Key Insights

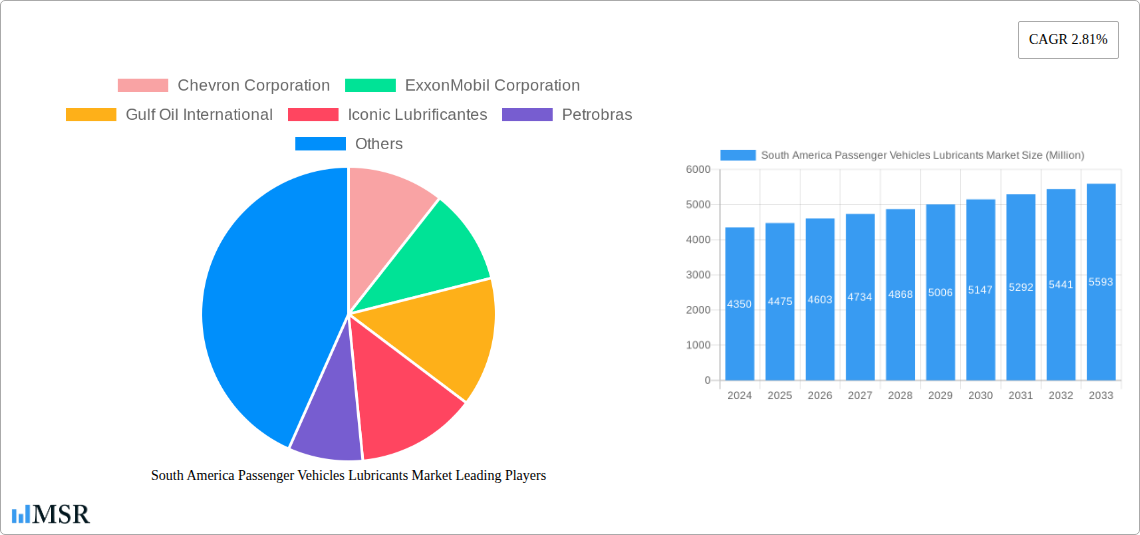

The South America Passenger Vehicles Lubricants Market is poised for robust growth, projected to reach a market size of $2.81 billion by 2025. The Compound Annual Growth Rate (CAGR) is estimated at 2.46% through 2033. This expansion is fueled by an increasing automotive parc in key nations like Brazil and Argentina, driven by a growing middle class and a demand for personal mobility. Technological advancements in fuel-efficient and durable lubricants, alongside a trend towards premium vehicles, further contribute to market expansion. Evolving vehicle designs, including engine downsizing and turbocharging, necessitate specialized lubricants, creating innovation opportunities.

South America Passenger Vehicles Lubricants Market Market Size (In Billion)

Challenges include economic volatility and currency fluctuations impacting consumer spending. The long-term rise of electric vehicles (EVs) presents a shift, though the existing internal combustion engine fleet will continue to drive demand for traditional lubricants. Key product segments include Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, with Engine Oils dominating. Major players like Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell Plc, and Petrobras are actively competing through innovation and strategic expansion.

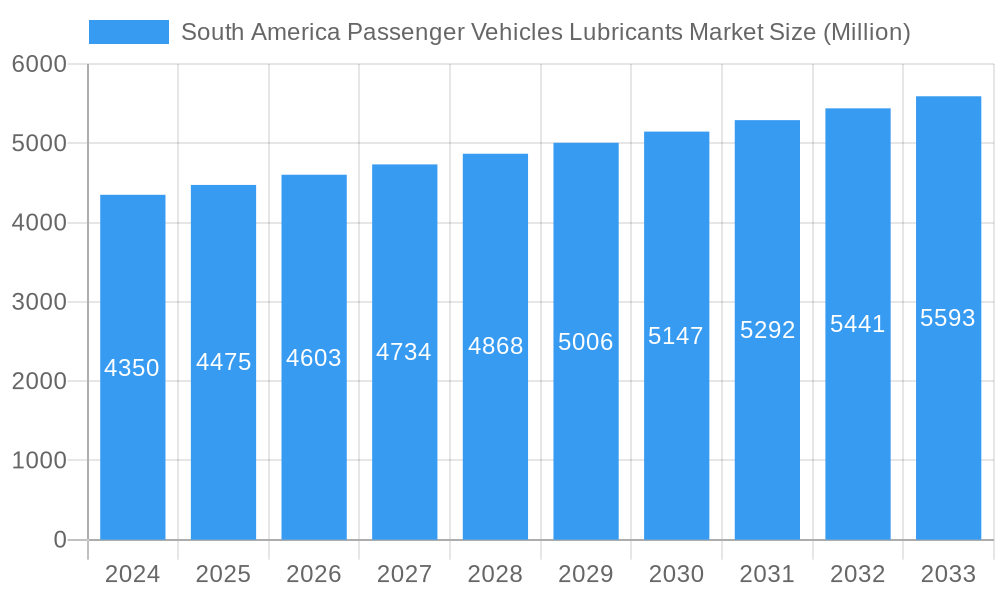

South America Passenger Vehicles Lubricants Market Company Market Share

South America Passenger Vehicles Lubricants Market: Strategic Insights & Future Outlook (2019-2033)

Access critical intelligence on the South America Passenger Vehicles Lubricants Market. This report, covering 2019–2033 with a 2025 base year, offers deep analysis, strategic recommendations, and forecasts for industry stakeholders. Discover market drivers, competitive landscapes, product advancements, and growth prospects across South America.

South America Passenger Vehicles Lubricants Market Market Concentration & Dynamics

The South America passenger vehicles lubricants market exhibits moderate concentration, with a few dominant players vying for market share. Innovation ecosystems are steadily evolving, driven by the pursuit of enhanced fuel efficiency, extended drain intervals, and superior engine protection. Regulatory frameworks are becoming more stringent, particularly concerning environmental standards and product safety, influencing formulation development and market entry. Substitute products, such as advanced coatings and alternative lubrication technologies, are on the horizon but currently hold a minor market presence. End-user trends indicate a growing preference for premium, high-performance lubricants that cater to sophisticated automotive technologies and demanding driving conditions. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market presence, acquiring technological capabilities, or expanding distribution networks. The M&A deal count is expected to see a steady rise as companies seek to strengthen their competitive positions. Key players are focusing on strategic alliances and partnerships to enhance their reach and product offerings across the vast South American landscape.

South America Passenger Vehicles Lubricants Market Industry Insights & Trends

The South America Passenger Vehicles Lubricants Market is poised for substantial growth, fueled by a burgeoning automotive sector and increasing vehicle parc across the region. The market size is projected to reach $X Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X% from 2025 to 2033. This expansion is primarily driven by rising disposable incomes, urbanization, and the subsequent increase in demand for personal mobility. Technological disruptions are playing a pivotal role, with a significant shift towards synthetic and semi-synthetic lubricants that offer superior performance, extended drain intervals, and enhanced engine protection. These advanced formulations are crucial for meeting the demands of modern passenger vehicles equipped with sophisticated emission control systems and advanced engine technologies. Evolving consumer behaviors are also shaping market trends, with a growing awareness among vehicle owners about the importance of using high-quality lubricants for optimal engine health and fuel efficiency. This consciousness translates into a greater willingness to invest in premium products, even at a higher price point. Furthermore, the aftermarket segment is experiencing robust growth, as consumers seek reliable and trusted brands for their vehicle maintenance needs. The increasing adoption of fuel-efficient vehicles and the ongoing development of electric and hybrid vehicle technologies, while presenting long-term considerations, are also driving innovation in lubricant formulations designed to address the unique requirements of these evolving powertrains. The market is witnessing a sustained demand for engine oils, which remain the largest segment, followed by transmission & gear oils, greases, and hydraulic fluids. The economic development of key South American nations, coupled with favorable government policies promoting automotive manufacturing and sales, will continue to be significant growth catalysts.

Key Markets & Segments Leading South America Passenger Vehicles Lubricants Market

The South America Passenger Vehicles Lubricants Market is characterized by distinct regional and product segment leadership. Brazil and Argentina currently stand out as dominant markets, driven by their substantial vehicle parc, robust automotive manufacturing base, and a growing middle class with increasing disposable income. Economic growth in these nations directly correlates with higher passenger vehicle sales and, consequently, a greater demand for lubricants.

- Drivers for Dominant Markets:

- Economic Growth & Rising Disposable Incomes: Directly translates to increased purchasing power for new vehicles and a greater willingness to invest in quality maintenance.

- Large Vehicle Parc: A higher number of passenger vehicles on the road naturally fuels consistent demand for lubricants.

- Automotive Manufacturing Hubs: Presence of major automotive manufacturers leads to OEM approvals and strong brand presence for lubricants.

- Infrastructure Development: Improved road networks encourage more vehicle usage and mileage, increasing lubricant consumption.

Within the product segments, Engine Oils undeniably lead the South America Passenger Vehicles Lubricants Market. This dominance stems from the fundamental requirement of every internal combustion engine to have engine oil for lubrication, cooling, cleaning, and sealing. The sheer volume of passenger vehicles, coupled with regular oil change intervals, makes engine oils the largest revenue generator.

- Engine Oils: This segment benefits from continuous innovation in viscosity grades and additive technologies to meet the evolving demands of modern engines, including those with turbochargers and direct injection. The increasing adoption of fuel-efficient vehicles also necessitates advanced engine oil formulations.

Following engine oils, Transmission & Gear Oils constitute a significant segment. The complexity of modern transmission systems, including automatic, semi-automatic, and continuously variable transmissions (CVTs), requires specialized fluids that ensure smooth gear changes, optimal performance, and longevity of these critical components.

- Transmission & Gear Oils: The trend towards more sophisticated transmission technologies, including those in electric vehicles (though the focus here is passenger vehicles with ICE), drives the demand for specialized and high-performance transmission and gear oils.

Greases also hold a notable position, essential for lubricating various moving parts and bearings within a passenger vehicle, such as chassis components, wheel bearings, and CV joints. Their long-lasting lubrication properties make them a vital, albeit lower-volume, lubricant.

- Greases: Demand for greases is consistent with vehicle production and the aftermarket segment, focusing on products that offer excellent wear protection and resistance to water washout.

Hydraulic Fluids, while typically associated with heavier machinery, find application in specific passenger vehicle systems like power steering and convertible tops. Their demand is more niche but consistent with the overall vehicle parc.

- Hydraulic Fluids: The reliability and performance of power steering systems, particularly in a region where vehicle maneuverability is key, ensure a steady demand for hydraulic fluids.

The interplay of these segments, driven by economic factors and technological advancements in the automotive industry, defines the leading edge of the South America Passenger Vehicles Lubricants Market.

South America Passenger Vehicles Lubricants Market Product Developments

Product development in the South America passenger vehicles lubricants market is characterized by a strong emphasis on enhancing performance, extending durability, and improving environmental sustainability. Manufacturers are increasingly focusing on advanced synthetic and semi-synthetic formulations that offer superior protection against wear, deposit formation, and oxidation, even under extreme operating conditions. Innovations are geared towards achieving higher fuel efficiency and lower emissions, aligning with global environmental regulations and consumer demand for greener solutions. The development of lubricants with extended drain intervals is also a key focus, catering to the convenience needs of vehicle owners and reducing overall maintenance costs. Furthermore, specific product lines are being tailored to meet the unique demands of different engine types, including turbocharged, direct-injection, and hybrid powertrains, ensuring optimal performance and longevity.

Challenges in the South America Passenger Vehicles Lubricants Market Market

The South America Passenger Vehicles Lubricants Market faces several significant challenges that can impede growth and impact market dynamics.

- Economic Volatility: Fluctuations in regional economies, currency depreciation, and inflation can impact consumer spending power on vehicle maintenance and new vehicle purchases, directly affecting lubricant demand.

- Regulatory Stringency & Compliance Costs: Evolving environmental regulations, such as those concerning emissions and biodegradability, require significant investment in R&D and reformulation, increasing compliance costs for manufacturers.

- Supply Chain Disruptions: Geopolitical instability, logistical complexities across vast territories, and potential disruptions in raw material availability can lead to price volatility and affect product availability.

- Counterfeit Products: The prevalence of counterfeit lubricants poses a threat to brand reputation and consumer safety, leading to market fragmentation and reduced trust in legitimate products.

- Price Sensitivity: Despite a growing awareness of quality, a significant portion of the market remains price-sensitive, creating a barrier for premium product adoption.

Forces Driving South America Passenger Vehicles Lubricants Market Growth

Several powerful forces are propelling the growth of the South America Passenger Vehicles Lubricants Market. The expanding middle class across key South American nations is leading to increased vehicle ownership and a higher demand for personal transportation, consequently driving lubricant consumption. Furthermore, a growing awareness among consumers regarding the importance of regular vehicle maintenance and the benefits of using high-quality lubricants for engine longevity and fuel efficiency is a significant catalyst. Technological advancements in the automotive industry, particularly the increasing sophistication of engine designs that necessitate advanced lubricant formulations for optimal performance and protection, are also a major driver. Government initiatives promoting automotive manufacturing and supporting economic development contribute to a more favorable market environment.

Challenges in the South America Passenger Vehicles Lubricants Market Market

Long-term growth in the South America Passenger Vehicles Lubricants Market will be significantly influenced by strategic adaptations to evolving automotive technology and consumer preferences. The increasing adoption of electric vehicles (EVs) presents a long-term challenge as ICE passenger vehicles, the primary consumers of traditional lubricants, will gradually decline. Therefore, companies that can effectively transition their product portfolios to cater to the specialized lubrication needs of EVs, such as those for transmissions, gearboxes, and battery cooling systems, will be well-positioned for future success. Partnerships and collaborations with EV manufacturers for the development and supply of these specialized fluids will be crucial. Furthermore, a continued focus on sustainability and the development of bio-based or more environmentally friendly lubricant alternatives will be essential to meet evolving regulatory demands and consumer expectations. Investing in robust R&D to stay ahead of these technological shifts and proactively addressing market changes will be key to sustained growth.

Emerging Opportunities in South America Passenger Vehicles Lubricants Market

The South America Passenger Vehicles Lubricants Market presents several compelling emerging opportunities for astute industry players. The rapid growth of the ride-sharing economy and the increasing demand for commercial passenger transport services in urban centers are creating a steady demand for high-mileage lubricants and specialized maintenance solutions. Furthermore, the untapped potential in less developed regions within South America, where vehicle ownership is still growing, represents a significant market expansion opportunity. The increasing consumer awareness about the benefits of advanced synthetic and semi-synthetic lubricants, driven by educational campaigns and positive word-of-mouth, is creating a growing segment willing to pay a premium for superior performance and extended drain intervals. Developing and marketing sustainable lubricant options, including those with reduced environmental impact, will also tap into a growing consumer preference.

Leading Players in the South America Passenger Vehicles Lubricants Market Sector

- Chevron Corporation

- ExxonMobil Corporation

- Gulf Oil International

- Iconic Lubrificantes

- Petrobras

- PETRONAS Lubricants International

- Royal Dutch Shell Plc

- Terpel

- TotalEnergies

- YPF

Key Milestones in South America Passenger Vehicles Lubricants Market Industry

- October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network. This expansion significantly broadened the reach of Texaco lubricants in a key South American market.

- July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers. This milestone indicates a growing distribution network and increasing market penetration for Gulf Oil in Argentina.

- June 2021: YPF partnered with the GM company to supply YPF INFINIA fuels and ACDELCO lubricants for the Chevrolet brand in Argentina. This strategic partnership solidifies YPF's position in the automotive aftermarket and strengthens its relationship with a major vehicle manufacturer.

Strategic Outlook for South America Passenger Vehicles Lubricants Market Market

The strategic outlook for the South America Passenger Vehicles Lubricants Market is one of cautious optimism, with significant opportunities for growth and market leadership. Key growth accelerators include continued investment in advanced synthetic lubricant technologies that offer superior engine protection and fuel efficiency, catering to the evolving demands of modern passenger vehicles. Expanding distribution networks, particularly into emerging markets within South America, and forging strategic partnerships with automotive OEMs and large service providers will be crucial for market penetration. Furthermore, focusing on sustainable product development and marketing initiatives that highlight environmental benefits will resonate with increasingly conscious consumers. Proactive engagement with regulatory bodies to ensure compliance and influence future standards will also be vital. The market is ripe for companies that can offer a combination of high-performance products, competitive pricing, and a strong commitment to customer service and technical support.

South America Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

South America Passenger Vehicles Lubricants Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of South America Passenger Vehicles Lubricants Market

South America Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Oil International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iconic Lubrificantes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PETRONAS Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Terpel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: South America Passenger Vehicles Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: South America Passenger Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Passenger Vehicles Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: South America Passenger Vehicles Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: South America Passenger Vehicles Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Brazil South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Argentina South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Chile South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Colombia South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Peru South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Venezuela South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ecuador South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Bolivia South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Paraguay South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Uruguay South America Passenger Vehicles Lubricants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 2.46%.

2. Which companies are prominent players in the South America Passenger Vehicles Lubricants Market?

Key companies in the market include Chevron Corporation, ExxonMobil Corporation, Gulf Oil International, Iconic Lubrificantes, Petrobras, PETRONAS Lubricants International, Royal Dutch Shell Plc, Terpel, TotalEnergies, YP.

3. What are the main segments of the South America Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network.July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers.June 2021: YPF partnered with the GM company to supply YPF INFINIA fuels and ACDELCO lubricants for the Chevrolet brand in Argentina.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the South America Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence