (In Billion)

Competition in the South American compound feed market is fierce, with both international and regional players vying for market share. Major companies like Cargill, Nutreco, Alltech, and others are leveraging their extensive distribution networks and technological expertise to capture a larger share of the growing market. The forecast period (2025-2033) is expected to witness a sustained CAGR of 4.80%, potentially resulting in a market value exceeding $YY million by 2033 (estimated based on the CAGR and 2025 market size). Strategic partnerships, mergers, and acquisitions, along with the development of innovative feed solutions tailored to specific animal needs, are key strategies for success in this competitive and dynamic market. The continued growth of the aquaculture segment also presents significant opportunities for players in the coming years.

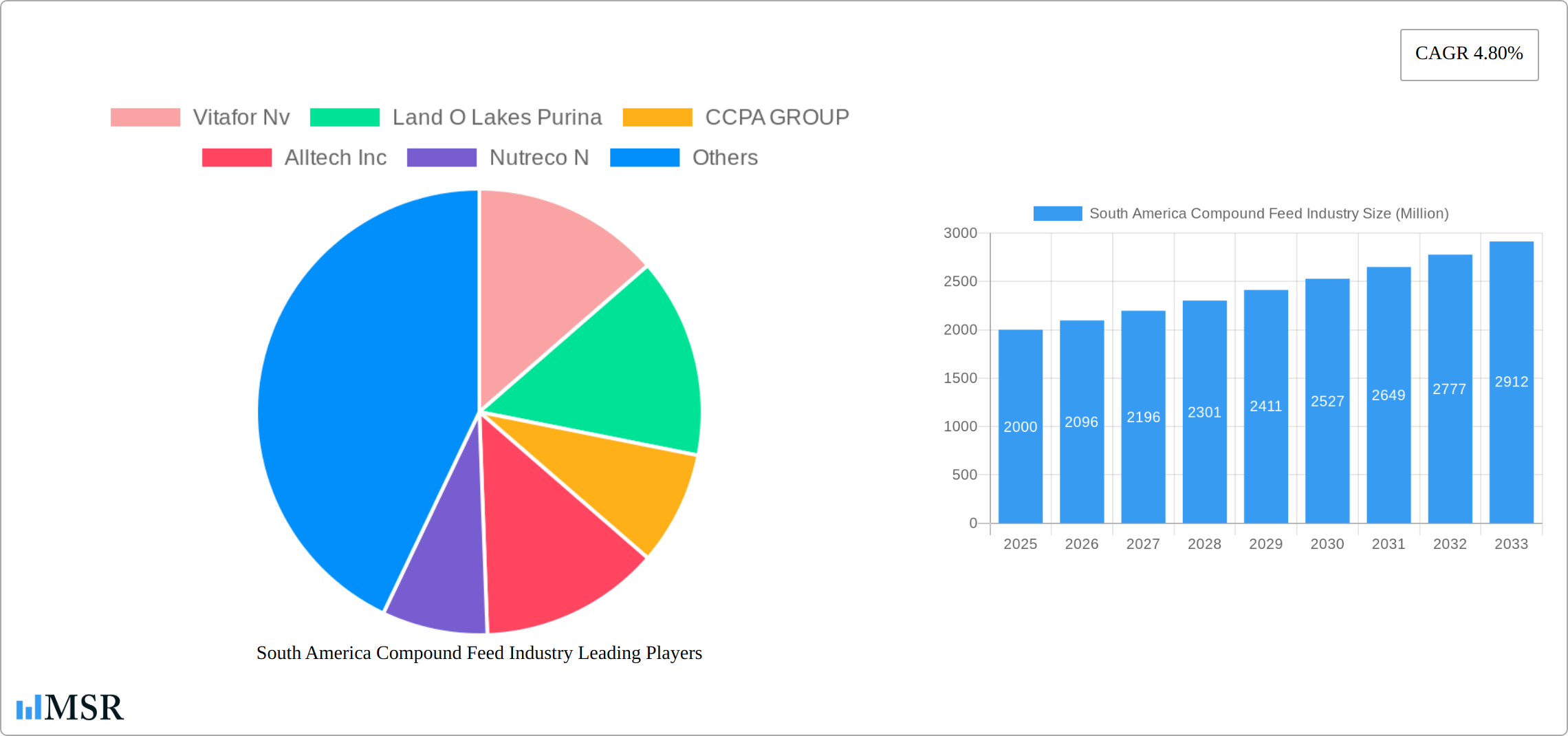

South America Compound Feed Industry Company Market Share

South America Compound Feed Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the South America compound feed industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Key segments analyzed include animal types (ruminants, poultry, swine, aquaculture, and other animal types) and ingredients (cereals, cakes & meals, by-products, and supplements). Leading players such as Vitafor Nv, Land O Lakes Purina, CCPA GROUP, Alltech Inc, Nutreco N.V., ICC, Cargill Inc, and Kemin Industries Inc. are profiled, providing crucial competitive intelligence. This report is essential for strategic decision-making, investment planning, and understanding the future trajectory of the South American compound feed market.

South America Compound Feed Industry Market Concentration & Dynamics

The South American compound feed market is characterized by a moderately concentrated landscape, where a few dominant global players, alongside significant regional and local enterprises, shape the industry's trajectory. Companies like Cargill Inc. and Nutreco N.V., leveraging their extensive global networks and established regional operations, are projected to hold a substantial combined market share in 2025, potentially reaching around XX%. Beyond these giants, a vibrant ecosystem of smaller, agile regional players and independent feed mills plays a crucial role in fulfilling diverse market demands and contributing significantly to the overall volume. Innovation remains a key differentiator, with a pronounced focus on enhancing feed conversion ratios, the strategic integration of novel ingredients to bolster animal health and optimize productivity, and the development of environmentally sustainable feed solutions. The regulatory framework across South American nations presents a patchwork of varying requirements concerning feed composition, additive approvals, and product labeling, necessitating careful navigation by market participants. While locally sourced ingredients may offer a competitive price advantage, they often fall short in providing the consistent nutritional value and specialized formulations that compound feeds deliver. End-user preferences are increasingly shifting towards premium, high-quality feed products, particularly within the burgeoning poultry and swine sectors, thereby fueling the demand for advanced and precisely formulated feed solutions. The historical period from 2019 to 2024 witnessed approximately XX mergers and acquisitions (M&A) deals, signaling ongoing consolidation and strategic expansion. Projections for the forecast period of 2025-2033 anticipate a further increase in M&A activity, driven by strategic consolidation efforts, the pursuit of economies of scale, and aggressive expansion strategies into new markets and product segments.

- Market Concentration: Moderately concentrated, with a blend of major global players and strong regional contenders vying for market dominance.

- Innovation Drivers: Continued emphasis on enhancing feed efficiency, the incorporation of cutting-edge ingredients for improved animal welfare and performance, and the development of sustainable and eco-friendly feed alternatives.

- Regulatory Environment: A complex and diverse regulatory landscape across South American countries, requiring strategic adaptation to varying standards for feed formulation, additive usage, and transparent labeling.

- Competitive Landscape: While local ingredients present a cost-effective alternative, the demand for specialized compound feeds with guaranteed nutritional consistency and efficacy remains high.

- End-User Demand: A discernible upward trend in the demand for premium and specialized feed products, especially within the rapidly expanding poultry and swine industries.

- M&A Activity: Approximately XX M&A deals occurred between 2019-2024, with an estimated XX deals anticipated in the 2025-2033 forecast period, reflecting ongoing industry consolidation and strategic growth initiatives.

South America Compound Feed Industry Industry Insights & Trends

The South American compound feed industry is experiencing robust growth, driven by factors like increasing livestock production, rising consumer demand for animal protein, and favorable government policies in certain countries promoting agricultural development. The market size reached approximately $XX Billion in 2025 and is projected to reach $XX Billion by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements, particularly in precision feeding and automated feed production, are improving efficiency and reducing costs. Changing consumer preferences toward healthier and more sustainably produced animal products are influencing feed formulation trends, with a growing emphasis on natural ingredients and reduced reliance on antibiotics and growth promoters. The industry is actively adopting digital technologies for improved supply chain management, inventory control, and data-driven decision-making. Furthermore, investment in research and development is creating innovative feed solutions tailored to specific animal needs and environmental conditions.

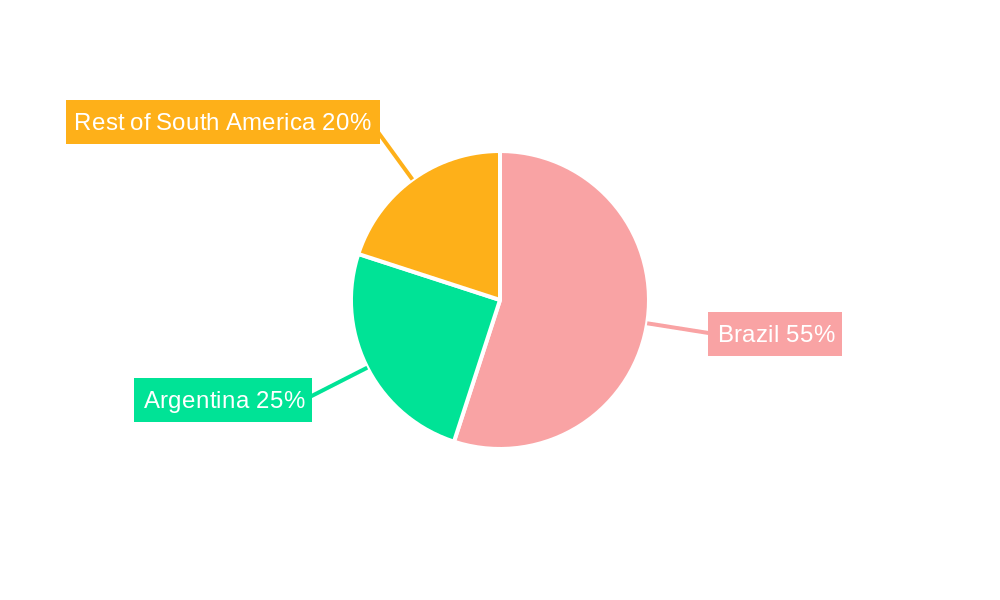

Key Markets & Segments Leading South America Compound Feed Industry

Poultry feed dominates the South American compound feed market, accounting for the largest share due to the high demand for poultry products across the region. Brazil is the leading national market, driven by its significant poultry production and well-established feed industry.

Key Drivers:

- Poultry: High consumer demand for poultry meat and eggs.

- Brazil: Largest national market due to high poultry production and advanced feed industry infrastructure.

- Economic Growth: Growing disposable incomes fueling demand for animal products.

- Infrastructure: Improvements in logistics and transportation supporting feed distribution.

Dominance Analysis:

The poultry segment enjoys robust growth primarily because of the increasing population and rising per capita income. This has increased the demand for affordable protein sources, making poultry a popular choice. Furthermore, improvements in poultry farming techniques and advancements in feed formulations have enhanced the productivity and profitability of poultry farming, further stimulating the demand for poultry feed. Brazil’s dominance reflects its large-scale poultry production, robust infrastructure for feed manufacturing and distribution, and supportive government policies.

Swine: This segment shows significant potential for growth, driven by expanding pork consumption and improvements in swine farming practices.

Ruminants: This segment is experiencing steady growth, although at a slower pace than poultry and swine, due to factors such as market demands and fluctuations in the cattle industry.

Aquaculture: While smaller than the terrestrial animal feed segments, aquaculture shows considerable growth potential with increased investments in aquaculture farms and technological advancements in sustainable aquaculture practices.

Other Animal Types: This category includes various smaller animal feed markets, which contribute to the overall market size.

Ingredient Dominance: Cereals are the predominant ingredient in compound feeds due to their availability and cost-effectiveness. However, the use of by-products and supplements is increasing to enhance nutritional value and promote animal health.

South America Compound Feed Industry Product Developments

The South America compound feed industry is witnessing significant product innovation, focusing on tailored feed formulations to optimize animal health, performance, and sustainability. Advancements in precision feeding technologies enable precise nutrient delivery based on animal needs, leading to improved feed efficiency and reduced environmental impact. The development of novel functional feed additives, such as probiotics and prebiotics, contributes to enhanced gut health and disease resistance, minimizing antibiotic usage. The incorporation of sustainable and locally sourced ingredients reduces environmental impact and improves supply chain resilience. Competition is intense, leading companies to focus on specialized feed products, unique ingredient blends, and improved technical support for customers.

Challenges in the South America Compound Feed Industry Market

The South American compound feed industry faces various challenges, including fluctuations in raw material prices, particularly grains and soy, impacting feed costs and profitability. Supply chain disruptions, logistical bottlenecks, and infrastructure limitations, especially in remote areas, can hinder efficient feed distribution. Furthermore, regulatory hurdles regarding feed composition, labeling, and environmental regulations may differ across countries, increasing compliance costs and complexities for companies operating across the region. Intense competition from both large multinational companies and smaller local players adds pressure on margins. These challenges collectively impact overall industry profitability and growth trajectories.

Forces Driving South America Compound Feed Industry Growth

Several factors contribute to the positive outlook of the South America compound feed industry. Growing populations and rising per capita incomes are increasing the demand for animal protein, driving higher consumption of poultry, pork, and other livestock products. Government initiatives supporting agricultural development and livestock production provide a conducive environment for industry expansion. Technological advancements in feed production, formulation, and precision feeding enhance efficiency and reduce costs, improving competitiveness. The increasing adoption of sustainable farming practices and the development of environmentally friendly feed solutions further drive market growth and attract environmentally conscious consumers.

Challenges in the South America Compound Feed Industry Market

Long-term growth hinges on addressing several challenges. Sustained investment in research and development is needed to develop novel feed formulations that enhance animal health, productivity, and sustainability. Strengthening partnerships between feed manufacturers, farmers, and researchers is crucial to disseminate information and ensure best practices are adopted. Strategic expansions into new markets, targeting niche segments, and developing diversified product portfolios will mitigate risk and ensure long-term growth resilience.

Emerging Opportunities in South America Compound Feed Industry

The South American compound feed industry is ripe with significant growth opportunities. Expanding into high-potential segments such as aquaculture, which is experiencing robust expansion across the continent, and specialized animal feed niches catering to specific health or production requirements, presents a clear avenue for broadening market reach and accessing new, lucrative revenue streams. The adoption of advanced technologies is poised to revolutionize the industry; embracing precision feeding systems, implementing sophisticated digital platforms for streamlined supply chain management, and leveraging predictive analytics for enhanced operational decision-making can dramatically boost efficiency, reduce waste, and improve overall profitability. Furthermore, the development of value-added services, beyond basic feed provision, and a strong commitment to customer-centric solutions will foster deeper customer relationships and cultivate robust brand loyalty. Crucially, proactively responding to the escalating global and regional demand for sustainable and environmentally responsible feed solutions will not only attract environmentally conscious consumers and business partners but also strategically position companies at the vanguard of industry evolution and future-proofing their operations.

Leading Players in the South America Compound Feed Industry Sector

Key Milestones in South America Compound Feed Industry Industry

- 2020: Cargill Inc. launched an innovative sustainable feed line, significantly advancing efforts to reduce the environmental footprint of animal agriculture.

- 2022: Nutreco N.V. successfully acquired a key regional feed mill, strategically bolstering its market presence and operational capacity within southern Brazil.

- 2023: Alltech Inc. introduced a groundbreaking precision feeding system, heralding a new era in optimizing feed efficiency and animal productivity through data-driven insights.

- 2024: CCPA Group implemented a comprehensive new traceability system, dramatically enhancing supply chain transparency and reinforcing commitment to food safety standards across its operations.

Strategic Outlook for South America Compound Feed Industry Market

The South American compound feed industry is poised for a period of substantial and dynamic growth in the foreseeable future. Continued, strategic investments in cutting-edge research and development, coupled with the proactive adoption of advanced technologies, will serve as critical catalysts for driving operational efficiency, fostering groundbreaking innovation, and maintaining a competitive edge. A concentrated focus on sustainability, the implementation of precision feeding methodologies, and the development of highly tailored feed formulations will be paramount in attracting a discerning customer base and fortifying the industry's resilience against market fluctuations and environmental challenges. The landscape is expected to witness increased strategic partnerships and further consolidation through mergers and acquisitions, facilitating market expansion into untapped regions and enhancing economies of scale. Overall, the industry is on track for a trajectory of robust expansion, presenting considerable opportunities for forward-thinking companies that are agile, innovative, and committed to adapting to evolving market demands and technological advancements.

South America Compound Feed Industry Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

-

2.4. Supplements

- 2.4.1. Vitamins

- 2.4.2. Amino Acid

- 2.4.3. Enzymes

- 2.4.4. Prebiotics and Probiotics

- 2.4.5. Acidifiers

- 2.4.6. Other Supplements

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Compound Feed Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Compound Feed Industry Regional Market Share

Geographic Coverage of South America Compound Feed Industry

South America Compound Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Shift in Consumer Preference Towards Animal Sourced Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Compound Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.2.4.1. Vitamins

- 5.2.4.2. Amino Acid

- 5.2.4.3. Enzymes

- 5.2.4.4. Prebiotics and Probiotics

- 5.2.4.5. Acidifiers

- 5.2.4.6. Other Supplements

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Brazil South America Compound Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.2.4.1. Vitamins

- 6.2.4.2. Amino Acid

- 6.2.4.3. Enzymes

- 6.2.4.4. Prebiotics and Probiotics

- 6.2.4.5. Acidifiers

- 6.2.4.6. Other Supplements

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Argentina South America Compound Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.2.4.1. Vitamins

- 7.2.4.2. Amino Acid

- 7.2.4.3. Enzymes

- 7.2.4.4. Prebiotics and Probiotics

- 7.2.4.5. Acidifiers

- 7.2.4.6. Other Supplements

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Rest of South America South America Compound Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.2.4.1. Vitamins

- 8.2.4.2. Amino Acid

- 8.2.4.3. Enzymes

- 8.2.4.4. Prebiotics and Probiotics

- 8.2.4.5. Acidifiers

- 8.2.4.6. Other Supplements

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Vitafor Nv

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Land O Lakes Purina

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CCPA GROUP

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Alltech Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nutreco N

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 ICC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cargill Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemin Industries Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Vitafor Nv

List of Figures

- Figure 1: South America Compound Feed Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Compound Feed Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Compound Feed Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: South America Compound Feed Industry Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 3: South America Compound Feed Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Compound Feed Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Compound Feed Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: South America Compound Feed Industry Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 7: South America Compound Feed Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Compound Feed Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Compound Feed Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 10: South America Compound Feed Industry Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 11: South America Compound Feed Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Compound Feed Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Compound Feed Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 14: South America Compound Feed Industry Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 15: South America Compound Feed Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Compound Feed Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Compound Feed Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the South America Compound Feed Industry?

Key companies in the market include Vitafor Nv, Land O Lakes Purina, CCPA GROUP, Alltech Inc, Nutreco N, ICC, Cargill Inc, Kemin Industries Inc.

3. What are the main segments of the South America Compound Feed Industry?

The market segments include Animal Type, Ingredient, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Shift in Consumer Preference Towards Animal Sourced Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Compound Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Compound Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Compound Feed Industry?

To stay informed about further developments, trends, and reports in the South America Compound Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence