Key Insights

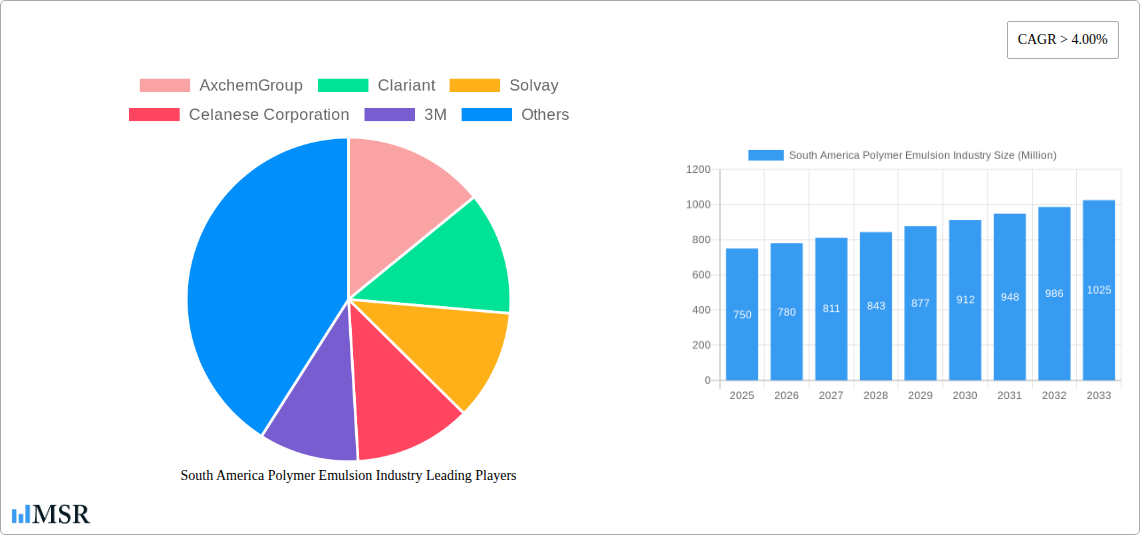

The South America Polymer Emulsion Industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.00%. This expansion is driven by increasing demand across key application sectors, most notably in adhesives & carpet backing, paper & paperboard coatings, and paints & coatings. The rising construction activities and infrastructure development across the region are significant catalysts for the paints & coatings segment, while the growing packaging industry fuels demand for paper and paperboard coatings. Furthermore, the expanding textile and flooring sectors contribute substantially to the adhesives & carpet backing market. Acrylics are anticipated to dominate the product type segment due to their versatility and cost-effectiveness, alongside a growing adoption of Polyurethane (PU) dispersions for their superior performance characteristics. The overall market valuation is estimated to be in the hundreds of millions, with projections indicating a steady upward trajectory throughout the forecast period of 2025-2033.

South America Polymer Emulsion Industry Market Size (In Million)

The market's growth trajectory is further supported by emerging trends such as the increasing preference for sustainable and eco-friendly polymer emulsions, driven by regulatory pressures and consumer awareness. Innovations in product formulations leading to enhanced performance, such as improved durability, water resistance, and adhesion, are also playing a crucial role. Key players like BASF SE, Dow, and Arkema Group are actively investing in research and development to capitalize on these trends and expand their regional footprint. However, challenges such as fluctuating raw material prices and intense competition within the fragmented market structure could pose moderate restraints. Nevertheless, the expanding industrial base and growing middle-class population in countries like Brazil, Argentina, and Colombia are expected to provide significant opportunities, ensuring a dynamic and expanding market landscape for polymer emulsions in South America.

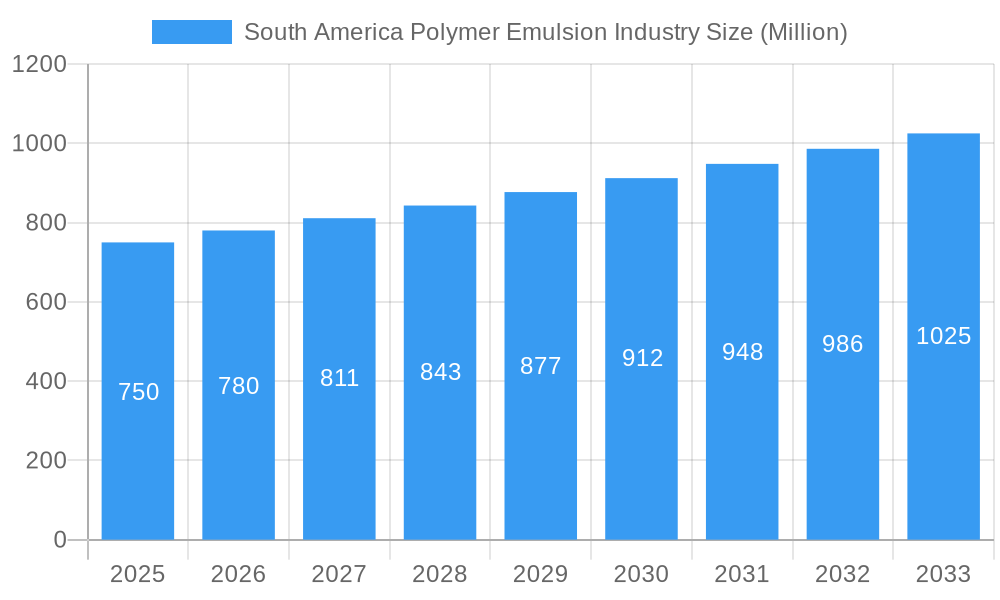

South America Polymer Emulsion Industry Company Market Share

This in-depth report provides a granular analysis of the South America Polymer Emulsion Industry, offering critical insights into market dynamics, growth drivers, competitive landscape, and future trends. Covering the study period of 2019–2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to capitalize on opportunities within this rapidly evolving sector.

South America Polymer Emulsion Industry Market Concentration & Dynamics

The South America Polymer Emulsion Industry exhibits a moderate to high market concentration, driven by the significant presence of global chemical giants and a growing number of regional players. Innovation ecosystems are flourishing, with increasing investments in R&D for sustainable and high-performance polymer emulsions. Regulatory frameworks are evolving, with a greater emphasis on environmental compliance and safety standards influencing product development and manufacturing processes. Substitute products, such as solvent-based alternatives, are facing increased competition from the superior performance and environmental benefits of polymer emulsions. End-user trends are leaning towards eco-friendly formulations and applications in construction, textiles, and packaging. Mergers and acquisitions (M&A) activities are anticipated to rise as companies seek to expand their market reach, diversify their product portfolios, and achieve economies of scale. For instance, the market share of leading players is estimated to be upwards of xx%, with a projected M&A deal count of xx to xx over the forecast period.

- Innovation Ecosystems: Focus on water-based, low-VOC, and bio-based polymer emulsions.

- Regulatory Landscape: Stringent environmental regulations driving adoption of sustainable solutions.

- Substitute Products: Competition from solvent-based systems, but polymer emulsions offering advantages.

- End-User Trends: Growing demand from construction, paper, paints, and adhesives sectors.

- M&A Activities: Strategic consolidations to enhance market position and product offerings.

South America Polymer Emulsion Industry Industry Insights & Trends

The South America Polymer Emulsion Industry is poised for substantial growth, projected to reach a market size of US$X,XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of X.X% from 2025 to 2033. This growth is primarily fueled by the escalating demand from the construction sector, driven by significant infrastructure development projects and urbanization across key economies like Brazil and Colombia. The increasing adoption of polymer emulsions in paints and coatings, owing to their superior performance characteristics such as durability, adhesion, and low volatile organic compound (VOC) content, is another significant growth catalyst. The paper and paperboard coatings segment is also witnessing steady expansion, driven by the demand for enhanced printability and barrier properties in packaging applications. Furthermore, the adhesives and carpet backing sectors are benefiting from increased industrial activity and consumer spending on home improvement.

Technological disruptions are playing a crucial role, with ongoing advancements in emulsion polymerization techniques leading to the development of novel polymer systems with tailored properties. This includes the innovation of specialized acrylics for weather-resistant coatings, advanced polyurethane (PU) dispersions for flexible and durable applications, and styrene-butadiene (SB) latex for improved paper strength and carpet performance. The evolving consumer behaviors, with a growing preference for sustainable and environmentally friendly products, are pushing manufacturers to develop and promote water-based polymer emulsions, reducing reliance on solvent-based alternatives. This shift is not only driven by consumer awareness but also by stricter environmental regulations across the region. The historical period of 2019-2024 witnessed a steady growth trajectory, laying a strong foundation for the projected expansion in the coming years. The estimated year of 2025 represents a pivotal point, with a projected market value of US$X,XXX million, reflecting the resilience and inherent growth potential of this industry.

Key Markets & Segments Leading South America Polymer Emulsion Industry

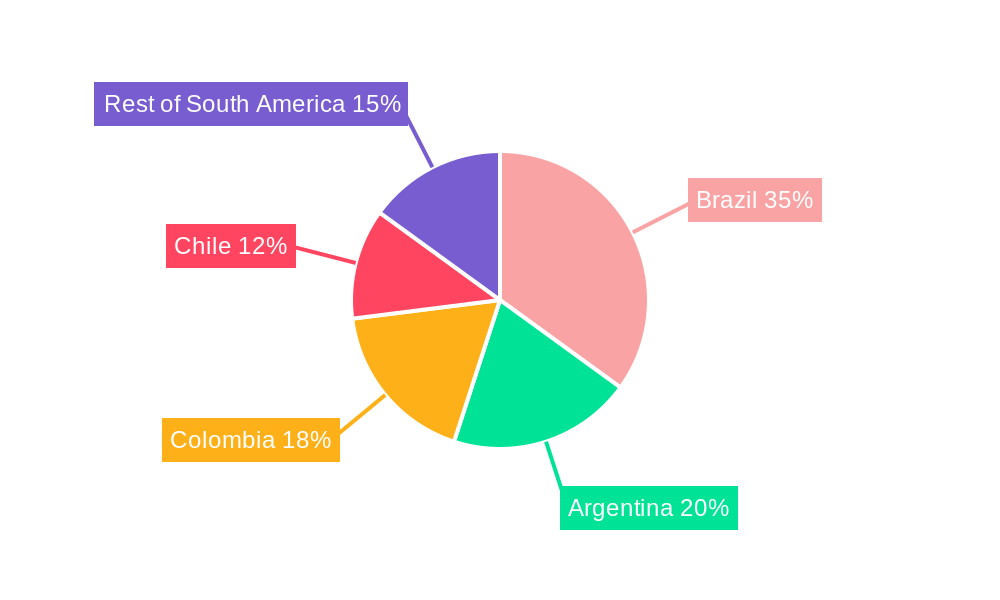

The South America Polymer Emulsion Industry is significantly influenced by the robust performance of its key segments and geographical markets. Brazil stands out as the dominant geographical region, driven by its large industrial base, extensive infrastructure development projects, and a burgeoning construction sector. The economic growth in Brazil, coupled with government initiatives to boost manufacturing and housing, directly translates into higher demand for polymer emulsions in paints & coatings, adhesives, and construction materials.

Within the Product Type segmentation, Acrylics currently lead the market. This dominance is attributed to their versatility, excellent weatherability, UV resistance, and cost-effectiveness, making them the preferred choice for a wide array of applications, particularly in paints, coatings, and adhesives. The demand for water-based acrylic emulsions is surging as industries increasingly prioritize eco-friendly solutions.

In terms of Application, Paints & Coatings represent the largest and most dynamic segment. The growth in this segment is intrinsically linked to the construction industry's expansion and the automotive sector's recovery. The increasing trend towards architectural coatings with enhanced durability and aesthetic appeal, along with industrial coatings offering superior protection, fuels the demand for various polymer emulsions. The Adhesives & Carpet Backing segment also holds substantial importance, propelled by the growth in furniture manufacturing, automotive interiors, and the construction of commercial and residential spaces.

Dominant Geography: Brazil

- Drivers: Large industrial base, significant infrastructure projects, urbanization, government stimulus for construction and manufacturing.

- Analysis: Brazil's economic scale and its role as a manufacturing hub for South America make it a critical market. Investment in infrastructure, including roads, bridges, and commercial buildings, directly boosts demand for polymer emulsions used in protective coatings, sealants, and construction adhesives.

Leading Product Type: Acrylics

- Drivers: Versatility, excellent performance in outdoor applications, cost-effectiveness, growing demand for low-VOC formulations.

- Analysis: Acrylic emulsions are the workhorses of the polymer emulsion industry. Their ability to form durable films with excellent adhesion to various substrates, coupled with their resistance to weathering and chemicals, makes them indispensable for paints, coatings, and adhesives. The continuous innovation in acrylic chemistries to offer enhanced properties like self-healing and improved flexibility further solidifies their leadership.

Leading Application: Paints & Coatings

- Drivers: Robust construction activity, automotive sector recovery, increasing demand for protective and decorative coatings, growing preference for water-based and eco-friendly paints.

- Analysis: The paints and coatings industry is a primary consumer of polymer emulsions. The constant need for new construction, renovation of existing structures, and the automotive industry's demand for high-performance finishes create a sustained market. The shift towards sustainable building practices and stricter emission standards further propels the adoption of water-based polymer emulsions in this segment.

South America Polymer Emulsion Industry Product Developments

Product development in the South America Polymer Emulsion Industry is characterized by a strong focus on sustainability, enhanced performance, and niche applications. Innovations are centered around creating low-VOC, water-based emulsions that meet stringent environmental regulations and consumer preferences. Manufacturers are developing specialized acrylics offering superior weather resistance, self-cleaning properties, and improved adhesion for architectural and industrial coatings. Polyurethane (PU) dispersions are being engineered for enhanced flexibility, abrasion resistance, and chemical inertness, finding applications in high-performance coatings, textiles, and footwear. Styrene-Butadiene (SB) latex innovations are targeting improved strength, water resistance, and printability for paper and packaging applications. The Vinyl Acetate segment is seeing developments in formulations for wood adhesives and interior paints. These advancements are crucial for gaining a competitive edge and addressing the evolving needs of various end-use industries, particularly in construction and packaging.

Challenges in the South America Polymer Emulsion Industry Market

The South America Polymer Emulsion Industry faces several significant challenges that can impede its growth trajectory. Raw material price volatility, particularly for petrochemical derivatives, poses a constant threat to profit margins and production costs. Intensifying competition from both global and local players, coupled with the threat of substitute products, necessitates continuous innovation and cost optimization. Stringent environmental regulations and evolving sustainability mandates, while driving innovation, also increase compliance costs and require significant investment in greener manufacturing processes. Supply chain disruptions, exacerbated by logistical complexities within the continent and global geopolitical factors, can lead to production delays and increased operational expenses. The economic instability and political uncertainties in some South American nations can also impact investment decisions and overall market demand.

Forces Driving South America Polymer Emulsion Industry Growth

Several powerful forces are propelling the growth of the South America Polymer Emulsion Industry. Robust economic development and infrastructure expansion across key countries like Brazil and Colombia are significantly boosting demand for polymer emulsions in construction, paints, and coatings. The increasing emphasis on sustainability and eco-friendly solutions is a major driver, as water-based polymer emulsions offer a viable alternative to solvent-based products, aligning with global environmental trends and stricter regulations. Technological advancements in emulsion polymerization are leading to the development of higher-performance and specialized emulsions, opening up new application areas and enhancing product capabilities. The growing middle class and increasing disposable incomes in many South American nations are also contributing to higher consumer spending on housing, renovation, and consumer goods, thereby driving demand in related industries.

Challenges in the South America Polymer Emulsion Industry Market

(This heading is a duplicate, assuming it was intended to be a different section. Below is a section that addresses long-term growth catalysts as per the prompt's structure, assuming this is the intended meaning.)

Long-Term Growth Catalysts in the South America Polymer Emulsion Industry Market

The long-term growth of the South America Polymer Emulsion Industry is underpinned by several compelling catalysts. Continued investments in renewable energy infrastructure and sustainable building practices will create sustained demand for advanced coatings and construction materials formulated with polymer emulsions. The increasing adoption of circular economy principles will drive innovation in bio-based and recyclable polymer emulsions. Strategic partnerships and collaborations between raw material suppliers, emulsion manufacturers, and end-users will foster co-creation and accelerate the development of bespoke solutions for emerging market needs. Market expansion into underserved regions within South America and the development of tailored product offerings for specific local requirements will unlock new growth avenues. Furthermore, ongoing research into novel polymerization techniques and the development of smart emulsions with responsive properties will create significant opportunities for high-value applications.

Emerging Opportunities in South America Polymer Emulsion Industry

Emerging opportunities in the South America Polymer Emulsion Industry are diverse and promising. The burgeoning demand for sustainable packaging solutions presents a significant avenue for growth, particularly for SB latex in paper coatings and acrylics in flexible packaging adhesives. The increasing focus on green building certifications and energy-efficient construction is driving the demand for advanced, low-VOC paints and coatings formulated with high-performance polymer emulsions. The textile industry's shift towards sustainable and functional finishes is creating opportunities for specialized PU dispersions and acrylic emulsions. Furthermore, the potential for penetration into niche markets such as electronics, automotive interiors, and medical devices with advanced polymer emulsion formulations offers significant upside. The growing awareness and adoption of digitalization and automation in manufacturing will also lead to more efficient production and improved product quality, further enhancing competitiveness.

Leading Players in the South America Polymer Emulsion Industry Sector

- AxchemGroup

- Clariant

- Solvay

- Celanese Corporation

- 3M

- BASF SE

- Arkema Group

- Akzo Nobel N V

- Dow

- The Lubrizol Corporation

- Wacker Chemie AG

Key Milestones in South America Polymer Emulsion Industry Industry

- 2019: Increased adoption of water-based acrylics in paints and coatings across Brazil, driven by environmental regulations.

- 2020: Supply chain disruptions due to the global pandemic impact raw material availability for polymer emulsion production.

- 2021: Growing investment in sustainable packaging solutions boosts demand for SB latex in paperboard applications.

- 2022: Several key players announce strategic expansion plans in Colombia and Chile to tap into growing construction markets.

- 2023: Introduction of bio-based polyurethane dispersions with enhanced performance characteristics for textile applications.

- 2024 (estimated): Significant M&A activity anticipated as larger players seek to consolidate market share and acquire innovative technologies.

Strategic Outlook for South America Polymer Emulsion Industry Market

The strategic outlook for the South America Polymer Emulsion Industry is exceptionally positive, marked by a strong emphasis on innovation, sustainability, and market expansion. Future growth will be accelerated by the continued development of advanced, eco-friendly polymer emulsions, catering to the increasing demand for low-VOC and bio-based solutions. Strategic partnerships and acquisitions will play a crucial role in enhancing market penetration, diversifying product portfolios, and gaining access to new technologies and customer bases. The industry will witness a greater focus on tailor-made solutions for specific applications and regions, capitalizing on the diverse economic and developmental landscapes across South America. Investments in R&D to develop novel functionalities and high-performance emulsions will be key differentiators, driving profitability and market leadership in the coming years.

South America Polymer Emulsion Industry Segmentation

-

1. Product Type

- 1.1. Acrylics

- 1.2. Polyurethane (PU) Dispersions

- 1.3. Styrene Butadiene (SB) Latex

- 1.4. Vinyl Acetate

- 1.5. Other Product Types

-

2. Application

- 2.1. Adhesives & Carpet Backing

- 2.2. Paper & Paperboard Coatings

- 2.3. Paints & Coatings

- 2.4. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Polymer Emulsion Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Polymer Emulsion Industry Regional Market Share

Geographic Coverage of South America Polymer Emulsion Industry

South America Polymer Emulsion Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Awareness with Regard to Volatile Organic Compound (VOC); Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Paints and Coatings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Acrylics

- 5.1.2. Polyurethane (PU) Dispersions

- 5.1.3. Styrene Butadiene (SB) Latex

- 5.1.4. Vinyl Acetate

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Adhesives & Carpet Backing

- 5.2.2. Paper & Paperboard Coatings

- 5.2.3. Paints & Coatings

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Acrylics

- 6.1.2. Polyurethane (PU) Dispersions

- 6.1.3. Styrene Butadiene (SB) Latex

- 6.1.4. Vinyl Acetate

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Adhesives & Carpet Backing

- 6.2.2. Paper & Paperboard Coatings

- 6.2.3. Paints & Coatings

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Acrylics

- 7.1.2. Polyurethane (PU) Dispersions

- 7.1.3. Styrene Butadiene (SB) Latex

- 7.1.4. Vinyl Acetate

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Adhesives & Carpet Backing

- 7.2.2. Paper & Paperboard Coatings

- 7.2.3. Paints & Coatings

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Colombia South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Acrylics

- 8.1.2. Polyurethane (PU) Dispersions

- 8.1.3. Styrene Butadiene (SB) Latex

- 8.1.4. Vinyl Acetate

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Adhesives & Carpet Backing

- 8.2.2. Paper & Paperboard Coatings

- 8.2.3. Paints & Coatings

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Chile South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Acrylics

- 9.1.2. Polyurethane (PU) Dispersions

- 9.1.3. Styrene Butadiene (SB) Latex

- 9.1.4. Vinyl Acetate

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Adhesives & Carpet Backing

- 9.2.2. Paper & Paperboard Coatings

- 9.2.3. Paints & Coatings

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of South America South America Polymer Emulsion Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Acrylics

- 10.1.2. Polyurethane (PU) Dispersions

- 10.1.3. Styrene Butadiene (SB) Latex

- 10.1.4. Vinyl Acetate

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Adhesives & Carpet Backing

- 10.2.2. Paper & Paperboard Coatings

- 10.2.3. Paints & Coatings

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AxchemGroup

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Celanese Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arkema Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akzo Nobel N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dow

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Lubrizol Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wacker Chemie AG*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 AxchemGroup

List of Figures

- Figure 1: South America Polymer Emulsion Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Polymer Emulsion Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South America Polymer Emulsion Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Polymer Emulsion Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Polymer Emulsion Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South America Polymer Emulsion Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: South America Polymer Emulsion Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: South America Polymer Emulsion Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: South America Polymer Emulsion Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: South America Polymer Emulsion Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: South America Polymer Emulsion Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Polymer Emulsion Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the South America Polymer Emulsion Industry?

Key companies in the market include AxchemGroup, Clariant, Solvay, Celanese Corporation, 3M, BASF SE, Arkema Group, Akzo Nobel N V, Dow, The Lubrizol Corporation, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the South America Polymer Emulsion Industry?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Awareness with Regard to Volatile Organic Compound (VOC); Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Paints and Coatings.

7. Are there any restraints impacting market growth?

; Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Polymer Emulsion Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Polymer Emulsion Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Polymer Emulsion Industry?

To stay informed about further developments, trends, and reports in the South America Polymer Emulsion Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence