Key Insights

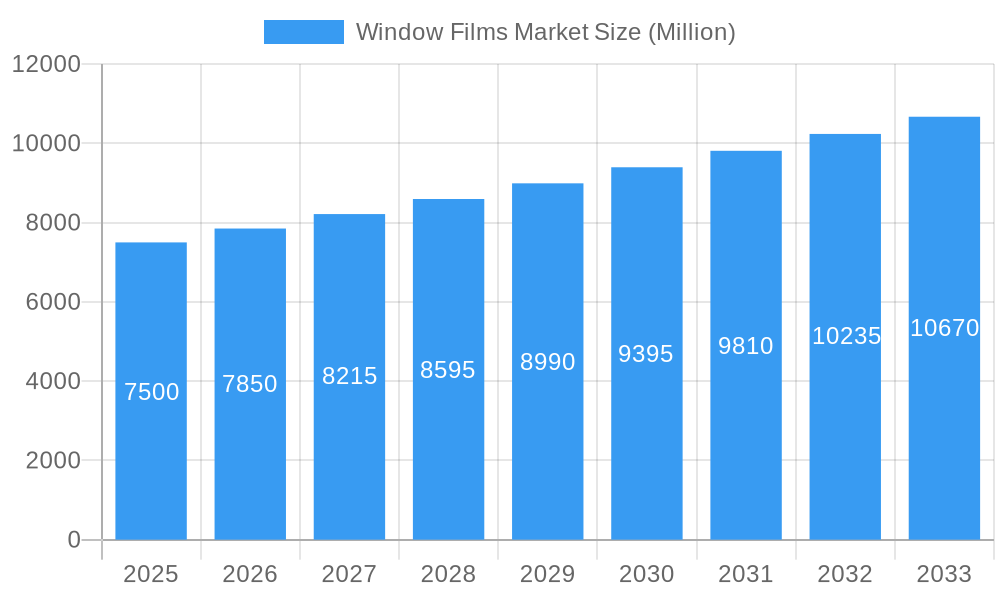

The global Window Films Market is poised for robust expansion, projected to reach a substantial market size by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 4.50%. This dynamic growth is fueled by increasing consumer awareness regarding energy efficiency and the demand for enhanced building aesthetics and safety. Key drivers include the rising adoption of solar control films to reduce cooling costs in residential and commercial buildings, particularly in regions experiencing hotter climates. Furthermore, the escalating need for improved safety and security in both automotive and architectural applications, due to concerns about vandalism and accidental breakage, is a significant growth catalyst. The decorative films segment is also experiencing a surge as individuals and businesses seek cost-effective ways to personalize and upgrade spaces without extensive renovations. Advancements in film technology, offering superior UV protection, glare reduction, and thermal insulation, are further stimulating market demand across various end-user industries.

Window Films Market Market Size (In Billion)

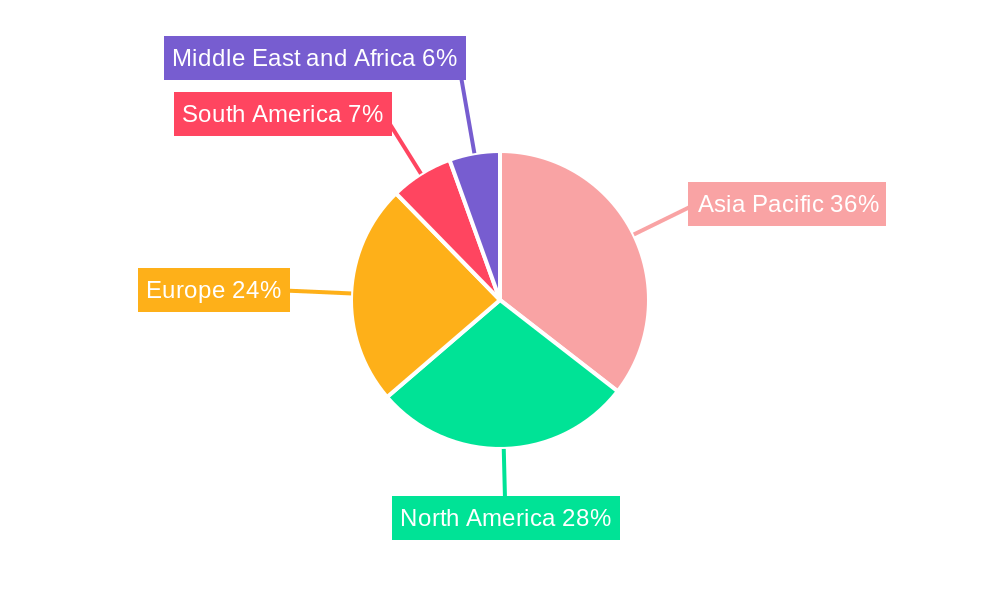

The market is segmented into several key types, with Solar Control and UV Blocking Films, and Safety and Security Films expected to dominate in terms of revenue generation due to their critical functionalities. The Building and Construction sector, encompassing residential, commercial, infrastructural, and institutional sub-segments, represents the largest end-user industry, benefiting from stringent energy efficiency regulations and the growing preference for smart building solutions. The Automotive industry also presents a significant opportunity, driven by vehicle customization trends and the desire for enhanced passenger comfort and protection. Geographically, the Asia Pacific region, led by China and India, is anticipated to exhibit the fastest growth, owing to rapid urbanization, burgeoning construction activities, and increasing disposable incomes. North America and Europe remain mature yet substantial markets, characterized by a strong focus on retrofitting existing buildings for energy efficiency and security upgrades. Restraints such as fluctuating raw material prices and the presence of counterfeit products in some developing markets might pose challenges, but the overarching trend towards sustainable and secure environments ensures sustained market prosperity.

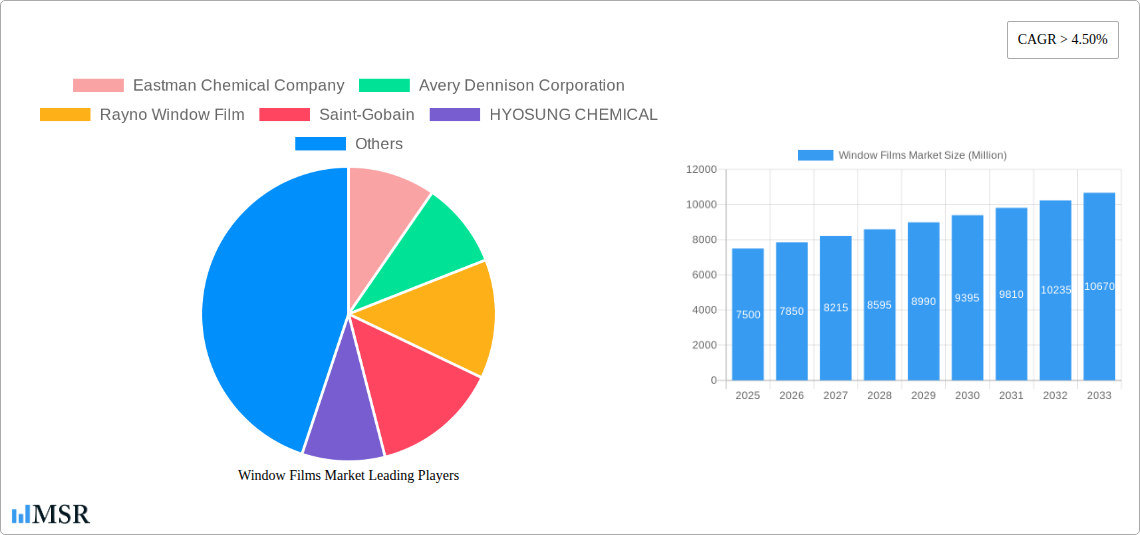

Window Films Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Window Films Market, forecasting a substantial market size of over $12,000 Million by 2033, with a robust CAGR of approximately 6.5% during the forecast period (2025–2033). Serving as an indispensable resource for automotive window films, architectural window films, residential window films, and commercial window films stakeholders, this study delves into critical market dynamics, key trends, and future growth trajectories. Our analysis spans the historical period of 2019–2024 and presents detailed estimations for the base and estimated year of 2025. The report meticulously examines various window film types, including solar control window films, UV blocking window films, decorative window films, safety and security window films, privacy window films, and insulating window films, alongside their applications across diverse end-user industries such as Automotive, Building and Construction, Marine, and Others.

Window Films Market Market Concentration & Dynamics

The global Window Films Market exhibits a moderately concentrated landscape, characterized by strategic initiatives and evolving competitive pressures. Leading players are actively engaged in innovation and expansion to capture significant market share, with an estimated market share for top players exceeding 60% in 2025. The innovation ecosystem is dynamic, driven by advancements in material science and manufacturing technologies aimed at enhancing film performance, durability, and application ease. Regulatory frameworks, particularly concerning energy efficiency and safety standards in the building and construction sector, play a crucial role in shaping market demand for energy-saving window films and safety window films. Substitute products, such as advanced glazing technologies, present a competitive challenge, but the cost-effectiveness and retrofitting capabilities of window films continue to drive their adoption. End-user trends, including increasing consumer awareness regarding energy conservation and enhanced building aesthetics, are significant market influencers. Merger and acquisition (M&A) activities are prevalent, with an estimated xx M&A deal counts recorded during the historical period, as companies seek to consolidate their market position and expand their product portfolios and geographic reach.

Window Films Market Industry Insights & Trends

The Window Films Market is experiencing robust growth, propelled by escalating demand for energy efficiency solutions in buildings and a growing automotive aftermarket. The global market size was estimated at over $7,000 Million in 2024 and is projected to reach over $12,000 Million by 2033, growing at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Key growth drivers include stringent government regulations promoting energy conservation, rising global temperatures leading to increased demand for solar control films, and a heightened focus on occupant safety and security, fueling the adoption of safety and security films. Technological disruptions are also shaping the industry, with continuous advancements in film materials and application technologies. For instance, the development of tinted window films with superior UV rejection properties and improved heat rejection capabilities is a significant trend. Furthermore, the evolving consumer behaviors, driven by a desire for enhanced comfort, privacy, and aesthetic appeal in both residential and commercial spaces, are contributing to the market's expansion. The increasing disposable income and urbanization in emerging economies are further bolstering the demand for retrofitting existing structures with high-performance window films.

Key Markets & Segments Leading Window Films Market

The Window Films Market is characterized by strong regional and segmental dominance, driven by specific economic, environmental, and regulatory factors. North America and Europe currently lead the market in terms of window film sales, owing to established building codes mandating energy efficiency and a mature automotive sector. However, the Asia Pacific region is emerging as a high-growth market, fueled by rapid urbanization, infrastructure development, and increasing disposable incomes.

Dominant Segments by Type:

- Solar Control and UV Blocking Films: This segment holds the largest market share due to its critical role in reducing building energy consumption, preventing heat gain, and protecting interiors from UV damage. Drivers include government incentives for green buildings and rising energy costs.

- Safety and Security Films: Growing concerns about vandalism, break-ins, and natural disasters are driving the demand for these films, which offer enhanced shatter resistance and blast mitigation. Infrastructure projects and commercial building security upgrades are key demand catalysts.

- Decorative Films: The increasing focus on interior design and branding in commercial spaces, coupled with the aesthetic appeal for residential applications, makes this segment a significant contributor. Drivers include architectural trends and the desire for privacy and visual enhancement.

Dominant Segments by End-user Industry:

- Building and Construction: This sector is the largest consumer of window films.

- Residential: Demand is driven by homeowners seeking energy savings, comfort, and UV protection.

- Commercial: High demand from offices, retail spaces, and hospitality sectors for energy efficiency, privacy, and aesthetic customization.

- Infrastructural and Institutional: Growing adoption in public buildings, schools, and hospitals for safety, security, and energy management.

- Automotive: The aftermarket for automotive window films is robust, driven by consumer demand for heat rejection, UV protection, privacy, and aesthetics.

Window Films Market Product Developments

Product innovation is a cornerstone of the Window Films Market. Manufacturers are continuously developing advanced films with enhanced performance characteristics. Recent developments include intelligent window films that can dynamically adjust their tint based on sunlight intensity, offering unparalleled energy savings and comfort. Nano-ceramic technologies are enabling the creation of highly effective UV blocking films and solar control films that minimally impact visible light transmission. Furthermore, manufacturers are focusing on improving the ease of application and removability of films, particularly for the architectural market, with innovations like repositionable adhesives that minimize installation time and reduce waste. These advancements are crucial for maintaining a competitive edge and meeting the evolving demands of both the automotive aftermarket and the building and construction sectors.

Challenges in the Window Films Market Market

Despite robust growth, the Window Films Market faces several challenges. The increasing adoption of integrated smart glass technologies and advancements in double or triple-glazed windows present a significant substitute threat, potentially limiting the market for traditional window films. Furthermore, fluctuating raw material prices, particularly for polyester and adhesives, can impact manufacturing costs and profit margins. Supply chain disruptions, exacerbated by global events, can also lead to production delays and increased lead times. Intense competition among numerous players, both global and regional, often leads to price wars, putting pressure on profitability. Regulatory compliance, especially for new product introductions in different regions, can also be a time-consuming and costly process.

Forces Driving Window Films Market Growth

Several forces are propelling the Window Films Market forward. The escalating global concern for climate change and energy conservation is a primary driver, leading to stricter building codes and mandates for energy-efficient solutions. The automotive industry's focus on enhancing vehicle comfort and fuel efficiency also contributes significantly, with automotive window films playing a key role in reducing cabin temperatures and thus engine load. Growing awareness among consumers and businesses about the detrimental effects of UV radiation on human health and material degradation is further boosting the demand for UV blocking window films. Moreover, the increasing trend of urbanisation and the retrofitting of older buildings with modern efficiency upgrades provide a substantial market opportunity. The continuous technological advancements leading to improved film performance and diverse aesthetic options also play a crucial role.

Challenges in the Window Films Market Market

Long-term growth catalysts for the Window Films Market are firmly rooted in innovation and sustainability. The development of "smart" window films, capable of responding to environmental conditions by adjusting their tint or energy transmission properties, represents a significant future growth avenue. Furthermore, the increasing demand for sustainable building materials and energy-efficient solutions will continue to drive the adoption of advanced window films. Expansion into emerging economies with rapidly growing construction sectors offers substantial untapped potential. The ongoing research into new polymer formulations and adhesive technologies promises to yield films with even greater durability, superior performance, and improved environmental profiles. Strategic partnerships between window film manufacturers and construction firms or automotive OEMs can also accelerate market penetration and foster wider adoption.

Emerging Opportunities in Window Films Market

Emerging opportunities in the Window Films Market are driven by technological advancements and evolving consumer preferences. The growing demand for customizable solutions in both architectural and automotive applications presents a significant opportunity for manufacturers to offer personalized films with unique patterns, colors, and functionalities. The integration of window films with IoT (Internet of Things) technology, enabling smart control and monitoring of indoor climate, is another promising area. Furthermore, the increasing focus on health and well-being is creating opportunities for films with anti-microbial properties or enhanced air purification capabilities. The expansion of the green building movement and the push for net-zero energy buildings will continue to fuel demand for high-performance energy-saving window films. Exploring niche markets, such as specialized films for marine vessels or public transportation, also offers significant growth potential.

Leading Players in the Window Films Market Sector

- Eastman Chemical Company

- Avery Dennison Corporation

- Rayno Window Film

- Saint-Gobain

- HYOSUNG CHEMICAL

- NEXFIL

- TORAY INDUSTRIES INC

- Johnson Window Films Inc

- LINTEC Corporation

- 3M

- Armolan Greece

Key Milestones in Window Films Market Industry

- February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia-Pacific region. This acquisition demonstrates Eastman's commitment to driving growth in performance films and the paint protection and window film markets. The investment further strengthens the company's ability to deliver consistent, superior value as a specialty materials company and expands the service level in China and the Asia Pacific region. This site will align with Eastman's performance film operations and its high standard of quality supply into the market.

- April 2022: Avery Dennison introduced its all-new Dusted Crystal decorative architectural window film. The frosted film, available in a matte and luster finish, offers privacy while providing a translucent light effect for interior environments using glass to signify specially-designated spaces. The film features a remarkable, first-to-market, wet-apply quick-release adhesive that allows the film to be repositioned during installation and removed easily after drying with virtually no residue left on the glass. Moreover, the film's adhesive doesn't stick to itself, eliminating mishaps when removing the film from its liner before application.

Strategic Outlook for Window Films Market Market

The strategic outlook for the Window Films Market is exceptionally positive, driven by a confluence of factors centered on sustainability, energy efficiency, and enhanced living/working environments. Growth accelerators include the ongoing global push towards stricter energy conservation regulations in the building and construction sector, coupled with increasing consumer demand for comfort and UV protection in their vehicles. The market is poised for expansion through continued innovation in high-performance films, such as dynamic tinting and self-healing technologies, catering to niche applications and premium segments. Strategic opportunities lie in expanding geographical reach, particularly in developing economies undergoing rapid infrastructure development and urbanization. Furthermore, collaborations with architectural firms and automotive manufacturers will be crucial in integrating advanced window film solutions from the design phase, solidifying their role as essential components in modern construction and vehicle design, and ensuring sustained market growth.

Window Films Market Segmentation

-

1. Type

- 1.1. Solar Control and UV Blocking Films

- 1.2. Decorative Films

- 1.3. Safety and Security Films

- 1.4. Privacy Films

- 1.5. Insulating Films

- 1.6. Other Types

-

2. End-user Industry

- 2.1. Automotive

-

2.2. Building and Construction

- 2.2.1. Residential

- 2.2.2. Commercial

- 2.2.3. Infrastructural and Institutional

- 2.3. Marine

- 2.4. Other End-user Industries

Window Films Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Thailand

- 1.6. Vietnam

- 1.7. Malaysia

- 1.8. Indonesia

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Turkey

- 3.7. NORDIC

- 3.8. Spain

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Qatar

- 5.4. Nigeria

- 5.5. United Arab Emirates

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Window Films Market Regional Market Share

Geographic Coverage of Window Films Market

Window Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Safety and Security Window Films; Increasing Emphasis on Reducing Carbon Footprint

- 3.3. Market Restrains

- 3.3.1 Technical

- 3.3.2 Warranty

- 3.3.3 and Installation Issues; Growing Smart Glass Market; Decreasing Automotive Production; Unfavorable Conditions Arising due to the COVID-19 Impact

- 3.4. Market Trends

- 3.4.1. The Building and Construction Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Window Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Control and UV Blocking Films

- 5.1.2. Decorative Films

- 5.1.3. Safety and Security Films

- 5.1.4. Privacy Films

- 5.1.5. Insulating Films

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Building and Construction

- 5.2.2.1. Residential

- 5.2.2.2. Commercial

- 5.2.2.3. Infrastructural and Institutional

- 5.2.3. Marine

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Window Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solar Control and UV Blocking Films

- 6.1.2. Decorative Films

- 6.1.3. Safety and Security Films

- 6.1.4. Privacy Films

- 6.1.5. Insulating Films

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Building and Construction

- 6.2.2.1. Residential

- 6.2.2.2. Commercial

- 6.2.2.3. Infrastructural and Institutional

- 6.2.3. Marine

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Window Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solar Control and UV Blocking Films

- 7.1.2. Decorative Films

- 7.1.3. Safety and Security Films

- 7.1.4. Privacy Films

- 7.1.5. Insulating Films

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Building and Construction

- 7.2.2.1. Residential

- 7.2.2.2. Commercial

- 7.2.2.3. Infrastructural and Institutional

- 7.2.3. Marine

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Window Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solar Control and UV Blocking Films

- 8.1.2. Decorative Films

- 8.1.3. Safety and Security Films

- 8.1.4. Privacy Films

- 8.1.5. Insulating Films

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Building and Construction

- 8.2.2.1. Residential

- 8.2.2.2. Commercial

- 8.2.2.3. Infrastructural and Institutional

- 8.2.3. Marine

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Window Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solar Control and UV Blocking Films

- 9.1.2. Decorative Films

- 9.1.3. Safety and Security Films

- 9.1.4. Privacy Films

- 9.1.5. Insulating Films

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Building and Construction

- 9.2.2.1. Residential

- 9.2.2.2. Commercial

- 9.2.2.3. Infrastructural and Institutional

- 9.2.3. Marine

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Window Films Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solar Control and UV Blocking Films

- 10.1.2. Decorative Films

- 10.1.3. Safety and Security Films

- 10.1.4. Privacy Films

- 10.1.5. Insulating Films

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Building and Construction

- 10.2.2.1. Residential

- 10.2.2.2. Commercial

- 10.2.2.3. Infrastructural and Institutional

- 10.2.3. Marine

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eastman Chemical Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Avery Dennison Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rayno Window Film

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saint-Gobain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HYOSUNG CHEMICAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NEXFIL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TORAY INDUSTRIES INC *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson Window Films Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LINTEC Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 3M

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Armolan Greece

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Eastman Chemical Company

List of Figures

- Figure 1: Global Window Films Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Window Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Window Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Window Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Window Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Window Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Window Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Window Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Window Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Window Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Window Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Window Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Window Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Window Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Window Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Window Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Window Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Window Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Window Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Window Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Window Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Window Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Window Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Window Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Window Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Window Films Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Window Films Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Window Films Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Window Films Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Window Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Window Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Window Films Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Window Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Thailand Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Vietnam Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Malaysia Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Indonesia Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Window Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United States Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Mexico Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Window Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Italy Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Russia Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Turkey Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: NORDIC Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Spain Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Window Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Colombia Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Global Window Films Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 42: Global Window Films Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Window Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Qatar Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: United Arab Emirates Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Egypt Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Window Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Window Films Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Window Films Market?

Key companies in the market include Eastman Chemical Company, Avery Dennison Corporation, Rayno Window Film, Saint-Gobain, HYOSUNG CHEMICAL, NEXFIL, TORAY INDUSTRIES INC *List Not Exhaustive, Johnson Window Films Inc, LINTEC Corporation, 3M, Armolan Greece.

3. What are the main segments of the Window Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Safety and Security Window Films; Increasing Emphasis on Reducing Carbon Footprint.

6. What are the notable trends driving market growth?

The Building and Construction Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Technical. Warranty. and Installation Issues; Growing Smart Glass Market; Decreasing Automotive Production; Unfavorable Conditions Arising due to the COVID-19 Impact.

8. Can you provide examples of recent developments in the market?

February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia-Pacific region. This acquisition demonstrates Eastman's commitment to driving growth in performance films and the paint protection and window film markets. The investment further strengthens the company's ability to deliver consistent, superior value as a specialty materials company and expands the service level in China and the Asia Pacific region. This site will align with Eastman's performance film operations and its high standard of quality supply into the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Window Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Window Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Window Films Market?

To stay informed about further developments, trends, and reports in the Window Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence