Key Insights

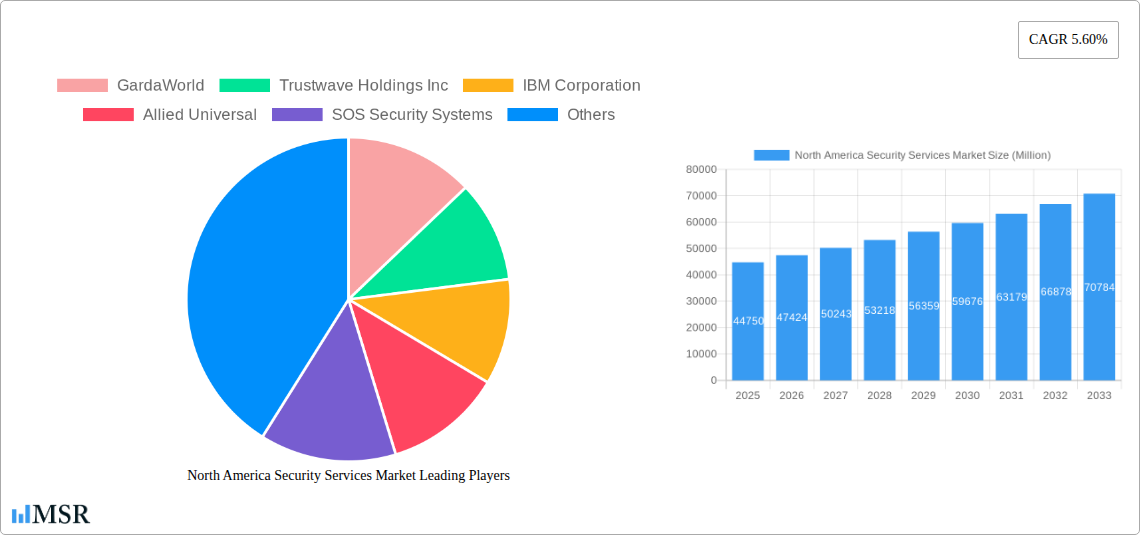

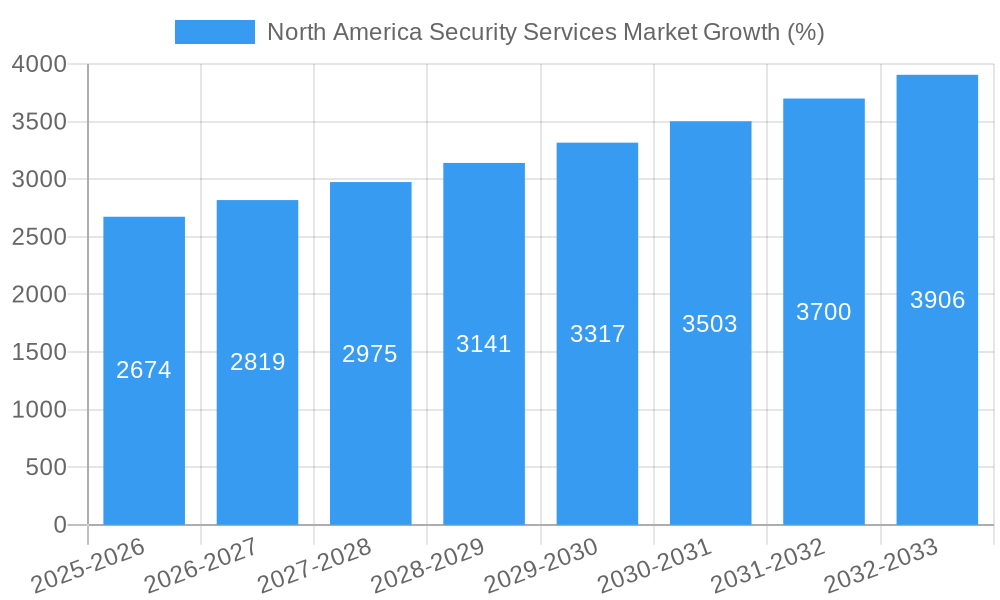

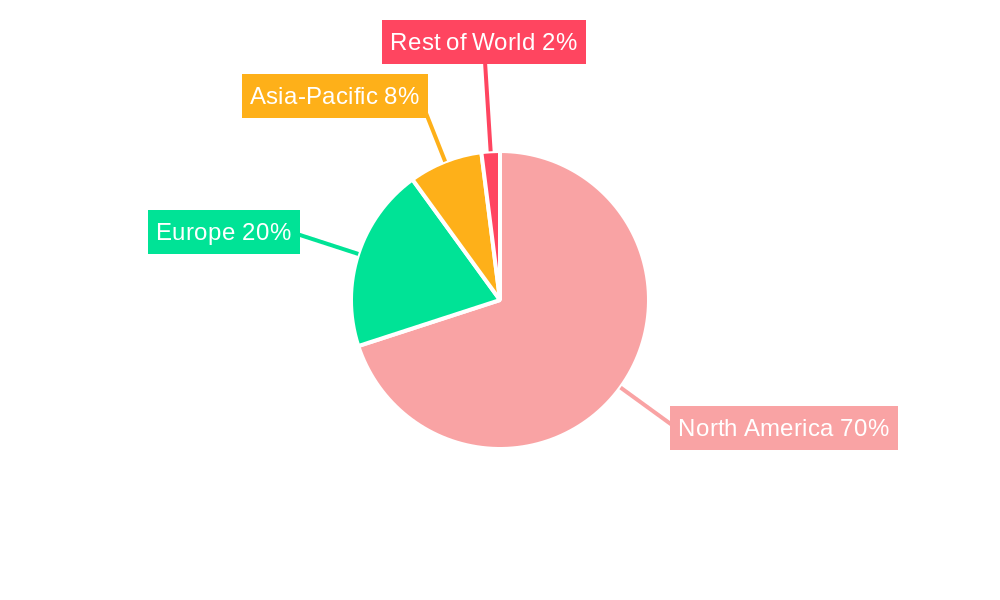

The North America security services market, valued at $44.75 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.60% from 2025 to 2033. This expansion is fueled by several key factors. Increasing cyber threats targeting businesses and governments necessitate robust cybersecurity solutions, boosting demand for managed security services and threat intelligence. Furthermore, rising concerns about physical security, particularly in high-value industries like banking and healthcare, are driving adoption of professional security services, including guarding and surveillance. Government initiatives promoting cybersecurity infrastructure and regulations further stimulate market growth. The on-premise deployment model continues to hold a significant market share, but cloud-based security services are rapidly gaining traction due to their scalability, cost-effectiveness, and accessibility. Within the end-user industry segment, IT and infrastructure, government, and banking sectors are the largest contributors, exhibiting high spending on security solutions. The United States represents the largest market within North America, followed by Canada. Competition in the market is intense, with established players like IBM, GardaWorld, and Securitas alongside specialized providers vying for market share through innovation and strategic partnerships.

The market's growth trajectory is expected to remain positive throughout the forecast period, influenced by technological advancements in areas such as artificial intelligence (AI) and machine learning (ML) for enhanced threat detection and response. However, factors such as the high initial investment required for implementing advanced security solutions and skilled cybersecurity professional shortages could pose challenges to the market’s expansion. Despite these restraints, the increasing reliance on digital infrastructure across all sectors and the heightened awareness of security risks will continue to propel demand for diverse security services in North America, making it an attractive market for both established and emerging players. The ongoing development and adoption of innovative security technologies will be a crucial factor determining market competitiveness and overall growth in the coming years.

North America Security Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America security services market, encompassing market size, growth drivers, key players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The market is segmented by mode of deployment (on-premise, cloud), end-user industry (IT and Infrastructure, Government, Industrial, Healthcare, Transportation and Logistics, Banking, Other End-user Industries), country (United States, Canada), and service type (Managed Security Services, Professional Security Services, Consulting Services, Threat Intelligence Security Services). Key players analyzed include GardaWorld, Trustwave Holdings Inc, IBM Corporation, Allied Universal, SOS Security Systems, Broadcom Inc, Fujitsu Limited, Palo Alto Networks, G4S Limited, Securitech Security Services, Fortra LL, Securitas Inc, and Diebold Nixdorf. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Security Services Market Concentration & Dynamics

The North American security services market exhibits a moderately concentrated landscape, with a few large players holding significant market share. Market share data for 2024 indicates that Allied Universal and GardaWorld collectively hold approximately xx% of the market, followed by G4S Limited and Securitas Inc with a combined xx%. The remaining market share is distributed among numerous smaller companies and regional players. The market is characterized by a dynamic innovation ecosystem, driven by advancements in AI, cloud computing, and cybersecurity technologies. Regulatory frameworks, such as data privacy regulations (e.g., GDPR, CCPA), significantly influence market dynamics and investment strategies. Substitute products, including self-service security systems and DIY security solutions, present competitive pressures. End-user trends towards enhanced cybersecurity measures, particularly within the IT and infrastructure sectors, are driving market growth. M&A activities remain significant, with xx M&A deals recorded in the last five years, reflecting consolidation and expansion strategies among key players.

- Market Concentration: High, with a few dominant players.

- Innovation Ecosystem: Highly dynamic, driven by technological advancements.

- Regulatory Frameworks: Stringent data privacy regulations impact market operations.

- Substitute Products: Growing competition from self-service security options.

- End-User Trends: Increasing demand for robust cybersecurity measures across sectors.

- M&A Activity: Significant consolidation and expansion through mergers and acquisitions.

North America Security Services Market Industry Insights & Trends

The North America security services market is experiencing robust growth, driven by several factors. The increasing prevalence of cyber threats, coupled with stringent data privacy regulations and rising awareness of security risks across various sectors, are key market drivers. The market size in 2024 was estimated at xx Million and is projected to reach xx Million by 2033. Technological disruptions, such as the adoption of AI-powered surveillance systems and cloud-based security solutions, are reshaping market dynamics. Evolving consumer behaviors, including a preference for integrated security solutions and managed security services, are influencing market segmentation and product development strategies. The market’s considerable growth is largely attributed to an escalating demand for advanced security solutions to counteract evolving cyber threats and data breaches. This demand is primarily fueled by the increasing reliance on digital technologies and the expansion of connected devices across various sectors. Furthermore, the rising adoption of cloud-based solutions and the integration of artificial intelligence (AI) in security systems are driving innovation and market growth. Government regulations concerning data privacy and security are another major factor influencing market expansion.

Key Markets & Segments Leading North America Security Services Market

The United States represents the largest market within North America, driven by its extensive IT infrastructure, large government sector, and substantial private sector investment in security solutions. The IT and Infrastructure, Government, and Banking sectors are dominant end-user industries, exhibiting high demand for advanced security services.

- By Mode of Deployment: Cloud-based solutions are gaining traction due to scalability and cost-effectiveness.

- By End-user Industry: The IT & Infrastructure sector demonstrates the highest growth, followed by Government and Banking.

- By Country: The United States dominates the market due to its large economy and high cybersecurity concerns.

- By Service Type: Managed security services represent the largest segment due to their comprehensive nature and cost-efficiency.

The growth of these segments is primarily fueled by the rise in cyberattacks, growing concerns about data breaches, and the increasing need for sophisticated security solutions. The demand for cloud-based solutions is driven by their scalability and cost-effectiveness, making them an attractive option for organizations of all sizes.

North America Security Services Market Product Developments

Recent product innovations focus on integrating AI and cloud technologies into security services. Hybrid solutions, combining on-site human security with AI-driven surveillance, are gaining popularity, offering comprehensive threat detection and response capabilities. These advancements provide enhanced situational awareness, improved threat detection accuracy, and streamlined security management. The competitive edge lies in providing integrated, adaptable solutions that meet the evolving needs of diverse industries and address dynamic threat landscapes.

Challenges in the North America Security Services Market Market

Significant challenges include the high cost of implementing advanced security solutions, particularly for small and medium-sized enterprises (SMEs), skilled labor shortages within the security sector, and intense competition among established players and new entrants. Regulatory compliance requirements represent a significant operational burden for companies, potentially impacting profitability. Supply chain disruptions can affect the availability of necessary equipment and technology. The ever-evolving threat landscape demands continuous investment in research and development, impacting the overall market dynamics and profitability. These factors, when combined, contribute to a complex and dynamic market environment.

Forces Driving North America Security Services Market Growth

Technological advancements in AI, IoT, and cloud computing are key drivers, enabling sophisticated threat detection and response capabilities. The rise of cybercrime and data breaches fuels demand for advanced security solutions. Government regulations mandating enhanced cybersecurity measures further accelerate market growth. Strong economic growth in key sectors, particularly technology and finance, fuels investment in security services.

Challenges in the North America Security Services Market Market

Long-term growth hinges on continued technological innovation, strategic partnerships to expand service offerings, and geographic market expansion into underserved regions. Investing in skilled workforce development is crucial to mitigate labor shortages and ensure the long-term sustainability of this sector. Maintaining adaptability to a continuously evolving threat landscape will be essential for sustaining growth in the security services market.

Emerging Opportunities in North America Security Services Market

The growing adoption of IoT devices presents opportunities for specialized security services. The rising demand for managed security services (MSS) and cloud-based security solutions indicates significant growth potential. Expansion into niche markets, such as critical infrastructure protection and healthcare security, presents significant opportunities. The increasing integration of AI and machine learning into security systems offers avenues for innovation and competitive differentiation.

Leading Players in the North America Security Services Market Sector

- GardaWorld

- Trustwave Holdings Inc

- IBM Corporation

- Allied Universal

- SOS Security Systems

- Broadcom Inc

- Fujitsu Limited

- Palo Alto Networks

- G4S Limited

- Securitech Security Services

- Fortra LL

- Securitas Inc

- Diebold Nixdorf

Key Milestones in North America Security Services Market Industry

- April 2023: GardaWorld and EcamSecure launched hybrid security solutions integrating on-site human guards with AI-driven video analytics. This reflects a market shift towards comprehensive, integrated security systems.

- March 2023: Trustwave secured an extended database security contract with the USPTO, showcasing the increasing demand for robust database security solutions and Zero Trust Architectures within the government sector.

Strategic Outlook for North America Security Services Market Market

The North America security services market exhibits strong growth potential, driven by ongoing technological advancements, increasing cybersecurity threats, and rising regulatory pressure. Strategic opportunities lie in developing integrated, AI-powered security solutions, expanding service offerings to address niche markets, and forging strategic partnerships to enhance market reach and capabilities. The market’s future success hinges on adapting to the evolving threat landscape, investing in skilled personnel, and offering innovative, cost-effective solutions to meet the diverse needs of various industries.

North America Security Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Services

- 1.2. Professional Security Services

- 1.3. Consulting Services

- 1.4. Threat Intelligence Security Services

-

2. Mode of Deployment

- 2.1. On-Premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. IT and Infrastructure

- 3.2. Government

- 3.3. Industrial

- 3.4. Healthcare

- 3.5. Transportation and Logistics

- 3.6. Banking

- 3.7. Other End-user Industries

North America Security Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Digital Disruption and Increased Compliance; Rapid Cloud Adoption; Growing Adoption of Managed Security Services

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. The IT and Infrastructure Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Security Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Services

- 5.1.2. Professional Security Services

- 5.1.3. Consulting Services

- 5.1.4. Threat Intelligence Security Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-Premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Infrastructure

- 5.3.2. Government

- 5.3.3. Industrial

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistics

- 5.3.6. Banking

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Security Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Security Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Security Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Security Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 GardaWorld

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trustwave Holdings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Allied Universal

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SOS Security Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Broadcom Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fujitsu Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Palo Alto Networks

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 G4S Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Securitech Security Services

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Fortra LL

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Securitas Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Diebold Nixdorf

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 GardaWorld

List of Figures

- Figure 1: North America Security Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Security Services Market Share (%) by Company 2024

List of Tables

- Table 1: North America Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Security Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: North America Security Services Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 4: North America Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Security Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: North America Security Services Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 13: North America Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Security Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Security Services Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the North America Security Services Market?

Key companies in the market include GardaWorld, Trustwave Holdings Inc, IBM Corporation, Allied Universal, SOS Security Systems, Broadcom Inc, Fujitsu Limited, Palo Alto Networks, G4S Limited, Securitech Security Services, Fortra LL, Securitas Inc, Diebold Nixdorf.

3. What are the main segments of the North America Security Services Market?

The market segments include Service Type, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Digital Disruption and Increased Compliance; Rapid Cloud Adoption; Growing Adoption of Managed Security Services.

6. What are the notable trends driving market growth?

The IT and Infrastructure Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

April 2023: Hybrid Security Solutions were launched by GardaWorld and EcamSecure, a GardaWorld company. These solutions are designed to address the ever-evolving nature of dynamic threats, as they have become increasingly sophisticated and adaptive to technological and business developments. As the threat landscape becomes increasingly unpredictable, organizations must maintain high vigilance and expertise to protect their most valuable assets. This comprehensive package provides a unified approach between on-site human guards, property staff, emergency medical personnel, and AI technology. AI-driven video analytics can identify potential property threats, such as suspicious activity, unforeseen work hazards, damage, and loitering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Security Services Market?

To stay informed about further developments, trends, and reports in the North America Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence