Key Insights

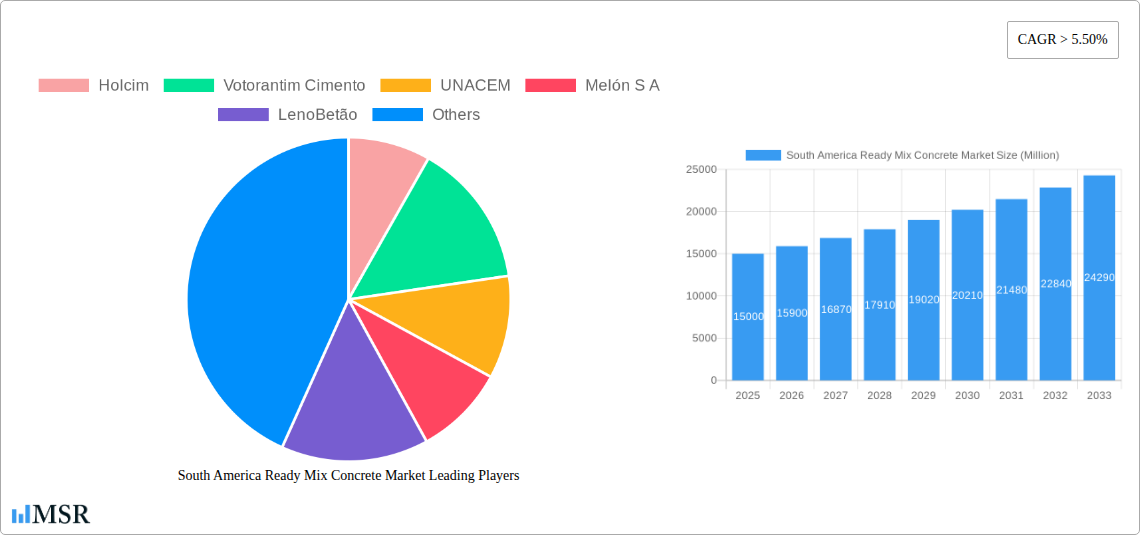

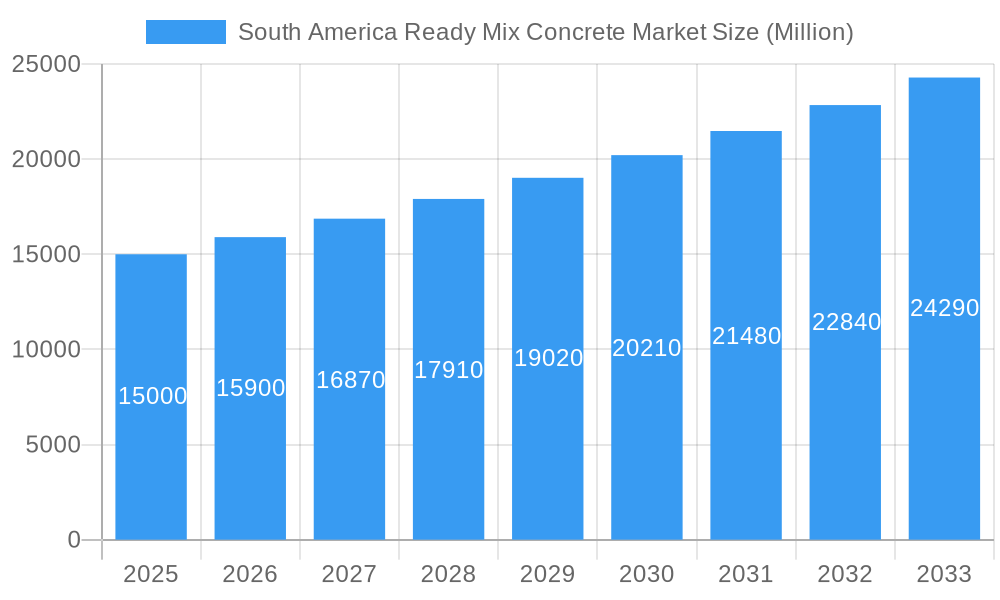

The South American ready-mix concrete market is experiencing robust growth, driven by significant infrastructure development projects across Brazil and Argentina, coupled with a burgeoning residential construction sector in these key economies. The market's Compound Annual Growth Rate (CAGR) exceeding 5.50% since 2019 indicates a sustained expansion, projected to continue through 2033. Increased urbanization, government initiatives promoting sustainable infrastructure, and rising disposable incomes are key factors fueling this demand. The market is segmented by end-use sector (commercial, industrial & institutional, infrastructure, residential) and product type (central mixed, shrink mixed, transit mixed). While infrastructure projects currently dominate market share, the residential segment is showing particularly strong growth potential, particularly in expanding urban areas. Major players like Holcim, Votorantim Cimento, and CEMEX are actively competing for market share, investing in new production facilities and expanding their distribution networks to cater to this growing demand. The market faces challenges such as fluctuating cement prices and potential regulatory hurdles related to environmental sustainability. However, the long-term outlook remains positive, with the sustained demand for housing and infrastructure upgrades bolstering market expansion in the coming years.

South America Ready Mix Concrete Market Market Size (In Billion)

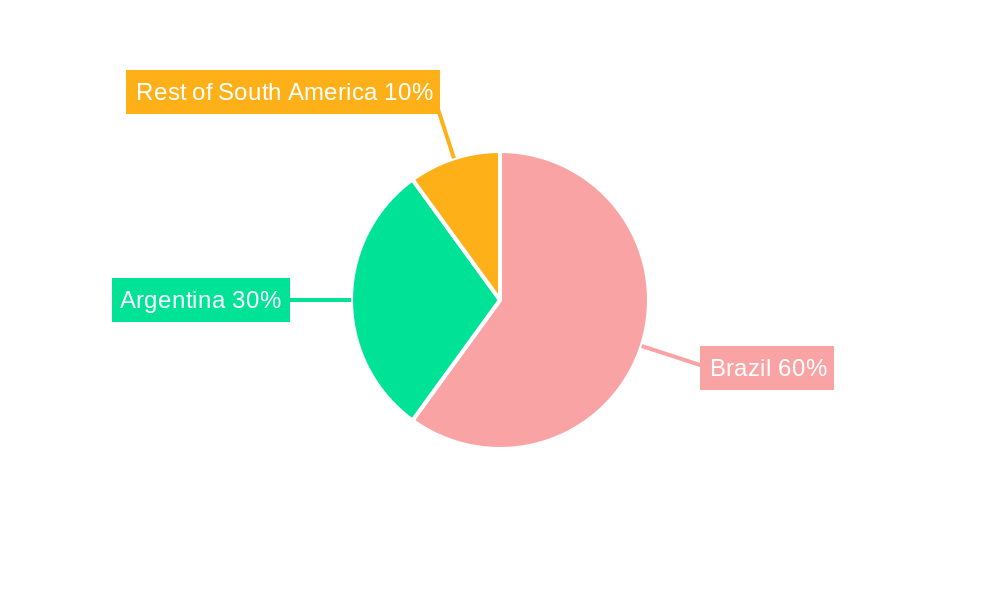

The dominance of Brazil and Argentina in the South American ready-mix concrete market is undeniable. However, other South American nations are expected to witness gradual growth, albeit at a slower pace than the leading two. This is attributable to varying levels of economic development and infrastructure investment across the region. The product segmentation reveals a preference for central mixed concrete, reflecting the established logistics and distribution networks in place. However, the shrink mixed and transit mixed segments are expected to exhibit growth, driven by smaller-scale construction projects and increased demand for efficient delivery solutions. Continued innovation in concrete technology, incorporating sustainable materials and improving production efficiency, is likely to play a significant role in shaping the future of the market, particularly as concerns around environmental impact become increasingly prominent. The competitive landscape is intense, with both international and regional players vying for dominance. Strategic alliances, mergers, and acquisitions are likely to become more prevalent in the coming years as companies seek to enhance their market position and expand their reach.

South America Ready Mix Concrete Market Company Market Share

South America Ready Mix Concrete Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Ready Mix Concrete market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The study meticulously examines key market segments, leading players, and recent industry developments, providing a complete picture of this dynamic sector.

South America Ready Mix Concrete Market Market Concentration & Dynamics

The South American ready-mix concrete market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Holcim, Votorantim Cimento, and CEMEX S A B de C V are prominent examples, although market share data fluctuates due to ongoing mergers and acquisitions (M&A) activity. The innovation ecosystem is driven by advancements in concrete formulations (e.g., high-performance concrete, self-consolidating concrete), and improved mixing and delivery technologies. Regulatory frameworks vary across countries but generally focus on quality control, environmental standards, and worker safety. Substitute products, such as precast concrete and other construction materials, pose a level of competitive pressure. End-user trends reveal a shift towards sustainable and high-performance concrete solutions. M&A activity, exemplified by Holcim's divestment of its Brazilian operations in 2022, significantly impacts market concentration and competitive dynamics.

- Market Share: Holcim (xx%), Votorantim Cimento (xx%), CEMEX (xx%), Others (xx%) (These are estimated values for 2025)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Focus: Environmental impact, quality standards, worker safety.

South America Ready Mix Concrete Market Industry Insights & Trends

The South American ready-mix concrete market is poised for robust growth, driven by substantial infrastructure development projects, booming construction activities in both residential and commercial sectors, and government initiatives promoting urbanization and economic development. The market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further amplified by technological advancements, including the adoption of advanced concrete technologies and digitalization of operations, leading to enhanced efficiency and productivity. However, economic fluctuations and volatile raw material prices present challenges to sustained growth. Consumer behavior leans toward environmentally friendly and cost-effective solutions, driving innovation in sustainable concrete products.

Key Markets & Segments Leading South America Ready Mix Concrete Market

Brazil, followed by Colombia and Mexico, constitute the dominant markets within South America's ready-mix concrete sector. The infrastructure segment holds the largest market share driven by extensive government investments in transportation networks, housing developments, and other public works. The residential segment also experiences significant growth due to rising urbanization and population growth.

- Dominant Region: Brazil

- Dominant End-Use Sector: Infrastructure

- Dominant Product Type: Central Mixed

Drivers for Dominant Segments:

- Infrastructure: Government investment in roads, bridges, and public works.

- Residential: Rapid urbanization and population growth.

- Commercial & Industrial: Growth of commercial and industrial projects across the region.

South America Ready Mix Concrete Market Product Developments

Recent product innovations focus on enhancing concrete properties, like durability, strength, and sustainability. High-performance concrete mixes, incorporating advanced additives and admixtures, are gaining traction. The development of self-consolidating concrete and fiber-reinforced concrete addresses construction efficiency and structural integrity. These innovations offer competitive advantages by reducing construction time, improving structural performance, and minimizing environmental impact.

Challenges in the South America Ready Mix Concrete Market Market

The South American ready-mix concrete market faces challenges including price volatility of raw materials (cement, aggregates), supply chain disruptions, stringent environmental regulations, and intense competition among established players. These factors impact profitability and operational efficiency, requiring companies to adapt strategies for cost optimization and sustainable practices. Furthermore, the uneven economic development across the region contributes to market segmentation and varied growth rates. Regulatory hurdles concerning permits and compliance also add complexity for businesses operating in this sector.

Forces Driving South America Ready Mix Concrete Market Growth

Several key factors propel the growth of the South American ready-mix concrete market. Significant government investments in infrastructure development, particularly in transportation and housing projects, create a strong demand for ready-mix concrete. The growing population and rapid urbanization further fuel this demand. Technological advancements such as automated batching plants and efficient delivery systems enhance productivity and reduce costs. Favorable government policies promoting sustainable construction practices also contribute to market expansion.

Long-Term Growth Catalysts in South America Ready Mix Concrete Market

Long-term growth in the South American ready-mix concrete market hinges on continuous innovation in materials science, resulting in more sustainable and high-performance concrete products. Strategic partnerships between manufacturers and construction companies can optimize supply chains and streamline project execution. Expanding into new markets with strong growth potential, particularly in rapidly urbanizing regions, will be key to sustained expansion. Additionally, integrating digital technologies to enhance efficiency and customer service will play a crucial role in future success.

Emerging Opportunities in South America Ready Mix Concrete Market

Emerging opportunities exist in the development and adoption of sustainable concrete solutions. The demand for green building materials and the implementation of circular economy principles open avenues for eco-friendly products. The expansion into underserved regions with growing infrastructure needs presents lucrative opportunities for ready-mix concrete manufacturers. Moreover, leveraging digital technologies for improved supply chain management and customer relationship management will offer significant competitive advantages.

Leading Players in the South America Ready Mix Concrete Market Sector

- Holcim

- Votorantim Cimento

- UNACEM

- Melón S A

- LenoBetão

- ULTRACEM S A S

- CEMEX S A B de C V

- Argos Group

- Polimix Concreto

- Supermix

Key Milestones in South America Ready Mix Concrete Market Industry

- September 2022: Holcim divested its Brazilian business to Companhia Siderúrgica Nacional for USD 1.025 Billion, impacting market share.

- May 2023: Polimix Concreto commissioned a new manufacturing facility in Mooca, Sao Paulo, expanding its capacity.

- August 2023: Polimix Concreto inaugurated a new ready-mix concrete production facility in Campinas, Sao Paulo, further strengthening its market presence.

Strategic Outlook for South America Ready Mix Concrete Market Market

The South American ready-mix concrete market presents substantial growth potential over the coming years. Strategic investments in new technologies, sustainable product development, and efficient supply chain management will be crucial for companies to succeed. Expanding into new markets and forging strategic partnerships are key avenues for capturing increased market share. Adapting to evolving regulatory landscapes and addressing sustainability concerns will be vital for long-term success in this dynamic and competitive market.

South America Ready Mix Concrete Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Central Mixed

- 2.2. Shrink Mixed

- 2.3. Transit Mixed

South America Ready Mix Concrete Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Ready Mix Concrete Market Regional Market Share

Geographic Coverage of South America Ready Mix Concrete Market

South America Ready Mix Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Ready Mix Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Central Mixed

- 5.2.2. Shrink Mixed

- 5.2.3. Transit Mixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Holcim

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Votorantim Cimento

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UNACEM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melón S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LenoBetão

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ULTRACEM S A S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEMEX S A B de C V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Argos Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polimix Concreto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Supermix

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Holcim

List of Figures

- Figure 1: South America Ready Mix Concrete Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Ready Mix Concrete Market Share (%) by Company 2025

List of Tables

- Table 1: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 2: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: South America Ready Mix Concrete Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Ready Mix Concrete Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 8: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: South America Ready Mix Concrete Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Ready Mix Concrete Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Ready Mix Concrete Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South America Ready Mix Concrete Market?

Key companies in the market include Holcim, Votorantim Cimento, UNACEM, Melón S A, LenoBetão, ULTRACEM S A S, CEMEX S A B de C V, Argos Group, Polimix Concreto, Supermix.

3. What are the main segments of the South America Ready Mix Concrete Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

August 2023: Polimix Concreto augmented its presence in Brazil's concrete market by inaugurating a new production facility for ready-mix concrete in Campinas, Sao Paulo.May 2023: Polimix Concreto expanded its presence in Brazil's concrete market by commissioning a new manufacturing facility in Mooca, Sao Paulo. Polimix Concreto aims to cater to more customers through this expansion.September 2022: Holcim completed divesting its business in Brazil to Companhia Siderúrgica Nacional for USD 1.025 billion. The divestment includes Holcim's 19 ready-mix concrete plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Ready Mix Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Ready Mix Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Ready Mix Concrete Market?

To stay informed about further developments, trends, and reports in the South America Ready Mix Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence